Slimming Cream Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442082 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Slimming Cream Market Size

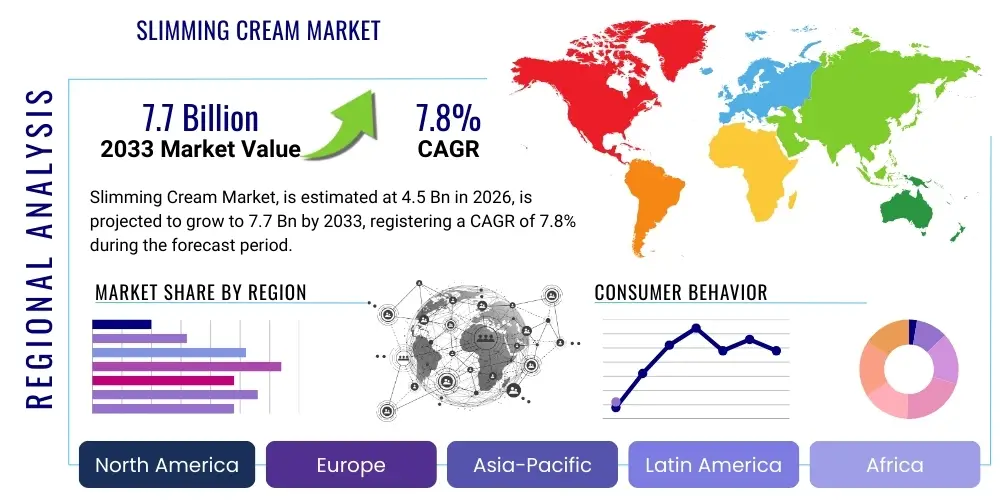

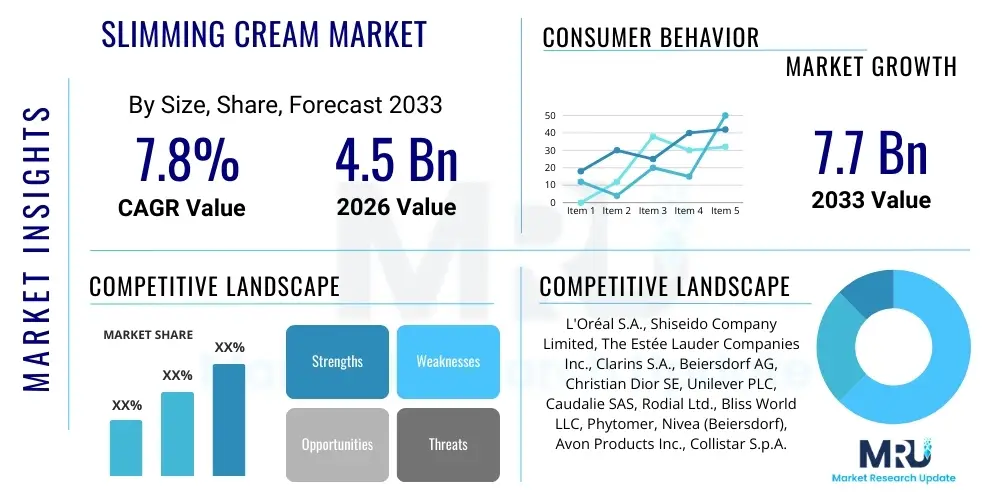

The Slimming Cream Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by rising consumer focus on aesthetic well-being, the increasing acceptance of non-invasive cosmetic solutions, and rapid advancements in formulation chemistry, particularly incorporating potent botanical extracts and novel lipolytic agents. The market expansion reflects a global shift toward accessible and convenient body contouring alternatives, bridging the gap between traditional surgical procedures and lifestyle adjustments.

Market valuation is significantly influenced by geographic variations in consumer disposable income, cultural perceptions of beauty, and the regulatory environment governing cosmetic claims. Developed markets, particularly North America and Europe, contribute substantially to current revenues due to high consumer awareness and willingness to spend on premium, clinically tested products. However, emerging economies in the Asia Pacific are expected to drive the highest growth rates, fueled by a burgeoning middle class, urbanization, and intense marketing campaigns leveraging social media platforms and celebrity endorsements. The professional segment, encompassing clinics and spas, also plays a crucial role, offering specialized treatments that incorporate high-concentration slimming creams, thereby justifying higher price points and enhancing overall market value.

Slimming Cream Market introduction

The Slimming Cream Market encompasses topical cosmetic and dermatological products designed to reduce localized fat deposits, minimize the appearance of cellulite, and firm the skin. These formulations typically contain active ingredients such as caffeine, retinoids, botanical extracts (like guarana and seaweed), and lipolytic peptides that work by stimulating microcirculation, promoting lipolysis (the breakdown of fats), and enhancing lymphatic drainage. Products are broadly categorized based on their application area—abdomen, thighs, hips, and arms—and their intended use, ranging from daily moisturizing firming agents to intensive night-time treatments. The global demand is driven by the desire for quick, easy, and painless body reshaping solutions without resorting to invasive surgical methods, making slimming creams a key component of the broader cosmetic body care industry.

Major applications of slimming creams extend beyond simple weight loss, focusing primarily on aesthetic improvements like contour refinement and texture smoothing. Consumers utilize these products as complementary aids to diet and exercise regimens, seeking enhanced results, particularly in stubborn areas resistant to traditional methods. Furthermore, the market benefits from increasing geriatric populations who seek skin firming solutions as elasticity naturally declines, expanding the user base beyond just younger demographics focused on immediate contouring. The clinical application segment, where dermatologists and aestheticians recommend specific formulations post-procedure or as intense treatments, adds a layer of credibility and professional validation to the product category, thereby boosting consumer confidence and uptake globally.

Key benefits driving market adoption include the non-invasive nature of application, convenience, and affordability relative to alternatives like liposuction or cryolipolysis. Driving factors involve rising body image consciousness, aggressive marketing by key players highlighting scientifically backed ingredients, and the growing influence of social media trends promoting achievable beauty standards. Rapid product innovation, particularly the integration of encapsulation technologies for sustained ingredient release and the focus on natural and organic ingredients to meet clean beauty demands, further stimulates market growth. Regulatory shifts demanding greater transparency in efficacy testing also compel manufacturers to invest in clinical trials, reinforcing consumer trust and fueling sustained demand across diverse geographic regions.

Slimming Cream Market Executive Summary

The global Slimming Cream Market is characterized by intense competition and a continuous stream of product innovation focused on efficacy and sustainability. Business trends indicate a strong move toward personalized beauty, leveraging digital tools and e-commerce platforms to match specific consumer needs with tailored product recommendations. Strategic mergers, acquisitions, and partnerships between cosmetic giants and specialized biotechnology firms are common, aiming to secure proprietary ingredients and advanced delivery systems. Furthermore, manufacturers are increasingly emphasizing transparent labeling, focusing on proven natural extracts and scientifically validated compounds, responding directly to consumer demand for clean and effective formulations, which influences procurement and supply chain management significantly across all market segments.

Regionally, the market dynamics are polarized, with mature markets in North America and Western Europe demonstrating high average selling prices and a preference for premium, clinically-proven anti-cellulite and firming products. Conversely, the Asia Pacific region, particularly China, India, and South Korea, is experiencing explosive volume growth driven by a vast, aspirational consumer base and the prominence of local beauty trends focused on thinness and body shape modification. Latin America also presents a significant growth avenue, characterized by a high cultural emphasis on aesthetics and a strong uptake of cosmetic procedures, positioning slimming creams as essential post-treatment maintenance. Manufacturers strategically adapt ingredient profiles and packaging to meet diverse regional preferences, suchvolving thermal sensations preferred in some areas versus cooling effects favored in others.

Segment trends highlight the dominance of the mass market segment in terms of volume, catering to price-sensitive consumers via retail channels, although the professional and premium segments lead in terms of revenue growth due to higher margins and specialized formulations. In terms of ingredients, the shift towards vegan, cruelty-free, and highly concentrated natural compounds like coffee seed oil and seaweed derivatives is a major defining trend. Distribution channel analysis shows a significant acceleration in online sales, fueled by direct-to-consumer models and the ease of comparing reviews and clinical data. This digital shift compels traditional retail channels to enhance in-store experiences, such as providing consultation services or integrating digital product information to remain competitive against the rapid accessibility of e-commerce platforms.

AI Impact Analysis on Slimming Cream Market

The integration of Artificial Intelligence (AI) is rapidly transforming the Slimming Cream market, primarily by enhancing personalization, streamlining product development, and optimizing retail strategy. User inquiries frequently center on how AI can guarantee personalized product efficacy, focusing on whether algorithms can accurately predict the best formulation for an individual’s specific fat deposition pattern, skin type, and lifestyle factors. Consumers are also keenly interested in AI’s role in verifying claims, asking whether AI-driven imaging analysis can provide objective proof of visible results, thereby mitigating skepticism often associated with topical cosmetic claims. Furthermore, questions arise regarding AI's application in supply chain resilience, specifically anticipating demand spikes for high-performing ingredients based on real-time social media sentiment and purchasing data, ensuring manufacturers maintain optimal inventory levels.

Manufacturers are leveraging AI-powered diagnostics tools, often integrated into mobile applications, that allow users to upload images of target areas (e.g., thighs or abdomen). These tools use computer vision and machine learning algorithms to analyze parameters such as skin texture, cellulite grade, and localized fat accumulation, subsequently recommending the most effective slimming cream composition and usage regimen. This level of personalized consultation, previously exclusive to professional settings, is now scalable through AI, significantly improving the consumer journey and boosting conversion rates in the competitive e-commerce space. The ability to offer hyper-personalized solutions addresses a core restraint of the market: the variability of efficacy across different users.

In research and development, AI algorithms are accelerating the discovery of novel lipolytic agents and optimizing ingredient combinations. By simulating molecular interactions and predicting the bioavailability and stability of complex formulations, AI drastically reduces the time and cost associated with traditional laboratory testing. Furthermore, Generative AI is being used in marketing content creation, enabling rapid generation of tailored advertisements and educational materials based on demographic and psychographic targeting, maximizing campaign effectiveness and ensuring that the complex scientific backing of advanced slimming creams is communicated clearly and compellingly to diverse consumer segments worldwide.

- AI-driven personalized product recommendation based on body scanning and skin diagnostics.

- Optimization of ingredient efficacy and stability through machine learning predictive modeling.

- Enhanced supply chain management predicting ingredient demand fluctuations based on social media trends.

- Improved consumer engagement via AI chatbots providing personalized consultation and usage instructions.

- Objective efficacy verification using AI analysis of before-and-after photographic evidence.

- Automated quality control and ingredient sourcing traceability using blockchain integrated with AI monitoring.

DRO & Impact Forces Of Slimming Cream Market

The Slimming Cream Market is primarily driven by societal pressure and increased awareness regarding body aesthetics, coupled with the rising availability of sophisticated, scientifically backed non-invasive solutions. Restraints include significant consumer skepticism regarding product efficacy, regulatory scrutiny over unsubstantiated claims, and the high cost associated with premium formulations utilizing cutting-edge delivery systems. Opportunities lie in penetrating emerging markets, developing specialized products for specific demographic needs (e.g., post-pregnancy contouring, men’s body care), and integrating active ingredients derived from sustainable and organic sources, appealing to the environmentally conscious consumer. These forces collectively shape the competitive intensity and market structure, requiring strategic maneuverability from established players and innovative entrants alike.

Drivers exerting powerful upward force include the substantial increase in health and wellness spending globally, the prevalence of sedentary lifestyles leading to localized fat accumulation, and continuous innovation in ingredient technology, such as micro-encapsulation techniques that improve transdermal delivery of active compounds like caffeine and L-carnitine. The accessibility and convenience of applying a topical cream compared to invasive surgical options position these products favorably among busy consumers seeking incremental improvements. Furthermore, the robust growth of the e-commerce sector acts as a significant catalyst, providing global reach for niche brands and facilitating consumer access to detailed product information and testimonials, which builds confidence and encourages trial purchases across various economic strata.

Conversely, the primary restraints include the historical reputation of many products being ineffective, leading to a general trust deficit that requires substantial marketing investment in clinical trials and transparent communication. Regulatory bodies, particularly in North America and Europe, are increasingly stringent regarding cosmetic claims, demanding verifiable data, which raises R&D costs and time-to-market. The competitive landscape is also strained by the presence of numerous counterfeit or substandard products, particularly through unregulated online channels, which negatively impacts the reputation and pricing power of legitimate, high-quality brands. Overcoming these restraints necessitates a concerted effort towards scientific substantiation and robust intellectual property protection.

Segmentation Analysis

The Slimming Cream Market is segmented extensively based on product type, active ingredient, distribution channel, and application area, allowing manufacturers to target specific consumer needs and purchasing behaviors effectively. The segmentation by ingredient—natural/organic versus synthetic—reflects the growing divergence in consumer preferences, with a strong trend favoring natural botanical extracts like green tea, algae, and essential oils, perceived as safer and more sustainable. Analysis of distribution channels reveals the shift in consumer purchasing power, with online retail channels rapidly gaining prominence over traditional brick-and-mortar pharmacies and supermarkets, driven by competitive pricing, product variety, and ease of comparison shopping, demanding dynamic omnichannel strategies from market participants.

Segmentation by product application focuses on differentiation between anti-cellulite creams, firming/toning creams, and specialized products for localized fat reduction, with anti-cellulite formulations dominating the current market share due to the widespread nature of the condition. Within the End-User segment, differentiation exists between the institutional use (spas, clinics, professional treatments) where high-potency, concentrated formulations are utilized, and the individual consumer segment, which favors user-friendly, daily-use creams. Understanding these diverse segments is critical for developing targeted marketing campaigns and optimizing inventory management, ensuring that product positioning aligns perfectly with the intended consumer’s perceived needs and willingness to pay premium prices for specialized benefits.

Furthermore, segmentation by geography highlights distinct regional consumption patterns; for instance, Asian consumers often prefer products focusing on overall slenderizing and skin whitening, while Western consumers prioritize localized contouring and severe cellulite reduction. The complexity of segmentation demands highly flexible manufacturing and supply chain operations, capable of adapting to varied packaging regulations, ingredient sourcing requirements, and marketing narratives tailored to cultural nuances. This detailed understanding of segmentation allows firms to identify high-growth segments, such as male grooming or specialized medical aesthetics support, enabling focused investment for maximizing revenue potential throughout the forecast period.

- By Product Type: Anti-Cellulite Creams, Firming and Toning Creams, Localized Fat Reduction Creams.

- By Active Ingredient: Caffeine and Derivatives, Botanical Extracts (Algae, Guarana, Green Tea), Peptides and Retinoids, Others (L-Carnitine, Aminophylline).

- By End-User: Individual Consumers, Professional Settings (Spas, Clinics, Salons).

- By Distribution Channel: Online Retail (E-commerce Websites, Company Websites), Offline Retail (Pharmacies/Drug Stores, Hypermarkets/Supermarkets, Specialty Stores).

- By Geography: North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

Value Chain Analysis For Slimming Cream Market

The value chain for the Slimming Cream market begins with the upstream activities centered on the sourcing and processing of raw materials, which is highly critical given the reliance on specialized active ingredients, particularly high-grade botanical extracts like natural caffeine, seaweed, and rare plant oils. This stage involves rigorous quality control, ensuring ingredient potency and compliance with global cosmetic safety standards (such as REACH or FDA regulations). Key challenges at this stage include price volatility of natural commodities, ensuring sustainable sourcing practices, and managing the intellectual property surrounding novel lipolytic molecules. Strong relationships with certified suppliers of specialty chemicals and bio-extracted compounds are paramount for maintaining product efficacy and margin stability in a highly competitive formulation landscape.

Midstream activities involve research and development, formulation, and manufacturing. R&D focuses on enhancing transdermal penetration (e.g., using nanoemulsions or liposomal delivery systems) and conducting clinical trials to substantiate efficacy claims—a necessary investment for achieving premium positioning. Manufacturing requires specialized equipment for sterile mixing, temperature control, and high-speed packaging, adhering to Good Manufacturing Practices (GMP). Efficient production scaling is vital to meet the volume demands of the mass market while maintaining the precise specifications required for niche, high-performance professional lines. Cost optimization in packaging and filling operations is a continuous focus area to protect profitability against rising raw material costs.

Downstream analysis encompasses distribution and marketing, leading to the end consumer. Products reach consumers through two primary channels: direct (company websites, direct sales) and indirect (retailers, pharmacies, professional distributors). The shift toward e-commerce necessitates significant investment in digital marketing, search engine optimization (SEO), and logistics infrastructure capable of rapid, secure delivery. Professional channels, though lower in volume, are crucial for validation and brand prestige. Effective marketing strategies leverage scientific evidence and consumer testimonials to overcome skepticism. The final stage involves post-sale customer engagement, including feedback loops and loyalty programs, which are essential for maintaining consumer trust and driving repeat purchases in this claims-sensitive product category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Shiseido Company Limited, The Estée Lauder Companies Inc., Clarins S.A., Beiersdorf AG, Christian Dior SE, Unilever PLC, Caudalie SAS, Rodial Ltd., Bliss World LLC, Phytomer, Nivea (Beiersdorf), Avon Products Inc., Collistar S.p.A., Guam (Lacote S.r.l.), Nu Skin Enterprises, Inc., ELEMIS Ltd., Dr. Brandt Skincare, Sol de Janeiro, Natura & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slimming Cream Market Potential Customers

The primary potential customers for the Slimming Cream market are individuals aged 25 to 55 who are actively engaged in maintaining their physical appearance and body contour but prefer non-surgical or less aggressive solutions compared to surgical interventions. This segment is highly diversified, including fitness enthusiasts looking to enhance muscle definition, individuals seeking post-pregnancy body reshaping, and those struggling with the aesthetic appearance of cellulite. Purchasing decisions are heavily influenced by perceived product efficacy, brand reputation bolstered by clinical studies, and price point relative to competing treatments. These consumers are typically well-informed, relying on digital reviews, influencer endorsements, and scientific literature available online to validate product claims before making a purchase, favoring products that offer multi-functional benefits like hydration and firming alongside contouring.

A rapidly growing segment of potential customers includes professional entities such as aesthetic clinics, specialized dermatological practices, and high-end spa chains. These institutions serve as high-volume buyers of concentrated, professional-grade slimming formulations used during specialized body treatments (e.g., wraps, radiofrequency treatments, or lymphatic drainage massages) or prescribed as essential post-treatment care products. For these professional customers, factors such as demonstrable clinical synergy with existing technological equipment, ease of application, safety profile, and comprehensive technical support from the manufacturer are crucial considerations. Their bulk purchasing capacity and role as trusted authorities make them a strategically important target segment, often setting the trends for ingredient acceptability and clinical efficacy standards across the broader consumer market.

Furthermore, the male grooming segment represents an untapped potential customer base, increasingly interested in products that help define the abdominal area or reduce localized fat accumulation, particularly as social acceptance of male cosmetic enhancement grows. This demographic often seeks products with discreet packaging and specific functional benefits, distinct from formulations targeting traditional female body concerns like cellulite. Geographically, emerging middle-class populations in regions like Southeast Asia and Latin America, driven by aspirational consumerism and rising disposable income, constitute another critical mass of potential customers. Targeting these regions requires adapting marketing materials to local beauty standards and developing distribution networks that can efficiently reach densely populated urban centers with robust e-commerce capabilities, ensuring product accessibility and competitive pricing tailored to local economic conditions.

Slimming Cream Market Key Technology Landscape

The technological landscape of the Slimming Cream market is continuously evolving, primarily focusing on enhancing the bioavailability and targeted delivery of active ingredients to dermal and subcutaneous fat layers. A major technological advancement involves encapsulation systems, such as liposomes, nanosomes, and micro-sponges, which protect sensitive active compounds like vitamins and peptides from degradation and ensure sustained, controlled release directly into the targeted tissue over several hours. This controlled delivery mechanism significantly boosts overall product efficacy compared to traditional formulations where active ingredients may degrade rapidly or fail to penetrate the skin barrier effectively. Manufacturers heavily invest in proprietary encapsulation technologies, seeking patent protection to gain a distinct competitive advantage in this sophisticated cosmetic segment, leading to higher-performance, premium product offerings.

Another crucial technological area is transdermal penetration enhancement, employing penetration promoters and advanced formulation bases (e.g., thermogenic or cooling agents) to temporarily alter the skin barrier, facilitating deeper ingredient absorption. The development of specialized bio-active complexes, often involving synergistic blends of natural extracts and synthetic molecules, is also central. For instance, incorporating specific plant stem cells or fermented ingredients enhances cellular communication and metabolic activity within adipose tissue, promoting effective lipolysis. Furthermore, the integration of ‘smart’ packaging technology, such as airless pump systems, ensures product stability and hygienic dispensing, maintaining the potency of sensitive ingredients throughout the product lifecycle, thus meeting the consumer expectation for premium performance and long shelf life.

Beyond formulation, the market increasingly relies on advanced clinical testing technologies to substantiate efficacy claims. This includes non-invasive imaging techniques such as high-frequency ultrasound and specialized optical coherence tomography (OCT) to quantitatively measure changes in fat layer thickness and skin density before and after product application. These objective measurement methods replace subjective evaluations, lending scientific credibility to marketing claims, which is vital for compliance with stricter regulatory environments globally. Furthermore, sophisticated dermatological labs utilize in-vitro cell culture models and genomics to rapidly screen potential new slimming agents, optimizing the R&D pipeline and ensuring that novel ingredients demonstrate measurable biological activity relevant to fat metabolism and collagen synthesis before they are integrated into commercial formulations, solidifying the market's trajectory towards scientifically rigorous products.

Regional Highlights

Regional dynamics play a crucial role in shaping the Slimming Cream Market, dictated by varying cultural beauty standards, economic factors, and regulatory frameworks. North America, particularly the United States, represents a highly lucrative market characterized by high consumer awareness, readiness to adopt new cosmetic technologies, and substantial expenditure on body contouring products. The market here is driven by premium brands offering clinically tested, high-concentration formulations, often distributed through specialty retail and professional channels. Consumer demand focuses heavily on evidence-based anti-cellulite solutions and firming treatments, coupled with a growing preference for products that align with clean beauty standards, such as those free from parabens and phthalates.

Europe holds a significant market share, distinguished by stringent cosmetic regulations and a mature consumer base that values natural ingredients and scientific heritage. Countries like France, Italy, and Germany demonstrate high per capita spending on cosmetic body care. The European market sees strong competition between traditional pharmaceutical cosmetic brands and organic skincare lines. The focus remains largely on effective cellulite reduction and skin elasticity improvement, often integrated into comprehensive wellness routines offered through spa and beauty salon networks, which act as powerful opinion leaders in driving consumer preferences and product trials.

The Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly increasing disposable incomes, urbanization, and a strong cultural emphasis on thinness and flawless skin texture. Key markets such as China, South Korea, and Japan exhibit high demand, driven largely by intense digital marketing campaigns and the influence of regional beauty trends. Consumers in APAC often seek multi-functional products that combine slimming effects with moisturizing and skin brightening properties. The region's vast and increasingly digitally connected population makes it a highly attractive target for international brands, necessitating localized product adaptation and the leveraging of e-commerce and social commerce platforms for maximum market penetration.

Latin America, particularly Brazil and Mexico, presents a dynamic market due to a high cultural prioritization of aesthetic appearance and a widespread acceptance of cosmetic procedures. Slimming creams are frequently purchased as maintenance products following treatments, or as affordable alternatives. The market is competitive, featuring strong local brands alongside international players, with demand focusing heavily on products offering immediate visible firming effects. The Middle East and Africa (MEA) market, though smaller, is showing growth, particularly in the GCC countries, driven by luxury spending and an increasing interest in specialized body care. This region often favors high-end international brands and products that offer strong visual appeal and prestige positioning.

- North America (US & Canada): Focus on premium, clinically proven anti-cellulite and firming formulations; strong e-commerce penetration and demand for clean beauty products.

- Europe (France, Germany, UK): Mature market valuing natural ingredients and regulatory compliance; significant distribution through pharmacies and professional spa networks.

- Asia Pacific (China, Japan, South Korea): Highest growth rate driven by urbanization and rising disposable income; preference for multi-functional products combining slimming, firming, and skin texture improvement; high reliance on social media marketing.

- Latin America (Brazil, Mexico): High cultural emphasis on aesthetics; strong demand for affordable and effective body contouring solutions; often used complementary to professional treatments.

- Middle East & Africa (MEA): Emerging market characterized by a preference for high-end international luxury brands in urban centers; growth linked to expanding wellness tourism sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slimming Cream Market.- L'Oréal S.A.

- Shiseido Company Limited

- The Estée Lauder Companies Inc.

- Clarins S.A.

- Beiersdorf AG

- Christian Dior SE

- Unilever PLC

- Caudalie SAS

- Rodial Ltd.

- Bliss World LLC

- Phytomer

- Nivea (Beiersdorf)

- Avon Products Inc.

- Collistar S.p.A.

- Guam (Lacote S.r.l.)

- Nu Skin Enterprises, Inc.

- ELEMIS Ltd.

- Dr. Brandt Skincare

- Sol de Janeiro

- Natura & Co.

Frequently Asked Questions

Analyze common user questions about the Slimming Cream market and generate a concise list of summarized FAQs reflecting key topics and concerns.Are slimming creams medically proven to replace diet and exercise for weight loss?

No, slimming creams are cosmetic products designed to temporarily improve the appearance of localized fat and cellulite by firming and toning the skin. They are most effective when used as a complementary aid alongside a balanced diet and regular physical activity, optimizing contouring results rather than providing standalone weight reduction.

What is the most effective active ingredient typically found in high-performance slimming creams?

Caffeine is widely considered the most effective and scientifically validated active ingredient. It works by inhibiting phosphodiesterase, stimulating lipolysis (fat breakdown), and improving microcirculation, which aids in reducing fluid retention and smoothing the visible appearance of cellulite. Botanical extracts like guarana and high-concentration retinoids are also highly valued for their efficacy.

How long does it typically take to observe visible results from using slimming creams?

Visible results, primarily focusing on skin texture improvement, increased firmness, and reduced cellulite appearance, usually become noticeable after consistent daily application for four to eight weeks. Optimal results depend significantly on the product's concentration, the individual's metabolic rate, and adherence to recommended usage instructions.

What are the primary distribution channels driving current sales in the Slimming Cream Market?

The primary distribution channels driving current sales are Online Retail (e-commerce platforms and brand direct-to-consumer sites), which offer convenience and comparison tools, closely followed by Offline Retail, particularly Pharmacies and Specialty Cosmetic Stores, which provide consumers with trusted advice and immediate availability.

Is the Slimming Cream Market moving towards natural and organic formulations?

Yes, there is a strong and accelerating market trend towards natural and organic formulations. Consumers increasingly prefer products free from parabens, synthetic fragrances, and mineral oils, demanding formulations that utilize sustainably sourced botanical extracts, essential oils, and vegan ingredients to achieve contouring and firming effects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager