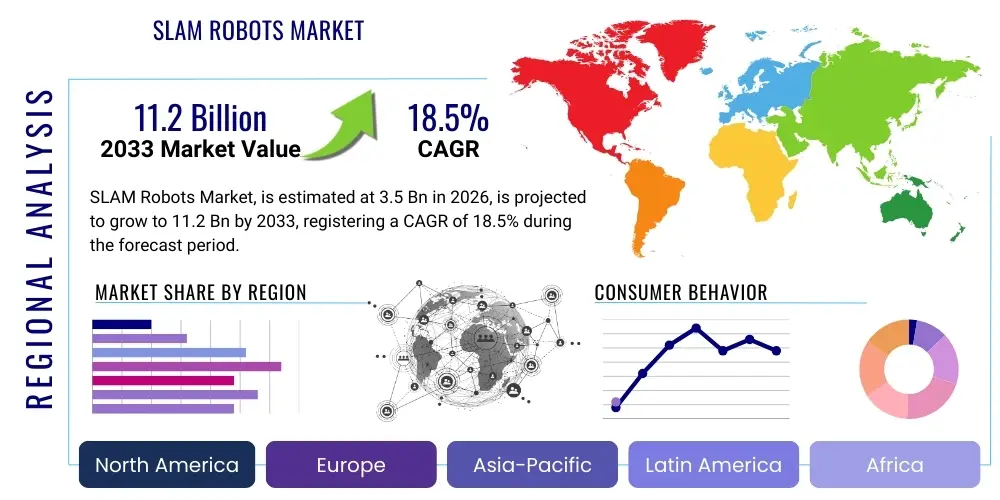

SLAM Robots Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443178 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

SLAM Robots Market Size

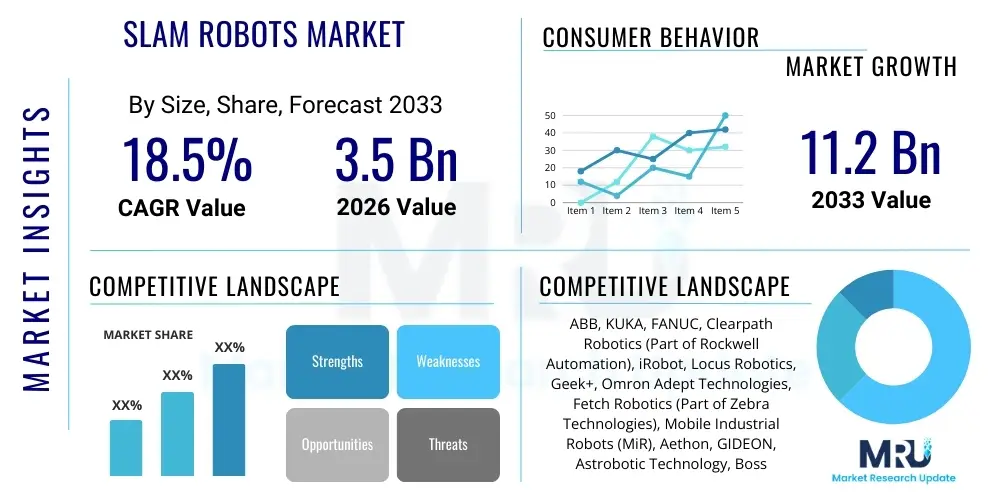

The SLAM Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for automation across pivotal industrial sectors, particularly logistics, manufacturing, and healthcare. The increasing sophistication of simultaneous localization and mapping (SLAM) algorithms, coupled with the decreasing cost of necessary sensor technologies such as LiDAR and advanced cameras, positions the market for aggressive long-term growth. Furthermore, the imperative for enhanced operational efficiency and reduced human error in complex environments fuels the adoption curve of these advanced robotic systems.

SLAM Robots Market introduction

The Simultaneous Localization and Mapping (SLAM) Robots Market encompasses autonomous mobile robots that utilize computational algorithms to concurrently build or update a map of an unknown environment while tracking their own location within that map. SLAM technology is crucial for achieving true autonomy in complex, dynamic, and unstructured operational settings, differentiating these systems from traditional guided vehicles. The core product category includes automated guided vehicles (AGVs), autonomous mobile robots (AMRs), service robots, and drones that rely on SLAM for navigation and precise execution of tasks. These systems typically integrate sophisticated sensor arrays, including LiDAR, 3D cameras, inertial measurement units (IMUs), and advanced probabilistic algorithms like Extended Kalman Filters (EKF) or particle filters to process spatial data and maintain positional accuracy, even in GPS-denied environments. The versatility of SLAM architecture makes it indispensable for modern industrial automation.

Major applications of SLAM robots span industrial warehousing, where they facilitate inventory management and material handling; healthcare facilities, used for sanitation and delivery of medical supplies; and commercial spaces, utilized for security surveillance and cleaning. In manufacturing, SLAM-enabled AMRs optimize assembly lines by flexibly moving components without needing fixed infrastructure. Key benefits derived from the deployment of SLAM robots include significantly improved throughput and operational continuity due to 24/7 working capacity, reduced operational costs associated with manual labor, and enhanced workplace safety by handling hazardous tasks or navigating congested areas reliably. These benefits are particularly pronounced in Industry 4.0 environments where flexible manufacturing systems require agile and scalable automation solutions that can adapt quickly to changes in layout or task requirements.

The market is significantly driven by several macroeconomic and technological factors. Increasing investments in smart factory initiatives globally, coupled with a growing labor shortage in logistics and manufacturing sectors, propel the demand for autonomous solutions. Technological advancements, specifically in computational efficiency—enabling real-time complex map processing on smaller, affordable embedded systems—are lowering the barrier to entry for SLAM deployment. Moreover, the standardization of robot communication protocols and the maturation of 5G infrastructure are providing the necessary high-bandwidth, low-latency connectivity crucial for large fleets of coordinated SLAM robots, further solidifying their market penetration across diverse commercial and industrial landscapes.

SLAM Robots Market Executive Summary

The SLAM Robots Market is experiencing dynamic transformation, characterized by aggressive technological integration and shifting geographical adoption patterns. Business trends emphasize the move from traditional industrial robots to highly flexible, collaborative autonomous mobile robots (AMRs), driven by the requirement for rapid scalability and adaptability in e-commerce fulfillment and manufacturing supply chains. Strategic partnerships between established automation providers and niche software developers specializing in computer vision and deep learning are becoming crucial for competitive differentiation. Furthermore, the shift towards Robot-as-a-Service (RaaS) models is lowering the initial capital expenditure barrier for smaller and medium-sized enterprises (SMEs), thereby accelerating market access and driving broader adoption across previously untapped sectors such as retail and hospitality. This financial flexibility, coupled with demonstrated return on investment (ROI) in large-scale logistics operations, underscores the immediate commercial viability of advanced SLAM systems.

Regionally, North America and Europe maintain technological leadership, focusing on high-value applications requiring complex navigation, such as specialized inventory management in large distribution centers and precise robotic surgery assistance in medical environments. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive government investments in smart cities, rapid industrialization, and high volume manufacturing capacity, particularly in China, Japan, and South Korea. These APAC markets prioritize high throughput and scalable automation solutions, making them dominant consumers of logistics and manufacturing AMRs. Regulatory landscapes also vary, with European Union directives focusing heavily on robot-human interaction safety and data privacy, which shapes the development of collaboration-focused SLAM solutions, while North American markets often prioritize deployment speed and fleet management efficiencies across large, distributed operational sites.

Segment-wise, 3D SLAM technology, offering superior environmental understanding compared to 2D methods, is rapidly gaining market share, driven by increasing complexity in operating environments. The navigation technology segment sees LiDAR-based SLAM dominating industrial applications requiring high precision and long range, though vision-based SLAM is surging in service robotics due to its lower cost profile and rich contextual data capture capabilities. End-user vertical analysis indicates that the logistics and warehousing sector remains the largest consumer, primarily due to the intense pressure from e-commerce growth requiring optimized material flow. Simultaneously, the burgeoning market for professional cleaning and disinfection robots, particularly post-pandemic, represents a significant short-to-medium-term growth opportunity within the service robotics segment, demanding robust and reliable SLAM capabilities for consistent coverage in public spaces.

AI Impact Analysis on SLAM Robots Market

User queries regarding the impact of Artificial Intelligence (AI) on the SLAM Robots Market primarily center on three areas: how AI enhances mapping robustness and long-term stability in dynamic environments, the role of machine learning in improving perception and collision avoidance capabilities, and the potential for AI to facilitate fleet management and inter-robot coordination. Users frequently express concerns about the transition from traditional, rule-based SLAM algorithms to learning-based methods, asking if AI can truly handle complex, unpredictable situations like crowded public spaces or highly variable warehouse traffic better than established probabilistic filters. There is also significant interest in how AI-powered predictive maintenance, derived from SLAM data, can reduce downtime and improve the overall longevity of robotic fleets. The consensus expectation is that AI integration will shift SLAM from purely geometric mapping to semantic understanding of the environment, enabling robots to not only know where they are but also what objects surround them and the functional context of the location.

The integration of deep learning models, specifically Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs), is fundamentally transforming how SLAM systems perceive and react to their surroundings. AI enables visual SLAM systems to accurately classify objects (e.g., distinguishing a temporary obstacle from a permanent wall), drastically improving the persistence and efficiency of maps. Furthermore, reinforcement learning is being utilized to train robots in navigation strategies, allowing them to optimize routes dynamically based on real-time traffic conditions and past mission successes, moving beyond static path planning. This shift moves SLAM from a purely state estimation problem to a complex decision-making challenge, where AI provides the framework for superior autonomy and adaptability in unstructured settings.

AI also plays a critical role in addressing the historically challenging problem of data association and loop closure in SLAM—ensuring the robot recognizes a location it has previously visited accurately, even under varying lighting or seasonal conditions. By applying advanced feature extraction techniques through neural networks, robots achieve more robust and computationally efficient recognition of landmarks. Moreover, in large-scale deployments, AI-powered fleet management systems utilize centralized learning capabilities to share environmental knowledge among multiple robotic agents. This collective intelligence dramatically reduces the time required for new robots to build accurate maps and ensures coordinated behavior, maximizing operational throughput and minimizing navigational conflicts across the entire operational domain.

- AI enhances mapping robustness through semantic understanding and object recognition.

- Deep learning algorithms significantly improve real-time collision avoidance and predictive path planning.

- Reinforcement learning optimizes navigation strategies based on historical performance data.

- AI-driven data association improves loop closure accuracy under variable environmental conditions.

- Centralized AI fleet management facilitates knowledge sharing and coordinated multi-robot operations.

DRO & Impact Forces Of SLAM Robots Market

The SLAM Robots Market is currently shaped by a robust interplay of driving forces, inherent limitations acting as restraints, and emergent opportunities that dictate strategic direction. The primary driving force is the relentless pursuit of automation efficiency in supply chains, necessitated by the global surge in e-commerce and the associated pressure on warehousing and logistics infrastructure to process higher volumes at faster speeds. This commercial urgency is compounded by the technological advancements which have made SLAM sensors (LiDAR, cameras) smaller, more powerful, and significantly cheaper, facilitating widespread adoption. However, key restraints include the high initial capital investment required for comprehensive fleet deployment and integration with legacy enterprise resource planning (ERP) systems. The persistent need for specialized technical expertise for maintenance, programming, and large-scale deployment management also acts as a bottleneck, particularly in regions with nascent automation ecosystems. These counteracting forces necessitate careful consideration of total cost of ownership (TCO) during implementation.

Significant opportunities exist in emerging application areas, particularly the use of SLAM robots in last-mile delivery, professional cleaning, agriculture (e.g., autonomous harvesting), and construction surveying. The development of Visual SLAM (VSLAM) solutions that rely predominantly on less expensive cameras rather than costly LiDAR units represents a substantial opportunity for democratizing access to autonomous mobility across cost-sensitive sectors. Furthermore, the ongoing standardization of robot interfaces and the growth of 5G networks present an opportunity to deploy vast, globally distributed fleets managed centrally, allowing for sophisticated over-the-air updates and performance optimization. The shift towards modular robot hardware and software components allows end-users to customize solutions more effectively, targeting specific, niche operational challenges, thus unlocking specialized market segments.

The impact forces influencing the market are multifaceted, encompassing macroeconomic trends, regulatory frameworks, and competitive dynamics. Regulatory clarity, especially concerning safety protocols for Human-Robot Collaboration (HRC) in shared workspaces, acts as a pivotal force, directly influencing the design and adoption speed of collaborative AMRs. Competitive intensity is forcing continuous innovation, particularly in areas like multi-sensor fusion capabilities and robust performance in challenging, low-texture environments. The macro impact of global geopolitical uncertainty and fluctuating supply chains for specialized electronic components (chips, sensors) affects the manufacturing scalability and pricing strategy of robot manufacturers. Ultimately, the market trajectory is heavily dictated by the successful mitigation of technical restraints, such as achieving centimeter-level accuracy reliably across diverse light conditions, while fully capitalizing on the clear operational and cost benefits offered by advanced autonomous navigation.

Segmentation Analysis

The SLAM Robots Market segmentation provides a granular view of the industry structure, dissecting it based on technology utilized, application type, component structure, and end-user vertical. Understanding these segments is crucial for identifying precise growth pockets and formulating targeted market strategies. The market is primarily categorized by the core navigation technology—ranging from 2D SLAM, which utilizes planar data, to the more complex 3D SLAM necessary for volumetric understanding, and the distinct methods of sensor data acquisition, such as Visual SLAM (VSLAM) and LiDAR SLAM. Furthermore, the market differentiates based on the type of robot platform, including ground-based Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), as well as aerial platforms like drones. This detailed breakdown allows stakeholders to benchmark competition and allocate resources towards the most lucrative and rapidly evolving segments within the automation ecosystem.

- By Component: Hardware (Sensors, Processors, Actuators), Software (Algorithms, Operating Systems, Simulation Tools), Services (Installation, Maintenance, Training).

- By Technology Type: 2D SLAM, 3D SLAM.

- By Sensor Type: LiDAR, Vision Sensor (Stereo Camera, Depth Camera), Ultrasonic Sensors, Inertial Measurement Units (IMUs).

- By Robot Type: Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Service Robots (Professional, Personal), Drones/UAVs.

- By End-User Vertical: Industrial (Manufacturing, Logistics & Warehousing, Automotive), Commercial (Retail, Healthcare, Hospitality), Defense & Security, Agriculture.

- By Application: Inventory Management, Material Handling, Inspection & Monitoring, Mapping & Surveying, Collaborative Robotics, Delivery Services.

Value Chain Analysis For SLAM Robots Market

The value chain of the SLAM Robots market initiates with upstream activities focused on the production of critical enabling hardware components and the development of core software algorithms. The upstream segment is characterized by specialized suppliers providing high-performance sensors (LiDAR units, sophisticated depth cameras, and IMUs) and high-density, low-power processing units (CPUs, GPUs, and specialized AI accelerators). Core intellectual property resides in the development of proprietary SLAM algorithms and sensor fusion software necessary for accurate localization and mapping. Competition at this stage is intense, driving rapid cycles of technological innovation and cost reduction, which ultimately benefits downstream integrators. Strategic sourcing and vertical integration capabilities regarding microelectronics and optoelectronics are key factors influencing profitability and supply chain resilience within the upstream component providers.

Midstream activities involve the design, assembly, and testing of the complete robotic platform, integrating the components and the navigation software stack into a functional autonomous system. This stage includes hardware platform manufacturing, systems integration, and extensive testing for regulatory compliance and operational reliability across various environments. Major robot manufacturers often partner with software specialists to refine the user interface and fleet management capabilities. Distribution channels are varied: direct sales channels are typically employed for large enterprise clients requiring highly customized industrial solutions, often involving long-term support contracts and system integration services. Indirect distribution relies heavily on regional distributors, value-added resellers (VARs), and system integrators who handle localized sales, installation, and first-line support for standardized AMR or service robot models, particularly targeting SMEs.

The downstream segment focuses on deployment, maintenance, and end-user engagement. This involves the crucial step of site assessment, custom mapping, commissioning the robot fleet, and ensuring seamless integration with the client's existing operational infrastructure (e.g., WMS, MES systems). Post-sale services, including software updates (often delivered remotely), predictive maintenance, and operational data analytics, are increasingly critical revenue streams, often managed through RaaS subscription models. The efficiency of the downstream support network directly impacts client satisfaction and the scalability of deployment, making localized technical support a strong competitive differentiator. The shift towards cloud-based fleet management solutions allows for continuous performance optimization and centralized control of globally deployed assets, solidifying the long-term relationship between manufacturers and end-users.

SLAM Robots Market Potential Customers

Potential customers for SLAM Robots are concentrated across sectors characterized by repetitive, high-volume tasks, complex indoor navigation needs, or hazardous operating conditions, all seeking optimized resource utilization and operational consistency. The largest immediate customers are logistics and warehousing companies, including major e-commerce fulfillment centers, third-party logistics (3PL) providers, and retail distribution networks, where AMRs are essential for automated material transport, picking optimization, and dynamic inventory auditing. In these environments, SLAM capabilities provide the flexibility needed to operate alongside human workers and adapt to frequent layout changes without costly infrastructure modifications, driving measurable improvements in supply chain velocity and accuracy.

The industrial manufacturing sector represents another major segment, particularly in automotive assembly, electronics production, and heavy machinery fabrication. These customers utilize SLAM robots for just-in-time material delivery to production lines, quality inspection via mobile sensors, and automated tool transfer. Healthcare facilities, including large hospitals and medical laboratories, are increasingly adopting SLAM service robots for tasks such as drug and linen delivery, biohazard waste transport, and environmental disinfection, motivated by efficiency gains and stringent sanitation requirements. The demand here is driven by the need to free up skilled medical personnel from logistical duties, allowing them to focus on patient care, simultaneously mitigating infection risks through autonomous cleaning.

Beyond traditional industrial users, significant growth potential lies in specialized verticals. The agricultural sector uses SLAM-enabled robots and UAVs for autonomous crop monitoring, precision spraying, and detailed field mapping. Construction and infrastructure firms employ SLAM-equipped devices for surveying, progress tracking, and site safety inspections, drastically reducing manual labor time and improving data capture accuracy. Commercial customers, such as large shopping centers, airports, and corporate campuses, deploy SLAM cleaning and security robots to maintain extensive facilities efficiently. The common denominator among all potential customers is the strategic requirement for autonomous mobility that can operate reliably in complex, real-world, dynamic environments without fixed infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA, FANUC, Clearpath Robotics (Part of Rockwell Automation), iRobot, Locus Robotics, Geek+, Omron Adept Technologies, Fetch Robotics (Part of Zebra Technologies), Mobile Industrial Robots (MiR), Aethon, GIDEON, Astrobotic Technology, Bossa Nova Robotics, SESTO Robotics, NAVVIS, SLAMTEC, Brain Corporation, KION Group, Teradyne (Universal Robots/MiR Parent). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SLAM Robots Market Key Technology Landscape

The technological landscape of the SLAM Robots Market is dominated by advancements in sensor fusion, computational algorithms, and hardware optimization. Core SLAM algorithms primarily fall into two categories: filter-based (like the Extended Kalman Filter and Particle Filter) and optimization-based (like Bundle Adjustment and Graph SLAM). Graph SLAM has emerged as the prevailing method for modern, large-scale mapping due to its ability to incorporate loop closure corrections efficiently, maintaining long-term map consistency crucial for industrial use. Recent breakthroughs focus on real-time optimization techniques that minimize computational latency, making these complex algorithms viable for deployment on compact, power-constrained mobile platforms, thereby maximizing the robot's battery life and operational duration. Further technological differentiation is achieved through the development of robust visual-inertial odometry (VIO) solutions, which tightly couple camera and IMU data to provide highly accurate dead reckoning, particularly critical when primary sensors like LiDAR temporarily fail or provide ambiguous readings.

Sensor technology remains a cornerstone of the SLAM ecosystem, with LiDAR units providing highly accurate, dense 3D point clouds essential for long-range industrial navigation. However, the rapidly decreasing cost and improved resolution of solid-state LiDAR are making it increasingly accessible. Simultaneously, vision sensors, including stereo cameras and RGB-D sensors, are driving the growth of Visual SLAM (VSLAM), especially in commercial and service robotics where environmental textures and colors are important for semantic understanding. The key technological challenge here is achieving robust VSLAM performance in texture-poor environments or under extreme lighting variability. Advanced sensor fusion techniques are therefore essential, enabling the system to intelligently weigh inputs from disparate sensor modalities—combining the accuracy of LiDAR with the contextual richness of vision and the stability of IMUs—to ensure continuous, accurate localization regardless of environmental conditions.

Beyond core navigation, the technology landscape is being redefined by software platforms that enable multi-robot collaboration and centralized fleet management. Technologies leveraging edge computing and cloud integration allow individual robots to offload heavy mapping computations and share localized maps or recognized features with the entire fleet instantly. This centralized data processing capability is vital for large-scale logistics operations, preventing inter-robot collision and optimizing collective efficiency. Furthermore, predictive modeling and simulation tools, often powered by digital twin technology, allow companies to test and validate SLAM algorithms in virtual environments before physical deployment, drastically reducing development time and enhancing the safety of complex robotic systems before they interact with human workers or valuable assets in the real world.

Regional Highlights

- North America: Dominates the SLAM Robots Market in terms of early adoption and technological innovation. The presence of major technology hubs, high investment in R&D, and substantial capital expenditure by large e-commerce giants and logistics providers drive demand. Focus areas include advanced 3D SLAM for complex warehouse automation and autonomous vehicles, and the fastest adoption of the Robot-as-a-Service (RaaS) financial model.

- Europe: Characterized by stringent safety regulations promoting Human-Robot Collaboration (HRC), leading to a high demand for robust, collaborative AMRs utilizing SLAM. Germany and the Scandinavian countries are leaders in industrial automation, while the Netherlands is prominent in advanced agricultural robotics (Agri-Food Tech), heavily utilizing SLAM for precision farming and internal logistics.

- Asia Pacific (APAC): Projected to be the fastest-growing region, driven by rapid industrialization, large-scale manufacturing capacity, and significant government support for robotics in China, Japan, and South Korea. High volume manufacturing and the sheer scale of logistics operations in emerging economies necessitate cost-effective, scalable SLAM solutions, particularly favoring 2D and low-cost VSLAM for deployment speed.

- Latin America (LATAM): Currently represents a nascent market with localized growth concentrated in mature manufacturing economies like Mexico and Brazil. Adoption is primarily driven by multinational corporations implementing automation standards established in North America and Europe. Challenges include infrastructure limitations and lower capital spending capacity, favoring budget-conscious solutions.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) nations, fueled by ambitious smart city projects (e.g., NEOM in Saudi Arabia) and massive investments in critical infrastructure, particularly in defense, security, and large-scale facility management (airports, exhibition centers). Demand often focuses on high-performance SLAM for surveillance and complex indoor mapping.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SLAM Robots Market.- ABB

- KUKA

- FANUC

- Clearpath Robotics (Part of Rockwell Automation)

- iRobot

- Locus Robotics

- Geek+

- Omron Adept Technologies

- Fetch Robotics (Part of Zebra Technologies)

- Mobile Industrial Robots (MiR)

- Aethon

- GIDEON

- Astrobotic Technology

- Bossa Nova Robotics

- SESTO Robotics

- NAVVIS

- SLAMTEC

- Brain Corporation

- KION Group

- Teradyne (Universal Robots/MiR Parent)

- BlueBotics SA

- Simbe Robotics

- Pudu Robotics

- Gaussian Robotics

- Seegrid Corporation

Frequently Asked Questions

Analyze common user questions about the SLAM Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between SLAM and traditional guided navigation systems?

SLAM (Simultaneous Localization and Mapping) allows robots to autonomously build a map of an unknown environment while simultaneously locating themselves within it. Traditional guided systems, such as Automated Guided Vehicles (AGVs), require pre-installed infrastructure like magnetic tapes or wires, making them less flexible and highly dependent on fixed operational layouts.

Which sensor technology is most prevalent for accurate SLAM implementation in industrial settings?

LiDAR (Light Detection and Ranging) remains the most prevalent sensor for high-precision industrial SLAM due to its ability to generate highly accurate, dense 3D point clouds necessary for reliable navigation and obstacle avoidance over long distances, particularly in large, complex warehousing and manufacturing facilities.

How is Visual SLAM (VSLAM) impacting the future growth of the service robotics segment?

VSLAM significantly boosts the service robotics segment because it relies primarily on cameras, offering a lower component cost compared to LiDAR-based systems. This cost efficiency, combined with the camera's ability to provide rich contextual and semantic data, makes VSLAM ideal for deployment in cost-sensitive commercial applications like retail inventory management and professional cleaning.

What are the primary challenges restraining the widespread adoption of SLAM robots in SMEs?

The primary restraints for Small and Medium-sized Enterprises (SMEs) include the substantial upfront capital investment required for procurement and integration, coupled with the lack of in-house technical expertise necessary to manage and maintain complex autonomous robot fleets effectively. This challenge is increasingly being mitigated by RaaS (Robot-as-a-Service) financing models.

Which geographical region is forecast to demonstrate the highest growth rate in the SLAM Robots Market?

The Asia Pacific (APAC) region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid investment in smart factory infrastructure, the substantial scale of manufacturing operations, and aggressive government initiatives promoting automation and industrial modernization, particularly across China and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- SLAM Robots Market Size Report By Type (Industrial Robots, Service Robots), By Application (Hospitals and Healthcare, Manufacturing, Logistics and Warehouse, Military, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- SLAM Robots Market Statistics 2025 Analysis By Application (Hospitals and Healthcare, Manufacturing, Logistics and Warehouse, Military), By Type (Industrial Robots, Service Robots), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager