Ski Gloves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443080 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Ski Gloves Market Size

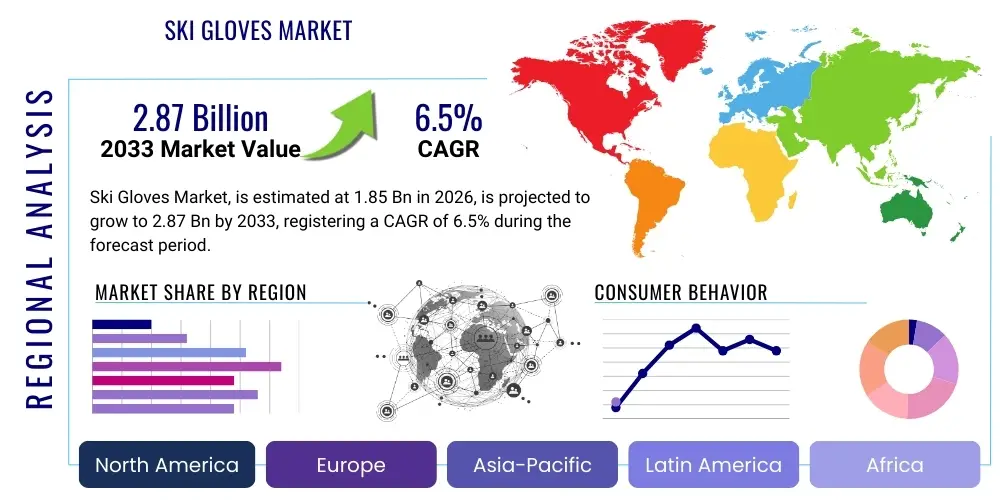

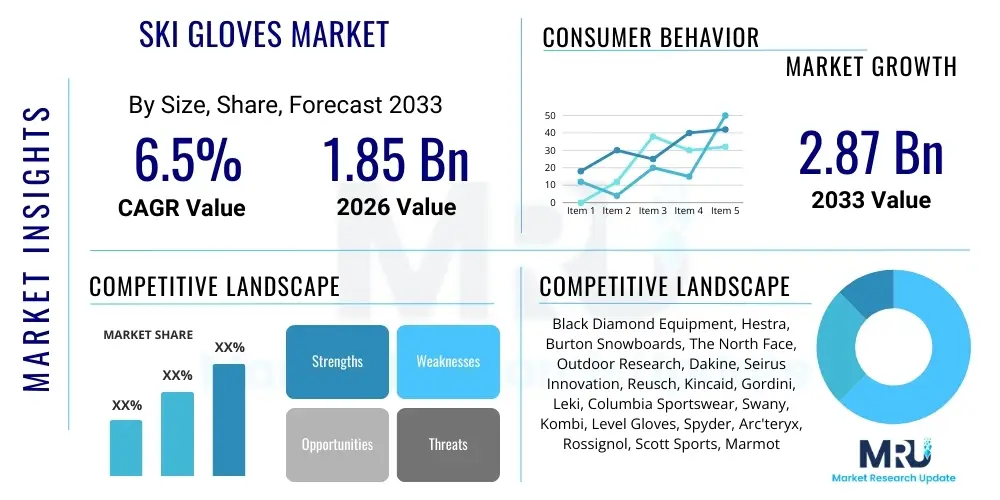

The Ski Gloves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% CAGR between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Ski Gloves Market introduction

The Ski Gloves Market encompasses the manufacturing, distribution, and sale of specialized hand protection gear designed specifically for winter sports, primarily skiing and snowboarding. These products are crucial components of cold-weather sports apparel, offering essential protection against cold temperatures, moisture, and abrasion, which significantly impacts user safety and performance on the slopes. Key products range from heavily insulated mittens suitable for extreme cold to lighter, more flexible gloves designed for performance and dexterity. Major applications include recreational skiing, professional competitive skiing, backcountry touring, and general winter resort activities. The market's growth is inherently linked to the popularity of winter tourism, increasing disposable incomes in developed and emerging economies, and continuous technological advancements in material science, focusing on superior waterproofing, breathability, and thermal retention capabilities.

Ski gloves are specialized technical apparel, fundamentally distinct from general winter gloves, due to the integration of complex layered constructions. These typically involve a robust outer shell for durability and water resistance (often utilizing durable water repellent, or DWR, coatings), a waterproof and breathable membrane (such as derivatives of polyurethane or ePTFE) to manage internal moisture while preventing external penetration, and high-performance insulation materials (like natural down or synthetic fibers such as PrimaLoft or Thinsulate) to maximize heat retention. Furthermore, critical design features include ergonomic pre-curved fingers, reinforced palms, wrist closures to prevent snow ingress, and often include features like nose wipes or touch-screen compatibility, catering to the modern user's convenience needs. The market is heavily influenced by seasonal purchasing cycles and brand reputation tied to quality and durability in challenging alpine environments.

The driving factors behind sustained market expansion include the increasing participation rates in winter sports globally, supported by improved ski infrastructure and accessibility, particularly in regions like Eastern Europe and Asia Pacific. Additionally, consumer awareness regarding the importance of high-quality protective gear to prevent cold-related injuries, such as frostbite, is boosting demand for premium and technically advanced products. The development of heated gloves, incorporating micro-battery technology, represents a significant growth vector, addressing the needs of users highly susceptible to cold or those engaging in prolonged exposure. Finally, the emphasis on fashion and aesthetics, coupled with performance, ensures that consumers frequently update their gear, further stimulating market activity across all price points.

Ski Gloves Market Executive Summary

The global Ski Gloves Market exhibits robust growth driven by escalating winter sports participation, technological integration in materials, and heightened consumer demand for durable, high-performance protective wear. Key business trends indicate a strong shift towards sustainability, with manufacturers increasingly utilizing recycled fabrics and PFC-free water repellents to appeal to environmentally conscious consumers. Regional trends show North America and Europe maintaining dominant market shares due to established ski cultures and extensive infrastructure, while the Asia Pacific region, particularly China and South Korea, is emerging as the fastest-growing market, propelled by significant government investment in winter sports development and rising middle-class disposable income. Segment trends highlight the dominance of synthetic insulated gloves due to their cost-effectiveness and moisture resistance, although the demand for premium leather and heated gloves segments continues to expand rapidly, reflecting premiumization across the industry. The market is characterized by intense competition, prompting frequent innovation focused on dexterity improvement and thermal efficiency maximization.

Strategic market evolution is centered on refining product offerings to cater to niche user requirements, such as professional athletes demanding maximum grip and minimal bulk, or recreational users prioritizing comfort and integrated safety features. Manufacturers are leveraging advanced data analytics and predictive modeling to optimize inventory management, crucial for a highly seasonal product category, mitigating risks associated with overstocking or under-supply during peak winter months. Mergers, acquisitions, and strategic partnerships between technical apparel specialists and smaller, innovative start-ups focused on smart wearables (e.g., integrated sensors or heating elements) are defining the competitive landscape. Furthermore, the Direct-to-Consumer (D2C) sales model is gaining traction, allowing brands to capture higher margins, foster direct customer relationships, and gather valuable feedback for rapid product iteration, bypassing traditional wholesale channels to a greater extent.

From an investment perspective, the market is presenting significant opportunities in material science and customization platforms. The ongoing quest for materials that offer greater thermal insulation per unit of weight, superior breathability, and enhanced environmental friendliness is driving R&D spending. Geographically, investing in robust distribution networks and localized marketing strategies in APAC markets, particularly those with developing ski tourism sectors like Japan, South Korea, and increasingly China, is crucial for future revenue maximization. The regulatory environment, particularly concerning chemical usage (e.g., phasing out per- and polyfluoroalkyl substances - PFAS) in waterproof coatings, necessitates continuous adaptation in manufacturing processes, providing an edge to companies that proactively invest in compliance and sustainable alternatives. This dynamic environment rewards agility and innovation in both product design and supply chain logistics.

AI Impact Analysis on Ski Gloves Market

Common user questions regarding AI's impact on the Ski Gloves Market often revolve around personalized product selection, material durability prediction, and supply chain efficiency for seasonal inventory. Users frequently inquire: "How can AI help me find the perfect glove fit and warmth level?", "Will AI design better, more durable materials?", and "Can AI prevent stockouts during peak season?" These questions reveal key themes: a strong desire for hyper-personalized recommendations that address the complexity of glove sizing and thermal needs, an expectation that AI will accelerate material science breakthroughs (e.g., optimizing membrane porosity or insulation density), and a commercial imperative for mitigating the high risks associated with seasonal forecasting through improved demand planning. The general user expectation is that AI integration will lead to a more tailored purchasing experience, superior product quality through simulation, and enhanced market stability via optimized logistics.

In the realm of product development, Artificial Intelligence (AI) and machine learning (ML) algorithms are being increasingly deployed to analyze vast datasets pertaining to human physiology, thermodynamic properties of materials, and performance data collected from prototype testing. This sophisticated analysis allows manufacturers to virtually simulate how different glove architectures—combinations of shell materials, membrane types, and insulation layers—will perform under various extreme environmental conditions (e.g., high altitude, specific humidity levels, and varying wind speeds) without requiring extensive physical testing cycles. This drastically reduces the time-to-market for innovative products and ensures that the final design offers optimal thermal efficiency and dexterity balance. AI models are also being trained to identify optimal ergonomic patterns based on 3D scans of thousands of hands, leading to significant improvements in fit and comfort across standard size ranges.

Furthermore, the operational and commercial segments of the market are being fundamentally transformed by AI-powered logistics and customer relationship management. On the supply side, ML models process historical sales data, weather forecasts, social media trends, and regional economic indicators to generate highly accurate demand forecasts, minimizing inventory risks inherent to seasonal industries. This precision ensures that production schedules align closely with anticipated consumer demand, improving cash flow and reducing waste. On the consumer side, AI drives personalized marketing and recommendation engines on e-commerce platforms, analyzing past purchase behavior, stated preferences (e.g., type of skiing, frequency), and geographic location (affecting required warmth levels) to suggest the ideal glove model, leading to higher conversion rates and reduced product return incidents related to poor fit or inadequate performance specifications.

- AI-driven personalized fit and thermal rating recommendations based on biometric data and environmental variables.

- Machine learning optimization of insulation density and membrane permeability for superior material performance simulation.

- Predictive analytics for highly accurate seasonal demand forecasting, minimizing inventory risk and optimizing supply chain logistics.

- AI enhancement of quality control processes, identifying microscopic material defects in technical fabrics during manufacturing.

- Utilization of generative design algorithms to explore novel ergonomic shapes and construction methods for improved dexterity and grip.

DRO & Impact Forces Of Ski Gloves Market

The Ski Gloves Market is propelled by strong Drivers such as increasing global participation in winter sports and the continuous innovation in high-performance materials, offering enhanced waterproofing and warmth-to-weight ratios. Restraints include the high initial cost associated with premium technical gloves, which can deter casual participants, and the strong seasonality of demand, complicating inventory management and investment recovery. Significant Opportunities arise from the expansion of ski infrastructure in emerging markets, coupled with the rising adoption of smart and heated glove technology. These market dynamics are critically shaped by Impact Forces, notably consumer safety awareness driving demand for certified protective gear, and the accelerating impact of climate variability necessitating adaptable product specifications and sustainable manufacturing practices across the supply chain.

The primary Drivers fostering market expansion are fundamentally rooted in socioeconomic improvements and technological advancements. Increased leisure spending and disposable incomes in key economies enable higher investment in quality sporting equipment, moving consumers away from basic utility gloves towards specialized technical products. Furthermore, the commitment of leading manufacturers to research and development has yielded breakthroughs like advanced insulation (e.g., aerogels, refined synthetic microfibers) and sophisticated membrane technology that manages moisture vapor transmission more effectively, enhancing comfort during strenuous activities. Regulatory standards related to product safety and material transparency, although sometimes posing short-term challenges, ultimately drive innovation and differentiate high-quality brands, reinforcing market growth by building consumer trust in technical apparel performance.

Despite robust drivers, the market faces structural Restraints. The most prominent is the high barrier to entry price point for gloves incorporating proprietary technical membranes (e.g., GORE-TEX) or specialized heating elements, limiting the addressable market size to primarily affluent consumers or dedicated enthusiasts. Furthermore, the market's dependence on adequate snowfall and cold weather is a vulnerability, making it susceptible to the increasingly erratic effects of global climate change, which shortens ski seasons in many traditional regions. This climate instability forces brands to diversify their product lines or face greater revenue fluctuations. However, these challenges simultaneously open Opportunities, particularly in developing highly durable, multi-season gloves and penetrating fast-growing Asian markets where winter sports culture is actively being cultivated through government incentives and infrastructure projects, such as those spurred by major winter international athletic events.

Segmentation Analysis

The Ski Gloves Market is meticulously segmented across various dimensions, including Product Type, Insulation Material, End-User, Distribution Channel, and Geographic Region, providing a granular view of market dynamics and consumer preferences. Product Type segmentation distinguishes between gloves, mittens, and three-finger models, catering to varying requirements for dexterity versus maximum warmth. Insulation materials are categorized into synthetic, down, and electrically heated options, reflecting performance and price spectrums. End-user categories differentiate between men, women, and children, acknowledging specific ergonomic and aesthetic demands. Analyzing these segments is crucial for manufacturers to tailor their R&D investments, marketing strategies, and distribution logistics effectively, ensuring alignment with specific consumer demographics and prevailing market trends across different global regions.

The segmentation by Product Type is vital as it directly correlates with the intended use and performance requirements. Mittens generally offer superior warmth retention by keeping the fingers grouped, minimizing surface area exposure, making them popular for extreme cold environments or low-dexterity activities. Conversely, gloves provide individual finger articulation, which is essential for tasks requiring fine motor control, such as adjusting ski boots or handling equipment. The three-finger (or lobster) model attempts to balance these attributes, offering moderate dexterity with enhanced thermal properties. Market trends indicate a rising demand for models that incorporate high-dexterity materials in the palm and fingers while maximizing insulation in the backhand, reflecting an increasing focus on technical skiing that requires both warmth and precise grip.

Segmentation based on Insulation Material defines the core technological competitive landscape. Synthetic insulation, derived from polyester microfibers, remains the market leader due to its ability to retain heat even when wet, superior durability, and favorable cost structure, making it the standard choice for mid-range and high-volume products. Down insulation (typically goose or duck down) provides the highest warmth-to-weight ratio but loses efficacy when saturated, relegating it primarily to dry, high-altitude, or luxury segments. The electrically Heated segment, though currently smaller, represents the fastest-growing niche, appealing directly to users with circulation issues or those operating in exceptionally severe cold. Manufacturers are focusing on reducing battery size and weight while increasing heating duration to improve the commercial viability and user acceptance of heated gloves.

- By Product Type:

- Gloves

- Mittens

- Three-Finger Gloves (Lobster)

- By Insulation Material:

- Synthetic (e.g., PrimaLoft, Thinsulate)

- Down

- Electrically Heated

- By End-User:

- Men

- Women

- Children

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Offline Retail (Specialty Stores, Department Stores, Hypermarkets)

Value Chain Analysis For Ski Gloves Market

The value chain for the Ski Gloves Market initiates with the Upstream Analysis, which focuses heavily on the procurement of highly specialized raw materials, including technical textiles like waterproof membranes (e.g., PU, PTFE), high-density insulation fibers, durable shell fabrics (nylon, polyester blends), and specialized leather treatments. Manufacturing then involves complex layering and bonding processes to ensure structural integrity and functional performance. The chain proceeds to Distribution Channels, utilizing both direct-to-consumer models and indirect routes through wholesalers, specialty sports retailers, and online platforms. Downstream Analysis addresses sales, marketing, and post-sale services, where brand reputation, technological claims, and warranty support are critical determinants of consumer choice and loyalty, significantly influencing product life cycles and subsequent purchase decisions. The efficiency of this chain dictates cost structure and market competitiveness.

The upstream segment is characterized by reliance on a few specialized suppliers for critical components, such as fluoropolymer membranes and proprietary synthetic insulation. This concentration introduces potential supply chain risks and cost fluctuations based on global chemical and textile market dynamics. Ethical sourcing, especially for natural down and leather components, is becoming increasingly scrutinized, forcing manufacturers to implement robust traceability and certification systems (e.g., Responsible Down Standard). Manufacturers must navigate this complexity by establishing long-term strategic relationships with membrane and insulation providers to secure supply consistency and maintain a competitive edge through exclusive access to newer, more efficient material technologies. Furthermore, the selection of raw materials directly impacts the ability to comply with stringent European and North American environmental regulations, particularly concerning hazardous chemicals.

The distribution and downstream phases are highly diversified. Direct distribution through brand-owned e-commerce sites and flagship retail stores offers the highest control over brand messaging and customer experience, facilitating premium pricing strategies. Indirect channels, particularly specialty sporting goods stores, remain vital as they offer consumers professional advice and the ability to physically test the fit and feel of technical gear, which is crucial for items like gloves. The rise of large multinational e-commerce platforms has intensified price competition but expanded geographic reach into areas without dedicated specialty retailers. Effective downstream strategies involve robust digital marketing campaigns that leverage performance data and consumer reviews, focusing on the functional benefits—warmth, waterproofing, and durability—to justify the premium pricing structure common in this high-tech apparel sector. After-sales support, including repair services and extended warranties, enhances perceived product value and minimizes obsolescence.

Ski Gloves Market Potential Customers

The potential customer base for the Ski Gloves Market is broad, extending beyond traditional alpine skiers and encompassing various segments based on dedication level, environment, and specific activity. Primary end-users include recreational skiers and snowboarders (who prioritize comfort, moderate performance, and aesthetics), professional and competitive athletes (who require maximum dexterity, specialized grip, and minimal bulk), and backcountry enthusiasts or ski mountaineers (who demand extreme durability, maximum breathability, and reliable waterproof features for sustained aerobic activity in remote environments). Additionally, institutional buyers, such as ski resorts, mountain guides, and rental operations, represent a significant B2B customer segment requiring rugged, easily maintainable, and bulk-purchase appropriate models. The expansion of winter tourism into non-traditional markets also introduces a new cohort of novice customers focused on entry-level, cost-effective protective solutions.

A crucial segmentation of potential customers revolves around the distinction between dedicated enthusiasts and casual participants. Dedicated enthusiasts, who engage in skiing or snowboarding multiple times per season, typically invest heavily in technical gear. These customers are highly informed about material technology (e.g., membrane types, insulation grams) and actively seek out top-tier, performance-driven products, often showing brand loyalty to specialized outdoor apparel companies. They prioritize features like advanced wrist protection, heating technology, and articulated finger design. Marketing efforts targeting this group must emphasize performance metrics, technical specifications, and durability guarantees to satisfy their detailed purchasing criteria and justify the premium investment required for advanced equipment.

Conversely, the vast segment of casual and rental market users focuses more on essential protection, comfort, and affordability. These consumers often make purchase decisions based on accessibility at general sporting goods stores or through bundled resort rental packages. Their needs are met by durable, mid-range synthetic gloves that offer adequate weather protection without the complexity or high cost of professional-grade features. The children's segment is also highly important, characterized by rapid growth and turnover, necessitating robust, easy-to-put-on gloves and mittens that provide excellent insulation for younger hands more susceptible to cold. Targeting institutional buyers requires a focus on bulk pricing, repairability, and standardization across models to streamline their operational requirements for equipment fleets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Black Diamond Equipment, Hestra, Burton Snowboards, The North Face, Outdoor Research, Dakine, Seirus Innovation, Reusch, Kincaid, Gordini, Leki, Columbia Sportswear, Swany, Kombi, Level Gloves, Spyder, Arc'teryx, Rossignol, Scott Sports, Marmot |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ski Gloves Market Key Technology Landscape

The Ski Gloves Market is defined by a dynamic technological landscape centered on enhancing the core functions of insulation, waterproofing, and breathability, while also integrating elements of smart technology. The most critical proprietary technologies involve advanced waterproof and breathable membranes, notably various derivatives of expanded Polytetrafluoroethylene (ePTFE) and Polyurethane (PU), which are laminated within the glove structure to block liquid water penetration while allowing moisture vapor (sweat) to escape. This delicate balance is vital for preventing clamminess and subsequent heat loss. Furthermore, insulation technology sees continuous refinement, with lightweight synthetic microfibers like PrimaLoft and Thinsulate offering superior compressibility and performance consistency compared to traditional bulkier alternatives. These material innovations are pivotal in driving the high-end market segment and justifying premium pricing points, providing consumers with optimal comfort and performance during demanding activities.

A significant technological vector involves the integration of micro-electronics, specifically in the realm of heated gloves. These products incorporate flexible heating elements, often carbon fiber wires, strategically placed around the fingers and backhand, powered by rechargeable lithium-ion battery packs seamlessly integrated into the cuff or wrist structure. Recent advancements focus heavily on miniaturization of battery packs, extending heat duration, and introducing intelligent temperature control systems that allow users to precisely regulate warmth levels via small, glove-mounted controllers or even smartphone applications. This addresses the historical challenge of limited battery life and weight constraints, broadening the appeal of heated gloves from specialty use to general recreational skiing, particularly for users sensitive to cold or requiring extra thermal assurance.

Beyond thermal management, the industry is increasingly adopting technologies that improve interface and durability. For dexterity, complex anatomical pre-curving and the strategic placement of stretch panels and leather reinforcements are crucial, leveraging knowledge from biomechanics. For enhanced functionality, many modern gloves feature touch-screen compatible materials woven into the fingertips, allowing users to interact with smart devices without removing their hand protection, a key convenience feature for the digitally connected consumer. Furthermore, durability is boosted through specialized ceramic or synthetic palm grips and the use of sonic welding or advanced seam sealing techniques instead of traditional stitching, minimizing potential leak points and increasing the structural lifespan of the glove in high-abrasion environments.

Regional Highlights

- North America: This region, particularly the United States and Canada, represents a mature and dominant market for ski gloves, characterized by high consumer spending power and a deep-rooted skiing culture across the Rocky Mountains and the Northeast. The market here is highly receptive to technological advancements, driving demand for premium products such as heated gloves, advanced GORE-TEX derivatives, and environmentally certified apparel. Competition is intense, with both domestic heavyweights and European specialized brands vying for market share. Marketing strategies often focus on lifestyle branding, extreme performance capabilities, and alignment with sustainability movements. The presence of numerous large-scale ski resorts and the popularity of backcountry skiing heavily influence product design towards durability and expedition-grade thermal regulation.

- Europe: Europe holds a substantial market share, deeply influenced by the historic importance of the Alps as a global skiing destination. Countries like Switzerland, Austria, France, and Italy exhibit strong demand for high-quality, heritage-focused brands that emphasize craftsmanship and traditional materials alongside modern performance. The European market is highly segmented, with strong local brand loyalty. Regulatory requirements, particularly related to chemicals (REACH) and environmental certifications, are strict, compelling manufacturers to lead in sustainable innovation, such as the adoption of PFC-free DWR finishes. The touring and ski mountaineering segments are particularly strong here, necessitating gloves that prioritize breathability and lightweight construction for uphill performance.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, primarily fueled by the massive investment in winter sports infrastructure in China and South Korea, spurred by recent global sporting events. Rising middle-class disposable income, coupled with an increasing number of indoor and outdoor ski facilities, is expanding the user base rapidly. While penetration rates are lower than in the West, the growth potential is enormous. The market is currently dominated by entry-to-mid-level synthetic products, but demand for high-end international brands is escalating, particularly in urban centers. Japan remains a key technical market, focusing on niche, high-performance apparel adapted for specific local snow conditions, often integrating subtle technology and superior craftsmanship.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions represent emerging or highly specialized markets. LATAM, particularly Chile and Argentina, possesses established seasonal ski areas, driving localized demand for technical apparel, albeit smaller in volume compared to North America or Europe. The MEA region's demand is largely concentrated in high-income, urban areas or through niche markets like indoor ski facilities (e.g., Dubai). Growth in these regions is highly reliant on leisure travel trends and the expansion of destination skiing, generally favoring globally recognized brands accessible through online retail channels or specialized imported goods distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ski Gloves Market.- Black Diamond Equipment

- Hestra

- Burton Snowboards

- The North Face

- Outdoor Research

- Dakine

- Seirus Innovation

- Reusch

- Kincaid

- Gordini

- Leki

- Columbia Sportswear

- Swany

- Kombi

- Level Gloves

- Spyder

- Arc'teryx

- Rossignol

- Scott Sports

- Marmot

Frequently Asked Questions

Analyze common user questions about the Ski Gloves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor driving the growth of the Ski Gloves Market?

The most critical factor driving market growth is the consistent technological advancement in materials science, specifically the development of lighter, warmer, and more breathable waterproof membranes and insulation fibers, which significantly enhance user comfort and performance, encouraging investment in premium gear.

How does the segmentation by Insulation Material influence purchasing decisions?

Insulation material dictates warmth and weight. Synthetic materials are favored for their moisture resistance and cost-effectiveness, appealing to most users. Down is chosen for maximum warmth-to-weight in dry conditions. Electrically heated gloves are sought by users prioritizing absolute warmth assurance regardless of ambient temperature or circulation issues.

What role does the Asia Pacific region play in the future market outlook?

The Asia Pacific region, particularly China, is projected to be the fastest-growing market due to massive infrastructure investment in winter sports, rising disposable incomes, and increasing governmental support for winter recreational activities, presenting significant opportunities for market penetration and sales volume expansion.

Are heated ski gloves becoming a mainstream product, and what are their limitations?

Heated ski gloves are moving toward mainstream adoption, driven by improved battery life and reduced weight. While offering superior warmth, their primary limitation remains the reliance on rechargeable battery systems, which necessitates careful management of charging cycles and adds to the overall product cost and weight compared to non-heated alternatives.

How do sustainability concerns affect the manufacturing of ski gloves?

Sustainability concerns heavily influence manufacturing by pushing companies towards using recycled shell fabrics, ethically sourced insulation (e.g., RDS-certified down), and phasing out harmful chemicals like PFAS in water repellent treatments. This focus on eco-friendly production is crucial for maintaining market share among environmentally conscious consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager