Single Crystal Germanium Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442037 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Single Crystal Germanium Market Size

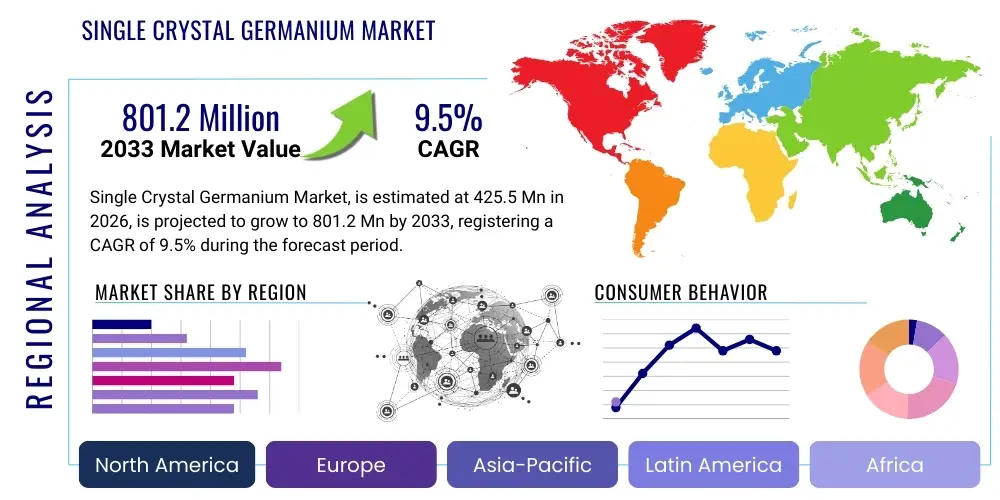

The Single Crystal Germanium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [9.5%] between 2026 and 2033. The market is estimated at [USD 425.5 Million] in 2026 and is projected to reach [USD 801.2 Million] by the end of the forecast period in 2033.

Single Crystal Germanium Market introduction

Single Crystal Germanium (SCGe) is a critical semiconductor material, distinguished by its lattice structure purity and superior electronic properties, including high carrier mobility and a suitable bandgap for specific applications. Historically significant in the early days of transistor technology, SCGe has re-emerged as indispensable in modern high-performance fields such as infrared optics, high-efficiency photovoltaics, and advanced fiber optics. Its high refractive index and excellent transmission in the 2 to 14 micrometer infrared band make it the material of choice for thermal imaging lenses and defense surveillance systems. The demand acceleration is intrinsically linked to global security investments, the rollout of 5G and 6G infrastructure requiring high-speed electronic components, and the burgeoning space-based solar power industry.

The primary product forms of SCGe include wafers, ingots, and optical blanks, tailored to precise application requirements. Germanium wafers, often used as substrates for epitaxial growth of compound semiconductors like Gallium Arsenide (GaAs) and Gallium Indium Phosphide (GaInP), are central to producing high-efficiency multi-junction solar cells critical for space satellites and terrestrial Concentrator Photovoltaics (CPV). Furthermore, the unique benefits of SCGe, such as its mechanical robustness and ease of processing compared to alternative infrared materials, solidify its position in demanding environments. Major applications span military night vision systems, automotive thermal sensing, satellite communication equipment, and the foundational materials for advanced semiconductor research aimed at next-generation computing.

Driving factors propelling this market include the escalating need for sophisticated thermal imaging technology in industrial monitoring and defense, the necessity for radiation-hardened solar cells in aerospace missions, and sustained investment in fiber optic networks that utilize germanium-doped cores for enhanced data transmission capabilities. The integration of SCGe into Silicon-Germanium (SiGe) alloys further fuels semiconductor applications, enabling the production of high-frequency integrated circuits (HIC) essential for modern wireless communication devices and high-speed data centers. The market benefits from continuous innovation in crystal growth techniques, which aim to reduce defects and improve the diameter size of SCGe ingots, consequently lowering overall production costs and broadening applicability.

Single Crystal Germanium Market Executive Summary

The Single Crystal Germanium market is currently defined by significant technological advancements across key application sectors, necessitating stringent quality control and high-purity material requirements. Business trends highlight a consolidation among primary germanium producers and wafer fabricators, striving for vertical integration to secure stable supply chains amid geopolitical tensions affecting raw material sourcing, primarily zinc and coal byproducts, from which germanium is extracted. Strategic partnerships between raw material providers and specialized crystal growth facilities are becoming commonplace to address the high capital expenditure and technical expertise required for producing defect-free, large-diameter SCGe ingots, driving market stability and pricing dynamics. Furthermore, the semiconductor industry's transition towards heterogeneous integration and smaller feature sizes is generating renewed interest in SiGe substrates, promising sustained growth in the electronics segment.

Regionally, the market is spearheaded by the Asia Pacific (APAC) region, largely due to immense investment in advanced electronics manufacturing, particularly in countries like China, Japan, and South Korea, which dominate global semiconductor and photonics production. North America and Europe maintain significant market shares, driven primarily by strong defense budgets demanding sophisticated infrared optics and robust aerospace programs requiring high-efficiency solar cells. Geopolitical maneuvering and export control regulations regarding high-purity materials, especially those with dual-use potential (military and civilian), significantly influence regional dynamics, encouraging regional self-sufficiency in manufacturing capacities within the major economic blocs.

Segment trends indicate that the Infrared Optics segment remains the dominant application area, closely followed by the Solar Cell segment, which exhibits the highest growth trajectory, particularly in the space-based power generation market. In terms of purity, the 99.999% and 99.9999% purity grades are experiencing rapid demand expansion, essential for semiconductor and fiber optic applications where minute impurities can drastically degrade performance. The focus on increasing the diameter of SCGe wafers—moving from 4-inch to 6-inch and 8-inch standards—is a key technology trend within the segmentation, reflecting the industry's need for higher throughput and reduced manufacturing costs in electronic component fabrication.

AI Impact Analysis on Single Crystal Germanium Market

User inquiries regarding the confluence of Artificial Intelligence (AI) and the Single Crystal Germanium (SCGe) market often center on three main themes: how AI enhances the material science and manufacturing processes, the role of SCGe in enabling AI hardware (especially edge computing and high-frequency systems), and potential market disruption from AI-driven material discovery. Users are specifically concerned about whether AI can optimize the challenging Czochralski growth method to reduce crystal defects and boost yield, thereby stabilizing supply and lowering costs. There is also significant interest in the indirect demand surge: AI models requiring massive data center infrastructure necessitate advanced high-speed interconnects (fiber optics) and specialized high-frequency transistors (SiGe-based RF front ends), both of which depend on Germanium substrates and components. The prevailing expectation is that AI will act as a primary demand driver for high-performance Germanium-containing components while simultaneously providing optimization tools for complex SCGe production.

The implementation of machine learning algorithms in SCGe production facilitates unprecedented levels of process control. Monitoring melt dynamics, temperature gradients, and crystal rotation speed in real-time allows AI systems to predict and preempt defect formation, such as twinning or dislocation clusters, which are detrimental to the material's electronic performance. This advanced monitoring capability is crucial for achieving the extremely high purity (up to 9N purity) demanded by epitaxial processes used in advanced photodetectors and next-generation communication devices. Furthermore, AI is increasingly employed in Quality Control (QC) protocols, utilizing image recognition and spectral analysis to automatically classify wafer quality and sort materials, significantly accelerating the qualification cycle for military and aerospace-grade components.

From a hardware perspective, the relentless computational requirements of large language models and other deep learning algorithms are pushing existing silicon capabilities to their limit, leading to greater adoption of specialized materials. SiGe heterojunction bipolar transistors (HBTs) offer superior speed and power efficiency compared to pure silicon alternatives, making them ideal for the RF and high-speed analog portions of AI accelerators and 5G/6G communication systems. Therefore, the proliferation of AI and the associated need for faster data throughput and reduced latency directly translates into increased demand for high-quality Germanium substrates and alloys, positioning SCGe as a fundamental enabler for the future infrastructure of AI-driven technologies.

- AI-driven optimization of the Czochralski crystal growth process, leading to reduced defect rates and higher material yield.

- Increased demand for Germanium-based SiGe HBTs and RF components, foundational to high-speed AI computing infrastructure and 5G/6G deployment.

- Enhanced quality control and automated fault detection in SCGe wafer fabrication using machine vision and deep learning models.

- Acceleration of materials discovery and testing for new Germanium compounds used in next-generation photonics and sensors.

- Predictive maintenance schedules for expensive SCGe manufacturing equipment, reducing downtime and improving operational efficiency.

DRO & Impact Forces Of Single Crystal Germanium Market

The dynamics of the Single Crystal Germanium (SCGe) market are governed by a robust set of driving factors intertwined with significant limitations and contingent upon emerging technological opportunities. The primary driver is the accelerating demand for high-resolution thermal imaging systems in global defense and security sectors, coupled with the mandatory requirement for radiation-hardened, high-efficiency multi-junction solar cells in the expanding satellite and space exploration industry. These applications demand the unique infrared transparency and suitable lattice match properties of SCGe. Conversely, the market faces constraints primarily related to the inherently high cost of raw germanium extraction, which is typically a byproduct of zinc smelting or fly ash processing, and the technical complexity and energy intensity of the single crystal growth process, which requires high capital investment and precision. The market remains sensitive to cyclical price volatility of raw Germanium, often influenced by geopolitical supply management strategies, particularly in regions that control the majority of the world's raw material reserves.

Opportunities in the SCGe market are substantial, centering on the growth of silicon-germanium (SiGe) technology for advanced microelectronics, specifically in high-frequency wireless communications (5G/6G), radar systems, and automotive sensors. Furthermore, the development of Germanium-based photodetectors and modulators is critical for Silicon Photonics, addressing the increasing need for high-speed, low-power optical interconnects within large data centers and telecommunication networks. These opportunities are catalyzed by ongoing materials science research focused on integrating Germanium onto silicon platforms, aiming to leverage silicon's low cost while utilizing Germanium’s superior optical and electronic characteristics. The impact forces acting upon the market are largely defined by substitution threats from alternative materials, such as chalcogenide glasses for infrared optics or III-V compounds for solar cells, though SCGe often maintains a performance advantage in specific, high-specification niches.

The impact forces also include regulatory pressures and environmental considerations. Germanium production, being linked heavily to zinc or coal processing, is subject to increasingly strict environmental regulations concerning mining and waste management, potentially raising production costs and restricting supply. However, increasing efforts in recycling Germanium from electronic scrap and end-of-life solar panels present a stabilizing force, offering a sustainable alternative to primary extraction. The competitive intensity within the crystal growth sector—dominated by a few highly specialized firms—exerts significant influence on pricing and technological innovation. The continued success of the SCGe market relies heavily on government investments in defense and space infrastructure, and the continuous push by the semiconductor industry toward higher performance, which SCGe intrinsically enables. The long-term trajectory is positive, provided raw material supply chains can be diversified and crystal growth yields are further optimized.

Segmentation Analysis

The Single Crystal Germanium market is categorized based on purity level, crystal growth method, application, and end-use industry. These segmentations are crucial for understanding market dynamics as the required quality and specifications of SCGe vary drastically depending on the intended use—for instance, semiconductor applications demand much higher purity (up to 9N) and lower defect density than standard optical components. The segmentation by crystal growth method, primarily Czochralski (CZ) versus Vertical Gradient Freeze (VGF) or Float Zone (FZ), dictates the achievable size, uniformity, and internal stress of the resulting ingot, directly influencing the suitability for high-demand electronic devices. Analyzing these segments helps stakeholders target specific niches, such as the rapidly expanding market for high-efficiency space solar cells or the stable, defense-driven market for infrared lenses.

- By Purity Level:

- 4N (99.99%)

- 5N (99.999%)

- 6N (99.9999%) and Higher (7N, 9N)

- By Crystal Growth Method:

- Czochralski (CZ) Method

- Vertical Gradient Freeze (VGF) Method

- Float Zone (FZ) Method

- By Application:

- Infrared Optics (Lenses, Windows, Filters)

- Solar Cells (Multi-Junction Space Solar Cells, CPV)

- Semiconductors and Electronics (SiGe Epitaxial Wafers, RF Devices, Detectors)

- Fiber Optics and Photonics (Optical Fibers, Modulators)

- Others (Chemical Catalysts, Scintillation Detectors)

- By End-Use Industry:

- Defense and Aerospace

- Telecommunications

- Consumer Electronics and Automotive

- Energy and Power

- Healthcare

Value Chain Analysis For Single Crystal Germanium Market

The value chain for Single Crystal Germanium is complex and highly concentrated, beginning with the upstream extraction and refining of raw Germanium metal. Germanium is predominantly sourced as a minor byproduct from primary zinc ore smelting and, in some regions, from the ash generated by specific coal combustion. This upstream dependence on other major commodity markets creates inherent price and supply volatility. Refinement processes involve extensive chemical purification to produce Germanium dioxide (GeO2), followed by reduction to high-purity Germanium metal (typically 4N to 5N). This initial stage requires significant chemical expertise and specialized high-temperature processing facilities, concentrating the initial control of the supply in the hands of a few global refining entities.

The midstream phase involves the highly specialized and capital-intensive process of Single Crystal Growth, where high-purity Germanium metal is melted and grown into defect-free single crystal ingots using techniques like the Czochralski method. These ingots are then sliced, polished, and finished into wafers or optical blanks of various diameters and thicknesses. This processing stage requires proprietary technological know-how regarding thermal management, atmospheric control, and mechanical cutting to maintain the structural integrity and purity essential for end-use applications. Specialized Germanium wafer fabricators and optical component manufacturers operate within this phase, adding substantial value through precision engineering and adherence to strict military and space-grade specifications.

Downstream distribution channels vary significantly based on the end application. For high-volume semiconductor and telecommunication customers (e.g., manufacturers of SiGe HBTs or fiber optic preforms), distribution often occurs directly from the specialized wafer or component fabricator to the OEM or epitaxial growth facility. For defense and aerospace applications, distribution frequently involves highly secure, indirect channels through approved defense contractors and system integrators who incorporate the SCGe optics or solar cells into final systems (e.g., satellites, night vision cameras). The inherent nature of SCGe as a mission-critical component often necessitates long-term supply agreements and direct engagement between the crystal grower and the high-value end-user, minimizing reliance on generalized material distributors, thereby ensuring quality and traceability throughout the entire chain.

Single Crystal Germanium Market Potential Customers

Potential customers for Single Crystal Germanium are concentrated within high-technology sectors where material performance and reliability are paramount, often overriding cost considerations. The largest segment of buyers comprises defense contractors and government agencies requiring advanced infrared (IR) systems for surveillance, missile guidance, and targeting. These entities purchase finished IR lenses and windows fabricated from SCGe due to its superior transmission characteristics in the long-wave infrared (LWIR) spectrum. A second major customer group includes aerospace companies and satellite manufacturers that require ultra-efficient, radiation-hardened multi-junction solar cells, utilizing Germanium wafers as the foundational substrate for their photovoltaic arrays, ensuring power stability in the harsh space environment. This segment is characterized by long development cycles and extremely demanding qualification standards.

The third substantial category of buyers includes leading semiconductor manufacturers and specialized epitaxial growth foundries. These customers acquire high-purity SCGe wafers, primarily 6N grade or higher, which are then used as substrates for the deposition of SiGe alloys or III-V compound semiconductors like GaAs and InGaP. These materials are integral to producing high-frequency transistors (HBTs), specialized photodetectors, and complex integrated circuits essential for 5G/6G infrastructure, high-speed networking, and advanced automotive radar systems (e.g., LiDAR). These customers seek large-diameter wafers (8-inch increasingly) to maximize yield and reduce per-chip cost. The final customer group encompasses telecommunication equipment providers and data center operators, which indirectly drive demand for SCGe used in fiber optic communication systems and optical modulators necessary for high-capacity data transmission and routing.

In essence, the primary buyers are not general electronics manufacturers but highly specialized firms operating in technologically critical fields. The buying process is characterized by rigorous material specification validation and often involves proprietary, long-term relationships to secure supply. Emerging customer segments include developers of quantum computing components and next-generation lithography systems, seeking Germanium’s unique physical properties for novel electronic and photonic devices. The geographic distribution of these customers mirrors the concentration of global defense spending and advanced semiconductor fabrication capabilities, reinforcing the market’s reliance on North America, APAC, and specific European nations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 425.5 Million] |

| Market Forecast in 2033 | [USD 801.2 Million] |

| Growth Rate | [9.5% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Umicore, Teck Resources, Indium Corporation, Yunnan Germanium Co., Ltd., AXT Inc., JSC Germanium, Photoneur, China Germanium, PPM Pure Metals GmbH, Recapture Metals Inc., Shanghai Zhaoxi Photoelectric Technology Co., Ltd., Nanjing Germanium Co., Ltd., Sumitomo Metal Mining Co., Ltd., Goodfellow Cambridge Ltd., American Elements, Wafer World Inc., Beijing Sanmu Electronic Materials Co., Ltd., Hebei Kinga Germanium Technology Co., Ltd., Xiamen Powerway Advanced Material Co., Ltd., PAM-XIAMEN. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Single Crystal Germanium Market Key Technology Landscape

The technological landscape of the Single Crystal Germanium (SCGe) market is centered on achieving ultra-high material purity, minimizing crystal defects, and scaling up wafer diameters to meet the throughput demands of the microelectronics industry. The Czochralski (CZ) method remains the dominant technique for growing large-diameter SCGe ingots, prized for its relatively high throughput. However, continual innovation is focused on enhancing CZ control systems—using sophisticated magnetic fields (MCZ) and advanced thermal modeling—to reduce melt convection turbulence, thereby decreasing impurities (especially oxygen) and eliminating micro-defects that degrade electronic performance. Simultaneously, the Float Zone (FZ) method, while lower volume, is critical for achieving the absolute highest purity (often 9N grade) required for specialized radiation detection and high-performance electronic research, as it avoids crucible contamination entirely. Manufacturers are investing heavily in automated pullers and post-growth annealing processes to optimize material characteristics.

In the application space, a major technological trend is the advancement of Silicon-Germanium (SiGe) epitaxy. Modern technology utilizes Chemical Vapor Deposition (CVD) techniques to grow strained or relaxed SiGe layers on silicon substrates, leveraging the high carrier mobility of Germanium while maintaining compatibility with low-cost silicon processing infrastructure. This technology is foundational for Heterojunction Bipolar Transistors (HBTs) and FinFET structures operating in the millimeter-wave spectrum, essential for 5G, 6G, and sophisticated radar systems. The ability to precisely control the Germanium concentration and strain profile within the epitaxial layer is a key differentiating technology among leading market players, driving performance metrics for high-speed devices.

Furthermore, significant focus is placed on enhancing the efficiency of multi-junction solar cells. SCGe wafers serve as critical substrates for the subsequent growth of multiple III-V compound semiconductor layers (e.g., GaInP/GaAs/Ge). Technological efforts are concentrated on improving the quality of the Germanium substrate surface preparation and minimizing lattice mismatch induced defects at the interface, thereby boosting the overall conversion efficiency and radiation tolerance of the solar cell. In the infrared optics sector, the technology involves specialized anti-reflection coatings and surface treatments applied to SCGe lenses to maximize transmission efficiency across the 8–14 µm thermal band, ensuring performance stability under extreme operational conditions, crucial for military and space imaging systems. These technological advancements ensure SCGe maintains its competitive edge against substitute materials like zinc sulfide or silicon lenses.

Regional Highlights

- Asia Pacific (APAC): The APAC region is the undisputed leader in the Single Crystal Germanium market, driven by its expansive semiconductor manufacturing base and substantial investment in telecommunications infrastructure. Countries like China, which holds a dominating position in raw Germanium production, and key manufacturing hubs such as Taiwan and South Korea, which host major foundries producing SiGe chips, are central to this dominance. The region’s aggressive push into 5G deployment, coupled with large-scale data center construction, fuels demand for high-speed Germanium-enabled optical fibers and RF components. Furthermore, domestic defense and space programs in India, Japan, and China contribute significantly to the demand for IR optics and multi-junction solar cells. The presence of vertically integrated companies, from raw material extraction to final wafer processing, solidifies APAC's market control, though recent export restrictions introduced by some regional governments have created supply chain complexity for Western consumers, influencing global pricing and encouraging diversification efforts elsewhere. The sheer volume of electronics production and the continuous drive for technological superiority in areas like artificial intelligence hardware ensure that APAC will remain the primary consumption and production center for SCGe materials throughout the forecast period.

- North America: North America represents a mature, high-value market segment, characterized by rigorous quality requirements and strong governmental investment in defense and aerospace sectors. The United States, in particular, drives substantial demand for SCGe, primarily for its application in high-performance thermal imaging systems used by the Department of Defense (DoD) and in advanced satellite and space probe missions managed by NASA and private aerospace entities. The technological focus in this region is on high-specification, radiation-hardened components and the development of cutting-edge SiGe architectures for military radar and advanced communications systems (e.g., electronic warfare). While North America relies heavily on imported raw Germanium, the region excels in downstream crystal growth and specialized fabrication, producing some of the world's highest-quality optical and electronic grade wafers. Sustained high defense spending and private sector innovation in space technology and telecommunications maintain robust demand, emphasizing materials that deliver superior reliability and longevity.

- Europe: Europe holds a strong position, particularly in specialized industrial and automotive applications, alongside its established role in defense and space programs (e.g., European Space Agency - ESA). Key countries like Germany, France, and the UK are major consumers, leveraging SCGe for advanced infrared sensors in autonomous vehicles, high-end industrial monitoring equipment, and sophisticated medical imaging devices. The European focus on sustainability and energy efficiency also drives demand for high-efficiency photovoltaic applications, although often concentrated in CPV systems rather than traditional utility-scale solar farms. European market players are often specialized material suppliers and component manufacturers, emphasizing R&D into alternative growth methods and recycling technologies to mitigate reliance on external raw material sources. The market growth is supported by EU initiatives promoting advanced microelectronics and the adoption of cutting-edge sensing technology across diverse industrial automation processes.

- Latin America, Middle East, and Africa (MEA): The MEA and Latin American regions currently represent smaller but growing markets for Single Crystal Germanium. Growth in the Middle East is primarily driven by significant security and defense expenditures, leading to increased adoption of advanced thermal surveillance and security systems, which rely heavily on Germanium IR optics. Additionally, sovereign wealth fund investments in diversified high-technology sectors, including satellite communication projects, contribute to the demand for space-grade solar cells. Latin America’s demand is more segmented, often tied to specific large-scale infrastructure projects, such as upgrades to telecommunication networks requiring fiber optics and specific energy sector applications. These regions are primarily end-users and rely almost entirely on imports for both raw materials and finished SCGe components, making their market dynamics sensitive to global supply fluctuations and pricing structures established by manufacturers in APAC, North America, and Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Single Crystal Germanium Market.- Umicore

- Teck Resources

- Indium Corporation

- Yunnan Germanium Co., Ltd.

- AXT Inc.

- JSC Germanium

- Photoneur

- China Germanium

- PPM Pure Metals GmbH

- Recapture Metals Inc.

- Shanghai Zhaoxi Photoelectric Technology Co., Ltd.

- Nanjing Germanium Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Goodfellow Cambridge Ltd.

- American Elements

- Wafer World Inc.

- Beijing Sanmu Electronic Materials Co., Ltd.

- Hebei Kinga Germanium Technology Co., Ltd.

- Xiamen Powerway Advanced Material Co., Ltd.

- PAM-XIAMEN

Frequently Asked Questions

Analyze common user questions about the Single Crystal Germanium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Single Crystal Germanium?

The demand for Single Crystal Germanium (SCGe) is primarily fueled by high-specification applications in three critical areas: high-performance infrared (IR) optics used in military and surveillance thermal cameras; high-efficiency multi-junction solar cells, essential for powering satellites and space missions due to their radiation tolerance; and advanced SiGe semiconductors utilized in high-frequency RF devices for 5G/6G communication systems and radar technology.

How do geopolitical factors impact the global supply and pricing of Single Crystal Germanium?

Geopolitical factors critically affect the SCGe market because raw Germanium is primarily a byproduct extracted during zinc refining, and a significant portion of global supply originates from a few concentrated regions. Export restrictions or tariffs imposed by major producing nations can severely disrupt the global supply chain, leading to significant price volatility and encouraging end-users, especially those in defense, to seek diversified or localized sourcing strategies to ensure supply stability.

What is the technological significance of using the Czochralski (CZ) method for SCGe production?

The Czochralski (CZ) method is the standard crystal growth technique for SCGe because it allows for the production of large-diameter ingots (up to 8 inches), which is essential for high-volume semiconductor wafer fabrication. While it requires rigorous control to minimize defects, CZ-grown SCGe provides the structural purity and size necessary to serve as the foundation substrate for epitaxial growth in both microelectronics and high-efficiency solar cell manufacturing, ensuring cost-effectiveness at scale.

How is Single Crystal Germanium utilized in the advancement of 5G and 6G technologies?

SCGe is foundational to next-generation wireless technology through its use in Silicon-Germanium (SiGe) alloys. SiGe epitaxial layers, grown on Germanium or silicon substrates, enable the creation of high-speed Heterojunction Bipolar Transistors (HBTs) that operate efficiently at the millimeter-wave frequencies required by 5G and emerging 6G networks. These materials provide superior carrier mobility and linearity, crucial for power amplifiers and RF front-end modules in advanced wireless communication devices.

Are there viable alternative materials that pose a threat of substitution to Single Crystal Germanium?

Yes, substitution threats exist, although SCGe retains critical performance advantages in specific niches. For infrared optics, chalcogenide glasses or specialized silicon can serve as alternatives, but they often lack SCGe's broad spectral range or robustness. In high-efficiency photovoltaics, certain III-V compounds can be used directly, but Germanium substrates offer a superior lattice match for specific multi-junction solar cell structures. Overall, substitution is highly dependent on the required operating specifications and cost constraints of the final product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Single Crystal Germanium Market Statistics 2025 Analysis By Application (Semiconductor Device, Solar Battery, Infrared Imager), By Type (Solar Grade, Infrared Grade, Detector Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Single Crystal Germanium Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Solar Grade, Infrared Grade, Detector Grade), By Application (Semiconductor Device, Solar Battery, Infrared Imager), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager