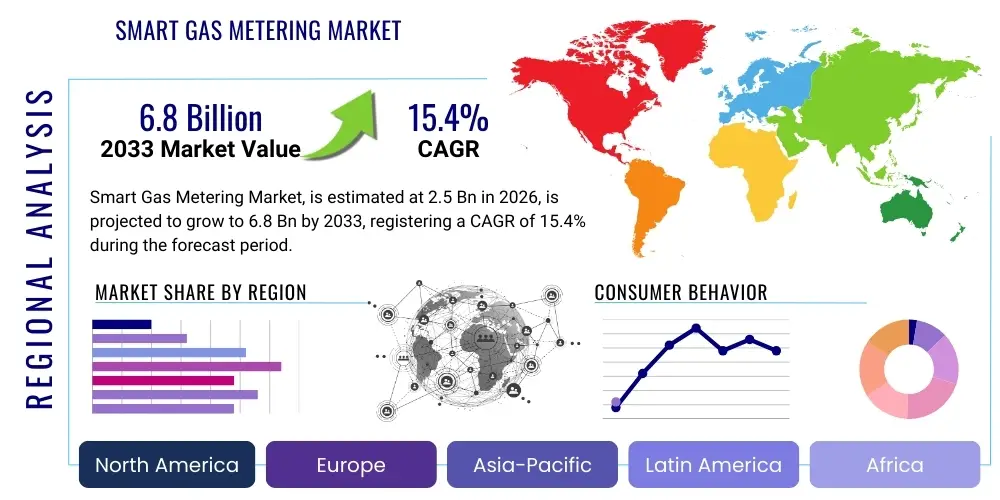

Smart Gas Metering Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441520 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Smart Gas Metering Market Size

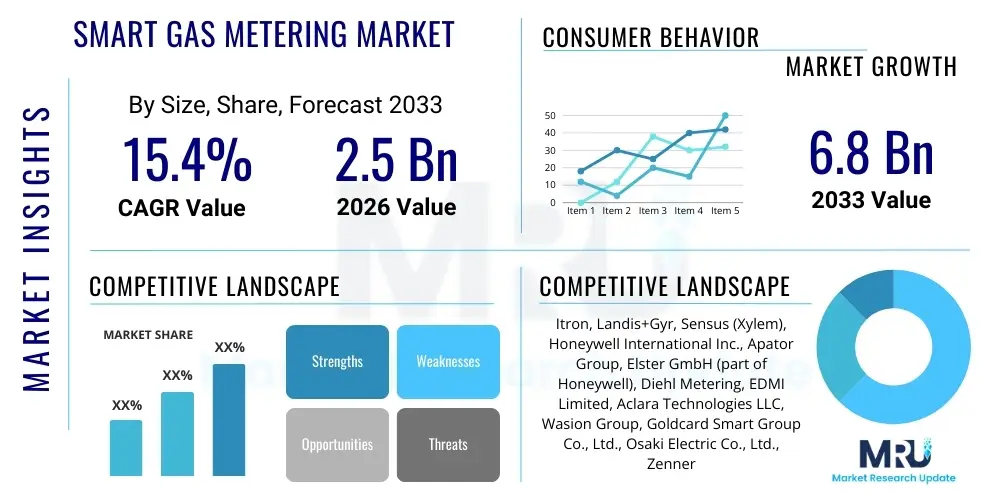

The Smart Gas Metering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.4% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033. This significant expansion is primarily fueled by increasing global mandates for energy efficiency, stringent regulations aimed at reducing non-revenue gas (NRG) losses, and the ongoing modernization of aging gas infrastructure, particularly across developed economies in North America and Europe. The high CAGR reflects the strong push toward implementing Advanced Metering Infrastructure (AMI) which provides utilities with crucial bidirectional communication capabilities, transforming traditional operational models into highly efficient, data-driven systems. Furthermore, technological advancements in communication protocols, such as Narrowband IoT (NB-IoT) and Low Power Wide Area Networks (LPWANs), are lowering deployment costs and improving data reliability, thereby accelerating adoption rates globally.

Smart Gas Metering Market introduction

The Smart Gas Metering Market involves the deployment of advanced electronic devices capable of measuring gas consumption, processing data, and transmitting this information wirelessly and securely to central utility systems. Unlike traditional mechanical meters, smart meters incorporate integrated communication modules enabling two-way data flow, which is fundamental for real-time monitoring, remote diagnostics, and improved customer engagement. The primary product offering includes smart meters, communication infrastructure (gateways, routers), meter data management (MDM) systems, and associated analytics software.

Major applications of smart gas metering span across residential, commercial, and industrial sectors. In the residential segment, the technology facilitates accurate billing, provides consumers with consumption insights, and enables prepayment options. For commercial and industrial users, smart meters support load profiling, demand response programs, and enhance safety through rapid leak detection and pressure monitoring. The benefits are extensive, encompassing reduced operational expenditure (OpEx) for utilities by eliminating manual meter reading, decreased non-revenue gas (NRG) losses due to improved detection of anomalies and tampering, and enhanced grid reliability and safety. Furthermore, these systems are integral to facilitating the transition towards smarter, more resilient energy grids.

Key driving factors accelerating market penetration include rigorous regulatory frameworks mandating smart meter deployment in regions like the European Union and parts of Asia Pacific, alongside the urgent need for infrastructure optimization. The integration of Internet of Things (IoT) technologies into metering systems allows for unprecedented data granularity, enabling utilities to perform predictive maintenance and manage assets more effectively. Additionally, the increasing cost of natural gas necessitates higher accuracy in measurement and billing, solidifying the economic case for smart gas metering solutions globally.

Smart Gas Metering Market Executive Summary

The Smart Gas Metering Market is characterized by robust business trends driven by significant capital investments in utility infrastructure digitalization and consolidation among key technology providers. Business trends indicate a shift from pure hardware sales towards integrated service models, where utilities purchase comprehensive solutions combining meters, communications infrastructure, MDM software, and advanced analytics. Geopolitical mandates promoting carbon neutrality and energy security are forcing utility companies to accelerate their rollout plans, leading to substantial market opportunities for system integrators and technology vendors specializing in advanced encryption and data security protocols. Furthermore, the market is experiencing intense competition, prompting manufacturers to focus heavily on developing modular meters compliant with international standards, such as MID (Measuring Instruments Directive) in Europe, ensuring interoperability and longevity.

Regional trends demonstrate distinct maturity levels. Europe remains a core growth engine due to ongoing national rollouts, particularly in countries finalizing their mandates. North America, while having mature infrastructure, is witnessing a major upgrade cycle focused on replacing older Automatic Meter Reading (AMR) systems with full AMI capabilities, emphasizing reliability and cybersecurity. The most dynamic growth is expected in the Asia Pacific region, fueled by massive urbanization and the establishment of new gas pipeline infrastructure in developing economies like China and India, which are adopting smart metering solutions from the initial infrastructure planning phase to minimize future losses and optimize distribution networks.

Segmentation trends highlight the increasing dominance of Advanced Metering Infrastructure (AMI) over Automatic Meter Reading (AMR), due to AMI's crucial two-way communication capabilities necessary for sophisticated grid management and instant remote shut-off functions vital for safety and efficiency. Communication technology segmentation is increasingly favoring cellular standards, specifically NB-IoT and LTE-M, as they offer superior coverage, reliability, and security features compared to proprietary radio frequency (RF) mesh networks, particularly in dense urban environments. The residential segment continues to hold the largest market share, but the commercial and industrial (C&I) sectors are demonstrating higher revenue per unit, driven by the need for advanced load balancing and comprehensive energy management systems that require higher data frequency and greater precision.

AI Impact Analysis on Smart Gas Metering Market

Common user questions regarding AI's impact on smart gas metering center on four primary themes: utility operational efficiency, enhanced safety protocols, predictive maintenance capabilities, and consumer data security. Users frequently inquire about how AI can transform raw meter data into actionable insights, specifically focusing on its role in proactive leak detection and the accurate prediction of infrastructure failures before they manifest into critical events. Concerns often revolve around the computational requirements and the integration complexity of AI algorithms within existing legacy Meter Data Management (MDM) systems. The overall expectation is that AI integration will significantly lower non-revenue gas (NRG) rates, improve customer service by personalizing consumption advice, and substantially bolster the cybersecurity posture of large-scale AMI deployments through real-time anomaly detection in data flow.

AI and machine learning (ML) are rapidly becoming indispensable tools in the smart gas ecosystem, moving beyond simple data aggregation to sophisticated pattern recognition. AI models are applied to meter data streams to identify consumption anomalies indicative of potential leaks, unauthorized tampering, or equipment malfunction with a level of precision unattainable by traditional rule-based systems. This shift enables utilities to transition from reactive maintenance schedules to highly efficient, predictive maintenance programs, optimizing resource allocation and reducing unnecessary field visits. For instance, ML algorithms can analyze historical pressure data and temperature fluctuations in conjunction with consumption profiles to accurately forecast the remaining useful life (RUL) of specific pipeline segments or meters, thereby extending asset longevity and enhancing network stability.

Furthermore, AI significantly enhances the accuracy of load forecasting and network optimization. By processing massive datasets that include variables such as weather patterns, demographic information, and historical usage trends, AI algorithms generate highly accurate predictions of future gas demand. This allows utilities to optimize gas supply purchasing and storage, leading to substantial cost savings. In terms of cybersecurity, AI utilizes behavioral analytics to establish baseline operational norms for each meter and communication node. Any deviation from this established baseline, such as unusual communication patterns or atypical data transmission frequencies, is flagged instantly, providing robust, layer-seven security monitoring against increasingly sophisticated cyber threats targeting critical national infrastructure.

- AI drives predictive maintenance, minimizing equipment failures and optimizing asset lifespan.

- Machine learning algorithms enable highly accurate, real-time leak and tamper detection, reducing Non-Revenue Gas (NRG).

- AI enhances load forecasting accuracy, optimizing gas procurement and network pressure management.

- Behavioral analytics powered by AI strengthens cybersecurity by detecting anomalous data communication patterns.

- Natural Language Processing (NLP) aids in analyzing customer feedback and personalizing energy consumption advice.

DRO & Impact Forces Of Smart Gas Metering Market

The Smart Gas Metering Market is propelled by a synergy of regulatory mandates and technological advancements, yet it faces friction from high initial investment costs and complexity in data management. The primary driver is the widespread implementation of energy efficiency and carbon reduction targets set by global governments, necessitating accurate, granular measurement of natural gas consumption. Conversely, a significant restraint is the substantial capital expenditure required for full-scale AMI deployment and the inherent cybersecurity risks associated with connecting millions of endpoints to the grid. Opportunities lie in integrating meters with advanced communication standards like 5G and expanding market penetration into emerging economies with nascent gas infrastructure. The core impact force influencing market direction remains regulatory pressure combined with the undeniable economic benefit derived from eliminating non-revenue gas losses, creating a powerful mandate for utilities to overcome initial deployment hurdles.

Drivers: Regulatory mandates, particularly in Europe, for complete smart meter penetration by specific deadlines (e.g., 2024 targets for some EU members) are non-negotiable forces accelerating adoption. The urgent global requirement to reduce carbon emissions and improve energy management necessitates the data provided by smart meters for effective conservation policies. Operationally, the imperative for gas utilities to minimize Non-Revenue Gas (NRG) losses—which can be substantial in older networks—is a critical economic driver. Furthermore, the enhanced safety features offered by smart meters, such as remote shut-off capabilities and early pressure anomaly detection, are driving utility investments, particularly in densely populated urban areas.

Restraints: The most prominent barrier to entry and deployment is the high upfront cost associated with acquiring, installing, and integrating the entire AMI ecosystem, including meters, communication modules, and centralized MDM systems. This cost challenge is compounded by the long replacement cycles of traditional meters, demanding significant financial planning and approval processes. Data privacy and cybersecurity represent significant constraints; managing sensitive consumption data for millions of households and protecting critical infrastructure against sophisticated cyberattacks requires continuous, expensive investment in robust security protocols, adding complexity and risk perception for utilities. Interoperability issues between meters from different vendors and legacy IT systems also slow down large-scale rollouts.

Opportunities: Emerging communication technologies like 5G and advanced LPWAN solutions (e.g., LoRaWAN) offer opportunities by promising lower latency, higher bandwidth, and greater network scalability, reducing the total cost of ownership over the meter's lifespan. Geographically, the rapidly developing economies in Asia Pacific and parts of Latin America, which are currently building out new gas distribution infrastructure, represent greenfield opportunities where smart metering can be integrated from the start without the burdens of legacy system replacement. Additionally, the increasing convergence of gas and electricity metering services offers opportunities for vendors to provide unified, multi-utility smart home solutions, simplifying management for both utilities and consumers.

Impact Forces: The overarching regulatory environment acts as the primary impact force, dictating the timeline and specifications for deployment. Secondarily, the technological standardization and commoditization of communication components (like cellular modules) are lowering per-unit costs, making large-scale deployment more financially feasible. The market is also heavily influenced by utility consolidations and mergers, often resulting in massive, coordinated purchasing decisions that dictate market dominance for key vendors. Consumer acceptance, while generally positive due to accurate billing and consumption transparency, is a continuous force requiring proactive communication and assurance regarding data privacy from the utilities.

Segmentation Analysis

The Smart Gas Metering Market is comprehensively segmented based on various technical and functional parameters to address the diverse needs of the global utility sector. Primary segmentation includes Component, Meter Type, Application, and Communication Technology, providing granularity in market analysis and strategic planning. The component segment differentiates between hardware (the meter itself, modules, and infrastructure) and software/services (MDM, analytics, maintenance). The Meter Type separation highlights the fundamental difference between Automatic Meter Reading (AMR), which is generally one-way communication, and the more advanced Advanced Metering Infrastructure (AMI), which supports two-way communication and advanced functionalities. Understanding these segmentations is crucial for stakeholders designing solutions tailored to specific regulatory environments, such as high-density urban areas requiring robust AMI cellular networks versus rural areas where basic AMR functionality may suffice temporarily.

The application segment distinguishes between residential, commercial, and industrial end-users, reflecting varying consumption profiles, data requirements, and safety protocols necessary for each group. Residential meters typically prioritize low cost and high volume, while industrial meters require extreme precision and often integrate with existing Supervisory Control and Data Acquisition (SCADA) systems. Furthermore, the communication technology segment is vital, comparing proprietary Radio Frequency (RF) Mesh networks, often favored for robust, self-healing local coverage, against licensed cellular options like GPRS, 3G, LTE-M, and increasingly NB-IoT, which leverage existing public telecommunications infrastructure for long-range, secure data transfer. The rapid evolution of cellular standards, particularly the optimization of NB-IoT for low-power, wide-area smart metering applications, is significantly driving the growth within this segment, offering better coverage in challenging environments like meter vaults and basements, a persistent issue for traditional RF technologies.

- By Component:

- Hardware (Smart Meters, Communication Modules, Control Systems)

- Software & Services (Meter Data Management (MDM), Analytics, System Integration)

- By Meter Type:

- Automatic Meter Reading (AMR)

- Advanced Metering Infrastructure (AMI)

- By Application/End User:

- Residential

- Commercial

- Industrial

- By Communication Technology:

- Radio Frequency (RF) Mesh

- Power Line Communication (PLC)

- Cellular (GPRS/3G/LTE-M/NB-IoT)

- Wired (Ethernet, Fiber Optic)

- By Installation Type:

- New Deployment

- Replacement/Upgrade

Value Chain Analysis For Smart Gas Metering Market

The value chain for the Smart Gas Metering Market is complex and involves several specialized layers, beginning with upstream component manufacturing, moving through system integration and deployment, and culminating in the downstream application and data utilization by utility operators. Upstream activities are dominated by specialized component suppliers, including semiconductor manufacturers providing metering chips, sensor technology firms, and communication module providers (e.g., NB-IoT chipsets). The quality and reliability of these core components dictate the final meter performance and longevity. Key companies at this stage invest heavily in R&D to enhance battery life, data encryption capabilities, and measurement accuracy, focusing on compliance with stringent gas industry standards.

The middle stage of the value chain involves the meter manufacturers and system integrators. Meter manufacturers assemble the upstream components into the final smart meter hardware. System integrators play a critical role, particularly in large-scale AMI rollouts, by bridging the gap between hardware installation and the utility’s existing IT infrastructure, including the deployment of Meter Data Management (MDM) systems and integrating communication gateways. This stage often involves complex procurement processes, high competition, and the necessity for robust project management to handle millions of deployment points. Successful integrators must possess expertise in cybersecurity, data migration, and utility operational technology (OT) protocols.

Downstream activities focus on the utilization of the smart metering data by the utility end-user. Distribution channels are predominantly direct, involving large-scale tenders and long-term contracts between utility companies and primary meter vendors (e.g., Itron, Landis+Gyr). However, indirect distribution through specialized regional channel partners or third-party service providers is common for maintenance, repair, and smaller, localized deployments. Utility companies transform the data gathered into actionable intelligence for accurate billing, optimized load balancing, proactive leak detection, and improved customer service. This downstream focus on data monetization and operational savings ultimately justifies the significant capital investment made earlier in the value chain, illustrating the market's fundamental dependence on sophisticated software and analytics services.

Smart Gas Metering Market Potential Customers

The primary customers and end-users of smart gas metering solutions are entities responsible for the distribution, management, and supply of natural gas to consumer endpoints. Gas Distribution Utilities (GDUs), which own and operate the vast majority of the distribution network, constitute the largest segment of potential customers globally. These publicly or privately owned utilities are driven by regulatory mandates to improve efficiency, reduce non-revenue gas (NRG), and enhance safety compliance. Their procurement decisions involve multi-year, multi-billion dollar contracts for hardware, software, and managed services, making them the central focus for all major market vendors.

Secondary potential customers include Municipalities and Local Government Agencies, especially those operating public gas utilities or those involved in smart city initiatives where energy efficiency and integrated infrastructure management are core priorities. Energy Service Companies (ESCOs) and specialized energy retailers also act as important buyers, particularly in deregulated markets, where they leverage smart meter data to offer value-added services such as advanced energy management consulting, specialized tariffs, and tailored consumption reduction programs to commercial and industrial clients. Furthermore, large industrial complexes, which manage their own localized gas distribution networks, may purchase smart metering systems directly to optimize internal processes, monitor usage for cost allocation, and meet stringent internal safety standards.

The purchasing criteria for these customers are stringent, prioritizing not just the initial cost of the meter but also factors like battery life (often required to last 15-20 years), communication reliability in challenging subterranean environments, robust cybersecurity certifications, and seamless compatibility with existing Meter Data Management (MDM) and billing systems. The decision-making process is highly formalized, often requiring proof of compliance with international metrology standards (like OIML or MID) and a proven track record of successful large-scale deployments, further emphasizing the mature and rigorous nature of utility procurement cycles globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 15.4% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Itron, Landis+Gyr, Sensus (Xylem), Honeywell International Inc., Apator Group, Elster GmbH (part of Honeywell), Diehl Metering, EDMI Limited, Aclara Technologies LLC, Wasion Group, Goldcard Smart Group Co., Ltd., Osaki Electric Co., Ltd., Zenner International GmbH & Co. KG, Sagemcom, Pietro Fiorentini S.p.A., Flonidan A/S, Linyang Energy, Siemens AG, and Genus Power Infrastructures Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Gas Metering Market Key Technology Landscape

The technological backbone of the Smart Gas Metering Market is defined by the continuous evolution of communication protocols, advanced measurement mechanisms, and sophisticated data processing capabilities embedded at the edge. Advanced Metering Infrastructure (AMI) represents the dominant foundational technology, providing the complete framework necessary for bidirectional communication between the central utility data center and the individual smart gas meters. This infrastructure relies heavily on robust data encryption standards (such as AES-128 or higher) to ensure the integrity and confidentiality of consumption data, a non-negotiable requirement for regulatory compliance and consumer trust. The meters themselves are transitioning from traditional diaphragm mechanisms to highly accurate, solid-state ultrasonic technology, which offers superior precision, reduced maintenance, and inherently lower susceptibility to tampering compared to mechanical components.

In terms of connectivity, the market is undergoing a significant migration toward standardized, licensed spectrum technologies, specifically Narrowband IoT (NB-IoT) and LTE-M (Long-Term Evolution for Machines). These cellular LPWAN technologies offer substantial advantages over proprietary Radio Frequency (RF) Mesh networks, particularly in challenging environments like deep basements or underground installations, due to their enhanced signal penetration and reliable connectivity over vast geographical areas. NB-IoT is optimized for the low data rate and extended battery life requirements typical of gas meters, often promising a 15-20 year operational lifespan without external power sources. The emergence of 5G is also on the horizon, promising ultra-low latency and massive machine-type communications (mMTC) capabilities, which will be critical for next-generation smart grid applications demanding instantaneous control and high-frequency data sampling.

Furthermore, the increased volume and velocity of data generated by AMI networks necessitate the adoption of Edge Computing. Smart meters equipped with edge processing capabilities can perform basic data validation, anomaly detection, and consumption aggregation locally before transmission. This significantly reduces the burden on the central Meter Data Management (MDM) system and lowers communication costs, while also improving response times for critical safety functions like instant remote shut-off. Software technologies, specifically advanced MDM platforms and integrated Artificial Intelligence (AI) and Machine Learning (ML) modules, are crucial for transforming raw data into actionable operational insights related to leak detection, infrastructure optimization, and load forecasting. The convergence of secure hardware, standardized cellular connectivity, and powerful cloud-based analytics defines the current and future technology landscape of smart gas metering.

Regional Highlights

The global smart gas metering market exhibits distinct regional dynamics, largely dictated by regulatory environments, infrastructure maturity, and rates of urbanization. North America, characterized by a highly mature gas infrastructure, focuses heavily on replacement cycles and technology upgrades. Utilities in the United States and Canada are progressively moving away from older Automatic Meter Reading (AMR) systems towards full Advanced Metering Infrastructure (AMI) deployments to enhance data granularity, improve operational safety, and meet cybersecurity standards imposed by federal and state regulators. Investment in this region is primarily driven by the need for advanced features such as remote disconnect/reconnect and integration with emerging smart home ecosystems, securing a stable, yet replacement-driven, market trajectory.

Europe represents one of the largest and most regulated markets globally, propelled by the European Union’s Energy Efficiency Directive and national mandates requiring significant smart meter penetration. Countries like the UK, France, and Italy have been at the forefront of large-scale rollouts. The market in this region is intensely competitive, with vendors adhering strictly to the Measuring Instruments Directive (MID) standards and focusing on providing solutions optimized for complex multi-dwelling units and varying gas network topologies. While the first wave of deployment is maturing, the market remains robust due to ongoing maintenance contracts, second-wave rollouts aimed at achieving 100% penetration, and the eventual necessity for communication module upgrades to future-proof the installed base.

Asia Pacific (APAC) is projected to experience the highest growth rate during the forecast period, driven by rapid urbanization, significant investments in new gas pipeline networks, and government-led initiatives in key economies like China, India, and South Korea. Unlike Europe and North America, APAC often represents a greenfield deployment scenario, allowing utilities to adopt the latest communication standards, particularly NB-IoT, from the outset. China's massive market potential, coupled with India's increasing reliance on natural gas and ambitious city gas distribution (CGD) plans, makes APAC a critical growth region. However, deployment challenges in this region include diverse geographical terrains, varying infrastructure standards, and pricing sensitivity.

The Latin America (LATAM) and Middle East and Africa (MEA) regions are emerging markets showing nascent but growing adoption. In LATAM, factors like combating energy theft and improving billing accuracy are key drivers for deploying smart meters, particularly in urban centers of Brazil and Mexico. The MEA region, heavily reliant on hydrocarbon resources, is focusing on modernizing its domestic energy infrastructure to support smart city concepts and optimize distribution efficiency. Saudi Arabia and the UAE have initiated pilot projects, recognizing the significant potential for non-revenue gas reduction. Growth in these regions is contingent upon stable regulatory frameworks, sustained government funding for infrastructure projects, and partnerships between local utilities and international technology vendors who can provide proven, robust AMI solutions tailored to specific regional climatic and security requirements.

- North America: Focus on AMI upgrades, replacing older AMR systems, driven by cybersecurity and operational efficiency mandates.

- Europe: High penetration driven by EU directives and national mandates; focus now shifting to data optimization and long-term maintenance.

- Asia Pacific (APAC): Highest growth rate; greenfield deployments utilizing NB-IoT in China and India due to massive urbanization and new infrastructure build-out.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets driven by the need to combat gas theft, improve billing accuracy, and support smart city initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Gas Metering Market.- Itron

- Landis+Gyr

- Sensus (a Xylem brand)

- Honeywell International Inc.

- Diehl Metering

- Apator Group

- EDMI Limited

- Aclara Technologies LLC

- Wasion Group

- Goldcard Smart Group Co., Ltd.

- Osaki Electric Co., Ltd.

- Zenner International GmbH & Co. KG

- Sagemcom

- Pietro Fiorentini S.p.A.

- Flonidan A/S

- Linyang Energy

- Siemens AG

- Genus Power Infrastructures Ltd.

- Schneider Electric SE

- Kamstrup A/S

Frequently Asked Questions

Analyze common user questions about the Smart Gas Metering market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between AMR and AMI gas metering systems?

The key distinction lies in communication capability. Automatic Meter Reading (AMR) primarily supports one-way data transmission (utility reads consumption). Advanced Metering Infrastructure (AMI) allows for secure, two-way communication, enabling remote configuration, instant shut-off/reconnect, and real-time network diagnostics essential for smart grid operations.

Which communication technologies are dominating new smart gas meter deployments?

Cellular Low Power Wide Area Network (LPWAN) technologies, specifically Narrowband IoT (NB-IoT) and LTE-M, are leading new deployments. They offer enhanced penetration through concrete/steel, high reliability, long battery life (up to 20 years), and utilize secure, licensed public telecom infrastructure, reducing the need for proprietary RF mesh build-outs.

How does smart gas metering contribute to reducing Non-Revenue Gas (NRG) losses?

Smart meters minimize Non-Revenue Gas (NRG) by providing granular, real-time data that facilitates rapid anomaly detection. AI algorithms instantly flag usage patterns indicative of meter tampering, leaks, or inaccurate measurement, allowing utilities to isolate and repair issues far faster than traditional inspection methods, thereby protecting utility revenue.

What are the greatest barriers to the mass adoption of smart gas meters?

The primary barriers are the high initial capital expenditure (CapEx) required for installing the meters and the entire AMI communication and software ecosystem. Secondary barriers include ensuring robust cybersecurity to protect critical infrastructure and consumer data privacy, as well as managing the complexity of integrating new AMI systems with legacy utility IT platforms.

What role does ultrasonic technology play in modern smart gas meters?

Ultrasonic technology is increasingly replacing traditional mechanical diaphragms. It uses sound waves to measure gas flow, offering significantly higher measurement accuracy, lower maintenance requirements, superior longevity, and greater resistance to magnetic or physical tampering compared to older, purely mechanical metering mechanisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager