Smart Connected Cooking Appliances Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442804 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Smart Connected Cooking Appliances Market Size

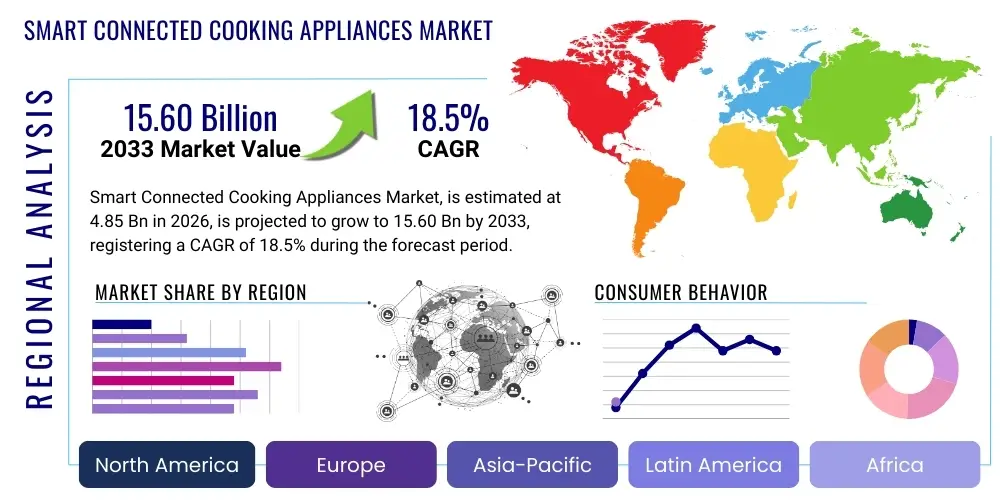

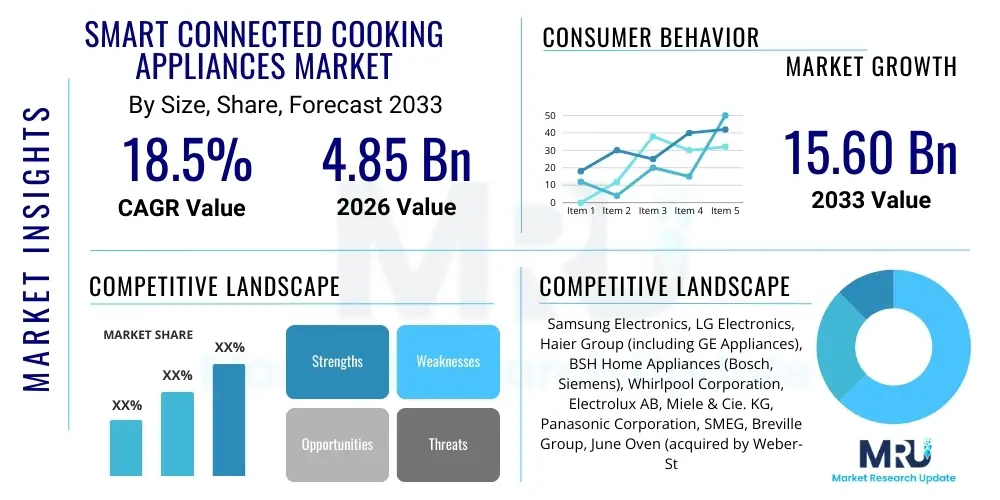

The Smart Connected Cooking Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 15.60 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated adoption of smart home ecosystems globally, coupled with consumers' increasing desire for kitchen automation, enhanced convenience, and energy-efficient solutions. The convergence of high-speed internet connectivity (5G, advanced Wi-Fi standards) and sophisticated sensor technology is enabling manufacturers to introduce appliances that offer truly interactive and personalized cooking experiences, moving beyond simple remote control functionality to predictive and adaptive capabilities.

Market growth is further supported by significant technological advancements in Internet of Things (IoT) integration within household appliances. Modern connected cooking devices, including ovens, cooktops, and specialized counter-top appliances, are now capable of syncing with nutritional tracking applications, voice assistants, and digital recipe databases. This integration facilitates guided cooking processes, automatically adjusting temperature and time settings based on real-time feedback from internal sensors and pre-programmed algorithms. As regulatory bodies continue to emphasize sustainability and energy conservation, smart appliances offering optimized energy usage and reduced food waste present a compelling value proposition, ensuring sustained market trajectory throughout the forecast period.

Smart Connected Cooking Appliances Market introduction

The Smart Connected Cooking Appliances Market encompasses a diverse range of kitchen devices that incorporate advanced connectivity features, primarily utilizing Wi-Fi, Bluetooth, or proprietary mesh networks, to communicate with users, other smart devices, and cloud-based services. These products include smart ovens, induction cooktops, connected microwave ovens, and specialized devices such as smart sous vide machines and pressure cookers. These appliances are fundamentally designed to enhance user convenience, optimize cooking precision, and improve overall kitchen safety and efficiency. Major applications span residential kitchens, light commercial settings (e.g., small cafes requiring precise control), and integrated smart apartment complexes. Key benefits include remote monitoring and control, automated recipe execution, proactive maintenance alerts, integration with energy management systems, and personalized dietary tracking. The market is primarily driven by the increasing global penetration of smart homes, falling costs of IoT sensors and modules, rising consumer disposable incomes in developing economies, and a growing emphasis on health-conscious meal preparation facilitated by technology.

The core technology underpinning these appliances revolves around embedded microprocessors, wireless communication modules, and sophisticated sensor arrays (temperature, humidity, weight). This allows for complex functionalities such as multi-stage cooking programs, self-diagnosis of technical issues, and over-the-air firmware updates that enhance features post-purchase. The transition from basic internet-enabled features to true predictive intelligence—where the appliance learns user preferences and anticipates needs—marks the current evolutionary phase of this market. Furthermore, compatibility standards are maturing, allowing seamless interoperability between different brands of kitchen appliances and wider smart home ecosystems, substantially increasing the perceived utility and driving consumer adoption.

In terms of product description, modern smart connected cooking appliances distinguish themselves through their interactive interfaces, often featuring high-resolution touchscreens that guide the user through complex recipes step-by-step. These systems frequently utilize cloud computing resources for real-time data processing, recipe adjustments, and nutritional calculations. The security aspect, protecting user data and preventing unauthorized access to home networks, is also a paramount design consideration. The market is seeing a particular surge in appliances offering specialized cooking modes (e.g., air frying, steam cooking) combined with connectivity, appealing to a broad demographic interested in healthier cooking methods without sacrificing convenience or flavor.

Smart Connected Cooking Appliances Market Executive Summary

The Smart Connected Cooking Appliances Market is experiencing robust growth fueled by converging trends in digitalization and lifestyle modernization. Business trends indicate a strong move towards subscription-based services accompanying physical appliance sales, offering premium content like exclusive recipes, professional chef consultations, and optimized cooking programs, thereby creating recurring revenue streams for manufacturers. Strategic partnerships between appliance makers and software developers, as well as food delivery services, are becoming commonplace, integrating the entire food lifecycle from planning and shopping to preparation and consumption. Furthermore, companies are prioritizing modular design and sustainability, responding to growing consumer demand for environmentally responsible products and ease of maintenance, thus fostering brand loyalty and justifying premium pricing strategies in the high-end segment.

Regionally, North America and Europe currently dominate the market share, attributed to high levels of smart home penetration, established high-speed internet infrastructure, and high consumer awareness regarding smart technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This acceleration is driven by rapid urbanization, increasing disposable incomes, and the massive scale of housing development in countries like China and India, where connected technology is often integrated into new residential construction from the outset. Regulatory support for energy-efficient appliances also plays a crucial role in shaping regional market dynamics, incentivizing manufacturers to launch compliant and technologically advanced models.

Segment trends reveal that the smart ovens segment, including built-in and freestanding models, holds the largest market share due to their high utility and central role in the kitchen. Conversely, specialized counter-top smart appliances, such as induction cookers and multi-function cooking robots, are expected to exhibit the fastest growth rate, propelled by their compact footprint, versatility, and appeal to smaller households and apartment dwellers. Connectivity technology segmentation highlights the dominance of Wi-Fi enabled devices, although Bluetooth remains significant for localized control and pairing with auxiliary sensors. The residential end-user segment remains the primary revenue source, while the commercial application segment is gaining traction, particularly in fast-casual dining and institutional food services seeking standardized cooking precision.

AI Impact Analysis on Smart Connected Cooking Appliances Market

Common user questions regarding AI's influence in the Smart Connected Cooking Appliances market revolve heavily around customization, safety, and proactive interaction. Users frequently ask: "How accurately can AI adjust cooking times based on the food quality or weight?" "Will AI detect potential fire hazards or overheating before they become critical?" and "Can the appliance truly learn my family’s favorite meals and suggest recipes autonomously?" This analysis reveals a consensus that AI is expected to move connected cooking beyond mere remote control to true cognitive assistance, focusing on adaptive cooking algorithms, predictive maintenance, and personalized nutritional guidance. Key themes users prioritize include ensuring that AI-driven features reduce human effort and error, enhance food safety, and deliver perfectly consistent results every time, justifying the higher investment cost associated with these intelligent systems.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the functionality of smart connected cooking appliances, shifting their role from tools to intelligent partners. AI algorithms are deployed to analyze sensor data in real-time—including internal temperature gradients, moisture levels, and even volatile organic compounds (VOCs) released during cooking—to make instantaneous adjustments to power settings and cooking cycles. This level of granular control ensures optimal food quality, texture, and nutritional retention, effectively minimizing the risk of overcooking or undercooking. Furthermore, AI enables predictive maintenance scheduling by monitoring component wear and tear, alerting users or service providers before a critical failure occurs, significantly extending the appliance lifespan and improving customer satisfaction.

Beyond technical optimization, AI enhances the user experience through sophisticated personalization and recommendation engines. By analyzing user cooking history, dietary constraints, preferred ingredients, and even time of day, ML models can curate personalized recipe suggestions, automate grocery list generation, and seamlessly integrate cooking instructions with smart home assistants. This cognitive layer simplifies meal preparation, making healthy eating more accessible and reducing 'cooking fatigue'. As natural language processing (NLP) improves, user interaction with these appliances via voice commands becomes more intuitive and contextual, further embedding these smart devices into the fabric of the modern, automated home environment.

- Adaptive Cooking Algorithms: Real-time adjustment of power and time based on internal food condition and external environment factors.

- Predictive Maintenance: Monitoring component health (e.g., heating elements, fans) to preemptively schedule repairs, reducing downtime.

- Personalized Recipe Generation: Utilizing Machine Learning to suggest meals based on historical data, available ingredients, and dietary restrictions.

- Enhanced Safety Features: AI-driven anomaly detection to identify potential hazards (smoke, excessive heat) and initiate automated shut-off sequences.

- Optimized Energy Consumption: ML models learning peak demand hours and adjusting preheating cycles to reduce overall energy load without compromising cooking time.

- Voice Command Integration: Advanced Natural Language Processing (NLP) enabling complex, contextual control through smart home ecosystems.

- Nutritional Tracking Synchronization: Automatic logging of preparation methods and estimated nutritional values directly into health and wellness applications.

DRO & Impact Forces Of Smart Connected Cooking Appliances Market

The Smart Connected Cooking Appliances Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant Impact Forces on market evolution. Primary drivers include the massive global surge in smart home adoption, where cooking appliances form a critical hub for household activity, alongside consumers' increasing prioritization of convenience and precision in meal preparation. Furthermore, advancements in IoT technology and the reduced cost of connectivity modules are making these sophisticated appliances economically viable for broader segments of the population. Restraints, however, pose challenges; these include heightened concerns regarding data privacy and cybersecurity associated with internet-enabled devices, the relatively high initial capital expenditure compared to traditional appliances, and the complexity of user interfaces which can deter non-tech-savvy consumers. Opportunities lie primarily in the integration of AI-driven personalized services, expansion into untapped emerging markets, and the development of energy-harvesting or highly sustainable models that appeal to eco-conscious consumers.

The impact forces stemming from these DRO elements are reshaping competitive strategies. Technological acceleration acts as a powerful pull force, compelling manufacturers to rapidly innovate and standardize communication protocols to ensure interoperability within diverse smart home ecosystems. Conversely, regulatory friction, particularly around consumer data protection (e.g., GDPR in Europe), acts as a significant restraint, demanding substantial investment in secure firmware and transparent data handling policies. Market penetration is also heavily influenced by the availability and stability of high-speed internet infrastructure; regions with robust 5G rollouts demonstrate quicker adoption rates due to the enhanced reliability and speed required for complex, cloud-dependent cooking features. The overall market momentum favors integration, specialization, and value-added services over standalone product features.

Key drivers also include evolving consumer lifestyles, characterized by time scarcity and a willingness to invest in technologies that simplify daily chores. The trend towards home cooking, spurred partly by global health consciousness and sustained remote work practices, has amplified the demand for appliances that offer professional-grade results with minimal effort. However, market adoption faces resistance from the replacement cycle characteristic of major kitchen appliances, which is typically long (8-15 years). Overcoming this inertia requires offering compelling feature sets and demonstrable long-term cost savings (e.g., energy efficiency) to motivate consumers to replace existing, functional non-connected devices prematurely. The perceived vulnerability of connected devices to hacking remains a critical barrier requiring continuous mitigation through rigorous security updates and certifications.

Segmentation Analysis

The Smart Connected Cooking Appliances Market is intricately segmented across various dimensions including product type, connectivity technology, application, and distribution channel, providing a granular view of market dynamics and targeted opportunities. Understanding these segments is crucial for strategic planning, allowing manufacturers to tailor their R&D efforts and marketing strategies to specific consumer needs. The diverse product offerings, ranging from high-capacity built-in ovens suitable for large families to compact, smart induction cooktops optimized for urban apartments, underscore the fragmented yet highly specialized nature of this market. Connectivity remains the backbone, with Wi-Fi dominating for long-range control and cloud communication, while Bluetooth serves localized, device-to-device interaction or integration with specialized smart accessories like thermometers.

In terms of application, the residential segment accounts for the overwhelming majority of revenue, driven by broad consumer desire for kitchen automation and lifestyle upgrades. However, the commercial segment, though smaller, is showing exponential growth, particularly within quick-service restaurants, test kitchens, and corporate cafeterias that leverage smart appliances for consistency, reduced labor costs, and real-time monitoring of food preparation processes to comply with stringent health regulations. Distribution channels are undergoing transformation, moving from reliance on traditional brick-and-mortar stores toward robust e-commerce platforms, which offer consumers greater choice, comprehensive product information, and streamlined home delivery and installation services for these high-value items.

Further analysis of the product type segmentation reveals a clear differentiation between core cooking appliances (ovens, cooktops) which represent foundational investments, and supplementary smart appliances (pressure cookers, toasters, specialty fryers) which offer enhanced convenience and are often purchased later as add-ons to the smart kitchen ecosystem. Price point sensitivity varies dramatically across these segments; while high-end smart ovens target affluent early adopters, mass-market adoption is being driven by affordable, smart counter-top devices. The evolution of connectivity standards, particularly the move towards Thread and Matter protocols, is expected to further influence segment performance by simplifying the setup and interoperability challenges currently faced by end-users.

- Product Type:

- Smart Ovens (Built-in and Freestanding)

- Smart Cooktops (Induction, Electric, Gas)

- Smart Microwave Ovens

- Smart Specialty Appliances (e.g., Sous Vide Devices, Pressure Cookers, Air Fryers, Toasters)

- Connectivity Technology:

- Wi-Fi

- Bluetooth

- NFC/RFID

- Application:

- Residential

- Commercial (QSRs, Institutional, Professional Kitchens)

- Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Stores, Department Stores, Direct Sales)

Value Chain Analysis For Smart Connected Cooking Appliances Market

The value chain for the Smart Connected Cooking Appliances Market begins with upstream activities centered on raw material procurement and component manufacturing. This includes the acquisition of essential materials such as stainless steel and specialized glass for durability and aesthetics, alongside the critical sourcing of advanced electronic components. Key electronic inputs involve microcontrollers, specialized temperature and humidity sensors, power management integrated circuits (ICs), and crucially, Wi-Fi/Bluetooth modules and sophisticated touch panel displays. The performance and cost efficiency of the final appliance are heavily dependent on the quality and miniaturization achieved in the upstream semiconductor and sensor supply chain. Suppliers in this phase are often globally specialized firms offering high volumes of standardized components, emphasizing rigorous quality control and stable pricing to maintain profitability margins for appliance manufacturers.

Moving through the value chain, the manufacturing and assembly phase involves complex integration of mechanical and electrical systems, requiring advanced robotics and precise assembly lines to ensure durability and aesthetic quality. This phase also includes rigorous testing, particularly for safety certifications and wireless connectivity performance. The midstream involves core appliance manufacturers who invest heavily in R&D to develop proprietary AI/ML algorithms, user interfaces, and cloud infrastructure required to support connected functionality. This R&D component is the primary source of competitive differentiation in the market. Distribution channels then move the finished goods to the end consumer, utilizing a mix of direct and indirect sales strategies.

The downstream activities focus on distribution, sales, installation, and after-sales service. Distribution relies significantly on indirect channels, primarily through large electronics retailers, specialized kitchen showrooms, and big-box department stores, which offer display space and hands-on demonstrations essential for high-ticket appliances. However, the importance of direct-to-consumer (D2C) sales via e-commerce is rapidly increasing, offering manufacturers better control over branding and customer data. Post-sales service is critical for connected devices, encompassing firmware updates, remote diagnostics, and technical support related to connectivity and smart features. The value generated downstream is enhanced through high-margin subscription services for personalized content or predictive maintenance, cementing the manufacturer's long-term relationship with the customer.

Smart Connected Cooking Appliances Market Potential Customers

Potential customers for the Smart Connected Cooking Appliances Market span a broad demographic but are primarily concentrated in segments prioritizing technological integration, convenience, and culinary precision, reflecting the high value proposition of these products. The core end-users are modern homeowners and apartment dwellers residing in urban and suburban areas with high disposable incomes, robust internet connectivity, and a strong affinity for smart home technologies. These individuals, often early adopters, seek appliances that integrate seamlessly with existing voice assistants and home automation platforms, viewing the connected kitchen as a cornerstone of their digital lifestyle. They typically value features that save time, such as automated multi-step cooking and remote monitoring, allowing them to manage cooking tasks while multitasking.

A secondary, rapidly growing segment consists of health-conscious consumers and culinary enthusiasts. Health-focused buyers utilize connected appliances to maintain precise control over cooking methods (e.g., exact temperature for sous vide or oil-free air frying) and to sync preparation data directly with nutritional tracking applications, supporting specific dietary regimens. Culinary enthusiasts, on the other hand, are drawn to the professional-grade precision and guided cooking features that enable them to replicate complex recipes successfully. This group is less deterred by the high initial cost, viewing the appliance as an investment in improving their skill and consistency.

Furthermore, the commercial segment represents significant potential, specifically in institutional kitchens (hospitals, schools) and franchise food service operations. These buyers are motivated by the need for standardization, traceability, and operational efficiency. Smart connected ovens and cooktops allow these operations to ensure every prepared item meets exact specifications, reducing waste and maintaining brand consistency across multiple locations. The ability for a central management team to monitor and update appliance settings remotely across a network of locations offers substantial operational advantages, making the commercial sector a high-growth area for specialized, high-durability connected appliances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 15.60 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Electronics, Haier Group (including GE Appliances), BSH Home Appliances (Bosch, Siemens), Whirlpool Corporation, Electrolux AB, Miele & Cie. KG, Panasonic Corporation, SMEG, Breville Group, June Oven (acquired by Weber-Stephen Products), Tovala, Middleby Corporation, Xiaomi Corporation, Gorenje Group, Kenmore, Sub-Zero Group, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Connected Cooking Appliances Market Key Technology Landscape

The technological landscape of the Smart Connected Cooking Appliances Market is defined by the synergistic integration of Internet of Things (IoT) platforms, advanced sensor technology, and high-performance wireless communication protocols. The foundation relies on high-fidelity temperature and humidity sensors coupled with infrared or thermal imaging sensors to monitor food conditions non-invasively, providing the necessary data input for adaptive cooking algorithms. Communication standards like Wi-Fi 6 (802.11ax) ensure robust, high-bandwidth connections essential for transferring large amounts of data, streaming instructional videos, and enabling seamless integration with cloud services for recipe storage and firmware updates. Furthermore, the adoption of new standardized protocols like Matter (developed by the Connectivity Standards Alliance) is critical, as it aims to eliminate compatibility barriers between different manufacturers’ products, enhancing the user experience and driving ecosystem expansion.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the differentiating factor in modern connected appliances. Manufacturers utilize deep learning models hosted in the cloud or increasingly on edge devices within the appliance itself to facilitate complex functions such as food recognition, automatic calibration based on elevation or ambient temperature, and predictive fault detection. Voice control technology, powered by sophisticated Natural Language Processing (NLP) engines integrated with platforms like Amazon Alexa or Google Assistant, allows users to initiate cooking cycles, check status, and modify settings hands-free. This shift toward intuitive, cognitive functionality is moving the market away from simple remote on/off switches toward genuine cooking assistance and autonomy.

Energy efficiency technologies are also central to the landscape, particularly focusing on optimized heating elements (e.g., highly efficient induction coils) and advanced insulation techniques, all managed by smart energy management software. This software uses connectivity to learn local energy pricing and adjust high-power operations (like preheating) to off-peak times, reducing utility costs for the consumer. Finally, the rise of modular connectivity solutions and Software-as-a-Service (SaaS) models enables manufacturers to deploy feature upgrades and security patches over-the-air, ensuring the appliances remain current and functional throughout their extended lifecycle, thus protecting the consumer’s initial investment and maintaining high security standards against emerging threats.

Regional Highlights

- North America: This region maintains the largest market share, characterized by high consumer readiness for technology adoption, established smart home infrastructure, and significant market presence of major global players. The United States and Canada lead in terms of revenue, primarily driven by high average disposable incomes and a strong focus on kitchen renovations incorporating high-end smart appliances. The market here emphasizes robust integration with dominant smart ecosystems (e.g., Apple HomeKit, Google Home) and a demand for appliances offering maximum convenience and sophisticated multi-functionality. High-speed internet penetration facilitates the heavy reliance on cloud-based recipe libraries and AI services.

- Europe: The European market is mature but highly diversified, driven by stringent energy efficiency regulations and a strong cultural appreciation for precise culinary tools. Countries like Germany, the UK, and France are key contributors. Market growth is stimulated by regulatory mandates favoring energy-efficient appliances, compelling manufacturers to launch advanced connected models that comply with strict sustainability standards. Consumers here prioritize durability, design aesthetics (especially integration into minimalist kitchen designs), and data privacy, driving demand for appliances with certified data security protocols.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive residential construction projects, and the expanding middle class in populous nations such as China, India, and South Korea. Government initiatives promoting digitalization and the increasing penetration of affordable smart devices are accelerating adoption. The market trend in APAC often favors compact, smart counter-top appliances due to space constraints in urban living, and a strong preference for mobile-centric control interfaces over traditional physical controls. Localization of recipe content and language support is a critical factor for success.

- Latin America (LATAM): The LATAM market is emerging, demonstrating steady growth driven by improving internet infrastructure and increasing consumer awareness of smart technology benefits. Brazil and Mexico are the largest markets in this region. Adoption is currently focused on convenience and basic remote control functionalities, with high initial cost sensitivity. Future growth is dependent on economic stability and expanded accessibility to affordable smart home packages, often bundled with internet and utility services.

- Middle East and Africa (MEA): This region shows potential, particularly in the affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high disposable incomes support the purchase of luxury, high-end connected appliances. Infrastructure development for smart cities and luxury residential projects is a key driver. In contrast, the African segment is nascent, with limited penetration, though mobile connectivity growth suggests future potential for simpler, connected devices focused on efficiency and resource management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Connected Cooking Appliances Market.- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Haier Group Corporation (including GE Appliances)

- BSH Home Appliances Group (Bosch and Siemens)

- Whirlpool Corporation

- Electrolux AB

- Miele & Cie. KG

- Panasonic Corporation

- Teka Group

- Sub-Zero Group, Inc. (Wolf)

- Breville Group Limited

- Gorenje Group (owned by Hisense)

- June Oven (acquired by Weber-Stephen Products LLC)

- Tovala

- Middleby Corporation (Commercial focus)

- Kenmore (Transformco)

- Xiaomi Corporation (focus on smart ecosystem integration)

- Fisher & Paykel Appliances (part of Haier Group)

Frequently Asked Questions

Analyze common user questions about the Smart Connected Cooking Appliances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of investing in a smart connected cooking appliance?

The primary benefits include enhanced convenience through remote monitoring and control, improved cooking precision via automated recipe execution and sensor-driven adjustments, and increased energy efficiency through optimized power management. These appliances also offer proactive diagnostics and integration with broader smart home ecosystems for seamless user interaction.

How do smart cooking appliances ensure data privacy and cybersecurity?

Manufacturers utilize robust encryption protocols (e.g., TLS/SSL) for all cloud communication, implement secure authentication methods (OAuth 2.0), and adhere to regional data privacy regulations (like GDPR). Regular over-the-air firmware updates are crucial for patching vulnerabilities and maintaining high security standards against evolving cyber threats.

What is the difference between an IoT-enabled appliance and an AI-driven smart appliance?

An IoT-enabled appliance typically offers basic connectivity features like remote monitoring and simple control via an app. An AI-driven smart appliance goes further, incorporating Machine Learning algorithms to analyze historical user data, recognize food types, adapt cooking cycles autonomously in real-time based on internal feedback, and provide personalized recipe recommendations and predictive maintenance alerts.

Which segment—residential or commercial—is growing faster in the connected cooking appliances market?

While the residential segment holds the largest current market share, the commercial segment is projected to exhibit a higher growth rate. This acceleration is driven by the commercial need for enhanced operational consistency, centralized remote management of cooking processes, reduced labor dependencies, and strict regulatory compliance achieved through automated monitoring.

Are smart connected cooking appliances compatible with all major smart home platforms, and what connectivity protocols are dominant?

Most leading smart appliances are designed for interoperability with major platforms like Google Home, Amazon Alexa, and increasingly, Apple HomeKit. Wi-Fi remains the dominant connectivity protocol for cloud-based control. However, emerging standards like Matter are critical for simplifying cross-brand device setup and ensuring future-proof, localized connectivity within the home environment.

What is the forecasted CAGR for the Smart Connected Cooking Appliances Market between 2026 and 2033?

The Smart Connected Cooking Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% over the forecast period from 2026 to 2033, reflecting accelerated adoption driven by smart home proliferation and technological innovation.

How do smart appliances contribute to sustainability and reducing food waste?

Smart appliances contribute to sustainability by optimizing energy usage through smart scheduling and precise control. They reduce food waste by ensuring optimal cooking results, minimizing errors, and connecting with inventory management systems to suggest recipes based on ingredients nearing expiration, thereby enhancing household resource management.

What role does 5G technology play in the adoption of advanced connected cooking appliances?

5G technology provides the necessary low latency and high bandwidth required for seamless, real-time data exchange between the appliance, the cloud-based AI processing units, and the user's mobile devices. This superior connectivity ensures reliable execution of complex, sensor-driven cooking commands and rapid firmware updates, essential for premium features.

Which geographic region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is anticipated to exhibit the highest CAGR due to rapid economic development, increasing penetration of affordable smart technology, vast urbanization, and large-scale government and private sector investments in smart city infrastructure and residential digitalization projects.

What are the main segments within the Product Type categorization of the market?

The key product type segments include Smart Ovens (built-in and freestanding, holding the largest share), Smart Cooktops (induction and electric), Smart Microwave Ovens, and Smart Specialty Appliances (such as air fryers, sous vide devices, and multi-function pressure cookers).

What is the biggest restraint impacting widespread adoption of connected cooking appliances?

The most significant restraint is the high initial capital expenditure compared to traditional appliances. Consumers often face a long replacement cycle for major kitchen items, requiring a substantial value proposition—such as significant energy savings or drastically improved convenience—to justify the premium price point and early replacement of existing, functional appliances.

How do manufacturers create recurring revenue streams from smart cooking appliances?

Manufacturers are increasingly implementing subscription-based service models. These services typically include access to premium content, such as exclusive or certified chef recipes, personalized nutritional coaching, advanced remote diagnostics, and predictive maintenance contracts, ensuring a continuous revenue flow post-purchase.

What is 'Guided Cooking' and how is it facilitated by smart technology?

'Guided Cooking' is a feature where the appliance, often displaying instructions on a high-resolution screen, walks the user through a recipe step-by-step, automatically adjusting the heat, temperature, and timing settings based on the recipe stage. This is facilitated by connectivity to cloud recipe libraries and integrated precision sensors.

In the value chain, where is the most significant source of competitive differentiation located?

The most significant source of competitive differentiation lies in the midstream R&D and manufacturing phases, specifically in the development of proprietary, high-fidelity sensor technology, sophisticated AI/ML algorithms for adaptive cooking, and the creation of seamless, secure user interfaces and robust cloud infrastructures.

Beyond Wi-Fi, which other technology is crucial for localized connectivity in the market?

Bluetooth technology remains crucial for localized connectivity, particularly for direct device-to-device communication (e.g., connecting a smart thermometer probe directly to the oven) and for initial device setup and pairing with nearby auxiliary smart kitchen tools.

How are changing consumer lifestyles driving the demand for smart ovens?

Changing lifestyles, characterized by increased time constraints and greater interest in healthy eating, drive demand for smart ovens because they offer automation, remote management capabilities, and precision cooking methods (like steam or air frying), allowing consumers to prepare complex, healthy meals with minimal hands-on effort and maximized time efficiency.

What is the estimated market size of the Smart Connected Cooking Appliances Market in 2033?

The Smart Connected Cooking Appliances Market is projected to reach an estimated value of USD 15.60 Billion by the end of the forecast period in 2033, showcasing substantial expansion from the base year.

How are distribution channels evolving for these appliances?

Distribution channels are shifting significantly from reliance on traditional brick-and-mortar showrooms towards robust online retail and e-commerce platforms. E-commerce offers greater selection, detailed product specifications, consumer reviews, and logistical simplicity for the delivery and installation of large appliances, complementing manufacturer-led direct sales efforts.

What impact does regulatory emphasis on sustainability have on smart appliance manufacturing?

Regulatory emphasis forces manufacturers to prioritize the development of highly energy-efficient appliances. For smart cooking devices, this translates into incorporating AI-driven energy management systems, optimizing heating cycles, and utilizing superior insulation and heat recovery technologies to meet and exceed government-mandated energy efficiency indices, particularly in Europe.

Can smart connected ovens recognize different types of food placed inside them?

Yes, advanced smart ovens are increasingly equipped with internal cameras and sophisticated AI-driven computer vision systems. These systems can recognize certain raw or prepared food items, enabling the appliance to automatically suggest or load the appropriate cooking program based on visual identification and estimated weight, substantially simplifying the cooking process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager