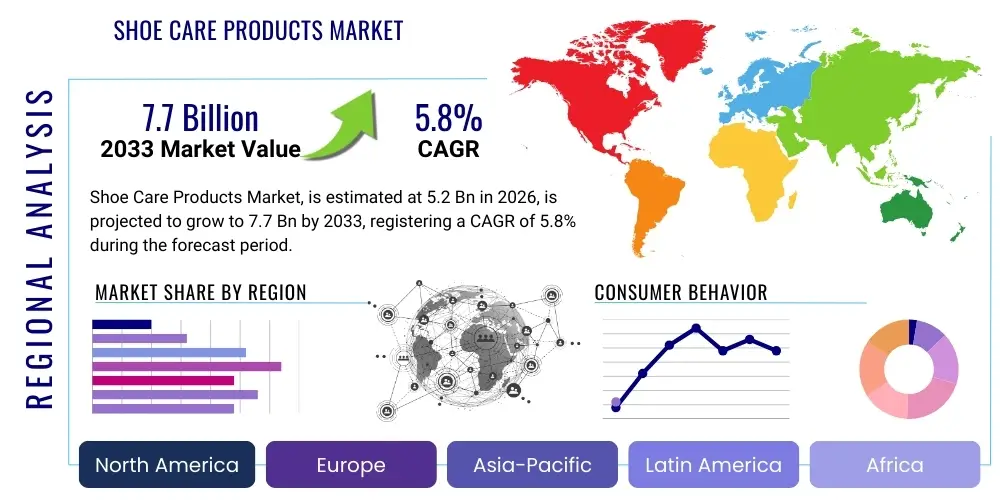

Shoe Care Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442263 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Shoe Care Products Market Size

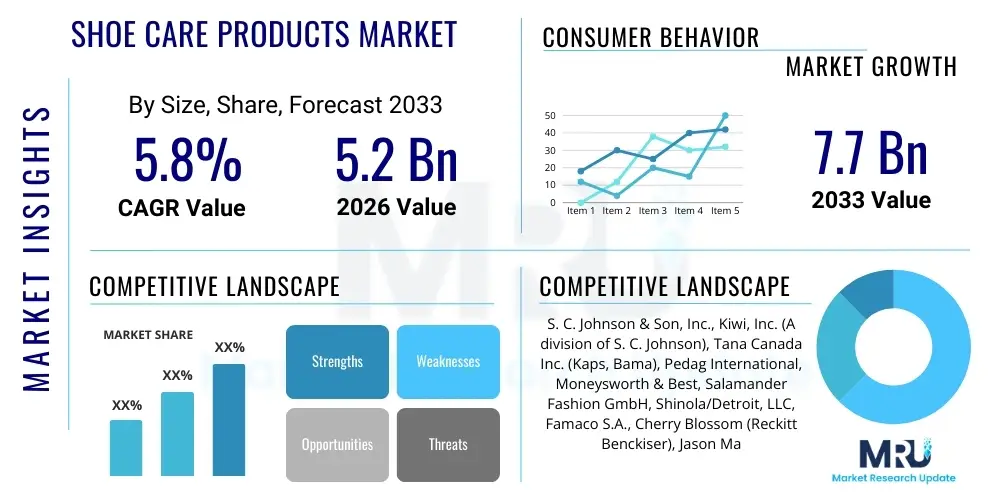

The Shoe Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Shoe Care Products Market introduction

The Shoe Care Products Market encompasses a wide array of chemical and accessory items designed to clean, protect, restore, and prolong the lifespan of footwear across various materials, including leather, suede, synthetic fabrics, and canvas. These products range from basic cleaners and polishes to advanced protective sprays, specialized brushes, and deodorizers. The primary objective of these products is to maintain the aesthetic appeal and structural integrity of shoes, which has become increasingly important as footwear transitions from a purely functional item to a significant fashion and investment piece. Market expansion is fundamentally driven by rising disposable incomes globally, increasing fashion consciousness among consumers, and the growing prevalence of premium and specialty footwear that necessitates specialized maintenance.

Product descriptions within this market are diverse, reflecting the complexity of modern shoe materials. Polishes and waxes traditionally dominate the leather segment, offering restoration of shine and moisture, while protective sprays constitute a rapidly growing segment, providing invisible barriers against water, stains, and UV damage, particularly crucial for expensive sneakers and delicate fabric shoes. Major applications span consumer households, commercial settings such as hotels and dry cleaners, and specialized military and industrial sectors requiring stringent footwear maintenance standards. The benefits derived from utilizing these products include enhanced durability, improved hygiene (through deodorizers and antibacterial agents), and significant cost savings by extending the replacement cycle of expensive shoes.

The principal driving factors propelling this market include the global athleisure trend, which has normalized the wearing of high-value sports shoes in everyday settings, consequently increasing the demand for specific, high-performance cleaning solutions. Furthermore, heightened consumer awareness regarding sustainability and responsible consumption encourages maintenance over replacement. Regulatory shifts favoring eco-friendly, non-toxic, and biodegradable formulations are also steering product innovation, forcing manufacturers to reformulate traditional solvent-based products to meet stringent environmental and consumer health standards, thereby broadening market appeal and penetration across environmentally conscious demographics.

Shoe Care Products Market Executive Summary

The Shoe Care Products Market is currently undergoing a robust transformation, characterized by significant business trends focusing on sustainability and digitalization. Companies are heavily investing in research and development to introduce water-based, natural, and biodegradable formulations, moving away from potentially harmful chemical compounds, thereby aligning with stringent global environmental regulations and shifting consumer preferences toward eco-conscious purchasing. Strategic mergers, acquisitions, and partnerships are increasingly common, particularly those aimed at vertical integration to secure raw material supply or horizontal expansion to capture niche markets like premium sneaker care. The rise of direct-to-consumer (D2C) online sales channels is revolutionizing distribution, offering specialized brands the ability to reach global audiences without relying solely on traditional brick-and-mortar retail structures.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by rapid urbanization, substantial growth in middle-class disposable income, and the pervasive influence of Western fashion trends, particularly in emerging economies like China and India, where footwear consumption is skyrocketing. North America and Europe, while mature, maintain dominance in terms of market value, driven by strong consumer awareness regarding product quality and a willingness to pay a premium for specialized, high-performance care solutions, especially within the luxury and outdoor footwear segments. Regulatory harmonization attempts within the EU concerning chemical standards are simultaneously creating compliance challenges and stimulating innovation towards safer products, influencing global manufacturing standards.

Segmentation trends indicate a pronounced shift from traditional polish and wax segments toward modern, convenience-focused products such as protective sprays and specialized cleaners, reflecting the dominance of synthetic and mixed-material footwear (e.g., performance sneakers). The distribution channel analysis highlights the accelerating importance of the online segment, driven by convenience and the ability of retailers to provide detailed product information and usage tutorials. However, the offline segment, particularly specialty stores, maintains relevance for high-touch, consultative sales, enabling consumers to receive expert advice on complex leather or suede care, thereby ensuring market segmentation remains dynamically balanced between digital efficiency and personalized expertise.

AI Impact Analysis on Shoe Care Products Market

User queries regarding the impact of Artificial Intelligence (AI) on the Shoe Care Products Market frequently center on efficiency, personalization, and supply chain transparency. Common questions explore how AI can optimize inventory management in fluctuating retail environments, the feasibility of using machine learning for personalized product recommendations based on consumer purchasing history and shoe type, and the role of AI in quality control and formulation development, particularly for eco-friendly products where ingredient efficacy is critical. There is also a strong thematic concern about whether AI-driven manufacturing processes can reduce costs while maintaining the artisanal quality often associated with premium shoe care items. Users are fundamentally seeking assurance that AI will enhance convenience and customization without sacrificing product performance or ethical sourcing.

The primary key theme emerging from this analysis is the expectation of hyper-personalization in consumer engagement. AI-powered diagnostic tools integrated into e-commerce platforms or mobile applications are anticipated to analyze user-uploaded images of footwear, automatically identifying the material, damage type, and required care products, leading to highly specific, tailored product recommendations. This capability moves beyond generic segmentation, providing a competitive advantage to brands that can accurately diagnose a customer's specific maintenance needs. Furthermore, AI's role extends deeply into the operational side, offering robust predictive maintenance models for production machinery, reducing downtime, and optimizing resource allocation for formulation mixing, which is critical for consistent product quality.

A secondary, yet crucial, area of impact relates to supply chain resilience and demand forecasting. Given the volatility in raw material costs (e.g., natural waxes, specialty chemicals), AI algorithms can analyze historical sales data, market sentiment, and global supply fluctuations to generate precise demand forecasts, minimizing both stockouts and excess inventory. This sophisticated forecasting capability is essential for managing the shorter product life cycles and seasonal demand spikes often seen in this market, ensuring timely and cost-effective distribution. Ultimately, AI is positioned as a tool for streamlining operations, enhancing the end-user experience through targeted offerings, and supporting the shift toward sustainable and customized product development.

- AI-driven personalized product recommendation engines based on shoe material, usage patterns, and geographic climate.

- Optimization of supply chain and logistics through predictive analytics, reducing waste and transportation costs.

- Implementation of machine learning for advanced quality control in manufacturing, ensuring formulation consistency and purity.

- AI integration in retail for smart inventory management and automated reordering based on real-time consumer demand signals.

- Development of smart packaging and labeling systems utilizing AI to provide instantaneous, detailed product application instructions via augmented reality (AR).

- Analysis of consumer feedback and market trends using natural language processing (NLP) to accelerate R&D cycles for new formulations (e.g., bio-based alternatives).

DRO & Impact Forces Of Shoe Care Products Market

The Shoe Care Products Market is shaped by a powerful interplay of drivers, restraints, and opportunities that dictate its trajectory and competitive intensity. Key drivers include the exponential growth in the global luxury and premium footwear market, where consumers are highly motivated to protect their investments, alongside the increasing awareness regarding hygiene and foot health, boosting the demand for specialized deodorizers and antibacterial sprays. Furthermore, the pervasive influence of social media and fashion blogging has amplified consumer consciousness about maintaining aesthetic appearance, making shoe care an essential routine rather than an occasional task. The market is also benefiting significantly from regulatory pressures in developed economies that mandate clearer labeling and safer ingredients, inadvertently pushing manufacturers towards superior, innovative formulations.

Conversely, the market faces significant restraints that slow its growth potential. The most critical restraint involves the high degree of product fragmentation and the presence of low-quality, inexpensive local brands, particularly in emerging markets, which undercut established players and confuse consumers regarding efficacy and safety standards. Another major constraint is the environmental impact associated with traditional solvent-based polishes and aerosol sprays, which faces mounting scrutiny from regulatory bodies and environmental groups, leading to expensive reformulation requirements. Moreover, general consumer apathy or lack of education regarding the proper use and necessity of specialty care products remains a perennial hurdle, requiring substantial marketing and consumer outreach efforts.

Opportunities for growth are primarily centered around technological advancements and the surging interest in eco-friendly solutions. The development of nanotechnology-based protective coatings that offer superior water and stain repellency without altering the look or breathability of the shoe represents a substantial opportunity for premiumization. The untapped potential of the industrial and institutional sector (e.g., airlines, uniformed services, hospitals) for large-scale procurement of specialized sanitizing and protective care systems offers another high-value revenue stream. Lastly, leveraging e-commerce and subscription-based service models provides an opportunity to ensure recurring revenue and integrate personalized advice directly into the customer journey, enhancing loyalty and market penetration.

Segmentation Analysis

The segmentation of the Shoe Care Products Market provides a granular view of market dynamics, revealing key areas of current strength and future growth potential based on product type, application material, and distribution channels. The structure of consumption is rapidly evolving, moving away from generalized solutions towards specialized, high-performance products tailored to specific materials like prime leather, sensitive suede, or modern performance synthetics. This trend towards specialization underscores the necessity for companies to diversify their portfolios beyond conventional polishes and cleaners to include niche items such as sneaker protectors and color restorers for unique materials. Understanding these segments is critical for developing targeted marketing strategies and optimizing supply chains to meet varied consumer needs across different material types and retail preferences.

The type segmentation highlights the shift in market dominance. While shoe polish and wax have historically been the foundational segments, offering high margins in traditional markets, the rapid expansion of the athleisure segment has propelled specialized cleaners and protective sprays to the forefront. Consumers value the convenience, quick application, and material-specific results offered by these modern formats. Protective sprays, particularly those offering advanced hydrophobic properties, are witnessing accelerated adoption as they cater directly to the high-value sneaker and outdoor gear markets, where preserving appearance and performance under challenging conditions is paramount. Deodorizers and fresheners also exhibit solid growth, driven by increasing consumer focus on personal hygiene and the frequent use of non-breathable synthetic footwear.

Distribution channels represent a fierce competitive battlefield. The offline segment, comprising supermarkets, hypermarkets, and specialty stores, still accounts for the majority of sales, benefiting from immediate availability and the opportunity for in-store consultation. However, the online channel is demonstrating superior growth rates. This acceleration is driven by the rise of specialized e-commerce platforms focused solely on high-end shoe and sneaker care, which provide detailed product demonstrations, user reviews, and educational content. The online channel effectively services niche demand for imported or specialty products that are not readily available in general retail, offering consumers greater choice and price comparison capabilities, cementing its role as the future growth engine for the market.

- By Product Type:

- Shoe Polish and Waxes (Paste, Liquid, Cream)

- Shoe Cleaners (Foam, Gel, Spray)

- Protective Sprays and Waterproofers

- Deodorizers and Fresheners (Insoles, Sprays)

- Shoe Brushes and Applicators

- Shoe Dyes and Repair Kits

- By Application Material:

- Leather (Smooth, Patent, Exotic)

- Suede and Nubuck

- Fabric and Canvas

- Synthetic and Rubber

- By Distribution Channel:

- Offline Retail (Supermarkets & Hypermarkets, Specialty Stores, Drug Stores, Convenience Stores)

- Online Retail (E-commerce Platforms, Company-owned Websites)

- By End-User:

- Household/Residential

- Commercial/Institutional (Hotels, Military, Uniformed Services)

Value Chain Analysis For Shoe Care Products Market

The value chain for the Shoe Care Products Market is complex, beginning with the sourcing of specialized raw materials, moving through formulation and manufacturing, and concluding with extensive global distribution networks. Upstream activities involve the procurement of critical components such as natural waxes (carnauba, beeswax), specialty solvents, chemical polymers for protective coatings, fragrances, and eco-friendly biosurfactants. Volatility in the commodity prices of these raw materials, coupled with increasing consumer and regulatory demand for sustainable, non-toxic sourcing, heavily influences manufacturing costs and supply chain stability. Manufacturers are increasingly focused on vertical integration or long-term strategic contracts with specialized chemical suppliers to mitigate price risks and ensure the consistent quality of core ingredients.

The midstream stage, encompassing formulation, blending, and packaging, is characterized by high levels of R&D investment, particularly concerning nanotechnology applications for advanced repellency and biodegradable ingredient efficacy. Specialized contract manufacturers often play a crucial role, allowing smaller brands to scale production rapidly. Downstream activities involve reaching the end consumer through diverse distribution channels. Traditional distribution relies on large wholesalers and regional distributors who manage inventory and logistics for mass retailers, providing broad market penetration but often reducing margin control for the brand owner.

Distribution channels are divided into direct and indirect routes. Direct distribution involves D2C sales via company websites or brand-owned physical stores, offering maximum control over branding, pricing, and consumer data—a strategy increasingly adopted by premium brands. Indirect distribution dominates, relying heavily on hypermarkets and supermarkets for volume sales, specialty shoe stores for consultative sales on high-end leather care, and general e-commerce platforms like Amazon or eBay for wide geographic reach and convenience. The efficiency and optimization of this distribution network, especially in managing international shipping regulations for chemical products, are vital differentiators in the competitive landscape.

Shoe Care Products Market Potential Customers

Potential customers for the Shoe Care Products Market are broadly categorized into residential end-users, comprising individuals and households focused on personal footwear maintenance, and commercial/institutional clients requiring bulk or specialized care systems. Residential users are further segmented by their level of engagement: the high-value segment consists of sneaker enthusiasts, luxury shoe owners, and outdoor adventurers who routinely invest in specialized, high-performance, and often premium-priced cleaning and protection kits to protect their significant footwear investments. These customers are highly educated about materials and care techniques, relying on online reviews and expert recommendations.

The mass-market residential segment focuses on basic maintenance for everyday work and casual shoes, prioritizing value, convenience, and availability at local supermarkets. This segment drives volume sales for standard polishes, basic cleaners, and deodorizers. For both segments, demographic factors such as rising disposable income, urbanization, and increasing participation in sports and outdoor activities directly correlate with increased spending on shoe care, as consumers recognize the tangible benefits of longevity and hygiene derived from proper maintenance routines.

Commercial and institutional end-users represent a lucrative, often cyclical, market. This includes military and police forces requiring rigorous, specification-compliant polishes and protective coatings for boots and uniforms; large hotel chains and hospitality services requiring bulk cleaning solutions; and specialized industries like aviation and healthcare, which demand specific anti-microbial or non-slip protective treatments. Marketing to this B2B segment requires robust certifications, proven industrial performance, and the capacity for large-scale, consistent supply, often necessitating dedicated sales teams and customized contractual agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S. C. Johnson & Son, Inc., Kiwi, Inc. (A division of S. C. Johnson), Tana Canada Inc. (Kaps, Bama), Pedag International, Moneysworth & Best, Salamander Fashion GmbH, Shinola/Detroit, LLC, Famaco S.A., Cherry Blossom (Reckitt Benckiser), Jason Markk LLC, Reshoevn8r, A. P. Nonweiler Co., Tarrago Brands International, Angelus Brand, Crep Protect, Collonil GmbH, Cadillac Shoe Products, Chemical Guys, Vantek. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shoe Care Products Market Key Technology Landscape

The technology landscape within the Shoe Care Products Market is rapidly evolving, driven primarily by material science innovations and the push for greater sustainability and convenience. Traditional formulations relied heavily on petroleum-based solvents and silicones, but modern technological efforts are focused on developing water-based, non-flammable, and bio-degradable alternatives that maintain superior performance. A major technological advancement is the integration of nanotechnology, specifically using polymers and silica-based nanoparticles to create ultra-thin, invisible hydrophobic layers on shoe surfaces. These nano-coatings offer exceptional resistance to water, oil, and dirt without compromising the material's breathability, proving vital for premium sneakers and technical outdoor gear.

In the domain of cleaning agents, biotechnology is gaining prominence. Manufacturers are leveraging enzymatic cleaners, which use specialized non-pathogenic bacteria to break down organic stains (like sweat, mud, and food) at a molecular level. These bio-enzymatic solutions offer powerful, odor-neutralizing cleaning capabilities while being significantly milder on delicate materials and safer for the environment than harsh chemical detergents. Furthermore, technological innovation is extending beyond the chemical composition to the delivery systems. Advanced aerosol technology minimizes propellant usage while ensuring even dispersion of protective sprays, while ergonomic brush designs and specialized applicator heads (such as those made from heat-sensitive microfiber) enhance the user experience and prevent damage to soft materials like suede or knit fabrics.

Digital technology also plays an indispensable role in contemporary market operations. Specialized mobile applications are being developed to utilize visual recognition software, enabling consumers to identify shoe materials and receive tailored product recommendations and step-by-step video tutorials. This convergence of chemical science and digital technology is crucial for improving user education and ensuring the correct application of specialized products, which directly translates to consumer satisfaction and product efficacy. Smart manufacturing processes, incorporating advanced metering and blending technologies, ensure precise formulation ratios, thereby guaranteeing the consistent quality and performance expected from premium shoe care brands worldwide.

Regional Highlights

- North America (NA): North America represents a mature and high-value market, characterized by strong consumer brand loyalty, a high propensity for owning luxury and specialty footwear, and the dominance of the multi-billion dollar sneaker culture. The region is driven by high per capita spending on personal care and maintenance, and consumers are readily willing to adopt specialized, premium-priced products, particularly protective sprays and high-performance cleaners for synthetic and athletic shoes. Regulatory standards, while less restrictive than in the EU, increasingly favor non-VOC (volatile organic compound) formulations, prompting continuous innovation among leading market players. The market is also seeing strong growth through D2C channels, leveraging social media influence and specialized online sneaker cleaning services.

- Europe: Europe holds a significant share, with countries like Germany, the UK, and France driving demand, underpinned by a deep-rooted cultural appreciation for high-quality leather footwear and traditional shoe maintenance. The market dynamics here are heavily influenced by stringent environmental regulations, particularly the REACH legislation in the European Union, which restricts the use of certain chemicals, pushing the market rapidly toward water-based, eco-certified, and biodegradable products. The presence of numerous heritage brands specializing in fine leather care ensures that traditional polish and wax segments maintain their robust position, even as modern performance sprays gain traction among younger, urban populations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period, primarily due to rapid economic growth, rising disposable incomes in countries like China, India, and Southeast Asian nations, and accelerating urbanization rates that increase exposure to dirt and pollution. This region is witnessing a cultural shift where footwear is increasingly viewed as a status symbol, driving high consumption of both affordable mass-market products and imported premium care solutions. The market growth here is further supported by the expanding footwear manufacturing industry, which simultaneously generates demand for institutional-grade cleaning and finishing products used in retail and repair services.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by large populations in Brazil and Mexico. Demand is highly price-sensitive, leading to a strong prevalence of local, affordable brands, although the premium segment is expanding in major metropolitan areas mirroring global fashion trends. The region presents opportunities for manufacturers who can navigate fluctuating local economic conditions and provide effective products suitable for varied climates, ranging from high humidity coastal areas to arid inland regions, which necessitate tailored protective and anti-fungal treatments.

- Middle East and Africa (MEA): The MEA region is developing, with growth concentrated in the GCC states (Saudi Arabia, UAE) due to high wealth and import capabilities, sustaining strong demand for luxury leather footwear and, consequently, high-end shoe care products. The market growth is also tied to the large presence of military and uniformed personnel, creating consistent demand for institutional boot care. However, challenges related to complex import tariffs, regional conflicts, and varying consumer education levels across different countries present barriers to uniform market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shoe Care Products Market.- S. C. Johnson & Son, Inc.

- Kiwi, Inc. (A division of S. C. Johnson)

- Tana Canada Inc. (Kaps, Bama)

- Pedag International

- Moneysworth & Best

- Salamander Fashion GmbH

- Shinola/Detroit, LLC

- Famaco S.A.

- Cherry Blossom (Reckitt Benckiser)

- Jason Markk LLC

- Reshoevn8r

- A. P. Nonweiler Co.

- Tarrago Brands International

- Angelus Brand

- Crep Protect

- Collonil GmbH

- Cadillac Shoe Products

- Chemical Guys

- Vantek

Frequently Asked Questions

Analyze common user questions about the Shoe Care Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Shoe Care Products Market?

The Shoe Care Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by increasing consumer investments in premium and athletic footwear and rising hygiene consciousness globally.

Which product segment is expected to show the highest growth rate?

The protective sprays and waterproofers segment is anticipated to exhibit the fastest growth, largely fueled by the surge in demand for specialized care for expensive, sensitive synthetic sneakers and outdoor gear, requiring advanced nanotechnology-based protection.

How are sustainability trends influencing product innovation in shoe care?

Sustainability is driving a significant shift toward water-based, biodegradable, and non-toxic formulations, particularly in Europe and North America, where stringent regulations and consumer preferences mandate the replacement of traditional solvent-based polishes and chemical aerosols with eco-friendly alternatives.

Which geographical region dominates the Shoe Care Products Market in terms of value?

North America and Europe currently dominate the market in terms of overall value, characterized by high consumer spending on specialized premium products and established market maturity, whereas the Asia Pacific region is forecast to lead in growth rate.

What role does the online distribution channel play in the market?

The online distribution channel is critical for future growth, offering convenience, access to specialized imported goods, and enabling D2C brands to provide enhanced customer education, personalized recommendations, and subscription services, supplementing traditional offline retail channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager