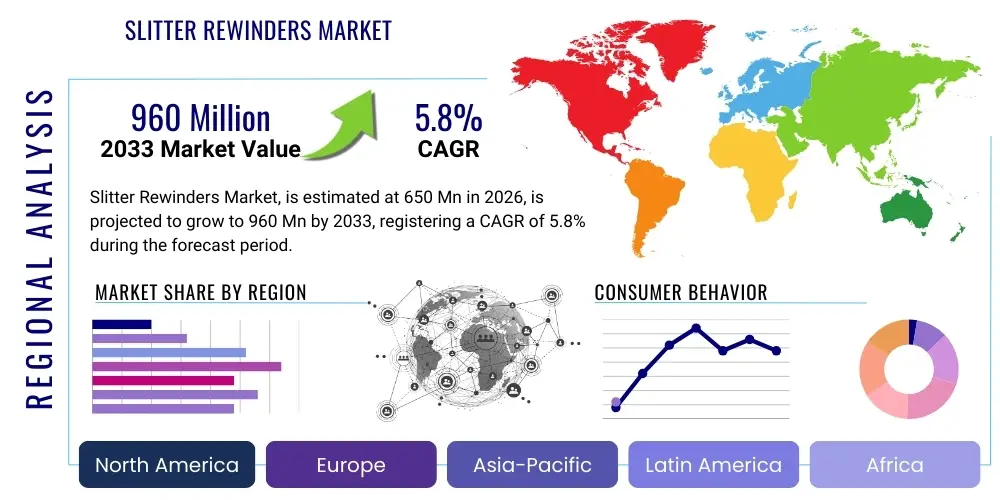

Slitter Rewinders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442329 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Slitter Rewinders Market Size

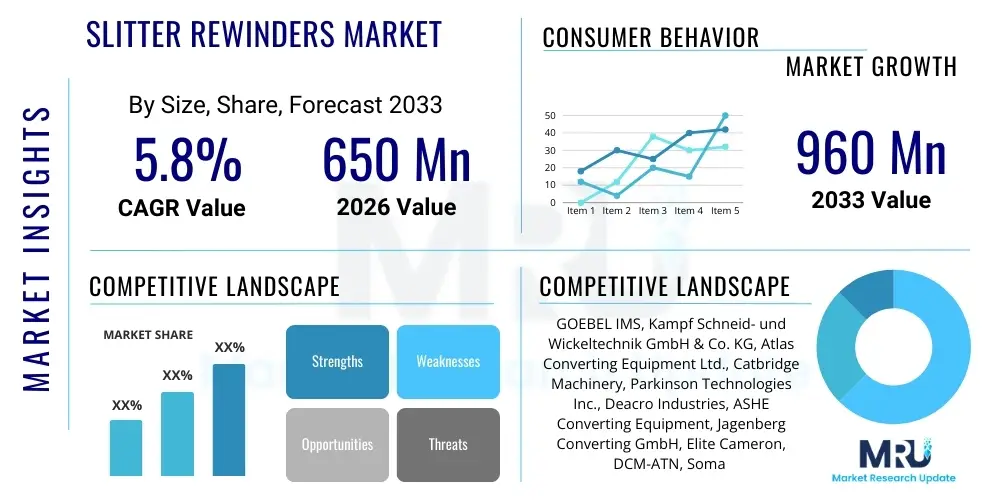

The Slitter Rewinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $650 million in 2026 and is projected to reach $960 million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for flexible packaging materials, high-performance films, and specialty papers across various industrial sectors globally, compelling manufacturers to invest in advanced machinery capable of handling diverse substrates at higher operational speeds and improved precision.

The valuation reflects robust expansion in emerging economies, particularly across Asia Pacific, where urbanization and the proliferation of e-commerce activities necessitate higher volumes of converted goods. The market valuation calculation considers factors such as the replacement cycle of aging machinery in developed regions, the integration of automation technologies like Industry 4.0 standards, and the increasing complexity of substrate materials, which demand sophisticated winding and tension control systems, thus raising the average selling price (ASP) of modern slitter rewinders.

Slitter Rewinders Market introduction

The Slitter Rewinders Market encompasses specialized industrial machinery designed for converting large master rolls of flexible materials—such as films, foils, paper, nonwovens, and laminates—into narrower, precisely sized rolls ready for end-use processing or packaging. These machines are critical components within the converting, printing, and packaging industries, ensuring optimal roll quality, precise edge alignment, and consistent web tension control. Modern slitter rewinders utilize advanced mechanisms, including razor slitting, shear slitting, or crush slitting techniques, coupled with highly sophisticated differential winding systems to manage variations in material thickness and inherent tension disparities across the web.

Major applications of slitter rewinders span high-speed printing operations, flexible food packaging, pharmaceutical blister packs, high-performance adhesive tapes, and technical textile production. The primary benefit derived from these systems is the ability to maintain stringent quality standards while achieving high throughput rates, which is essential for maintaining cost efficiency in high-volume production environments. Moreover, the flexibility offered by advanced machines allows converters to switch rapidly between different materials and roll specifications, a crucial factor in meeting the rapidly diversifying demands of the modern consumer market, particularly relating to sustainable packaging materials.

Key driving factors fueling market expansion include the global surge in flexible packaging consumption, largely attributable to e-commerce growth and the need for lighter, more efficient product containment solutions. Furthermore, continuous technological advancements focused on higher levels of automation, improved safety features, and the integration of vision inspection systems are enhancing operational efficiency, thereby accelerating the adoption rate of new, high-specification slitting and rewinding equipment across established and nascent industrial landscapes.

Slitter Rewinders Market Executive Summary

The Slitter Rewinders Market executive summary highlights a prevailing trend toward automation, high-speed capabilities, and precision engineering across all major business segments. Manufacturers are increasingly integrating features compliant with Industry 4.0 principles, such as predictive maintenance sensors, Human-Machine Interface (HMI) controls, and integrated diagnostic tools, to minimize downtime and optimize operational throughput. The business trends indicate a consolidation among specialized machinery providers and an increased focus on providing customized solutions tailored to specific substrate challenges, particularly in the rapidly evolving sectors of bio-plastics and compostable films, where web handling requires exceptional care and specialized tension profiling.

Regionally, the Asia Pacific (APAC) region continues its dominance, driven by massive investments in new manufacturing facilities and the rapid expansion of the packaging and nonwovens industries in countries like China, India, and Southeast Asia. North America and Europe, while growing at a slower volume rate, exhibit a stronger demand for premium, highly automated, and technically advanced machines focusing on efficiency, minimal waste generation, and stringent quality assurance. These developed regions are prioritizing the replacement of older hydraulic systems with servo-driven, high-precision models to meet stricter regulatory standards for product quality and operational safety.

Segment trends demonstrate robust demand for high-performance duplex slitter rewinders due to their ability to achieve higher operational speeds and facilitate efficient turret changes, thereby reducing cycle times significantly. The primary slitting segment, typically integrated within the initial material production line (e.g., paper mills or film extrusion plants), shows steady growth, driven by expansion in base material capacity. Concurrently, the secondary and tertiary slitting segments, serving converters, are experiencing accelerated growth spurred by the diversification of packaging sizes and the increasing requirement for just-in-time inventory management across the consumer goods supply chain.

AI Impact Analysis on Slitter Rewinders Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Slitter Rewinders Market predominantly revolve around optimizing machine performance, ensuring flawless roll quality, and maximizing equipment uptime. Users are keenly interested in understanding how AI can facilitate predictive maintenance scheduling, diagnose subtle mechanical anomalies before catastrophic failure, and automate the complex process of setting optimal web tension profiles across diverse substrates. A central concern is the integration complexity and the return on investment (ROI) associated with implementing sophisticated AI-powered vision inspection systems designed to detect minute defects, such as wrinkles, gauge variation, or coating imperfections, at high operational speeds, thereby minimizing material waste and ensuring compliance with demanding client specifications.

The influence of AI is fundamentally transforming the operational paradigm of slitter rewinders by shifting decision-making capabilities from human operators to intelligent, data-driven control systems. AI algorithms are now capable of analyzing real-time sensor data—including temperature, vibration, speed, and tension readings—to dynamically adjust winding parameters, virtually eliminating common issues such as telescoping or blocking. This proactive adjustment capability is critical in high-value material conversion, where even minor defects can result in the rejection of entire master rolls. Furthermore, the ability of machine learning models to learn from historical operational data, identifying patterns linked to successful material runs, allows for instant parameter recommendation when a new material combination is introduced, significantly reducing setup time and material wastage during calibration phases.

The overarching expectation is that AI integration will lead to unprecedented levels of operational efficiency and product quality consistency. The adoption is currently focused on high-end, newly purchased machinery, but retrofitting solutions are increasingly sought after for existing high-capacity machines. The key thematic summary is clear: AI is viewed as the necessary catalyst for achieving true 'zero-defect' manufacturing and maximizing throughput efficiency in increasingly competitive converting environments, provided implementation costs can be managed effectively and data security concerns are adequately addressed by Original Equipment Manufacturers (OEMs).

- AI-driven predictive maintenance forecasts component failure, maximizing uptime and optimizing spare parts inventory management.

- Machine learning algorithms automatically optimize web tension and winding density based on substrate properties and ambient conditions, ensuring superior roll geometry.

- Integrated AI vision systems conduct high-speed, 100% web inspection, classifying and mapping defects for immediate operator feedback and quality control reporting.

- Neural networks enhance control over differential winding mechanisms, mitigating issues like roll telescoping or sagging, particularly for sensitive or varied substrates.

- AI assists in automated fault diagnosis, reducing troubleshooting time and enabling faster recovery from unexpected operational disruptions.

- Data analytics platforms leverage AI to optimize energy consumption patterns within the machinery, contributing to operational sustainability objectives.

DRO & Impact Forces Of Slitter Rewinders Market

The Slitter Rewinders Market is propelled by a confluence of robust drivers, notably the sustained expansion of the global flexible packaging sector, driven by heightened consumer preference for convenience and portability, and the accelerating growth of e-commerce necessitating protective, lightweight packaging materials. Simultaneously, regulatory and consumer demand for sustainable packaging solutions mandates the processing of novel, often challenging, materials such as biodegradable films and thin-gauge substrates, requiring converters to upgrade to advanced, high-precision slitter rewinders. These drivers are fundamentally supported by continuous innovations in automation and control systems, which promise reduced labor costs and superior product consistency, justifying significant capital investments in new machinery.

Conversely, the market faces significant restraints, primarily stemming from the high initial capital expenditure associated with purchasing and installing sophisticated slitter rewinders, which presents a barrier to entry for smaller converting operations. Furthermore, the complexity of modern machinery requires a highly skilled workforce for operation and maintenance, and a widespread shortage of such technical expertise, particularly in emerging markets, limits the rapid deployment and optimization of new equipment. Economic volatility and cyclical downturns in the industrial manufacturing sector can also temporarily stifle investment decisions in large-scale machinery, impacting the immediate market growth rate despite long-term positive forecasts.

Opportunities for market growth are vast and are concentrated around the strategic adoption of Industry 4.0 principles, allowing OEMs to offer advanced machinery integrated with IoT and cloud connectivity for remote monitoring, diagnostic services, and performance benchmarking. The increasing focus on specialization presents opportunities for manufacturers to develop niche machines optimized specifically for challenging materials, such as extremely thin films, metalized foils, or heavy-duty technical textiles. Furthermore, the drive toward minimizing material waste and improving yield offers a significant market opportunity for slitter rewinders equipped with advanced tension control systems and precision slitting technologies that enhance material utilization rates, aligning with global corporate sustainability goals and providing a critical competitive advantage.

Segmentation Analysis

The Slitter Rewinders Market is comprehensively segmented based on machine type, operational type, application (end-user industry), and material type, reflecting the diverse requirements of the converting industry. Segmentation by machine type primarily distinguishes between Duplex Slitter Rewinders (offering two rewind shafts for high-speed, differential winding) and Center-Surface Slitter Rewinders (providing exceptional tension control for challenging materials). Operational segmentation categorizes machines by their placement in the overall production flow: Primary Slitters (integrated into the initial production of base material), Secondary Slitters (used by converters for intermediate roll size changes), and Tertiary Slitters (tailored for final roll production for end-users, such as label printers). Analyzing these segments reveals shifting demand dynamics influenced by industrial centralization, technological advancement, and regional infrastructure development.

- By Machine Type:

- Duplex Slitter Rewinders (Center-Wound, High-Speed Differential)

- Center-Surface Slitter Rewinders (Ideal for tension-sensitive and wide webs)

- Single-Shaft Slitter Rewinders (Typically for less demanding or narrow web applications)

- Turret Slitter Rewinders (For maximizing efficiency and minimizing downtime during roll changes)

- By Operational Type:

- Primary Slitter Rewinders (For material producers like paper mills, film extruders)

- Secondary Slitter Rewinders (For converting operations handling large volumes)

- Tertiary Slitter Rewinders (For final product preparation, often specialized formats)

- By Application (End-User Industry):

- Flexible Packaging (Food & Beverage, Consumer Goods)

- Paper & Board (Printing, Corrugated Packaging)

- Films & Foils (Technical Films, Metalized Foils, Laminates)

- Labels & Tapes (Pressure-Sensitive Adhesives, Industrial Tapes)

- Nonwovens & Textiles (Hygiene Products, Medical Supplies, Technical Fabrics)

- Others (Rubber, Specialized Composites)

- By Slitting Mechanism:

- Razor Slitting (High-speed, suitable for light films)

- Shear Slitting (Precision, best for paper and thick materials)

- Crush Slitting (Economical, often used for nonwovens and certain papers)

- By Automation Level:

- Semi-Automatic Slitter Rewinders

- Fully Automatic Slitter Rewinders (Featuring automatic core loading and roll handling)

Value Chain Analysis For Slitter Rewinders Market

The value chain for the Slitter Rewinders Market begins with upstream analysis, which involves the sourcing of critical components, including high-precision servo motors, robust structural steel, advanced pneumatic and hydraulic systems, and sophisticated electronic control units (PLCs, HMIs, and tension transducers). Key raw material suppliers provide specialized steel alloys necessary for structural integrity and high-wear components like slitting knives. The strength and reliability of the value chain are fundamentally dependent on component quality and the ability of OEMs to source standardized yet high-performance automation components, ensuring compliance with global manufacturing standards and facilitating easy maintenance and spare parts availability for the lifetime of the machinery.

The mid-stream segment is dominated by the Slitter Rewinder OEMs who design, assemble, and rigorously test the final machinery. These manufacturers add substantial value through proprietary design, engineering expertise in web handling and tension control, and the integration of advanced software for operational efficiency and defect detection. The distribution channel subsequently plays a pivotal role, operating through a mix of direct and indirect methods. Direct sales are common for large, highly customized primary slitter projects where continuous technical consultation is required. Indirect channels, involving authorized distributors, agents, and local technical service providers, dominate sales for secondary and tertiary standard machines, particularly in regions requiring localized support and efficient logistics management.

The downstream analysis focuses on the end-users, encompassing the converting industry which deploys these machines for flexible packaging, printing, and specialty material processing. The efficiency of the downstream operations directly correlates with the machine performance, specifically in terms of speed, precision, and minimizing material waste. The final stage involves after-sales service, technical support, and the provision of specialized consumables like slitting blades and spare parts. This post-sales engagement is crucial for maintaining customer loyalty and recurring revenue streams for OEMs, underscoring the shift towards service-based models facilitated by remote diagnostics capabilities and cloud-based performance monitoring, thereby closing the loop in a service-intensive value chain.

Slitter Rewinders Market Potential Customers

Potential customers, or end-users/buyers, of slitter rewinders are fundamentally those entities engaged in the large-scale conversion of flexible web materials into intermediate or final products. This group is highly diverse, ranging from integrated material producers (such as major paper mills, large film extrusion plants, and metal foil manufacturers) who require high-capacity primary slitters for their base production, to specialized independent converters who purchase secondary slitters to service specific printing, laminating, or coating applications. The core customer base includes companies in the flexible packaging industry, which utilize these machines to manage complex multi-layer films for perishable goods, demanding precise tension control to prevent delamination or tearing.

Furthermore, the pharmaceutical and healthcare sectors represent a significant customer segment, particularly requiring machines capable of handling medical-grade nonwovens, sterile barrier packaging, and specialized labeling materials with exceptional precision and traceability features. Companies specializing in pressure-sensitive adhesive (PSA) tapes and labels form another vital customer group, relying on highly accurate slitting technology to maintain tight dimensional tolerances required for automated dispensing applications. The demand profile of potential customers is characterized by a need for reliability, high throughput, minimal operational footprint, and increasingly, the ability to seamlessly integrate with existing enterprise resource planning (ERP) systems for real-time production data exchange and inventory management, justifying the investment in automated solutions.

The rapid expansion of the nonwovens industry, fueled by demand for hygiene products and personal protective equipment (PPE), has created a distinct and growing potential customer segment requiring specialized slitting and winding systems optimized for soft, delicate, and often highly elastic materials where traditional shear or razor slitting methods may be unsuitable. These customers prioritize wide web capacity, exceptional dust minimization features, and customized winding profiles that preserve the integrity and loft of the finished rolls, distinguishing their technical requirements significantly from those in the high-speed film conversion segment, necessitating highly bespoke machinery solutions provided by market-leading OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million |

| Market Forecast in 2033 | $960 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GOEBEL IMS, Kampf Schneid- und Wickeltechnik GmbH & Co. KG, Atlas Converting Equipment Ltd., Catbridge Machinery, Parkinson Technologies Inc., Deacro Industries, ASHE Converting Equipment, Jagenberg Converting GmbH, Elite Cameron, DCM-ATN, Soma Engineering, Laem System S.r.l., Mario Cotta SpA, A.Celli Nonwovens S.r.l., Totani Corporation, New Era Converting Machinery Inc., CEVENINI SRL, Comexi Group, Cason S.r.l., Tidland Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slitter Rewinders Market Key Technology Landscape

The technological landscape of the Slitter Rewinders Market is characterized by a strong emphasis on precision control, modular design, and enhanced automation features critical for handling modern, high-performance substrates. A central technology is the sophisticated web tension control system, often utilizing closed-loop feedback mechanisms involving dancer rolls, load cells, and highly responsive servo drives. This technology is vital for maintaining constant, drift-free tension across the web, regardless of changes in speed or roll diameter, preventing defects such as wrinkles, baggy edges, or film stretching, particularly when processing materials with varying elastic properties like thin plastics and multi-layer laminates, thereby optimizing the final roll quality and minimizing scrap rates significantly.

Advanced winding technologies, particularly differential winding (slip winding) and center-driven winding, represent another cornerstone of the current landscape. Differential winding is essential for high-speed slitting of rolls with multiple narrow widths, compensating for slight variations in material caliper or tension by allowing individual roll shafts to rotate at independent speeds. Coupled with fully automatic turret systems, these technologies drastically reduce non-productive downtime associated with manual roll changes, core loading, and finished roll unloading. The use of highly sensitive, laser-guided or ultrasonic edge guiding systems ensures precise lateral alignment, which is indispensable for applications requiring perfect registration, such as high-quality printing and labeling processes, thereby contributing significantly to overall product quality metrics.

Furthermore, the integration of digitized controls, incorporating powerful Programmable Logic Controllers (PLCs) and intuitive Human-Machine Interfaces (HMIs), facilitates streamlined machine setup, real-time diagnostic reporting, and seamless integration into factory-wide manufacturing execution systems (MES). The ongoing development of slitting tool technology, including specialized materials for shear blades and optimized geometry for razor cutting systems, aims to extend blade life, reduce dust generation, and maintain consistent cut quality even at elevated operating speeds. The synergistic deployment of these technologies ensures the slitter rewinder functions not merely as a mechanical cutting device but as a highly precise, data-rich conversion unit capable of meeting the stringent requirements of advanced industrial materials and high-speed packaging production environments.

Regional Highlights

The Slitter Rewinders Market exhibits distinct regional dynamics influenced by industrial maturity, regulatory frameworks, and economic growth rates. The Asia Pacific (APAC) region stands out as the primary growth engine, characterized by robust investment in new manufacturing capacities across China, India, and Southeast Asian nations. This growth is directly attributable to the burgeoning consumer base, massive urbanization driving the demand for packaged goods, and the relocation or expansion of global manufacturing facilities seeking lower operational costs. The high volume requirements often necessitate the adoption of reliable, medium-to-high capacity slitter rewinders, although the investment trend is increasingly moving towards highly automated systems to manage escalating labor costs and quality standards.

North America and Europe represent mature, high-value markets that prioritize advanced technological capabilities, energy efficiency, and compliance with rigorous safety and quality protocols. In these regions, market growth is sustained primarily through the replacement cycle of aging equipment, coupled with demand for specialized slitter rewinders designed to handle innovative and sustainable substrates, such as bio-plastics and ultra-thin films. European manufacturers, in particular, lead in offering highly customized, precision-engineered machinery focusing on minimal waste generation, superior ergonomics, and comprehensive data capture capabilities for process optimization and regulatory compliance, commanding premium pricing structures in the global market.

Latin America and the Middle East & Africa (MEA) markets currently contribute smaller yet steadily expanding shares. Growth in Latin America is tied to the development of local packaging industries aiming to replace imports and cater to regional consumer demand, often showing a preference for cost-effective yet reliable semi-automatic machines. The MEA region, particularly the GCC countries, is witnessing growth spurred by infrastructure development and diversification away from oil dependence, leading to investments in large-scale paper, packaging, and nonwovens converting plants. These regions are characterized by a focus on establishing base capacities, creating significant opportunities for OEMs to supply machinery that balances performance capabilities with favorable capital expenditure requirements, thereby broadening the geographical footprint of the global market.

- Asia Pacific (APAC): Dominates the market share due to rapid industrialization, massive e-commerce growth, and extensive investment in flexible packaging and film extrusion capacity, particularly in China and India.

- North America: High demand for sophisticated, fully automated slitter rewinders focusing on productivity, minimal scrap, and integration of Industry 4.0 standards, driven by stringent quality requirements and high labor costs.

- Europe: Characterized by demand for precision machinery designed for sustainable and sensitive materials (e.g., medical, luxury packaging), adherence to strict safety standards (CE certification), and technological leadership in web handling and control systems.

- Latin America: Emerging market growth driven by localizing packaging production and increasing consumer goods manufacturing, showing steady adoption of dependable semi-automatic and basic automatic machines.

- Middle East and Africa (MEA): Growth fueled by government initiatives to diversify economies and build local capacity in paper, nonwovens, and flexible material conversion, especially within the GCC states and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slitter Rewinders Market.- GOEBEL IMS (An affiliate of IMS Technologies S.p.A.)

- Kampf Schneid- und Wickeltechnik GmbH & Co. KG

- Atlas Converting Equipment Ltd.

- Catbridge Machinery

- Parkinson Technologies Inc. (Marshall & Williams Plastics)

- Deacro Industries

- ASHE Converting Equipment

- Jagenberg Converting GmbH

- Elite Cameron

- DCM-ATN

- Soma Engineering

- Laem System S.r.l.

- Mario Cotta SpA

- A.Celli Nonwovens S.r.l.

- Totani Corporation

- New Era Converting Machinery Inc.

- CEVENINI SRL

- Comexi Group

- Cason S.r.l.

- Tidland Corporation (A Maxcess International Company)

Frequently Asked Questions

Analyze common user questions about the Slitter Rewinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for high-speed slitter rewinders?

The demand is primarily driven by the exponential growth of the flexible packaging industry and e-commerce, which necessitate high-volume, high-precision production of narrower rolls. Advancements in material science requiring complex web handling and the trend toward factory automation (Industry 4.0) also compel converters to adopt faster, more reliable machinery to maintain competitiveness and reduce production bottlenecks efficiently.

How do shear slitting and razor slitting mechanisms differ, and when is each preferred?

Shear slitting operates like scissors, providing a clean, burr-free edge, ideal for thicker materials like paperboard, laminates, and heavier films requiring high precision. Razor slitting, utilizing disposable or guided blades, is preferred for high-speed conversion of thin, delicate materials such as plastic films and foils, offering economic benefits and flexibility for quick job changes, although it produces less robust edges.

What role does automation play in the future of the slitter rewinders market?

Automation is central to market evolution, driving efficiency and quality consistency. Future machines feature fully automatic core placement, robotic roll handling, and sophisticated computer controls (HMI/PLC) to minimize manual intervention. Crucially, integrated AI and sensor technology facilitate predictive maintenance and dynamic tension adjustment, maximizing uptime and reducing material waste significantly.

Which geographical region holds the largest market share for slitter rewinders, and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is due to rapid industrial expansion, large-scale capacity addition in the packaging and nonwovens sectors, robust domestic consumption growth in countries like China and India, and ongoing foreign direct investment into manufacturing infrastructure across the region.

What is differential winding, and why is it essential for modern slitting operations?

Differential winding, or slip winding, uses friction or air pressure to allow individual rolls on the same shaft to rotate independently, compensating for variations in material gauge, diameter, or internal stress. This technique is essential because it ensures uniform tension across multiple narrow rolls slit from a single web, preventing common defects like telescoping, roll tightness variation, and starring, thus guaranteeing superior roll quality for downstream processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager