Sinter HIP Furnaces Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442121 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Sinter HIP Furnaces Market Size

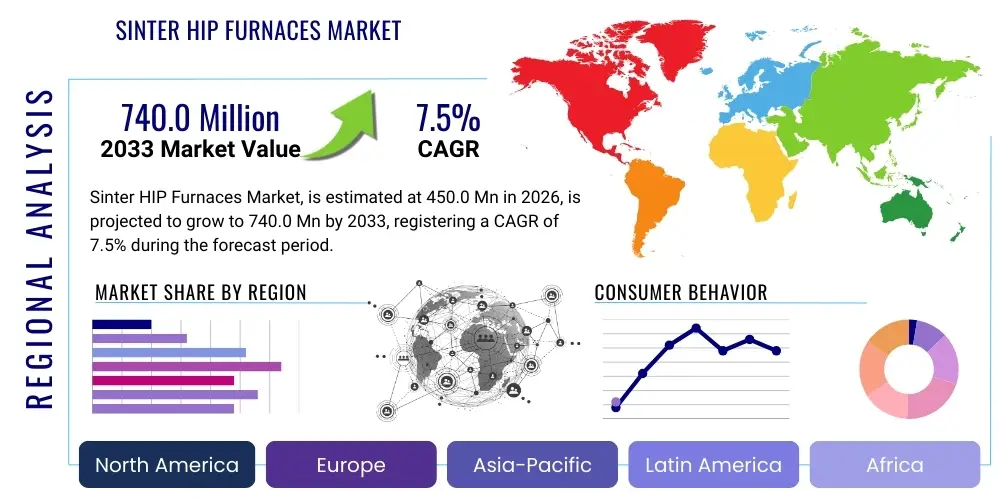

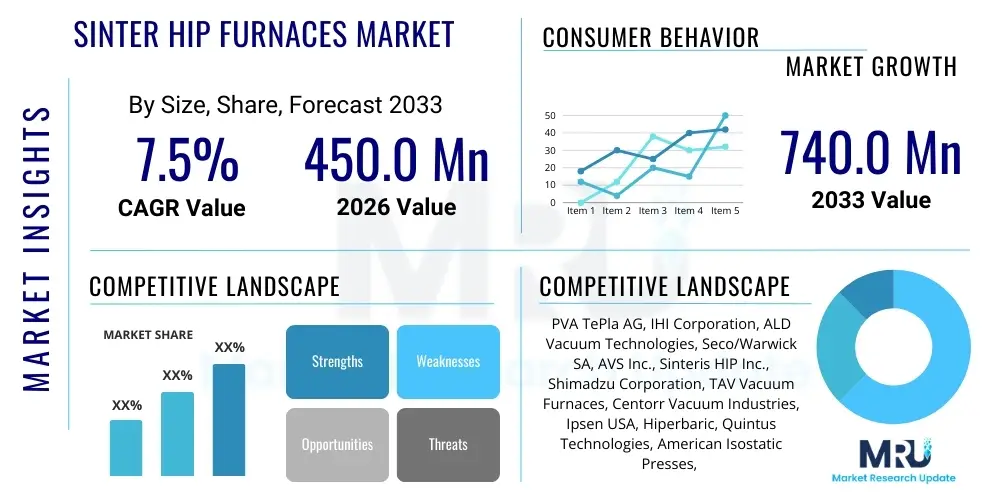

The Sinter HIP Furnaces Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.0 million in 2026 and is projected to reach USD 740.0 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance components characterized by exceptional density, reduced porosity, and superior mechanical properties, particularly within critical industries such as aerospace, defense, and advanced tooling. The shift towards materials like ceramics, hard metals, and superalloys necessitates specialized processing capabilities that only Sinter HIP (Hot Isostatic Pressing) furnaces can reliably provide, ensuring material integrity and lifecycle performance.

Sinter HIP Furnaces Market introduction

Sinter HIP Furnaces, highly specialized vacuum equipment, combine the process of pressure sintering with Hot Isostatic Pressing (HIP) in a single cycle. This integration is crucial for the densification of powder metallurgy parts, eliminating residual porosity left after conventional sintering and significantly enhancing the components’ mechanical strength, fatigue resistance, and overall reliability. These furnaces typically operate at extreme temperatures, often exceeding 2,000°C, and under high inert gas pressure, commonly argon, which facilitates optimal metallurgical bonding and microstructural homogeneity across complex geometries.

Major applications for Sinter HIP technology span across various high-stakes sectors. In the aerospace industry, they are indispensable for manufacturing turbine blades, engine components, and structural parts made from nickel-based superalloys, where zero defect rates are paramount. The medical sector utilizes Sinter HIP for creating porous coatings on orthopedic implants and manufacturing high-strength ceramic components. Furthermore, the tooling and defense industries rely on these furnaces for producing high-speed steels, cemented carbides, and armor plating materials that require superior wear resistance and toughness under extreme operating conditions. The primary benefit derived is the production of near-net-shape components with densities approaching 100% of theoretical maximum, drastically reducing the need for costly post-processing machining.

Driving factors for market growth include the global expansion of additive manufacturing (AM), particularly metal 3D printing, which often requires subsequent HIP treatment to close internal defects and achieve structural integrity suitable for end-use parts. Additionally, increasing investments in renewable energy technologies, such as advanced wind turbine components and high-performance electronic packaging, are fueling demand for materials processed under Sinter HIP conditions. The continuous innovation in materials science, focusing on complex composites and ultra-hard materials, further mandates the use of these advanced processing solutions, positioning Sinter HIP furnaces as foundational technology for future industrial manufacturing.

Sinter HIP Furnaces Market Executive Summary

The Sinter HIP Furnaces market exhibits robust business trends characterized by intense technological competition focused on increasing chamber size, improving energy efficiency, and integrating sophisticated automation systems. Key industry players are increasingly investing in modular designs that allow customization for specific material requirements, addressing the diverse needs of aerospace and medical device manufacturers. The overarching business strategy centers on providing turnkey solutions that include pre-sintering preparation and fully integrated data logging capabilities, enhancing traceability and quality assurance for mission-critical parts. Furthermore, market participants are establishing stronger service networks globally to manage the complex maintenance requirements associated with high-pressure, high-temperature equipment, thereby locking in long-term customer relationships and optimizing operational uptime.

Regionally, the market is spearheaded by the Asia Pacific (APAC) region, primarily driven by rapid industrialization, expansive growth in the automotive sector (especially electric vehicles requiring high-density magnetic materials and battery components), and significant governmental investments in defense and aerospace capabilities in countries like China, Japan, and South Korea. North America maintains a strong position, focusing on high-value, low-volume production related to advanced aerospace research, defense contracts, and specialized medical implant manufacturing, demonstrating a preference for ultra-high-precision and rapid prototyping capabilities. Europe, particularly Germany and France, remains a vital hub due to its established precision engineering heritage and stringent quality standards, driving demand for furnaces capable of handling specialized hard metals and cutting tools used across the manufacturing base.

In terms of segment trends, the capacity segment reveals a growing bifurcation: a strong demand for small, flexible research and development scale units to support materials innovation, alongside increasing requirements for very large chambers necessary for mass production of large structural components, particularly in the defense and infrastructure sectors. The material processing segment shows cemented carbides and high-performance ceramics dominating current revenue, although superalloys and intermetallics are projected to exhibit the fastest growth trajectory, stimulated by the evolution of gas turbine technology and advanced battery materials. Manufacturers are therefore concentrating their R&D efforts on enhancing temperature uniformity and ensuring reliable pressure control systems to handle the volatile processing requirements of these highly sensitive materials, optimizing yield rates and reducing material waste.

AI Impact Analysis on Sinter HIP Furnaces Market

Common user questions regarding AI’s impact on Sinter HIP Furnaces often revolve around predictive maintenance schedules, optimization of complex processing cycles, and real-time defect detection capabilities. Users are keen to understand how machine learning can analyze vast datasets of pressure, temperature, and material inputs to autonomously adjust cycle parameters, reducing cycle time while simultaneously maximizing component density and microstructure uniformity. Key concerns include the reliability of AI algorithms in interpreting anomalies within high-pressure environments and the integration challenges with legacy furnace control systems. The overarching expectation is that AI will transform Sinter HIP from a highly empirical, operator-dependent process into a fully automated, self-optimizing system, significantly improving throughput, energy efficiency, and material yield, especially for extremely costly materials processed in these high-value systems.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature drift, and pressure fluctuation data to predict component failure (e.g., heating elements, compressors) before operational disruption, maximizing furnace uptime.

- Cycle Optimization and Recipe Generation: Machine learning models process thousands of historical runs to automatically suggest or modify temperature ramps, pressure application timing, and soak times to achieve optimal material properties with reduced energy consumption.

- Real-Time Quality Control (QC): AI systems integrate with internal sensors to monitor gas composition and thermal gradients, instantly flagging deviations that could lead to component porosity or grain boundary defects.

- Energy Efficiency Management: AI dynamically adjusts power input based on real-time material behavior and energy spot pricing, minimizing operational costs associated with the extremely high power draw of HIP systems.

- Accelerated R&D and Materials Discovery: AI facilitates the simulation and testing of new processing parameters for novel alloys and ceramics, dramatically shortening the lead time for developing high-performance Sinter HIP applications.

DRO & Impact Forces Of Sinter HIP Furnaces Market

The Sinter HIP Furnaces market is primarily driven by the mandatory requirements for high-integrity components in critical applications, coupled with technological advancements in powder metallurgy and additive manufacturing post-processing. Key restraints include the exceptionally high initial capital investment required for these furnaces and the associated operational complexity, demanding highly skilled technicians and specialized infrastructure. Opportunities are emerging through the adoption of large-format Sinter HIP systems tailored for next-generation electric vehicle (EV) battery components and advanced defense platforms. The overall impact forces dictate a shift towards automation and operational efficiency, compensating for high upfront costs and positioning Sinter HIP as a prerequisite for achieving performance benchmarks in advanced material engineering, particularly as globalization drives down tolerance for material defects and emphasizes lightweighting strategies across transportation sectors.

Drivers: A major driver is the accelerating demand for advanced hard metals and ceramics used in wear parts, cutting tools, and mining equipment, which require maximum density and superior toughness achievable only through Sinter HIP. Furthermore, the rapid growth of the commercial aerospace maintenance, repair, and overhaul (MRO) sector, which relies on defect-free parts, continuously fuels the need for Sinter HIP capacity. The increasing prevalence of complex superalloys in extreme temperature environments, such as those found in hypersonic flight programs and high-efficiency gas turbines, mandates integrated densification techniques to ensure structural reliability. The commitment by key industrial nations to upgrade military technology also drives consistent demand for high-strength, lightweight armor materials and specialized ammunition components, all processed using this technology.

Restraints: The primary restraint is the extremely high cost of acquiring, installing, and maintaining Sinter HIP equipment. These systems require specialized high-pressure vessels, intricate heating and cooling systems, and robust safety protocols, leading to significant financial barriers to entry for smaller manufacturers. Operational complexity, including the need for specialized training in high-pressure gas handling and vacuum technology, poses a bottleneck for widespread adoption. Additionally, the lengthy cycle times associated with combined sintering and HIP processes, which can span several hours or days depending on the material and component size, limit throughput and necessitate careful production planning, potentially restraining high-volume manufacturing applications.

Opportunities: Significant market opportunities lie in the integration of Sinter HIP technology into the Additive Manufacturing (AM) workflow, offering a vital pathway to achieving fully certified, high-density metal AM parts. The burgeoning demand for high-performance materials in the electrification of vehicles, specifically components like power electronics substrates, magnetic cores, and high-energy-density battery parts, presents a fertile ground for new applications. Furthermore, the development of furnaces that can handle reactive materials or implement faster cooling rates represents a major opportunity to enhance efficiency and expand the material spectrum addressable by Sinter HIP, opening doors to advanced material research and specialized industrial components.

Segmentation Analysis

The Sinter HIP Furnaces Market is highly specialized and segmented based on key operational parameters that dictate their suitability for various industrial applications. Segmentation by processing capacity (small, medium, large) is critical, differentiating units used for academic research and prototyping from those designed for high-volume industrial production. The segmentation by temperature range (up to 1600°C, 1600°C to 2000°C, and above 2000°C) directly reflects the type of advanced material the furnace is capable of handling, with ultra-high temperature models being essential for processing advanced ceramics and specific refractory metals. This detailed segmentation allows manufacturers to target specific end-user needs, offering tailored solutions that optimize capital expenditure and operational throughput.

Further segmentation by end-use application highlights the core revenue streams of the market. The aerospace segment demands the highest precision and reliability, often utilizing larger, high-temperature units for superalloys. Conversely, the tooling and hard metals sector, focusing on cemented carbides, drives consistent demand across medium-sized furnaces. The burgeoning medical and dental application segment emphasizes smaller, highly controlled units suitable for complex, biocompatible materials. Understanding these nuanced segments is essential for strategic market penetration and product development, ensuring that furnace design meets the stringent regulatory and performance requirements unique to each industry.

Technological advancement is continuously influencing these segments. For instance, the demand for furnaces with integrated rapid cooling capabilities is growing across all segments to reduce overall cycle time, which directly impacts production economics. Similarly, the integration of advanced sensors and control systems, often leveraging AI, is becoming a standard feature, especially in high-temperature and large-capacity furnaces, reflecting the industry's focus on maximizing yield and ensuring batch consistency across all specialized operations, thereby driving value propositions beyond mere dimensional capacity.

- By Capacity (Volume):

- Small Capacity (Under 50 Liters) - Predominantly R&D and specialized medical/dental applications.

- Medium Capacity (50 Liters to 200 Liters) - Standard for cemented carbides and general tooling.

- Large Capacity (Above 200 Liters) - Utilized for mass production, aerospace components, and large structural parts.

- By Operating Temperature:

- Low-Temperature Systems (Up to 1600°C) - Used mainly for specific metal alloys and powder forging.

- Mid-Temperature Systems (1600°C to 2000°C) - Standard for superalloys and most hard metals.

- Ultra-High-Temperature Systems (Above 2000°C) - Essential for advanced technical ceramics and refractory materials like Tungsten.

- By Material Processed:

- Cemented Carbides (Hard Metals)

- Technical Ceramics (e.g., Alumina, Zirconia)

- Superalloys and Intermetallics (Nickel-based, Titanium alloys)

- High-Speed Steels (HSS)

- By End-Use Application:

- Aerospace and Defense

- Automotive and Transportation (including EV components)

- Tooling and Wear Parts Manufacturing

- Medical and Dental Implants

- Electronics and Semiconductors

Value Chain Analysis For Sinter HIP Furnaces Market

The Sinter HIP Furnaces value chain begins with highly specialized upstream suppliers who provide critical components, including high-purity graphite and molybdenum heating elements, advanced insulation materials (like graphite felt or molybdenum sheets), and high-pressure compressors and vessels. These raw materials and component providers must adhere to extremely high quality and specification standards, as the operational integrity of the furnace relies heavily on the durability of these internal components under simultaneous high heat and extreme pressure. The competition in this upstream segment focuses on material purity, thermal stability, and long-term reliability, directly impacting the overall manufacturing cost and performance characteristics of the final furnace system. Manufacturers often maintain long-term, exclusive partnerships with these core suppliers to ensure material traceability and predictable supply of exotic materials.

The middle segment of the value chain consists of the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the Sinter HIP systems. This stage involves complex engineering tasks related to vacuum system integrity, thermal uniformity, and safety interlocking mechanisms necessary for handling high-pressure inert gases. OEMs differentiate themselves through technological innovation, such as developing proprietary hot zones, improving furnace energy efficiency, and integrating sophisticated control software, often customized for specific material processing cycles. Distribution channels are predominantly direct, given the high capital value and technical complexity of the equipment. Direct sales allow OEMs to provide comprehensive pre-sales consultation, installation support, technical training, and subsequent maintenance services, which are critical components of the total value proposition.

Downstream analysis focuses on the end-users—the component manufacturers (e.g., aerospace parts suppliers, carbide tooling factories) and research institutions. The indirect distribution route occasionally involves specialized technical distributors or engineering firms that facilitate sales, particularly in emerging markets, but the primary long-term value capture is through aftermarket services, spare parts supply, and process optimization consulting provided directly by the OEM. The end-users prioritize process reliability, throughput capacity, and the ability to achieve stringent material certification, making operational uptime and technical support the most critical factors in the downstream segment. The successful integration into the customer's production line is the final crucial step, where the furnace’s performance directly translates into the quality and profitability of the end product, such as a high-performance turbine blade or a durable cutting insert.

Sinter HIP Furnaces Market Potential Customers

The primary consumers of Sinter HIP Furnaces are enterprises deeply involved in manufacturing components where material integrity and performance under extreme stress are non-negotiable. This encompasses major Original Equipment Manufacturers (OEMs) in the aerospace industry, including those producing commercial jet engines and military aircraft, who require materials like superalloys and ceramics to operate reliably at high temperatures. These buyers are characterized by rigorous qualification processes, long procurement cycles, and a continuous need for equipment capable of handling increasingly complex and exotic materials. Their purchase decisions are heavily influenced by process control accuracy, data logging capabilities for certification compliance, and the ability to minimize material waste due to the high cost of input materials.

Another significant customer segment includes specialized manufacturers in the tooling and hard metals sector. These companies produce cemented carbide cutting tools, drilling inserts, and wear components used across various industries, from construction and mining to precision machining. For these end-users, throughput and consistency are key metrics. They seek medium to large capacity Sinter HIP systems that offer high efficiency and durability to maximize the lifespan of their products, which directly translates to improved performance for their downstream clients. The need for uniform density and grain structure to enhance tool longevity drives their reliance on combined Sinter HIP technology over conventional sintering methods.

Furthermore, the growing biomedical and dental implant manufacturing industry represents a high-growth segment of potential customers. These manufacturers require small to medium-sized, high-precision furnaces to process biocompatible materials such as titanium alloys and specialized ceramics for orthopedic and dental applications. For this segment, regulatory compliance, the ability to achieve highly specific material porosity levels (e.g., for osseointegration), and exceptional cleanliness standards are paramount. Research institutions and advanced materials laboratories also form a consistent customer base, purchasing smaller, flexible units for materials research, process development, and establishing fundamental knowledge required for future industrial adoption across emerging technological fields like solid-state batteries and advanced nuclear components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 million |

| Market Forecast in 2033 | USD 740.0 million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PVA TePla AG, IHI Corporation, ALD Vacuum Technologies, Seco/Warwick SA, AVS Inc., Sinteris HIP Inc., Shimadzu Corporation, TAV Vacuum Furnaces, Centorr Vacuum Industries, Ipsen USA, Hiperbaric, Quintus Technologies, American Isostatic Presses, CETAC Technologies, CM Furnaces. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sinter HIP Furnaces Market Key Technology Landscape

The technological landscape of Sinter HIP Furnaces is rapidly evolving, driven primarily by the need for enhanced process control, increased operational safety, and higher energy efficiency. A pivotal innovation involves advanced hot zone design, moving beyond traditional resistance heating elements to adopt inductive or hybrid heating systems, which offer superior temperature uniformity and faster ramping capabilities, particularly crucial when processing large or geometrically complex parts. The use of robust, modular graphite or refractory metal hot zones ensures longevity under cyclic high-temperature operations, while sophisticated multi-zone temperature control systems, often utilizing dozens of thermocouples, maintain thermal precision across the entire chamber volume. These advancements are necessary to meet the stringent material property requirements demanded by the aerospace and medical sectors, where deviations in microstructure are unacceptable.

Another significant technological development focuses on high-pressure gas management and sealing systems. Modern Sinter HIP furnaces utilize advanced digital proportional control valves for precise and repeatable pressure ramping and cooling, enabling complex, multi-step processing cycles required for intermetallic and ceramic matrix composites. Safety systems have also seen substantial upgrades, incorporating multiple layers of interlocks, non-destructive monitoring of the pressure vessel integrity (acoustic emission monitoring), and improved rapid decompression protocols. Furthermore, the integration of vacuum technology has improved, ensuring ultra-low base pressure levels before gas introduction, which is vital for preventing material contamination and ensuring optimal chemical reactions during the sintering phase, particularly with materials sensitive to residual oxygen or moisture.

Finally, the focus on digitalization and automation defines the future trajectory of Sinter HIP technology. Modern furnaces incorporate SCADA (Supervisory Control and Data Acquisition) systems, enabling remote monitoring, detailed data logging, and seamless integration with factory management systems. This level of digitalization is foundational for implementing AI-driven process optimization, allowing the furnace to adapt cycle parameters based on real-time material feedback and predicted outcomes. Furthermore, automated material handling, including robotic loading and unloading systems, is becoming standard for large-capacity industrial furnaces, minimizing human interaction with the high-temperature environment, enhancing workplace safety, and reducing the potential for batch contamination or damage during material transfer, thereby dramatically boosting overall production throughput and reducing operational variability.

Regional Highlights

North America: The North American market, dominated by the United States, represents a core hub for high-value Sinter HIP applications, characterized by strong governmental and private investment in aerospace, defense, and advanced biomedical technology. This region commands a significant share due to the stringent quality requirements and high regulatory standards imposed by bodies such as the FAA and FDA, mandating the use of densification technologies that guarantee zero-defect parts. Demand here is typically focused on small to medium-batch production of superalloys for next-generation jet engines and orthopedic implants. Key market drivers include the resurgence in defense spending, particularly in military modernization and advanced materials research related to hypersonic propulsion, and a robust ecosystem of specialized powder metallurgy companies constantly pushing the boundaries of material performance. The regional emphasis is on technological leadership, driving demand for furnaces incorporating the latest automation and digital integration features, supporting localized, highly precise manufacturing capabilities.

Europe: Europe holds a technologically mature market position, driven by Germany’s dominance in precision tooling and hard metal production, and France’s robust aerospace sector. European manufacturers demonstrate a strong focus on energy efficiency and sustainability, driving demand for Sinter HIP systems that minimize power consumption per processed kilogram. The regional market is characterized by a strong historical presence of cemented carbide producers who rely on these furnaces for high-volume, reliable production of wear parts and cutting tools. Furthermore, advanced European R&D projects, supported by organizations like the European Space Agency (ESA) and various EU funding initiatives, consistently generate demand for ultra-high-temperature furnaces required for novel ceramic matrix composites and intermetallic compounds. Strict environmental regulations also push equipment suppliers to develop closed-loop gas recycling and cleaner operational methodologies, positioning European demands as a bellwether for sustainable advanced manufacturing practices globally.

Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth rate, fueled by massive expansion in manufacturing capabilities, particularly in China, India, and South Korea. This growth is underpinned by substantial domestic investments in infrastructure, the automotive industry (specifically EV battery components and powertrains), and localized defense modernization programs. The APAC market segment tends to focus on high-throughput, large-capacity Sinter HIP furnaces to meet the scale of industrial demand for hard metal inserts and automotive components. China, in particular, is rapidly becoming a global leader in both consumption and localized manufacturing of these furnace systems, often adapting designs to meet aggressive production quotas. While North America and Europe prioritize complexity and precision, the APAC region emphasizes scalability, cost-effectiveness, and the rapid adoption of mature technologies to achieve industrial dominance, making it the highest volume market for Sinter HIP equipment globally.

Latin America and Middle East & Africa (MEA): These regions currently represent smaller but growing markets for Sinter HIP furnaces. Demand in Latin America is primarily driven by the mining and resource extraction sectors, which require durable, high-wear resistant tools and components, particularly in countries like Brazil and Chile. The MEA region's demand is spurred by burgeoning defense budgets and strategic investments in localized energy infrastructure, including oil and gas drilling equipment that utilizes specialized wear-resistant materials. While market penetration remains limited compared to the dominant regions, opportunities exist for focused sales of medium-capacity systems targeting specific high-growth industrial clusters, often facilitated through strategic partnerships with local distributors who can provide necessary technical support and training in environments with less established high-tech service infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sinter HIP Furnaces Market.- PVA TePla AG

- IHI Corporation

- ALD Vacuum Technologies GmbH

- Seco/Warwick SA

- Quintus Technologies AB

- AVS Inc.

- TAV Vacuum Furnaces

- Centorr Vacuum Industries

- Hiperbaric S.A.

- Sinteris HIP Inc.

- Shimadzu Corporation

- Ipsen USA

- Brewster & Co. Industrial Heat Treating Equipment

- American Isostatic Presses (AIP)

- CM Furnaces

- G-M Enterprises

- CETAC Technologies Co., Ltd.

- Dongpu Vacuum Technology

- Zhuji Huasheng Industrial Furnace Co., Ltd.

- Dowa Thermotech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Sinter HIP Furnaces market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a Sinter HIP furnace over separate sintering and HIP processes?

The primary benefit is process integration, which drastically reduces cycle time and energy consumption by consolidating two critical thermal operations into one vacuum chamber. This single-step processing minimizes material handling, reduces the risk of contamination, and ultimately ensures superior final material properties, such as near 100% theoretical density and optimized microstructures, crucial for aerospace certification.

Which end-use industry drives the highest demand for Sinter HIP Furnaces?

The aerospace and defense sector consistently drives the highest demand, particularly for large, high-temperature Sinter HIP systems. This industry requires absolutely defect-free components made from advanced superalloys and ceramics, where the material integrity provided by combined pressure sintering is mandatory for safety-critical applications like turbine components and structural airframe parts.

How does the high initial cost of Sinter HIP equipment impact market entry for small manufacturers?

The extremely high initial capital cost for Sinter HIP furnaces acts as a significant barrier to entry for small and medium-sized enterprises (SMEs). This often forces smaller companies to rely on specialized third-party service providers (toll-processing centers) for their densification needs, limiting direct ownership primarily to large-scale component manufacturers or specialized niche material innovators.

What role does Additive Manufacturing (AM) play in the growth of the Sinter HIP market?

Additive Manufacturing is a critical growth driver. Components produced via metal 3D printing often contain inherent internal porosity. Sinter HIP is the most effective post-processing method to close these internal voids, achieving the necessary high density and mechanical robustness required for final-use parts, making the furnace a prerequisite technology for certified AM production.

What technological factors are currently prioritizing Sinter HIP equipment manufacturers?

Manufacturers are currently prioritizing increased automation, integration of AI for predictive maintenance and cycle optimization, and enhanced energy efficiency. Focus is placed on developing modular, scalable furnace designs with faster cooling rates and superior temperature uniformity across larger chamber volumes to reduce overall operational costs and increase throughput reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager