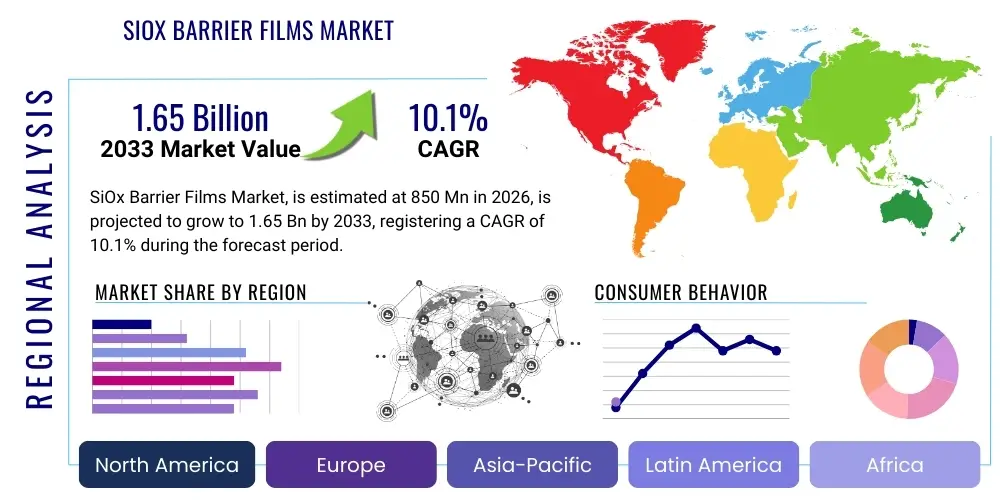

SiOx Barrier Films Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441649 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

SiOx Barrier Films Market Size

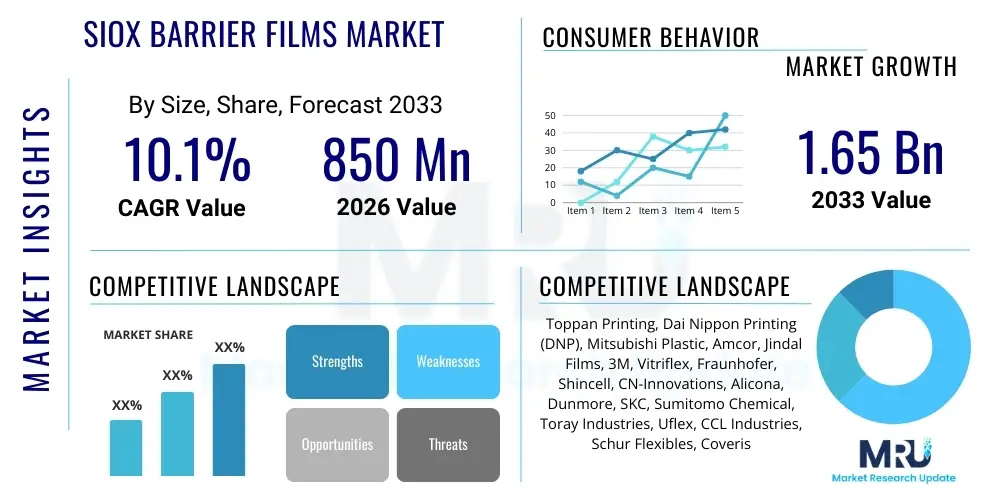

The SiOx Barrier Films Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1.65 billion by the end of the forecast period in 2033.

SiOx Barrier Films Market introduction

SiOx (Silicon Oxide) barrier films are advanced flexible packaging materials utilizing plasma-enhanced chemical vapor deposition (PECVD) or physical vapor deposition (PVD) to coat plastic substrates, primarily polyethylene terephthalate (PET), with ultra-thin layers of silicon oxide. This inorganic coating provides exceptional barrier properties against oxygen and moisture, crucial for preserving sensitive products. These films are increasingly replacing traditional aluminum foil barriers in applications requiring transparency, microwaveability, and recyclability. The core benefit lies in achieving high barrier performance using minimal material, contributing significantly to sustainable packaging goals across various industries.

The principal applications of SiOx barrier films span across the packaging sectors, dominated by food and beverages where extended shelf life and freshness preservation are paramount. This includes snack foods, ready-to-eat meals, processed meats, and dairy products. Beyond food packaging, these films are critical components in the advanced electronics sector, specifically used for encapsulating Organic Light-Emitting Diodes (OLEDs) and flexible solar cells, where even minuscule ingress of moisture or oxygen can severely degrade device performance. The transparent nature of the SiOx coating allows for visual inspection of the packaged product, further enhancing consumer appeal and quality control.

Key market drivers include stringent regulations concerning food safety and waste reduction, necessitating high-performance, lightweight packaging solutions. The growing global demand for packaged and convenience foods, particularly in emerging economies, fuels the need for films that can withstand diverse supply chain conditions. Furthermore, the inherent advantages of SiOx over metallic barriers, such as inertness and superior clarity, position them favorably for high-end applications and sustainability initiatives focused on monomaterial flexible packaging structures that are easier to recycle.

SiOx Barrier Films Market Executive Summary

The SiOx Barrier Films market is characterized by robust growth, driven primarily by the transition from multilayer, non-recyclable structures to sustainable, high-barrier monomaterials in the packaging industry. Business trends indicate a significant investment in roll-to-roll vacuum deposition technologies to achieve higher throughput and greater coating uniformity. Strategic collaborations between coating technology providers and major packaging converters are accelerating the adoption of these films across fast-moving consumer goods (FMCG) sectors. Furthermore, the increasing complexity of flexible electronics demands ultra-high barrier performance, pushing innovation towards denser, multi-layer SiOx structures combined with other inorganic materials like Aluminum Oxide (AlOx).

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, largely due to explosive growth in electronics manufacturing (OLED displays in South Korea and China) and the massive, expanding consumer base requiring processed and packaged foods in countries like China and India. Europe follows, propelled by stringent EU directives focusing on circular economy principles and plastic waste reduction, creating high demand for recyclable barrier solutions. North America, while mature, sees steady expansion driven by high-value applications in pharmaceutical packaging and advanced materials for flexible photovoltaic cells.

Segment trends confirm that the food and beverage application segment holds the largest market share, though the electronics segment is exhibiting the highest CAGR, primarily fueled by OLED penetration in mobile devices and large format displays. By substrate type, PET continues to be the preferred material due to its mechanical strength and cost-effectiveness, but ongoing research focuses on enhancing the compatibility of SiOx coatings with more environmentally friendly substrates like bio-based polymers and paper/cardboard to align with global sustainability mandates.

AI Impact Analysis on SiOx Barrier Films Market

Common user questions regarding AI's impact on the SiOx Barrier Films market typically revolve around optimizing deposition processes, enhancing quality control for ultra-thin coatings, and predicting material performance variability. Users frequently inquire about how AI can minimize defects (like pinholes) that compromise barrier integrity, which is a critical concern in high-stakes applications like OLED encapsulation. Furthermore, there is significant interest in utilizing AI to simulate and optimize complex coating recipes and machine parameters for different substrates, thereby reducing material waste and accelerating new product development cycles. The prevailing expectation is that AI will transform SiOx film manufacturing from an experience-driven process to a highly data-driven, predictive operation, ensuring superior batch consistency and throughput efficiency.

- AI-driven optimization of Plasma-Enhanced Chemical Vapor Deposition (PECVD) parameters for maximizing coating uniformity.

- Predictive maintenance schedules for vacuum deposition equipment to minimize downtime and reduce process drift.

- Machine Vision systems powered by AI for real-time, high-speed detection and classification of microscopic defects and pinholes.

- Enhanced material informatics, using machine learning to predict the long-term barrier performance (Oxygen Transmission Rate (OTR) and Water Vapor Transmission Rate (WVTR)) based on initial coating structure and environmental factors.

- Supply chain risk modeling and inventory optimization for precursor gases and substrate materials used in SiOx film production.

- AI integration into R&D to simulate novel barrier material combinations (e.g., SiOx/AlOx stacks) before physical prototyping, shortening time-to-market.

DRO & Impact Forces Of SiOx Barrier Films Market

The SiOx Barrier Films market is primarily driven by the escalating global focus on sustainable packaging solutions, which favor transparent, recyclable monomaterial structures over traditional aluminum foil or complex multilayer plastics. The inherent ability of SiOx films to provide exceptional barrier properties while maintaining clarity and offering recyclability addresses critical market needs in both food preservation and high-tech electronics encapsulation. Counterbalancing this growth are restraints such as the high initial capital investment required for sophisticated vacuum deposition equipment and the technical challenge of scaling up production while maintaining ultra-low defect rates, especially for ultra-high barrier applications like flexible displays.

Significant opportunities exist in emerging applications, particularly in the rapidly expanding market for flexible and printable electronics, where SiOx layers are indispensable for protecting sensitive organic materials from environmental degradation. Furthermore, developing cost-effective, high-speed coating processes compatible with biodegradable substrates represents a major growth avenue, aligning with future regulatory shifts toward fully compostable packaging materials. The high impact forces stem from technological advancements in roll-to-roll processing speed and the decreasing cost of precursor materials, making SiOx films economically viable for a broader range of mid-tier packaging applications, thus accelerating displacement of traditional barrier materials.

The market faces structural challenges related to adhesion failure and cracking when SiOx coatings are applied to highly flexible or stretchable substrates, requiring ongoing material science innovation. The complexity of quality control, where microscopic defects can compromise the entire barrier layer, necessitates advanced inspection technologies. The cumulative impact of these forces—high demand for sustainability, coupled with continuous technological refinement and increasing application diversity in electronics—is projected to ensure sustained high-growth trajectory for the SiOx barrier films market throughout the forecast period.

Segmentation Analysis

The SiOx Barrier Films market is segmented based on critical technical and application parameters, providing a detailed view of current market dynamics and future growth pockets. Key segmentation is primarily defined by the substrate material utilized, which dictates the film's mechanical properties and specific end-use suitability, and the application sector, which drives demand based on regulatory requirements and consumer needs. This layered analysis allows stakeholders to target investments toward high-growth areas, such as the intersection of PET substrates with the demanding requirements of the pharmaceutical packaging and flexible electronics industries.

- By Substrate Material:

- PET (Polyethylene Terephthalate)

- PP (Polypropylene)

- PE (Polyethylene)

- PEN (Polyethylene Naphthalate)

- Paper & Cardboard

- Others (e.g., PVC, Polyimide)

- By Application:

- Food & Beverages (Snack foods, Processed meats, Beverages)

- Pharmaceuticals & Medical (Blister packs, Medical devices)

- Electronics (OLED displays, Flexible solar cells, Smart cards)

- Cosmetics & Personal Care

- Others (e.g., Industrial protective films)

- By Type:

- Standard Barrier SiOx Films (Used for general food packaging)

- High Barrier SiOx Films (Used for sensitive foods, pharmaceuticals)

- Ultra-High Barrier SiOx Films (Used primarily in electronics encapsulation)

Value Chain Analysis For SiOx Barrier Films Market

The value chain for the SiOx Barrier Films market begins with upstream material suppliers, focusing on specialized precursor gases (such as Hexamethyldisiloxane, or HMDS) required for the chemical vapor deposition process, and manufacturers of high-quality polymer substrates (PET, PP, PEN). These material inputs significantly influence the final film quality, cost, and mechanical performance. The middle stage involves the core film conversion and coating process, where specialized companies utilize complex, high-vacuum roll-to-roll equipment for applying the SiOx layer, often involving proprietary plasma technologies to achieve superior barrier uniformity and adhesion. This stage is capital-intensive and requires high technical expertise in vacuum engineering and surface science.

The downstream analysis focuses on the integration and use of these barrier films. Coated films are typically sold to packaging converters, who then print, laminate, and shape the films into finished products like pouches, lids, and blister packs tailored for specific brand requirements. For the electronics sector, these films go directly to display manufacturers or solar panel assemblers for critical encapsulation processes. The distribution channel is predominantly indirect, relying on specialized converters acting as intermediaries between the film producer and the ultimate end-users (FMCG companies, pharmaceutical firms, or electronics OEMs). However, large, vertically integrated packaging conglomerates often handle coating and converting internally, representing a direct channel segment.

The profitability and efficiency of the value chain are increasingly determined by achieving superior coating speed and consistency, thus reducing the cost per square meter of the high-barrier film. Innovations in equipment design that allow for lower processing temperatures also reduce damage to heat-sensitive substrates, opening up new material options. The strategic importance of the coating equipment manufacturers and their related intellectual property cannot be overstated, as they dictate the technological limits and scalability of SiOx film production globally.

SiOx Barrier Films Market Potential Customers

The primary customers for SiOx barrier films are large-scale manufacturers operating within industries where product preservation, safety, and visual appeal are paramount, alongside meeting stringent sustainability goals. These end-users are fundamentally seeking solutions that extend shelf life, reduce product spoilage, and comply with rapidly evolving environmental mandates concerning packaging waste. The shift towards lightweight, high-performance flexible packaging makes these films highly attractive across multinational corporations and specialized niche manufacturers alike.

In the consumer goods sector, major food and beverage companies, including global giants in snacks, coffee, and prepared meals, are the largest volume buyers. These companies require films that maintain aroma, prevent oxidation, and offer excellent mechanical properties for high-speed filling lines. In the high-value sectors, pharmaceutical companies utilize SiOx films for blister packs and medical device sterilization wraps, prioritizing ultra-safe, inert barriers that ensure drug efficacy and compliance. Electronic device manufacturers, particularly those involved in OLED and flexible display production, represent the most technically demanding customer segment, requiring the highest achievable barrier performance (Ultra-High Barrier) to protect moisture-sensitive components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1.65 billion |

| Growth Rate | 10.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toppan Printing, Dai Nippon Printing (DNP), Mitsubishi Plastic, Amcor, Jindal Films, 3M, Vitriflex, Fraunhofer, Shincell, CN-Innovations, Alicona, Dunmore, SKC, Sumitomo Chemical, Toray Industries, Uflex, CCL Industries, Schur Flexibles, Coveris, Berry Global, Celanese Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SiOx Barrier Films Market Key Technology Landscape

The SiOx Barrier Films market is underpinned by sophisticated vacuum deposition technologies, principally Plasma-Enhanced Chemical Vapor Deposition (PECVD) and Physical Vapor Deposition (PVD), with PECVD being the dominant method due to its ability to create dense, pinhole-free SiOx layers at high speeds and relatively lower temperatures. PECVD utilizes plasma to activate precursor gases, such as HMDS, allowing the silicon oxide layer to be deposited uniformly on flexible substrates in a continuous roll-to-roll process. Recent technological advancements focus heavily on optimizing plasma sources, controlling process parameters with ultra-high precision, and achieving deposition speeds that are competitive with traditional lamination techniques, thereby improving throughput and reducing manufacturing costs per unit area.

A crucial technological trend involves the development of hybrid multi-layer structures, combining SiOx with other inorganic barriers like Aluminum Oxide (AlOx) or proprietary organic layers, creating ‘tandem’ or ‘stack’ structures. This combination approach effectively mitigates defect propagation, dramatically lowering the overall Oxygen Transmission Rate (OTR) and Water Vapor Transmission Rate (WVTR) to meet the demanding requirements of ultra-high barrier applications necessary for OLED lifetime and stability. Furthermore, manufacturers are increasingly integrating in-line monitoring systems, such as optical emission spectroscopy and laser-based defect detection, to ensure real-time quality control and immediate parameter adjustments during the coating process.

Future technological developments are directed towards low-temperature processing to enable the use of heat-sensitive, bio-based and recyclable substrates without compromising mechanical integrity or barrier performance. Atmospheric Pressure Plasma Deposition (APPD) is a burgeoning technology that promises to eliminate the need for expensive vacuum chambers, potentially lowering capital expenditure and further increasing processing speed. However, APPD currently struggles to match the defect-free uniformity achieved by high-vacuum PECVD systems, making the latter remain the industry standard for high-performance SiOx films in the near term.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the SiOx Barrier Films market, dominating both production capacity and consumption. This growth is bifurcated into two major demand centers: high-volume packaging applications driven by booming populations and rising middle-class consumption in China and India, and the technologically intensive demand from the flexible electronics hubs in South Korea (OLEDs) and Taiwan (semiconductors). Government initiatives supporting sustainable packaging and massive investment in consumer electronics manufacturing ensure APAC's leading market position and fastest growth rate.

- Europe: The European market is characterized by stringent sustainability regulations, such as the EU Plastics Strategy, which necessitate the adoption of recyclable, high-performance barrier solutions like SiOx films. Demand is strong in Western Europe, particularly in Germany, France, and the UK, driven by the pharmaceutical sector and premium food packaging segments. The emphasis here is less on volume and more on developing specialized, complex barrier structures optimized for monomaterial recycling streams.

- North America: North America presents a mature but highly innovative market. Key drivers include the pharmaceutical industry, where high-barrier films are critical for drug stability and compliance, and the growth of high-value specialty packaging. The market sees significant investment in technology aimed at optimizing process efficiency and broadening the application of SiOx to emerging areas such as controlled-release fertilizer packaging and advanced medical textiles.

- Latin America, Middle East, and Africa (LAMEA): This region is an emerging consumer market for SiOx films, primarily driven by the increasing need for extended shelf life solutions for packaged goods due to challenging logistics and varied climate conditions. While the market base is smaller, steady industrialization and foreign direct investment in local manufacturing hubs are expected to gradually increase the adoption of advanced barrier technologies over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SiOx Barrier Films Market.- Toppan Printing Co., Ltd.

- Dai Nippon Printing Co., Ltd. (DNP)

- Mitsubishi Plastic, Inc.

- Amcor PLC

- Jindal Films Ltd.

- 3M Company

- Vitriflex, Inc. (acquired by Toppan)

- Fraunhofer Institute for Organic Electronics, Electron Beam and Plasma Technology (FEP)

- Shincell Co., Ltd.

- CN-Innovations Co., Ltd.

- Alicona Imaging GmbH

- Dunmore Corporation

- SKC Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Uflex Ltd.

- CCL Industries Inc.

- Schur Flexibles Group

- Coveris Holdings S.A.

- Berry Global Group, Inc.

Frequently Asked Questions

Analyze common user questions about the SiOx Barrier Films market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of SiOx barrier films compared to traditional aluminum foil packaging?

The primary benefit of SiOx films is providing high barrier properties against oxygen and moisture while maintaining transparency and offering enhanced recyclability when used in monomaterial packaging structures, unlike opaque and resource-intensive aluminum foil laminates.

Which application segment drives the highest demand volume for SiOx Barrier Films?

The Food and Beverages application segment currently drives the highest demand volume, utilizing SiOx films extensively for snack packaging, ready meals, and processed foods to significantly extend shelf life and maintain product freshness.

What technological challenge is most critical in manufacturing Ultra-High Barrier SiOx films?

The most critical challenge is maintaining coating uniformity and eliminating sub-micron defects (pinholes) across large surface areas at high speeds, as even minute defects can compromise the barrier integrity required for sensitive electronics like OLED displays.

How is the SiOx Barrier Films market aligned with global sustainability goals?

SiOx barrier films are highly aligned with sustainability goals because they enable the creation of high-performance, monomaterial plastic packaging (e.g., PET-only) that is easier to sort and recycle compared to complex, multi-material laminates which include different plastics or metal foils.

What role does Plasma-Enhanced Chemical Vapor Deposition (PECVD) play in SiOx film production?

PECVD is the dominant technology, utilized for depositing a dense, uniform layer of silicon oxide onto flexible substrates in a roll-to-roll process, ensuring superior barrier performance (low OTR and WVTR) necessary for sophisticated packaging and electronics encapsulation.

The SiOx Barrier Films Market outlook remains strong, positioning silicon oxide technology as a strategic asset for industries facing intense pressure to innovate packaging solutions. Market participants are prioritizing R&D into flexible substrate compatibility, especially concerning biodegradable materials, aiming to overcome current limitations related to heat sensitivity during the deposition process. The convergence of consumer demand for fresh, longer-lasting products and legislative pushes toward a circular economy creates a highly favorable investment climate for advanced barrier solutions. Furthermore, the sustained expansion of flexible electronics, particularly in Asia, guarantees a continuous need for Ultra-High Barrier SiOx films with demanding specifications for moisture exclusion. Key industry players are focusing on vertical integration and acquiring specialized coating expertise to capture higher margins across the value chain. Technological differentiation through proprietary plasma sources and in-line defect monitoring systems is becoming a competitive necessity. The strategic importance of SiOx coatings extends beyond conventional packaging, finding increased utility in sophisticated medical devices where material inertness and sterilization compatibility are non-negotiable requirements. The report highlights that capital expenditure, particularly in vacuum equipment, remains a significant barrier to entry for new competitors, solidifying the market position of established global leaders with vast technical intellectual property. Future growth will be contingent upon further cost reduction in high-speed deposition and successful commercialization of SiOx barriers on sustainable substrates like bio-plastics and engineered cellulose-based materials, supporting the overarching transition toward truly green packaging solutions globally. Regional market characteristics show divergence, with Europe focusing on premium, fully recyclable solutions, while Asia Pacific concentrates on capacity expansion and cost efficiency to meet mass-market demand in food and electronics. North America drives innovation in high-value specialty pharmaceutical packaging. The market’s resilience against macroeconomic fluctuations is bolstered by its essential nature in food safety and the irreversible shift toward flexible, portable electronic devices, making SiOx a core component of modern manufacturing supply chains. Investment in AI and machine learning for quality control and process optimization is accelerating, promising to mitigate the inherent technical variability associated with ultra-thin film deposition processes. This transformation from traditional manufacturing to a predictive, data-driven operation ensures consistent quality and maximizes resource efficiency, directly impacting profitability. The long-term viability of this market depends on continuous improvement in barrier properties and the ability to seamlessly integrate SiOx into next-generation packaging architectures that simplify end-of-life recycling processes. The demand for transparent barriers for microwave applications and enhanced consumer visual appeal further reinforces the SiOx value proposition against alternative opaque barriers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager