Silica Antiblock Additives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443276 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Silica Antiblock Additives Market Size

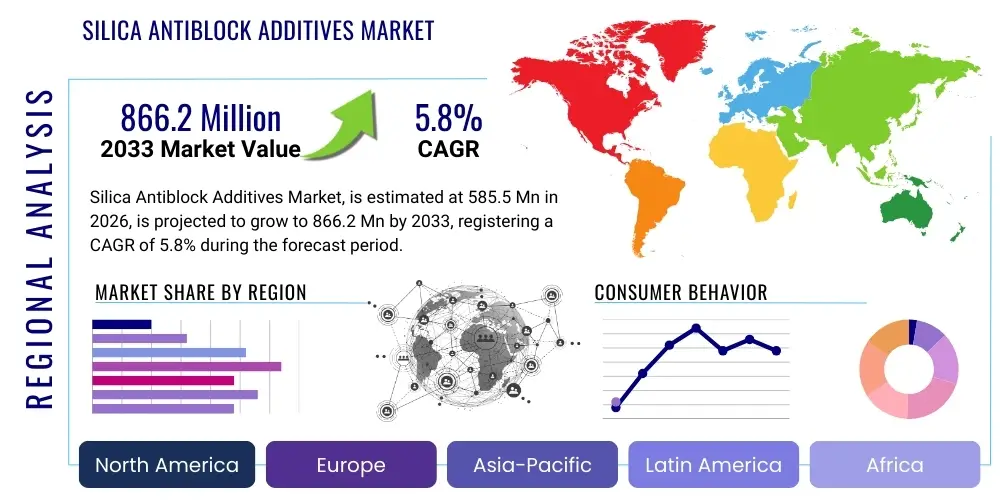

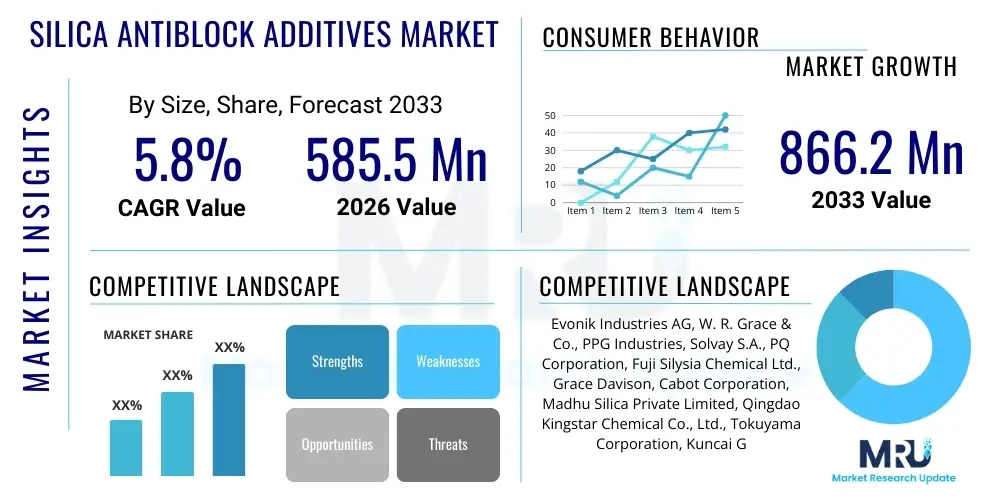

The Silica Antiblock Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $550.0 million in 2026 and is projected to reach $755.0 million by the end of the forecast period in 2033.

Silica Antiblock Additives Market introduction

Silica antiblock additives are specialized functional materials incorporated primarily into polymer films and sheets to prevent unwanted adhesion, often referred to as "blocking." This blocking phenomenon occurs when adjacent layers of plastic film stick together under pressure or heat, making separation difficult or impossible during high-speed processing or end-use application. Synthetic silica, particularly precipitated or fumed silica, is highly effective due to its controlled particle size distribution, spherical shape, and high porosity, which creates microscopic roughness on the film surface, reducing the contact area between layers and thus mitigating tackiness.

The core application sectors driving this market are flexible packaging, agricultural films, and specialized industrial films. In flexible packaging, which includes pouches, wraps, and bags made from polyolefins (like polyethylene and polypropylene), the demand for high clarity and consistent coefficient of friction (COF) necessitates the precise use of antiblock agents. Furthermore, the push towards thinner films for sustainability and cost reduction intensifies the need for effective antiblocking performance, as thinner films are inherently more prone to blocking due to increased surface area interaction relative to film thickness.

Key driving factors include the rapid expansion of the flexible packaging industry globally, particularly in emerging economies, coupled with stringent quality requirements for processing efficiency. The shift towards higher processing speeds in converting operations demands additives that ensure smooth unwinding and sealing. Benefits of using silica antiblock additives encompass improved film handling, enhanced clarity (depending on the grade used), precise control over the coefficient of friction, and overall efficiency improvements in packaging lines, ensuring product integrity and operational uptime for manufacturers.

Silica Antiblock Additives Market Executive Summary

The Silica Antiblock Additives Market is experiencing robust growth fueled primarily by dynamic shifts in the global packaging landscape and technological advancements in film extrusion processes. Business trends show a strong preference among film producers for highly specialized, synthetic silica grades that offer superior transparency and narrow particle size distribution, addressing the continuous consumer demand for visually appealing, high-clarity flexible packaging. Sustainability mandates are also impacting the market; as converters adopt biodegradable or recyclable polymer bases, the requirement for compatible, non-migratory antiblock agents becomes critical, pushing suppliers toward surface-treated and coated silica varieties designed for specialty resins. Strategic mergers and acquisitions among major silica producers are aimed at expanding geographic reach and consolidating proprietary processing technologies, thereby stabilizing pricing structures and ensuring supply chain resilience against fluctuating raw material costs.

Regionally, Asia Pacific (APAC) stands as the dominant market and the fastest-growing region, driven by massive consumption in China, India, and Southeast Asian nations where urbanization and the growth of organized retail accelerate flexible packaging adoption. North America and Europe, while mature, are characterized by intense focus on premium, high-performance applications, such as specialized BOPP (Biaxially Oriented Polypropylene) films and high-density polyolefin films used in technical packaging and automotive sectors. The Middle East and Africa (MEA) exhibit promising growth potential, linked to infrastructural investments and increasing domestic manufacturing capabilities in plastics conversion. Localized regulatory shifts regarding food contact materials necessitate regionalized product development for silica suppliers.

Segmentation trends highlight the dominance of the precipitated silica segment due to its cost-effectiveness and versatility across standard polyethylene and polypropylene films. However, the fumed silica segment is witnessing accelerated adoption in premium applications demanding ultra-high clarity and superior thermal stability, particularly for co-extruded multi-layer barrier films. Application-wise, flexible packaging maintains the largest share, although the agricultural sector, particularly greenhouse films requiring specific UV protection and controlled transparency, is forecasted to show above-average growth. The market also observes an increasing integration of antiblock functions within masterbatch formulations, streamlining processing for end-users and ensuring optimal dispersion of the silica particles.

AI Impact Analysis on Silica Antiblock Additives Market

User queries regarding AI's influence on the Silica Antiblock Additives Market primarily center on how artificial intelligence and machine learning (ML) optimize manufacturing processes, predict material performance, and refine quality control for highly technical silica grades. Key concerns revolve around the integration of AI-driven predictive analytics for identifying optimal silica loading levels to balance anti-blocking efficacy with film clarity, minimizing waste, and managing the intricate supply chains associated with specialty chemical inputs. Users are also keen on understanding how AI facilitates R&D by simulating the interaction between silica particles and various polymer matrices, thereby accelerating the development cycle for new, high-performance, and sustainable antiblocking solutions customized for demanding applications like high-speed form-fill-seal (FFS) machinery. The general expectation is that AI will significantly enhance batch consistency and reduce the variability inherent in traditional additive manufacturing.

AI's role in synthesizing material data extends to correlating particle morphology (size, surface area, porosity) with end-product properties (COF, haze, gloss). By analyzing vast datasets generated during production runs, ML algorithms can identify non-linear relationships that traditional statistical methods miss, leading to more robust process controls and fewer off-spec batches. Furthermore, AI-powered systems are being implemented to manage inventory and forecast demand for specific silica grades based on real-time data from downstream polymer converters, leading to highly optimized production schedules and reduced lead times. This level of predictive maintenance and process optimization translates directly into cost savings and quality improvements for both the silica producers and the polymer film manufacturers.

In essence, AI is transforming the market from a reactive supply chain model to a predictive, precision manufacturing environment. It enables the customization of surface treatments for silica particles based on the specific end-polymer and processing equipment used by the customer, ensuring maximized dispersion and minimal negative impact on optical properties. This focus on "smart manufacturing" through AI integration enhances operational efficiency, addresses stringent quality control standards, and supports the rapid scaling required to meet the surging global demand for high-quality flexible packaging, positioning AI as a critical enabler for future market competitiveness.

- AI optimizes silica particle synthesis parameters for enhanced morphological consistency.

- Machine learning algorithms predict optimal additive loading in polymer formulations to balance clarity and anti-blocking efficacy.

- Predictive maintenance schedules for extrusion lines are improved by analyzing friction data generated by film incorporating silica additives.

- AI-driven supply chain management forecasts demand for specialized silica grades, reducing inventory holding costs.

- Quality control utilizes computer vision and ML to instantly detect dispersion flaws and aggregation in masterbatch formulations.

DRO & Impact Forces Of Silica Antiblock Additives Market

The Silica Antiblock Additives Market is dynamically shaped by a crucial interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces on market progression. A primary Driver is the relentlessly growing demand for flexible packaging solutions across the food and beverage, pharmaceutical, and consumer goods sectors, especially as global e-commerce activities escalate the need for lightweight, protective, and cost-effective packaging materials. This is intrinsically linked to the market because high-speed automated packaging machinery requires perfectly unwound film, making the consistent performance of antiblock agents non-negotiable. Furthermore, regulatory trends favoring lightweight packaging materials and recycling initiatives inadvertently support the use of highly efficient additives that allow for minimal loading levels while maintaining functionality in thin films.

However, the market faces significant Restraints, most notably the requirement for high optical clarity in many premium film applications. Higher concentrations of standard silica antiblock agents, while effective in preventing blocking, often lead to increased haze and reduced gloss, negatively impacting the aesthetics of packaged products. This forces manufacturers to seek more expensive, high-performance grades like surface-treated or ultra-fine fumed silica, raising overall production costs. Another restraint is the volatile pricing and supply chain instability associated with precursor materials for synthetic silica, such as sodium silicate, which can impact profitability for additive producers. Moreover, dispersion challenges during the compounding process—where poor mixing can lead to agglomerates, causing defects in the final film—require specialized equipment and expertise, posing a barrier to entry for smaller film manufacturers.

Significant Opportunities exist in the development of specialized grades tailored for sustainable and advanced polymer systems. The shift towards bio-based plastics, compostable films, and high-performance engineering plastics (e.g., polyamides, polyesters) creates a vacuum for novel, compatible antiblock solutions that maintain efficacy without compromising the unique properties of these advanced materials. Furthermore, geographical expansion into rapidly industrializing regions of Africa and Latin America, coupled with increased focus on precision-engineered silica for highly specialized applications like optical films, technical protective coatings, and demanding agricultural applications, offers avenues for premium market segment growth. The pursuit of synergistic additive packages, where silica is combined with slip agents or anti-fog compounds, also presents opportunities for integrated product offerings, enhancing market penetration and value proposition for end-users.

Segmentation Analysis

The Silica Antiblock Additives Market is strategically segmented based on factors including the type of silica material used, the physical form in which it is supplied, the end-user application demanding the anti-blocking function, and the polymer type into which it is incorporated. Understanding these segments is crucial for market stakeholders to tailor product development and target specific high-growth niches. The segmentation by type is dominated by synthetic silicas—primarily precipitated and fumed—due to their superior control over particle morphology and purity compared to natural alternatives like talc or diatomaceous earth, which are used in lower-end applications but often compromise film clarity.

Further analysis of the segmentation reveals distinct performance profiles and price points. Precipitated silica is valued for its balance of cost and performance, serving the high-volume commodity polyethylene film market for general packaging and construction films. Conversely, fumed silica, produced through the high-temperature hydrolysis of silicon tetrachloride, commands a premium price but delivers unparalleled clarity and performance, making it the preferred choice for high-end BOPP and multilayer barrier films where optical properties are paramount. The form segmentation, masterbatch versus powder, indicates a clear trend towards masterbatches, which offer easier handling, safer processing, and superior dispersion during film extrusion, thereby mitigating common quality control issues associated with powder handling.

Application segmentation confirms the dominance of flexible packaging, covering everything from food wraps and snack bags to industrial stretch wrap. However, specialized sectors like agricultural films (e.g., mulching and greenhouse films requiring specific light transmission characteristics), photographic films, and protective films for electronic displays represent high-value segments demanding highly refined, surface-modified silica grades. This detailed segmentation allows manufacturers to optimize capacity utilization and R&D investment towards areas offering the highest return on investment and technological differentiation.

- By Type:

- Precipitated Silica

- Fumed Silica

- Gel Silica (Hydrogel, Xerogel)

- Natural Silicates (Diatomaceous Earth, Talc)

- By Form:

- Powder

- Masterbatch

- By Application:

- Flexible Packaging

- Agricultural Films

- Automotive Films

- Industrial Films (Stretch and Shrink Wrap)

- Consumer Goods Films

- Other Specialty Films

- By Polymer Type:

- Polyethylene (PE)

- LDPE (Low-Density Polyethylene)

- LLDPE (Linear Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Polypropylene (PP)

- BOPP (Biaxially Oriented Polypropylene)

- Cast PP

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Other Resins (PA, EVOH)

- Polyethylene (PE)

Value Chain Analysis For Silica Antiblock Additives Market

The value chain for the Silica Antiblock Additives Market begins with the upstream sourcing and production of key raw materials, primarily sodium silicate, which is derived from sand (silica source) and sodium carbonate/hydroxide. This stage involves intense chemical processing, including precipitation and filtration processes for precipitated silica, or high-temperature flame hydrolysis for fumed silica, demanding significant energy input and capital investment. Manufacturers in this upstream phase focus heavily on achieving precise particle morphology, surface area, and controlled porosity, as these characteristics directly govern the anti-blocking performance and impact on film optics. Efficiency in raw material procurement and process energy management is critical for determining final product cost and maintaining competitiveness in the commodity silica market.

The midstream phase involves the purification, surface treatment, and functionalization of the raw silica powder, followed by conversion into a market-ready form, often a masterbatch. Surface treatments, such as organic coatings, are applied to improve compatibility and dispersion within specific polymer matrices (e.g., PE or PP), ensuring that the silica particles do not aggregate and compromise film integrity or clarity. The shift toward masterbatch formulation (concentrates of silica dispersed in a carrier resin) is a key trend, as it significantly simplifies the dosing process for downstream film extruders, ensuring uniform dispersion and eliminating powder handling risks. Distributors and specialized compounders play a critical role here, bridging the gap between large chemical manufacturers and the dispersed, diverse customer base.

Downstream analysis focuses on the end-users: the polymer film extruders, converters, and specialized masterbatch makers. These entities integrate the silica antiblock additives into their base resins during the extrusion process, often using multi-layer co-extrusion equipment. Distribution channels are predominantly indirect, utilizing specialized chemical distributors who possess technical expertise in additive application specific to film type (blown film, cast film, BOPP). Direct sales are generally reserved for very large, strategic polymer converters or global packaging groups. The ultimate end consumers of the finished film are the consumer goods, food, and industrial sectors, whose demand for high-speed processing and package quality ultimately dictates the performance metrics required from the original silica additive.

Silica Antiblock Additives Market Potential Customers

The primary potential customers and end-users of silica antiblock additives are polymer film manufacturers and specialized plastics compounders operating globally. These customers are highly sensitive to product performance metrics, particularly the balance between anti-blocking capability (measured by Coefficient of Friction, COF) and optical properties (Haze and Clarity). Film manufacturers, especially those producing high volumes of flexible packaging films for the food and retail industries, constitute the largest customer segment. Their needs are centered on high processability—ensuring smooth, rapid unwinding on high-speed converting machinery—and adherence to strict food contact regulations (such as FDA and EU guidelines), demanding high purity, non-migratory grades of silica.

A secondary, high-value customer group includes specialty film producers catering to technical and premium markets, such as agricultural greenhouse films, protective films for electronics (e.g., touch screens, flat panel displays), and specialized industrial films (e.g., release liners, insulation tapes). These customers require ultra-fine, highly specific grades of fumed or precipitated silica, often surface-modified, to achieve extremely low haze values while maintaining highly effective anti-blocking properties in demanding environments. Their purchasing decisions are driven less by price and more by technical performance, consistency, and the ability of the supplier to provide customized, application-specific formulations through advanced masterbatch technology.

Furthermore, independent masterbatch producers represent a critical customer segment. These companies purchase large volumes of silica powder to formulate proprietary additive concentrates, which they then supply to smaller or regional film extruders. By using masterbatches, end-users bypass the complexities of handling pure silica powder, ensuring better dispersion and consistency. Therefore, silica manufacturers must maintain strong relationships with these compounders, offering bulk supply, technical support, and partnership opportunities for co-developing next-generation additive packages optimized for emerging polymer technologies and sustainable substrates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.0 Million |

| Market Forecast in 2033 | $755.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, W. R. Grace & Co., PPG Industries, Solvay S.A., Fuji Silysia Chemical Ltd., Cabot Corporation, Imerys S.A., Madhu Silica Pvt. Ltd., PQ Corporation, Nouryon, Tokuyama Corporation, K. K. S. Chemical Co., Ltd., AdvanSix, Huntsman Corporation, Dow Chemical Company, Huber Engineered Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Silica Antiblock Additives Market Key Technology Landscape

The technology landscape within the Silica Antiblock Additives Market is characterized by continuous refinement in particle engineering, driven by the need to minimize impact on optical properties while maximizing anti-blocking performance. A central technological focus involves developing highly controlled precipitation processes and fine-tuning flame hydrolysis reactors to achieve ultra-fine particle sizes (often less than 5 microns) with a narrow particle size distribution (PSD). A tighter PSD is essential to prevent large agglomerates that can lead to visible defects, commonly known as "fish eyes," in extruded films. Advanced analytical techniques, such as laser diffraction and scanning electron microscopy, are integral to quality control, ensuring batch-to-batch consistency in morphology and surface characteristics, which is a key competitive differentiator.

A significant technological shift is the emphasis on surface modification and functionalization of silica particles. Standard, untreated silica can exhibit poor compatibility with non-polar polymers like PE, leading to inadequate dispersion. To overcome this, manufacturers employ advanced coating technologies, often involving organic polymers or silanes, which chemically bond to the silica surface. This surface treatment enhances compatibility with the host resin, ensures uniform dispersion throughout the polymer melt, and reduces the risk of particle migration, making the additive suitable for strict food contact and medical applications. The technology used in masterbatch manufacturing is also evolving, utilizing high-shear mixing equipment to achieve optimal, de-agglomerated dispersion of the treated silica particles at high concentration before the masterbatch is supplied to the film converter.

Furthermore, technology is being deployed to integrate anti-blocking properties with other functionalities. Manufacturers are developing synergistic additive packages, where silica is co-formulated with slip agents (like erucamide or oleamide) and sometimes anti-fog agents, to provide a multi-functional additive solution. This reduces the complexity for end-users and ensures compatibility among different functional chemistries. The development of specialized silica grades tailored for high-temperature processing resins, such as those used in sterilization or medical packaging, requires robust thermal stability technologies, preventing additive degradation during extrusion and post-processing, thereby broadening the application scope of advanced silica antiblock solutions.

Regional Highlights

The global market for silica antiblock additives displays pronounced regional variations in growth rate, technological sophistication, and application concentration, largely correlating with local industrial development and packaging regulatory environments. Asia Pacific (APAC) stands out as the undisputed leader, driven by sheer volume of demand. Countries like China, India, and Indonesia are experiencing rapid expansion in flexible packaging due to increasing disposable incomes, growth in organized retail chains, and robust domestic manufacturing sectors. The APAC market is characterized by high demand for cost-effective, high-volume precipitated silica for standard LLDPE films, although the demand for premium, high-clarity BOPP films in fast-growing markets like China and South Korea is rapidly accelerating, fueling the adoption of fumed silica and specialized masterbatches.

North America and Europe represent mature markets defined by stringent quality standards and a strong focus on sustainability and specialized high-performance applications. The European market, guided by REACH regulations and significant emphasis on recycling and circular economy initiatives, favors advanced, non-migratory silica grades that are compatible with recycled polymers and bio-based resins. Demand here is concentrated in technical films, such as high-barrier food packaging and specialized agricultural films, requiring tailored solutions. North America mirrors this trend, with significant investment in advanced extrusion technologies demanding highly consistent, narrow-PSD silica to maximize line speeds and ensure the pristine clarity required by premium consumer brands.

Latin America and the Middle East & Africa (MEA) are emerging as high-potential growth regions. Latin America's growth is tied to the expansion of regional food processing and pharmaceutical sectors, creating a rising need for protective and flexible packaging that requires anti-blocking capabilities. The MEA region, particularly the Gulf Cooperation Council (GCC) countries and major African economies, is benefiting from infrastructural investments and diversification away from oil, leading to the establishment of domestic plastic conversion industries. While initial demand centers on commodity film grades, there is a distinct and growing need for highly specialized films for water management, construction, and agricultural applications, creating localized pockets of demand for premium silica additives and technical support services.

- Asia Pacific (APAC): Dominates consumption volume; high growth in flexible packaging (food, e-commerce); rapid industrialization in China, India, and Southeast Asia drives demand for both precipitated and specialty fumed silica grades.

- North America: Mature market focused on high-performance, technical films (e.g., medical, automotive); stringent quality control necessitates high-purity, consistency, and optimized masterbatch delivery.

- Europe: Driven by sustainability and circular economy mandates; strong preference for non-migratory, high-compatibility silica additives suited for recycled and bio-based polymers; robust presence in specialized industrial film applications.

- Latin America (LATAM): Emerging market characterized by rising demand in food and pharmaceutical packaging sectors; increasing foreign investment boosts local film manufacturing capabilities.

- Middle East & Africa (MEA): High potential growth linked to expanding agricultural sector (greenhouse films) and infrastructure projects; increasing establishment of domestic polymer conversion plants creating new consumption hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Silica Antiblock Additives Market.- Evonik Industries AG

- W. R. Grace & Co.

- PPG Industries

- Solvay S.A.

- Fuji Silysia Chemical Ltd.

- Cabot Corporation

- Imerys S.A.

- Madhu Silica Pvt. Ltd.

- PQ Corporation

- Nouryon

- Tokuyama Corporation

- K. K. S. Chemical Co., Ltd.

- AdvanSix

- Huntsman Corporation

- Dow Chemical Company

- Huber Engineered Materials

- O. C. Specialties

- Silica International

- Gelest, Inc.

- Axon Technologies

Frequently Asked Questions

Analyze common user questions about the Silica Antiblock Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of silica antiblock additives in polymer films?

Silica antiblock additives are incorporated into polymer films to prevent layers from sticking together (blocking) during winding, storage, or processing. They function by creating microscopic surface roughness, reducing the contact area and coefficient of friction (COF), enabling smooth film unwinding on high-speed lines.

How do fumed silica and precipitated silica differ in terms of performance?

Fumed silica, produced via flame hydrolysis, is typically purer, finer, and offers superior optical properties (lower haze/higher clarity) at a higher cost, making it ideal for premium films like BOPP. Precipitated silica is more cost-effective and used widely in high-volume polyethylene films, offering a better balance between cost and standard anti-blocking performance.

Which application segment accounts for the largest share of the silica antiblock market?

The flexible packaging sector represents the largest application segment. This includes films used for food wraps, snack bags, pouches, and industrial stretch films, driven by global consumer trends toward convenience and e-commerce growth which necessitates efficient, reliable packaging materials.

What are the main technical challenges associated with using silica antiblock agents?

The main challenges include maintaining high film clarity (minimizing haze) while achieving adequate anti-blocking effect, ensuring proper dispersion within the polymer matrix to prevent agglomeration defects, and managing the potential impact of high loading levels on film mechanical properties like tear strength and sealability.

Are silica antiblock additives compatible with sustainable and bio-based plastics?

Yes, compatibility is a growing area of R&D. Manufacturers are developing specific, surface-treated silica grades that are non-migratory and chemically compatible with emerging sustainable polymers, such as PLA (polylactic acid) and other bio-based resins, to support circular economy initiatives in packaging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager