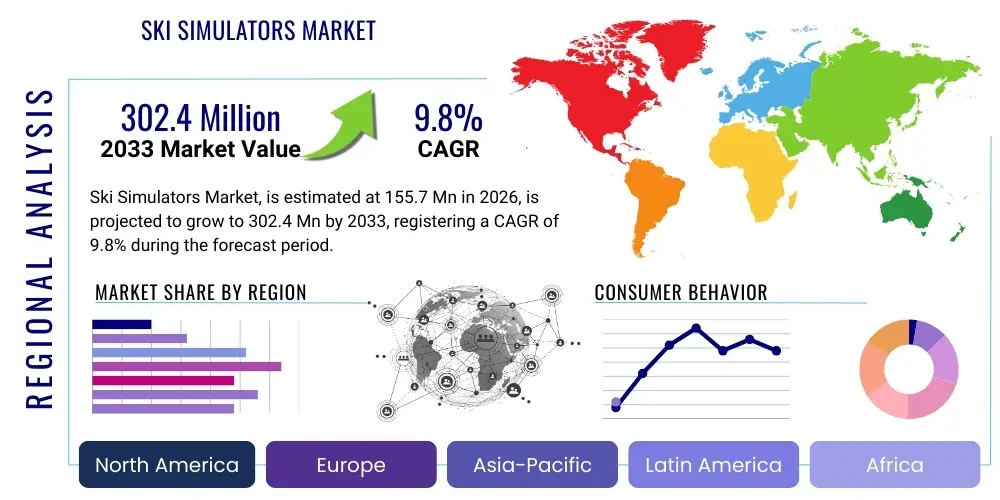

Ski Simulators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441646 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Ski Simulators Market Size

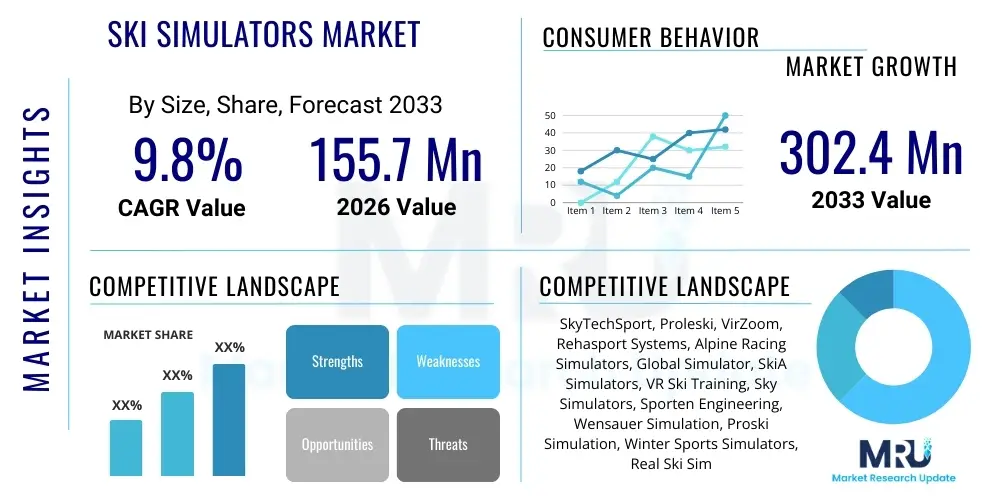

The Ski Simulators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 155.7 million in 2026 and is projected to reach USD 302.4 million by the end of the forecast period in 2033.

Ski Simulators Market introduction

The Ski Simulators Market encompasses advanced electromechanical systems designed to replicate the physical sensation and biomechanics of downhill skiing or snowboarding in a controlled, indoor environment. These sophisticated machines utilize motion platforms, sensor technology, and realistic visual projections to provide users with a comprehensive training experience, offering benefits such as skill development, fitness maintenance, and rehabilitation, irrespective of geographic location or seasonal availability. Initially utilized primarily by professional athletes for off-season training and technique refinement, the application scope has broadened considerably to include commercial fitness centers, entertainment venues, luxury residential installations, and specialized rehabilitation clinics, driven by improvements in simulator fidelity and decreasing hardware costs, making high-quality simulation accessible to a wider demographic of winter sports enthusiasts.

Product offerings in the market range from basic stationary units focusing purely on cardiovascular fitness and lower body endurance to highly complex dynamic platforms featuring six degrees of freedom (6 DOF) motion, integrated force plates, and virtual reality (VR) headsets, offering unparalleled realism. Major applications include sports training, where simulators provide measurable data on edge control, pressure distribution, and angulation; entertainment, where they serve as engaging attractions in amusement parks and family entertainment centers (FECs); and physical therapy, where controlled, low-impact exercise aids recovery from knee or leg injuries. The primary benefits derived from these devices are the ability to train year-round, significantly mitigate the risk of injury associated with real-world skiing, and utilize instantaneous data feedback for targeted skill improvement, optimizing the learning curve for novice skiers.

Driving factors for market expansion include the increasing global interest in experiential fitness solutions, the rising disposable income in emerging economies enabling investment in leisure and specialized sports equipment, and continuous technological advancements integrating better physics engines and immersive visual environments. Furthermore, safety concerns related to crowded slopes and the environmental impact of climate change affecting natural snow conditions are positioning ski simulators as reliable, sustainable alternatives for consistent training. The confluence of demand for performance optimization among competitive skiers and the desire for convenient, safe recreational alternatives among casual enthusiasts underpins the robust growth trajectory anticipated for this specialized equipment market over the forecast period.

Ski Simulators Market Executive Summary

The global Ski Simulators Market is experiencing a robust period of expansion characterized by significant technological diversification and broadening end-user applications. Key business trends indicate a strong focus on merging physical motion systems with highly realistic virtual reality (VR) and augmented reality (AR) environments, moving beyond simple screen displays to offer genuinely immersive training experiences. Manufacturers are prioritizing modular designs and subscription-based software updates to enhance longevity and provide continuous value, catering to both high-end commercial training facilities and space-constrained residential users. Furthermore, market competition is intensifying, pushing companies to integrate advanced biometric sensors and personalized AI coaching modules to differentiate their products based on data accuracy and tailored feedback capabilities, which is crucial for professional development and rehabilitation protocols.

Regionally, the market dynamics are heavily influenced by the established skiing cultures and high disposable incomes in North America and Europe, which currently account for the largest share of simulator adoption, particularly within high-performance training centers and luxury fitness clubs. However, the Asia Pacific region, especially countries like China and South Korea, is emerging as a critical growth engine, driven by significant government investment in winter sports infrastructure ahead of major international events and a rapid urbanization trend leading to increased demand for indoor recreational activities. The Middle East is also showing nascent demand, primarily for high-end entertainment and private installations, compensating for the lack of natural snow conditions with technologically advanced indoor sports venues.

Segment trends reveal that the Motion Platform segment, specifically those offering 6 DOF systems, commands a premium price and is seeing high adoption rates in professional training and rehabilitation settings due to superior fidelity. Conversely, the Fixed/Stationary simulator segment maintains strong volumetric growth, particularly in the consumer and standard commercial gym sectors, where affordability and lower maintenance requirements are primary selection criteria. The application segment is witnessing the fastest growth in the leisure and entertainment category, leveraging the appeal of gamification to attract non-skiers, while the professional training segment maintains steady, high-value demand focused exclusively on data precision and technical replication fidelity for competitive athletes.

AI Impact Analysis on Ski Simulators Market

Common user questions regarding AI's impact on ski simulators frequently revolve around personalization, real-time feedback accuracy, and the capability of the simulator to adapt dynamically to performance flaws. Users often inquire if AI can replace human coaching, how sophisticated algorithms analyze complex biomechanical data, and whether AI can facilitate faster skill acquisition for beginners without inducing bad habits. There is significant interest in understanding AI's role in creating personalized training regimes that adjust difficulty, terrain, and weather conditions in real-time based on the user's fatigue levels, heart rate data, and specific technique weaknesses detected by embedded sensors. Key themes summarizing user expectations highlight a demand for AI-driven systems that offer instantaneous, unbiased performance diagnostics, predictive maintenance scheduling for high-value components, and sophisticated gamification mechanics that maintain user engagement through adaptive challenges.

The integration of Artificial Intelligence transforms ski simulators from sophisticated mechanical trainers into intelligent coaching platforms. AI algorithms are primarily utilized for processing the massive amounts of data generated by sensors related to pressure distribution, edge angle, weight shift velocity, and overall body posture. By comparing this data against established biomechanical models of elite performance, AI can identify minute technique errors that human eyes might miss and provide specific, actionable feedback instantly, such as "shift center of gravity 3 degrees forward" or "increase pressure on the downhill ski." This immediate, data-driven correction loop accelerates the learning curve significantly, particularly for complex motor skills required in skiing.

Furthermore, AI plays a crucial role in creating genuinely adaptive simulation environments. Unlike pre-programmed routines, AI can dynamically adjust the resistance, speed, and responsiveness of the simulator’s motion platform, effectively mimicking variable snow conditions or unanticipated terrain changes found in the real world. This adaptive challenge increases training effectiveness, preparing the user for a wider range of actual skiing scenarios. In the commercial sector, AI-powered predictive analytics monitor wear patterns on mechanical parts, allowing operators to schedule maintenance proactively, minimizing downtime, maximizing equipment longevity, and optimizing operational efficiency, thereby significantly enhancing the ROI for high-capital investment systems.

- AI provides real-time biomechanical analysis and instantaneous performance feedback, surpassing traditional human coaching limitations.

- Predictive modeling algorithms utilize sensor data to anticipate and correct user technique flaws before they become ingrained habits.

- AI enables dynamic environment adaptation, automatically adjusting platform responsiveness and virtual terrain difficulty based on user skill and fatigue.

- Machine learning optimizes gamification by creating personalized, skill-appropriate challenges to maximize engagement and retention.

- AI facilitates predictive maintenance schedules for motion platforms, minimizing mechanical failures and reducing operational costs for commercial operators.

DRO & Impact Forces Of Ski Simulators Market

The Ski Simulators Market is shaped by a complex interplay of positive momentum generated by increasing consumer demand for experiential training and significant barriers related to cost and accessibility. The primary drivers include the ability to offer year-round, weather-independent training, the superior safety profile compared to on-slope training which significantly reduces injury risk, and the high-fidelity data capture capabilities essential for professional athletes seeking marginal performance gains. These factors position simulators as invaluable tools for both skill acquisition and physical conditioning, particularly in non-traditional skiing regions or during off-seasons. However, the market is restrained by the inherently high initial capital investment required for professional-grade motion platforms and the substantial space requirements for installation, limiting adoption primarily to affluent consumers, specialized training facilities, and high-end commercial venues.

Opportunities for future expansion are predominantly centered around technological democratization and new application areas. The development of more compact, accessible, and potentially subscription-based consumer models utilizing advanced software algorithms offers a pathway to penetrate the mid-tier home fitness market. Furthermore, significant potential exists in medical and rehabilitation centers, where the controlled, measurable environment of a simulator is ideal for physical therapists managing patient recovery from lower extremity injuries, offering precise progression tracking. The integration of competitive esports formats and gamified training protocols is also poised to attract a younger, digitally native audience, transforming simulators into engaging entertainment assets beyond pure training utility.

The market impact forces are currently skewed towards high demand and technological push. Supplier power is moderate; while there are relatively few manufacturers of complex motion platforms, the long lifecycle of the equipment and specialized technology requirements provide these key suppliers with leverage. Buyer power is also moderate, driven by the high cost of entry, which encourages detailed comparison shopping and demands for strong warranties and comprehensive service agreements. The threat of substitutes is relatively low, as no other indoor fitness equipment accurately replicates the specific biomechanical load and motion dynamics of downhill skiing. Barriers to entry for new competitors remain high, requiring significant R&D investment in physics engines, motion platform engineering, and proprietary software integration, thus protecting existing market leaders.

Segmentation Analysis

The Ski Simulators Market is comprehensively segmented across several dimensions, including component type, motion platform complexity, end-user application, and regional adoption patterns. Analyzing these segments provides a nuanced view of market demand, investment priorities, and target demographics, ranging from the high-fidelity, high-cost solutions demanded by professional training centers to the more basic, cost-effective models preferred by individual fitness enthusiasts. The market structure reflects a clear bifurcation between high-technology, data-intensive segments driving value growth (e.g., dynamic platforms, software) and high-volume segments focused on accessibility and recreation (e.g., fixed platforms, commercial applications). Understanding the interplay between hardware and advanced software modules, particularly in the context of personalized training, is central to strategic positioning in this specialized sector.

- By Component:

- Hardware (Motion Platforms, Actuators, Skis/Boots Interfaces, Display Systems)

- Software (Physics Engines, Training Programs, Virtual Environments, Data Analytics Modules)

- Services (Installation, Maintenance, Training & Coaching Subscriptions)

- By Motion Platform Type:

- Fixed/Stationary Simulators

- Dynamic Simulators (2 DOF, 3 DOF, 4 DOF, 6 DOF Systems)

- By Application:

- Professional Training and Coaching Centers

- Fitness and Health Clubs (Commercial Gyms)

- Residential Use (Home Fitness Installations)

- Leisure and Entertainment Centers (FECs, Resorts)

- Rehabilitation and Physical Therapy Clinics

- By Sales Channel:

- Direct Sales (B2B Contracts)

- Indirect Sales (Distributors, Specialized Retailers)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Switzerland, Austria, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ski Simulators Market

The value chain for the Ski Simulators Market begins with upstream activities heavily focused on sourcing specialized high-precision components and developing proprietary simulation software. Raw material sourcing involves acquiring high-grade metals and composites for the robust motion platforms, advanced hydraulic or electric actuators, and sophisticated sensor arrays. A crucial element upstream is the intensive research and development phase dedicated to perfecting the physics engine—the core software responsible for accurately modeling snow friction, gravity, momentum, and edge engagement. Partnerships with specialized engineering firms and high-tech software developers are essential at this stage, as the fidelity of the simulation directly correlates with market acceptance and premium pricing capabilities.

Midstream activities involve the highly technical manufacturing and assembly of the simulators. Manufacturing requires specialized precision engineering to ensure the motion platform is capable of rapid, accurate, and repeatable movements under varying loads, prioritizing safety and durability. Quality assurance and rigorous testing are paramount to validate that the hardware interfaces seamlessly with the complex software environment and real-time data feedback loops. Because simulators are large, complex systems, packaging and logistics require specialized handling to minimize transit damage. The development of proprietary ski boot interfaces and sensor integration systems, which capture nuanced movements, further adds complexity to the manufacturing process, making vertical integration or strategic component sourcing necessary for market leaders.

Downstream analysis focuses on distribution channels and post-sale support. Direct sales channels are dominant for high-value installations, such as professional training academies and large commercial fitness chains, enabling manufacturers to provide tailored solutions and specialized installation services. Indirect channels utilize specialized sports equipment distributors or technology integrators, particularly targeting smaller commercial gyms or high-net-worth individuals for residential installations. Post-sales services, including technical maintenance, software updates, and dedicated technical support, are critical value-added components due to the high initial investment and technical nature of the equipment. Furthermore, developing ongoing revenue streams through subscription models for advanced training content and virtual environment libraries enhances long-term customer relationship management and reinforces brand loyalty.

Ski Simulators Market Potential Customers

The potential customer base for the Ski Simulators Market is diverse, spanning professional sports organizations, commercial enterprises, healthcare providers, and individual consumers. The primary high-value end-users are professional skiing and snowboarding teams, national sports institutes, and high-performance training centers focused on elite athlete development. These buyers require the most sophisticated 6 DOF systems, demanding extremely high fidelity, precise data telemetry, and customization capabilities to replicate specific training conditions and measure minute biomechanical adjustments critical for competitive advantage. Investment decisions in this segment are typically driven by the need for measurable performance improvement and safe, year-round access to highly controlled training environments, often bypassing geographical and seasonal restrictions entirely.

Another significant customer group includes commercial fitness centers, global gym chains, and specialized indoor sports facilities. For these customers, the simulator serves as a high-value differentiator and a revenue generator, attracting members interested in specialized training or unique recreational activities. They generally prioritize systems that are robust, durable, easy to maintain, and offer accessible user interfaces for a wide range of skill levels, often favoring fixed or less complex dynamic platforms. Furthermore, the burgeoning leisure and entertainment sector, encompassing Family Entertainment Centers (FECs), cruise lines, and luxury resorts, represents a growing customer segment utilizing simulators as novelty attractions, emphasizing immersive visual experiences and gamified content over strict biomechanical accuracy.

The rapidly expanding customer base also includes private residential users and rehabilitation clinics. High-net-worth individuals who are passionate about skiing purchase simulators for luxury home gyms, prioritizing compact design, aesthetic integration, and personalized access to year-round practice. In the healthcare sector, physical therapy and orthopedic rehabilitation clinics are increasingly adopting simulators to offer controlled, low-impact exercise for patients recovering from knee, ankle, or hip injuries. These customers value the measurable progression tracking offered by the software, the controlled loading environment, and the ability to tailor resistance and movement patterns precisely to the patient’s stage of recovery, making the simulator a medical necessity rather than just a recreational tool.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.7 Million |

| Market Forecast in 2033 | USD 302.4 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SkyTechSport, Proleski, VirZoom, Rehasport Systems, Alpine Racing Simulators, Global Simulator, SkiA Simulators, VR Ski Training, Sky Simulators, Sporten Engineering, Wensauer Simulation, Proski Simulation, Winter Sports Simulators, Real Ski Simulators, Ski Training Systems, Apex Ski Systems, NordicTrack Simulators, Dynamic Motion, Snow Simulators, Power Carver. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ski Simulators Market Key Technology Landscape

The technological sophistication of ski simulators is underpinned by the convergence of mechanical engineering, advanced sensor technology, and immersive software development, essential for replicating the highly nuanced physics of snow sports. Central to the simulator’s functionality is the motion platform, which is increasingly dominated by 4-DOF and 6-DOF hydraulic or electric actuator systems. Electric actuation offers higher energy efficiency and lower noise levels, making them preferable for residential and smaller commercial settings, while high-force hydraulic systems remain crucial for replicating the extreme G-forces and rapid dynamic responses required in high-performance professional training scenarios. Precision engineering of these platforms is necessary to ensure movements are smooth, responsive, and accurately correlated with user input and virtual terrain data, maintaining the critical illusion of real downhill motion.

Sensor technology constitutes the intelligence layer of the simulator, collecting continuous, high-resolution data on the user's performance. Key technologies include integrated force plates embedded beneath the ski interfaces, which measure instantaneous pressure distribution, critical for analyzing edge control and weight transfer efficiency. Furthermore, highly precise inertial measurement units (IMUs) and optical tracking systems monitor the angulation of the skis and the overall body posture. This sensor data feeds into the physics engine, which uses complex algorithms derived from real-world snow dynamics to calculate the resulting resistance and platform movement in real-time. The fidelity of the physics engine, often leveraging proprietary algorithms, determines how realistically the virtual environment responds to subtle shifts in the user’s weight and edging technique.

Visual immersion technology is rapidly evolving, moving the market towards fully integrated Virtual Reality (VR) and Augmented Reality (AR) solutions. While traditional simulators rely on large projection screens, the adoption of high-resolution VR headsets eliminates peripheral distractions and significantly enhances the sense of presence and speed, leading to better motor skill transference. AR technology, though less common, offers possibilities for overlaying real-time instructional feedback and performance metrics directly onto the user's view, creating a seamless coaching experience. Additionally, cloud computing is enabling the development of large, shared databases of virtual slopes and training programs, facilitating remote coaching and online competitive leagues, which further enhances the utility and market reach of advanced simulator systems.

Regional Highlights

The regional market landscape for ski simulators demonstrates a clear segmentation based on existing skiing culture, economic wealth, and investment in indoor sports infrastructure. Europe currently holds a leading position in market share, driven primarily by the strong, deeply rooted winter sports culture across the Alpine regions (Switzerland, Austria, France, Italy, Germany). These countries host numerous professional training centers, sophisticated sports rehabilitation clinics, and a high concentration of affluent consumers who invest in premium residential units. Demand is consistently high for high-fidelity, data-centric simulators used for serious training and technique analysis. Furthermore, Europe has been a hub for key simulator manufacturers and technology developers, supporting strong regional innovation.

North America (NA) is the second largest market and is characterized by rapid adoption in both the professional and commercial fitness sectors. The high disposable incomes in the U.S. and Canada, coupled with a strong emphasis on personalized fitness and luxury home installations, fuel demand. Key trends in NA include the integration of simulators into major national gym chains and the increasing use of these devices by university and private sports academies looking to maintain a competitive edge year-round. Marketing often focuses on the fitness and cardiovascular benefits, alongside the technical training advantages. The market here is highly receptive to technology integration, leading to rapid uptake of VR and AI-enhanced models.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This accelerated growth is primarily attributed to large-scale government investments in winter sports, particularly in China and South Korea, following the hosting of international winter games. Rapid urbanization and the lack of natural snow conditions across vast parts of the region drive demand for high-quality indoor sports facilities and recreational centers. As disposable incomes rise, consumer interest in niche recreational activities grows, making simulators popular in FECs and large indoor sports parks. Japan also contributes significantly, maintaining strong interest in high-tech fitness solutions. Meanwhile, Latin America and the Middle East & Africa (MEA) represent emerging but smaller markets, where demand is focused mainly on luxury residential purchases and high-end entertainment venues compensating for lack of local snow environments, with growth constrained by economic instability and lower general awareness of the technology.

- Europe: Dominant market share due to established Alpine skiing culture, high density of professional training facilities, and leading presence of core manufacturing companies.

- North America: Strong demand in the commercial fitness and residential luxury segments, driven by high disposable income and year-round athlete training needs.

- Asia Pacific (APAC): Fastest-growing region, fueled by infrastructure investment in China and South Korea, and increasing interest in indoor leisure activities due to urbanization.

- Latin America (LATAM): Niche market focused on high-end commercial entertainment centers and private affluent buyers, with growth dependent on economic stability.

- Middle East and Africa (MEA): Emerging market concentrated in wealthy urban centers, primarily for luxury private installations and indoor resort attractions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ski Simulators Market.- SkyTechSport

- Proleski

- VirZoom

- Rehasport Systems

- Alpine Racing Simulators

- Global Simulator

- SkiA Simulators

- VR Ski Training

- Sky Simulators

- Sporten Engineering

- Wensauer Simulation

- Proski Simulation

- Winter Sports Simulators

- Real Ski Simulators

- Ski Training Systems

- Apex Ski Systems

- NordicTrack Simulators

- Dynamic Motion

- Snow Simulators

- Power Carver

Frequently Asked Questions

Analyze common user questions about the Ski Simulators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fixed and dynamic ski simulators?

Fixed (stationary) simulators primarily focus on cardiovascular fitness, core strength, and basic carving movements. Dynamic simulators utilize complex motion platforms (up to 6 DOF) and advanced actuators to replicate precise G-forces, inclination changes, and realistic terrain feedback, essential for professional technique training and high-fidelity immersion.

How effective are ski simulators for improving technique compared to real slope training?

Simulators are highly effective for technique refinement because they provide safe, continuous, and measurable training sessions with instant, data-driven feedback on key metrics like edge angle and pressure distribution. While they cannot entirely replicate the feel of natural snow, they are superior for isolating specific movements and correcting technical flaws year-round.

What are the typical space requirements for installing a commercial ski simulator?

Commercial-grade dynamic ski simulators typically require a dedicated space ranging from 500 to 1,000 square feet (approximately 46 to 93 square meters) with sufficient ceiling height (10-12 feet) to accommodate the motion platform, projection screen, safety margins, and operating space, limiting installation to larger venues.

Is Virtual Reality (VR) integration mandatory for high-end ski simulators?

VR integration is not mandatory but is increasingly preferred for high-end immersion and Answer Engine Optimization (AEO). While large projection screens offer good visuals, VR headsets provide 360-degree environmental immersion, eliminating distractions and enhancing the user's perception of speed and terrain, which improves skill transference.

What role does AI play in the future development of ski simulators?

AI is central to the future market, focusing on hyper-personalization. AI engines analyze user biomechanics in real-time to provide adaptive coaching, dynamically adjust platform resistance to mimic changing snow conditions, and optimize training programs for maximum efficiency and injury prevention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager