Slurry Separator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441799 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Slurry Separator Market Size

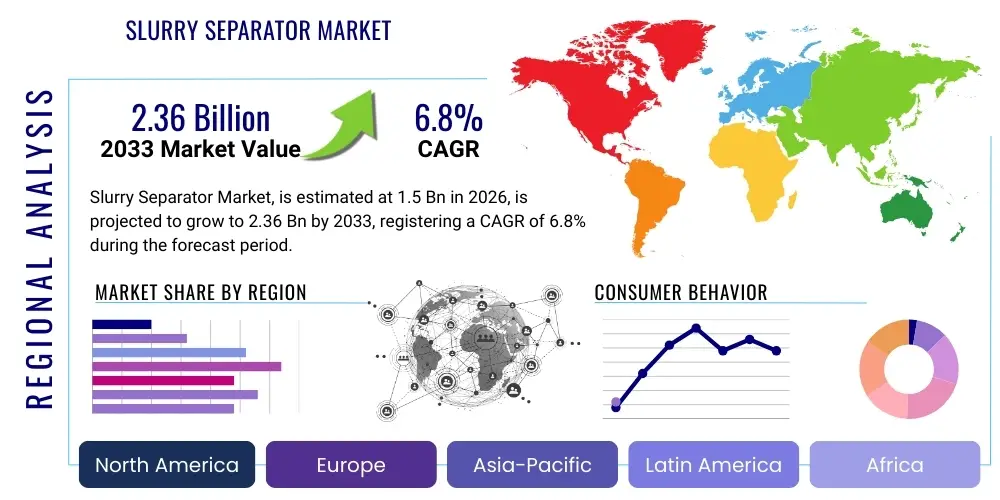

The Slurry Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.36 Billion by the end of the forecast period in 2033.

Slurry Separator Market introduction

The Slurry Separator Market encompasses equipment and systems designed to efficiently separate solid particles from liquid phases within a slurry mixture. These separators are critical components across various heavy industries where solid-liquid separation is mandatory for operational efficiency, resource recovery, and environmental compliance. Key equipment types include centrifuges, hydrocyclones, filtration systems, and decanters, each optimized for different particle sizes, slurry viscosities, and throughput requirements. The fundamental purpose is to dewater solids, recover valuable liquids, minimize waste volume, and purify process streams, ensuring that industrial effluent meets stringent regulatory standards before discharge or reuse.

The primary applications of slurry separators span sectors such as mining and minerals processing, where significant volumes of waste tailings and valuable mineral concentrates require dewatering; municipal and industrial wastewater treatment, focused on sludge reduction and water reclamation; and agriculture, particularly in managing livestock waste (manure slurry). The demand for high-efficiency separators is directly linked to global trends in resource scarcity and sustainable manufacturing practices. As industries strive for a circular economy model, maximizing water reuse and recovering solid byproducts, the technological sophistication and deployment rate of slurry separation equipment escalate significantly.

The core benefits derived from implementing advanced slurry separation technology include reduced operational costs associated with waste disposal, enhanced product quality through improved dryness, and compliance with increasingly rigorous environmental legislation globally. Driving factors for market expansion are centered on the rapid industrialization in developing economies, the necessity for treating complex industrial wastewater streams generated by burgeoning manufacturing sectors, and technological advancements focusing on automation and energy efficiency within the separation process. Furthermore, the global emphasis on sustainability mandates robust solid-liquid separation technologies to minimize environmental footprint.

Slurry Separator Market Executive Summary

The Slurry Separator Market is currently undergoing significant transformation, primarily driven by converging demands for environmental sustainability and operational efficiency. Business trends highlight a strong shift toward advanced automation, utilizing sensors and data analytics to optimize separation performance in real-time, thereby reducing chemical consumption and energy costs. Manufacturers are focusing heavily on developing modular, scalable systems that can be easily integrated into existing infrastructure, catering to both large-scale mining operations and decentralized municipal treatment facilities. The competitive landscape is characterized by innovation in high-pressure filtration and high-speed centrifugation, pushing the boundaries of dryness achieved in the separated solids.

Regionally, the Asia Pacific (APAC) stands as the dominant market, fueled by massive industrial and infrastructure development, particularly in China and India, coupled with rapid urbanization that necessitates extensive municipal wastewater infrastructure investment. North America and Europe, while mature markets, exhibit strong growth driven by strict regulatory mandates regarding water quality and sludge disposal, prompting continuous upgrading of existing separation installations with high-efficiency technologies compliant with EU directives and EPA standards. Emerging markets in Latin America (driven by mining activities) and the Middle East & Africa (driven by new infrastructure and petrochemical projects) are demonstrating accelerated adoption rates, contributing significantly to the global market expansion.

Segment trends indicate that the hydrocyclone segment remains crucial due to its cost-effectiveness and high throughput capacity in mineral processing, whereas advanced membrane filtration systems are gaining traction in applications requiring ultra-fine separation and high purity output, such as pharmaceutical and specialty chemical manufacturing. The key end-use application driving demand remains the mining sector, followed closely by the burgeoning wastewater treatment segment, especially with the global focus on tertiary treatment and effluent reuse. The trend towards servicing the agricultural sector for nutrient recovery from livestock manure represents a specialized, high-growth niche within the overall segmentation, reflecting broader efforts toward sustainable farming and resource management.

AI Impact Analysis on Slurry Separator Market

User inquiries regarding AI's role in the Slurry Separator Market frequently revolve around optimizing real-time operational parameters, predicting maintenance failures, and achieving superior separation consistency despite variable input slurry conditions. Users often question how Artificial Intelligence and Machine Learning algorithms can monitor factors like solid concentration, particle size distribution, and flow rates simultaneously to adjust separator settings (such as centrifuge bowl speed or filter press cycle times) dynamically. A major concern is the high cost of implementation versus the return on investment in legacy industrial settings. Expectations center on AI significantly reducing energy consumption and downtime while improving the final product's dryness or purity specifications, moving industrial separation processes from reactive monitoring to proactive, predictive control mechanisms.

The integration of AI leverages data collected from numerous sensors monitoring pressure, temperature, vibration, and chemical composition within the slurry separation process. Machine Learning models analyze this historical and real-time operational data to identify optimal operational windows and detect anomalies that precede equipment failure. For complex and continuous processes, AI-driven process control ensures that minor fluctuations in input slurry characteristics, often unavoidable in mining or municipal environments, are immediately compensated for by the system. This capability significantly enhances the stability and efficiency of the separation output, a critical factor for subsequent processes or environmental compliance.

Furthermore, AI plays a pivotal role in predictive maintenance scheduling. By analyzing vibration spectra and operational wear patterns, algorithms can accurately predict the remaining useful life of key components, such as bearings in centrifuges or filter cloth lifespan in presses. This capability minimizes unplanned downtime—a major expense in continuous industrial operations—by shifting maintenance from time-based or failure-based schedules to condition-based optimization. This proactive approach not only saves costs related to emergency repairs but also extends the overall lifespan and reliability of high-capital separation equipment, fundamentally altering the service and maintenance models within the market.

- AI-driven Predictive Maintenance: Minimizes unplanned downtime by forecasting equipment failure based on sensor data analysis (vibration, temperature).

- Real-time Process Optimization: Machine Learning algorithms adjust separator parameters (e.g., flocculant dosage, rotational speed) to maintain peak efficiency despite varying slurry input.

- Enhanced Resource Recovery: Optimization models maximize the recovery rate of target solids or liquids, supporting circular economy initiatives.

- Automated Fault Detection: AI systems quickly identify operational anomalies, reducing human intervention and error rates.

- Energy Consumption Reduction: Intelligent control systems ensure equipment runs only at the necessary intensity, significantly lowering energy expenditure per unit of throughput.

DRO & Impact Forces Of Slurry Separator Market

The Slurry Separator Market dynamics are fundamentally shaped by a combination of stringent regulatory enforcement, technological advancements focusing on sustainability, and fluctuating industrial investment cycles. Drivers center predominantly on the increasing global mandate for water quality and wastewater management, pushing industries to invest in sophisticated separation technologies. Restraints primarily involve the substantial initial capital outlay required for high-capacity equipment and the operational complexities associated with treating heterogeneous slurry streams. Opportunities are abundant in the emerging markets undergoing rapid industrialization and the niche field of resource recovery and beneficial reuse of separated solids, aligning with global sustainable development goals. These forces collectively dictate the adoption rate and strategic direction of technological innovation within the market.

Key drivers sustaining market growth include the global expansion of mining operations, particularly in copper, gold, and iron ore extraction, which generates vast quantities of tailings requiring efficient dewatering for storage stability and water reuse. Concurrently, environmental regulations, such as those governing effluent discharge limits (TSS, heavy metals), are becoming globally standardized and stricter, compelling industries to adopt best available technologies (BAT). Furthermore, the societal push towards maximizing material recovery from waste, transforming sludge into beneficial products like biogas or construction aggregates, provides a strong economic incentive for acquiring high-efficiency separation systems capable of producing cleaner, drier solid outputs.

However, the market faces significant restraints. The initial procurement cost of advanced separation systems (especially large-scale filter presses or high-speed centrifuges) is prohibitive for many small and medium-sized enterprises. Furthermore, the specialized knowledge required for operating, maintaining, and troubleshooting complex separation equipment presents a significant barrier, particularly in regions with limited skilled labor. Impact forces influencing market direction include geopolitical stability affecting commodity prices (especially metals, impacting mining investment), technological obsolescence requiring periodic equipment replacement, and macroeconomic shifts influencing public and private infrastructure spending on water and waste treatment facilities worldwide.

Segmentation Analysis

The Slurry Separator Market is systematically segmented based on Technology Type, Component, Application, and Geographical Region, providing a detailed understanding of market dynamics within specialized industrial contexts. Analysis across these dimensions reveals distinct patterns of adoption; for instance, filtration technologies dominate sectors requiring high dryness levels, while centrifugation is preferred for high-volume liquid clarification. Understanding these segmentation nuances is crucial for strategic planning, enabling market players to target specific end-user requirements, ranging from the need for robust, high-throughput systems in mining to the requirement for ultra-precise separation in biotechnology and food processing applications. The market structure reflects the diversity of industrial processes that rely on efficient solid-liquid segregation.

- By Technology Type:

- Centrifuges (Decanter Centrifuges, Disc Stack Centrifuges, Tubular Centrifuges)

- Filtration Systems (Filter Presses, Belt Filters, Vacuum Filters)

- Hydrocyclones

- Settling Tanks and Clarifiers

- Other Separation Techniques (Membrane Filtration, Thickeners)

- By Component:

- Equipment (New Sales)

- Aftermarket (Spares, Services, and Consumables)

- By Application/End-User:

- Mining and Metallurgy

- Municipal Wastewater Treatment

- Industrial Wastewater Treatment (Chemical, Food & Beverage, Pulp & Paper)

- Chemical Processing

- Agriculture and Livestock Management

- Construction and Infrastructure

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Slurry Separator Market

The value chain of the Slurry Separator Market commences with the upstream supply of specialized raw materials, primarily high-grade stainless steel, alloys, composite materials, and rubber components crucial for ensuring corrosion resistance and structural integrity against abrasive slurries. Manufacturing involves precision engineering, casting, and assembly of complex mechanical systems like centrifuge bowls, filter press plates, and robust pump systems. Given the high stress and abrasive environment in which separators operate, the quality and sourcing of raw materials, coupled with strict manufacturing tolerances, are critical determinants of equipment longevity and performance, driving cost structures early in the chain.

Midstream activities focus on the core engineering and system integration. This includes designing customized solutions based on specific client slurry characteristics, incorporating sophisticated automation and control systems (PLCs, VFDs), and testing systems to meet strict operational guarantees. Distribution channels are varied: large equipment is often sold directly through Original Equipment Manufacturers (OEMs) who handle complex installation and commissioning. Smaller, standardized units, and increasingly, aftermarket components, are distributed through specialized industrial distributors and local service partners who provide crucial localized maintenance support and rapid spares delivery, impacting the overall lifecycle cost for the end-user.

Downstream analysis highlights the critical role of service and aftermarket support. Because separation equipment operates in harsh environments, wear and tear are significant, making the provision of maintenance services, spare parts, consumables (like filter cloths and flocculants), and performance optimization contracts a vital, high-margin revenue stream. End-users, including mining companies and municipal authorities, rely heavily on reliable, long-term support to minimize production halts. The efficacy of the downstream service network—including direct support, third-party repair centers, and technical consulting—strongly influences customer loyalty and repeat purchasing decisions, thereby completing the cycle of value generation.

Slurry Separator Market Potential Customers

The primary customers for slurry separation equipment are capital-intensive industries characterized by high-volume wet processes. Mining and metallurgy companies represent the largest segment, requiring separation technologies for dewatering mineral concentrates (e.g., iron ore, coal, copper) and processing voluminous tailings streams to ensure environmental safety and water recovery. These customers prioritize robustness, high throughput capacity, and low operational expenditure (OPEX) over the equipment's lifecycle, often necessitating custom-engineered solutions tailored to unique mineral characteristics and remote operating conditions.

Municipal wastewater and water treatment facilities constitute the second major customer base, driven by public health requirements and environmental regulatory compliance. These customers invest in separators primarily for sludge dewatering to minimize disposal volume and costs, and for water clarification to meet potable standards or effluent discharge limits. Procurement decisions here are heavily influenced by governmental budgeting cycles, compliance standards, energy efficiency, and long-term reliability, favoring standardized, proven technologies with minimal maintenance demands and reliable performance in continuous, 24/7 operational cycles.

Additionally, various industrial sectors act as key potential customers. This includes the chemical processing industry, where separation is integral to product purification and catalyst recovery; the food and beverage industry, focusing on effluent treatment and product component separation (e.g., starch separation); and the pulp and paper sector, dealing with fiber recovery and dewatering of cellulosic sludge. These industrial customers seek solutions offering high precision, sanitary design (where applicable), and integration capabilities with complex chemical processes, often leading to demand for advanced technologies like membrane filtration or specialty high-speed centrifuges to achieve stringent quality metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.36 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andritz AG, Alfa Laval AB, FLSmidth & Co. A/S, Weir Group PLC, Siemens AG, GEA Group AG, Mitsubishi Kakoki Kaisha, Ltd., Evoqua Water Technologies Corp., Komline-Sanderson, Russell Finex Ltd., Tecalemit Flow, Schlumberger Limited, SUEZ, Parkson Corporation, WesTech Engineering, Phoenix Process Equipment, McLanahan Corporation, Eriez Manufacturing Co., Baker Hughes Company, Hiller GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slurry Separator Market Key Technology Landscape

The technology landscape for the Slurry Separator Market is characterized by continuous innovation aimed at enhancing separation efficiency, reducing energy consumption, and improving automation capabilities. Decanter centrifuges remain a cornerstone, leveraging high gravitational forces to achieve rapid solid-liquid separation. Recent advancements focus on materials science for abrasion resistance, developing sophisticated scroll designs, and integrating Variable Frequency Drives (VFDs) to precisely control bowl and scroll speeds, optimizing dryness for varying slurry inputs. This technological refinement allows for greater flexibility and significantly lower maintenance cycles compared to older generation models, meeting the industry demand for continuous, reliable operation.

Filtration technology, particularly automated filter presses and belt filters, is seeing significant development. Modern filter presses incorporate higher filtration pressures and optimized cloth materials, enabling the achievement of extremely low moisture content in filter cakes, which is vital for waste minimization and reducing disposal costs. Furthermore, the adoption of smart systems employing Internet of Things (IoT) sensors allows for automated monitoring of cake thickness, washing cycles, and cloth integrity. This connectivity minimizes manual intervention and ensures consistently high throughput, directly addressing the restraint of operational complexity typically associated with filtration systems.

A crucial technological trend across all separator types is the integration of advanced process control and remote monitoring capabilities. Technologies like machine vision are being deployed to analyze slurry feed characteristics in real-time, feeding data back into AI models that dynamically adjust flocculant dosage or operational settings. This shift towards smart separation plants ensures optimal chemical consumption and maximizes throughput stability. Furthermore, advancements in membrane technology, particularly robust ceramic and polymer membranes, are opening up opportunities for ultra-fine particle separation and high-purity water reclamation, expanding the market into niche high-value processing sectors like specialty chemicals and biotechnology.

Regional Highlights

- North America: This region is a mature yet dynamically growing market, primarily driven by stringent environmental regulations, particularly regarding PFAS removal and wastewater sludge disposal standards set by the EPA. Growth is focused on replacing aging infrastructure, upgrading municipal treatment facilities with high-efficiency dewatering technologies, and heavy investment in sustainable oil and gas production processes requiring efficient solids control. The strong presence of major technology providers and a high adoption rate of automation and digital integration define this market, with significant expenditure allocated to R&D for next-generation slurry management solutions in the mining and aggregate sectors.

- Europe: Characterized by a strong emphasis on the circular economy and resource recovery, European market growth is propelled by EU directives mandating the reduction of landfill waste and the reuse of treated sludge (biosolids) in agriculture or energy generation (biogas). Germany, the UK, and France are key contributors, focusing on innovative membrane filtration and advanced thermal drying solutions to achieve the highest possible dryness and purity levels. The market requires solutions that minimize carbon footprint and energy consumption, leading to high demand for energy-efficient decanter centrifuges and highly automated filter presses compliant with strict European standards.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by rapid industrialization, massive urban population growth, and corresponding infrastructure development in wastewater treatment in economies like China, India, and Southeast Asia. The sheer scale of mining activities (e.g., in Australia and Indonesia) and heavy manufacturing (e.g., chemical, textile, and paper industries) necessitates high-throughput, robust slurry separation systems. While price sensitivity remains a factor, the escalating environmental regulatory pressure from regional governments is increasingly shifting procurement towards high-performance and reliable equipment for pollution control and water conservation efforts.

- Latin America (LATAM): Market expansion in LATAM is overwhelmingly concentrated in the mining sector, covering copper, iron ore, and lithium extraction, particularly in countries such as Chile, Peru, and Brazil. The demand is primarily for robust equipment capable of handling large volumes of abrasive tailings and optimizing water recovery in water-scarce regions. Infrastructure limitations sometimes favor simpler, low-maintenance technologies like hydrocyclones and thickeners, although major international mining operators are adopting advanced filtration and dewatering systems to improve operational efficiency and comply with global corporate sustainability commitments.

- Middle East and Africa (MEA): Growth in MEA is highly localized, driven by large infrastructure projects, petrochemical processing, and rapidly developing municipal facilities in the GCC countries and parts of South Africa. The need for advanced separation technology is linked to treating complex industrial wastewater from oil and gas operations and coping with water scarcity, which mandates maximizing wastewater reuse. Investment is often concentrated in high-specification equipment, including large-scale clarifiers and specialized centrifuges, often procured through international partnerships and large public sector tenders focusing on long-term water security goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slurry Separator Market.- Andritz AG

- Alfa Laval AB

- FLSmidth & Co. A/S

- Weir Group PLC

- Siemens AG

- GEA Group AG

- Mitsubishi Kakoki Kaisha, Ltd.

- Evoqua Water Technologies Corp.

- Komline-Sanderson

- Russell Finex Ltd.

- Tecalemit Flow

- Schlumberger Limited

- SUEZ

- Parkson Corporation

- WesTech Engineering

- Phoenix Process Equipment

- McLanahan Corporation

- Eriez Manufacturing Co.

- Baker Hughes Company

- Hiller GmbH

Frequently Asked Questions

Analyze common user questions about the Slurry Separator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Slurry Separator Market?

Market growth is primarily driven by increasingly stringent global environmental regulations mandating cleaner industrial effluent and efficient waste management, coupled with the rapid expansion of capital-intensive industries such as mining and municipal wastewater treatment that require high-performance solid-liquid separation for operational compliance and water reuse initiatives.

Which technology segment holds the largest share in the Slurry Separator Market and why?

Centrifuges, particularly decanter centrifuges, typically hold a significant market share due to their versatility, high throughput capacity, and ability to continuously process large volumes of diverse slurries across critical applications like mining tailings dewatering and municipal sludge reduction, offering high efficiency with relatively lower footprint compared to large settling tanks.

How is Artificial Intelligence (AI) influencing the operational efficiency of slurry separation equipment?

AI is profoundly enhancing operational efficiency by enabling real-time process optimization through sensor data analysis, automatically adjusting parameters such as flow rates and chemical dosing based on input variability. Crucially, AI models facilitate predictive maintenance, minimizing unplanned downtime and reducing overall operational costs by anticipating component failure.

What are the major challenges restraining the broader adoption of advanced slurry separation systems?

Major restraints include the substantial initial capital investment required for high-efficiency separation equipment like automated filter presses or large decanter centrifuges. Additionally, the operational complexity and the need for specialized technical expertise to manage and maintain these sophisticated systems in remote industrial settings pose significant barriers to entry for smaller operators.

Why is the Asia Pacific (APAC) region expected to exhibit the fastest growth in the Slurry Separator Market?

APAC is projected to show the highest growth rate owing to massive governmental investments in infrastructure and urbanization, leading to an exponential rise in municipal wastewater treatment capacity requirements. Furthermore, rapid industrialization across sectors like chemical manufacturing and mineral processing, coupled with increasingly enforced pollution control standards, drives demand for advanced separation solutions across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager