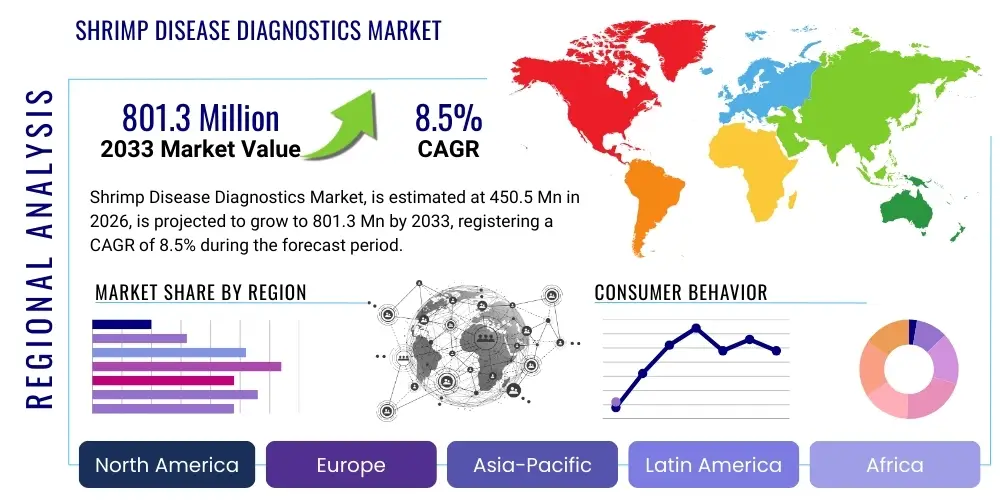

Shrimp Disease Diagnostics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441534 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Shrimp Disease Diagnostics Market Size

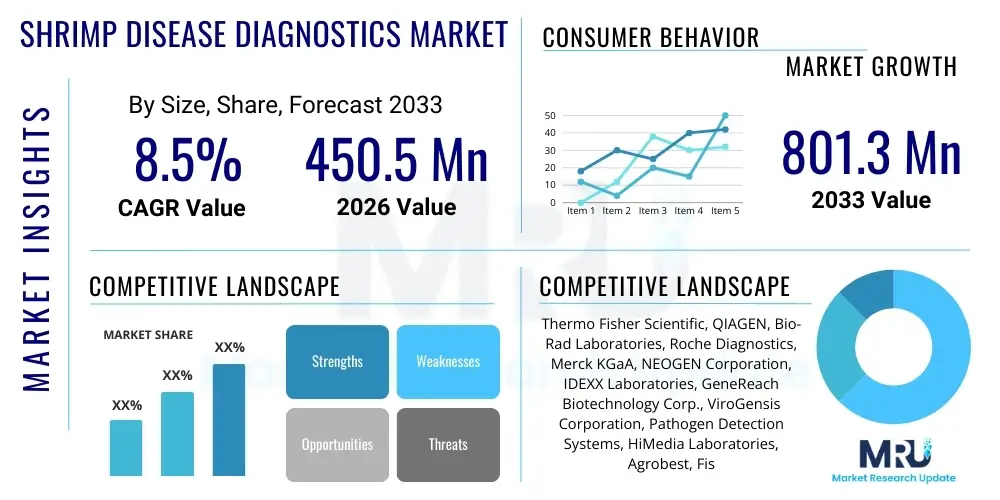

The Shrimp Disease Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 801.3 Million by the end of the forecast period in 2033.

Shrimp Disease Diagnostics Market introduction

The Shrimp Disease Diagnostics Market encompasses technologies and services used to identify and monitor pathogenic agents affecting farmed shrimp populations, a critical component of global aquaculture health management. This sector provides essential tools, ranging from traditional microbiological testing to advanced molecular techniques like PCR and biosensors, aimed at early detection and rapid response to infectious diseases such as White Spot Syndrome Virus (WSSV), Acute Hepatopancreatic Necrosis Disease (AHPND), and Enterocytozoon hepatopenaei (EHP). The market's primary objective is to minimize economic losses caused by massive mortality events and ensure sustainable shrimp production, thereby protecting global food security and the livelihoods dependent on coastal aquaculture.

Products available in this market include diagnostic kits, reagents, instruments, and specialized laboratory services. Major applications span farm-level testing, hatchery screening, import/export certification, and large-scale surveillance programs implemented by governmental and international bodies. The inherent benefits of effective diagnostics are manifold: they enable timely intervention strategies, reduce reliance on prophylactic antibiotics, improve feed conversion ratios, and facilitate the development of genetically resistant shrimp stocks. Furthermore, robust diagnostics enhance compliance with international sanitary and phytosanitary standards, opening up premium export markets for producers.

Driving factors propelling market expansion include the continuous escalation of global shrimp demand, leading to intensified farming practices which inherently increase disease risk. The growing awareness among farmers regarding the correlation between biosecurity, health management, and profitability is fostering greater investment in diagnostic tools. Technological advancements, particularly the development of rapid, portable, and highly sensitive testing platforms (e.g., Point-of-Care devices), are making diagnostics more accessible, even in remote farming regions. Regulatory mandates imposing strict disease surveillance and reporting requirements also contribute significantly to the sustained growth of the Shrimp Disease Diagnostics Market.

Shrimp Disease Diagnostics Market Executive Summary

The Shrimp Disease Diagnostics Market is experiencing robust growth driven by the globalization of aquaculture and the persistent threat of high-virulence pathogens like WSSV and AHPND. Current business trends indicate a strong shift towards molecular diagnostics (PCR and RT-PCR) due to their unparalleled specificity and sensitivity, moving away from slower, culture-based methods. Key market players are focusing on developing integrated diagnostic solutions that combine sample preparation automation with high-throughput analysis, catering to large corporate farms and regulatory agencies that require rapid, scalable testing capabilities. There is also a significant push towards integrating data analytics and cloud-based reporting platforms to facilitate disease trend tracking and epidemiological research, transforming diagnostics from a reactive tool into a proactive management system.

Regionally, Asia Pacific dominates the market, primarily due to countries like China, India, Vietnam, and Thailand being the epicenter of global shrimp farming and thus, the most affected by endemic diseases. These regions represent both the largest installed base for current diagnostic technologies and the primary demand center for novel, cost-effective solutions suitable for small and medium-sized farms. North America and Europe, while smaller in production volume, are highly lucrative markets driven by stringent food safety regulations and advanced governmental surveillance programs, favoring premium, validated diagnostic products and specialized reference laboratory services. Latin America, particularly Ecuador and Brazil, is emerging as a critical growth region, driven by expanding production volumes and increasing foreign investment in advanced aquaculture infrastructure.

Segment trends highlight the dominance of molecular testing techniques within the technology landscape, as they offer the definitive detection required for high-value export markets. However, the lateral flow assays (LFAs) and biosensors segment is projected for accelerated growth due to their utility as rapid, field-deployable screening tools (Point-of-Care testing), bridging the gap between farm detection and laboratory confirmation. The end-user analysis confirms that commercial shrimp farms represent the largest immediate consumer base for kits and field devices, while research institutions and diagnostic laboratories remain the key purchasers of high-throughput instruments and specialized reagents, reflecting distinct purchasing drivers across the value chain.

AI Impact Analysis on Shrimp Disease Diagnostics Market

Common user questions regarding the integration of Artificial Intelligence (AI) and machine learning (ML) in the Shrimp Disease Diagnostics Market center around several core themes: the feasibility of real-time predictive modeling for disease outbreaks, the application of computer vision in histopathology automation, and the potential for AI-driven data integration to enhance farm-level biosecurity protocols. Users are keen to understand how AI can move diagnostics beyond mere detection to true risk forecasting, asking if current data sparsity (e.g., environmental factors, genetic resistance data) limits effective ML model training. Furthermore, there is strong interest in how AI tools can democratize advanced diagnostic interpretation, making sophisticated analyses available to farm managers without extensive laboratory training, thereby improving overall operational efficiency and reducing human error in complex data interpretation.

The deployment of AI tools is anticipated to revolutionize the efficiency and speed of disease diagnostics, particularly in areas requiring extensive data processing. AI can be used to analyze large, complex datasets generated by high-throughput sequencing (metagenomics) to quickly identify novel or emerging pathogens that conventional PCR panels might miss. In parallel, machine learning algorithms are being developed to integrate environmental telemetry (water quality, temperature), feed consumption data, and historical mortality records to create predictive models that warn farmers of impending disease outbreaks days or weeks before clinical signs appear. This transition from reactive testing to proactive risk management represents the most transformative application of AI in this sector.

Furthermore, AI-powered image analysis is increasingly used to automate and standardize histopathological assessments, particularly for complex diseases like EHP or specific bacterial infections. By employing deep learning models, diagnostic laboratories can significantly reduce the time required for microscopic examination, increase diagnostic consistency across different technicians, and flag subtle morphological changes indicative of early-stage infection. This automation reduces labor costs and accelerates turnaround times, ensuring that clinical decisions regarding quarantine, water treatment, or harvest scheduling can be made instantaneously based on highly reliable, AI-validated data outputs.

- AI-driven predictive modeling for outbreak forecasting using multivariate environmental and biological data.

- Automation of microscopic image analysis (histopathology) via computer vision, increasing speed and accuracy.

- Integration of genomics and proteomics data through machine learning for novel pathogen discovery and strain identification.

- Optimization of sampling strategies and resource allocation based on AI-assessed risk scores for specific farm ponds.

- Development of smart sensor networks utilizing AI to interpret complex physicochemical and biological indicators in real-time for immediate health alerts.

DRO & Impact Forces Of Shrimp Disease Diagnostics Market

The Shrimp Disease Diagnostics Market is shaped by a powerful interplay of dynamic factors spanning biological necessity, technological innovation, and economic pressures. Primary market Drivers (D) include the critical need to mitigate devastating economic losses from major diseases (WSSV, AHPND), the global trend toward aquaculture intensification, and rising consumer demand for traceable, sustainably farmed seafood. These drivers necessitate robust, immediate diagnostic solutions. Restraints (R), however, exist primarily in the high initial capital expenditure required for advanced molecular diagnostics, particularly in developing aquaculture nations, and the persistent challenge of training skilled personnel capable of operating and interpreting sophisticated instruments. Additionally, the fragmented nature of the global shrimp farming industry, dominated by numerous small-scale operators, makes large-scale adoption of centralized diagnostic services challenging.

Significant Opportunities (O) for market expansion lie in the rapid development of Point-of-Care (POC) testing devices—simple, affordable, and accurate kits that can be used directly on the farm, bypassing the need for sophisticated laboratory infrastructure. Furthermore, the increasing regulatory pressure in major importing regions (e.g., EU, USA) demanding disease-free certification for imported shrimp drives the adoption of internationally validated diagnostic standards. The development of customized diagnostic panels capable of simultaneously detecting multiple endemic and emerging pathogens (multiplex assays) also presents a high-growth opportunity, maximizing efficiency per test.

The overall Impact Forces driving the market momentum are predominantly positive, stemming from the economic imperative to safeguard shrimp crops. The catastrophic consequences of unchecked disease outbreaks—which can lead to 100% mortality rates and multi-million dollar losses—ensure continuous, non-negotiable demand for effective diagnostic tools. While cost restraints affect adoption speed, the technological momentum towards miniaturization, automation, and enhanced sensitivity ensures that these tools become progressively more accessible over the forecast period, cementing diagnostics as a fundamental operational expenditure rather than an optional safeguard in modern shrimp farming.

- Drivers: Intensification of shrimp farming leading to increased disease transmission; mounting economic losses from major epidemics (WSSV, AHPND, EHP); stricter food safety and import regulations globally.

- Restraints: High cost of advanced molecular diagnostic equipment (e.g., qPCR instruments); lack of standardized testing protocols across different geographical regions; dependence on cold chain logistics for reagents and samples in remote areas.

- Opportunities: Development and commercialization of rapid, affordable, Point-of-Care (POC) diagnostic kits; expansion of centralized reference laboratory networks; integration of high-throughput sequencing (metagenomics) for comprehensive surveillance.

- Impact Forces: High leverage of economic loss mitigation (reducing mortality rates); strong push from government agencies for disease surveillance; rapid evolution of biotechnology lowering instrument costs and increasing test sensitivity.

Segmentation Analysis

The Shrimp Disease Diagnostics Market is segmented primarily based on the technology utilized, the type of disease targeted, the product category, and the end-user base. Understanding these segments is crucial as they reflect the varying needs and capacities of shrimp producers worldwide. The technological landscape is highly stratified, ranging from traditional serology and culture methods suitable for resource-limited settings, to cutting-edge molecular techniques dominating high-volume, biosecure facilities. The market exhibits a clear preference for technologies offering rapid, definitive results, reflecting the time-sensitive nature of disease intervention in aquaculture.

Segmentation by product type typically differentiates between Instruments (such as thermocyclers, ELISA readers, and DNA sequencers), Reagents and Kits (the consumable elements crucial for testing), and Services (including outsourced laboratory analysis and consulting). The Kits and Reagents segment commands the largest market share due to its recurring revenue nature and direct applicability at the farm level, particularly for routine screening and early detection. Conversely, the Services segment is expected to show the highest growth rate, fueled by the increasing complexity of emerging pathogens and the need for specialized confirmatory diagnosis by centralized reference labs.

Analyzing the segmentation by end-user reveals distinct procurement patterns. Commercial shrimp farms, ranging from large integrated operations to small-scale producers, form the core demand for immediate, rapid diagnostic kits. Government and Academic Research Institutions, meanwhile, are the primary purchasers of high-end instruments and novel technology platforms, driving innovation and surveillance efforts. The evolving ecosystem demands scalable and customized solutions; therefore, market players focus on developing tiered product offerings—highly sensitive, laboratory-grade tests for regulatory bodies, and simplified, robust field tests for commercial operators.

- By Technology:

- Molecular Diagnostics (PCR, qPCR, RT-PCR)

- Immunological Diagnostics (ELISA, Lateral Flow Assays)

- Microbiological Diagnostics (Culture-based methods, Microscopy)

- Advanced Sequencing (Metagenomics, NGS)

- By Disease Type:

- Viral Diseases (WSSV, Taura Syndrome Virus, Infectious Hypodermal and Hematopoietic Necrosis Virus)

- Bacterial Diseases (AHPND/EMS, Vibriosis)

- Parasitic Diseases (EHP)

- Fungal Diseases

- By Product Type:

- Kits and Reagents

- Instruments and Analyzers

- Services (Testing and Consulting)

- By End User:

- Commercial Shrimp Farms

- Hatcheries

- Diagnostic Laboratories (Private and Government)

- Research and Academic Institutions

Value Chain Analysis For Shrimp Disease Diagnostics Market

The value chain for the Shrimp Disease Diagnostics Market initiates with the upstream segment, dominated by biotechnology and life science companies responsible for the research, development, and manufacturing of core diagnostic components. This includes the production of specialized enzymes, primers, probes, antibodies, and standardized reagents required for molecular or immunological assays. Upstream innovation success is critical, focusing on maximizing test specificity, sensitivity, and stability under varied environmental conditions, often requiring significant investment in genomics and bioinformatics research to keep pace with pathogen evolution. Intellectual property surrounding novel target sequences and proprietary buffer formulations is a key competitive differentiator in this phase.

The middle segment involves the conversion of raw components into finished diagnostic products, specifically the assembly of integrated diagnostic kits, the calibration of instruments, and the establishment of quality control standards. Distribution channels play a vital role here, dictating how these complex, often temperature-sensitive products reach the end-users. Direct distribution is favored for high-value instruments and large governmental contracts, allowing for comprehensive technical support and installation services. Indirect distribution, leveraging specialized veterinary diagnostic distributors and regional dealers, is used primarily for high-volume, consumable kits and reagents, providing necessary local market expertise and managing complex import regulations across diverse aquaculture regions, particularly in Southeast Asia.

The downstream segment includes the various end-users—hatcheries, farms, and diagnostic laboratories—where the testing is executed. The final step involves the utilization of the diagnostic results for critical management decisions, such as culling, treatment, or harvest scheduling. Effective diagnostics in this downstream phase relies heavily on swift data interpretation and integration into farm management systems. The rapid evolution towards Point-of-Care testing shifts diagnostic capabilities closer to the farm, reducing dependency on external labs for initial screening and driving demand for user-friendly, robust platforms requiring minimal specialized training.

Shrimp Disease Diagnostics Market Potential Customers

The primary consumers and end-users of shrimp disease diagnostics solutions are broadly categorized into three distinct groups: commercial production entities, regulatory bodies/research institutions, and specialized service providers. Commercial shrimp farms and hatcheries represent the largest volume purchasers, driving demand for consumable diagnostic kits and field-ready devices. For hatcheries, early and accurate screening of broodstock and post-larvae is non-negotiable, given the high susceptibility of juvenile shrimp to pathogens and the devastating long-term consequences of stocking infected populations. Large-scale integrated farms, which operate sophisticated internal biosecurity protocols, require high-throughput molecular diagnostics for routine surveillance and rapid intervention, viewing diagnostic investment as insurance against catastrophic failure.

Government agencies (e.g., departments of fisheries, veterinary services) and public/private diagnostic laboratories constitute the second major customer base. These entities purchase high-end, capital-intensive instruments (like qPCR systems and sequencers) and specialized reagents for surveillance, certification, and epidemiological tracking. Their purchasing decisions are driven less by per-test cost and more by regulatory mandates, test validity, international standards compliance, and the need for definitive confirmation of outbreaks. They often require solutions certified by international reference bodies (such as OIE-compliant assays) to uphold national trade and public health standards.

Furthermore, academic institutions and aquaculture research centers are crucial buyers, focused on utilizing the most advanced diagnostic technologies, including next-generation sequencing (NGS) and sophisticated bioinformatics software, for pathogen characterization, vaccine development, and resistance breeding programs. These customers are integral to the long-term innovation pipeline, creating demand for novel diagnostic targets and technology updates. The interaction between these customer segments ensures a steady market for both high-volume consumables and cutting-edge analytical instrumentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 801.3 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, QIAGEN, Bio-Rad Laboratories, Roche Diagnostics, Merck KGaA, NEOGEN Corporation, IDEXX Laboratories, GeneReach Biotechnology Corp., ViroGensis Corporation, Pathogen Detection Systems, HiMedia Laboratories, Agrobest, Fish Vet Group, Diagcor Bioscience Inc., Speedy Diagnostics, Aquatic Diagnostics Ltd., LGC Limited, Biogenetic Technology, SINTX Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shrimp Disease Diagnostics Market Key Technology Landscape

The Shrimp Disease Diagnostics market is predominantly defined by the adoption of molecular techniques, specifically Polymerase Chain Reaction (PCR) and its quantitative real-time variant (qPCR). These methods are widely considered the gold standard due to their high specificity and exceptional sensitivity, capable of detecting extremely low viral or bacterial loads before clinical signs manifest. qPCR offers the critical advantage of quantification, allowing farmers to track pathogen load progression and determine the appropriate time for intervention or harvest. Continuous innovation in this space focuses on multiplex PCR, enabling simultaneous detection of multiple endemic pathogens (e.g., WSSV, AHPND, and EHP) in a single reaction, significantly reducing testing time and cost per target.

Complementing molecular techniques are immunological diagnostics, primarily Enzyme-Linked Immunosorbent Assays (ELISA) and Lateral Flow Assays (LFAs). While generally less sensitive than PCR, LFAs are revolutionizing farm-level screening due to their simplicity, low cost, and rapid results (often within 15–30 minutes), requiring minimal equipment. These devices serve as crucial Point-of-Care (POC) tools for immediate, preliminary assessment of pathogen presence, enabling rapid triaging of infected ponds. Technological advancements in LFAs are centered on enhancing detection limits and incorporating colloidal gold or fluorescent nanoparticle technology to improve visual clarity and sensitivity, moving them closer to laboratory-grade performance for routine surveillance.

The frontier of diagnostic technology involves Next-Generation Sequencing (NGS) and advanced biosensors. NGS, particularly whole-genome sequencing and metagenomics, is vital for high-resolution surveillance, enabling the discovery of emerging or novel pathogen variants and providing comprehensive pathogen profiles of entire farms. Although cost-prohibitive for routine use, NGS is essential for reference laboratories and regulatory bodies. Furthermore, biosensors, utilizing electrochemical or optical detection platforms, are being developed for real-time monitoring of biological markers in water or hemolymph samples. These systems promise continuous data streams integrated with AI, offering a glimpse into the future of fully automated, preventative disease management in controlled aquaculture environments.

Regional Highlights

The Asia Pacific (APAC) region fundamentally dominates the global Shrimp Disease Diagnostics Market, holding the largest market share and demonstrating the highest growth potential. This prominence is directly attributable to the fact that APAC countries, including China, India, Vietnam, Thailand, and Indonesia, account for over 80% of global shrimp production. The dense concentration of farming activity, coupled with endemic, high-impact diseases such as WSSV and AHPND, creates an overwhelming, continuous demand for large volumes of diagnostic kits, particularly molecular (qPCR) assays and field-deployable LFA tests. Governments in key producing countries are increasingly subsidizing or mandating disease testing, further bolstering market growth as the region focuses on improving biosecurity and ensuring export viability.

North America and Europe represent mature markets characterized by stringent regulatory environments and a focus on high-quality, certified diagnostic products. Although domestic shrimp production is relatively modest, the rigorous import standards drive demand for comprehensive diagnostic services, primarily through reference laboratories, ensuring that all imported shrimp products are free from specified pathogens. These regions exhibit high adoption rates for advanced technologies like automated sample processing, high-throughput qPCR systems, and specialized genomics services. The market here is driven by quality assurance, traceability requirements, and sophisticated governmental surveillance programs rather than sheer volume of domestic farm testing.

Latin America, led by key producers like Ecuador and Brazil, is rapidly becoming a significant growth engine. Ecuador, a major global exporter, has increasingly invested in advanced diagnostics to maintain its competitive edge and biosecurity integrity, following significant economic losses from past epidemics. The expansion of large, corporatized shrimp farms in this region facilitates the adoption of centralized, high-volume testing facilities. The Middle East and Africa (MEA) currently hold the smallest share, but market growth is anticipated as regional governments increasingly view aquaculture as a strategic sector for food security diversification, prompting initial investments in essential diagnostic infrastructure and baseline surveillance capabilities, often relying on imported, internationally certified diagnostic kits.

- Asia Pacific (APAC): Dominant market share; highest volume demand for consumables; driven by massive production volumes (China, India, Vietnam); focus on cost-effective molecular and POC solutions to combat endemic WSSV and AHPND.

- North America: High-value market focused on import quality control and stringent regulatory surveillance; preference for certified, automated, high-throughput diagnostics and specialized laboratory services.

- Europe: Driven by strict food safety regulations and robust aquaculture health monitoring; demand for validated diagnostic standards compliant with EU directives; growth in niche services for sustainable aquaculture.

- Latin America: Emerging high-growth region (Ecuador, Brazil); increasing corporate investment in modern aquaculture; strong demand for reliable diagnostics to support expanding export production and biosecurity protocols.

- Middle East and Africa (MEA): Nascent market stage; potential driven by governmental initiatives in food security and aquaculture development; initial demand focused on basic screening kits and establishing regional diagnostic capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shrimp Disease Diagnostics Market.- Thermo Fisher Scientific

- QIAGEN

- Bio-Rad Laboratories

- Roche Diagnostics

- Merck KGaA

- NEOGEN Corporation

- IDEXX Laboratories

- GeneReach Biotechnology Corp.

- ViroGensis Corporation

- Pathogen Detection Systems

- HiMedia Laboratories

- Agrobest

- Fish Vet Group

- Diagcor Bioscience Inc.

- Speedy Diagnostics

- Aquatic Diagnostics Ltd.

- LGC Limited

- Biogenetic Technology

- SINTX Technologies

- Applied Genomics Inc.

Frequently Asked Questions

Analyze common user questions about the Shrimp Disease Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current gold standard technology for detecting major shrimp diseases like WSSV and AHPND?

The current gold standard technology is quantitative Real-Time Polymerase Chain Reaction (qPCR). qPCR offers superior sensitivity, specificity, and the critical ability to quantify the pathogen load, which is essential for informed biosecurity and treatment decisions on commercial shrimp farms.

How is the market addressing the need for diagnostics in remote or resource-limited aquaculture areas?

The market is rapidly developing and adopting Point-of-Care (POC) solutions, primarily based on Lateral Flow Assays (LFAs) or portable, battery-operated PCR devices. These technologies provide rapid, field-deployable results with minimal training and infrastructure requirements, improving disease management access in remote areas.

Which geographical region represents the largest demand center for shrimp disease diagnostics?

Asia Pacific (APAC) represents the largest demand center. This dominance is due to the region housing the majority of global shrimp production (China, India, Vietnam) and dealing with persistent endemic disease outbreaks, requiring high volumes of surveillance and screening kits.

What is the primary factor restraining growth in the advanced molecular diagnostics segment?

The primary restraint is the high initial capital expenditure (CapEx) required for sophisticated instruments like high-throughput qPCR systems and DNA sequencers, along with the subsequent need for specialized laboratory facilities and highly trained technical personnel.

What role does Artificial Intelligence (AI) play in the future of shrimp disease diagnosis?

AI is crucial for the future, enabling predictive analytics by integrating complex data (environmental, historical infection rates) to forecast outbreaks. AI also enhances efficiency by automating image analysis in histopathology and streamlining the interpretation of high-volume genomic data.

The Shrimp Disease Diagnostics Market continues to evolve rapidly, transitioning from conventional microscopy and culture techniques to highly sophisticated molecular and AI-integrated platforms. This shift is mandatory, given the intensification of global shrimp production and the relentless emergence of new, highly virulent pathogens that threaten global food security and economic stability in coastal communities. Investment across the value chain, from upstream reagent manufacturing to downstream field service optimization, remains robust. Technological drivers such as miniaturization and the push for multiplexing capabilities are making advanced diagnostics more accessible and cost-effective. Key market players are strategically positioning themselves to cater to the diverging needs of major end-user groups: supplying high-volume, affordable screening tools to commercial farms in Asia, and providing high-accuracy, regulatory-compliant laboratory services to export-focused operations in North America and Europe.

The future trajectory of the market is heavily reliant on the successful translation of laboratory innovations into practical, field-ready solutions. Collaborative efforts between private diagnostic companies, government surveillance agencies, and academic research institutions are vital for establishing global standards and ensuring the rapid validation and deployment of new assays designed to target newly identified threats. Furthermore, the integration of big data analytics and cloud-based platforms will transform diagnostic testing from a standalone procedure into an integrated component of overall farm management, allowing for immediate regional data sharing and coordinated response strategies, thereby mitigating the risk of large-scale disease pandemics within the aquaculture sector.

The continuous threat posed by pathogens such as White Spot Syndrome Virus (WSSV) and Acute Hepatopancreatic Necrosis Disease (AHPND, or EMS) ensures that the demand for efficient diagnostic tools remains inelastic. As sustainable aquaculture practices gain prominence globally, the role of diagnostics will expand beyond mere disease detection to proactive health monitoring, genetic selection for disease resistance, and effective biosecurity auditing. This expansion guarantees sustained market growth above the global average, positioning the Shrimp Disease Diagnostics Market as an indispensable pillar supporting the long-term viability and profitability of the global shrimp industry.

The global shrimp industry's reliance on imported and exported products further magnifies the importance of standardized diagnostic protocols. International regulatory bodies exert significant influence, demanding proof of disease absence for major trade pathways. This regulatory push elevates the importance of suppliers who can offer OIE-validated or internationally recognized diagnostic kits, driving premium pricing and market differentiation based on quality and certification. As a result, market players must continuously invest in research to update their product portfolios to cover novel or mutated strains of known pathogens, ensuring their diagnostic tools maintain relevance and efficacy in a constantly evolving biological landscape. The drive towards zero-antibiotic aquaculture also places immense pressure on diagnostics to serve as the primary tool for early intervention, reducing the need for chemical treatments and promoting healthier farming environments.

Technological advancement, particularly in point-of-care (POC) testing, is crucial for market penetration in developing nations where infrastructure for centralized laboratories is limited. POC devices, leveraging technologies such as loop-mediated isothermal amplification (LAMP) or advanced biosensors, are designed to deliver highly accurate results without the need for sophisticated lab equipment or extensive sample preparation. This democratization of high-level diagnostic capability is anticipated to significantly broaden the addressable market, moving diagnostics beyond large corporate farms to small and medium enterprises (SMEs) which represent the majority of shrimp producers globally. The affordability and ease-of-use of these next-generation field devices will be key determinants of competitive success in the coming forecast period.

Furthermore, the segmentation analysis confirms that the service segment, encompassing reference testing and specialized consulting, is poised for accelerated expansion. As diseases become more complex and multiplex detection becomes the norm, many smaller farms prefer outsourcing advanced testing to accredited diagnostic laboratories rather than investing in in-house equipment and expertise. These services often include comprehensive health checkups, water quality analysis integrated with pathogen screening, and advisory services on biosecurity improvements based on diagnostic outcomes. This trend highlights a fundamental shift in the industry toward integrated health management solutions where diagnostics function as a continuous operational tool rather than a crisis management measure, securing reliable and recurring revenue streams for service providers.

The geopolitical landscape also subtly influences the market, as trade tensions or regional health crises can trigger immediate and temporary spikes in demand for specific diagnostic panels. For instance, an outbreak in a major exporting region can lead to immediate implementation of mandatory testing requirements in importing nations, necessitating a sudden mobilization of high-volume testing capabilities. Companies with robust global supply chains and diversified manufacturing bases are better equipped to capitalize on these volatile demand fluctuations. The persistent global effort to combat antibiotic resistance further underscores the necessity of precise diagnostics, ensuring that antimicrobial agents are used judiciously and only when confirmed bacterial infections necessitate treatment, thereby enhancing environmental stewardship and public health protection globally.

In summary, the Shrimp Disease Diagnostics Market is characterized by high technological velocity, necessity-driven demand, and strong regulatory support. While challenges related to cost and implementation in low-resource settings persist, the strategic development of decentralized, rapid testing platforms and the integration of predictive analytical tools promise to solidify diagnostics as the central pillar of modern, profitable, and sustainable shrimp aquaculture worldwide. The focus on mitigating economic risk ensures that investment in this sector remains resilient throughout economic cycles.

The market trajectory is significantly influenced by collaborative public-private partnerships aimed at combating global shrimp epidemics. Governments, particularly in high-volume producing nations, often co-fund research and development of diagnostics to ensure national biosecurity. These partnerships help standardize protocols, validate new test kits, and establish comprehensive national surveillance programs. Such initiatives create stable, large-scale procurement opportunities for diagnostic providers, acting as a powerful de-risking mechanism for investments in advanced R&D. Furthermore, these collaborations facilitate the rapid dissemination of diagnostic knowledge and best practices to remote farming communities, which is crucial for overall industry resilience and disease containment.

Within the technology breakdown, the rising popularity of biosensors marks a significant, albeit niche, segment poised for future disruption. Unlike traditional batch testing, biosensors promise continuous, real-time monitoring of specific pathogenic DNA/RNA or immunological markers directly within the shrimp pond environment. While currently expensive and complex, ongoing R&D aims to improve their robustness and specificity for field use. Successful commercialization of robust, affordable biosensor systems could fundamentally alter the biosecurity landscape, enabling instantaneous alert systems and vastly reducing the time lag between infection onset and detection, moving the industry decisively into a preventative monitoring paradigm.

Finally, understanding the end-user landscape confirms a bifurcated market demand. Large, integrated corporate farms often seek comprehensive, automated laboratory setups to minimize labor costs and maximize throughput for daily screening of thousands of samples. In contrast, smaller farms prioritize simplicity, robustness, and the lowest possible cost per test, driving demand for simple LFAs. Diagnostic companies must therefore maintain a multi-tiered product strategy: offering high-capital, automated systems to the corporate sector and providing high-volume, low-cost consumables to the SME sector, ensuring market relevance across the diverse economic spectrum of global shrimp aquaculture.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager