Snow Goggles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443509 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Snow Goggles Market Size

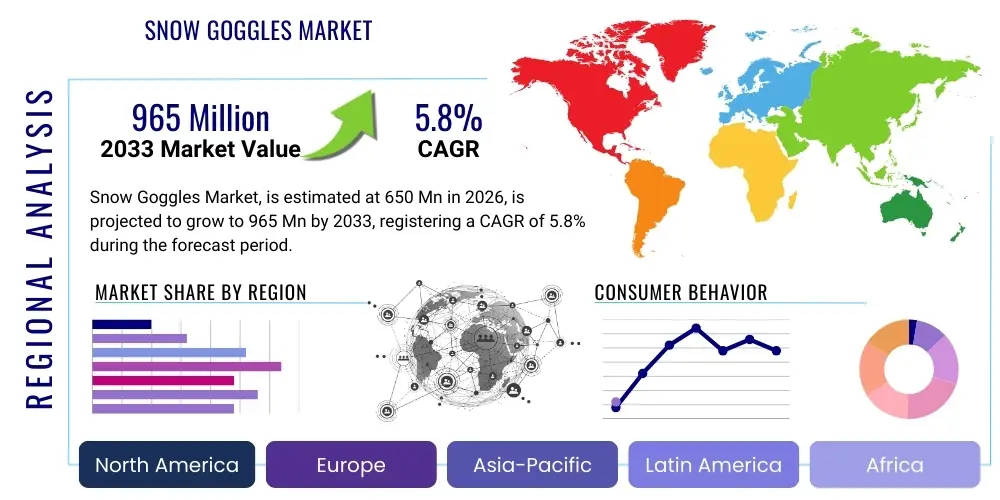

The Snow Goggles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 965 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing popularity of winter sports globally, coupled with significant technological advancements in lens and frame design aimed at improving visibility, comfort, and safety for enthusiasts ranging from recreational skiers to professional athletes. The valuation reflects sustained investment in product innovation, particularly focusing on photochromic technology, anti-fog coatings, and integrated electronic features.

The steady rise in disposable income across key regions, such as North America and Europe, facilitates greater participation in high-cost recreational activities like skiing and snowboarding, directly boosting demand for premium snow goggles. Furthermore, robust marketing efforts by leading manufacturers highlighting the critical role of proper eye protection against UV radiation, wind, and impact contribute significantly to market penetration. The forecasted growth trajectory underscores the necessity of high-quality protective gear as participants seek enhanced performance and durability in varied alpine conditions, making specialized snow goggles a non-negotiable component of winter sports equipment.

Snow Goggles Market introduction

The Snow Goggles Market encompasses the design, manufacture, and distribution of specialized eyewear crafted to protect the eyes of winter sports participants, primarily skiers, snowboarders, and mountaineers, from adverse environmental elements such as harsh sunlight, ultraviolet (UV) radiation, high-speed wind, snow, and ice debris. These essential protective devices feature advanced lens technologies, including polarized, mirrored, or photochromic tints, incorporated into ergonomic frames designed for seamless helmet integration and maximized peripheral vision. Major applications span competitive alpine racing, recreational resort skiing, backcountry snowboarding, and general winter recreational activities, offering critical visual clarity in dynamic weather conditions.

Key benefits derived from modern snow goggles include superior optical precision, minimized glare, prevention of snow blindness (ophthalmia nivalis), and enhanced contrast perception vital for identifying terrain variations, especially in flat-light conditions. Driving factors for market expansion are multi-faceted, including a global resurgence in adventure tourism, continuous product innovation introducing smart goggle features (e.g., GPS, HUD displays), stricter safety regulations promoting mandatory use of protective gear, and the growing influence of professional winter sports events which drive consumer demand for high-performance equipment mirroring professional standards. The market introduction phase is currently characterized by high competition centered on material science and digital integration.

Snow Goggles Market Executive Summary

The Snow Goggles market demonstrates robust momentum driven by evolving consumer preferences favoring sophisticated, high-performance protective gear and favorable demographic shifts toward health and outdoor recreation. Business trends indicate a strong focus on sustainability and eco-friendly manufacturing processes, alongside aggressive mergers, acquisitions, and strategic partnerships aimed at consolidating market share and achieving economies of scale in specialized lens production. The competitive landscape is intensely focused on patenting proprietary anti-fog solutions and developing seamless magnetic lens interchange systems, catering to the end-user requirement for quick adaptability to changing weather conditions.

Regional trends highlight North America and Europe as the dominant revenue generators, attributed to deeply ingrained winter sports cultures, established infrastructure, and high consumer spending power on premium equipment. However, the Asia Pacific (APAC) region, particularly China, Japan, and South Korea, is emerging as the fastest-growing market, propelled by significant government investment in winter sports infrastructure ahead of major international events and a rapid increase in the middle-class population participating in skiing and snowboarding. Segment trends illustrate a pronounced shift toward higher-end products, specifically spherical and toric lenses, due to their superior optical clarity and reduced distortion, alongside substantial growth in the online distribution channel offering consumers greater access to specialized niche brands.

AI Impact Analysis on Snow Goggles Market

Common user questions regarding AI’s impact on snow goggles often revolve around enhanced safety features, personalized visibility adjustments, and the integration of heads-up display (HUD) technology for real-time performance data. Users are keen to understand how AI algorithms can improve anti-fogging effectiveness based on ambient temperature and humidity, or how machine learning can personalize lens tinting automatically to maximize terrain contrast under highly variable light conditions. Key concerns center on battery life, the potential distraction caused by digital overlays, and the cost associated with incorporating sophisticated AI processors into rugged outdoor gear, prompting manufacturers to prioritize seamless, non-intrusive integration that elevates the user experience without compromising essential protective function.

The core expectation is that AI will transform snow goggles from purely protective equipment into intelligent visual interfaces. This transition requires sophisticated sensor fusion—combining data from light sensors, temperature gauges, and GPS—to provide contextual awareness to the wearer. While fully autonomous lens adjustment remains complex, initial applications are focused on optimizing data presentation in HUDs, analyzing user performance metrics (speed, vertical descent), and offering predictive warnings regarding potential hazards or changes in weather visibility. Such integration aims to significantly reduce decision fatigue and enhance situational awareness for the athlete.

- AI-Driven Adaptive Lens Technology: Algorithms automatically adjust electronic lens tinting or polarization based on real-time light exposure, optimizing contrast and clarity.

- Predictive Anti-Fogging Systems: AI models analyze internal humidity, temperature differentials, and airflow to proactively manage ventilation systems and heating elements, drastically minimizing fogging incidents.

- Integrated Performance Tracking and HUD Optimization: Machine learning processes speed, altitude, and trajectory data to display relevant metrics via a Heads-Up Display (HUD), tailoring information density to the user’s current activity level.

- Enhanced Safety Features: Utilizing computer vision through tiny integrated cameras for hazard detection (e.g., icy patches, obstacles) and providing auditory or visual alerts to the user.

- Personalized Equipment Recommendations: AI analyzes user data (usage frequency, typical conditions, performance style) to recommend the optimal lens type and frame configuration for future purchases.

DRO & Impact Forces Of Snow Goggles Market

The market dynamics for snow goggles are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping the industry's growth trajectory. Key drivers include the exponential growth in global winter tourism, increased consumer awareness regarding the necessity of UV protection and safety standards, and relentless innovation in materials science resulting in lighter, more durable, and optically superior products. These forces collectively push manufacturers toward high-value offerings, compelling continuous R&D investment focused on integrated electronics and seamless helmet compatibility, solidifying the importance of goggles beyond mere protective eyewear.

Conversely, significant restraints hinder market growth, most notably the highly seasonal nature of the product, which leads to unpredictable demand patterns and substantial inventory management challenges outside of the winter season. High manufacturing costs, particularly associated with advanced lens technologies (photochromic, toric), translate into premium pricing that may deter budget-conscious consumers, particularly in emerging markets. Furthermore, the market faces saturation in established regions like Western Europe, demanding disruptive innovation for sustained growth. These restraints necessitate strategic pricing models and diversified product portfolios to maintain relevance across various consumer segments.

Opportunities for expansion are primarily concentrated in two areas: the proliferation of smart goggle technology, offering connectivity and integrated display features, and market penetration into underdeveloped skiing regions, specifically Eastern Europe and parts of Asia, through infrastructure development and targeted marketing. The increasing consumer desire for customized and aesthetically pleasing gear also presents opportunities for specialization and limited-edition product releases. The cumulative impact forces emphasize technological leadership as the primary differentiator, pushing non-innovative players to consolidate or exit, while rewarding companies that successfully blend optical performance with digital integration and environmental responsibility.

Segmentation Analysis

The Snow Goggles Market is segmented based on critical technical and commercial factors, allowing for targeted product development and marketing strategies. Key segmentation criteria include the optical geometry of the lens (spherical, cylindrical, toric), the mechanism for lens replacement (interchangeable vs. fixed), the primary end-user application (skiing, snowboarding), and the distribution channel used to reach the consumer. Understanding these segment dynamics is crucial for manufacturers to align their offerings with specific consumer demands for field of view, clarity, anti-fog performance, and ease of use, ensuring optimized product placement across global retail environments. The shift towards premium, high-definition (HD) lenses across all segments reflects consumers’ willingness to invest in superior visual experiences.

- By Lens Type:

- Cylindrical Goggles

- Spherical Goggles

- Toric Goggles

- By Product Type:

- Fixed Lens Goggles

- Interchangeable Lens Goggles

- By Application:

- Alpine Skiing

- Snowboarding

- Mountaineering/Other Winter Sports

- By Distribution Channel:

- Offline Retail (Specialty Stores, Departmental Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

- By End-User:

- Men

- Women

- Unisex/Youth

Value Chain Analysis For Snow Goggles Market

The Value Chain for the Snow Goggles Market begins with upstream activities focused on raw material sourcing, predominantly involving specialized polycarbonate and polyurethane materials for lenses and frames, alongside advanced chemicals for proprietary coatings (anti-fog, anti-scratch). Innovation at this stage, particularly in sustainable or bio-based material development, directly impacts final product performance and cost. Key upstream suppliers include specialty plastics manufacturers and chemical engineering firms, whose quality control dictates the optical integrity and durability of the finished product. Optimization of supply chain logistics is crucial here due to the precise manufacturing requirements for high-performance optical gear.

The midstream phase involves manufacturing and assembly, where sophisticated techniques like injection molding, vacuum coating deposition (for mirror finishes), and precise alignment of multiple lens layers occur. This stage represents the highest value addition, where intellectual property related to lens geometry (spherical vs. toric) and ventilation systems is applied. Downstream activities encompass warehousing, marketing, and distribution. Effective branding and storytelling, often involving professional athlete endorsements and high-definition media production, are essential to drive premium consumer perception and demand in a visually competitive market space.

Distribution channels are broadly categorized into direct and indirect methods. Direct channels involve sales through the brand's official e-commerce website and flagship stores, offering maximum control over pricing and customer experience. Indirect channels primarily rely on partnerships with specialty sports retailers (brick-and-mortar), large department stores, and major multi-brand online marketplaces. The specialty retail channel remains critical as consumers often seek professional advice regarding lens selection and helmet compatibility, though the online channel is rapidly gaining dominance due to its convenience and extensive product range, particularly for interchangeable lens systems requiring detailed visual representation.

Snow Goggles Market Potential Customers

The primary potential customers and end-users of snow goggles are diverse groups united by their participation in winter activities requiring specialized eye protection. This core demographic includes alpine skiers and snowboarders, ranging from novices renting equipment for their annual vacation to expert backcountry enthusiasts requiring rugged, high-performance gear with maximum field of vision and durability. Geographically, potential customers are concentrated in regions with established ski resorts, notably the Alps in Europe, the Rocky Mountains in North America, and major ski destinations in Japan, South Korea, and increasingly, China.

A second crucial customer segment consists of professional athletes and competitive racers. This high-end segment demands state-of-the-art technology, including toric lenses for minimal distortion, superior optical clarity for high-speed performance, and precise helmet integration. These users are typically less price-sensitive and often serve as key influencers driving trends for recreational consumers. Furthermore, specialized end-users, such as mountain rescue teams, military personnel operating in arctic environments, and mountaineers, represent a niche segment seeking durability, extreme temperature resistance, and highly specific light filtering capabilities, often preferring photochromic lenses for adaptability across long expeditions.

The growing family tourism sector presents a significant opportunity, with increased demand for youth and junior-sized goggles featuring robust anti-fog capabilities and comfortable, flexible frames designed specifically for smaller faces. Marketing strategies targeting potential customers must address their specific pain points—visual distortion for experts, fogging for intermediates, and comfort/safety for youth—tailoring product features and communication accordingly to convert interest into purchase across all these varied buying groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 965 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oakley (Luxottica Group), Smith Optics, Anon Optics (Burton), Spy Optic, Dragon Alliance, Scott Sports, Uvex Sports, POC Sports, Bolle Brands, Zeal Optics, Electric Visual, Giro Sport Design, Outdoor Master, Julbo, Carrera, Shred Optics, Roxy, Alpina Sports, Quiksilver, Revo |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Snow Goggles Market Key Technology Landscape

The technology landscape of the Snow Goggles market is rapidly evolving, driven by the imperative to minimize visual distortion, eliminate fogging, and maximize comfort and adaptability. The most critical technological advancements center on lens material science, specifically the development of proprietary polycarbonate blends that offer high impact resistance and superior optical clarity. Anti-fog technologies, typically involving hydrophilic chemical coatings applied to the interior surface of the lens, remain a core competitive battleground, with manufacturers continually refining these treatments for extended durability and performance under extreme temperature fluctuations. Furthermore, advanced ventilation systems integrated into the frame structure ensure consistent airflow, a non-electronic method for moisture management crucial for high-intensity activity.

Optical geometry represents another foundational technological area, with the widespread adoption of spherical and toric lenses replacing traditional cylindrical designs. Spherical lenses mimic the curvature of the eye, offering better peripheral vision and less distortion, while toric lenses offer a complex curvature that optimizes vision both horizontally and vertically, providing the highest level of optical precision and minimizing the 'bubble' effect. The development of quick-change lens systems, primarily utilizing strong magnetic connections, has transformed user convenience, allowing athletes to swap tints rapidly in response to light changes, a critical feature driving consumer preference in the premium segment.

The market's future technological direction is heavily invested in 'Smart Goggles,' integrating micro-electronic components such as Heads-Up Displays (HUDs), GPS tracking, Bluetooth connectivity, and micro-heaters. Photochromic technology, which allows lenses to automatically adjust tint density based on UV exposure, is also becoming increasingly sophisticated, reducing the need for interchangeable lenses. These integrations require complex miniaturization and power management solutions to ensure the goggles remain lightweight, durable, and functional in freezing conditions, setting the stage for highly differentiated product offerings aimed at performance and connectivity.

Regional Highlights

- North America (Dominant Market): North America, particularly the United States and Canada, represents a mature and dominant market segment characterized by high consumer spending on premium outdoor gear and a deeply entrenched culture of skiing and snowboarding. The region benefits from extensive infrastructure, including world-class resorts in the Rocky Mountains and the Cascades. Consumer demand here is intensely focused on technological features, such as polarized lenses, magnetic interchangeable systems, and seamless integration with helmets. Major regional market drivers include a high rate of participation in recreational winter sports and the presence of leading global outdoor apparel and equipment brands, ensuring a highly competitive and innovative retail environment.

- Europe (High-Value and Traditional Market): Europe, especially the Alpine regions encompassing Austria, Switzerland, France, and Italy, constitutes a cornerstone of the global snow goggles market. The European consumer base emphasizes optical quality, durability, and brand heritage, often favoring established European optics manufacturers. Strict safety and protective equipment standards enforced across many EU member states ensure sustained demand for certified, high-quality products. The market growth is stable, driven by the consistent influx of international ski tourists and robust domestic winter sports participation, although growth rates are often slower than in emerging markets due to high market penetration.

- Asia Pacific (Fastest Growing Market): The APAC region, led by China, Japan, and South Korea, is projected to exhibit the highest growth rate during the forecast period. This accelerated growth is primarily attributed to significant governmental and private sector investments in building state-of-the-art winter sports facilities, particularly following major international sporting events. Japan and South Korea possess established, highly sophisticated winter sports cultures, characterized by demand for high-tech, aesthetically pleasing designs. Crucially, the burgeoning middle-class in China is rapidly adopting winter sports, driving unprecedented demand for entry-to-mid-level protective gear, offering substantial opportunities for both established global brands and local manufacturers focusing on accessible pricing strategies.

- Latin America & Middle East/Africa (Emerging Potential): While currently holding smaller market shares, these regions present niche opportunities. South American countries like Chile and Argentina, with their extensive mountain ranges and seasonal ski operations, show steady, albeit localized, demand. The Middle East, surprisingly, presents growth potential due to investment in large indoor ski resorts (e.g., Dubai) and high-net-worth individuals traveling internationally for winter holidays, creating demand for ultra-premium, luxury snow goggles, characterized by specialized materials and limited-edition designs. These markets are highly sensitive to global tourism trends and economic stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Snow Goggles Market.- Oakley (Luxottica Group)

- Smith Optics

- Anon Optics (Burton)

- POC Sports

- Dragon Alliance

- Scott Sports

- Uvex Sports

- Bolle Brands

- Zeal Optics

- Electric Visual

- Giro Sport Design

- Outdoor Master

- Julbo

- Carrera

- Shred Optics

- Roxy

- Alpina Sports

- Quiksilver

- Revo

- Spy Optic

Frequently Asked Questions

Analyze common user questions about the Snow Goggles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between spherical and toric snow goggles lenses?

Spherical lenses curve uniformly across the vertical and horizontal axes, closely mimicking the shape of the human eye to offer improved peripheral vision and reduced distortion compared to cylindrical lenses. Toric lenses, a newer advancement, incorporate a complex geometry by curving differently on the vertical and horizontal axes, optimizing optical precision further by providing superior clarity, minimal visual distortion, and enhanced air volume to combat fogging, often favored by competitive athletes.

How effective are anti-fog technologies in modern snow goggles, and what factors influence their performance?

Modern anti-fog technologies rely on advanced hydrophilic coatings and sophisticated ventilation systems to prevent condensation. They are highly effective when properly maintained, but their performance is significantly influenced by the user's activity level (excessive sweating), rapid changes in external temperature (e.g., entering a warm lodge), and physical damage to the interior coating. Premium models often feature active ventilation or micro-heating elements for enhanced protection.

Which distribution channel is experiencing the fastest growth for snow goggles sales?

The Online Retail distribution channel, encompassing both brand-specific e-commerce sites and major multi-brand marketplaces, is currently the fastest growing segment. This rapid expansion is driven by consumer desire for convenience, extensive product availability, detailed reviews, and competitive pricing, allowing users to easily compare advanced features like magnetic lens technology and different lens tints without visiting a physical store.

What are 'Photochromic' lenses, and why are they becoming popular in the Snow Goggles market?

Photochromic lenses, also known as transition lenses, automatically darken or lighten their tint density in response to the intensity of ultraviolet (UV) light exposure. They are highly popular because they offer unparalleled versatility, eliminating the need for the wearer to carry or swap multiple lenses for varying conditions, providing optimal visibility instantly whether skiing under bright sun or in overcast, flat-light conditions.

What is the expected CAGR for the Snow Goggles market, and what is driving this growth?

The Snow Goggles Market is projected to grow at a CAGR of 5.8% between 2026 and 2033. This growth is predominantly driven by increasing global participation in winter recreational sports, rising disposable incomes in emerging economies, continuous technological innovations in optical clarity and smart goggle integration, and heightened consumer awareness regarding the necessity of professional-grade eye protection against UV damage and physical impact in alpine environments.

The global snow goggles market is at an inflection point, moving beyond fundamental protective functions to integrate sophisticated optical science and digital technology. The next phase of market development will be characterized by a relentless pursuit of the perfect visual experience, demanding lighter materials, personalized fit, and non-intrusive smart features. Manufacturers that successfully marry these high-tech requirements with sustainable production practices and appealing aesthetic designs are positioned to capture the highest market share and define industry standards for the next decade. Strategic geographical expansion into APAC, supported by localized marketing and accessible pricing for high-volume entry-level segments, will be crucial for maximizing revenue growth beyond the saturated North American and European markets.

In conclusion, the competitive intensity remains high, compelling key players to invest heavily in intellectual property protecting their anti-fog and rapid-change lens systems. The future viability of players rests on their ability to manage complex global supply chains, ensuring quality control for high-precision optical components while adapting quickly to consumer shifts favoring products that offer versatility (e.g., photochromic technology) and connectivity (e.g., HUD integration). This dynamic environment reinforces the market's strong projected growth trajectory through 2033.

Further analysis into consumer behavior indicates a growing segment of environmentally conscious buyers who prioritize products made with recycled or bio-based materials. Leading brands are responding by launching ‘green’ product lines, often utilizing plant-based plastics for frames and straps. This trend, while currently niche, is expected to gain significant traction, especially among younger generations of winter sports enthusiasts who view sustainability as integral to their purchasing decisions. Companies neglecting this shift risk losing relevance in key demographics. The interplay between high-performance demands and eco-friendly manufacturing presents a complex challenge, requiring innovation not just in the final product, but throughout the entire sourcing and production lifecycle.

Market consolidation remains a notable factor, with large eyewear conglomerates increasingly acquiring specialized goggle manufacturers to integrate proprietary lens technologies and expand their dominance across the broader sports optics segment. This strategic M&A activity streamlines distribution and leverages existing retail networks, often accelerating the global availability of high-end features. Conversely, smaller, innovative startups continue to emerge, often focusing on a single disruptive technology, such as specialized polarized tints for specific snow conditions or highly personalized frame fitting via 3D scanning, challenging established players and fostering rapid technological diffusion throughout the industry. The interplay between consolidation and agile innovation keeps the competitive landscape fluid and exciting.

Technological advancement is not solely focused on visual performance; comfort and fit are equally important drivers. Innovations in triple-layer face foam, designed to conform precisely to facial contours and wick away moisture efficiently, enhance long-term wearability and helmet integration. Furthermore, advancements in strap technology, including silicone grips and sophisticated adjusters, ensure goggles remain securely positioned during high-impact maneuvers. The convergence of superior optical clarity with ergonomic excellence defines the next generation of premium snow goggles, catering directly to the needs of athletes demanding zero distraction and maximum confidence in challenging mountain environments. Effective marketing must consistently communicate these subtle but impactful engineering improvements to justify premium pricing.

The regulatory environment, particularly concerning eye safety and impact resistance, continues to tighten, especially in North America and Europe. Compliance with standards such as ASTM F659 (Standard Specification for Ski and Snowboard Goggles) and CE EN 174 (Personal eye-protection - Ski goggles for downhill skiing) is mandatory, pushing all manufacturers, regardless of their scale, to maintain rigorous testing protocols. This regulatory pressure acts as a barrier to entry for lower-quality manufacturers while simultaneously reinforcing the market position of established brands known for their commitment to safety and quality assurance. Future regulations may also address the standards for embedded electronics and battery safety in smart goggles, potentially influencing design and material choices in the rapidly expanding connected eyewear category.

Finally, the growing popularity of backcountry and off-piste skiing and snowboarding introduces unique demands for snow goggles. Participants in these activities require gear that offers exceptional durability, maximum protection from intense sunlight at high altitudes, and the ability to operate reliably in extremely remote conditions. This specialized segment favors features such as high-contrast, VLT (Visible Light Transmission) adaptable lenses, extremely robust anti-fog systems, and frames designed to accommodate supplemental ventilation or even basic communication devices. Marketing efforts targeting this high-expertise demographic must emphasize reliability and performance under critical, challenging circumstances, differentiating these high-end products from recreational resort-focused eyewear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager