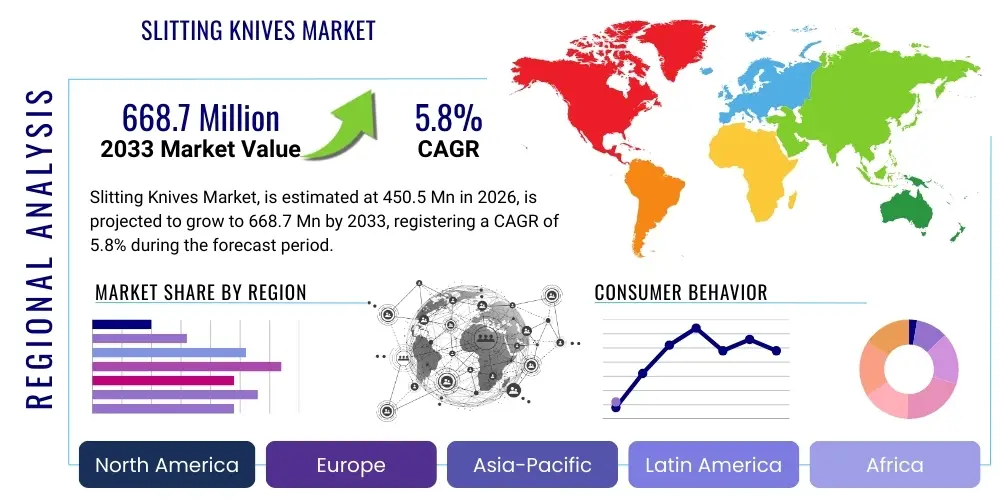

Slitting Knives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443473 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Slitting Knives Market Size

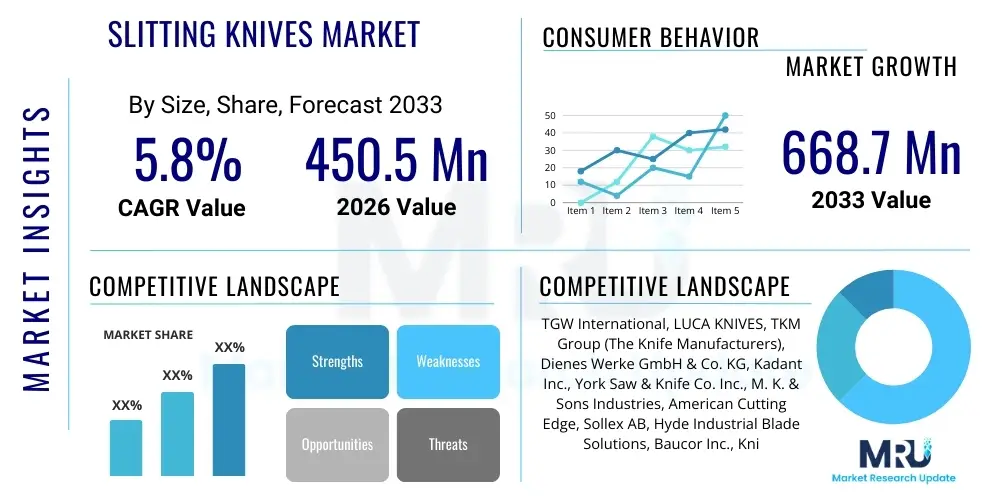

The Slitting Knives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.7 Million by the end of the forecast period in 2033.

Slitting Knives Market introduction

The Slitting Knives Market is defined by the production and deployment of highly precise cutting tools utilized across diverse industrial sectors to convert wide web materials into narrower rolls or sheets. These critical components are integral to slitting and rewinding machinery, serving essential roles in processing substrates ranging from extremely delicate films and flexible packaging to abrasive textiles, heavy-duty paperboard, and even thin metal foils. Slitting knives are engineered in various configurations—including circular (shear cut), razor, and score cut—with the selection of the configuration being strictly dictated by the physical characteristics of the material being processed, the required cutting precision, and the operational speed of the conversion line. The fundamental objective of these specialized knives is to ensure a clean, accurate, and consistent edge finish, minimizing material waste and maximizing throughput efficiency in high-volume manufacturing settings globally.

The primary drivers propelling the expansion of this market include the relentless global surge in demand for sophisticated packaging solutions, largely attributed to the sustained growth of the e-commerce sector and the corresponding increase in disposable income across emerging economies. Furthermore, technological advancements in material science have necessitated equally advanced cutting tools; for instance, the introduction of complex, multi-layer barrier films in the food and pharmaceutical packaging industries demands blades manufactured from superior materials such as tungsten carbide or specialized ceramics, often enhanced with advanced coatings like DLC or PVD compounds. These high-performance knives offer extended operational longevity, superior thermal stability, and enhanced resistance to wear and abrasion, thereby drastically reducing production downtime and lowering the total cost of ownership (TCO) for industrial converters. The continuous innovation in blade geometry and material hardness ensures that slitting knives remain indispensable tools for maintaining the integrity and quality required by modern manufacturing specifications.

Beyond packaging and printing, major applications of slitting knives span the textile industry, where they cut intricate non-woven materials, and the metal processing sector, where heavy-duty circular knives manage steel and aluminum coils. The universal benefit derived from utilizing high-quality slitting knives is the assurance of dimensional stability and edge quality, which directly impacts the subsequent processing stages. Driving factors are deeply linked to efficiency optimization: high-precision knives reduce dust generation, prevent material fusion or stretching, and ensure maximum utilization of expensive raw materials. This operational synergy between high-performance knives and high-speed machinery underscores the market's strategic importance within the broader manufacturing ecosystem, fostering continuous investment in R&D to address emerging material challenges and tighter tolerance requirements. The precision required extends to micro-level control, vital for sensitive applications such as battery separator films, where even minor irregularities can compromise product safety and functionality, further reinforcing the demand for technologically advanced slitting solutions.

Slitting Knives Market Executive Summary

The Slitting Knives Market demonstrates a compelling trajectory of growth, underpinned by significant global business trends, strategic regional developments, and distinct segmental shifts. Business trends are characterized by a pronounced industrial focus on operational efficiency, leading to increased investment in fully automated slitting machines that demand premium, longer-lasting cutting tools. There is a palpable shift away from standard tool steels towards high-performance materials like cemented tungsten carbide and ceramic composites, driven by the necessity to process abrasive, high-specification materials prevalent in modern packaging and specialty films. Furthermore, industry consolidation among large machinery manufacturers is creating integrated supply chain relationships, favoring specialized knife producers who can offer custom-engineered solutions and comprehensive resharpening services, reinforcing market stability and quality expectations globally. The sustained pressure on manufacturers to reduce material waste and energy consumption is directly translating into a preference for knives that guarantee cleaner cuts and require less machine power.

Geographically, the Asia Pacific (APAC) region stands out as the predominant market driver, commanding the largest share in volume and exhibiting the highest growth rate, a direct result of rapid industrialization and governmental investment in infrastructure across manufacturing sectors in countries like China, India, and Vietnam. The booming population and expanding middle class in APAC fuel monumental demand for converted paper and plastic products. North America and Europe, while mature, maintain strong regional trends focused on quality and advanced material adoption; these regions are leading the charge in integrating smart manufacturing concepts, utilizing sensor-equipped knives for real-time performance monitoring and predictive maintenance protocols. Regional demand in Western economies is highly sensitive to total cost of ownership and environmental sustainability, promoting the use of ultra-durable and reusable tooling solutions, contrasting with APAC's current emphasis on volume and competitive pricing and often requiring localized material compliance testing.

Segment trends reveal that the Shear Slitting segment (utilizing rotary/circular knives) dominates the market due to its superior efficiency and precision in high-speed, continuous material processing across the largest end-user industries: packaging, paper, and printing. Concurrently, the Material Type segment highlights the accelerating adoption rate of Tungsten Carbide, especially in applications involving heavy-duty or exceptionally abrasive materials such as non-wovens and certain laminated barrier films, where its resistance to wear provides unparalleled lifecycle value. The packaging and converting industry remains the undisputed largest end-user segment, perpetually driving demand for innovative slitting solutions that can handle increasingly complex, multi-layer substrates designed for enhanced product preservation and extended shelf life, thereby ensuring that innovation in blade technology must keep pace with packaging material evolution. Specialized niche segments, like the medical and automotive sectors, also show high demand for customized, ultra-high-tolerance ceramic and coated steel knives, reflecting the market's segmentation into high-volume standard tools and high-value specialty solutions.

AI Impact Analysis on Slitting Knives Market

The discourse surrounding Artificial Intelligence (AI) and Machine Learning (ML) integration in the slitting knives domain centers primarily on maximizing operational efficiency, mitigating unscheduled downtime, and achieving superior cut consistency through advanced predictive modeling. Users commonly seek concrete data on how AI can transition maintenance from time-based schedules to condition-based, truly predictive systems, particularly inquiring about the practical feasibility and data requirements for training effective wear prediction models based on machine vibration, acoustic patterns, and material throughput metrics. Key concerns often involve the high upfront investment in sensor technology and data acquisition infrastructure required to feed these AI models, alongside intellectual property issues related to proprietary cutting data and algorithms developed by OEMs or specialized service providers. The ultimate expectation is that AI will provide a highly accurate, prescriptive maintenance regimen, ensuring that a knife is only replaced or sharpened precisely when its cutting performance approaches a predefined quality threshold, rather than relying on generalized hours-of-operation estimates, thereby vastly optimizing tooling inventory and minimizing operational disruptions, leading to substantial cost savings and waste reduction.

AI's influence is profoundly shifting the approach to tool management, moving away from reactive measures towards proactive, data-driven optimization. Advanced ML algorithms, when fed data streams from accelerometers, load cells, and acoustic sensors mounted near the cutting head, are capable of discerning subtle shifts in operational parameters that signify incipient knife dullness or micro-chipping long before a human operator or simple sensor threshold would detect it. This deep learning capability allows the system to establish intricate correlations between specific cutting variables—such as pressure fluctuation, lateral runout, or slight temperature spikes—and the degradation profile of the blade edge. The output is a highly granular, probabilistic prediction of remaining useful life (RUL), allowing maintenance planners to schedule resharpening activities during planned pauses, thus eradicating the risk of costly material spoilage or emergency shutdown caused by sudden knife failure. Furthermore, this historical performance data, collected and processed by AI, becomes invaluable feedback for knife manufacturers, driving the next generation of durable blade designs by highlighting precise points of failure or accelerated wear under specific operational conditions, leading to iterative design improvements.

In addition to predictive maintenance, AI is rapidly making inroads into automated Quality Assurance (QA) and process optimization on the production floor. High-speed camera systems, integrated with Convolutional Neural Networks (CNNs), are being deployed to inspect the slit edge in real time, detecting micro-tears, burrs, or inconsistent material geometry at conversion speeds previously impossible for human inspection. If defects are detected, the AI system can not only flag the issue but can also initiate immediate, minute adjustments to machine settings—such as adjusting the shear angle, optimizing the overlap, or varying the web tension—to bring the cut quality back into tolerance immediately. This closed-loop feedback mechanism ensures unparalleled quality consistency, a crucial competitive differentiator in highly regulated sectors like medical device packaging and precision electronics. The application of AI extends beyond simple monitoring; it is transforming the operational intelligence of the entire slitting process, maximizing material utilization, and significantly contributing to energy efficiency by ensuring the cutting system operates at peak mechanical efficiency at all times, thereby optimizing power consumption and reducing the thermal load on the machinery.

- Predictive Maintenance: AI models forecast knife wear based on operational data, minimizing unplanned downtime and optimizing replacement cycles.

- Real-Time Quality Control: Machine vision systems powered by AI detect minute surface defects or cutting imperfections instantaneously, ensuring superior edge quality.

- Parameter Optimization: AI adjusts machine settings (e.g., speed, pressure, blade gap) dynamically based on material type and knife condition for maximized efficiency and reduced material stress.

- Inventory Management: Automated systems predict replacement blade demand accurately based on aggregated wear data, reducing capital tied up in slow-moving inventory and minimizing stock-out risks.

- Design Optimization: Generative AI assists in creating novel, high-performance blade geometries and selecting optimal materials for specific, challenging applications, accelerating R&D cycles.

- Process Diagnostics: ML identifies root causes of recurrent cutting issues (e.g., web wandering, excessive dust) by analyzing correlations across complex sensor datasets.

- Operational Efficiency: AI optimizes machine parameters to reduce energy consumption and heat generation during high-speed slitting operations.

DRO & Impact Forces Of Slitting Knives Market

The Slitting Knives market's dynamism is rooted in a compelling interplay between powerful drivers, significant restraints, attractive opportunities, and pervasive impact forces that collectively dictate market direction and competitive structure. The most significant driving force is the global proliferation of flexible packaging, which requires consistently reliable, high-speed slitting processes to meet explosive consumer demand across food, beverage, and medical sectors. The continuous advancement in web processing machinery, which operates at ever-increasing speeds, directly necessitates corresponding improvements in knife durability and precision, pushing manufacturers towards premium carbide and ceramic materials that can maintain a sharp edge under intense dynamic loads. Furthermore, global supply chain optimization requires that conversion facilities minimize waste and maximize yield, making the precision and longevity of the slitting knife a direct contributor to corporate profitability, thus ensuring sustained investment in quality tooling. The stringent demand for dust-free cutting, particularly in pharmaceutical packaging and clean room environments, further mandates the use of highly precise, optimized shear cut systems and corresponding high-quality blades.

Conversely, the market faces considerable restraints, primarily concerning the elevated total cost of ownership (TCO) associated with high-performance tooling. Specialized materials, particularly tungsten carbide and technical ceramics, involve high initial purchase costs compared to traditional steel blades. Moreover, these premium knives necessitate sophisticated and specialized maintenance, requiring dedicated resharpening equipment and highly trained technicians to preserve the critical micron-level edge geometry. This complexity in maintenance and service represents a substantial barrier, particularly for smaller and mid-sized converters who might lack the in-house capability, forcing reliance on external, often costly, specialized service providers. Another restraint is the volatile pricing environment for key metallurgical inputs, such as cobalt (used in carbide binders) and specialized tool steel alloys, which directly impacts manufacturer profitability and necessitates careful cost management across the supply chain, often leading to temporary price fluctuations for end-users, complicating long-term procurement strategies for major converters globally.

The market is rich with opportunities, particularly those stemming from the global commitment to sustainable packaging and material innovation. The shift toward bio-plastics, recycled content films, and complex multilayer structures designed for easy recyclability often introduces new challenges (e.g., stickiness, varying material densities) that traditional knives cannot handle effectively, thereby creating a strong commercial opening for newly engineered, application-specific knives utilizing novel coatings or advanced geometries. The integration of smart features, such as embedded sensors and digital identification (RFID/QR codes) into the knife holder or body, presents a robust opportunity for manufacturers to transition from being simple component suppliers to providers of integrated tooling solutions, offering value-added services like real-time data monitoring, lifecycle tracking, and automated maintenance scheduling, fundamentally changing the business model toward service-based revenue streams. These opportunities promise significant differentiation and margin enhancement for technologically agile players who can provide documented ROI through efficiency gains and waste reduction by leveraging these integrated smart systems.

Finally, several impact forces shape the competitive landscape. Intense competitive pressure, particularly from Asian manufacturers offering highly cost-effective alternatives, exerts constant downward pressure on pricing, compelling established players to focus heavily on superior performance and technical service rather than merely cost leadership. Technological substitution remains a latent force; while traditional slitting remains dominant, niche applications may see increasing adoption of alternative cutting technologies such as laser cutting, especially for ultra-delicate or highly customized materials, pushing slitting knife manufacturers to continuously prove their superior throughput and cost-efficiency in high-volume environments. Furthermore, stringent occupational safety regulations necessitate ongoing focus on knife handling safety and reduced dust/noise generation from the cutting process, influencing machine design and the ancillary features (e.g., dust extraction systems, quick-change mechanisms) that knife suppliers must accommodate in their product design and mounting systems, requiring substantial R&D investment in user safety and environmental compliance.

- Drivers:

- Exponential growth in flexible packaging, corrugated board, and non-woven industries.

- Increasing automation and demand for high-speed, continuous production processes requiring minimum changeovers.

- Strict quality requirements demanding precise, clean, and consistent slitting results (e.g., dust-free cutting).

- Expansion of e-commerce driving higher consumption of packaging materials.

- Restraints:

- High procurement and maintenance costs associated with premium carbide and ceramic knives.

- Complexity and skill required for accurate knife alignment, setup, and specialized resharpening services.

- Vulnerability to volatile raw material pricing for specialized alloys and coatings, impacting profitability.

- Technical challenges in efficiently slitting complex, multilayer, or difficult-to-handle recycled materials.

- Opportunities:

- Development and commercialization of next-generation coatings (e.g., advanced PVD/CVD coatings) for extended blade life and reduced friction.

- Rising demand for customized knives designed specifically for challenging, multilayer, and sustainable packaging materials.

- Integration of smart features (sensors, RFID) for advanced usage tracking and predictive maintenance compatibility, creating value-added services.

- Market penetration into high-tolerance niche sectors such as battery manufacturing and specialized aerospace components.

- Impact Forces:

- Technological substitution pressure (e.g., non-contact cutting methods for niche applications).

- Intense pricing competition, particularly from APAC manufacturers focused on volume.

- Need for compliance with global safety and environmental standards (e.g., noise reduction, dust control).

- The growing influence of OEMs requiring specific tooling certifications and long-term partnership agreements.

Segmentation Analysis

The Slitting Knives Market structure is meticulously defined by segmentation across product type, material composition, end-user application, and geometric form factor, providing crucial granularity for strategic market assessment. The Product Type segmentation distinguishes between the three core mechanical cutting methods: shear slitting, which involves two blades meeting like scissors and is preferred for high-speed, high-precision film and paper; score (crush) slitting, where a sharp or rounded blade crushes the material against a hardened anvil roll, suitable for materials like adhesives or light paperboard; and razor slitting, where a single, sharp edge (often disposable) is pulled through the material, ideal for extremely thin and delicate films. The relative dominance of the shear cut segment reflects its superior output quality and speed, making it the preferred method for the vast majority of primary conversion lines globally, cementing its position as the largest segment by revenue and volume across the forecast period, especially as line speeds continue to increase requiring dynamic, highly stable knife sets.

Segmentation by Material Type is arguably the most critical dimension concerning product performance and cost structure. High-Speed Steel (HSS) knives remain widely used due to their affordability and adequate performance in standard paper and textile applications, forming the foundation of the entry-level market. However, the premium market is defined by Tungsten Carbide knives, which are significantly harder and more durable, offering lifespan improvements of up to 10-20 times that of HSS in abrasive environments, justifying their high cost for converters prioritizing maximum uptime and minimal changeovers. Ceramic knives, though specialized and brittle, offer exceptional chemical resistance and non-magnetic properties, finding niche applications in sensitive environments such as battery component manufacturing or specific medical product slitting. The ongoing technological development focuses on optimizing the composite structure of carbide materials and enhancing the surface topography of ceramics to improve their toughness against sudden impact, thereby expanding their applicability across more demanding industrial scenarios where high operational temperatures and complex material structures are common.

The End-User Industry segmentation clearly indicates market drivers, with Packaging and Converting holding the largest share, encompassing flexible packaging, corrugated boxes, and label manufacturing, reflecting the global consumer goods ecosystem's reliance on high-quality slitting. The Printing and Publishing sector follows, focusing on high-volume paper slitting for magazines and books, necessitating high-throughput shear systems. The Metal Processing segment requires unique, heavy-duty circular knives capable of slitting thick steel and aluminum coils with precision, representing a highly specialized, capital-intensive niche where tooling stability and resistance to shock load are paramount. Analyzing these segments reveals varying purchasing criteria: packaging demands high throughput and minimal dust; metal processing requires maximum strength and resistance to chipping; and textile manufacturers often prioritize non-stick properties and clean separation of synthetic fibers. This diversified demand profile necessitates a broad product portfolio from leading knife manufacturers to effectively address the specific technical requirements inherent to each major end-use application, including compliance with industry-specific certifications and safety protocols.

- Product Type:

- Shear Slitting Knives (Circular/Rotary Knives)

- Score/Crush Cut Knives

- Razor Slitting Knives

- Dished/Dished Bottom Knives

- Material Type:

- High-Speed Steel (HSS)

- Tungsten Carbide (Cemented/Sintered)

- Ceramic (Zirconia, Silicon Nitride, Alumina)

- Tool Steel/Alloy Steel (D2, M2)

- Proprietary Composites

- Application/End-User Industry:

- Packaging and Converting (Flexible Films, Laminates, Labels, Food Packaging)

- Printing and Publishing (Paper, Board, High-Speed Web Printing)

- Textiles and Non-Woven Fabrics (Hygiene Products, Medical Textiles, Industrial Filters)

- Metal Processing (Slitter Lines for Steel, Aluminum, Copper Coil Processing)

- Rubber and Tire Manufacturing (Calendering Lines)

- Adhesives and Tape Manufacturing

- Specialty/Technical Materials (e.g., Battery Separator Films, Composites)

- Geometry/Form Factor:

- Straight/Guillotine Knives

- Circular/Rotary Knives (Top and Bottom Knives, Multi-Groove Knives)

- D-Shaped Blades

- Disposable Blades

Value Chain Analysis For Slitting Knives Market

The Slitting Knives market value chain is structured around core competencies beginning with the sourcing of specialized raw materials, primarily focusing on high-purity metal powders for tungsten carbide, sophisticated tool steel alloys (like D2 or M4), and advanced ceramic precursors. The upstream segment is characterized by relatively few, highly specialized metallurgical and chemical suppliers who manage complex processing techniques (e.g., powder metallurgy, sintering) necessary to achieve the extreme hardness and homogeneity required for premium blades. Price volatility and supply security in these raw material markets present continuous challenges that knife manufacturers must actively manage through strategic purchasing and long-term supply agreements, ensuring input quality maintains the stringent standards necessary for high-precision tooling fabrication. This upstream control over material purity is crucial, as microscopic imperfections can lead to premature failure in high-stress cutting environments, making rigorous material verification a core component of this initial value stage.

The core manufacturing and midstream processes involve highly sophisticated engineering disciplines, including precision forging, advanced heat treatment protocols, and, most critically, CNC grinding and lapping to achieve micron-level tolerances on cutting edges and critical dimensions like runout and parallelism. Coating application, utilizing techniques such as PVD (Physical Vapor Deposition) and CVD (Chemical Vapor Deposition), is also integral at this stage, adding ultra-hard layers of ceramic, carbon, or titanium compounds to enhance surface durability and reduce friction. This manufacturing stage represents the highest value-add activity, requiring significant capital investment in machinery and intellectual property in proprietary grinding and coating recipes. Rigorous quality control, including non-destructive testing and surface finish measurement, ensures that every knife adheres to the tight specifications required by the demanding end-users, differentiating high-quality providers from general manufacturers.

The downstream activity focuses on distribution and service, which is vital for maintaining customer relationships and maximizing tool lifespan. Distribution channels bifurcate into direct sales to large Original Equipment Manufacturers (OEMs) of slitting machinery and major global converters, where technical consulting, custom design, and volume pricing are critical; and indirect sales through specialized industrial distributors and tooling resellers, who cater to the vast aftermarket for replacement and standard-sized knives, providing local inventory and often bundling essential resharpening services. The quality of the downstream service, particularly precision resharpening, is a major differentiating factor, as poorly maintained blades negate the benefits of premium materials. Furthermore, the provision of technical application support—advising customers on optimal knife setup, alignment, and clearance based on specific material characteristics—adds significant value, helping converters optimize their slitting lines and reduce costly material defects.

Slitting Knives Market Potential Customers

The potential customer base for slitting knives is expansive and fundamentally rooted in any industry requiring the accurate and high-speed processing of web-based materials. The largest segment of end-users are material converters operating in the packaging sector, including producers of flexible plastic films, laminated barrier foils, self-adhesive labels, and specialized industrial tapes. These customers prioritize knife consistency and durability because downtime severely impacts high-throughput production lines, making them willing to invest in premium carbide tooling that guarantees maximum operational uptime and superior edge quality necessary for regulatory compliance in food and pharma packaging. The purchasing decision for this segment is heavily influenced by documented performance metrics, particularly Mean Time Between Sharpening (MTBS).

Another critical customer segment comprises manufacturers in the hygiene and medical textiles sectors who utilize non-woven materials; the unique fibrous nature of these substrates demands specific, often customized, knife geometries and coatings to prevent fiber pull-out and maintain sterilization standards, making them high-value, albeit specific, buyers. These users require knives that offer non-stick properties and extreme precision to ensure material integrity in products like surgical drapes and diapers. Furthermore, the print and paper industry, including commercial printing presses and large-scale paper mills, continuously requires large volumes of standardized circular and straight knives for precision sheeting and trimming operations, focusing heavily on reliable supply and cost-effectiveness for bulk purchases of high-volume tooling. The technical requirements and purchasing criteria vary significantly, from seeking ultra-premium, data-integrated carbide blades for aerospace material slitting to standard, reliable HSS blades for general paper cutting tasks, necessitating targeted marketing and product development strategies for each customer cluster.

In addition to these major segments, the metal service center industry represents a robust, specialized customer group. These centers rely on extremely large, heavy-duty circular slitting knives to process steel, aluminum, and copper coils into narrower strips. Their purchasing decisions are driven by the requirement for shock resistance, toughness, and high tonnage capacity, often demanding proprietary alloy steels. Lastly, emerging technological sectors, such as the electric vehicle battery market, are creating new, high-value demand for specialty ceramic and ultra-thin steel blades required for slitting sensitive battery separator films and electrode materials under tightly controlled cleanroom conditions. These niche buyers prioritize zero contamination and extreme precision over volume, often requiring manufacturers to adhere to specialized quality management certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TGW International, LUCA KNIVES, TKM Group (The Knife Manufacturers), Dienes Werke GmbH & Co. KG, Kadant Inc., York Saw & Knife Co. Inc., M. K. & Sons Industries, American Cutting Edge, Sollex AB, Hyde Industrial Blade Solutions, Baucor Inc., Knife & Shear International, Custom Coils Inc., Spadone Machine Company, Accurate Industrial Knife, Arbor Industrial Knives, Zenith Cutter, Imperial Blade & Grinding, Simmons Engineering Corporation, Heavens Machine Knives, ASKO Inc. (A division of Arconic), Martor Australia, Forbo Siegling, Hakko Knives, Buss Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slitting Knives Market Key Technology Landscape

The technology landscape governing the Slitting Knives Market is fundamentally driven by advancements in three interdependent areas: high-performance material composition, ultra-precision surface finishing, and the increasing digitalization of tool management. Material innovation focuses on pushing the boundaries of hardness and toughness simultaneously. While traditional materials like D2 tool steel and M2 HSS remain relevant for general applications, the competitive advantage lies in sophisticated powder metallurgy techniques used to produce cemented tungsten carbide (WC) blades with extremely fine, homogeneous grain structures. This microscopic optimization results in an edge that is significantly less prone to micro-chipping and catastrophic failure under impact, extending the lifecycle exponentially when compared to conventionally produced carbide. Furthermore, research is intensifying into specialized technical ceramics, such as Zirconia and Silicon Nitride, which offer unparalleled resistance to corrosion and high temperatures, opening up specialized niches in chemical and demanding food processing environments where metallic contamination must be strictly avoided, demonstrating the market's continuous pursuit of application-specific material excellence.

Precision manufacturing technologies are crucial, ensuring that the theoretical benefits of advanced materials translate into real-world cutting performance. State-of-the-art five-axis Computer Numerical Control (CNC) grinding machines, often equipped with automated, in-process laser gauging and error compensation systems, are essential for achieving the necessary micron-level tolerances for critical parameters like concentricity, parallelism, and TIR (Total Indicated Runout) on circular knives. Any deviation in these measurements can introduce vibration, leading to poor cut quality, excessive dust generation, and premature knife wear. Complementing the grinding process are advanced surface treatment technologies. Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) are standard processes for applying ultra-thin, hard coatings—including TiN, TiCN, AlTiN, and the high-performance Diamond-Like Carbon (DLC). DLC coatings, in particular, provide exceptional hardness coupled with a remarkably low friction coefficient, which is transformative for slitting sticky or heat-sensitive materials like certain plastics and adhesive tapes, drastically reducing material build-up (galling) and improving operational uptime by keeping the blade edge clean for longer periods under intense mechanical stress.

The digitalization trend is establishing the third pillar of modern slitting knife technology. Manufacturers are increasingly adopting smart tooling concepts, where individual knives or knife holders are equipped with embedded radio-frequency identification (RFID) tags or specialized QR codes. These digital identifiers allow for real-time tracking of the tool's usage history, cumulative processing distance, maintenance records (including the number of resharpening cycles), and current location within the plant or service cycle. This seamless data integration is mandatory for feeding the AI and ML-driven predictive maintenance systems. By linking tool-specific performance data back to the centralized manufacturing execution systems (MES), companies can transition to a true Industry 4.0 framework for tool management. This technology not only optimizes inventory and replacement planning but also enforces crucial quality control by preventing the accidental use of a blade that has exceeded its safe usage lifecycle or has been incorrectly resharpened, ensuring a consistently high standard of output across all conversion processes. This integration moves the knife from a static component to a dynamic, data-generating asset within the industrial network, maximizing both efficiency and compliance.

Emerging technologies also include the development of proprietary heat treatment processes designed to selectively harden different zones of the knife body, optimizing core toughness for impact resistance while maintaining extreme hardness at the cutting edge. Furthermore, environmentally conscious manufacturing techniques, focusing on minimizing waste during the grinding process and utilizing energy-efficient coating systems, are becoming a crucial competitive factor, aligning product technology with global sustainability goals. The collective advancement across metallurgy, nanocoatings, and smart systems ensures that slitting knives continue to evolve from mere consumables into sophisticated, high-value industrial assets critical to the performance envelope of modern high-speed conversion machinery, cementing the technological foundation of the market for the foreseeable future and justifying the premium pricing commanded by market leaders who innovate in these areas. Continued innovation in laser hardening and plasma nitriding techniques promises further refinement of tool steel properties for enhanced durability in applications not yet ready for the full transition to carbide or ceramic tooling solutions.

Regional Highlights

The global Slitting Knives Market exhibits distinct regional dynamics driven by localized industrial activity and manufacturing investment trends. Asia Pacific (APAC) stands out as the largest and fastest-growing region, primarily fueled by the enormous scale of packaging, printing, and textile manufacturing in China, India, and Southeast Asian nations. The rapid urbanization, coupled with soaring e-commerce growth, mandates continuous expansion and modernization of conversion facilities, leading to high demand for slitting knives, particularly the cost-effective HSS and standard carbide types for high-volume production. This region is also becoming a major hub for specialized manufacturing, driving the need for precision tooling and advanced coating services, although price sensitivity remains a key determinant in procurement decisions across many sectors within the region.

North America and Europe represent mature markets characterized by stringent quality standards and a high adoption rate of premium, technology-intensive slitting solutions. Demand in these regions is less focused on volume expansion and more on efficiency gains, sustainability compliance, and utilizing advanced materials like ceramic and specialized coated carbide knives to minimize downtime and maximize the lifespan of expensive machinery. European manufacturers, in particular, are pioneers in integrating smart tooling and pursuing closed-loop recycling models for blade materials, driven by strong regulatory pressure and environmental corporate responsibility goals. The focus here is heavily on minimizing material waste, reducing energy consumption, and optimizing complex, multi-layer material slitting required by the highly sophisticated consumer goods and industrial supply chains prevalent in these economies, translating to higher average unit prices for slitting knives compared to APAC.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets experiencing moderate to high growth, largely concentrated around localized packaging and processing hubs responding to internal consumer demands. While pricing sensitivity is higher in these regions, ongoing foreign direct investment in manufacturing and infrastructure development is gradually increasing the demand for reliable, industrial-grade slitting equipment and corresponding high-quality replacement knives. The MEA region, specifically the GCC countries, shows promising potential driven by diversification efforts away from oil economies and into manufacturing and logistics sectors, requiring robust cutting solutions for industrial materials and specialized packaging requirements, positioning it as a future target for high-end tool deployment. Infrastructure constraints and logistical complexity, however, necessitate local partnerships and robust service networks for efficient market penetration and sustained growth in these territories.

- Asia Pacific (APAC): Dominant market volume, highest growth rate, driven by expansive packaging and printing industries (China, India). Focus on mass production, cost-efficiency, and rapid capacity expansion.

- North America: Mature market characterized by high automation, strong demand for high-performance carbide/ceramic blades, and rapid adoption of predictive maintenance technologies and smart tooling.

- Europe: Focus on high-precision, premium tooling, sustainability, and adherence to strict quality and safety regulations. High penetration of advanced coating technologies and strong emphasis on resharpening/refurbishment services.

- Latin America (LATAM): Moderate growth linked to local industrialization and consumer goods packaging expansion. Price sensitivity is a key purchasing factor, but quality demand is steadily rising.

- Middle East and Africa (MEA): Emerging demand driven by manufacturing diversification and infrastructure projects, particularly in specialized industrial materials processing, with long-term growth potential tied to foreign investment and technology transfer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slitting Knives Market.- TGW International

- LUCA KNIVES

- TKM Group (The Knife Manufacturers)

- Dienes Werke GmbH & Co. KG

- Kadant Inc.

- York Saw & Knife Co. Inc.

- M. K. & Sons Industries

- American Cutting Edge

- Sollex AB

- Hyde Industrial Blade Solutions

- Baucor Inc.

- Knife & Shear International

- Custom Coils Inc.

- Spadone Machine Company

- Accurate Industrial Knife

- Arbor Industrial Knives

- Zenith Cutter

- Imperial Blade & Grinding

- Simmons Engineering Corporation

- Heavens Machine Knives

- ASKO Inc. (A division of Arconic)

- Martor Australia

- Forbo Siegling

- Hakko Knives

- Buss Manufacturing

Frequently Asked Questions

Analyze common user questions about the Slitting Knives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Slitting Knives Market?

The market growth is primarily propelled by the exponential expansion of the global packaging industry, particularly flexible packaging and corrugated board production, coupled with the increasing integration of high-speed automation in material conversion processes that necessitate durable, high-precision cutting tools for efficiency. The continuous demand for consistent quality in consumer goods packaging across emerging and mature markets is a fundamental underlying driver.

Which type of slitting knife material is gaining the most traction in industrial applications?

Tungsten Carbide (WC) slitting knives are experiencing the highest growth traction in value terms. Their superior hardness, exceptional wear resistance, and ability to hold a critical edge significantly extend operational life compared to traditional High-Speed Steel (HSS), making them essential for high-volume, abrasive cutting applications common in modern film and composite material converting.

How does the choice between shear, score, and razor slitting affect the cutting process?

The selection depends entirely on the substrate material and required speed. Shear slitting (rotary knives) provides the cleanest, most precise edge for materials like paper, film, and foil at maximum line speeds. Score cutting (crush cut) is economical for materials with inherent compressibility, like paperboard and pressure-sensitive labels. Razor slitting is reserved for ultra-thin, delicate films where minimal cutting force is required to prevent material stretching or distortion.

What is the role of advanced coatings, such as DLC, in the slitting knives sector?

Advanced coatings like Diamond-Like Carbon (DLC), TiN, and TiCN are crucial for enhancing the performance and longevity of slitting knives. They significantly reduce the coefficient of friction on the blade surface, thereby minimizing heat build-up, preventing material stickiness (adhesive wear), and drastically extending the time between necessary resharpening or replacement, especially when processing complex plastic films and tapes.

Which geographical region holds the largest share of the Slitting Knives Market?

Asia Pacific (APAC), specifically driven by manufacturing powerhouses like China and India, holds the largest market share globally. This dominance is attributed to massive industrial investments in packaging, printing, and textiles, resulting in a substantial volume of slitting machinery operations and consistently high demand for replacement and OEM tooling components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager