Sign language apps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443212 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Sign language apps Market Size

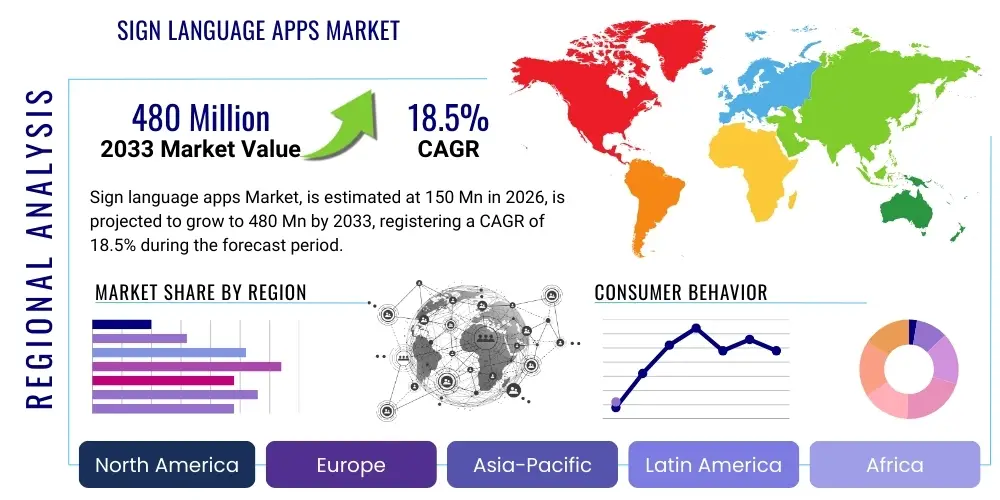

The Sign language apps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. This robust expansion is driven primarily by increasing awareness of accessibility needs, advancements in mobile learning technology, and strong institutional adoption across educational and corporate sectors globally. The market is estimated at $150 Million in 2026 and is projected to reach $480 Million by the end of the forecast period in 2033, reflecting a significant digital transformation in communication assistance and language acquisition.

The valuation forecast underscores the rapid maturation of mobile and AI-driven platforms that facilitate real-time sign language translation and structured learning modules. Key contributors to this growth trajectory include government initiatives promoting inclusivity, mandatory accessibility standards in developed economies, and continuous technological refinements in gesture recognition and computer vision, making these applications more accurate, versatile, and user-friendly. Furthermore, the shift towards remote learning and personalized educational tools post-pandemic has accelerated consumer reliance on dedicated language learning applications.

Sign language apps Market introduction

The Sign language apps Market encompasses software applications designed to teach, interpret, or facilitate communication using various standardized sign languages, such as American Sign Language (ASL), British Sign Language (BSL), or French Sign Language (LSF). These applications leverage cutting-edge technology including machine learning, augmented reality (AR), and sophisticated video playback features to provide comprehensive learning pathways, real-time conversation aids, and educational resources for individuals who are deaf or hard-of-hearing (DHH), their families, educators, and the general public interested in learning sign languages for personal or professional reasons.

Major applications of sign language apps span several critical sectors. In education, they serve as primary or supplemental tools for structured curriculum delivery, offering interactive lessons, vocabulary drills, and practical dialogue practice. In the enterprise and healthcare spheres, these apps facilitate instant communication between hearing and DHH individuals, significantly improving service delivery and accessibility compliance. Benefits derived from widespread adoption include reduced communication barriers, enhanced social inclusion, increased employment opportunities for DHH individuals, and improved cognitive skills for learners. The market is fundamentally driven by the global imperative for digital accessibility and the increasing demand for specialized language learning solutions that cater to diverse linguistic needs.

Driving factors propelling market expansion include the miniaturization of high-performance cameras and sensors in mobile devices, enabling highly accurate gesture detection necessary for translation features. Additionally, the rising prevalence of deafness and hearing impairments worldwide necessitates robust and accessible communication solutions. The commitment from leading technology companies to integrate accessibility features within their operating systems further validates and accelerates the development and distribution of specialized sign language applications, establishing them as essential communication tools rather than niche educational software.

Sign language apps Market Executive Summary

The Sign language apps Market is characterized by vigorous business trends centered on monetization through subscription models, strategic partnerships between technology developers and educational institutions, and a strong focus on incorporating artificial intelligence for real-time translation accuracy. Technological competition is high, driving continuous innovation in 3D avatar rendering for sign visualization and integration with telecommunications platforms. Regional trends indicate North America and Europe currently dominate the market due to robust regulatory frameworks mandating accessibility and higher penetration of advanced mobile technology, while Asia Pacific is emerging as the fastest-growing region, fueled by rising digital literacy and governmental initiatives supporting disability rights and inclusion.

Segment trends demonstrate strong consumer preference for Android and iOS platforms due to ubiquity and processing power, while the Education and Individual Learner segments account for the largest share of revenue, driven by self-paced learning demands. There is a notable upward trend in enterprise adoption, particularly in customer service and government sectors, where compliance requirements necessitate scalable and reliable translation tools. Furthermore, the segmentation by Sign Language Type highlights the continued dominance of ASL applications, though localized versions for languages like BSL and JSL are gaining traction as vendors tailor content to specific regional linguistic requirements, necessitating localization strategies for global expansion.

Overall, the market dynamic is shifting from basic dictionary applications to comprehensive, interactive learning ecosystems that offer certification pathways and community integration features. The integration of Gamification and personalized learning algorithms is crucial for retaining users, particularly within the competitive consumer education segment. The executive outlook suggests that investments in machine learning for nuance detection in signing and expansion into wearable technology integration will define competitive advantage over the forecast period, emphasizing precision and immediacy in communication assistance.

AI Impact Analysis on Sign language apps Market

Common user questions regarding AI's impact on sign language apps often revolve around the accuracy and reliability of real-time translation, ethical concerns related to data privacy and representation, and the potential for AI to fully replace human interpreters. Users seek clarity on how AI-driven computer vision algorithms handle subtle facial expressions and complex manual gestures, which are crucial components of sign language grammar. The prevailing expectation is that AI will democratize accessibility by making instantaneous, affordable translation available everywhere, yet concerns linger about the technology's ability to interpret context, emotion, and cultural nuances accurately, leading to a summary theme of cautious optimism regarding AI's transformative, yet ethically sensitive, role.

The core theme summarizing AI's influence is the transition from static, dictionary-based apps to dynamic, interactive communication tools. AI fundamentally enables sophisticated features such as gesture recognition via neural networks, natural language processing (NLP) for converting signed output into spoken or written text, and personalized learning path generation based on individual performance data. These capabilities are crucial for overcoming the limitations of previous generations of software, which often struggled with variable signing speeds, lighting conditions, and regional sign variations, thereby significantly enhancing the utility and market acceptance of these applications across professional and personal use cases.

Furthermore, AI is instrumental in reducing development costs associated with generating large datasets of signed vocabulary and phrases. Machine learning models can be trained on extensive video libraries to automatically categorize and annotate signs, accelerating the pace at which new languages or specialized terminology (e.g., medical or legal signs) can be integrated into app platforms. This scalability, coupled with AI-driven avatar animation that accurately mimics human movement and expression, positions AI not just as an enhancement tool but as the foundational technology driving the next decade of growth and innovation in digital sign language solutions.

- AI enables real-time, bidirectional sign language translation using deep learning models and computer vision.

- Personalized learning pathways are generated via machine learning analysis of user error patterns and retention rates.

- Enhanced accuracy in gesture recognition, including subtle facial expressions (non-manual markers), through advanced neural networks.

- Automated generation and rendering of realistic 3D signing avatars, improving visual clarity for learners.

- Improved accessibility integration with operating systems, allowing AI-powered translation overlays across various mobile applications.

DRO & Impact Forces Of Sign language apps Market

The Sign language apps Market is highly influenced by the synergistic relationship between technological advancements (Drivers) and the essential requirement for ethical and linguistic accuracy (Restraints), balanced against the vast potential for global inclusion (Opportunity). The primary driver is the pervasive adoption of smartphones equipped with high-resolution cameras and processing power capable of running complex AI algorithms necessary for sign recognition. However, a significant restraint is the fragmented nature of global sign languages, where hundreds of distinct languages and regional dialects exist, posing a monumental challenge for developers striving for comprehensive coverage and translation accuracy across multiple linguistic standards. The convergence of these elements shapes the market trajectory, making precision and localization key competitive differentiators.

Impact forces currently shaping the market include high leverage from societal movements pushing for universal design and accessibility, which acts as a powerful external driver compelling organizations and governments to adopt reliable communication solutions. Conversely, the restraint imposed by the high cost and computational intensity of developing robust AI models for accurate sign language interpretation, particularly in low-resource settings, creates a barrier to entry for smaller developers. Opportunities, however, abound in the untapped corporate training and B2B sectors, offering specialized vocabulary modules and customized enterprise solutions for staff communication and compliance training, thereby shifting the market focus beyond purely consumer-based educational tools towards comprehensive professional applications.

The core market opportunity lies in bridging the digital divide for DHH communities in developing nations, where mobile technology penetration is rising rapidly but accessible educational and communication tools remain scarce. Furthermore, the force of technological substitution, where generic translation apps attempt to incorporate basic sign interpretation, serves as a competitive pressure. Developers must continuously innovate to offer specialized features, superior user experience, and verifiable linguistic quality to maintain their market position against broader tech offerings, ensuring the long-term viability and specialized value proposition of dedicated sign language applications.

Segmentation Analysis

The Sign language apps Market is meticulously segmented across platform type, application use case, the end-user base, and the specific sign language supported. This segmentation is crucial for vendors to tailor their marketing strategies, product features, and monetization models to specific audience needs. For instance, educational institutions require comprehensive curriculum support, high-quality assessment tools, and robust licensing options, contrasting sharply with individual learners who prioritize self-paced, gamified content and affordable subscription tiers. The market structure reflects the diversity in how sign language learning and translation are consumed globally.

Analysis by platform reveals that mobile operating systems (iOS and Android) dominate due to ease of access and integrated camera capabilities essential for interactive learning and translation features. The Application segmentation highlights the growing importance of translation and communication tools, moving beyond traditional educational content to address immediate, real-world communication needs in retail, healthcare, and public services. Furthermore, segmentation by end-user illustrates the transition from a purely B2C market (individual learners) to a rapidly expanding B2B and B2G market driven by corporate compliance training and government accessibility mandates, offering higher-value contracts and stable revenue streams for specialized solution providers.

Segmentation by Sign Language Type is critical for global market penetration. While American Sign Language (ASL) commands the largest market share due to its widespread teaching and the concentration of major tech companies in the US market, significant growth is anticipated in segments covering European Sign Languages (BSL, LSF, DGS) and major Asian Sign Languages (JSL, CSL). Successful regional expansion relies entirely on culturally and linguistically sensitive content localization, requiring significant investment in regional subject matter experts and linguistic validation processes to ensure content quality and user trust.

- By Platform:

- iOS

- Android

- Web-Based Applications

- Hybrid Solutions

- By Application:

- Education and Learning (Curriculum Integration, Self-Study)

- Real-time Translation and Communication Assistance

- Accessibility and Compliance Tools

- Professional Training and Certification

- By End-User:

- Individual Learners/Consumers

- Educational Institutions (K-12, Higher Education)

- Enterprises and Corporate Training

- Healthcare Providers and Clinics

- Government and Public Sector Agencies

- By Sign Language Type:

- American Sign Language (ASL)

- British Sign Language (BSL)

- French Sign Language (LSF)

- German Sign Language (DGS)

- Japanese Sign Language (JSL)

- Other Regional Sign Languages

Value Chain Analysis For Sign language apps Market

The Value Chain for the Sign language apps Market begins with upstream activities focused heavily on content creation and technological research. This involves the acquisition or development of high-quality video datasets of native signers, linguistic validation by certified interpreters, and intensive research and development into sophisticated computer vision and machine learning algorithms required for accurate gesture detection and real-time processing. Key upstream suppliers include data providers, specialized AI development firms, and linguistic consultants who ensure the integrity and cultural appropriateness of the learning and translation modules. Investment at this stage is critical for maintaining a competitive edge in translation accuracy.

The midstream component involves the development and deployment of the application itself. This includes software engineering, user experience (UX) design focused on accessibility (e.g., color contrasts, intuitive navigation), and the integration of cloud computing services necessary for housing large video libraries and managing real-time AI processing loads. Distribution channels, forming the downstream segment, are heavily reliant on app stores (Apple App Store, Google Play) for consumer reach and direct sales teams or partnerships for B2B/B2G enterprise licensing. Direct channels are crucial for high-value contracts with schools and corporations, allowing for customized feature integration and dedicated support services.

Indirect channels primarily utilize affiliate marketing, educational blogs, and strategic partnerships with accessibility advocacy groups to drive consumer downloads. Effective value chain management focuses on optimizing the link between the linguistic quality (upstream) and the user experience (midstream) delivered through efficient, scalable cloud infrastructure. The emphasis on customer feedback loops is vital downstream to continuously improve the accuracy of AI models and tailor features to evolving user needs, particularly in high-stakes environments like emergency services or medical consultations.

Sign language apps Market Potential Customers

Potential customers for sign language applications represent a diverse spectrum, primarily categorized into individual learners seeking personal enrichment or professional skills, and institutions requiring compliance and operational efficiency. The largest segment remains individual consumers, encompassing deaf and hard-of-hearing individuals utilizing the apps for communication assistance, family members and friends looking to communicate more effectively, and students or professionals motivated by the linguistic challenge or career enhancement. These users typically favor subscription models offering comprehensive, self-paced learning content, often with gamified elements to boost engagement and retention.

The second major category involves institutional buyers, which include public and private educational bodies ranging from preschools through universities. These institutions are potential buyers for bulk licensing, integrating sign language instruction into modern foreign language curricula or specialized education programs. Furthermore, the rapidly expanding enterprise segment includes corporations, particularly those in customer-facing industries such as retail, banking, and telecommunications, mandated or motivated to provide accessible services. These entities require enterprise-grade solutions that offer accurate real-time translation features for employee training, customer service interactions, and compliance auditing, focusing on integration capability with existing communication infrastructure.

A highly specific, yet high-value, customer group consists of government agencies, healthcare providers, and non-profit organizations focused on disability services. Healthcare systems, for instance, are increasingly adopting translation apps to ensure effective patient-provider communication, minimizing misdiagnosis risks and adhering to health equity standards. These customers require highly reliable, secured, and often specialized vocabulary sets (e.g., medical terminology), representing a premium segment where accuracy, security, and data privacy are paramount purchasing criteria. The market is increasingly pivoting resources towards these high-value B2B/B2G opportunities due to stable long-term contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million |

| Market Forecast in 2033 | $480 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lingvano, SignSchool, The ASL App, POCKETSIGN, Ava, Google (Accessibility Tools), Microsoft (Accessibility Tools), JSL Sign Language App, Marlee Signs, Fingerspelling App, Communication Service for the Deaf (CSD), Glide, HandSpeak, Deafult, MotionSavvy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sign language apps Market Key Technology Landscape

The technological landscape of the Sign language apps Market is rapidly evolving, driven primarily by advancements in computer vision and artificial intelligence. Core technologies involve deep learning frameworks, specifically Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), used to accurately process video input and recognize complex hand shapes, movements, and orientations that constitute signs. These models require massive, carefully annotated video datasets of native signers to achieve high translation accuracy and minimize latency, particularly crucial for real-time communication functionality. The necessity for high-performance processing pushes many providers toward cloud-based or edge computing solutions to deliver rapid, seamless translation experiences directly on mobile devices.

A second critical technology involves sophisticated 3D animation and rendering software used to create realistic and anatomically correct signing avatars. These avatars serve as virtual instructors in learning apps and visual translators in communication tools, providing standardized visual output when translating spoken language into sign. The effectiveness of these avatars relies heavily on motion capture technology and procedural animation algorithms that accurately mimic the subtleties of human expression, including non-manual markers (facial movements, head tilts) which are grammatical elements of most sign languages. The trend is moving towards photorealistic and highly customizable avatars to enhance learner engagement and cultural sensitivity.

Furthermore, the market is integrating advanced sensor technology, including wearable devices and specialized camera arrays, though primarily in research and enterprise piloting phases. Augmented Reality (AR) is increasingly used in educational apps, allowing learners to overlay digital signing avatars onto real-world scenes or compare their own signed movements against a digital guide using the phone's camera, thereby providing instant feedback. The strategic utilization of these technologies ensures that sign language apps move beyond mere digital dictionaries, transforming them into comprehensive, interactive, and highly personalized communication and learning ecosystems.

Regional Highlights

The global distribution of the Sign language apps Market shows significant concentration in developed economies, where technological infrastructure and regulatory pressures favor early adoption, yet emerging markets present explosive growth potential.

- North America (NA): Dominates the market share, largely driven by the widespread use of American Sign Language (ASL), high consumer spending on educational technology, and stringent accessibility laws (e.g., ADA compliance). Key growth drivers include robust venture capital funding for tech startups specializing in accessibility and strong academic partnerships facilitating advanced research in AI-driven translation technologies.

- Europe: Represents the second largest market, characterized by diverse linguistic demands requiring localization efforts for languages like BSL, LSF, and DGS. Growth is sustained by strong public sector investment in inclusive education and EU directives promoting digital accessibility for all citizens. Germany, the UK, and France are crucial hubs for specialized enterprise solutions.

- Asia Pacific (APAC): Exhibits the highest projected Compound Annual Growth Rate (CAGR). This acceleration is fueled by massive growth in smartphone penetration, increasing governmental focus on disability rights and inclusion (notably in China, Japan, and India), and a large, young population seeking digital learning tools. Localization challenges are significant due to the complexity and number of distinct regional sign languages (e.g., JSL, CSL, ISL).

- Latin America (LATAM): This region is experiencing steady adoption, though often constrained by fluctuating economic stability and lower average consumer disposable income for premium subscriptions. The market is primarily focused on foundational educational apps for national sign languages (e.g., Lengua de Señas Mexicana), with growing opportunities in government initiatives aimed at improving public service accessibility.

- Middle East and Africa (MEA): Currently the smallest market but holds substantial long-term growth potential, particularly in urban centers within the UAE and South Africa, driven by investments in smart city infrastructure and educational modernization programs. Market expansion depends heavily on collaboration with local non-profits to ensure culturally appropriate content and overcome infrastructure limitations in remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sign language apps Market. Strategic analysis encompasses their product portfolios, recent developments, merger and acquisition activities, and geographical presence.- Lingvano

- SignSchool

- The ASL App

- POCKETSIGN

- Ava

- Google (Accessibility Tools)

- Microsoft (Accessibility Tools)

- JSL Sign Language App

- Marlee Signs

- Fingerspelling App

- Communication Service for the Deaf (CSD)

- Glide

- HandSpeak

- Deafult

- MotionSavvy

- Sorenson Communications (Through technology integration)

- Convo Communications

- Sign Language 101

- DPAN.TV

- RIT/NTID (Rochester Institute of Technology/National Technical Institute for the Deaf)

Frequently Asked Questions

Analyze common user questions about the Sign language apps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Sign language apps Market?

The primary driver is the accelerating integration of sophisticated Artificial Intelligence (AI) and computer vision technologies, enabling highly accurate, low-latency, real-time translation and improved interactive learning experiences directly on standard mobile devices, coupled with regulatory mandates for digital accessibility.

Which geographic region currently holds the largest market share for Sign language apps?

North America currently holds the largest market share, predominantly due to high technological penetration, a large user base for American Sign Language (ASL), and strong legal frameworks, such as the Americans with Disabilities Act (ADA), which necessitate accessible communication solutions.

How is AI impacting the translation accuracy of sign language applications?

AI is fundamentally improving accuracy by using deep learning models to recognize not only hand shapes and movements but also crucial non-manual markers like facial expressions and body posture, thereby providing a more contextually rich and grammatically precise interpretation compared to previous rule-based software.

What is the most promising opportunity segment in the Sign language apps Market?

The most promising opportunity segment is the Business-to-Business (B2B) and Government (B2G) sector, where specialized, enterprise-grade applications are required for corporate compliance training, customer service accessibility, and professional medical or legal communication, offering high-value recurring revenue.

What are the main segmentation categories used to analyze the Sign language apps Market?

The market is primarily segmented by Platform (iOS, Android, Web), Application (Education vs. Real-time Translation), End-User (Individual Learners, Institutions, Enterprises), and critically, by the specific Sign Language Type (ASL, BSL, LSF, etc.) to address linguistic diversity.

The detailed analysis within this report confirms the strategic importance of the Sign language apps market as a critical component of global digital accessibility and inclusive technology. Market expansion will continue to rely heavily on overcoming linguistic fragmentation through advanced AI localization strategies and robust data collection methodologies. Investment focus is shifting towards integrated solutions that seamlessly blend learning, real-time communication, and compliance reporting into single, unified platforms accessible globally.

Continuous monitoring of technological breakthroughs, particularly in wearable technology integration and machine learning advancements capable of understanding complex conversational dynamics, remains essential for stakeholders seeking to maximize market penetration and secure long-term competitive advantages. The trajectory of the market underscores a fundamental shift in how societies approach communication barriers, positioning these applications not as supplementary tools, but as essential infrastructure for global inclusion and accessibility compliance across public and private sectors.

The anticipated growth rate confirms that the foundational technology has reached a maturity level that enables mass adoption, moving from early adopters in educational settings to critical infrastructure in commercial and governmental operations. This formal market assessment provides a strategic framework for companies looking to enter, expand, or invest in the burgeoning sign language application ecosystem, emphasizing the need for robust AI governance and linguistic rigor to maintain user trust and market viability in this highly specialized technological domain.

The competitive landscape is expected to intensify, prompting key players to engage in strategic mergers and acquisitions to consolidate market share, acquire specialized regional language expertise, and integrate proprietary AI algorithms. Furthermore, partnerships between tech firms and DHH community organizations will be critical for product validation and ethical development, ensuring that technological solutions truly meet the needs of the end-users they are designed to serve. The long-term success of applications hinges on their ability to interpret emotion and context accurately, moving beyond mere word-for-sign translation to full conversational fluency, a goal achievable only through sustained AI investment.

The emphasis on data security and privacy is also escalating, particularly as these applications handle sensitive communication data. Enterprise clients, especially in healthcare and finance, demand high levels of encryption and compliance with global data protection regulations (e.g., GDPR, HIPAA). This regulatory pressure forces developers to build secure-by-design architectures, creating a competitive moat for providers who can demonstrate superior security protocols alongside high linguistic accuracy. These factors collectively contribute to a highly professionalized and regulated market environment, pushing out less rigorous educational software and favoring robust, enterprise-ready solutions.

The role of augmented reality (AR) in the educational segment is predicted to become more prominent, offering immersive learning environments where users can practice signing alongside virtual instructors in their own physical space. This immersive approach dramatically improves spatial awareness and muscle memory, which are vital components of signing proficiency, thereby enhancing the utility and perceived value of subscription-based learning apps. Developers are prioritizing mobile AR features, capitalizing on the capabilities of modern smartphone cameras and processing units to deliver these complex, interactive experiences without requiring specialized hardware.

The report’s projections reflect sustained investment confidence in technologies that promote inclusivity. The market is increasingly attracting non-traditional tech investors who prioritize social impact alongside financial returns, further stabilizing the funding environment for innovative accessibility solutions. As connectivity improves globally, especially with the rollout of 5G networks, the reliability and speed of real-time cloud-based AI translation will dramatically increase, removing one of the primary technical bottlenecks currently faced by high-demand communication use cases, securing the market's trajectory towards the projected 2033 valuation.

In summary, the Sign language apps Market is at a pivotal inflection point, transitioning from a niche educational sector to a mainstream technology segment critical for global communication infrastructure. Success in this market is intrinsically tied to ethical AI development, rigorous linguistic validation, and strategic localization efforts across diverse global sign languages. The convergence of governmental pressure, technological capability, and societal demand ensures continued robust expansion throughout the forecast period.

The growth trajectory within the Asia Pacific region, specifically, is set to redefine competitive dynamics. Countries with large populations and increasing disposable income, such as India and China, represent significant untapped potential. Vendors are advised to establish early partnerships with local deaf organizations and governmental bodies in these regions to ensure linguistic validity and compliance with local standards, which are often unique and highly localized. This necessitates a decentralized content creation strategy, moving away from centralized ASL-centric models.

Another area of concentrated effort involves specialized vocabulary sets. While general communication apps serve a broad market, the highest value will be found in vertical-specific solutions. For instance, an app tailored for construction site safety signs, or one focused exclusively on legal proceedings, provides irreplaceable value to corporate and governmental clients that generic translation cannot match. This verticalization strategy allows vendors to command premium pricing and establish deep relationships within specific, regulated industries.

Finally, the long-term impact of integrating sign language translation directly into virtual reality (VR) and metaverse platforms is being explored by leading technology firms. While still nascent, this integration promises completely immersive communication and learning environments, which could potentially revolutionize how sign language is taught and used in professional remote settings. Developers focusing on these advanced visualization technologies today are positioning themselves for leadership in the post-2030 technological landscape, bridging the gap between physical and virtual communication spaces for the deaf community.

The established market CAGR of 18.5% is supported by the rapid adoption curve observed in key segments, especially post-2025, when AI technology is expected to reach near-human level proficiency in recognizing basic conversational signing in controlled environments. This milestone will unlock massive B2B contract potential where reliability is paramount. The market structure strongly favors companies that maintain an open, collaborative approach with deaf community experts and certified interpreters, ensuring that technological innovation remains grounded in genuine communication needs and linguistic accuracy, preventing user skepticism and driving sustained consumer trust in automated systems.

Regulatory frameworks are expected to become more prescriptive, moving beyond mere accessibility mandates to specific quality standards for sign language interpretation tools, particularly those used in public service settings. This impending regulatory environment will create a clear advantage for established market players who have already invested heavily in data validation and ethical AI governance, making entry more difficult for smaller, under-resourced competitors. Hence, the focus on compliance and verifiable performance data will be a non-negotiable criterion for institutional procurement throughout the forecast period.

The investment outlook suggests a sustained flow of capital into startups focusing on multilingual sign language support and specialized applications leveraging edge computing for low-latency performance in areas with limited internet bandwidth. The convergence of mobility, AI, and regulatory requirements firmly establishes the Sign language apps Market as a high-growth sector critical for achieving comprehensive digital equity globally.

The report concludes that sustained market growth is contingent upon addressing the unique challenges posed by linguistic diversity and ensuring that technological advancements are applied ethically and inclusively. The future leaders of this market will be those who successfully translate complex linguistic nuances into robust, scalable, and secure digital tools.

This comprehensive market assessment highlights the transition from simple educational tools to complex, highly critical communication infrastructure. The high projected CAGR reflects both the historical under-served nature of this market and the current capacity of modern technology, particularly AI and mobile computing, to finally provide scalable and reliable solutions for deaf and hard-of-hearing communities and those seeking to communicate with them.

The evolution of monetization strategies is also noteworthy. While early models relied on one-time purchase fees, the current trend is overwhelmingly towards tiered subscription services (freemium, educational licensing, enterprise SaaS models). This shift ensures sustained revenue necessary for continuous research and development, particularly for updating AI models with new signs, dialects, and enhanced recognition algorithms, guaranteeing the long-term viability and competitiveness of the market leaders.

Final analysis of impact forces shows that technological maturation continues to be the most powerful driver. As deep learning models become lighter and more efficient, real-time translation capability will migrate further onto the mobile device itself (edge computing), reducing dependence on constant cloud connectivity and greatly enhancing the reliability of the app in diverse environments. This shift will be paramount for securing mass adoption in global regions where consistent high-speed internet access remains a challenge, fueling the market expansion into LATAM and MEA.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager