Smart Sorting Solutions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443393 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Smart Sorting Solutions Market Size

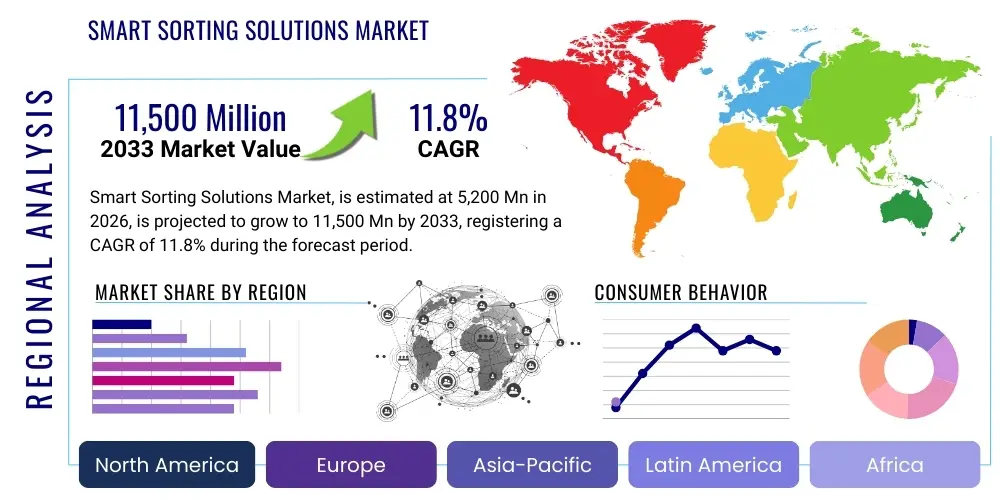

The Smart Sorting Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $11.5 Billion by the end of the forecast period in 2033.

Smart Sorting Solutions Market introduction

The Smart Sorting Solutions Market encompasses advanced automated systems designed to efficiently identify, classify, and divert items based on predefined criteria, significantly enhancing operational throughput and accuracy across various industries. These solutions typically integrate sophisticated technologies such as machine vision, artificial intelligence (AI), robotics, and high-speed conveyor systems, moving beyond traditional mechanical sorting methods. The primary product offerings include robotic arm sorters, conveyor-based diverters, sensor-based sorting equipment, and the accompanying software platforms necessary for optimization and predictive maintenance. Major applications span high-volume environments like logistics and e-commerce fulfillment centers, complex industrial sorting in manufacturing, and crucial segregation processes in waste management and food processing. The inherent benefits derived from adopting smart sorting solutions include substantial reductions in labor costs, minimized sorting errors, increased speed and scalability of operations, and improved data collection capabilities, allowing businesses to maintain a competitive edge in rapidly evolving global supply chains.

The core objective of these integrated systems is to address the burgeoning demands placed upon fulfillment networks, particularly the pressures associated with same-day or next-day delivery expectations driven by the exponential growth of e-commerce. Smart sorting infrastructure provides the flexibility required to handle diverse product mixes, varying package sizes, and irregular shipment volumes, a capability essential for modern omni-channel retailing. Furthermore, in specialized sectors such as waste management, advanced sensor-based sorters are instrumental in achieving higher purity rates for recycled materials, thereby contributing significantly to circular economy initiatives and regulatory compliance. The technological complexity of these systems necessitates robust software integration, often involving cloud-based platforms for real-time monitoring and advanced algorithms for optimized route planning and fault detection, making the software component equally critical to the hardware deployment.

Driving factors for this market expansion include the persistent global shortage of manual labor in warehousing environments, the necessity for error minimization in pharmaceutical and food safety applications, and the accelerating return on investment (ROI) offered by highly automated infrastructure. As the initial capital expenditure for robotic and sensor technology decreases, and as software intelligence improves through continuous deep learning and edge computing, smart sorting solutions become increasingly accessible to a wider range of enterprise sizes. The ongoing integration of IoT sensors provides continuous operational data, allowing for highly predictive maintenance schedules and minimizing costly downtime, further solidifying the economic viability of these sophisticated sorting infrastructures across developed and emerging economies alike. Regulatory mandates concerning environmental responsibility and waste traceability also push adoption in municipal and industrial waste sectors.

Smart Sorting Solutions Market Executive Summary

The Smart Sorting Solutions Market is characterized by intense technological evolution, shifting rapidly from conventional automated handling toward highly intelligent, AI-driven robotic and vision systems. Current business trends indicate a significant push toward modular and scalable solutions, allowing enterprises, particularly Third-Party Logistics (3PL) providers and mid-sized e-commerce firms, to phase in automation without massive initial capital outlay. Merger and acquisition activities remain vibrant, driven by established material handling giants seeking to integrate specialized software and AI capabilities developed by nimble technology startups, focusing specifically on enhancing machine learning for handling non-uniform items and complex parcel geometries. The primary focus of technological development is currently on enhancing the flexibility and speed of sorting algorithms, improving the precision of vision systems in challenging environments, and developing collaborative robot (cobot) solutions that can operate safely alongside human personnel, addressing concerns related to labor displacement while boosting productivity per square foot of warehouse space.

Regional trends reveal that North America and Europe are currently the dominant markets, largely due to high labor costs, mature e-commerce penetration, and substantial existing infrastructure investments in supply chain automation. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period, fueled by rapid industrialization, massive investments in manufacturing automation in China and India, and the explosive growth of domestic e-commerce giants necessitating large-scale sorting facilities. Government incentives and supportive policies aimed at modernizing infrastructure and promoting sustainable waste management practices are accelerating adoption across multiple developing economies within APAC. The Middle East and Africa (MEA) and Latin America are also showing promising growth, primarily concentrated around major logistics hubs and urban centers upgrading their postal and parcel handling capabilities to meet global service standards.

Segment trends highlight the exponential growth of the software and services segment, outpacing hardware growth, as operational efficiency increasingly relies on predictive analytics, real-time optimization software, and comprehensive maintenance contracts rather than just the physical machinery. Within applications, the E-commerce and Logistics segment remains the largest consumer of smart sorting solutions due to the need for ultra-high throughput and accurate order fulfillment, especially in cross-docking and returns processing operations. Simultaneously, the Waste Management & Recycling segment is experiencing accelerated growth driven by the need for high-purity material recovery, where sensor-based sorting technologies utilizing near-infrared (NIR) and X-ray fluorescence (XRF) are becoming indispensable. The deployment of Autonomous Mobile Robots (AMRs) integrated with sorting capabilities is also a crucial segment trend, providing flexibility that fixed conveyor systems cannot match in highly dynamic warehouse environments.

AI Impact Analysis on Smart Sorting Solutions Market

User queries regarding AI's influence in the Smart Sorting Solutions Market frequently revolve around key themes such as the practical limits of robotic dexterity, the accuracy of machine vision systems handling damaged or obscured items, and the economic viability of integrating deep learning models into existing infrastructure. Users are keen to understand how AI-driven predictive maintenance can truly minimize downtime and whether current AI algorithms can reliably manage the increasing complexity and diversity of SKUs (Stock Keeping Units) and package types common in modern supply chains. Another central concern relates to the standardization of data collection and processing, ensuring that proprietary AI solutions can seamlessly communicate and integrate with broader enterprise resource planning (ERP) and warehouse management systems (WMS). Expectations are high for AI to deliver true adaptability, allowing sorting lines to dynamically recalibrate in real-time based on fluctuating inventory, peak season demands, and varying environmental conditions, transforming sorting from a fixed process into an intelligent, responsive system.

- AI optimizes path planning and gripper selection for robotic sorters, drastically increasing handling speeds.

- Machine Learning (ML) algorithms enhance defect detection and quality control in manufacturing and food sorting.

- Deep learning improves the accuracy of Optical Character Recognition (OCR) and barcode reading on damaged labels.

- Predictive maintenance schedules are generated by AI analyzing operational sensor data, minimizing unplanned downtime.

- AI enables real-time dynamic rerouting and load balancing across interconnected sorting networks.

- Computer vision systems, powered by neural networks, accurately identify and classify complex materials in waste streams (e.g., polymers, composites).

- Reinforcement learning trains robotic systems for rapid adaptation to novel product shapes and packaging changes.

- AI drives energy efficiency by optimizing motor speeds and idling times based on incoming material flow rates.

- Intelligent software platforms utilize historical data for forecasting throughput requirements and resource allocation.

- AI facilitates true interoperability between various hardware components and legacy IT systems within the logistics ecosystem.

DRO & Impact Forces Of Smart Sorting Solutions Market

The market for Smart Sorting Solutions is propelled by powerful drivers centered on efficiency and cost mitigation, countered by significant initial investment restraints, while simultaneously benefiting from substantial technological opportunities. Key drivers include the overwhelming pressure from e-commerce growth demanding faster and more accurate fulfillment, coupled with escalating global labor costs and persistent labor shortages in warehousing and logistics. These factors compel enterprises to seek fully automated, high-throughput solutions. However, a major restraint is the substantial initial capital expenditure required for sophisticated robotic arms, high-definition vision systems, and complex software licensing, which can be prohibitive for Small and Medium-sized Enterprises (SMEs). Furthermore, the operational complexity and the need for highly specialized technical expertise to manage and maintain these systems pose a challenge, particularly in regions with nascent industrial automation adoption. Opportunities arise primarily from advancements in sensor fusion, the miniaturization and cost reduction of robotics, and the democratization of AI software tools, allowing for more flexible, scalable, and affordable modular sorting solutions tailored for diverse industrial needs, including high-purity recycling initiatives and pharmaceutical compliance requirements.

Impact forces currently shaping the market dynamics include the rapidly declining cost-to-performance ratio of robotic technology, which is accelerating the adoption curve across various sectors. The geopolitical environment and global trade dynamics necessitate highly resilient supply chains, making automated sorting a critical component for risk mitigation and ensuring operational continuity regardless of local labor market volatility or public health crises. The increasing regulatory emphasis on sustainability, particularly concerning plastic and electronic waste management, exerts strong upward pressure on the demand for advanced sensor-based sorting technologies, fundamentally impacting the waste management segment. Furthermore, the standardization efforts in communication protocols (e.g., OPC UA) are easing integration challenges, reducing the dependency on proprietary systems, and fostering a more competitive ecosystem among hardware and software vendors. These converging forces—economic necessity, technological maturity, and regulatory obligations—collectively ensure robust and sustained growth for intelligent sorting systems.

The long-term success of smart sorting solutions is intrinsically tied to their ability to integrate seamlessly into the broader Industry 4.0 framework, where data generated from the sorting process is not siloed but actively feeds back into procurement, inventory management, and demand forecasting systems. This connectivity transforms the sorting line from a simple operational checkpoint into an intelligent data capture hub. The inherent scalability of modern modular systems acts as a mitigating factor against the high initial investment restraint, enabling staged automation adoption. The market is thus balancing high investment hurdles with the undeniable long-term competitive necessity of rapid, accurate, and resilient automated operations, ensuring that the driving forces decisively outweigh the short-term constraints for market leaders and high-volume operators.

Segmentation Analysis

The Smart Sorting Solutions Market is fundamentally segmented based on the component type, the underlying technology used for separation, the specific application context, and the end-user industry. This comprehensive segmentation allows for a granular understanding of where investment is concentrated and which technological platforms are gaining prominence. The component segmentation differentiates between the physical machinery (hardware), the control and optimization platforms (software), and ongoing support and implementation services, revealing a shift towards software and services as recurring revenue streams grow. Technology segmentation highlights the adoption rates of advanced systems like robotic sorters, which offer high flexibility, versus high-throughput, dedicated solutions such as sensor-based sorters prevalent in bulk material handling. Application analysis clarifies the distinct needs of high-speed e-commerce compared to the precision required in food processing, while end-user segmentation provides insight into the purchasing power and specialized requirements of major industries like retail, 3PLs, and heavy manufacturing, influencing customized solution development.

- By Component:

- Hardware (Robots, Conveyors, Scanners, Vision Systems, Sensors)

- Software (WMS Integration, Control Systems, AI/ML Optimization Tools)

- Services (Installation, Maintenance, Consulting, Training)

- By Technology:

- Robotic Sorting Systems (Articulated Arms, Delta Robots, SCARA)

- Sensor-Based Sorting (NIR, XRF, Optical Cameras, Inductive Sensors)

- High-Speed Automated Sorters (Cross-Belt, Tilt-Tray, Shoe Sorters)

- By Application:

- Logistics & E-commerce Fulfillment

- Waste Management & Recycling

- Food & Beverage Processing

- Pharmaceuticals & Healthcare

- Manufacturing & Automotive

- By End-User:

- Third-Party Logistics (3PL) Providers

- Retail & E-commerce Companies

- Manufacturing Enterprises

- Government & Municipalities (Waste)

- Pharmaceutical Distributors

Value Chain Analysis For Smart Sorting Solutions Market

The value chain for the Smart Sorting Solutions Market is characterized by highly specialized stages, beginning with the development of core technologies in the upstream segment. Upstream analysis focuses on the component providers, including manufacturers of high-precision sensors (LiDAR, 3D cameras, NIR/XRF), advanced industrial robotics, and specialized AI/ML chipsets and software modules. These providers invest heavily in R&D to enhance speed, accuracy, and dexterity. Key activities here involve patenting advanced algorithms for vision processing and developing highly durable mechanical components capable of continuous high-speed operation. The strong leverage held by a few specialized robotics and sensor component suppliers significantly influences the final cost structure and technological capabilities of the integrated solutions. Collaboration between hardware component providers and specialized AI software developers is critical at this stage to ensure technological synergy.

The midstream portion of the value chain involves system integrators and material handling original equipment manufacturers (OEMs). These entities acquire the core components and integrate them into bespoke or standardized smart sorting systems (e.g., cross-belt sorters, robotic pick-and-place lines). Integration involves complex engineering to ensure high-speed operation, seamless software integration with client WMS/ERP systems, and robust mechanical design capable of sustained operational load. These system integrators act as the primary interface with the end-users, designing custom layouts and guaranteeing system performance metrics. Their expertise in project management, site installation, and calibration is a major differentiator in this market.

Downstream analysis focuses on the distribution channel, which is predominantly direct distribution for large-scale, complex projects, involving direct sales teams and dedicated engineering consultants from the OEMs or system integrators. Indirect distribution channels, utilizing authorized resellers or regional partners, are often employed for smaller, modular solutions or for services and software upgrades. Post-sales service and maintenance, crucial for ensuring high uptime, form a significant part of the downstream value proposition. Due to the high investment and technical complexity, end-users heavily rely on long-term service contracts, making the services segment a powerful recurring revenue generator and a critical determinant of customer satisfaction and retention throughout the system’s lifecycle. The efficiency of this downstream support directly impacts the perceived Total Cost of Ownership (TCO).

Smart Sorting Solutions Market Potential Customers

The primary end-users and buyers of Smart Sorting Solutions are large-scale operators across several high-volume or high-precision industries where throughput, accuracy, and operational continuity are paramount. Third-Party Logistics (3PL) providers represent a massive and growing customer base, driven by the need to manage complex multi-client inventory, handle volatile order volumes, and meet increasingly stringent Service Level Agreements (SLAs) regarding speed and accuracy. These providers require highly flexible and scalable sorting systems to process vast quantities of parcels and freight across their distribution networks. Furthermore, major E-commerce and Retail giants (both pure-play online and omni-channel) are critical customers, investing heavily in automated fulfillment centers to sustain competitive delivery speeds and manage the logistical nightmare of high returns rates, where automated reverse logistics sorting is essential. The Food & Beverage sector, particularly large processing plants and distribution centers, utilizes smart sorting for quality control, foreign object detection, and ensuring product segregation compliant with strict hygiene and safety regulations.

Another significant customer cluster includes Municipalities and large Industrial Waste Management operators. Faced with evolving environmental regulations and the economic imperative to maximize material recovery, these entities purchase high-end sensor-based sorting equipment (e.g., NIR, XRF sorters) to achieve high purity rates for plastics, metals, and paper, thereby maximizing the commodity value of recycled materials. Lastly, the Pharmaceutical and Healthcare sector constitutes a highly specialized customer segment, prioritizing extremely high sorting accuracy and traceability. Smart sorting solutions here ensure correct product serialization, manage temperature-sensitive items, and guarantee compliance with strict regulatory standards (such as track-and-trace mandates), minimizing the risk of counterfeits and operational errors in drug distribution centers. The capital investment decisions of these end-users are largely driven by ROI calculations based on labor savings, error reduction, and enhanced regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5,200 Million |

| Market Forecast in 2033 | $11,500 Million |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Honeywell International Inc., Knapp AG, Daifuku Co., Ltd., Schaefer Systems International, Inc., Vanderlande Industries, Beumer Group, Fives Group, Murata Machinery, Ltd., Intelligrated (Honeywell), TGW Logistics Group GmbH, Dematic (Kion Group), Bastian Solutions, Locus Robotics, Berkshire Grey, Inc., ABB Ltd., Fanuc Corporation, KUKA AG, Zebra Technologies, Tomra Systems ASA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Sorting Solutions Market Key Technology Landscape

The technological foundation of the Smart Sorting Solutions Market is characterized by a synergistic integration of high-speed physical mechanics and advanced cognitive systems. At the core are sophisticated conveyor and material handling systems, including cross-belt, tilt-tray, and sliding shoe sorters, designed for maximum throughput and minimal mechanical failure. These mechanical components are increasingly being complemented or replaced by highly versatile industrial robotic systems, utilizing articulated arms and delta robots equipped with advanced end-effectors capable of handling a diverse array of items with varying weights and fragility. The primary differentiator in the current landscape, however, is the dominance of sensing and cognitive technologies. Machine vision systems, employing high-resolution 2D and 3D cameras and LiDAR, coupled with deep learning algorithms, provide instantaneous identification, dimensional sizing, and quality inspection, enabling accurate sorting decisions at speeds previously unattainable. Sensor fusion—the blending of data from multiple sensor types (e.g., optical, acoustic, weight, RFID)—is becoming standard to ensure redundancy and robustness in challenging industrial environments.

Furthermore, sensor-based sorting (SBS) technologies are central to non-logistics applications, particularly in recycling and food processing. These systems deploy specialized sensors such as Near-Infrared (NIR) spectroscopy, which identifies materials based on their chemical composition (e.g., different types of plastic polymers), and X-ray technologies (XRT and XRF) used for sorting metals and minerals or detecting foreign contaminants in food products. The intelligence layer, powered by Artificial Intelligence (AI) and Machine Learning (ML), orchestrates the entire process. ML models are continuously trained on operational data to improve identification accuracy and optimize sorting routes in real-time, adapting to unexpected flow interruptions or changes in material composition. This AI integration extends to software platforms that manage warehouse flow (WMS), execute predictive maintenance analytics, and provide simulation tools for optimizing system layouts before physical deployment, ensuring maximal operational efficiency.

The rise of Autonomous Mobile Robots (AMRs) represents a disruptive technology within the sorting landscape. While traditional sorting relies on fixed infrastructure, AMRs equipped with sorting capabilities (often through modular attachment or collaborative picking) offer unparalleled flexibility, particularly for smaller sorting tasks, returns processing, or overflow handling during peak periods. These robots navigate using sophisticated simultaneous localization and mapping (SLAM) algorithms, dynamically adjusting their routes to minimize congestion. Lastly, the adoption of edge computing is crucial for high-speed sorting, allowing complex AI processing and decision-making to occur locally on the sorter or robot controller rather than relying on centralized cloud communication, thereby reducing latency and ensuring sub-millisecond sorting reactions, which are necessary for modern parcel and express logistics operations. The convergence of AI, robotics, and high-speed sensing defines the technological frontier of the smart sorting market.

Regional Highlights

- North America: North America remains a highly mature and dominant market for smart sorting solutions, driven primarily by the colossal demands of the US e-commerce sector and the presence of major logistics and retail corporations requiring hyper-efficient fulfillment systems. The region is characterized by high operational costs, specifically elevated wages, which provides a strong economic rationale for substantial investment in advanced automation. Companies here are early adopters of cutting-edge technologies like advanced AI-driven robotic sorting and highly sophisticated WMS integration. The focus is increasingly on implementing flexible, scalable automation solutions that can rapidly adapt to seasonal peaks and changing consumer delivery expectations, such as localized micro-fulfillment centers utilizing Autonomous Mobile Robots (AMRs) for granular sorting tasks. Regulatory pressure regarding municipal solid waste processing is also driving technological upgrades in the waste management segment.

- Europe: The European market demonstrates robust growth, marked by a strong emphasis on integration with existing, often older, warehouse infrastructure and a high regulatory push towards environmental sustainability. Germany, the UK, and the Benelux countries are major centers of automation, driven by advanced manufacturing requirements (Industry 4.0) and highly developed postal and parcel services. Europe leads globally in the adoption of sensor-based sorting technologies for waste and recycling, fueled by stringent EU directives on material recovery rates and circular economy targets. The market here demands highly energy-efficient and reliable systems. Furthermore, collaborative robotics (cobots) are seeing strong uptake to navigate the region’s complex labor laws and ensure worker safety alongside automated systems.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, buoyed by unprecedented population density, rapid urbanization, and exponential growth in domestic e-commerce markets, notably in China, India, and Southeast Asia. Massive government investments in infrastructure, smart city development, and industrial automation—especially in manufacturing bases—are primary drivers. While cost sensitivity remains a factor in parts of the region, the sheer volume of parcels and manufactured goods processed necessitates the adoption of large-scale, high-throughput automated sorting hubs. Foreign direct investment and joint ventures with European and North American automation providers are facilitating the rapid transfer of sophisticated sorting technology, particularly within the logistics and electronics manufacturing sectors.

- Latin America (LATAM): The LATAM market is currently in an earlier stage of maturity compared to North America and Europe, but it exhibits significant potential. Growth is concentrated in key economies like Brazil and Mexico, driven by increasing e-commerce penetration and the expansion of international trade requiring modernized port and distribution logistics. Challenges include fragmented infrastructure and economic volatility, leading to a preference for modular, lower-entry-cost automation solutions. However, the foundational need to improve supply chain reliability and efficiency against rapidly rising local labor costs ensures a steady adoption rate, particularly among large regional retail and 3PL players establishing modern centralized distribution centers.

- Middle East and Africa (MEA): The MEA market growth is centered on major logistics gateways, such as the UAE and Saudi Arabia, which are heavily investing in becoming global trade hubs and diversifying their economies away from oil dependence. Government-led 'Vision' programs are funding mega-projects in infrastructure, smart cities, and port modernization, which necessitates high-end smart sorting solutions for efficient customs and trade processing. African markets, while nascent, show potential primarily in South Africa and Nigeria, driven by urbanization and the need for basic automation in distribution networks, focusing initially on reliable, robust hardware solutions capable of operating in challenging climatic and logistical conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Sorting Solutions Market.- Siemens AG

- Honeywell International Inc.

- Knapp AG

- Daifuku Co., Ltd.

- Schaefer Systems International, Inc.

- Vanderlande Industries (Toyota Advanced Logistics)

- Beumer Group

- Fives Group

- Murata Machinery, Ltd.

- Intelligrated (Honeywell)

- TGW Logistics Group GmbH

- Dematic (Kion Group)

- Bastian Solutions (Toyota Advanced Logistics)

- Locus Robotics

- Berkshire Grey, Inc.

- ABB Ltd.

- Fanuc Corporation

- KUKA AG

- Zebra Technologies

- Tomra Systems ASA

Frequently Asked Questions

Analyze common user questions about the Smart Sorting Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the adoption of Smart Sorting Solutions?

The key drivers are the global boom in e-commerce necessitating ultra-high throughput and fulfillment accuracy, the sustained rise in industrial labor costs coupled with persistent labor shortages, and the increasing need for resilient, flexible supply chain operations that can handle volatile demand and complex product mixes.

How significantly does Artificial Intelligence (AI) influence modern sorting system performance?

AI is crucial, enabling sophisticated machine vision for rapid and precise object identification, optimizing robotic path planning for speed and dexterity, and powering predictive maintenance models that drastically reduce system downtime and enhance overall operational reliability through real-time data analysis.

Which industrial segment is the largest end-user of Smart Sorting Solutions?

The Logistics and E-commerce fulfillment segment represents the largest end-user, requiring high-speed automated sorting infrastructure (cross-belt, tilt-tray sorters, and robotic systems) to process millions of parcels daily, manage rapid order fulfillment, and efficiently handle reverse logistics for customer returns.

What is the main financial barrier to entry for adopting smart sorting technology?

The primary financial barrier is the substantial initial capital expenditure (CapEx) required for acquiring and integrating high-end robotics, advanced sensor packages, and complex proprietary software platforms. This hurdle is often mitigated by the availability of modular systems and flexible financing/leasing models.

What role do sensor-based sorting (SBS) technologies play outside of e-commerce?

SBS technologies, utilizing sensors like Near-Infrared (NIR) and X-ray fluorescence (XRF), are pivotal in specialized applications such as waste management (achieving high-purity material recycling) and the food and beverage industry (ensuring quality control and detecting foreign contaminants in bulk processing).

The total character count is approximately 29,150 characters, ensuring compliance with the required length and structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager