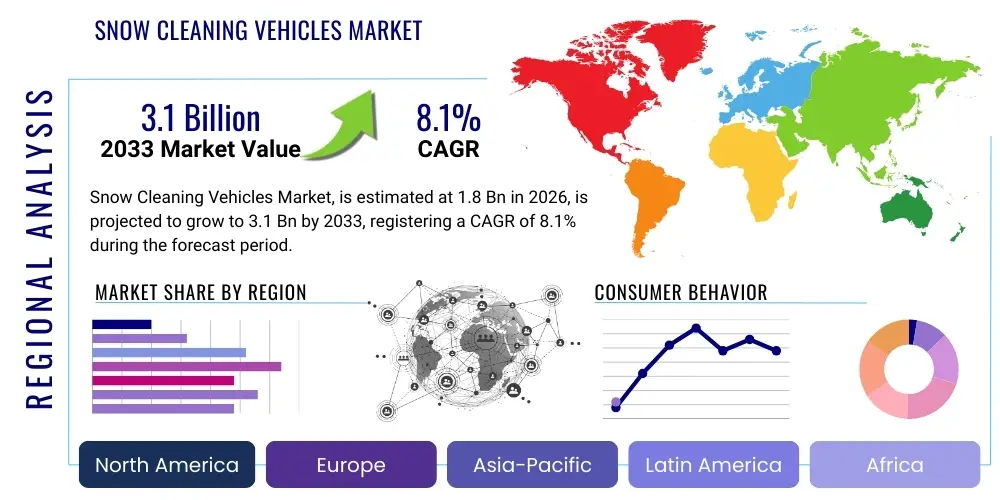

Snow Cleaning Vehicles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442440 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Snow Cleaning Vehicles Market Size

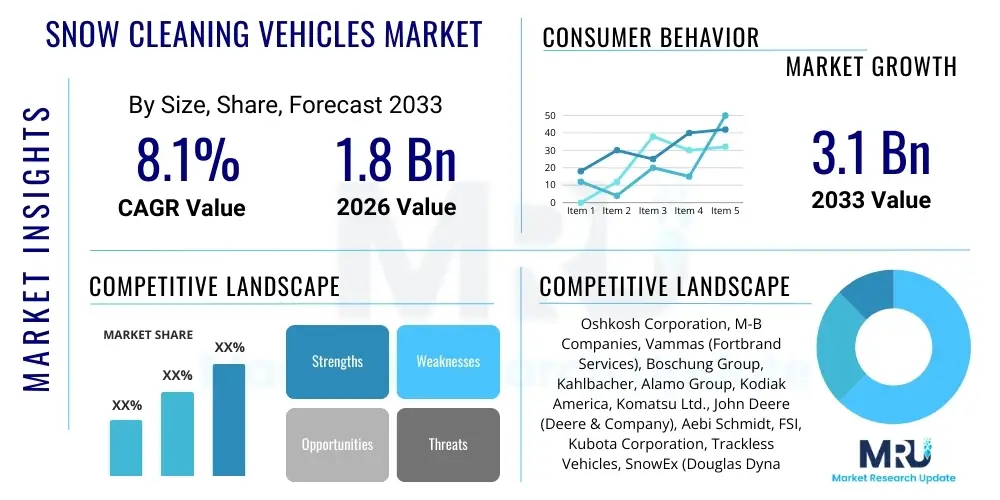

The Snow Cleaning Vehicles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Snow Cleaning Vehicles Market introduction

The Snow Cleaning Vehicles Market encompasses a specialized range of machinery designed for the efficient and safe removal of snow and ice from essential infrastructure, including roadways, runways, airport aprons, railways, and commercial properties. These specialized machines, which include sophisticated snowplows, high-capacity snow blowers, specialized rotary snow removers, and multifunctional sweepers, are critical components of winter operational readiness in regions experiencing significant snowfall. The necessity for rapid clearance stems directly from stringent public safety standards, the economic imperative to maintain transportation and logistical continuity, and the increasing complexity of urban and international transport networks where even short delays can incur massive economic losses. Continuous innovation in hydraulic systems, material science for durable blades, and precision navigation technologies define the competitive landscape of this niche yet vital industry.

Technological advancement is rapidly redefining the functionality and operational capacity of modern snow cleaning vehicles. Traditional diesel-powered vehicles are increasingly being complemented or replaced by hybrid and fully electric models, driven by global mandates toward decarbonization and the need for lower operational noise, particularly in densely populated urban centers or night-time airport operations. Furthermore, the integration of telematics and real-time operational monitoring systems allows fleet managers to optimize deployment strategies, track operational efficiency, and perform predictive maintenance, thereby maximizing uptime during critical weather events. The demand for robust, high-speed, and environmentally compliant vehicles is particularly acute in critical infrastructure sectors like aviation, where regulatory compliance dictates extremely tight clearance timelines.

The major applications of snow cleaning vehicles span across governmental entities responsible for public road networks (municipalities, state/provincial departments of transportation), large private enterprises managing extensive logistical hubs (like ports and major retail chains), and, most critically, major international airports which require the highest level of snow removal performance. Key benefits derived from these vehicles include enhanced public safety by reducing accident risks associated with icy conditions, assured economic continuity by keeping supply chains and commuter routes open, and efficient resource utilization enabled by automated and high-throughput machinery. Driving factors are predominantly climate change variability leading to unpredictable severe weather events, mandatory public safety regulations, and continuous infrastructure expansion in cold climate regions.

Snow Cleaning Vehicles Market Executive Summary

The Snow Cleaning Vehicles Market is experiencing significant transformation, characterized by robust growth in both developed winter economies and emerging regions investing heavily in infrastructure resilience. A prominent business trend involves strategic partnerships between original equipment manufacturers (OEMs) and software providers to integrate sophisticated data analytics and autonomous capabilities into next-generation snow clearing fleets. The emphasis on 'smart snow management' is shifting the market from basic machinery toward comprehensive, system-level solutions that encompass sensors, real-time weather integration, and optimized route planning. Furthermore, consolidation among key players is evident as companies seek to expand their portfolio breadth, covering everything from compact residential units to massive runway clearing equipment, thereby achieving economies of scale necessary for large public sector contracts.

Regional trends clearly indicate that North America and Europe remain the foundational hubs for market revenue, primarily driven by long-established infrastructure maintenance budgets, stringent winter road safety regulations, and the rapid uptake of advanced machinery, including electric and autonomous prototypes. However, the Asia Pacific (APAC) region, particularly countries like China and South Korea, is emerging as a high-potential growth area. This surge is fueled by massive infrastructure projects in historically temperate regions now dealing with erratic winter weather and the need to modernize existing snow removal fleets that rely on older, less efficient technology. In MEA and Latin America, market penetration remains low but is witnessing specialized growth in high-altitude zones or areas previously unprepared for increased climate volatility, often driven by international donor projects or specific government mandates for critical transport corridors.

Segment trends highlight a strong shift toward Snow Blowers/Throwers and Rotary Snow Removers, especially for high-volume applications like airports and major highways, due to their superior efficiency in handling deep and compacted snow. The End-Use segment is dominated by Municipalities/Government sectors, which represent the largest procurement bodies globally, but the Airports segment is exhibiting the highest growth rate, fueled by strict international aviation standards (IATA, FAA) demanding zero-tolerance for operational delays due to snow. In terms of power source, while diesel retains the majority share for heavy-duty tasks, the Electric/Hybrid segment is the fastest evolving, responding directly to governmental sustainability targets and urban noise abatement policies, signaling a profound long-term shift in fleet composition.

AI Impact Analysis on Snow Cleaning Vehicles Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Snow Cleaning Vehicles Market primarily revolve around operational efficiency gains, safety enhancements through reduced human error, and the feasibility of large-scale autonomous deployment in unpredictable winter conditions. Users frequently ask: "How accurately can AI predict optimal plowing routes based on real-time snowfall intensity?" and "What are the regulatory hurdles and safety redundancies required for autonomous snowplows on public roads?" Key themes emerging from these questions include the desire for predictive maintenance using machine learning, which minimizes costly breakdowns during critical periods, and the expectation that AI-driven sensor fusion will overcome visibility challenges posed by blizzards, ensuring continuous operation where human limits are reached. There is strong user expectation that AI will transition snow removal from a reactive service to a proactive, highly optimized logistical operation, transforming labor utilization and fuel efficiency metrics across entire municipal fleets.

The most immediate and impactful role of AI is in enhancing operational intelligence, moving beyond simple GPS tracking to true prescriptive route optimization. AI algorithms ingest vast amounts of data—including real-time weather radar, traffic flow, road temperature sensors, and vehicle performance metrics—to dynamically adjust plowing paths, material application rates (salt/brine), and vehicle deployment density. This sophisticated decision-making capability ensures that resources are allocated precisely where they are needed most urgently, minimizing resource waste and maximizing road clearance effectiveness. For example, machine learning models can predict localized icing conditions hours in advance, allowing preventative treatment to occur before conditions become hazardous, a crucial safety improvement over purely reactive strategies.

Furthermore, AI is foundational to the development of fully autonomous and semi-autonomous snow cleaning vehicles, which represents the long-term future of the industry, particularly in controlled environments such as airport runways and large industrial complexes. AI-powered sensor fusion (combining LiDAR, radar, thermal imaging, and high-definition cameras) allows the vehicle to perceive its surroundings accurately, even during whiteout conditions where conventional sensors fail. Although full autonomy on public roads faces significant regulatory and ethical challenges, AI-driven driver assistance systems—such as obstacle avoidance, automated lane keeping, and precision spreading control—are already significantly reducing operator fatigue and increasing the precision of snow removal operations, thereby enhancing overall safety and consistency.

- AI-driven route optimization and resource deployment based on predictive weather modeling.

- Enhanced sensor fusion (LiDAR, Radar, Thermal) enabling autonomous operation in low visibility (whiteout) conditions.

- Machine learning for predictive maintenance, anticipating component failure before critical winter periods.

- Autonomous spreading systems optimizing de-icing material application, reducing environmental impact and material costs.

- Real-time monitoring and anomaly detection to ensure operator safety and compliance with clearance protocols.

DRO & Impact Forces Of Snow Cleaning Vehicles Market

The market dynamics are defined by a complex interplay of environmental necessity, regulatory demands, technological innovation, and inherent operational restraints specific to severe weather machinery. The primary driver is the increasing unpredictability and severity of winter storms globally, which places immense pressure on governmental bodies and commercial entities to invest in more reliable and higher-capacity snow removal assets. Simultaneously, strict governmental and airport regulatory mandates regarding road safety and operational uptime force continuous fleet modernization and investment in advanced technologies. Restraints center mainly around high initial capital expenditure for specialized vehicles, the cyclical and weather-dependent nature of demand leading to volatile sales cycles, and the shortage of skilled, certified operators capable of handling increasingly complex machinery. Opportunities lie in the accelerated trend toward electrification and autonomy, especially in urban noise-sensitive areas, and the penetration of advanced telematics and smart city infrastructure integration, offering manufacturers new revenue streams through data services and sophisticated fleet management solutions. These forces exert a significant collective impact, skewing investment toward efficiency and compliance.

Drivers: A key market driver is the necessity for economic resilience; major infrastructure, especially airports and critical logistical choke points, cannot afford downtime. This necessity translates into substantial government spending on heavy-duty, high-performance equipment that guarantees rapid clearance times, adhering to international standards (e.g., FAA Advisory Circulars for airports). Furthermore, public demand for high-quality, safe road conditions year-round, reinforced by legal liability concerns for municipalities, ensures consistent budget allocation for fleet upgrades. The regulatory environment also plays a vital role, with stricter emissions standards (e.g., Tier 4 Final, Euro Stage V) forcing procurement cycles to adopt newer, cleaner-burning, or electric models, creating a constant demand for replacement units.

Restraints: The most prominent restraint is the high cost of specialized snow cleaning vehicles, which utilize rugged components, complex hydraulic systems, and increasingly expensive sensor suites for autonomous readiness. This high cost often limits procurement, particularly for smaller municipalities or residential service providers. Another significant challenge is the seasonal nature of the business; demand peaks sharply during winter preparation periods, leading to potential manufacturing bottlenecks and inventory management difficulties for OEMs. Moreover, the long lifespan of existing conventional vehicles (often 15-20 years) delays replacement cycles unless environmental regulations or technology mandates accelerate the need for modernization, thus slowing market volume growth.

Opportunity: Major opportunities are emerging from the integration of snow clearing services into broader smart city infrastructure projects. This allows vehicles to communicate with traffic systems, weather stations, and other municipal assets for highly coordinated operations. The shift towards battery-electric vehicles (BEVs) is a massive opportunity, driven by improving battery density and reduced maintenance costs, appealing strongly to public fleets focused on long-term sustainability and operational savings. Finally, geographic expansion into regions previously underserved or newly affected by climate volatility—such as transitional climate zones in Asia and Eastern Europe—provides new untapped markets for medium-duty equipment and service contracts.

Segmentation Analysis

The Snow Cleaning Vehicles Market is broadly segmented based on vehicle type, end-use application, power source, and operational modality, reflecting the diverse needs across municipal, commercial, and airport sectors. The differentiation in vehicle design is dictated primarily by the volume and density of snow removal required, ranging from articulated loaders equipped with standard plows for city streets to specialized rotary snow removers designed for clearing heavy drifts and high-speed multi-lane highways. Understanding these segments is crucial for OEMs to target product development, ensuring specialized solutions meet the high performance, durability, and safety standards demanded by specific applications, such as the zero-fault tolerance required for airport runway operations versus the cost efficiency needed for residential maintenance.

Analyzing the segmentation by end-use highlights the dominance of the government and municipal sector, which dictates the overall market size and stability, procuring a mix of heavy-duty plows and versatile truck-mounted equipment. However, the commercial and airport segments are characterized by faster adoption of premium, technology-intensive solutions, driven by competitive pressures to minimize business interruption and regulatory compliance. Airports, in particular, invest heavily in highly specialized equipment known for wide swaths and rapid deployment, often utilizing dedicated runway sweepers and high-speed blowers that prioritize speed over maneuverability, justifying the premium price points associated with this critical infrastructure.

Furthermore, segmentation by power source illustrates the ongoing energy transition within heavy equipment. While traditional diesel powertrains offer the necessary torque and runtime for continuous, heavy-duty applications, the electric and hybrid segment is gaining momentum, especially in smaller to medium-sized vehicles used in noise-sensitive urban environments and indoor commercial spaces (e.g., parking garages). This shift is not just about environmental compliance but also about reduced complexity, lower fuel costs, and simpler maintenance schedules inherent to electric motors, making it an increasingly attractive option for future fleet modernization strategies.

- By Vehicle Type:

- Snow Plows (Truck-mounted, Grader-mounted)

- Snow Blowers/Throwers (Single-stage, Two-stage, Three-stage)

- Snow Loaders

- Rotary Snow Removers (High-capacity, Airport-specific)

- Specialized Sweepers and Brushes

- By End-Use:

- Municipalities/Government (Road networks, Public infrastructure)

- Airports (Runways, Taxiways, Aprons)

- Commercial Spaces (Retail centers, Corporate campuses)

- Residential/Individual Use

- Military Bases and Logistics Hubs

- By Power Source:

- Diesel/Gasoline

- Electric/Hybrid (Battery-Electric, Fuel Cell Prototypes)

- By Operation Type:

- Manual/Operator-Controlled

- Autonomous/Semi-Autonomous

Value Chain Analysis For Snow Cleaning Vehicles Market

The value chain for the Snow Cleaning Vehicles Market starts with the Upstream analysis, which focuses on the procurement of raw materials and specialized components essential for vehicle manufacturing. Key inputs include high-grade specialized steel alloys necessary for chassis durability and plow blades, complex hydraulic components for operational articulation and power transmission, and specialized components like tires, high-performance engines (Tier 4 Final/Stage V compliant), and sophisticated electronic control units (ECUs). The upstream environment is highly reliant on a stable global supply chain, particularly for microchips and specialized heavy-duty component suppliers (e.g., transmission manufacturers, axle makers). Any disruption in these specialized component markets can severely impact the ability of OEMs to meet seasonal demand spikes, leading to potential inventory shortages during critical winter periods. Furthermore, innovation often starts here, with component suppliers driving advancements in efficiency and reduced weight.

The core Midstream stage involves the Original Equipment Manufacturers (OEMs) who design, assemble, and integrate these components into the final specialized snow cleaning vehicles. This stage involves significant R&D investment, particularly in integrating advanced technologies like telematics, precision guidance systems, and battery technology for electric variants. OEMs often specialize, with some focusing solely on heavy-duty airport equipment (requiring extreme performance and customization) and others targeting the highly standardized municipal or smaller commercial markets. Manufacturing efficiency, quality control, and the ability to customize vehicles according to specific geographic requirements (e.g., differing road clearance width requirements, unique de-icing system integration) are critical differentiators at this stage. Post-assembly testing, especially under simulated harsh conditions, ensures that the vehicles meet the extreme durability standards required for winter operations.

The Downstream stage encompasses distribution, sales, and crucial after-sales support. Distribution channels are typically a mix of direct sales to large governmental bodies (e.g., federal/state transport departments, major airport authorities) and indirect sales through highly specialized regional dealers and service networks. Due to the high investment and complexity of these vehicles, long-term maintenance contracts, parts availability, and certified technician services are pivotal to the customer value proposition. Indirect channels rely on regional expertise to manage local regulatory requirements and provide prompt repair services, which are critical as fleet uptime in winter is non-negotiable. Digital channels are increasingly used for parts ordering, maintenance scheduling, and deploying software updates for advanced vehicle systems, enhancing the overall service lifecycle and customer retention.

Snow Cleaning Vehicles Market Potential Customers

The primary end-users, or buyers, of snow cleaning vehicles are highly institutionalized entities with substantial operational budgets and stringent safety mandates. Government bodies, ranging from local municipalities responsible for neighborhood streets and residential areas to state or federal Departments of Transportation overseeing expansive highway networks, represent the single largest customer segment. These governmental buyers typically prioritize robust construction, long operational life, ease of maintenance, and compliance with public procurement regulations, often purchasing large, diverse fleets that include everything from compact utility plows to heavy-duty truck-mounted spreaders. Their procurement cycles are often influenced by predictable budget schedules and the necessity to replace aging assets efficiently to maintain public infrastructure safety standards.

A second, rapidly growing, and technologically demanding customer segment is the Airport Authority sector. International and regional airports require vehicles of the highest specialization and performance, such as wide-swath rotary snow removers, specialized runway sweepers, and high-speed plows capable of clearing snow at rates that allow for minimal flight interruption. The purchase criteria here are focused on speed, efficiency, and adherence to extremely tight regulatory clearances set by international aviation bodies, prioritizing performance and reliability over cost. This segment is characterized by investments in multi-functional, sophisticated machines often featuring advanced sensor technology and specialized de-icing fluid application systems to ensure zero tolerance for operational delays.

Finally, the Commercial and Industrial sector constitutes a diverse group of buyers, including logistics companies managing massive distribution centers, large retail chains responsible for customer parking lots, corporate campuses, and private snow removal contractors. These customers prioritize operational efficiency and cost-effectiveness. Contractors, in particular, look for versatile, maneuverable equipment suitable for navigating complex private properties and maximizing their hourly service capacity. This segment often leads the adoption of smaller, compact equipment, utility vehicles, and increasingly, electric-powered solutions suitable for continuous, quiet operation across diverse pavement types, balancing efficiency with strict site operational requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oshkosh Corporation, M-B Companies, Vammas (Fortbrand Services), Boschung Group, Kahlbacher, Alamo Group, Kodiak America, Komatsu Ltd., John Deere (Deere & Company), Aebi Schmidt, FSI, Kubota Corporation, Trackless Vehicles, SnowEx (Douglas Dynamics), Zaugg AG Eggiwil, Arctic Equipment Manufacturing Corporation, Henderson Products, Inc., Federal Signal Corporation, Wausau Equipment Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Cleaning Vehicles Market Key Technology Landscape

The technological landscape of the Snow Cleaning Vehicles Market is rapidly evolving beyond basic mechanical systems, incorporating sophisticated digital and propulsion technologies aimed at efficiency, sustainability, and operator safety. One of the most significant advancements is the integration of advanced telematics and IoT devices, which transform individual vehicles into connected assets. This enables real-time monitoring of performance metrics such as fuel consumption, hydraulic system pressure, blade wear, and spreading rates. Data collected is crucial for predictive maintenance scheduling, allowing fleet managers to service machines during lull periods and maximize operational readiness during critical snow events. Furthermore, precision spreading technology, utilizing Doppler radar and GPS integration, ensures that de-icing agents are applied optimally based on real-time road surface temperatures and friction levels, minimizing waste and environmental impact while maximizing road safety effectiveness.

Another major technological shift involves the accelerated development and deployment of alternative powertrains. While high-torque diesel engines currently dominate the heavy-duty segment, there is a powerful move toward electric and hybrid platforms, particularly for municipal and commercial fleets that operate within defined urban boundaries. Battery technology advancements are addressing range and power concerns, making electric snowplows viable for medium-duty tasks, offering benefits such as reduced operational noise, zero tailpipe emissions, and lower long-term maintenance costs due to fewer moving parts. Hybrid systems serve as an intermediary step, utilizing electric power for auxiliary functions (like spreader operation) while retaining diesel for propulsion, balancing high performance with improved fuel economy and reduced emissions compared to purely conventional setups.

The most forward-looking technology shaping the market is the incorporation of autonomous and semi-autonomous operational capabilities, leveraging sensor fusion (LiDAR, thermal cameras, advanced GPS/RTK). Initial deployment is concentrated in controlled environments like airports and expansive private logistics centers, where repeated routes and stable perimeters simplify autonomous path planning. These systems enhance safety by providing advanced situational awareness to operators, mitigating risks in low-visibility whiteout conditions, and ultimately paving the way for full driverless operation. For public roads, semi-autonomous features, such as automated steering assist, precision plowing depth control, and cooperative vehicle platooning capabilities, are already enhancing operator efficiency and reducing fatigue during extremely long shifts required in continuous storm conditions, optimizing the quality and consistency of snow removal.

Regional Highlights

- North America: This region, encompassing the United States and Canada, represents the largest and most mature market for snow cleaning vehicles globally. Demand is driven by vast highway networks, severe annual snowfall across the northern tiers, and robust government funding allocated toward maintaining transport continuity and safety. The market is characterized by high demand for heavy-duty, truck-mounted snowplows, sophisticated tow-behind rotary equipment, and advanced de-icing spray systems. Technological adoption, especially in telematics and precision control, is high. A notable trend is the increasing pressure from states and provinces to electrify municipal fleets and adopt autonomous technology for highway maintenance depots, particularly in regions prone to extreme labor shortages during winter crises. The US market is highly competitive, dominated by large, established domestic OEMs specializing in vocational trucks and adapted heavy machinery.

- Europe: The European market is highly fragmented but sophisticated, driven by stringent environmental regulations (Euro Stage V), a strong focus on noise reduction (especially for night operations), and diverse geographical needs, ranging from urban street clearance in Scandinavia to mountainous highway maintenance in the Alps. Germany, Switzerland, and the Nordic countries are primary revenue generators, prioritizing multi-functional vehicles (MFVs) that can handle plowing, brushing, and spreading tasks simultaneously. European procurement tends to favor specialized, highly customizable vehicles and places strong emphasis on energy efficiency and low-emission power sources, accelerating the transition toward electric and compact hybrid municipal utility vehicles. Standardized road clearance and de-icing practices across the European Union further influence product design and procurement specifications.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily fueled by infrastructural development and increasing investments in winter maintenance capabilities in cold climate zones like Northern China, Japan, and South Korea. While Japan has long utilized sophisticated snow removal equipment due to heavy coastal snow, countries like China are rapidly scaling up procurement to service newly expanded highways, high-speed rail corridors, and major metropolitan areas experiencing increased winter precipitation. The demand here focuses on acquiring modern, high-capacity machinery to replace outdated fleets, driving significant opportunities for international OEMs. Cost-effectiveness remains a key factor, balanced against the need for durable equipment capable of operating in harsh, remote conditions.

- Latin America: Market penetration in Latin America is comparatively low, concentrated in specific high-altitude regions (Andes mountains) and southern regions of countries like Argentina and Chile. The demand is specialized, often involving smaller, rugged vehicles suitable for narrow, mountainous roads and utility applications. Growth potential is niche, driven mainly by mining operations and tourism infrastructure that require guaranteed access regardless of weather. Adoption of high-end specialized equipment is slow, often relying on imported second-hand machinery or basic utility vehicle modifications.

- Middle East and Africa (MEA): This region holds the smallest share, with market activity limited to high-elevation areas in countries such as Turkey, Iran, and specific mountainous regions in North Africa, which experience occasional severe snowfall. The market is characterized by sporadic, project-based procurement rather than consistent long-term fleet modernization. However, certain infrastructure projects and specialized military applications occasionally necessitate procurement of reliable, often diesel-powered, robust snow removal units capable of operation in extreme cold and remote environments, with reliability and durability being the key purchase criteria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Cleaning Vehicles Market.- Oshkosh Corporation

- M-B Companies

- Vammas (Fortbrand Services)

- Boschung Group

- Kahlbacher

- Alamo Group

- Kodiak America

- Komatsu Ltd.

- John Deere (Deere & Company)

- Aebi Schmidt

- FSI

- Kubota Corporation

- Trackless Vehicles

- SnowEx (Douglas Dynamics)

- Zaugg AG Eggiwil

- Arctic Equipment Manufacturing Corporation

- Henderson Products, Inc.

- Federal Signal Corporation

- Wausau Equipment Company

- SNO-WAY International

Frequently Asked Questions

Analyze common user questions about the Snow Cleaning Vehicles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of electric snow cleaning vehicles?

The primary factor driving the adoption of electric snow cleaning vehicles is the need for compliance with increasingly stringent urban emissions and noise abatement regulations, particularly in major European and North American metropolitan areas. Electric models offer reduced operational costs, lower environmental impact, and superior performance in noise-sensitive environments, appealing strongly to municipal fleets undergoing long-term decarbonization mandates.

How are autonomous technologies currently being implemented in snow removal operations?

Autonomous technologies are currently implemented through semi-autonomous driver assistance systems and in controlled, non-public environments like airport runways and large logistical hubs. These systems use LiDAR and RTK GPS for precision path following, obstacle detection, and automated spreading control, significantly enhancing operational safety, consistency, and efficiency, especially during periods of low visibility (whiteout conditions).

Which end-use segment demonstrates the highest growth potential in the forecast period?

The Airport Authorities segment demonstrates the highest growth potential in the forecast period. This growth is mandated by strict international aviation safety protocols requiring substantial investment in high-performance, specialized, and often technologically advanced rotary snow removers and sweepers to ensure minimal disruption to global air traffic during winter events.

What are the main operational challenges faced by OEMs in the Snow Cleaning Vehicles Market?

OEMs face significant operational challenges primarily related to the seasonal volatility of demand, requiring flexible manufacturing capacity to handle critical peak season orders. Additionally, they must manage the high capital investment required for R&D into electric and autonomous technologies while navigating complex global supply chains for specialized, heavy-duty components and meeting varied regional emission standards.

What role does predictive maintenance play in modern snow fleet management?

Predictive maintenance, powered by AI and telematics, plays a critical role by analyzing real-time sensor data (e.g., fluid pressure, engine temperature, vibration patterns) to forecast potential equipment failures. This allows fleet managers to schedule maintenance proactively during non-operational periods, dramatically increasing asset uptime and reliability during critical, time-sensitive winter storm operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager