Single-component Primer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441072 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Single-component Primer Market Size

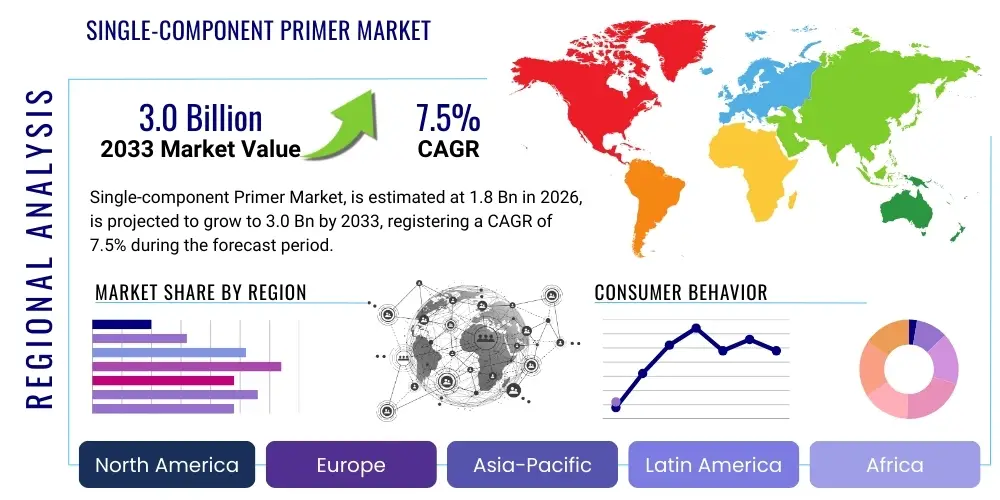

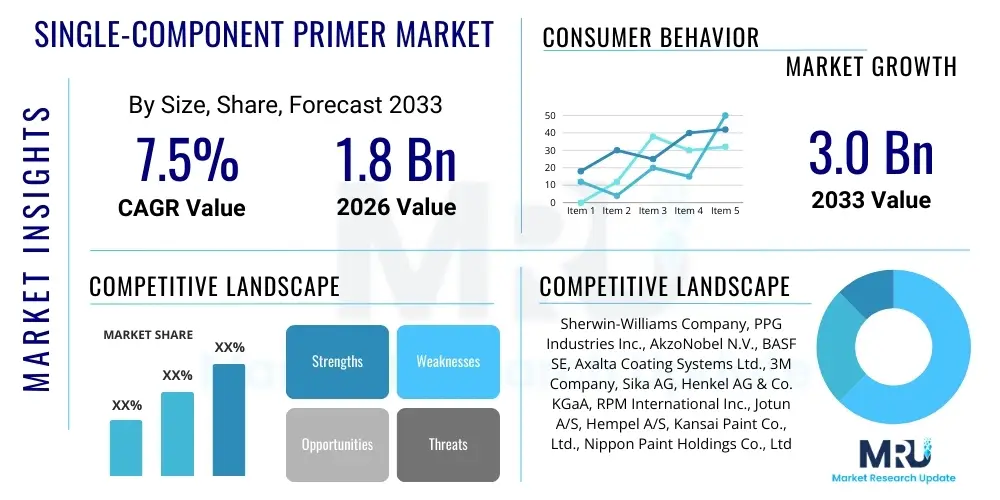

The Single-component Primer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.0 Billion by the end of the forecast period in 2033.

Single-component Primer Market introduction

Single-component primers, frequently referred to as 1K primers, represent a critical category within the protective and decorative coatings industry. Defined by their ready-to-use nature, these formulations eliminate the need for pre-mixing activators or hardeners, simplifying application protocols significantly. The curing mechanisms typically rely on natural atmospheric factors such as solvent evaporation, moisture absorption (in the case of moisture-cured polyurethanes), or oxidation. This ease of use provides substantial operational efficiencies, particularly favored in rapid repair environments, field applications, and situations where precise measuring of two-part systems is impractical or undesirable. These primers serve the fundamental purpose of preparing substrates—metals, plastics, wood, and composites—by promoting robust adhesion for subsequent topcoats, preventing corrosion, and providing a smooth, uniform surface finish.

The product portfolio within the 1K primer segment is technologically diverse, encompassing formulations based on acrylics, epoxies, polyurethanes, and alkyds, each tailored to specific performance criteria. Acrylic primers, for example, are prized for fast drying and excellent UV resistance, common in architectural and automotive refinish applications. Epoxy 1K primers, though less common than their 2K counterparts, offer satisfactory anticorrosion properties for industrial maintenance when application speed is paramount. Major applications are concentrated in sectors characterized by high volume and quick turnaround requirements. This includes the high-throughput automotive refinish segment, where 1K adhesion promoters and surface preparation layers are crucial for efficient body repair shops, as well as the general industrial sector for machinery and equipment coating where downtime must be minimized. The marine industry also utilizes specialized 1K wash primers for temporary protection of steel structures against atmospheric corrosion before final coating systems are applied.

Market growth is dynamically driven by several macroeconomic and industry-specific factors. Globally, the continuous expansion of infrastructure development, especially in emerging economies, necessitates durable anticorrosion solutions for structural steel, boosting demand. Concurrently, the robust growth of the global vehicle parc and the corresponding demand for automotive aftermarket repairs ensure sustained high consumption of efficient 1K refinish systems. Furthermore, regulatory shifts, particularly the tightening of environmental standards related to VOC emissions, are forcing manufacturers to innovate, leading to the rapid commercialization and acceptance of high-performance, water-based single-component solutions that offer a desirable balance between environmental compliance, superior performance, and application simplicity, thereby strengthening their market position against more complex two-component alternatives. The ongoing trend of using lighter materials in transport also necessitates specialized 1K adhesion layers.

Single-component Primer Market Executive Summary

The Single-component Primer Market is currently undergoing a period of accelerated evolution, fundamentally shaped by the confluence of sustainability mandates and end-user demands for enhanced performance characteristics within simplified application systems. Business trends clearly indicate a competitive focus on vertical integration among large chemical conglomerates to secure stable raw material supply chains, especially for specialty resins and bio-based solvents, aiming to mitigate the impact of volatile petrochemical pricing. Furthermore, consolidation via strategic acquisitions remains a key strategy for accessing specialized technology portfolios—such as proprietary waterborne dispersion techniques—and expanding geographic footprint, particularly into high-growth, regulatory-evolving regions like Southeast Asia. Successful manufacturers are those who strategically balance high-volume production of conventional, cost-effective primers with targeted development of premium, eco-compliant, quick-curing products for specialized industrial applications, maintaining a diverse product portfolio to address global needs.

Regional trends highlight a significant divergence in maturity and regulatory influence. Asia Pacific (APAC) not only leads in market volume but also showcases the fastest expansion rate, propelled by rapid urbanization and the establishment of vast manufacturing hubs that drive both OEM coating demand and heavy maintenance requirements. Conversely, established markets in North America and Western Europe are characterized by intense regulatory scrutiny, fostering innovation specifically in ultra-low VOC and non-isocyanate technologies. These regions prioritize specialized, high-cost single-component systems for niche applications such as aerospace and electric vehicle battery casing protection, demanding superior thermal and chemical resistance. This regional heterogeneity necessitates tailored product offerings, localized distribution strategies, and sophisticated compliance frameworks for global market leaders, making market entry complex but rewarding for specialized formulators who can meet stringent performance and environmental criteria.

Segmentation analysis reveals that the shift toward water-based formulations is the most compelling trend across all end-use sectors, driven by environmental responsibility and worker safety concerns. Within the application segments, the automotive refinish market maintains high demand for fast-drying 1K surfacers and adhesion promoters, valuing speed and sandability to maximize shop throughput. Conversely, the construction and industrial sectors demand large quantities of protective 1K primers, prioritizing extended corrosion warranty and ease of large-scale field application under varying climatic conditions. Overall, the market's robust trajectory is sustained by continuous product refinement, addressing the critical trade-off between performance requirements and the mandatory simplification offered by the single-component format, ensuring its relevance across diverse maintenance and manufacturing processes globally. The continuous research into hybrid resin technologies, merging the benefits of different chemistries (e.g., acrylic-polyurethane hybrids), underscores the commitment to next-generation performance in 1K systems.

AI Impact Analysis on Single-component Primer Market

Common user questions regarding AI’s influence typically center on improving R&D efficiency and maximizing application precision. Users want to know if AI can accelerate the complex task of developing new primer formulations that simultaneously meet stringent environmental standards (low VOC) and high performance metrics (adhesion, corrosion resistance, cure time). This is a historically iterative and expensive laboratory process involving numerous physical tests. Consequently, a key theme is the application of Machine Learning (ML) models to predict material interactions, optimize pigment dispersion stability, and simulate long-term durability under various environmental stressors, thereby drastically reducing the time-to-market for novel 1K products. Another major area of interest lies in integrating AI into industrial coating lines. Users inquire how sensor fusion and AI-driven image analysis can conduct real-time quality assurance (QA), monitoring film thickness, identifying microscopic defects, and adjusting application parameters automatically to maintain zero-defect output, optimizing the often-variable application characteristics inherent in ready-to-use primers.

Furthermore, there is a distinct interest in how AI can revolutionize the management of complex chemical inventories and supply chains that feed the 1K primer manufacturing process. Given the reliance on numerous specialty chemicals whose availability and pricing are often volatile, users seek AI solutions for predictive purchasing, optimizing stock levels, and dynamically routing logistics to minimize delays and cost impacts, especially concerning hazardous materials transport. This predictive capability extends into market forecasting, where AI analyzes macroeconomic indicators, construction project pipelines, and automotive sales data to provide highly accurate demand projections, allowing manufacturers to optimize production scheduling for both conventional solvent-based staples and specialized waterborne innovations. This operational enhancement is crucial in maintaining profitability amidst fluctuating input costs and high capital expenditure associated with advanced manufacturing setups required for high-solids and water-based production.

Ultimately, the consensus among industry stakeholders is that AI will transition 1K primer manufacturing from an experience-based science into a data-driven engineering discipline. The potential for digital twin technology to model and simulate entire coating processes—from raw material mixing dynamics to final curing parameters—is expected to dramatically reduce reliance on physical prototyping and accelerate the development of specialized primers for niche applications (e.g., aerospace composites). However, the immediate challenge remains the standardization and digitization of legacy data formats across the traditionally conservative coatings industry, which is essential for training robust and reliable AI algorithms capable of delivering actionable insights and maintaining the consistency required for high-performance single-component primers in a highly competitive global market.

- AI-driven optimization of primer formulation complexity, reducing R&D time for specific substrate adhesion and environmental compatibility by simulating chemical interactions and polymerization kinetics.

- Machine Learning (ML) integration into quality control (QC) systems for real-time defect detection during high-speed coating lines, ensuring film consistency and thickness control using computer vision.

- Predictive analytics enhancing supply chain resilience by forecasting demand fluctuations for specialized raw materials (resins, anti-corrosive pigments, advanced additives) and managing procurement logistics.

- Development of smart primers utilizing embedded sensors and AI analysis for monitoring coating health and structural integrity in high-risk environments (e.g., marine vessels, industrial pipelines), enabling proactive asset maintenance scheduling.

- Automation of coating application processes using robotic systems guided by AI vision, ensuring uniform film thickness, minimizing overspray waste, and maximizing application efficiency of 1K systems in OEM settings.

- Utilization of generative AI for rapid creation and testing of regulatory compliance documentation, accelerating product market entry in diverse global regions with varying VOC limits and chemical registration requirements.

- AI modeling of curing kinetics to optimize oven time and temperature settings in OEM facilities, maximizing energy efficiency and production throughput for fast-cure single-component primers.

DRO & Impact Forces Of Single-component Primer Market

The market dynamics for single-component primers are fundamentally shaped by the accelerating speed of global industrial activity and the regulatory push for safer, more sustainable products. Primary drivers include the massive global investment cycles in infrastructure renewal and new construction, particularly in developing economies, which rely heavily on durable anticorrosion primers for extended asset lifespan. This is coupled with the intrinsic driver of application efficiency: 1K systems significantly reduce preparation time, minimize labor costs, and virtually eliminate the risk of application failure associated with improper mixing ratios inherent in 2K systems, making them highly attractive for maintenance, repair, and overhaul (MRO) professionals seeking operational simplicity. Furthermore, the relentless expansion of the automotive aftermarket, driven by higher average vehicle ages globally and the complexity of modern vehicle repair, ensures a sustained high consumption of efficient 1K refinish systems.

However, significant market restraints impede uniform growth and profitability. The primary constraint is the extreme volatility in the pricing and availability of petrochemical-derived raw materials, including key epoxy and polyurethane intermediates, which directly impacts the cost structure of all major formulations. Compounding this challenge is the increasingly strict and fragmented global regulatory environment, particularly the tightening of VOC emission standards in regions like the EU and California. This regulatory pressure forces manufacturers into continuous, capital-intensive reformulation cycles, sometimes resulting in a performance drop-off when transitioning from established solvent-based systems to compliant alternatives. Another restraint is the inherent performance limitation: while 1K primers offer simplicity, they often cannot match the ultimate chemical resistance, high build, and long-term durability achievable by highly cross-linked 2K systems, thereby limiting their penetration into the most demanding industrial protective coating applications such as tank linings or severe corrosion zones.

Opportunities for growth are concentrated in technological breakthroughs and targeted geographical expansion. The development and commercialization of bio-based resins and sustainable solvent alternatives, derived from non-petroleum sources, present a major opportunity to capture market share among environmentally conscious corporations and government procurement bodies that prioritize sustainability certifications. Furthermore, the increasing adoption of lightweight composite materials in aerospace and electric vehicle construction necessitates new generations of highly specialized single-component adhesion promoters, a niche segment commanding premium pricing due to performance requirements. Key impact forces shaping the long-term outlook include the force of technological substitution, where highly sophisticated, multi-functional topcoats (often powder coatings or advanced hybrid coatings) may reduce or eliminate the need for a separate primer layer altogether, thereby compressing the traditional coating stack. Societal forces, particularly the consumer and industrial shift toward the circular economy, demand that primers be easily removable or composed of materials that facilitate material recycling at the end of the asset's life, compelling manufacturers to rethink their entire product life cycle design and chemical structure.

Segmentation Analysis

The Single-component Primer Market is comprehensively segmented to address the highly specific demands across various industrial and commercial environments. The formulation type segment is foundational, as it dictates the core performance characteristics and regulatory compliance profile. Water-based primers are increasingly dominating the growth trajectory due to their superior sustainability profile, ease of cleanup, and the rapidly falling performance gap compared to solvent-based counterparts. Solvent-based primers, while declining in market share in highly regulated regions, maintain a strong position in developing markets and niche applications where deep substrate penetration and extremely rapid solvent evaporation are required. The epoxy and polyurethane segments, even in 1K format, are crucial for robust corrosion protection and mechanical toughness, contrasting with the high flexibility and quick curing of acrylic formulations primarily used in automotive refinish and general-purpose consumer applications.

Segmentation by end-use industry highlights the differential needs of major consumer groups. The Automotive sector requires high precision and fast turnaround, driving demand for spray-applied, quick-sandable fillers and adhesion promoters that integrate seamlessly into complex paint systems. Conversely, the Construction segment demands vast quantities of anticorrosion primers for structural steel, often applied by brush or roller in field conditions, prioritizing cost efficiency, high film build capacity, and long-term protective performance under atmospheric exposure. The Marine segment requires primers capable of resisting harsh saltwater environments, chemical attack, and mechanical abrasion, necessitating specialized 1K wash primers for interim steel protection before hull coating. Understanding these specific application requirements and environmental exposures is critical for manufacturers tailoring their 1K product lines, ensuring the primer meets the unique requirements of substrate adhesion, regulatory compliance for the specific industry, and the expected service life of the coated asset.

Further segmentation by application method—spray, brush/roller, or dipping—reveals insights into market professionalization and volume needs. Spray application dominates high-volume manufacturing (OEM) and professional refinish facilities, necessitating optimized viscosity, sag resistance, and atomization characteristics in the primer formulation to achieve uniform coating thickness. Brush and roller application remain essential for maintenance, small repair jobs, and remote field work, valuing easy application, excellent leveling, and high film build capacity to reduce coat count. This detailed segmentation allows stakeholders to focus R&D efforts on specific market gaps, such as creating a highly thixotropic 1K waterborne primer that performs optimally when applied via high-volume airless sprayers in heavy industrial settings, combining high throughput with rigorous environmental safety standards, ultimately facilitating better strategic planning and competitive positioning within this dynamic and technologically demanding market.

- By Formulation Type:

- Water-based Primers (Focus on low VOC, quick cure, often acrylic, styrene-acrylic, or Polyurethane Dispersions (PUD))

- Solvent-based Primers (Traditional formulations, high penetration, used in demanding industrial conditions where VOC restrictions are less strict)

- High-solids Primers (Intermediate solution to reduce VOC content while maintaining high film thickness and build characteristics)

- Epoxy Primers (1K) (Used for temporary or light corrosion protection in MRO, offering improved durability over alkyds)

- Polyurethane Primers (1K) (Valued for flexibility, high durability, and superior UV stability in exterior applications)

- Acrylic Primers (Fast drying, excellent UV resistance, good color retention, common in refinish and architectural uses)

- Alkyd Primers (Cost-effective, used extensively in general industrial maintenance and wood applications due to good wetting characteristics)

- By Application Method:

- Spray Application (Conventional, Airless, HVLP - preferred for OEM and professional refinish due to speed and uniform finish)

- Brush and Roller Application (Dominant in MRO, construction field work, and DIY for ease of use and thick film capability)

- Dipping/Flow Coating (Used in specific high-volume industrial parts coating processes for complete coverage of complex shapes)

- By End-Use Industry:

- Automotive (OEM and Refinish - focusing on adhesion promoters, surfacers, and fillers for metal, plastic, and e-coating preparation)

- Construction and Infrastructure (Structural Steel, Concrete floor preparation, bridges, pipelines, high-volume atmospheric anticorrosion)

- General Industrial (Machinery, Heavy Equipment, Piping, Storage Tanks - general MRO and asset protection coatings)

- Marine and Protective Coatings (Above waterline application, vessel maintenance, internal tank protection, offshore platforms maintenance)

- Aerospace (Specialized adhesion promoters for composite and aluminum structures, requiring certification)

- Wood and Furniture (Used for sealing porous wood surfaces and achieving smooth finishes)

- DIY/Consumer Applications (Small-scale home improvement projects and craft uses)

- By Region:

- North America (U.S., Canada, Mexico - driven by high regulatory standards and advanced refinish markets)

- Europe (Germany, U.K., France, Italy - leading waterborne innovation and REACH compliance)

- Asia Pacific (China, Japan, India, South Korea - volume, infrastructure-led growth, and automotive production)

- Latin America (Brazil, Argentina - emerging industrial demand and expanding MRO activity)

- Middle East and Africa (MEA - extreme environment protection for oil/gas and civil infrastructure)

Value Chain Analysis For Single-component Primer Market

The upstream segment of the Single-component Primer value chain is dominated by the global chemical industry, responsible for manufacturing and supplying core raw materials. This includes specialized synthetic resins (epoxy, acrylic, polyurethane, alkyd resins), which form the backbone of the primer film, and whose performance dictates the final product quality. Other critical inputs include functional performance additives such as corrosion inhibitors (e.g., non-toxic variants replacing chromates), rheology modifiers, defoamers, biocides, and high-purity pigments like titanium dioxide and specialized anti-corrosive pigments. The upstream market is highly concentrated, with a few large chemical giants dictating supply stability and pricing, making manufacturers heavily susceptible to fluctuations in crude oil and natural gas prices, as these are the feedstocks for most synthetic resins. Manufacturers seek long-term contracts and dual sourcing strategies, including shifting toward bio-based feedstocks, to mitigate supply risks associated with these complex, high-purity chemicals, which are vital for maintaining the performance claims of advanced 1K formulations.

The midstream sector, comprising the primer manufacturers, represents the value-adding core of the chain. These companies acquire raw materials and transform them through proprietary formulation expertise and specialized blending processes into finished 1K products, optimized for specific application performance (e.g., viscosity for spraying, cure time, adhesion to difficult plastics). Manufacturing involves intricate compounding and dispersion processes, often requiring high capital investment in advanced mixing equipment and rigorous quality control laboratories to ensure batch-to-batch consistency—a non-negotiable requirement for critical end-users like automotive OEMs and aerospace suppliers. Competitive strategy at this stage focuses heavily on intellectual property protection related to novel polymer blends, high-solids technology development, and achieving economies of scale to offer competitive pricing, particularly for high-volume industrial and construction primers that are often highly price-sensitive.

The downstream distribution and sales channels are critical for market reach and are typically bifurcated based on end-user size and application complexity. Direct distribution is employed for large Original Equipment Manufacturers (OEMs), major construction firms, and specialized industrial clients. This approach allows manufacturers to provide direct technical support, custom color matching, and specific compliance certification documentation, enhancing customer relationships and securing long-term supply agreements. Indirect distribution utilizes a broad network of specialized coatings distributors, automotive refinish wholesalers, hardware stores, and increasingly, specialized e-commerce platforms. This channel is critical for reaching the vast Maintenance, Repair, and Overhaul (MRO) segment, independent contractors, and small-to-medium-sized enterprises (SMEs). Success in the indirect channel hinges on maintaining robust inventory levels, effective channel partner training on application techniques, and strong brand presence to drive pull-through demand among professional applicators who value quick access to standardized, reliable 1K primer solutions for their daily operations.

Single-component Primer Market Potential Customers

The primary customers for Single-component Primers are those entities that require efficient, reliable surface preparation solutions across large volumes of materials or within time-sensitive repair processes. Automotive OEMs and, more significantly, the expansive network of collision repair centers (refinish market) are foundational customers. These buyers demand primers with rapid drying characteristics, excellent filling capabilities (surfacers), superior adhesion to bare metals or plastics, and compatibility with numerous subsequent topcoat technologies from different suppliers. Their procurement is highly sensitive to product consistency, speed of application, sandability, and compliance with local environmental regulations regarding volatile emissions, driving demand for innovative fast-cure water-based products that minimize labor time and health risks.

Another major category comprises large industrial and construction enterprises, including steel fabricators, pipeline owners, utility companies, and civil engineering firms. These customers utilize primers primarily for asset protection against corrosion, demanding formulations suitable for high-build application in often challenging outdoor or abrasive environments, such as marine and coastal areas or heavy industrial zones. Purchasing decisions in this sector prioritize protective lifespan warranties (measured in years), ease of field application (often brush or airless spray under varied temperatures), and compliance with specific industry standards (e.g., ISO 12944, NACE). They are high-volume purchasers of specialized 1K epoxy or alkyd primers for structural maintenance, ensuring critical infrastructure longevity and minimizing costly downtime.

Finally, the MRO (Maintenance, Repair, and Overhaul) segment constitutes a substantial and highly diverse customer group. This includes thousands of independent industrial maintenance contractors, marine repair facilities (shipyards), fleet maintenance providers, and general facility managers. For these end-users, the non-mixing feature of 1K primers is the most significant selling point, as it dramatically simplifies jobsite operations, reduces the skill requirement of the labor force, and ensures minimal material waste from pot-life issues. These customers seek highly versatile primers that offer good adhesion across multiple substrates (e.g., rusty steel, old paint, concrete) for routine facility maintenance and small-scale repair work, relying heavily on local distributors for immediate product availability, competitive pricing, and technical advice on product selection for specific repair scenarios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sherwin-Williams Company, PPG Industries Inc., AkzoNobel N.V., BASF SE, Axalta Coating Systems Ltd., 3M Company, Sika AG, Henkel AG & Co. KGaA, RPM International Inc., Jotun A/S, Hempel A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Diamond Vogel, Chugoku Marine Paints, Ltd., Illinois Tool Works Inc. (ITW), Dow Inc., Wacker Chemie AG, Beckers Group, Carboline Company, Tikkurila Oyj (Part of PPG), Valspar Corporation (Part of Sherwin-Williams), Asian Paints, KCC Corporation, Huber Group, Cloverdale Paint Inc., Rust-Oleum Corporation, Fosroc International Ltd., Huntsman Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single-component Primer Market Key Technology Landscape

The technological evolution within the single-component primer market is centered on achieving high performance characteristics—specifically adhesion, anticorrosion, and rapid cure times—within compliant, ready-to-use formulas. A key technological trajectory involves advanced resin synthesis to create hybrid polymer systems. These systems, such as advanced acrylic-polyurethane hybrids or specialized moisture-cured resins, aim to combine the rapid curing and UV stability of one chemistry with the toughness and chemical resistance of another, offering true multi-functional 1K primers. These hybrid technologies are instrumental in enabling the transition to high-solids and waterborne formulations, maintaining low VOC content while ensuring that the primer film achieves sufficient thickness, barrier properties, and durability in a single coat application, minimizing the need for multiple passes and accelerating industrial throughput.

The second major pillar of technological focus is the development of next-generation corrosion inhibition systems that are environmentally benign. Traditional anticorrosion primers often relied on heavy metal compounds (like chromates or lead pigments), which are now globally restricted. Contemporary 1K primers incorporate innovative, non-toxic alternatives, such as organic corrosion inhibitors (OCIs) and various forms of phosphate or phosphonate compounds encapsulated or integrated directly into the polymer matrix. Smart pigmentation technologies are also gaining prominence, where specialized pigments react dynamically to environmental breaches, releasing anticorrosive agents only when the coating integrity is compromised (e.g., micro-capsule technology). This targeted, self-healing protection significantly extends the service life of the primer layer and enhances its reliability in long-term structural applications without increasing the overall hazardous content of the formulation.

Furthermore, technology related to application efficiency and substrate complexity is crucial. This includes formulating primers with specific thixotropic properties and highly refined rheology modifiers that optimize performance for diverse application equipment, ranging from high-pressure airless sprayers in heavy industry to precision HVLP guns in automotive refinish. Manufacturers are investing heavily in technologies that allow for rapid force drying (quick-cure formulations suitable for accelerated bake cycles in OEM or repair shops) without compromising the final film hardness, flexibility, or intercoat adhesion. The continuous development of specialized adhesion promoters for challenging modern substrates, such as various reinforced plastics, carbon fiber composites, and pre-treated galvanized metals, further underscores the market's reliance on precise chemical and material science advancements to sustain the single-component format's high-performance relevance in high-tech manufacturing sectors globally.

Regional Highlights

Regional dynamics play a crucial role in shaping demand patterns and technological emphasis within the single-component primer sector, necessitating localized product development and marketing strategies.

- Asia Pacific (APAC): Dominating in market size and growth velocity, APAC demand is intrinsically linked to massive urbanization and government-backed infrastructure rollouts, particularly in China, India, and Southeast Asian nations. The region exhibits high consumption of cost-effective general-purpose 1K alkyd and solvent-based primers, although regulatory pressures in industrialized zones (Japan, South Korea, coastal China) are rapidly shifting demand toward performance-driven waterborne and specialized high-solids products, especially in the automotive manufacturing and marine sectors where export standards must be met.

- North America: Defined by stringent regional environmental mandates, particularly by the US EPA and California's CARB, the North American market demands premium, technologically advanced 1K primers with ultra-low VOC content. High expenditure on infrastructure maintenance (e.g., bridges, pipelines) and sophisticated automotive refinish processes drives the market for high-performance 1K epoxies and polyurethane primers, valuing application compliance, quick turnaround times, and certified protective guarantees. The shift toward electric vehicles also drives specialized primer demand for battery enclosure protection.

- Europe: The European market is the global leader in the adoption of sustainable and waterborne 1K technologies, largely due to the pervasive influence of REACH regulations and comprehensive EU directives on worker safety and environmental protection. Demand is robust across all sectors—automotive OEM, marine, and construction—with a strong preference for non-hazardous, non-isocyanate, and high-efficiency application systems. Germany and the Scandinavian countries are key innovation hubs for bio-based and sustainable primer formulations, setting global standards for chemical compliance and circular economy integration.

- Latin America (LATAM): This region displays moderate but accelerating growth, heavily correlated with local economic stability and investment in resource extraction (mining, oil, gas) and manufacturing, particularly in Brazil and Mexico. The markets are seeing increased professionalization in coatings application, driving demand for more reliable 1K industrial primers for heavy equipment and facilities maintenance. While cost considerations often outweigh environmental preference, the increasing need to meet international quality standards for export goods is driving limited adoption of advanced waterborne systems.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major petrochemical and infrastructure projects (e.g., Saudi Arabia, UAE, Qatar). The extreme climate—characterized by intense UV radiation, high salinity, and temperature fluctuations—creates unique challenges. This drives specific demand for heavy-duty 1K protective primers, primarily specialized solvent-based epoxies and urethanes designed for superior UV and thermal stability on offshore structures and industrial assets, making long-term performance under duress the key purchasing criterion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single-component Primer Market.- Sherwin-Williams Company

- PPG Industries Inc.

- AkzoNobel N.V.

- BASF SE

- Axalta Coating Systems Ltd.

- 3M Company

- Sika AG

- Henkel AG & Co. KGaA

- RPM International Inc.

- Jotun A/S

- Hempel A/S

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Diamond Vogel

- Chugoku Marine Paints, Ltd.

- Illinois Tool Works Inc. (ITW)

- Dow Inc.

- Wacker Chemie AG

- Beckers Group

- Carboline Company

- Tikkurila Oyj (Part of PPG)

- Valspar Corporation (Part of Sherwin-Williams)

- Asian Paints

- KCC Corporation

- Huber Group

- Cloverdale Paint Inc.

- Rust-Oleum Corporation

- Fosroc International Ltd.

- Huntsman Corporation

Frequently Asked Questions

Analyze common user questions about the Single-component Primer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using a single-component primer over a two-component system?

Single-component (1K) primers offer inherent benefits in application simplicity, requiring no mixing of components, which eliminates potential human error and material waste. They also facilitate easier inventory management and reduced pot life concerns, making them ideal for quick-drying and field repair applications across various end-use sectors, including automotive refinish, maintenance, and small-scale industrial projects where speed and operational simplicity are critical.

How is the Single-component Primer Market addressing stringent VOC regulations?

The market is predominantly addressing stricter Volatile Organic Compound (VOC) regulations through technological shifts towards high-solids, low-solvent formulations, and the accelerated development of advanced water-based 1K primers. Manufacturers are utilizing sophisticated polymer chemistry, including self-crosslinking dispersions, to ensure these eco-friendly options maintain performance parity with traditional solvent-based systems regarding adhesion and corrosion protection while complying with global mandates like the EU VOC Directive.

Which end-use industry represents the largest demand segment for 1K primers globally?

The Construction and Infrastructure segment, closely followed by the high-volume Automotive sector (encompassing both OEM manufacturing preparation and aftermarket collision repair), typically represents the largest demand segments for single-component primers. This is due to the massive global requirement for protective anticorrosion coatings for structural steel and the high-throughput nature of vehicle surface preparation where fast, simple application systems are essential.

What technological innovations are driving the performance improvements in water-based 1K primers?

Key innovations include the integration of advanced polymer chemistry, such as high-performance Polyurethane Dispersions (PUDs) and specialized self-crosslinking acrylics, which enhance film hardness and chemical resistance post-cure. Furthermore, the use of micro-encapsulated organic corrosion inhibitors and nano-pigmentation technologies is significantly improving anti-corrosion barrier properties without relying on traditional toxic heavy metals, bridging the performance gap with solvent-based epoxies.

How does the volatility of raw material costs impact the Single-component Primer Market?

The reliance on petrochemical derivatives for resins, solvents, and specialized additives means raw material price volatility exerts intense pressure on manufacturing margins. This necessitates complex hedging strategies, forces companies to pursue greater supply chain integration, and often requires rapidly passing cost increases down the value chain, leading to fluctuating final product pricing and increased competitive complexity for all market participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager