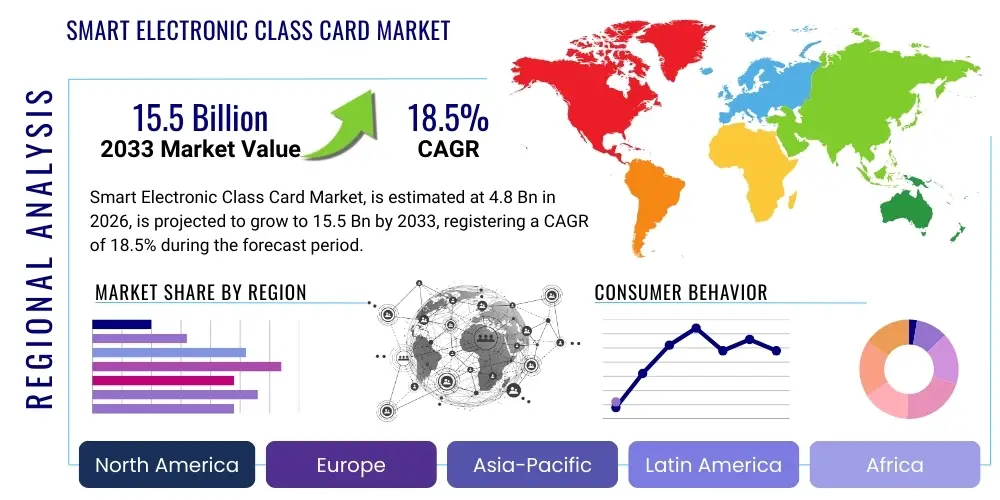

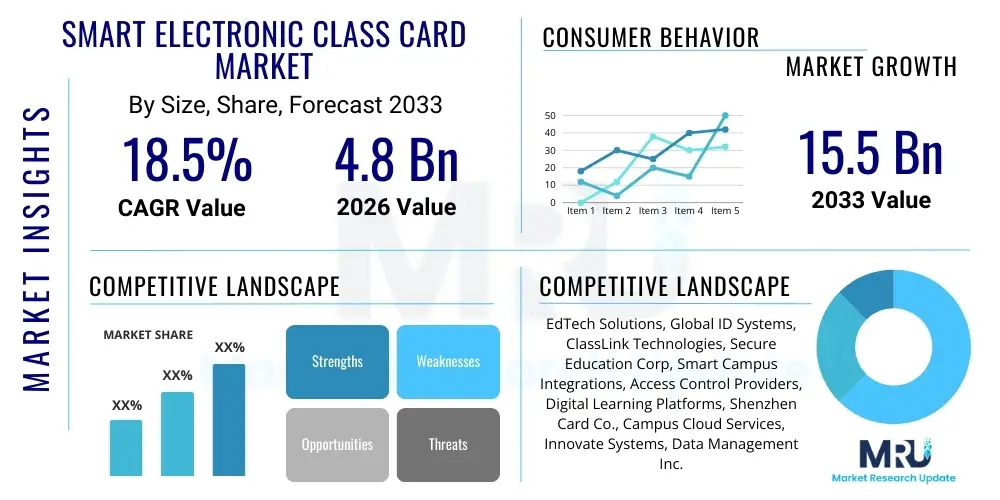

Smart Electronic Class Card Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442153 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Smart Electronic Class Card Market Size

The Smart Electronic Class Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.5 Billion by the end of the forecast period in 2033.

Smart Electronic Class Card Market introduction

The Smart Electronic Class Card Market encompasses the manufacturing, deployment, and integration of advanced identification and access control systems specifically designed for educational environments globally. These sophisticated cards leverage contactless technologies, primarily Radio Frequency Identification (RFID) and Near Field Communication (NFC), and are increasingly incorporating integrated biometric verification modules within the associated reading infrastructure. These systems are strategically positioned to replace outdated traditional paper-based or magnetic strip identification methods across K-12 and higher education institutions. The core deliverable is a multi-functional student or faculty credential that serves far beyond simple identification, functioning as a crucial element in creating a comprehensive, digitally connected campus ecosystem. The underlying technology facilitates automated attendance tracking, secures physical access to restricted facilities such as data centers, specialized laboratories, and residential dormitories, and critically, integrates seamlessly with institutional cashless payment platforms for services like cafeteria purchases and vending machine transactions. The market’s current trajectory is heavily influenced by the global imperative to enhance the physical safety of students and staff, coupled with the need for stringent auditing and compliance reporting mechanisms required by regional education authorities.

The operational scope and major applications of Smart Electronic Class Cards are extensive and deeply embedded in daily campus management. A fundamental application is automated roll call and classroom attendance, which provides verifiable, time-stamped data, drastically reducing administrative time previously spent on manual record-keeping and minimizing disputes over student presence. Beyond the classroom, these cards are indispensable for high-security areas, controlling entry to sensitive examination halls and critical infrastructure facilities, ensuring that only authenticated users gain access. Furthermore, the cards are crucial components of unified smart campus platforms; they provide the primary means of user authentication across various disparate administrative systems, including learning management systems (LMS), student information systems (SIS), and library resource management tools. This integration capability transforms the card from a mere identifier into a dynamic data collection instrument, supporting personalized student services and institutional resource planning based on empirical usage data. The adoption curve is accelerating as institutions recognize the immense benefits of centralized identity management and the operational efficiencies derived from unified data flows. The integration complexity mandates specialized service providers and robust software platforms capable of handling high transaction volumes securely and reliably.

The pervasive benefits fueling the adoption of these smart systems include substantial reductions in administrative overhead, achieved through the automation of time-consuming processes such as attendance monitoring and access log creation. This translates directly into improved operational efficiency and reallocation of staff resources towards educational priorities. Critically, these systems provide a demonstrable increase in campus security through real-time monitoring, instant revocation capabilities for lost or compromised cards, and robust audit trails for all access attempts, significantly mitigating potential risks associated with unauthorized entry or internal theft. Key driving factors for continued market expansion are robust global governmental mandates promoting the wholesale digital transformation of educational infrastructure, the growing demand from parents and students for frictionless, modern, and secure campus services, and the inherent necessity for institutions to implement advanced security measures in response to evolving external threats and internal management complexities. Technological advancements, particularly the reduced cost of secure RFID and NFC chipsets and the maturity of cloud-based identity platforms, are synergistically accelerating global deployment rates across all educational tiers, making sophisticated security solutions accessible to a broader range of institutions.

Smart Electronic Class Card Market Executive Summary

The global Smart Electronic Class Card Market is experiencing robust and accelerating expansion, primarily propelled by the worldwide transition towards centralized smart campus ecosystems and the persistent imperative for heightened institutional security across both K-12 and higher education segments. Current business trends indicate a decisive shift toward holistic platform integration, moving the smart card system from a peripheral security tool to a core component embedded within broader educational technology stacks. This approach focuses on delivering unified data analytics concerning student mobility, facility usage, administrative process efficiency, and real-time security alerts. This strategic pivot toward comprehensive integrated service delivery is actively fostering strategic partnerships between core hardware manufacturers and specialized EdTech software solution providers, increasingly resulting in comprehensive, long-term, subscription-based service models (SaaS) rather than traditional single upfront purchase agreements. Furthermore, market success is increasingly dependent on the ability to offer highly customized solutions, as educational institutions require systems tailored specifically to their regional regulatory environments, operational scale, and unique pedagogical delivery models, spanning from highly distributed metropolitan school districts to monolithic, single-campus universities.

Regional dynamics significantly influence market segmentation and growth velocity. Asia Pacific (APAC) stands out as the highest-growth region, driven by unparalleled governmental commitment and massive-scale investment in modernizing public school infrastructure, particularly implementing compulsory, digital attendance and identity systems in populous nations like China and India. Conversely, North America and Western Europe, categorized as mature markets, are focusing their investment cycles on upgrading established, older identification infrastructure (e.g., magnetic stripe or basic legacy RFID) to advanced, high-security Near Field Communication (NFC) and multi-factor biometric authentication cards. This technological upgrade is mandated partly by the need to strictly comply with stringent data privacy legislation, such as the European Union’s GDPR and the US's FERPA, and to enhance system resilience against sophisticated cyber threats. Meanwhile, emerging markets in Latin America and the Middle East and Africa (MEA) are characterized by initial, rapid-deployment phases of modern smart card solutions, heavily subsidized or directly fueled by both foreign direct investment and consequential rapid urbanization that necessitates the construction of vast new educational facilities.

Analysis of market segments highlights the rapidly increasing prominence of the Software and Services component segment, which now accounts for a growing proportion of total market revenue, reflecting the critical importance of sophisticated identity management, scalable cloud-based infrastructure, and mandatory continuous system maintenance and software updates over the one-time sales revenue generated by physical hardware components. Within the application vertical, Attendance Management and Access Control remain the indispensable, foundational revenue drivers for the market globally, serving as entry points for adoption. However, the uptake of integrated cashless payment functions, particularly within high-density environments like higher education campuses, is demonstrating the sharpest growth trajectory. Technologically, vendors are prioritizing the development and deployment of NFC and hybrid RFID solutions that are capable of seamlessly interacting across diverse reading infrastructures and offer superior cryptographic security features and cross-platform interoperability, significantly outpacing the performance and longevity of legacy low-frequency RFID tags, positioning the market for sustained high-value growth.

AI Impact Analysis on Smart Electronic Class Card Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smart Electronic Class Card Market predominantly concentrate on the tangible benefits AI can deliver in elevating campus security frameworks, enabling highly personalized educational interactions, and automating complex administrative workflows beyond basic data collection. Users frequently express interest in the practical deployment of AI for predictive security analytics—specifically, the capacity to instantaneously identify and flag unusual or anomalous access patterns or user behavior that might indicate a security breach or internal misuse. Furthermore, there is significant user expectation surrounding AI's role in optimizing resource allocation, using historical smart card transaction data to accurately forecast peak utilization times for shared facilities like specialized laboratories, sports complexes, or study areas. Privacy implications are a parallel concern, where the fusion of sophisticated AI learning algorithms with the high-granularity, real-time student location and transactional data collected via the cards necessitates robust ethical guidelines and transparency. Ultimately, the consensus expectation is that AI will be the catalyst for transforming the class card system from a static identifier into a highly dynamic, intelligent data instrument that drives proactive institutional decision-making and dramatically improves both physical safety and the efficiency of educational resource management.

- AI-Enhanced Predictive Security: Analyzing card usage data streams in conjunction with environmental factors to identify and flag potential security risks or unauthorized access attempts with high fidelity in real-time, moving from reactive monitoring to proactive threat mitigation.

- Automated Resource Optimization: Utilizing machine learning models to accurately forecast operational demand for specific campus facilities (e.g., library seating, specialized computer lab equipment) based on historical smart card access and check-in data, leading to dynamic scheduling adjustments and energy savings.

- Personalized Education Feedback Loops: Integrating specific card tap data (classroom entry frequency, library checkouts, gym usage) with academic performance data from the Learning Management System (LMS) to provide holistic, data-driven insights into individual student engagement patterns and identify early risk indicators.

- Frictionless Authentication Refinement: AI algorithms supporting rapid, low-latency facial recognition or advanced behavioral biometrics integrated directly into next-generation smart card readers, thereby enhancing the speed, reliability, and anti-spoofing capability of the access verification process.

- Administrative Task Automation: Leveraging AI to process highly complex attendance and access patterns, automatically generating and consolidating mandated regulatory compliance reports, significantly reducing the labor required for manual data auditing and ensuring institutional adherence to funding requirements.

- Data Pattern Recognition for Planning: Identifying macro trends in student mobility, facility flow, and resource consumption across the entire campus ecosystem to inform strategic campus development, urban planning initiatives, and long-term facility management capital expenditure decisions.

DRO & Impact Forces Of Smart Electronic Class Card Market

The global trajectory of the Smart Electronic Class Card Market is fundamentally dictated by a complex interplay of powerful market drivers, tempered by significant operational and financial restraints, yet yielding substantial future growth opportunities for innovative stakeholders. Key market drivers include the pervasive global regulatory push for mandatory digital student identity systems, often tied to governmental funding and accountability measures. This is compounded by the undeniable and escalating need for heightened campus security following various global incidents, alongside the overarching institutional demand for digital transformation that promises significant operational efficiencies, particularly in large administrative environments. These converging forces collectively generate a strong, sustained market pull for modern, highly integrated class card solutions capable of supporting multifaceted, interoperable smart campus functionalities, ranging from physical access to cloud-based academic record synchronization.

However, the market’s expansion rate is significantly constrained by several critical factors. The most immediate restraint is the substantial initial capital investment required for system installation, encompassing the cost of secure cards, advanced readers, network infrastructure upgrades, and initial software licensing. This cost barrier is particularly prohibitive for public education systems and smaller institutions in developing economies. Furthermore, acute concerns surrounding student data privacy, security vulnerabilities inherent in centralized identity systems, and the imperative to comply with evolving global data protection acts (such as GDPR in Europe and COPPA in the US) represent ongoing, complex restraints. The high technical proficiency required for system integration and the reliance on specialized IT personnel for maintenance also pose a significant adoption hurdle for resource-constrained educational bodies.

Despite these challenges, opportunities for market participants remain abundant, principally residing in the rapid global expansion of cloud-based Software as a Service (SaaS) models. These offerings effectively mitigate high upfront costs and facilitate easier scalability, making advanced systems accessible to institutions of all sizes. Further significant opportunities lie in the integration of cutting-edge technologies, including Internet of Things (IoT) sensors for environmental monitoring linked to card access, the promotion of mobile credentials (allowing students to use their personal smartphones as their primary ID), and the pioneering use of blockchain technology for highly secure, immutable record keeping of academic achievements and identity history. The strategic concept of the unified student digital wallet, which consolidates identity verification, financial payments, and relevant health records linked via the smart card platform, represents the most significant, high-value, untapped area of market evolution. The convergence of these technological innovations offers solution vendors the crucial opportunity to transition from mere component sales to becoming providers of comprehensive, interconnected digital educational infrastructure management platforms.

The impact forces within this market are transformative, exerting sustained pressure across the entire technological and operational value chain. The risk of technological obsolescence is a critical impact force; as security requirements heighten, vendors are continuously compelled to innovate, offering new authentication methods and ensuring robust backward compatibility with installed legacy infrastructure, inevitably forcing a necessary and rapid replacement cycle for aging, less secure hardware. Economic impact forces are tightly correlated with governmental budgetary cycles, national educational funding allocations, and fluctuating currency exchange rates, all of which critically dictate the timing, scale, and feasibility of large-scale public school smart card deployments. Societal impact forces, particularly the heightened expectations from parents for transparent, real-time safety updates and the growing reliance of students on intuitive digital tools, are fundamentally influencing feature development, driving a clear emphasis on highly responsive mobile applications, instant notification functionalities, and seamless user experience. The resulting impact on educational institutions is profound: achieving measurable operational efficiency gains, deploying data-driven security enhancements, and taking a demonstrable, essential step towards creating future-ready, resilient, and fully digitally enabled educational learning environments.

Segmentation Analysis

The Smart Electronic Class Card Market is meticulously segmented across multiple dimensions, including components, underlying technology, primary application use case, and the specific end-user educational category. This granular segmentation is essential for understanding the distribution of investment, identifying high-growth niches, and tracking the velocity of technological adoption across diverse institutional landscapes globally. The component segmentation effectively dissects the offerings into physical hardware (which includes the card bodies, specialized readers, and network controllers), the requisite proprietary software (Identity Management Systems, database structures), and the essential services segment (installation, maintenance contracts, and continuous cloud hosting). This structure is crucial for market participants to strategically tailor their business models, shifting capital allocation increasingly toward developing high-margin service and software subscription offerings which provide sustained recurring revenue.

Further analytical granularity is achieved through the technology segmentation, which clearly illustrates the market's migration away from traditional, lower-security identification methods (like LF RFID) toward highly secure communication protocols, primarily Near Field Communication (NFC) and advanced integrated biometrics. NFC-based solutions are highly favored due to their superior data encryption capabilities, rapid transaction speeds, and enhanced interoperability across different reader types. Application segmentation reveals the fundamental drivers of demand; mandated functions such as detailed attendance tracking and stringent facility access control form the indispensable, non-negotiable core revenue generators. Conversely, value-added, student-centric functions like integrated cashless payments for auxiliary services offer the most significant potential for aggressive growth, especially within the context of large, self-contained university campuses. The final analysis of end-user segments, which sharply distinguishes between the requirements of K-12 (Primary and Secondary Education) and Higher Education institutions, is critical, as their divergent priorities—K-12 focusing intensely on safety and parental communication, while Higher Education focuses on transactional efficiency and systems complexity—fundamentally dictate the requisite feature set and implementation architecture of the smart card deployment.

- By Component:

- Hardware (Readers, Secure Cards/Tags, System Controllers, Network Modules)

- Software (Identity Management Systems, Cloud Database Platforms, Access Control Logic)

- Services (System Installation, Continuous Maintenance, Technical Support, Cloud Hosting/SaaS)

- By Technology:

- Radio Frequency Identification (RFID) - High Frequency (HF) and Low Frequency (LF)

- Near Field Communication (NFC) - Including secure elements like MIFARE DESFire

- Biometrics (Fingerprint Scanners, Facial Recognition Integration at reader level)

- Mobile Credentials (Smartphone-based NFC/BLE ID)

- By Application:

- Attendance Management (Classroom and Mandatory Events)

- Access Control (Library, Dormitory, Labs, Administration Buildings, Parking)

- Cashless Payments (Cafeteria, Vending Machines, Campus Bookstores)

- Resource Tracking (Asset Management, Equipment Checkout, Inventory Control)

- By End-Use:

- K-12 Institutions (Primary and Secondary Education)

- Higher Education (Universities, Colleges, Polytechnics)

- Vocational Training Centers and Specialized Academies

Value Chain Analysis For Smart Electronic Class Card Market

The value chain for the Smart Electronic Class Card Market initiates with crucial upstream activities, which are entirely focused on the meticulous procurement of highly specialized core technological components. These include secure semiconductor chips, specialized antenna and inlay materials, robust security microcontrollers, and specialized high-grade plastic substrates necessary for durable card manufacturing. The key upstream suppliers are predominantly large-scale, global chip manufacturers and secure element providers whose dominance dictates the foundational security levels, cryptographic capabilities, and overall functional performance of the eventual product. These major component producers typically wield significant negotiating power due to the high technological barriers to entry and the specialized certifications required for secure identification technology manufacturing. Card manufacturers must therefore establish and maintain a highly reliable, audited, and certified supply chain for components that rigorously meet global educational and governmental security standards, a factor which significantly elevates the complexity of the initial procurement stage.

Midstream operations encompass the highly technical processes of secure card encoding, reader hardware assembly, development of proprietary system software, and the critical phase of overall solution integration. Within this stage, specialized system integrators fulfill an indispensable role, responsible for customizing core software platforms and configuring hardware to meet the highly specific architectural, regulatory, and procedural requirements of individual educational institutions. The sophisticated distribution channel utilized in this market is clearly bifurcated into both direct and indirect routes. Direct distribution typically manages large-scale, high-value institutional procurement contracts, involving competitive bidding where vendors engage directly with major university systems, centralized educational consortiums, or powerful government bodies overseeing national or regional public school districts. This channel ensures maximum control over implementation and maintenance.

Conversely, the indirect distribution channel heavily relies on a network of specialized EdTech resellers, local security solution providers, and expert IT consultancies. These partners efficiently package the smart card system alongside broader, complimentary school management software solutions, enabling effective market penetration to smaller private institutions and geographically dispersed educational facilities. Downstream activities are centered entirely on solution deployment, ongoing system maintenance, and the crucial, continuous provision of high-quality digital services. Once the system is fully installed, the sustainable, recurring revenue stream is primarily generated through mandatory software licensing fees, data hosting services (increasingly delivered as cloud-based Identity as a Service, or IDaaS), and detailed long-term technical support and maintenance contracts. Direct channels facilitate closer, more immediate client relationships and highly efficient feedback loops, which are critical for responsive, market-driven software updates and feature iteration. The indirect channel relies entirely on the partner network for effective local support and rapid issue resolution, necessitating comprehensive training and stringent certification programs deployed by the principal technology vendors. The long-term success of the smart card solution is ultimately quantified at the end-user level—judged by the functional experience of students and faculty—which profoundly influences contract renewal rates and the vendor’s market reputation, thus requiring an unyielding commitment to continuous service quality improvement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EdTech Solutions, Global ID Systems, ClassLink Technologies, Secure Education Corp, Smart Campus Integrations, Access Control Providers, Digital Learning Platforms, Shenzhen Card Co., Campus Cloud Services, Innovate Systems, Data Management Inc., Secure Identity Group, Nexus Technology, Education Systems Global, Integrated Campus Solutions, Pioneer Access Systems, Future ID Systems, Student Data Hub, Apex Security, Univision Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Electronic Class Card Market Potential Customers

The core customer base for the Smart Electronic Class Card Market consists of diverse institutional entities globally that are primarily responsible for the management of large, transient populations of students and staff and are obligated to maintain stringent security protocols alongside high administrative efficiency standards. The End-User/Buyers are segmentally bifurcated into two primary, high-volume categories: K-12 systems and Higher Education. K-12 institutions, which encompass primary and secondary schools often managed by centralized districts or governmental bodies, prioritize solutions hyper-focused on mandated, reliable attendance tracking, the provision of real-time safety and absence notifications to parental contacts, and the maintenance of basic, yet robust, perimeter access control across school premises. Their procurement decisions are typically centralized, driven by factors such as high volume discount potential, overall cost-effectiveness, mandated system robustness, and critically, ease of use for young students and non-technical teaching staff.

Conversely, higher education institutions, which include large colleges, sprawling universities, and specialized polytechnics, represent the demanding segment requiring the most advanced, complex, and highly integrated smart card systems. These buyers necessitate highly versatile, multifaceted credentials capable of managing complex functions such as dormitory entry and sophisticated room scheduling, integration with high-volume library circulation systems, authorization for campus transit services, granular departmental access controls (e.g., highly restricted scientific or server labs), and seamless, large-scale cashless payment capabilities across a broad spectrum of on-campus services. Their complex purchasing cycle is characteristically project-based, involving collaboration among multiple powerful departmental stakeholders, including IT services, physical security, treasury departments, and core administration, which results in significantly higher-value, specialized software integration contracts and demand for bespoke customization services.

A secondary, yet rapidly expanding, customer segment includes governmental agencies and national educational ministries that function as centralized funding and standardization bodies for educational infrastructure across entire geographic regions or nations. These powerful entities act as macro-buyers, initiating massive, centralized tenders for nationwide system deployment, explicitly targeting the comprehensive digitalization of public school systems. Their direct involvement acts as a powerful catalyst, accelerating mass market adoption and enforcing rigorous standardization in critical areas such as card technology specifications, data encryption protocols, and mandatory security compliance frameworks. For technology vendors, securing these immense governmental contracts provides substantial, predictable revenue visibility and allows for the rapid establishment of significant, defensible market share dominance within a region, often outweighing the fragmented and resource-intensive sales efforts required to win business from numerous individual private institutions. This influential customer segment is highly sensitive to achieving regulatory compliance milestones and optimizing the total cost of ownership (TCO) calculated over long-term, multi-year contract horizons.

Smart Electronic Class Card Market Key Technology Landscape

The technology landscape that forms the foundation of the Smart Electronic Class Card Market is currently undergoing significant transformation, strategically moving beyond mere passive identity verification toward the deployment of highly sophisticated, multi-layered security and operational protocols. The technological bedrock remains firmly rooted in Radio Frequency Identification (RFID) and Near Field Communication (NFC) standards, which are essential for facilitating rapid, secure, short-range wireless communication required for quick authentication taps at high-traffic entry points, cafeteria checkout terminals, or library gates. Contemporary market deployments strongly favor high-frequency (HF) RFID and advanced NFC protocols, largely due to their superior cryptographic encryption capabilities, ability to support sophisticated mutual authentication procedures, and inherent resilience, all of which substantially improve the integrity of data security compared to older, less secure, low-frequency (LF) cards. The mandatory integration of global standards such as MIFARE DESFire and similar high-security protocols is quickly becoming the market baseline, directly addressing institutional stakeholder concerns regarding malicious card cloning, data interception, and unauthorized physical access attempts.

In addition to traditional physical card-based systems, the market is experiencing profound disruption fueled by the widespread emergence of mobile credential technology, commonly referred to in the sector as 'Mobile ID.' This advanced method leverages the embedded NFC or Bluetooth Low Energy (BLE) capabilities within students' and faculties’ personal smartphones, enabling the device to function seamlessly as the primary class card credential. This eliminates the necessity of the physical plastic card entirely or, more commonly, serves as a highly secure, convenient digital backup credential. This significant trend is overwhelmingly driven by the near-ubiquitous penetration of smartphones among the target demographic and the overwhelming demand from users for a frictionless, converged interaction experience with campus services. Furthermore, the integration of advanced biometric technologies—specifically highly accurate facial recognition algorithms embedded within high-security reader systems—is increasingly being adopted for deployment in critically high-security access areas (e.g., specialized server rooms, chemistry laboratories, or financial offices) where an indispensable, additional layer of user verification is required, effectively mitigating security risks fundamentally associated with the loss or unauthorized sharing of physical smart cards. This ongoing convergence of contactless communication methods and biometric authentication defines the current competitive edge and future developmental path for smart card technology platforms.

Supporting the robust front-end card technology is a complex, high-capacity software infrastructure, which is overwhelmingly cloud-hosted to ensure maximum scalability and accessibility. These digital platforms utilize state-of-the-art Identity Management Systems (IMS) built on secure and reliable Application Programming Interfaces (APIs). The primary responsibility of these centralized platforms is the secure provisioning, rapid de-provisioning, and dynamic management of potentially millions of student identities and their corresponding access rights, ensuring real-time synchronization across the campus network. Cloud hosting facilitates crucial benefits such as guaranteed scalability to accommodate fluctuating enrollments, robust disaster recovery protocols, and mandatory seamless integration with all other core university systems (including LMS, HR management, and Financial ERP). Looking ahead, key future technologies poised to cause significant market disruption include the strategic incorporation of distributed ledger technology (blockchain) for the immutable and tamper-proof recording of certified academic credentials and attendance logs, promising unprecedented levels of transparency and third-party verification, and further reinforcing the security and long-term reliability of all data generated by the smart card ecosystem.

Regional Highlights

Regional market dynamics are instrumental in defining the specific implementation architecture, the technological maturity level, and the resultant growth trajectory of the global Smart Electronic Class Card Market, characterized by highly variable drivers and differential adoption rates across the various continents. North America, recognized for its highly mature educational IT infrastructure and high technological readiness, is strategically focused on the wholesale replacement of aging legacy systems and the deep integration of class card functionality within comprehensive, unified campus safety and security platforms. Investment is strongly weighted toward sophisticated software upgrades, robust cloud services, and the widespread adoption of mobile credentials, driven primarily by expansive university systems seeking both operational excellence and advanced, data-rich analytical capabilities, while simultaneously adhering to stringent federal privacy regulations like FERPA. The regional market emphasis is unequivocally placed on high-speed system resilience, superior security auditing, and seamless cross-platform interoperability.

The European market presents a technologically advanced, albeit fragmented landscape, where the pace and scope of adoption are heavily influenced by disparate national educational policies and the extremely demanding requirements of the General Data Protection Regulation (GDPR), which establishes high-priority compliance with data protection and privacy as the non-negotiable, paramount concern. Western European nations currently lead in the rapid adoption of highly secure NFC and mobile ID solutions, frequently driven by large-scale, coordinated public-private partnerships focused on achieving systems that are fully interoperable across diverse regional educational bodies and municipalities. Conversely, Eastern Europe is undergoing rapid technological modernization, exhibiting significantly faster growth rates fueled by targeted governmental investment in upgrading digital infrastructure across public schooling systems, transitioning swiftly toward integrated card solutions.

The Asia Pacific (APAC) region stands definitively as the primary global growth engine for the Smart Electronic Class Card Market. Governments in key nations such as China, India, Indonesia, and South Korea are executing vast, centralized projects specifically designed to digitalize the identities of millions of public school students. This phenomenal scale drives an immense global demand for high-volume, cost-effective hardware solutions, characterized by the mass deployment of standard, reliable RFID cards primarily utilized for mandatory attendance recording and basic facility access control. The sheer, overwhelming scale of the student population in APAC guarantees that the region will command the largest absolute market share throughout the entire forecast period, while simultaneously showing an accelerated transition toward integrating complex value-added features such as integrated cashless payment, smart library services, and rudimentary student health monitoring features as the underlying digital infrastructure reaches maturity.

Latin America (LATAM) and the Middle East and Africa (MEA) are confidently positioned as dynamic emerging markets experiencing rapidly accelerating adoption rates, albeit primarily concentrated initially in major urban centers and newly established, high-specification private or internationally funded educational institutions. LATAM is observing consistent, moderate growth primarily driven by new public security mandates and efforts to improve educational transparency, particularly in tracking student movement and presence. MEA benefits significantly from immense government and private capital investment in constructing massive, state-of-the-art educational cities and complex university campuses, particularly within the oil-rich Gulf Cooperation Council (GCC) countries. These regions often exhibit a tendency to bypass older, transitional technologies, opting instead to implement cutting-edge, fully modern digital systems from the outset, thus creating substantial opportunities for vendors capable of delivering highly scalable, comprehensive, end-to-end identity and access control solutions.

- North America (US, Canada): Characterized by high adoption of mobile credentials, stringent focus on FERPA compliance and data governance, and a mature market demanding complex software integration and advanced analytics services.

- Europe (UK, Germany, France, Nordics): Strong regulatory environment demanding strict GDPR compliance, rapid uptake of high-security NFC cards, significant centralized investment in seamless cross-institutional data platforms and privacy-by-design solutions.

- Asia Pacific (China, India, Japan, South Korea): The region with the highest overall growth rate due to large-scale government-led digitization projects, massive high-volume demand for affordable secure hardware, and serving as the primary manufacturing and supply chain hub.

- Latin America (Brazil, Mexico, Argentina): Steady, growing adoption driven by urbanization, increasing parental demand for security, and expanding government mandates for improved school security and verifiable attendance tracking protocols.

- Middle East and Africa (GCC nations, South Africa): Strong governmental and private sector investment in building modern smart campus infrastructure, creating high demand for integrated physical security, sophisticated identity management platforms, and premium cloud services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Electronic Class Card Market.- EdTech Solutions

- Global ID Systems

- ClassLink Technologies

- Secure Education Corp

- Smart Campus Integrations

- Access Control Providers

- Digital Learning Platforms

- Shenzhen Card Co.

- Campus Cloud Services

- Innovate Systems

- Data Management Inc.

- Secure Identity Group

- Nexus Technology

- Education Systems Global

- Integrated Campus Solutions

- Pioneer Access Systems

- Future ID Systems

- Student Data Hub

- Apex Security

- Univision Technologies

Frequently Asked Questions

Analyze common user questions about the Smart Electronic Class Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Smart Electronic Class Card Market?

The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 18.5% between the years 2026 and 2033, driven by global digital transformation initiatives in the education sector and increasing emphasis on comprehensive campus security protocols and administrative efficiency.

Which technology segment is expected to dominate the market?

While traditional RFID remains prevalent, the highly secure NFC and emerging Mobile Credentials technology segments are expected to show the fastest growth. NFC offers enhanced data security and better integration, while Mobile Credentials address student convenience and reduce reliance on physical plastic cards.

What are the primary drivers of market expansion in the APAC region?

Market expansion in the Asia Pacific region is predominantly fueled by massive-scale governmental investment in modernizing public school infrastructure and implementing centralized, mandatory digital identity and attendance management systems across vast, populous student demographics.

How does the Smart Electronic Class Card contribute to campus security?

Smart Electronic Class Cards significantly enhance security through real-time, auditable access control, ensuring only authorized individuals enter restricted facilities. Systems often integrate with real-time location and utilize advanced encryption to prevent card cloning and unauthorized use, providing a critical layer of safety management.

What is the main challenge facing the adoption of these systems?

The principal adoption challenge is the substantial initial capital investment required for deploying the necessary specialized hardware infrastructure (readers, network controllers) and for implementing the complex, highly secure Identity Management Software platforms, especially for large-scale, multi-campus institutional rollouts and necessary integration with legacy IT ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager