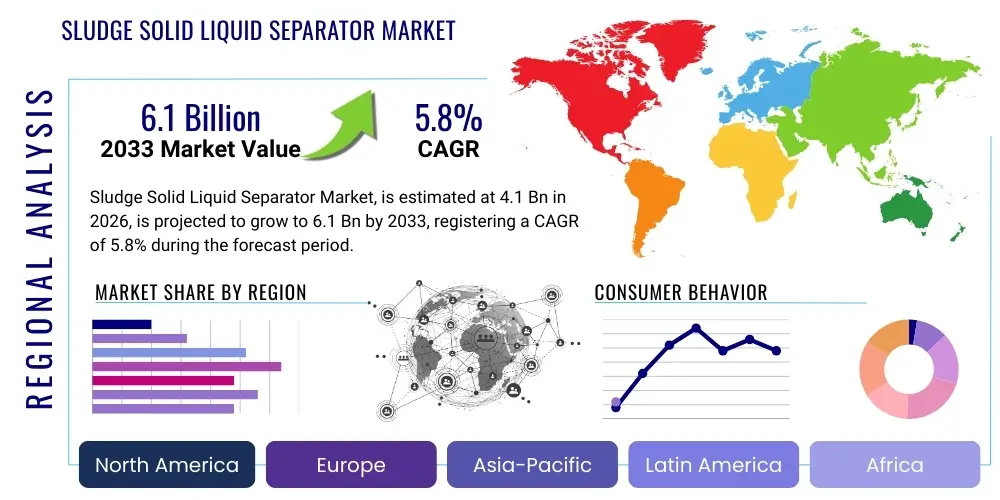

Sludge Solid Liquid Separator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441933 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Sludge Solid Liquid Separator Market Size

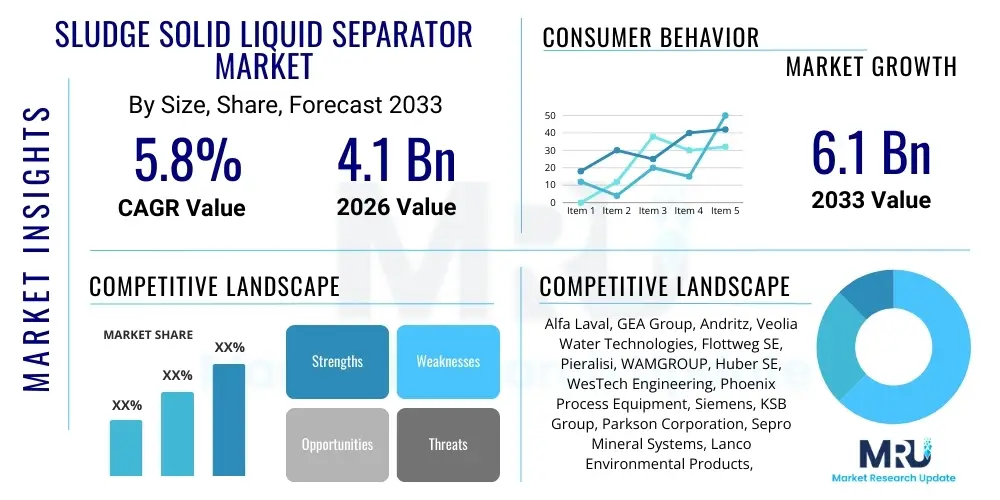

The Sludge Solid Liquid Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating global focus on industrial and municipal wastewater treatment efficiency, coupled with increasingly stringent regulatory frameworks mandating higher standards for sludge dewatering and disposal across developing and developed economies.

Sludge Solid Liquid Separator Market introduction

The Sludge Solid Liquid Separator Market encompasses technologies and equipment designed to efficiently separate solid particles from liquid sludge generated during industrial processes, wastewater treatment, and mining operations. These systems, including decanter centrifuges, filter presses, and belt press filters, are crucial for reducing the volume of sludge, thereby lowering transportation and disposal costs, and often enabling the recovery of valuable resources or cleaner water for reuse. The core objective of separation technology is to achieve high levels of dry solids content in the cake and excellent clarity in the effluent liquid, balancing operational efficiency with environmental compliance in sectors such as petrochemicals, food and beverage, and municipal sewage treatment.

Sludge separation technology is witnessing continuous innovation focused on enhancing automation, reducing energy consumption, and improving chemical conditioning processes necessary for optimal separation. Modern separators are integrated into comprehensive plant management systems, providing real-time data on performance and optimizing chemical dosing based on fluctuating sludge characteristics. This technological evolution addresses key market pain points related to handling complex, high-variability sludge streams, particularly those prevalent in emerging economies experiencing rapid industrialization and subsequent environmental pressures.

Major applications driving market growth include large-scale municipal wastewater treatment facilities seeking to minimize landfill burden and maximize biogas production from concentrated sludge, and intensive industrial sectors like mining and chemicals where resource recovery from process waste is vital for economic sustainability. The primary benefit derived from these separators is the substantial reduction in volume (often reducing sludge volume by 70-90%), translating directly into significant operational cost savings related to hauling and disposal, while adherence to strict environmental mandates regarding effluent discharge quality acts as a powerful non-negotiable driver for widespread adoption.

Sludge Solid Liquid Separator Market Executive Summary

The Sludge Solid Liquid Separator Market is characterized by robust business trends centered on automation and energy efficiency. Key manufacturers are prioritizing the integration of IoT and predictive maintenance features into their equipment, moving beyond simple separation towards comprehensive sludge management systems that offer reduced downtime and optimized performance. The shift towards circular economy principles is profoundly influencing business models, with increasing demand for systems capable of recovering valuable materials, such as metals from mining sludge or phosphorus from municipal sewage, rather than merely disposing of waste. This pivot towards resource extraction is driving investment in advanced technologies like membrane filtration and high-pressure filtration units designed for superior product purity.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, massive infrastructure spending on water sanitation projects, and the implementation of stricter environmental protection laws in countries like China and India. North America and Europe, while mature markets, maintain high demand driven by the continuous need to upgrade aging infrastructure and comply with evolving regulatory landscapes, particularly concerning per- and polyfluoroalkyl substances (PFAS) and microplastics in treated sludge. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, particularly in industrial sectors such as oil & gas and mining, where water scarcity and the need for localized treatment solutions are paramount.

Segment-wise, decanter centrifuges dominate the market due to their continuous operation, high capacity, and versatility across diverse sludge types. However, filter presses, particularly automated membrane filter presses, are gaining traction in applications requiring extremely low moisture content in the resulting solid cake, such as high-value chemical or pharmaceutical processing. The municipal wastewater treatment sector remains the largest end-user segment globally, though the industrial segment, particularly Food & Beverage and Chemicals, is exhibiting the highest growth trajectory, reflecting the global focus on internal environmental compliance and minimizing operational waste.

AI Impact Analysis on Sludge Solid Liquid Separator Market

User queries regarding AI in the Sludge Solid Liquid Separator Market frequently focus on how artificial intelligence can overcome traditional operational inefficiencies, particularly questions surrounding optimal chemical flocculant dosing, proactive equipment failure prediction, and real-time process adjustment based on fluctuating input sludge quality. Users are keen to understand if AI integration can lead to substantial reductions in energy consumption and chemical expenditure—two major operational costs. The summary of user expectations centers on AI transforming separation from a reactive, empirical process to a predictive, optimized, and autonomous operation. Key concerns revolve around the complexity of integrating AI models with existing legacy infrastructure and the required level of skilled labor necessary to manage and maintain these sophisticated systems, leading to a strong demand for user-friendly interfaces and robust cloud-based analytics platforms.

AI is beginning to fundamentally alter the performance envelope of solid liquid separation equipment by enabling dynamic process control. Machine learning algorithms analyze historical operational data alongside real-time sensor inputs—such as sludge flow rate, density, pH, and turbidity—to predict the optimal flocculant dose required microseconds before the sludge enters the separation unit. This precision dosing drastically minimizes chemical wastage while ensuring consistent separation efficiency, a feat impossible to replicate manually or with traditional control loops. Furthermore, neural networks are deployed to analyze vibration patterns, motor current draws, and temperature anomalies in high-wear components like centrifuge bowls or filter plate mechanisms, predicting impending mechanical failures hours or days in advance, thereby shifting maintenance from scheduled intervals to condition-based interventions, maximizing uptime.

The application of AI extends to optimizing energy usage, especially in continuous operation systems like decanter centrifuges, where energy consumption is significant. AI models dynamically adjust motor speeds and differential speeds based on current sludge load and desired output dryness, ensuring the equipment operates at the highest efficiency point possible under prevailing conditions. Moreover, for systems utilizing resource recovery (e.g., maximizing methane yield from anaerobic digesters fed with dewatered sludge), AI analyzes the quality of the dewatered cake and tailors the separation parameters to maximize biofuel or nutrient content, thereby contributing significantly to operational profitability and sustainability metrics, reinforcing the importance of intelligent process integration.

- Enhanced Flocculant Optimization: AI dynamically adjusts chemical dosing based on real-time sludge characteristics, minimizing chemical consumption by up to 20%.

- Predictive Maintenance: Machine learning analyzes sensor data to forecast component failures (e.g., bearings, scrolls) days in advance, reducing unplanned downtime by up to 30%.

- Autonomous Operation: Self-adjusting control loops based on AI analysis manage speed and torque, optimizing energy consumption and consistently meeting discharge standards.

- Resource Recovery Maximization: AI algorithms determine optimal separation parameters to maximize the concentration of valuable recovered materials (e.g., nutrients, biogas potential).

- Digital Twin Modeling: Creation of virtual models of separation units allows for simulation of various sludge compositions and operational scenarios, aiding in rapid troubleshooting and training.

DRO & Impact Forces Of Sludge Solid Liquid Separator Market

The dynamics of the Sludge Solid Liquid Separator Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key impact forces influencing investment and technological development. The central driver is undoubtedly the relentless pressure from global environmental mandates, particularly those governing wastewater discharge quality and the mandatory reduction in landfill waste volumes. Coupled with this is the economic driver of minimizing operational expenditure through volume reduction; efficient dewatering significantly cuts the hefty costs associated with sludge transportation and disposal, particularly in regions with high logistics costs. These drivers create a compelling and non-cyclical demand base for reliable separation technologies, ensuring market resilience even during economic downturns.

However, the market faces significant restraints. The primary challenge is the high initial capital expenditure (CapEx) associated with purchasing advanced separation equipment such as large-scale decanter centrifuges or membrane filter presses. This high cost often acts as a barrier to entry for smaller municipalities and industrial operators, particularly in developing regions. Furthermore, the operational complexity and variability of sludge—where characteristics like viscosity, particle size distribution, and chemical composition constantly shift—require sophisticated process control and often result in operational bottlenecks if the technology is not precisely matched to the application. Another critical restraint is the availability of skilled technical personnel capable of operating, maintaining, and troubleshooting complex mechanical and automated separation systems, which can limit the adoption of the most advanced technology.

Opportunities for growth are concentrated in technological advancements and new application areas. The push towards the circular economy presents a significant opportunity for separation equipment tailored for resource recovery, such as systems designed to extract specialized minerals from industrial effluent or nutrient recovery from municipal biosolids. Market players can capitalize on the development of compact, modular, and containerized separation units, which significantly lower installation time and are ideal for decentralized wastewater treatment or temporary industrial applications. Furthermore, the growing adoption of Industrial Internet of Things (IIoT) and AI offers opportunities for manufacturers to transition from selling hardware to providing comprehensive, performance-based service contracts, leveraging data analytics to guarantee efficiency and uptime for their clients, thereby creating resilient, recurring revenue streams.

Segmentation Analysis

The Sludge Solid Liquid Separator Market is highly diverse, segmented primarily by the type of separation technology employed, the specific end-user application, and the resulting operational parameters. Segmentation provides crucial insights into the technological preferences and capacity requirements of various industries, demonstrating the market's differentiation between high-volume, continuous processing needs (e.g., municipal sewage) and high-purity, batch processing requirements (e.g., pharmaceutical manufacturing). Analyzing these segments helps in targeting R&D efforts towards specialized solutions, such as optimizing filter media for specific chemical sludges or developing robust, abrasion-resistant materials for mining applications. The market structure reflects a preference for reliable mechanical separation techniques that minimize the use of thermal energy while maximizing dry solids content.

- By Product Type:

- Decanter Centrifuges

- Filter Press Separators (Plate and Frame, Membrane)

- Belt Press Filters

- Screw Press Separators

- Gravity Separation Units

- By Application:

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment

- Food & Beverage Processing

- Chemical and Petrochemical

- Pulp & Paper

- Mining & Metallurgy

- Textiles and Dyeing

- Pharmaceuticals

- By Operation Mode:

- Continuous Operation Systems

- Batch Operation Systems

- By End-User:

- Water Utilities and Municipalities

- Manufacturing Industries

- Energy and Power Generation

- Mining Sector

Value Chain Analysis For Sludge Solid Liquid Separator Market

The value chain for the Sludge Solid Liquid Separator Market begins with raw material suppliers and specialized component manufacturers, forming the crucial upstream segment. Key raw materials include high-grade stainless steel (necessary for corrosion resistance), specialized polymers for filtration media, and advanced elastomers for seals and belts, all vital for manufacturing equipment that must withstand harsh chemical and abrasive environments typical in sludge processing. Upstream activities also encompass the development and sourcing of precision components such as high-performance motors, robust bearings, sophisticated sensors, and programmable logic controllers (PLCs) which are essential for ensuring the efficiency, automation, and reliability of modern separation systems like decanter centrifuges and belt filter presses. Optimization of this upstream stage, focusing on sustainable sourcing, material innovation to reduce wear, and securing reliable supply chains for critical automation components, directly influences the final equipment cost, longevity, and overall operational efficiency, thereby impacting the competitiveness of the primary separator manufacturers. Manufacturers often engage in strategic partnerships with material science firms to secure proprietary coatings or alloys that enhance equipment lifespan in highly aggressive industrial sludges, demonstrating the strategic importance of the upstream segment.

The midstream segment is dominated by original equipment manufacturers (OEMs) who are responsible for the complex design, precision assembly, factory testing, and ultimate integration of the separation units. These manufacturers invest heavily in research and development to enhance fundamental separation metrics—such as achieving higher dry solids content in the cake, improving effluent clarity, reducing energy consumption per cubic meter of treated sludge, and minimizing the system's maintenance footprint. Differentiation at this stage often relies on proprietary technology—such as specialized scroll designs in high-speed centrifuges, advanced flocculation mixing mechanisms, or optimized membrane filter plate configurations—and sophisticated integration capabilities, particularly the incorporation of smart monitoring, vibration analysis, and fully autonomous control features. Following manufacturing, the distribution channel plays a critical role in market reach. Direct distribution is typically utilized for large-scale, custom-engineered projects, involving intensive engagement between the OEM and the end-user (e.g., a massive municipal water utility or a large-scale chemical refinery). This direct channel allows for highly tailored technical solutions, extensive pre-sales engineering consultation, and seamless integration with existing plant infrastructure, supported by comprehensive after-sales packages including installation and commissioning supervision.

Conversely, indirect distribution relies on a robust network of specialized engineering, procurement, and construction (EPC) firms, local market distributors, and expert system integrators. These intermediaries provide localized technical expertise, handle the sale and integration of smaller or standard capacity units, and are often responsible for bundling the separation equipment with other necessary surrounding wastewater treatment infrastructure, such as chemical dosing skids and conveyance systems. The downstream segment involves installation, rigorous commissioning, ongoing preventative and corrective maintenance, and continuous operational support, which is absolutely critical given the capital-intensive nature and long, mandated operational lifespan of these systems. Service providers, often strongly tied to or subsidiaries of the major OEMs, offer rapid delivery of essential spare parts, conduct technical audits for performance optimization, and provide crucial retrofitting services to ensure older installations meet evolving regulatory compliance and efficiency standards. The high variability and complexity of sludge characteristics across different industries necessitate robust and responsive after-market services, making the downstream service segment a substantial and growing revenue driver, crucial for long-term customer satisfaction, technology adoption, and brand loyalty.

Sludge Solid Liquid Separator Market Potential Customers

The core customer base for Sludge Solid Liquid Separator equipment comprises entities that generate high volumes of liquid waste streams requiring efficient dewatering and disposal, spanning both public utilities and private industrial enterprises. Municipal wastewater treatment plants represent the largest and most foundational customer segment globally. These governmental or quasi-governmental entities are driven by regulatory mandates to meet stringent effluent standards, minimize the environmental footprint of biosolids, and manage growing sludge volumes resulting from urban population expansion. Their procurement decisions heavily prioritize reliability, longevity, high throughput capacity, and low operational expenditure over a 20+ year lifespan, making technologies like robust decanter centrifuges and durable belt filters primary choices for their continuous, high-volume operations.

The second major cohort consists of diverse industrial end-users, where the motivation extends beyond pure compliance to include resource efficiency and product quality protection. Industries such as Chemical Processing and Food & Beverage use separation technologies not only for effluent treatment but also for product recovery (e.g., separating active ingredients, recovering process water, or separating yeast from beer). The Mining and Metallurgy sector constitutes another critical customer base, relying on high-capacity, heavy-duty filter presses and centrifuges to dewater tailings, recover valuable minerals, and ensure process water recycling in water-scarce regions. These industrial buyers often seek highly customized, specialized equipment capable of handling corrosive agents, extremely fine particles, or high temperatures, demanding specialized material construction and sophisticated process control.

Emerging customers include sectors focused on renewable energy and specialized manufacturing. Power generation facilities, particularly those utilizing coal or biomass, generate substantial ash or scrubber sludge that requires dewatering for safe handling. Furthermore, the burgeoning pharmaceutical and biotech industries require highly sterile, often batch-operated separation systems (like sealed filter presses) to separate active pharmaceutical ingredients (APIs) from fermentation broths, where purity and contamination control are paramount. Procurement decisions among these varying customer segments are heavily influenced by the specific characteristics of the sludge (e.g., abrasive, oily, biological), the required dry solids content, the budget for capital expenditure, and the availability of local maintenance support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfa Laval, GEA Group, Andritz, Veolia Water Technologies, Flottweg SE, Pieralisi, WAMGROUP, Huber SE, WesTech Engineering, Phoenix Process Equipment, Siemens, KSB Group, Parkson Corporation, Sepro Mineral Systems, Lanco Environmental Products, Evoqua Water Technologies, Aqseptence Group, Met-Chem, Nijhuis Saur Industries, Tecniplant SpA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sludge Solid Liquid Separator Market Key Technology Landscape

The technology landscape of the Sludge Solid Liquid Separator Market is highly diverse, centered on mechanical and physical separation principles, with a growing emphasis on smart system integration. Decanter centrifuges represent the dominant technology, valued for their continuous high-volume throughput and relatively small footprint. Recent innovations in this area focus on wear protection (using materials like tungsten carbide), energy-efficient drive systems (such as variable frequency drives), and advanced scroll geometries to handle highly abrasive or sticky sludge while maximizing the differential speed control necessary for optimal separation. Filter presses, particularly fully automated membrane filter presses, represent the high-performance niche, capable of achieving dry solids content up to 80%. Technological advancements here include faster plate shifting mechanisms, automated cloth washing, and sophisticated hydraulics to minimize cycle time and increase efficiency while maintaining low moisture content crucial for specialized industrial applications like pigments or fine chemicals.

Furthermore, technology development is heavily skewed towards smart integration and digitalization. Modern separation systems are increasingly equipped with multiple sensors (vibration, torque, acoustic emission) and edge computing capabilities to feed data into Industrial Internet of Things (IIoT) platforms. This facilitates real-time performance monitoring, predictive diagnostics, and remote operational adjustments, moving the industry towards the concept of autonomous sludge dewatering. Chemical conditioning, a prerequisite for efficient separation, has also seen technological refinement through the use of automated polymer preparation and dosing systems that utilize in-line analyzers to adjust flocculant concentration based on sludge stream fluctuations, ensuring chemical cost optimization and process stability, especially critical in municipal environments where sludge composition varies widely day-to-day.

Emerging technologies that are influencing the long-term outlook include thermal drying systems and electro-coagulation/flocculation units, often used post-separation to further reduce sludge mass or enhance dewatering efficacy for specific, difficult-to-treat sludges. Screw press separators are gaining popularity in smaller, decentralized applications due to their low-speed operation, minimal energy use, and simplified maintenance requirements, although they typically yield lower dry solids content compared to centrifuges or filter presses. Overall, the technological direction is clear: higher automation, integration of condition monitoring for enhanced reliability, and engineering focused on maximizing resource efficiency—be it water recovery, minimizing energy input, or maximizing dry solids for bioenergy potential.

Regional Highlights

The market dynamics of the Sludge Solid Liquid Separator Market vary significantly by region, driven by differences in environmental policy maturity, industrial density, and infrastructure investment levels.

- North America: Characterized by a mature market with high regulatory standards (e.g., EPA mandates) and a focus on upgrading aging municipal water infrastructure. Demand is centered on high-efficiency, automated systems, often integrating AI for predictive maintenance and compliance tracking. The region sees strong adoption of filter presses for achieving low moisture content in biosolids designated for land application or thermal processing.

- Europe: Driven by the stringent European Union directives concerning water quality and the circular economy, emphasizing resource recovery, particularly phosphorus and nitrogen from sewage sludge. Market growth is stable, focused on innovation in energy-efficient separation (low-G force centrifuges) and modular, scalable solutions suitable for decentralized treatment facilities. Germany, the UK, and France are key consumers, investing heavily in technology refurbishment.

- Asia Pacific (APAC): Represents the fastest-growing region globally, fueled by rapid industrialization, massive urban population growth, and substantial government investments in new centralized wastewater treatment plants (China, India). The demand here is volume-driven, favoring high-throughput technologies like large decanter centrifuges and belt filter presses, balancing CapEx with necessary capacity expansion. Strict environmental enforcement in countries like China is creating a massive immediate need for compliant separation solutions.

- Latin America: An emerging market characterized by significant activity in the mining, oil and gas, and food processing sectors. Market adoption is driven by corporate sustainability requirements and the need to recycle process water. Economic volatility can sometimes hinder large CapEx projects, leading to higher demand for reliable, mid-range separation equipment and localized service support.

- Middle East and Africa (MEA): Growth is concentrated in industrialized zones (e.g., GCC states, South Africa). Water scarcity is the dominant driver, necessitating separation equipment that maximizes water recovery and minimizes sludge volume from industrial activities (petrochemicals, desalination brine treatment). Investments are often tied to major infrastructure projects and driven by government sustainability visions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sludge Solid Liquid Separator Market.- Alfa Laval

- GEA Group

- Andritz

- Veolia Water Technologies

- Flottweg SE

- Pieralisi

- WAMGROUP

- Huber SE

- WesTech Engineering

- Phoenix Process Equipment

- Siemens

- KSB Group

- Parkson Corporation

- Sepro Mineral Systems

- Lanco Environmental Products

- Evoqua Water Technologies

- Aqseptence Group

- Met-Chem

- Nijhuis Saur Industries

- Tecniplant SpA

Frequently Asked Questions

What are the primary drivers for the adoption of Sludge Solid Liquid Separator technology?

The primary drivers include increasingly stringent global environmental regulations mandating cleaner effluent discharge, the high cost associated with transporting and disposing of wet sludge, and the economic benefits derived from resource recovery and water recycling made possible by effective dewatering.

Which separation technology is most widely used in municipal wastewater treatment plants?

Decanter centrifuges are the most widely used technology in large municipal wastewater treatment plants due to their ability to handle continuous, high-volume flows, achieve good dewatering efficiency, and operate reliably with minimal manual intervention.

How does AI contribute to improving the efficiency of sludge separation?

AI improves efficiency by enabling dynamic, predictive control over key operational variables, notably optimizing flocculant chemical dosing in real-time based on sludge input quality and providing predictive maintenance alerts to minimize unplanned downtime.

What is the main restraint hindering market growth in developing countries?

The main restraint is the high initial capital expenditure (CapEx) required for sophisticated separation systems, which poses a significant financial barrier for smaller industrial operators and municipal governments in developing economies, often leading to slower adoption of the most advanced equipment.

Which regional market is anticipated to show the highest growth rate through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to extensive urbanization, massive infrastructure projects dedicated to water sanitation, and the rapid implementation of modern environmental compliance laws across industrialized nations within the continent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager