Small Rotary Damper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442929 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Small Rotary Damper Market Size

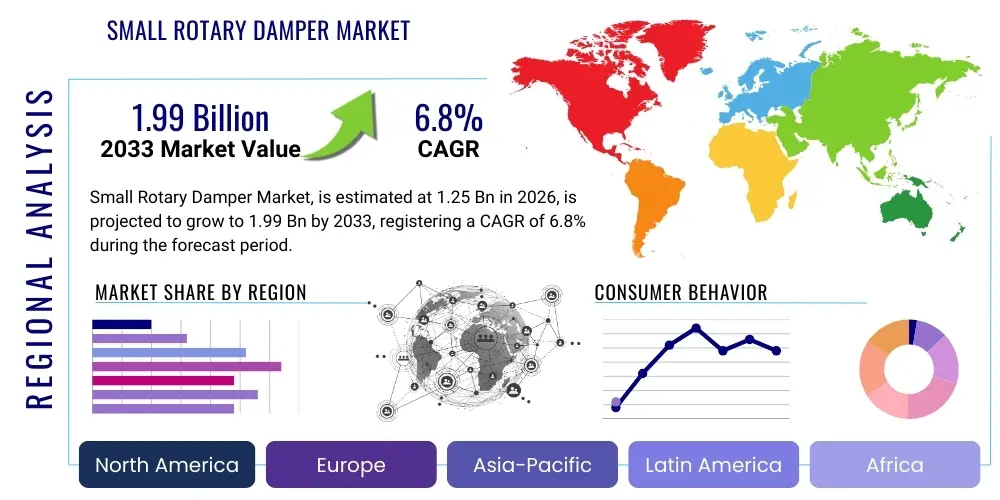

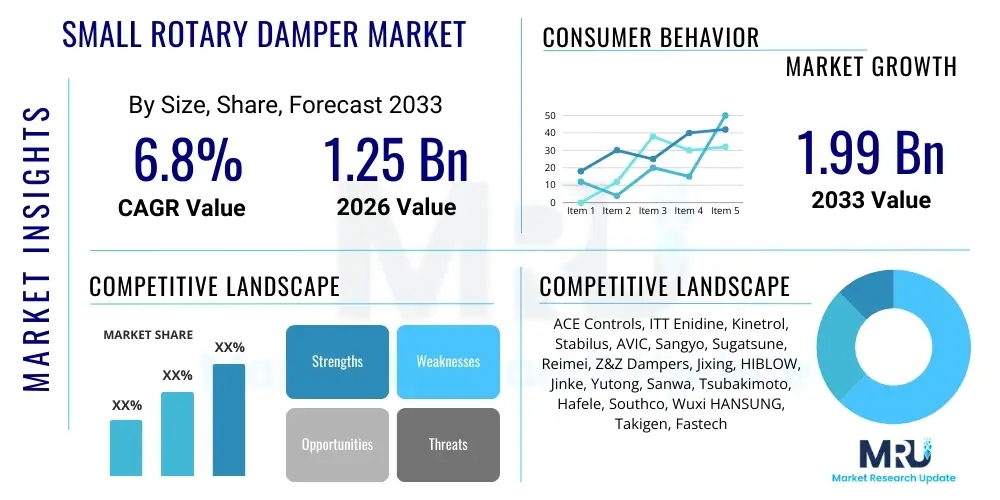

The Small Rotary Damper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Small Rotary Damper Market introduction

The Small Rotary Damper Market encompasses mechanical components designed to smoothly control the movement speed and deceleration of lightweight objects, preventing slamming, vibration, and noise pollution in various end-use applications. These precision-engineered devices utilize internal fluid mechanics, typically silicone oil (viscous fluid technology), or specific friction mechanisms (dry friction technology), to dissipate kinetic energy. The compact size and high reliability of these dampers make them indispensable in modern consumer goods and complex mechanical systems where durability and user experience are paramount. Key product types include vane dampers, barrel dampers, and gear dampers, each optimized for specific torque loads and operational environments.

Major applications of small rotary dampers span across high-volume sectors such as automotive interiors, where they ensure smooth operation of glove boxes, cup holders, and overhead compartments; consumer electronics, improving the tactile quality of laptop hinges and access panels; and home appliances, enhancing the lifespan and perceived quality of washing machine lids and oven doors. The primary benefit of integrating these components is the enhancement of product longevity and the delivery of a premium user experience characterized by controlled, silent motion. Furthermore, rotary dampers contribute significantly to safety by mitigating injury risk associated with quickly closing mechanisms.

The market growth is fundamentally driven by the escalating demand for ergonomic and sophisticated mechanical damping solutions across fast-growing industries. Increased automation in manufacturing, coupled with stricter consumer quality standards regarding noise reduction and operational smoothness, propels adoption. Specifically, the expansion of electric vehicles (EVs), which prioritize interior comfort and precision mechanics, along with the global proliferation of smart home devices featuring complex moving parts, serves as a primary driver. Manufacturers are continuously investing in advanced polymers and higher-viscosity silicone fluids to optimize performance and reduce component size, meeting the stringent space constraints of modern designs.

Small Rotary Damper Market Executive Summary

The Small Rotary Damper Market is experiencing robust expansion fueled by pervasive integration into high-growth sectors, particularly automotive and consumer electronics. Business trends indicate a strong shift towards customization, where manufacturers are offering bespoke torque profiles and materials to meet specialized needs, especially concerning extreme temperature resilience and dust sealing. Key manufacturers are focusing heavily on vertical integration and optimized supply chain management in response to fluctuating raw material costs, particularly for precision-machined plastics and specialized damping oils. Strategic alliances between damper producers and major automotive Tier 1 suppliers are shaping competitive dynamics, aiming to secure long-term, high-volume contracts. Furthermore, sustainability is becoming a minor but growing factor, pushing development towards eco-friendly materials and designs that minimize fluid leakage and maximize component lifespan.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by its unparalleled concentration of high-volume electronics manufacturing and the burgeoning automotive production hubs in China, Japan, and South Korea. North America and Europe maintain significant market shares, characterized by demand for high-precision, premium dampers used in medical devices and luxury architectural hardware, often commanding higher average selling prices (ASPs). The mature regulatory environments in these regions also necessitate dampers that meet strict compliance standards for fire resistance and material safety. Emerging economies in Latin America and MEA are showing promising growth, primarily driven by increasing urbanization and the resulting demand for better quality home appliances and furniture fittings.

Segmentation trends highlight the dominance of vane-type dampers due to their cost-effectiveness and relatively simple integration into small spaces, although gear dampers are gaining traction in applications requiring higher cyclical reliability and greater torque control precision. The market is also seeing polarization based on torque range; while low-torque applications remain the highest volume segment (e.g., spectacles cases, lightweight access panels), the medium-torque segment (e.g., washing machine lids, heavy automotive console covers) is demonstrating the fastest revenue growth due to the premiumization of durable consumer goods. Furthermore, the material segmentation reveals an increasing preference for engineered plastics over metals, driving down overall weight and manufacturing costs while maintaining adequate performance parameters.

AI Impact Analysis on Small Rotary Damper Market

Common user inquiries regarding AI’s influence on the Small Rotary Damper Market center primarily on whether AI-driven design software can optimize damper mechanisms, predict failure rates more accurately, and automate quality control during mass production. Users are keenly interested in the integration of predictive maintenance algorithms—often linked to IoT devices—that monitor motion profiles, potentially signaling the degradation of the damping fluid or internal mechanism before catastrophic failure occurs. The key themes revolve around enhanced simulation capabilities, enabling the rapid prototyping of complex viscous profiles, and the potential for AI-controlled manufacturing lines that achieve near-zero defect rates in assembly, crucial for components requiring high precision. Expectations include AI leading to lighter, more customizable, and consistently manufactured rotary dampers, potentially challenging traditional, empirical design methodologies.

- AI-Enhanced Simulation: Utilizing machine learning algorithms to simulate complex fluid dynamics (viscosity, temperature effects) within the damper, accelerating the design cycle and optimizing torque curves without extensive physical prototyping.

- Predictive Quality Control (QC): Implementing AI-powered vision systems and force sensors on production lines to detect microscopic defects or inconsistencies in damping performance in real-time, drastically reducing manufacturing variability.

- Generative Design Optimization: Using AI tools to suggest innovative damper geometries and material combinations (polymers/silicone ratios) tailored precisely to specific application constraints (size, load, cycle frequency).

- IoT Integration and Predictive Maintenance: Connecting dampers (or the host mechanisms) to IoT frameworks, using AI to analyze operational data (e.g., closing speed, ambient temperature) to predict the lifespan of the damper and schedule proactive replacement, particularly in critical industrial or medical equipment.

- Supply Chain Resilience: Employing AI to forecast demand fluctuations for specific damper types and raw materials (silicone oil, specialized plastic resins), improving inventory management and mitigating supply chain risks.

DRO & Impact Forces Of Small Rotary Damper Market

The dynamics of the Small Rotary Damper Market are shaped by a delicate balance of inherent industrial demands and technological limitations. Market Drivers (D) include the escalating global production of vehicles, especially those prioritizing high-end interior features, and the parallel boom in sophisticated consumer electronics, where controlled movement is a mark of quality. Restraints (R) primarily involve the high sensitivity of damping performance to ambient temperature variations, which necessitates expensive, high-grade damping fluids, and the constant pressure on manufacturers to reduce unit costs in highly commoditized markets like furniture hardware. Opportunities (O) lie in expanding applications within niche sectors such as robotics (for smooth joint operation) and advanced medical equipment, alongside the potential for developing self-adjusting dampers that compensate automatically for wear and environmental changes. These forces are amplified or mitigated by impact forces stemming from global economic stability, technological breakthroughs in material science, and regulatory shifts concerning product safety and environmental compliance.

The primary driver remains the pervasive global trend of consumer preference for products that exhibit high perceived quality, often directly correlated with controlled mechanical movement and silence during operation. This 'premiumization effect' compels original equipment manufacturers (OEMs) across various industries to integrate damping solutions, even in traditionally low-cost items. However, a major restraint is the highly specialized manufacturing process required to achieve consistent, leak-proof performance. Precision machining and filling with specific viscosity fluids present significant barriers to entry and necessitate stringent quality control, which adds to the final product cost, challenging mass market penetration in highly price-sensitive segments.

Significant opportunities are emerging from the shift towards miniaturization and greater functional integration. Developing micro-dampers capable of handling high loads in extremely confined spaces—such as those found in augmented reality (AR) glasses hinges or miniature medical drug delivery systems—presents a high-value niche. Furthermore, environmental regulations concerning the disposal of silicone-based damping fluids are pushing innovation toward alternative, potentially bio-degradable fluid formulations or advanced dry friction mechanisms that offer comparable performance characteristics. The combined interplay of cost pressure, performance demands, and application diversification will define the market trajectory through the forecast period.

Segmentation Analysis

The Small Rotary Damper Market is systematically segmented based on mechanism type, torque rating, raw material used in construction, and the diverse range of end-use applications. This granularity allows market participants to tailor product offerings and marketing strategies precisely to the needs of specific industries. Understanding these segments is critical for assessing market potential, identifying high-growth sectors, and navigating the competitive landscape, which is often polarized between high-volume, low-cost producers (primarily vane and barrel dampers) and specialized producers focusing on high-precision gear dampers for demanding applications like surgical equipment or high-cycle industrial automation.

- By Mechanism Type:

- Vane Dampers

- Gear Dampers

- Barrel Dampers

- Friction Dampers (Dry Mechanism)

- By Torque Range:

- Low Torque (< 1.0 Nm)

- Medium Torque (1.0 Nm – 5.0 Nm)

- High Torque (> 5.0 Nm)

- By Damping Direction:

- Bidirectional Dampers

- Unidirectional Dampers

- By End-Use Application:

- Automotive Interiors (Glove Boxes, Console Lids, Grab Handles)

- Consumer Electronics (Laptop Hinges, CD/DVD Players, Access Doors)

- Home Appliances (Washing Machine Lids, Refrigerators, Ovens)

- Furniture & Architectural Hardware (Drawers, Cabinet Doors, Toilet Seats)

- Medical Devices & Equipment (Analyzers, Patient Monitors, Trolleys)

- Industrial Equipment & Machinery

- By Material Type:

- Plastic Dampers (Engineered Polymers)

- Metal Dampers (Stainless Steel, Zinc Alloy)

Value Chain Analysis For Small Rotary Damper Market

The value chain for the Small Rotary Damper Market begins with upstream analysis centered on critical raw material suppliers, specifically providers of specialized silicone fluids (damping oil) and high-performance engineering thermoplastics such as polyoxymethylene (POM), polycarbonates (PC), and various polyamides. The consistent quality and supply stability of these materials, particularly the precise viscosity grades of silicone oil, directly dictate the final product performance and cost. Manufacturers must maintain robust relationships with these suppliers to ensure compliance with quality standards and to manage price volatility, as proprietary damping fluid formulations often offer a competitive edge in performance consistency across varying temperatures.

Midstream activities involve core manufacturing processes: high-precision injection molding for the damper housing and internal vanes/gears, micro-machining for critical components (shafts, seals), and the highly sensitive assembly and filling process. The core competency at this stage is minimizing fluid leakage and achieving precise torque calibration during assembly. Direct distribution channels are often preferred for large, strategic customers such as major automotive OEMs and Tier 1 suppliers, facilitating rigorous quality checks and customized component integration. Indirect channels, utilizing regional distributors and industrial hardware wholesalers, serve the fragmented market segments like furniture and general industrial maintenance, offering localized inventory and technical support.

Downstream analysis focuses on integration into end-user products. The primary consumers (OEMs) select dampers based on size constraints, required torque profile, durability specifications (cycle life), and cost-efficiency. Successful market players excel not just in manufacturing, but also in offering application-specific engineering support to assist OEMs in seamless product integration, ensuring the damper operates optimally within the host device. The choice of distribution channel—direct sales or specialized distributors—is highly dependent on the volume and complexity of the order, reflecting the necessity for a dual-channel strategy to effectively penetrate both the high-volume appliance market and the specialized medical equipment sector.

Small Rotary Damper Market Potential Customers

The primary consumers and end-users of small rotary dampers are diverse, spanning multiple high-volume and high-precision manufacturing sectors that demand enhanced operational quality and component longevity. Automotive manufacturers represent the largest segment, using dampers extensively throughout vehicle interiors to elevate the perceived quality of features like center consoles, storage compartments, ash trays, and sunglass holders, directly impacting customer satisfaction scores. Furthermore, the burgeoning electric vehicle market requires sophisticated damping solutions for battery access panels and charging port mechanisms.

Another significant customer base lies within the home appliance and consumer electronics industries. Manufacturers of high-end washing machines, kitchen cabinetry, toilet seats, and smart home gadgets integrate these dampers to achieve gentle closure, eliminate jarring noises, and protect internal mechanisms from impact damage. In the consumer electronics space, the demand is driven by the necessity for durable, smooth-operating hinges in premium laptops, tablets, and specialized camera equipment, where rotational control is critical to function and user experience.

Niche but high-value customer segments include the medical device and industrial automation sectors. Companies producing laboratory analysis equipment, patient monitoring systems, and specialized robotic arms require dampers that offer extremely reliable, consistent damping characteristics over extended periods, often demanding stainless steel or medical-grade polymer construction for hygiene and durability. These specialized applications often necessitate custom-engineered dampers, supporting higher profit margins for manufacturers capable of meeting strict regulatory and performance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACE Controls, ITT Enidine, Kinetrol, Stabilus, AVIC, Sangyo, Sugatsune, Reimei, Z&Z Dampers, Jixing, HIBLOW, Jinke, Yutong, Sanwa, Tsubakimoto, Hafele, Southco, Wuxi HANSUNG, Takigen, Fastech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Rotary Damper Market Key Technology Landscape

The technological landscape of the Small Rotary Damper Market is primarily characterized by advancements in fluid dynamics, material science, and precision engineering aimed at achieving consistent, long-lasting performance in ever-decreasing form factors. A core technology remains the utilization of high-viscosity silicone fluids, chosen for their relatively stable viscosity characteristics across a wide temperature range compared to conventional mineral oils. Recent innovations focus on synthesizing silicone polymers with optimized shear stability and low volatility, crucial for maintaining consistent damping force over hundreds of thousands of cycles and preventing fluid leakage (oil weepage), which is a critical failure point in cheaper dampers.

Material technology plays an equally significant role, particularly the shift towards advanced engineering thermoplastics for internal gears and housing components. High-precision injection molding techniques are essential for producing the tight tolerances required, ensuring minimal backlash and maximum torque transfer efficiency. Materials like PEEK and specialized POM grades are increasingly employed for their self-lubricating properties and excellent wear resistance, allowing for 'maintenance-free' designs. Furthermore, surface treatment technologies, such as plasma etching or specialized coatings on metal shafts, are used to reduce friction variability and improve sealing integrity, enhancing overall product lifespan and reliability.

Emerging technologies include the development of magnetorheological (MR) fluids, although currently cost-prohibitive for small, high-volume rotary dampers, they represent a future opportunity for actively controlled damping systems where the torque can be dynamically adjusted via an external magnetic field. For current passive systems, the focus is on optimizing the internal geometric design of vanes and fluid paths using advanced Computational Fluid Dynamics (CFD) modeling. This allows manufacturers to generate complex, non-linear damping curves tailored precisely to application requirements, such as slow initial movement followed by rapid deceleration, without relying solely on time-consuming empirical adjustments.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the global Small Rotary Damper Market, predominantly due to the region's status as the global manufacturing hub for automotive components, consumer electronics, and white goods. Countries such as China, Japan, South Korea, and India house vast production capacities where the integration of damping solutions is a standard procedure. The highly competitive environment drives demand for both high-volume, cost-effective dampers and high-precision units for specialized electronics. Investment in smart factory technologies and increasing domestic consumption of high-quality goods further solidify APAC’s dominance.

- North America: This region is characterized by high demand for premium, high-reliability dampers, especially in the automotive (high-end luxury vehicles), aerospace, and advanced medical equipment sectors. Strict quality and longevity standards drive the adoption of sophisticated, higher-cost gear dampers and customized solutions. Innovation is primarily focused on IoT-enabled functionality and dampers designed for extreme environmental performance (e.g., high-heat resistance, severe vibration). The presence of major Tier 1 automotive suppliers mandates a high degree of technical partnership with damper manufacturers.

- Europe: Europe maintains a strong position, particularly due to its robust automotive industry (Germany, France) and its stringent architectural hardware and furniture quality standards. Regulatory requirements, notably concerning material safety and environmental impact (REACH compliance), strongly influence product development. The European market exhibits high adoption rates for dampers in high-end office furniture, sophisticated access control systems, and machinery safety guards, prioritizing long-term durability and silent operation.

- Latin America (LATAM): The LATAM market is in an accelerated growth phase, largely driven by increasing urbanization and corresponding growth in local assembly of home appliances and automotive components (e.g., Mexico, Brazil). While price sensitivity remains a factor, the increasing quality expectations among the middle class are gradually pushing OEMs to adopt basic rotary damping solutions for improved product quality, moving the market away from purely friction-based movement controls.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) states, propelled by substantial construction and infrastructure projects. Demand is primarily focused on high-specification architectural hardware, luxury furniture, and automotive assembly plants established through foreign investment. Climate control requirements necessitate dampers engineered to maintain consistent performance in high-temperature environments, often requiring specialized internal materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Rotary Damper Market.- ACE Controls

- ITT Enidine

- Kinetrol

- Stabilus

- AVIC

- Sangyo Co., Ltd.

- Sugatsune Kogyo Co., Ltd.

- Reimei Co., Ltd.

- Z&Z Dampers

- Jixing Precision Technology Co., Ltd.

- HIBLOW

- Jinke Precision Manufacturing

- Yutong Hydraulic Components

- Sanwa Seiki Manufacturing Co., Ltd.

- Tsubakimoto Chain Co.

- Hafele GmbH & Co KG

- Southco, Inc.

- Wuxi HANSUNG Industrial Control

- Takigen Mfg. Co., Ltd.

- Fastech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Small Rotary Damper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Small Rotary Damper Market?

Market growth is primarily driven by the increasing integration of precision damping in automotive interiors and high-end consumer electronics to enhance user experience, noise reduction, and component longevity. The global push for product premiumization necessitates controlled mechanical movement.

How does temperature variability affect the performance of fluid-based small rotary dampers?

Temperature variability significantly impacts the viscosity of the internal silicone oil, causing fluctuations in the damping torque. Manufacturers counteract this by using high-grade, specialized silicone fluids designed for optimal viscosity stability across wide operating temperature ranges.

Which end-use application segment holds the largest market share for small rotary dampers?

The Automotive Interiors segment currently dominates the market share due to the high volume of components requiring smooth motion control (e.g., glove boxes, console lids) in standard and electric vehicles globally.

What is the key difference between vane dampers and gear dampers in terms of application?

Vane dampers are generally cost-effective and suitable for high-volume, basic applications requiring simple, controlled deceleration (e.g., toilet seats, small appliance lids). Gear dampers offer superior precision, higher cycle life, and more complex torque profiles, making them ideal for high-precision uses like medical devices and robotic equipment.

Where is the Small Rotary Damper Market experiencing the fastest geographic expansion?

The Asia Pacific (APAC) region, driven by the expanding manufacturing bases in China, India, and Southeast Asia, exhibits the fastest growth rates, especially within the mass production sectors of consumer electronics and home appliances.

The strategic importance of small rotary dampers transcends simple mechanical function; they are integral components of modern product quality and ergonomic design. The market's future expansion is intrinsically linked to advancements in material science and fluid dynamics, coupled with the relentless demand from OEMs for smaller, lighter, and more durable damping solutions. The competitive landscape is intensely focused on proprietary silicone formulations and highly efficient, automated manufacturing processes that can sustain high-volume production while maintaining stringent quality control standards.

Future trends indicate a move toward integrated smart systems. While current AI impact is focused on design and quality assurance, the potential for dampers with embedded sensors that communicate real-time performance data—essential for proactive maintenance in complex machinery—is a key opportunity. This integration will elevate the damper from a passive mechanical component to an active data source, particularly valuable in industrial automation and high-stakes medical applications where component failure is unacceptable. Furthermore, regulatory pressures regarding noise and vibration reduction across all major industrial sectors ensure that the functional necessity of these components will continue to drive steady market demand globally.

The market faces ongoing challenges related to cost optimization versus performance fidelity. As manufacturing scales in APAC, competitive pricing forces require constant innovation in material substitution and process efficiency without compromising the precision required for consistent damping characteristics, especially given the sensitivity of viscous fluids to minor manufacturing inconsistencies. Long-term success for manufacturers hinges on their ability to offer highly customized solutions quickly, leveraging digital tools (like AI simulation) to shorten the concept-to-production cycle and provide value-added engineering consultation to their OEM clients globally.

In summary, the Small Rotary Damper Market remains a critical niche within the broader mechanical component industry, characterized by stable growth and increasing complexity. The automotive industry's electrification trend and the continuous evolution of consumer electronics towards thinner, lighter, and more complex designs guarantee sustained innovation and investment within this specialized component sector through 2033. Strategic mergers and acquisitions aimed at securing proprietary damping fluid technology or expanding regional manufacturing footprint are anticipated to be key competitive maneuvers over the forecast horizon.

Manufacturers are also exploring advanced plastic composites, incorporating carbon fiber or glass fillers to enhance structural rigidity and thermal resistance of the damper housing while keeping the overall component weight minimal. This material shift directly supports the trends in electric vehicles and portable consumer electronics, where weight reduction is a critical performance metric. The convergence of material science innovation and high-precision fluid dynamics engineering is fundamentally reshaping the capabilities and applications of these small, yet functionally significant, mechanical components in the global marketplace.

Furthermore, the focus on sustainable manufacturing practices is subtly influencing market dynamics. Although silicone oil is highly reliable, its non-biodegradable nature poses long-term environmental concerns. Research into bio-based damping fluids or entirely mechanical friction-based systems that eliminate fluid dependency represents an embryonic but important growth opportunity, particularly as corporate environmental, social, and governance (ESG) commitments become more central to procurement decisions among large multinational OEMs in North America and Europe. This shift demands significant R&D investment but promises a strategic advantage in future compliance-driven markets.

The competitive environment is characterized by a few global leaders possessing extensive patent portfolios related to fluid formulations and sealing technologies, alongside numerous regional specialists who excel in custom, low-volume production for niche applications. Maintaining a robust intellectual property strategy surrounding the unique internal geometry of vane and gear components, which dictate the specific torque profile, is essential for securing market differentiation. Pricing pressure, particularly from Asian manufacturers, continues to challenge legacy players, forcing them to specialize in high-margin segments that require stringent quality assurance, such as aerospace or medical devices.

The requirement for higher cycle durability, often demanding reliable operation through 50,000 to 100,000 cycles without significant torque degradation, is pushing technology boundaries. This necessitates stricter quality control over internal material wear and tear, and the development of specialized lubricant coatings within the damper mechanism itself. As the market matures, standardization of performance testing protocols will become increasingly important to allow OEMs to reliably compare products from different suppliers, reducing the current high reliance on bespoke testing procedures.

In terms of distribution, the trend toward e-commerce and specialized online component platforms is impacting how smaller industrial users procure replacement or low-volume custom dampers. While high-volume orders remain tied to direct manufacturer relationships, indirect channels are gaining efficiency, offering streamlined access to technical specifications and rapid prototyping services, thereby accelerating adoption among smaller innovators and design firms.

Finally, the interplay between damper technology and the mechanisms they serve is becoming more intertwined. Instead of treating the damper as an add-on, leading OEMs are integrating the damping principle directly into the design of the hinge or moving part (e.g., integrated hinge dampers in laptop computers), requiring early collaboration between damper specialists and product designers. This early-stage involvement facilitates optimized component selection and can dramatically reduce overall assembly complexity and cost.

The market for Small Rotary Dampers is poised for continuous, incremental technical refinement rather than disruptive technological shifts. Growth will be derived primarily from increasing penetration into existing high-volume applications and successful entry into specialized, high-reliability sectors. The capability to manufacture flawlessly consistent, leak-proof dampers across varied temperature requirements remains the defining success factor in this technologically subtle yet critical industry segment.

Investment in advanced manufacturing techniques, such as micro-molding and automated vision inspection systems, is crucial for maintaining competitive edge. The tolerance requirements for the internal components—often measured in micrometers—are non-negotiable for achieving the specified damping curve. Any deviation in the geometry of the vanes or the internal surface finish can lead to inconsistent damping force, premature fluid breakdown, or eventual leakage, undermining product reliability and market reputation. Therefore, capital expenditure in high-precision machinery is a foundational requirement for all market participants aiming for the mid-to-high-tier segment.

The shift towards smaller footprints without compromising torque performance presents an engineering paradox that drives technological innovation. Miniaturization often leads to increased internal pressure and heat generation during operation. Manufacturers are addressing this through passive cooling strategies and selecting materials with superior thermal conductivity, ensuring that the damping fluid does not overheat and lose viscosity prematurely. This focus on thermal management is particularly critical in densely packed electronic devices and high-cycle applications where heat dissipation is naturally constrained.

Furthermore, regulatory changes concerning noise pollution in urban environments and workspaces implicitly boost the demand for high-quality damping solutions. Components that minimize the audible impact of closing actions (like cabinet doors or machinery guards) contribute to meeting evolving ergonomic standards, positioning small rotary dampers as essential components for compliance and superior product design. This market driver is less about cost savings and more about intrinsic value addition through silent, smooth operation.

The long-term viability of specific damper types (vane vs. gear) is constantly being evaluated by OEMs. While vane dampers offer simplicity and low cost, gear dampers, despite their higher initial cost, often provide superior longevity and torque adjustability, making them preferable for applications requiring extreme reliability (e.g., industrial robotics or aircraft interior components). The market is expected to see segment shifts based on overall total cost of ownership (TCO) assessments, where the superior durability of gear-based systems justifies the higher initial investment for certain industrial buyers.

Finally, market competition extends beyond performance and price to logistical efficiency. Global OEMs demand "just-in-time" delivery and localized support for design integration across multiple continents. Companies with extensive global warehousing and engineering support networks are better positioned to secure and retain major international contracts, requiring significant investment in global supply chain infrastructure. This requirement acts as a structural barrier to entry for smaller, localized damper manufacturers, consolidating market power among established global players with multi-regional operational capabilities.

The evolving technological and competitive environment underscores the specialized nature of the Small Rotary Damper Market. Success requires continuous investment in materials science, precision manufacturing, and strategic market positioning, ensuring that components meet the ever-increasing demands for reliability, compact size, and environmental resilience across diverse global applications.

The complexity associated with customizing damping characteristics, such as creating a non-linear damping profile—where resistance changes significantly through the rotational angle—is a crucial area of differentiation. Achieving this non-linearity requires proprietary internal channel designs and meticulous calibration of the damping fluid volume and air gap, processes that rely heavily on specialized engineering know-how. This level of customization allows manufacturers to solve highly specific kinematic problems for OEMs, forging stronger, enduring partnerships and moving away from commoditized product offerings.

In the medical device sector, the requirements for material inertness and sterilization capability add another layer of complexity. Dampers used in equipment that undergoes chemical cleaning or high-temperature sterilization processes must utilize medical-grade plastics and non-reactive silicone fluids. This niche demands rigorous documentation and compliance with regulatory bodies like the FDA, making it a high-barrier, high-margin market segment that only specialized manufacturers can reliably serve, further segmenting the market based on regulatory readiness.

Furthermore, digital tools are changing the procurement process. Prospective customers now frequently require detailed digital twins or CAD models of dampers, including simulated performance data, before making purchase decisions. Manufacturers that provide comprehensive online technical libraries, interactive selection guides, and rapid response engineering consultation gain a competitive advantage by simplifying the integration process for OEM design teams, thus accelerating time-to-market for the end-user product.

The market faces constant pressure from alternative motion control technologies, such as gas springs and friction hinges, particularly in medium-load applications. However, rotary dampers maintain an advantage in their ability to provide smooth, silent, and highly controlled deceleration in a small rotational footprint, often impossible to achieve with competing linear or friction-based solutions. The continuous improvement in size-to-torque ratio ensures rotary dampers remain the preferred choice for compact mechanisms requiring premium motion quality.

The long-term forecast suggests an increasing dichotomy in the market: on one side, highly commoditized, mass-produced dampers for home goods focusing purely on minimum viable cost; and on the other, highly specialized, customized dampers for robotics and medical systems focusing purely on maximum performance and guaranteed reliability. Manufacturers must clearly define their strategic focus to succeed in this bifurcated market structure, either through extreme cost efficiency or unparalleled technical specialization.

The necessity for continuous process innovation, particularly in sealing technology to guarantee zero leakage over the expected lifetime of the product, cannot be overstated. Leaks not only result in eventual damper failure but can also contaminate the surrounding mechanism, leading to expensive product recalls, especially in sterile or electronic environments. The development of advanced elastomer seals and ultrasonic welding techniques for housing components is thus a major technological focus area for leading market players seeking to guarantee product integrity.

Finally, while the core technology remains based on viscous fluid dissipation, the integration of magnetic braking concepts (using eddy currents in conjunction with fluid damping) is a nascent area of research. Should these combined technologies become cost-effective for small dampers, they could offer unparalleled control and adjustment capabilities, potentially revolutionizing the performance ceiling for high-end applications within the forecast period.

This report highlights that the Small Rotary Damper Market, while seemingly mature, is undergoing constant, subtle evolution driven by material science, stringent quality demands, and the pervasive need for enhanced ergonomic and operational smoothness in consumer and industrial products worldwide. Navigating this market requires a sophisticated understanding of both macro-economic trends and micro-level engineering specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager