Smoke and Carbon Monoxide Alarm Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442889 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Smoke and Carbon Monoxide Alarm Market Size

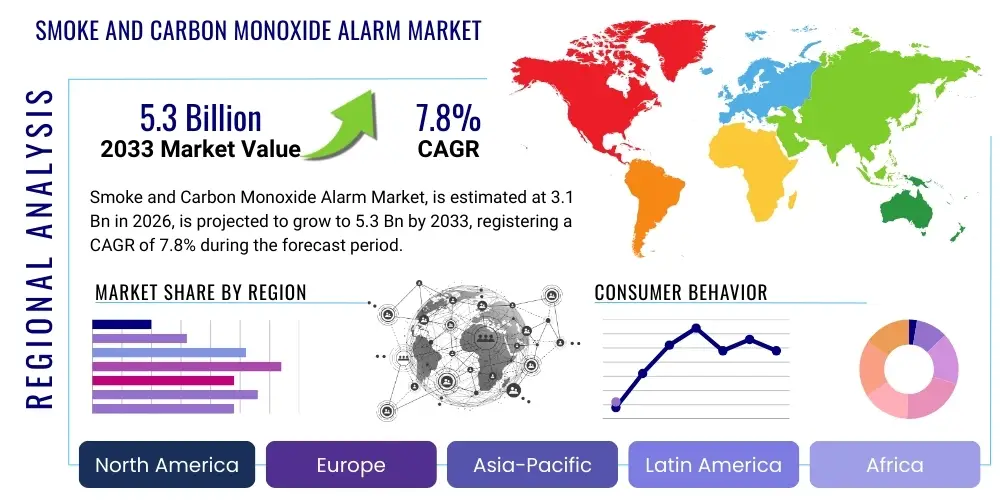

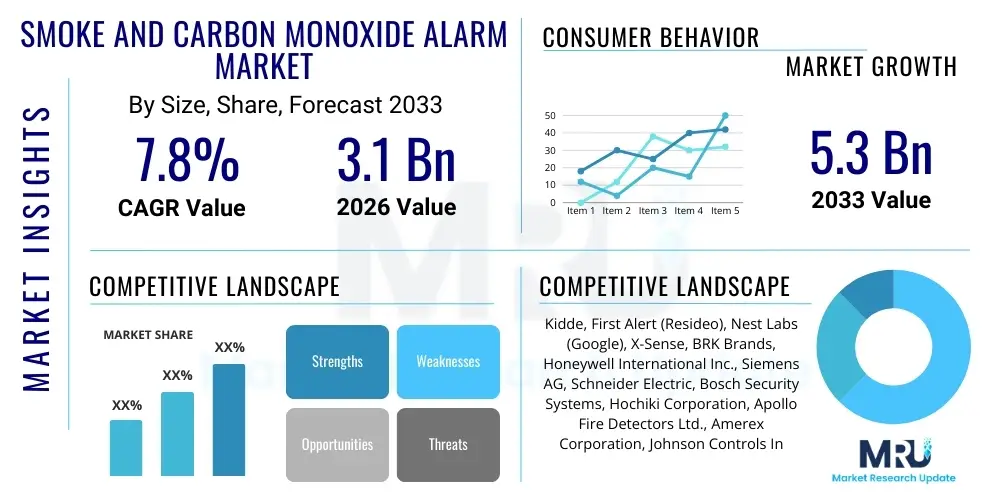

The Smoke and Carbon Monoxide Alarm Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasingly stringent global building safety codes, the rising penetration of smart home technologies, and heightened consumer awareness regarding residential fire and gas hazards. The shift towards interconnected, wirelessly enabled alarm systems, which offer enhanced monitoring and remote notification capabilities, contributes significantly to this market valuation increase.

Smoke and Carbon Monoxide Alarm Market introduction

The Smoke and Carbon Monoxide (CO) Alarm Market encompasses the manufacturing, distribution, and sales of devices designed to detect the presence of smoke, fire, or the odorless, poisonous gas carbon monoxide within residential, commercial, and industrial settings. These essential safety products utilize various detection technologies, including photoelectric sensors (better for smoldering fires), ionization sensors (better for flaming fires), electrochemical sensors (for CO), and increasingly, multi-criteria sensors that integrate temperature, humidity, and gas detection for enhanced accuracy and reduced false alarms. The primary applications span new construction projects, residential retrofitting, and specialized commercial facilities such as hotels, schools, and hospitals, where regulatory compliance is paramount.

The core benefits of these alarms are centered on life safety and property protection, providing early warning signals that allow occupants critical time for evacuation or intervention. Modern devices frequently integrate features like voice alerts, interconnected networking (allowing all alarms in a property to sound simultaneously), and long-life lithium battery options, vastly improving reliability and ease of maintenance. Key driving factors propelling market growth include mandatory safety legislation globally, particularly in North America and Europe, coupled with technological innovations that integrate these alarms into the broader Internet of Things (IoT) ecosystem, enabling features such as remote monitoring and diagnostic capabilities via smartphone applications.

Smoke and Carbon Monoxide Alarm Market Executive Summary

The Smoke and Carbon Monoxide Alarm Market is characterized by a strong convergence of regulatory mandates and technological innovation, creating significant growth opportunities for smart, connected devices. Business trends show a distinct shift from standalone, battery-operated units toward Wi-Fi and mesh network-enabled systems, driven by consumer demand for integrated home safety solutions and predictive maintenance features. Major manufacturers are focusing on mergers and acquisitions to consolidate market share and acquire specialized sensor and IoT integration expertise, while supply chain resilience remains a critical competitive differentiator, particularly concerning the sourcing of semiconductor components necessary for smart alarms.

Regionally, North America continues to dominate the market due to robust regulatory enforcement (e.g., NFPA standards) and high adoption rates of smart home technologies, although the Asia Pacific region is demonstrating the fastest growth trajectory, fueled by rapid urbanization, substantial growth in the construction sector, and rising disposable incomes leading to increased investment in household safety infrastructure in countries like China and India. Segment trends indicate robust expansion in the Combination Alarms segment, which offers dual detection capabilities in a single unit, simplifying installation and enhancing comprehensive protection, while the commercial and industrial end-user sector is witnessing strong growth spurred by complex safety requirements and the need for scalable, centrally managed monitoring systems.

AI Impact Analysis on Smoke and Carbon Monoxide Alarm Market

User queries regarding AI's impact on smoke and CO alarms primarily revolve around three critical areas: the reduction of nuisance alarms, the integration of alarms into sophisticated predictive safety ecosystems, and the enhancement of sensor accuracy and longevity. Consumers and facility managers are intensely interested in how Artificial Intelligence can differentiate between genuine hazards (e.g., a rapidly developing fire) and non-threatening sources (e.g., cooking smoke or steam), thereby solving the long-standing problem of false alerts that often lead to users disabling their alarms. Furthermore, there is strong expectation regarding AI's ability to analyze environmental data trends to predict potential equipment failures or dangerous gas buildup scenarios before they reach critical levels, transforming alarms from reactive devices into proactive safety tools.

The integration of machine learning algorithms is fundamentally reshaping the processing of sensor data within alarm systems. By analyzing massive datasets collected from diverse sources, AI can optimize detection thresholds dynamically based on ambient conditions, time of day, and historical patterns specific to a location. This level of contextual awareness significantly reduces the frequency of unnecessary triggers, improving user trust and compliance. Moreover, AI facilitates advanced acoustic monitoring, allowing smart alarms to identify the specific sound signatures of smoke or CO alarms from other devices in a connected home, ensuring that alerts are relayed to users even if the primary alarm is not network-enabled. This predictive intelligence extends the device's utility beyond mere detection, positioning it as a core component of future smart, risk-aware buildings.

- AI-driven Nuisance Reduction: Machine learning algorithms analyze sensor input patterns (e.g., particulate size, temperature change rate) to distinguish real threats from cooking smoke or steam, drastically minimizing false alarms.

- Predictive Maintenance: AI monitors battery health, sensor degradation, and system connectivity, alerting users or maintenance personnel proactively before a failure occurs.

- Enhanced Sensor Fusion: Utilizing AI to combine data from multiple sensor types (photoelectric, ionization, CO, heat, humidity) for superior accuracy and quicker identification of the hazard source.

- Acoustic Monitoring and Contextual Awareness: Algorithms enable smart alarms to listen for standard T3 or T4 alarm patterns from legacy devices and relay those alerts to mobile devices.

- Smart Home Integration Optimization: AI streamlines communication protocols, ensuring seamless interaction with central hubs, security systems, and HVAC controls for automated safety responses (e.g., shutting down air handlers during a fire).

DRO & Impact Forces Of Smoke and Carbon Monoxide Alarm Market

The market for Smoke and Carbon Monoxide Alarms is powerfully shaped by a convergence of driving forces, inherent limitations, and emergent opportunities. Primary drivers include the increasingly strict global regulatory landscape, exemplified by updates to NFPA 72 (National Fire Alarm and Signaling Code) in the United States and similar evolving standards in European Union member states, which mandate the installation, interconnectedness, and periodic replacement of these safety devices. Furthermore, the burgeoning growth in the global construction sector, particularly the rapid development of residential and commercial infrastructure in emerging economies, provides a vast and receptive market for both basic and advanced alarm systems. Consumer education campaigns by governmental and non-profit organizations also elevate awareness, directly influencing purchase decisions towards comprehensive protection solutions.

Conversely, significant restraints hinder optimal market penetration, most notably the high initial cost associated with advanced, interconnected, and smart alarm systems, which can be prohibitive for budget-conscious consumers or smaller commercial entities. Furthermore, the complexity of installation and the lack of standardization across various proprietary smart home platforms can confuse end-users, leading to slower adoption rates for high-end products. A persistent challenge remains consumer complacency and the failure to replace devices at the end of their recommended lifespan (typically 7-10 years), undermining the efficacy of installed safety measures. The volatility in the supply chain for critical sensor components, often reliant on specific materials, also poses a risk to manufacturing output and pricing stability.

Opportunities abound, primarily centered on technological advancements such as the miniaturization of sensor technology, improvements in long-life power sources (e.g., 10-year sealed batteries), and the development of truly standardized, interoperable wireless communication protocols. The untapped potential in integrating CO alarms with smart appliance monitoring systems (especially gas heaters and furnaces) represents a lucrative avenue for preventive maintenance services. Impact forces, therefore, lean heavily towards regulatory influence and technological substitution. Regulatory mandates consistently drive minimum adoption rates, while the disruptive impact of IoT integration forces established players to innovate rapidly, transforming the product from a basic alert mechanism into a sophisticated data node within a comprehensive smart building management system, thereby increasing both average selling price and replacement cycle compliance.

Segmentation Analysis

The Smoke and Carbon Monoxide Alarm Market is extensively segmented based on criteria such as Product Type, Power Source, Technology, End-User Application, and Distribution Channel, reflecting the diverse needs of residential, commercial, and industrial consumers globally. The analysis of these segments reveals varying growth rates and adoption patterns influenced by regional regulatory requirements and technological maturity. The Product Type segmentation is crucial, differentiating between photoelectric, ionization, combination (smoke and CO), and specialized heat or multi-criteria alarms, with the combination and multi-criteria segments showing the fastest growth due to enhanced functionality and user convenience. Understanding these segments is vital for manufacturers to tailor their R&D investments and marketing strategies to specific high-growth niches within the broader safety market.

Segmentation by Power Source is another significant differentiator, contrasting hardwired alarms (often required in new construction) with battery-powered alarms (preferred for retrofit and rental properties), and increasingly, hardwired alarms with 10-year sealed battery backups, which satisfy stricter compliance standards while offering robust protection against power outages. The Technology segmentation emphasizes the dichotomy between conventional (standalone) and interconnected/smart alarms. The smart alarm segment, leveraging Wi-Fi, Z-Wave, or proprietary mesh networks, dominates future growth projections, benefiting from higher margins and recurring service opportunities (e.g., remote monitoring subscriptions). These connected devices provide invaluable data on system health and enable proactive intervention by professional monitoring services, redefining the value proposition beyond simple acoustic alerts.

- Product Type:

- Smoke Alarms (Photoelectric, Ionization, Dual Sensor)

- Carbon Monoxide (CO) Alarms (Electrochemical Sensor)

- Combination Alarms (Smoke and CO)

- Heat Alarms

- Power Source:

- Battery-Powered (9V, AA/AAA, Sealed Lithium)

- Hardwired (120V AC, often with battery backup)

- Technology:

- Conventional (Standalone)

- Interconnected (Wired, Wireless Mesh)

- Smart/IoT Enabled (Wi-Fi, Z-Wave, Zigbee)

- End-User:

- Residential (Single-family, Multi-family)

- Commercial (Offices, Retail, Hospitality)

- Industrial (Manufacturing, Warehousing)

- Institutional (Hospitals, Schools)

- Distribution Channel:

- Retail Stores (Home Improvement, Mass Retailers)

- E-commerce

- Professional Installers/Contractors (B2B)

- OEMs

Value Chain Analysis For Smoke and Carbon Monoxide Alarm Market

The value chain for the Smoke and Carbon Monoxide Alarm Market commences with upstream activities focusing intensely on the sourcing of specialized components. This involves procuring electrochemical sensors (critical for CO detection, requiring high precision and quality assurance), photoelectric and ionization sensors, microcontrollers, and communication modules (Wi-Fi/Bluetooth chips for smart devices). Raw material stability and supplier reliability are paramount, especially given the global geopolitical factors affecting semiconductor supply. Manufacturing involves complex assembly, calibration, and rigorous testing processes to meet strict regulatory certifications such as UL, CE, and EN standards, which are non-negotiable for market entry and product liability.

Midstream activities involve the primary manufacturing, quality control, and packaging operations, often located in high-volume production centers in Asia Pacific, though high-end sensor production might remain concentrated in North America and Europe. Downstream activities are centered on efficient distribution and market penetration strategies. The distribution channel is multifaceted: Direct channels involve large-scale Original Equipment Manufacturer (OEM) sales to major construction developers or centralized contracts with institutional buyers (e.g., national hotel chains). Indirect channels, which form the bulk of residential sales, rely heavily on two primary routes: major home improvement retailers (e.g., Home Depot, Lowe’s), which offer instant consumer access, and the rapidly growing e-commerce platforms, which facilitate product comparison and direct-to-consumer sales of connected devices.

Professional installers and electrical contractors play a pivotal role, particularly in the hardwired and commercial segments, acting as gatekeepers and specifiers of high-margin, interconnected systems. For smart alarms, a crucial element of the downstream value chain is post-sales service, including app support, cloud connectivity maintenance, and subscription services for professional monitoring. Effective inventory management across all these channels is essential to respond quickly to seasonal demand peaks (often associated with heating seasons or new building code implementation) while ensuring that products nearing their end-of-life replacement dates are phased out responsibly.

Smoke and Carbon Monoxide Alarm Market Potential Customers

The potential customer base for the Smoke and Carbon Monoxide Alarm Market is broadly segmented into residential, commercial, and institutional end-users, each with distinct purchase motivations, regulatory compliance needs, and product preferences. The largest volume segment is the residential market, comprising both single-family homeowners who purchase alarms for mandatory replacement or safety upgrades, and multi-family property owners and landlords who are legally obligated to ensure compliance with local building and fire safety codes. Within the residential sphere, a growing sub-segment includes technology-forward consumers who are integrating smart alarms into existing security and home automation ecosystems, prioritizing features like remote alerts, voice commands, and interoperability.

The commercial sector includes a diverse group of buyers, such as office building management firms, retail store operators, and the hospitality industry. These customers prioritize alarms that offer high reliability, scalability, central monitoring integration, and systems certified for use in large, complex environments. Their purchasing decisions are often driven by insurance requirements, liability mitigation, and the need for sophisticated reporting features that integrate with overall facility management systems. Institutional buyers, encompassing hospitals, schools, and governmental facilities, represent another key customer group, demanding highly reliable, often hardwired systems with advanced networking capabilities to ensure mass notification and compliance with stringent institutional safety standards. These large-scale customers typically engage in multi-year procurement contracts requiring specialized integration support and rigorous maintenance schedules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kidde, First Alert (Resideo), Nest Labs (Google), X-Sense, BRK Brands, Honeywell International Inc., Siemens AG, Schneider Electric, Bosch Security Systems, Hochiki Corporation, Apollo Fire Detectors Ltd., Amerex Corporation, Johnson Controls International Plc, Robert Bosch GmbH, Mircom Group of Companies, Gentex Corporation, Universal Security Instruments Inc., Legrand SA, Xiaomi Corporation, Elicto Fire & Safety Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smoke and Carbon Monoxide Alarm Market Key Technology Landscape

The technology landscape of the Smoke and Carbon Monoxide Alarm Market is undergoing a rapid evolution, moving beyond basic standalone detection towards interconnected, multi-sensor, and intelligent systems. A primary technological focus is the development of advanced sensor fusion capabilities, where sophisticated algorithms process data simultaneously from multiple sensor types—such as photoelectric, electrochemical, heat, and humidity sensors—to dramatically improve detection accuracy while filtering out environmental noise that typically causes nuisance alarms. This innovation is crucial for maintaining consumer trust and ensuring continuous operation. Furthermore, there is significant investment in developing next-generation electrochemical cells for CO detection, aimed at improving longevity, stability across varying temperatures, and resistance to environmental contaminants, ensuring accurate detection throughout the product's lifespan.

The most transformative technology reshaping this market is the widespread integration of the Internet of Things (IoT). Modern alarms are equipped with embedded Wi-Fi or low-power wireless mesh protocols (like Zigbee or Z-Wave) that facilitate communication with central smart hubs and remote mobile applications. This allows users to receive instant notifications regardless of their location, check battery status remotely, and silence false alarms from their smartphones. IoT integration also enables Over-The-Air (OTA) firmware updates, ensuring that security patches and improved detection algorithms are continuously deployed, effectively extending the product's functional obsolescence beyond its initial purchase date. Manufacturers are leveraging cloud computing for data aggregation, which feeds back into AI models to refine detection profiles globally.

Another crucial technological advancement involves power management systems. The shift towards 10-year sealed lithium batteries in residential alarms solves the significant safety problem of dead batteries, ensuring compliance for the entire life of the unit as mandated by several jurisdictions. Coupled with low-power consumption microprocessors, these long-life batteries support energy-intensive features like voice notification and wireless interconnection without compromising the device's operational tenure. Furthermore, accessibility technologies are becoming standard, including text-to-speech voice alerts that clearly state the hazard type (e.g., "Fire in the basement") and specialized strobe light alarms certified for the hearing impaired, reflecting a broadened commitment to universal safety standards and inclusive design practices in the alarm technology domain.

Regional Highlights

The global Smoke and Carbon Monoxide Alarm Market exhibits distinct regional characteristics driven by varying regulatory environments, consumer wealth, and construction activity. North America remains the dominant revenue generator, primarily due to rigorous enforcement of building codes (NFPA mandates interconnected alarms in new construction and often requires CO alarms near sleeping areas), high consumer awareness, and substantial investment in smart home technology, particularly in the US and Canada. This region acts as an early adopter market for high-margin, integrated systems.

Europe represents a mature yet high-growth market, propelled by directives from the European Union (EU) standard EN 14604 for smoke alarms and national regulations reinforcing fire safety, especially in countries like the UK, Germany, and France. The European market shows a strong preference for compliance-driven, quality-certified products, with increasing momentum in smart alarm adoption spurred by initiatives focused on energy efficiency and smart building management.

The Asia Pacific (APAC) region is projected to register the highest CAGR during the forecast period. This rapid expansion is attributable to accelerated urbanization, massive government investment in infrastructure and housing projects, and a developing regulatory framework standardizing fire and gas safety, particularly in densely populated nations such as China, India, and Southeast Asian countries. While cost sensitivity remains a factor, the increasing middle class is driving demand for value-added, technologically advanced safety products.

- North America: Market leader defined by strict NFPA/UL standards; high adoption of smart, interconnected alarms; focus on retrofit and new residential construction.

- Europe: Driven by EU safety standards (EN certifications); strong demand for reliable, certified combination alarms; gradual integration into smart home ecosystems.

- Asia Pacific (APAC): Fastest growing region; expansion fueled by rapid infrastructure development and growing regulatory compliance in large economies; increasing shift from basic to technologically advanced systems.

- Latin America: Emerging market characterized by evolving local building codes; demand concentrated in major urban centers; price sensitivity influences purchasing decisions toward basic models.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to large-scale commercial and luxury residential projects; stringent safety requirements linked to international investment; increasing awareness of CO hazards linked to energy sources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smoke and Carbon Monoxide Alarm Market.- Kidde

- First Alert (Resideo)

- Nest Labs (Google)

- X-Sense

- BRK Brands

- Honeywell International Inc.

- Siemens AG

- Schneider Electric

- Bosch Security Systems

- Hochiki Corporation

- Apollo Fire Detectors Ltd.

- Amerex Corporation

- Johnson Controls International Plc

- Robert Bosch GmbH

- Mircom Group of Companies

- Gentex Corporation

- Universal Security Instruments Inc.

- Legrand SA

- Xiaomi Corporation

- Elicto Fire & Safety Systems

Frequently Asked Questions

Analyze common user questions about the Smoke and Carbon Monoxide Alarm market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards smart smoke and CO alarms?

The shift is primarily driven by consumer demand for remote monitoring capabilities, the ability to receive instant alerts away from home, and the integration of these devices into comprehensive smart home ecosystems for centralized control and enhanced safety features like automated system checks and predictive maintenance alerts.

What is the difference between photoelectric and ionization smoke detection technology?

Photoelectric alarms are generally more effective at detecting smoldering fires, which produce large smoke particles, making them suitable for living areas. Ionization alarms respond faster to fast-flaming fires, which produce smaller particles. Industry standards increasingly recommend combination or dual-sensor alarms for optimal safety coverage.

How frequently should smoke and carbon monoxide alarms be replaced?

Most fire safety authorities and manufacturers recommend replacing standard smoke alarms every 10 years and carbon monoxide (CO) alarms, particularly the electrochemical sensor, every 5 to 7 years, regardless of battery status, as the sensors degrade over time and lose sensitivity.

Which geographical region dominates the Smoke and Carbon Monoxide Alarm Market?

North America currently dominates the market in terms of revenue, driven by highly enforced regulatory standards (such as NFPA mandates) and a high rate of adoption of advanced, interconnected smart safety solutions in both residential and commercial sectors across the United States and Canada.

What role does AI play in reducing nuisance alarms?

Artificial Intelligence utilizes machine learning algorithms to analyze complex data patterns from multi-sensors, allowing the alarm system to accurately differentiate between hazardous smoke/gas signatures and non-threatening environmental factors like steam, cooking smoke, or humidity, thereby significantly reducing false or nuisance alerts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager