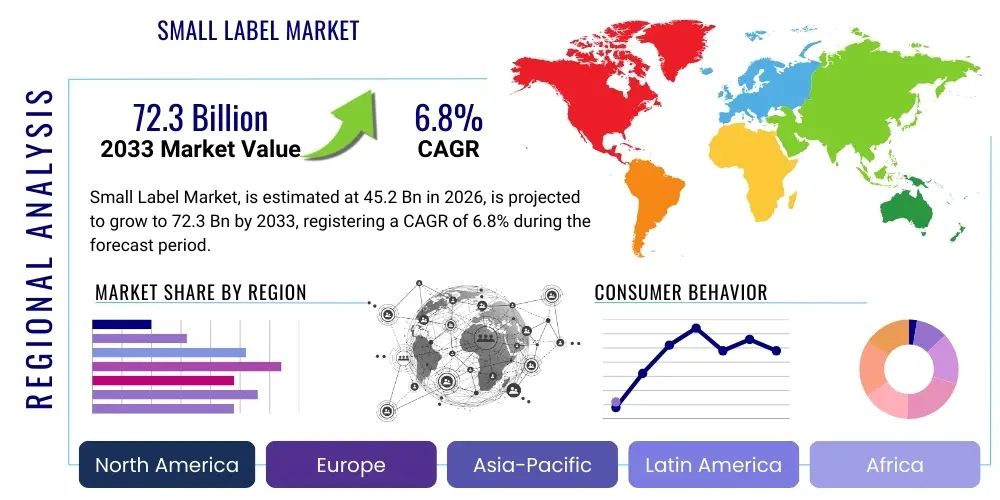

Small Label Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441738 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Small Label Market Size

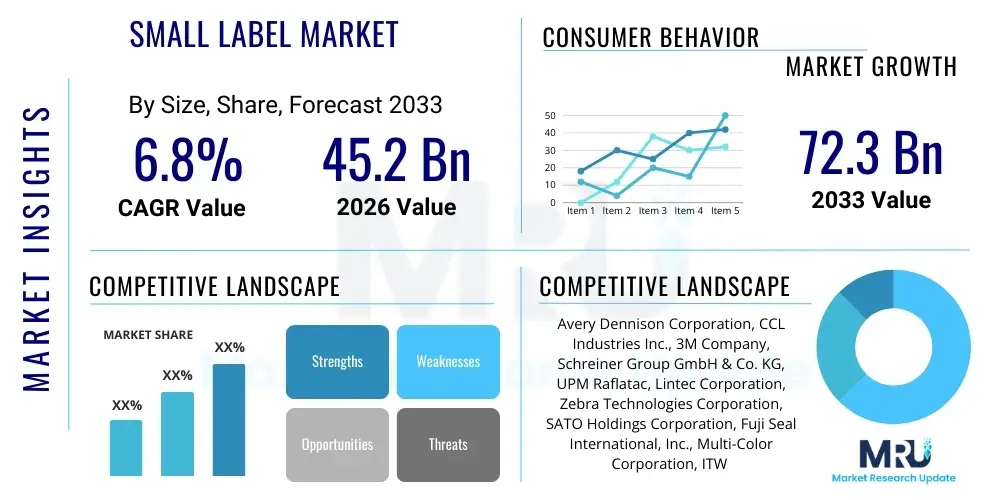

The Small Label Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 72.3 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing demand for miniaturized electronic components, the rigorous track-and-trace requirements in the pharmaceutical and healthcare sectors, and the expanding applications of IoT-enabled packaging solutions across global supply chains. The necessity for highly durable, precise, and readable identification marks on products with limited surface area drives innovation in material science and printing technology, particularly digital and flexographic processes tailored for small-format printing.

The valuation of the small label market reflects its critical role in high-value industries. Small labels are essential for products where space is severely restricted but regulatory compliance and consumer safety necessitate comprehensive information display. These labels include specialized types such as miniature barcodes, component identification tags, security seals, and dosage tracking labels. Geographically, Asia Pacific is anticipated to exhibit the fastest growth, supported by massive manufacturing outputs in electronics and automotive sectors, coupled with rapidly developing e-commerce logistics demanding intricate package labeling systems. Furthermore, the shift towards sustainable and eco-friendly label materials, even in small formats, presents both a challenge for material scientists and a significant opportunity for market expansion.

Market expansion is also intrinsically linked to advances in high-speed, high-resolution printing technologies capable of maintaining impeccable quality on substrates often smaller than a postage stamp. Investment in automated label application machinery that can handle precise placement at high speeds is accelerating the adoption rate. The demand landscape is characterized by a strong push for integration capabilities, where the label itself functions as part of a broader smart system, ensuring traceability from raw material sourcing through to the final consumer interaction. This technological convergence ensures that market size expansion is based not just on volume, but on the increased value and functionality embedded within each small label unit.

Small Label Market introduction

The Small Label Market encompasses the production and supply of adhesive and non-adhesive labels characterized by their compact dimensions, typically utilized in applications where space constraints are paramount. These labels serve critical functions including product identification, asset tracking, regulatory compliance, brand security, and intricate data presentation on small surface areas like electronic components, pharmaceutical vials, cosmetics packaging, and intricate machinery parts. Key applications span across healthcare (dosage tracking, tamper evidence), consumer electronics (serial numbers, battery information), automotive components (part traceability), and fast-moving consumer goods (FMCG) requiring shelf-space optimization. The primary driving factors for this specialized market include the globalization of supply chains demanding universal traceability standards, the persistent trend toward product miniaturization across sectors, and the evolving regulatory mandates that require substantial data to be presented legibly on minimal space, often utilizing micro-printing techniques and two-dimensional barcodes.

Small Label Market Executive Summary

The Small Label Market is positioned for robust expansion, driven by the escalating requirements for product serialization and miniaturization in high-growth industrial sectors. Business trends highlight a pronounced shift towards digital printing technologies, offering enhanced flexibility, variable data printing capabilities, and cost-effective short runs, crucial for customized small label batches. Strategic collaborations between material suppliers, printing equipment manufacturers, and end-user industries are optimizing the production process to achieve higher durability, resistance to harsh environments, and reduced material waste. Regional trends indicate that the Asia Pacific region, led by China, Japan, and South Korea, is emerging as the dominant growth engine, attributed to its massive electronic manufacturing base and increasing adoption of advanced pharmaceutical packaging standards. North America and Europe continue to hold significant market share, focusing heavily on specialized, high-security, and sustainable small label solutions.

Segment trends underscore the dominance of the pressure-sensitive segment due to its versatility and ease of application, particularly in logistics and electronics. Within the end-user spectrum, the healthcare and pharmaceutical segment shows exceptional growth potential, primarily driven by stringent track-and-trace regulations mandated globally to combat counterfeiting and ensure patient safety. Furthermore, the material segment is witnessing innovation focused on thin films and durable synthetics (such as polyimide and polyester) capable of withstanding extreme temperatures and chemical exposure typical in electronic assembly and medical sterilization processes. The prevailing market landscape is competitive, characterized by continuous technological refinement aimed at improving print quality, durability, and integration with automated dispensing systems.

AI Impact Analysis on Small Label Market

Common user questions regarding AI's impact on the Small Label Market often revolve around optimizing the design-to-print workflow, ensuring quality control in high-speed production environments, and leveraging machine learning for predictive maintenance of highly specialized printing and application equipment. Users are deeply interested in how AI can streamline variable data printing (VDP) for serialization, enhance the precision of micro-printing, and dynamically manage inventory and supply chains associated with specific label formats. The consensus expectation is that AI will primarily drive operational efficiencies, reduce material waste, and significantly improve the detection of print defects—a critical concern given the microscopic nature of data printed on these labels. There is also significant curiosity about AI-powered vision systems replacing human inspection in quality assurance, particularly in regulated environments where zero-defect rates are mandatory.

The integration of Artificial Intelligence is revolutionizing several facets of small label production and consumption, moving beyond simple automation into complex decision-making processes. In manufacturing, AI algorithms optimize ink usage, substrate tension, and drying times, leading to superior quality control and waste reduction, crucial for maximizing efficiency in high-volume, small-format runs. Furthermore, machine learning models analyze sensor data from high-resolution digital presses to predict equipment failure before it occurs, ensuring continuous uptime—a necessity when producing millions of mission-critical labels for industries like medical devices or semiconductors. This predictive capability translates directly into lower operational costs and enhanced reliability for label converters.

On the application side, AI-driven sorting and labeling systems are achieving unprecedented levels of precision and speed. For instance, in pharmaceutical packaging, AI-powered vision systems verify every single serialized code and graphic element on tiny labels instantaneously, conforming to strict global traceability standards (e.g., EU FMD, US DSCSA). This capability not only ensures regulatory compliance but also significantly elevates the security features embedded within the label. Additionally, AI assists in dynamic pricing and demand forecasting for customized label solutions, allowing suppliers to better align production schedules with erratic market demands for specialized, small-batch labels.

- AI-enabled quality inspection systems detect micro-defects at high production speeds.

- Predictive maintenance minimizes downtime on specialized digital and flexographic presses.

- Optimization of variable data printing (VDP) workflows for enhanced serialization efficiency.

- Machine learning models improve supply chain resilience for specialized label materials.

- Enhanced dynamic label design and layout optimization for maximum data density on minimal surface area.

- AI-driven automation reduces human error in high-precision label application processes.

DRO & Impact Forces Of Small Label Market

The Small Label Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive trend of miniaturization across consumer electronics and medical devices, necessitating compact, information-dense labels. Simultaneously, global regulatory pressure, particularly in pharmaceuticals (serialization and anti-counterfeiting measures), mandates the use of highly precise, small-format labels for traceability, thus acting as a powerful external impact force. However, the market faces significant restraints, chiefly the technical complexity and high initial investment required for high-resolution digital printing and precision dispensing equipment, as well as the difficulty in ensuring long-term durability and adhesion in harsh, fluctuating environments typical of logistics or industrial applications. Opportunities primarily reside in developing smart labels (RFID, NFC integrated) that maintain a small footprint, advancing sustainable and biodegradable label materials, and expanding into emerging applications such as micro-robotics and advanced diagnostics, all of which require highly specialized, compact identification markers. These forces collectively shape the competitive dynamics and future technological trajectory of the small label sector.

Segmentation Analysis

The Small Label Market is segmented based on several critical parameters, including material type, printing technology, application method, and end-user industry, reflecting the specialized requirements of this sector. The material segmentation typically includes paper, films (polypropylene, polyethylene, polyester, vinyl), and specialty substrates like polyimide, chosen based on the required durability, resistance to temperature, and chemical exposure. Technological segmentation heavily favors digital printing (inkjet and toner-based) due to its superior flexibility for variable data and short-run production, although high-volume applications still rely on advanced flexography. Application methods are divided between automatic high-speed dispensing systems and manual application, dependent on the scale and precision needed. The end-user analysis provides the deepest insight, with key demand centers residing in the Electronics, Pharmaceutical, Automotive, and Cosmetics sectors, each demanding unique adhesive and substrate properties tailored to their specific product life cycles and regulatory frameworks. This intricate segmentation allows market players to focus their R&D and manufacturing capabilities on niche, high-value small label solutions.

- By Material Type: Paper, Films (PP, PE, PET, Vinyl), Specialty Materials (Polyimide, Kapton)

- By Printing Technology: Digital Printing (Inkjet, Toner), Flexography, Screen Printing, Thermal Transfer

- By Application Method: Automatic, Semi-automatic, Manual

- By End-User Industry: Electronics & Semiconductors, Pharmaceuticals & Healthcare, Automotive, Cosmetics & Personal Care, FMCG, Industrial Manufacturing, Logistics & Transportation

- By Features: Standard Identification, Security/Anti-Counterfeiting, Track & Trace (RFID/NFC integration), Temperature Sensitive

Value Chain Analysis For Small Label Market

The Small Label Market value chain begins with raw material suppliers, who provide specialized substrates (papers, films, liners) and high-performance adhesives tailored for small surface areas, often requiring high-tack and resistance to extreme conditions. This upstream segment is characterized by complex formulations to ensure printability and durability. The critical midstream process involves label converters and printers, where advanced equipment, particularly high-resolution digital presses and precision die-cutting machinery, transforms raw materials into finished small labels. This stage demands significant technological investment to handle micro-printing and intricate cuts. Downstream, the distribution channel is highly specialized, often involving direct sales to large industrial end-users (like pharmaceutical manufacturers or electronics assemblers) who utilize automated high-speed applicators, or indirect sales through specialized industrial distributors. The efficiency of automated dispensing and application systems constitutes the final crucial link, ensuring the label is correctly placed and functional on the intended product, thereby maximizing the label's inherent value proposition. Direct distribution is favored for high-volume, highly customized, and mission-critical labels, whereas standardized small labels might move through indirect channels.

Small Label Market Potential Customers

Potential customers for specialized small labels are concentrated in sectors requiring high-density information display, meticulous asset tracking, or robust compliance verification on constrained surfaces. The largest segment of potential buyers includes multinational Pharmaceutical and Biotechnology companies who require labels for serialization on vials, syringes, blister packs, and clinical trial samples, where labels must withstand sterilization and cryogenic storage. Secondly, leading Consumer Electronics and Semiconductor manufacturers are major buyers, needing tiny, durable labels for component identification, circuit boards, batteries, and warranty seals, demanding heat resistance and fine-pitch printing capabilities. Other key customer groups include the Automotive Parts industry, utilizing small labels for part traceability and quality control within complex supply chains, and high-end Cosmetics companies requiring elegant yet compliant miniature labels for small product containers and testers. These end-users prioritize precision, material durability, and seamless integration with their automated assembly lines and supply chain management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 72.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avery Dennison Corporation, CCL Industries Inc., 3M Company, Schreiner Group GmbH & Co. KG, UPM Raflatac, Lintec Corporation, Zebra Technologies Corporation, SATO Holdings Corporation, Fuji Seal International, Inc., Multi-Color Corporation, ITW Labels, Weber Packaging Solutions, Inc., Loftware Inc., Consolidated Label Co., Coast Label Company, Hally Labels, TLF Graphics, Labeltronix, Hub Labels, Inc., Fort Dearborn Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Label Market Key Technology Landscape

The Small Label Market’s technological landscape is defined by the necessity for extreme precision, high throughput, and data variability. Digital printing, particularly UV inkjet and high-resolution toner-based systems, dominates the innovation curve, allowing for rapid changeovers, accurate color management on small areas, and seamless integration of variable data required for serialization and track-and-trace mandates. These technologies enable micro-printing capabilities essential for fitting complex information onto surfaces often measuring just a few millimeters. Concurrent advances in materials science focus on developing ultra-thin films and specialized adhesives that maintain integrity across extreme environmental fluctuations (e.g., sterilization processes or deep-freeze conditions) without peeling or degrading the printed information. Polyimide films, for instance, are crucial for small labels used in semiconductor and aerospace components due to their thermal stability.

Another pivotal area of technology is the integration of miniaturized smart features, transforming passive labels into active data carriers. This includes the incorporation of ultra-small RFID inlays (often passive HF or UHF) and Near Field Communication (NFC) chips, embedded within the label structure while maintaining the minimal footprint. This integration is paramount for high-value asset tracking and authentication in sectors like luxury goods and specialized medical devices. Furthermore, the efficiency of the value chain relies heavily on sophisticated automated dispensing and application machinery. These machines use precision robotics and advanced vision systems to ensure accurate placement of small labels at extremely high speeds, mitigating the risks associated with misaligned or wrinkled labels that could render critical information illegible.

In terms of security, covert and overt printing technologies are rapidly advancing. This includes micro-text, tamper-evident materials, holographic elements, and specialized inks (e.g., UV fluorescent inks) that can be applied within the constraints of a small label format. Continuous research is directed toward enhancing the security features without compromising the legibility of regulatory or identification data. The convergence of these printing, material, and automation technologies ensures that the small label remains a viable, compliant, and secure carrier of critical product intelligence in the evolving landscape of connected and highly regulated industries.

Regional Highlights

The Small Label Market exhibits distinct growth patterns influenced by regional manufacturing capacities, regulatory environments, and technological adoption rates.

- Asia Pacific (APAC): APAC is the epicenter of global electronic manufacturing, automotive production, and a rapidly expanding pharmaceutical industry, positioning it as the largest and fastest-growing market. Countries like China, India, and South Korea are driven by intense industrial output and increasing adoption of smart labeling solutions for export compliance and domestic track-and-trace initiatives. The demand for highly durable, heat-resistant small labels for semiconductors and components is immense.

- North America: This region is characterized by high adoption of high-security and high-functionality small labels, particularly within the advanced healthcare, aerospace, and high-tech sectors. Stringent regulations such as the Drug Supply Chain Security Act (DSCSA) drive consistent demand for serialized labels. North American players lead in material innovation, focusing on smart labels (RFID) and sustainable substrate options, emphasizing value over volume.

- Europe: Europe maintains a strong focus on environmental sustainability, driving demand for small labels made from recycled or bio-based materials, alongside compliance with regulations like the European Falsified Medicines Directive (EU FMD). The automotive industry, centered in Germany and France, requires intricate small labels for component identification throughout the vehicle lifecycle. Technological adoption is high, favoring automated application and high-quality digital printing.

- Latin America (LATAM): Growth in LATAM is stimulated by expanding consumer goods manufacturing and regional efforts to harmonize regulatory standards, increasing the need for compliant small labels across pharmaceutical and cosmetic exports. Market maturity varies widely, often presenting opportunities for imported high-end digital printing solutions.

- Middle East and Africa (MEA): This region is an emerging market, primarily driven by investments in healthcare infrastructure and rapid urbanization. Demand is growing for imported high-quality small labels, particularly for pharmaceuticals and international logistics hubs, emphasizing brand security and tamper evidence features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Label Market.- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Schreiner Group GmbH & Co. KG

- UPM Raflatac

- Lintec Corporation

- Zebra Technologies Corporation

- SATO Holdings Corporation

- Fuji Seal International, Inc.

- Multi-Color Corporation

- ITW Labels

- Weber Packaging Solutions, Inc.

- Loftware Inc.

- Consolidated Label Co.

- Coast Label Company

- Hally Labels

- TLF Graphics

- Labeltronix

- Hub Labels, Inc.

- Fort Dearborn Company

Frequently Asked Questions

Analyze common user questions about the Small Label market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industry drivers for the expansion of the Small Label Market?

The market expansion is primarily driven by the global trend toward product miniaturization, particularly in electronics and medical devices, coupled with stringent regulatory mandates requiring enhanced product serialization and track-and-trace capabilities in industries like pharmaceuticals and high-value logistics.

Which printing technology is most effective for high-volume variable data on small labels?

Digital printing technologies, specifically high-resolution UV inkjet and electrophotography (toner-based) presses, are the most effective. They offer superior precision for micro-printing and the flexibility required for rapid, cost-effective serialization and variable data integration on complex, small substrates.

How does AI impact quality control for small label manufacturing?

AI significantly enhances quality control by utilizing machine vision systems capable of detecting microscopic print defects, misregistration, and data errors on small labels at high production speeds, ensuring compliance with strict zero-defect standards required by regulated industries.

What are the key material challenges faced in the production of small labels?

Key challenges include developing adhesives with sufficient tack and durability to adhere to irregular or low-energy surfaces (plastics, metals) while resisting extreme conditions (heat, chemicals, moisture), all within the constraints of ultra-thin, manageable film or paper substrates necessary for automated application.

In which end-user sector is the demand for security features in small labels highest?

The highest demand for advanced security features, such as tamper evidence and embedded covert features (e.g., micro-text, holographic foils), is observed in the Pharmaceutical and Healthcare sector, primarily driven by global efforts to combat drug counterfeiting and ensure patient safety and supply chain integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager