Social Work Case Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443556 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Social Work Case Management Software Market Size

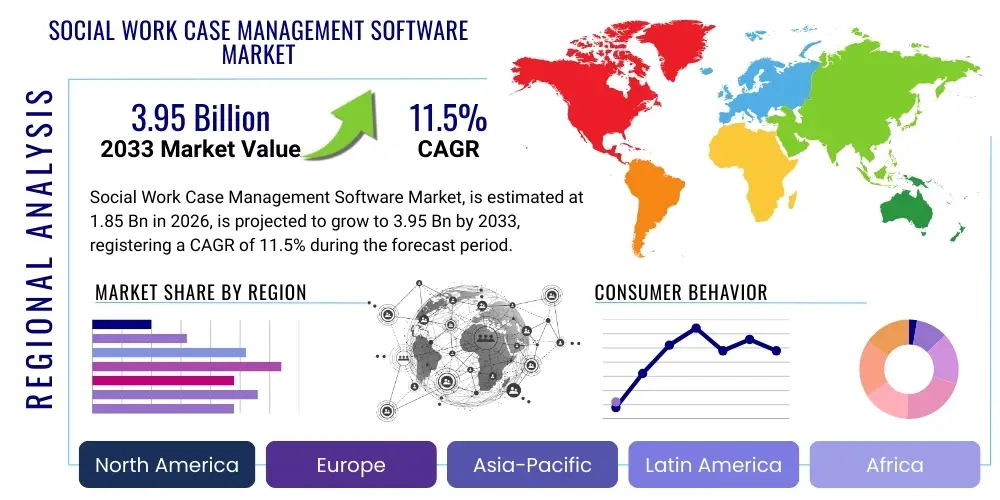

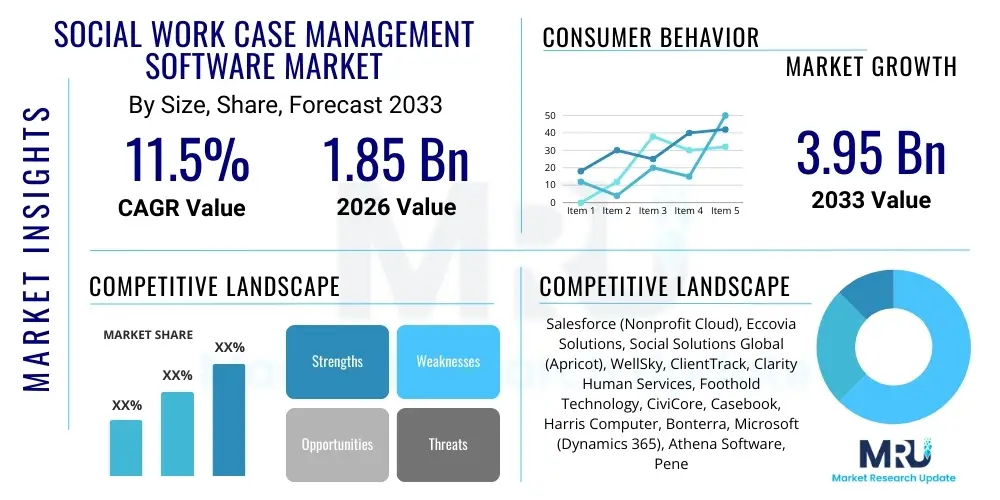

The Social Work Case Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.95 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for streamlined administrative processes within social service agencies, coupled with stringent regulatory requirements concerning client data security and outcome measurement. The inherent complexity of managing diverse social programs—ranging from child protective services to mental health support and housing assistance—necessitates robust, integrated technological solutions capable of handling multi-faceted client profiles and longitudinal data tracking. Furthermore, government initiatives focused on improving public sector efficiency and optimizing resource allocation are providing significant tailwinds for the adoption of sophisticated case management platforms, particularly those offering cloud-based deployment models and advanced reporting features.

The calculation of market size reflects the cumulative spending on software licenses, subscriptions (SaaS models), implementation services, and subsequent maintenance contracts across various end-user segments, including governmental organizations, non-profit entities, and private social service providers. The shift from legacy, paper-based or rudimentary spreadsheet systems to modern, interconnected digital platforms represents a critical modernization effort across global social welfare systems. The increasing prevalence of data-driven decision-making, where agencies utilize metrics to assess program efficacy and justify funding, further solidifies the essential nature of specialized case management software. This software not only centralizes confidential client information but also facilitates inter-agency communication and secure data sharing, paramount in complex, multi-stakeholder cases.

Social Work Case Management Software Market introduction

The Social Work Case Management Software Market encompasses technological solutions specifically designed to support social workers and human services professionals in managing their client caseloads efficiently and effectively. These platforms are comprehensive digital tools aimed at standardizing intake procedures, tracking service delivery progress, documenting clinical notes, managing resource allocation, and ensuring compliance with complex federal and state regulations. The core function of this software is to consolidate all pertinent client information—including demographic data, assessment results, personalized service plans, historical interactions, and outcomes data—into a secure, easily accessible system. This centralization enhances data integrity, minimizes administrative overhead, and allows social workers to dedicate more time to direct client engagement rather than paperwork.

Major applications of this software include child welfare services (tracking permanency planning and foster care), behavioral health services (managing treatment plans and coordinating care), housing assistance (tracking eligibility and tenancy), and general community outreach programs. Key benefits derived from adoption involve improved compliance reporting for governmental funding, enhanced coordination across multidisciplinary teams, reduction in errors due to manual data entry, and ultimately, better outcomes for service recipients through timely and targeted interventions. The market is primarily driven by the imperative for accountability in the public and non-profit sectors, the growing complexity of social issues requiring integrated service models, and continuous technological advancements making these solutions more intuitive and interoperable with existing health and justice systems.

Social Work Case Management Software Market Executive Summary

The global Social Work Case Management Software Market is characterized by robust business trends emphasizing cloud-native architectures, mobile accessibility, and the integration of advanced analytics capabilities to predict risk factors and measure long-term program efficacy. Key industry players are focusing on modular solutions that can be scaled and customized rapidly to meet the diverse needs of different social service domains, from substance abuse treatment centers to specialized elder care facilities. The competitive landscape is seeing increased merger and acquisition activity as larger technology providers seek to integrate specialized niche platforms, offering end-to-end solutions that span intake to billing. Furthermore, compliance requirements, particularly concerning HIPAA in the US and GDPR in Europe, drive continuous product development focused heavily on data security, anonymization, and audit trails, positioning security as a primary differentiating factor among competing software vendors.

Regionally, North America remains the dominant market, driven by high technology adoption rates, significant government funding for social programs, and complex regulatory environments that mandate detailed electronic record-keeping. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, albeit starting from a lower base, fueled by rapid urbanization, increasing governmental investment in social safety nets in countries like India and China, and the burgeoning digital infrastructure supporting SaaS deployment. Segment trends highlight a significant migration toward Cloud deployment models due to their cost-effectiveness, scalability, and ease of maintenance, especially appealing to smaller non-profit organizations and remote service providers. Additionally, the focus within application segments is shifting towards predictive analytics and reporting, moving beyond mere data storage to active insight generation.

AI Impact Analysis on Social Work Case Management Software Market

User inquiries regarding AI's influence in the social work domain frequently center on ethical considerations, data bias, and the potential for AI to augment, rather than replace, human judgment. Common questions explore how AI can assist with resource matching, predict client relapse or crisis risk, and automate routine documentation tasks (e.g., automated transcription of client interviews). Users are keen on understanding whether AI tools can responsibly handle highly sensitive data while providing actionable insights that support timely interventions. The consensus among market stakeholders is that AI integration will primarily focus on improving operational efficiency and providing proactive support capabilities, especially in identifying high-risk cases that require immediate social worker attention, thereby maximizing the impact of limited human resources and making case management processes more data-informed and predictive.

- AI-driven risk assessment: Utilizing machine learning algorithms to analyze historical client data, identifying individuals prone to specific risks (e.g., homelessness, recidivism, or treatment non-adherence), thus enabling proactive interventions.

- Automated documentation and note-taking: Leveraging Natural Language Processing (NLP) to transcribe client interactions, summarize case notes, and automatically populate structured fields, drastically reducing administrative time spent on data entry.

- Optimized resource matching: AI algorithms connecting client needs directly with available community resources and funding streams based on real-time eligibility criteria and organizational capacity, improving service access efficiency.

- Chatbots and virtual assistants: Providing 24/7 basic support for clients regarding program information, appointment scheduling, and form completion, freeing up social workers for complex case handling.

- Bias mitigation efforts: Focus on developing ethical AI models and implementing rigorous data governance frameworks to ensure fairness and prevent algorithmic bias in service provision and decision-making processes.

DRO & Impact Forces Of Social Work Case Management Software Market

The market trajectory is significantly shaped by a confluence of driving forces, inherent limitations, and untapped opportunities that collectively define the impact landscape. Key drivers include the global push for digital transformation across public services, regulatory mandates demanding standardized electronic record-keeping (essential for compliance and accountability), and the growing realization that optimized operational efficiency directly translates to improved client outcomes. These drivers are amplified by the increasing availability of sophisticated, yet user-friendly, SaaS solutions that lower the barrier to entry for smaller non-profits. However, the market faces restraints primarily related to significant initial implementation costs, particularly for custom enterprise solutions, data privacy concerns regarding highly sensitive client information, and resistance to technological change among long-tenured social work staff who are accustomed to traditional documentation methods. Overcoming these adoption inertia points requires robust training and demonstrable return on investment through tangible efficiency gains.

Opportunities in the sector are vast, centering around the expansion of Tele-social work capabilities, particularly post-pandemic, which necessitates integrated software supporting virtual sessions, secure file sharing, and remote access. Predictive analytics represents a transformative opportunity, allowing agencies to move from reactive case management to proactive intervention strategies. Furthermore, market expansion into developing economies, which are currently investing heavily in building formalized social safety nets, presents substantial long-term growth potential for adaptable and localization-ready software solutions. The primary impact forces affecting the market structure are the increasing consolidation of vendors offering specialized vertical solutions and the relentless pressure from government funders requiring detailed performance metrics and outcome tracking, making reporting features a non-negotiable component of any successful case management platform. The regulatory environment acts as a constant external force, demanding continuous software updates to maintain compliance.

Segmentation Analysis

The Social Work Case Management Software Market is comprehensively segmented based on deployment model, application focus, and end-user type, reflecting the varied technological requirements and operational scale of different social service providers. Analyzing these segments provides critical insights into purchasing trends and areas of maximum investment. The shift towards cloud-based solutions is fundamentally restructuring the market, offering accessibility and scalability crucial for non-profit organizations operating with limited IT infrastructure. Application segmentation reveals increasing sophistication, moving beyond basic client tracking to complex areas like behavioral health outcome measurement and integrated financial management (including Medicaid/insurance billing). Understanding these segmentation nuances is vital for vendors developing targeted marketing strategies and for agencies seeking solutions that precisely match their workflow and regulatory compliance needs.

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Application:

- Client Intake and Assessment

- Case Tracking and Management

- Service Planning and Coordination

- Reporting and Analytics

- Billing and Invoicing

- Documentation and Clinical Notes

- By End-User:

- Government Agencies (Federal, State, Local)

- Non-Profit Organizations (NGOs and Charities)

- Healthcare Providers (Hospitals and Clinics with Social Work Departments)

- Educational Institutions

- Private Social Service Providers

Value Chain Analysis For Social Work Case Management Software Market

The value chain for social work case management software starts with the upstream activities centered on core software development, intellectual property creation, and compliance module design. This phase involves extensive research into social work methodologies, regulatory frameworks (e.g., HIPAA, 42 CFR Part 2), and user experience design, ensuring the resulting product is both compliant and clinically relevant. Key upstream contributors include specialized developers, data scientists, and regulatory compliance consultants. The downstream segment focuses heavily on distribution, implementation, and post-sales support. Due to the high sensitivity of client data and the complexity of integration with existing legacy government systems, implementation services, data migration expertise, and extensive training constitute a major portion of the downstream value delivered. This stage often requires highly skilled implementation partners, including VARs (Value Added Resellers) and managed service providers, who specialize in public sector IT deployment and secure cloud hosting environments.

The distribution channel is bifurcated into direct sales and indirect channels. Large, established government contracts are typically handled via direct sales teams, often involving lengthy procurement processes and competitive bidding tailored to specific governmental requirements. In contrast, sales to smaller non-profit organizations and private practices frequently utilize indirect channels, including independent software vendors (ISVs), regional resellers, and referral partnerships, particularly those specializing in grant management or non-profit technology solutions. The indirect channels emphasize the scalability and ease of deployment of SaaS models. Both channels place significant emphasis on demonstrating robust security protocols and the software’s capability to generate accurate, audit-ready reports essential for justifying continued operational funding, making high-quality support and continuous regulatory updates critical value additions across the entire chain.

Social Work Case Management Software Market Potential Customers

The primary target demographic for Social Work Case Management Software spans three core organizational types, all requiring secure, systematic methods for handling complex client relationships and demonstrating quantifiable service outcomes. Government agencies, encompassing federal bodies overseeing large-scale welfare programs down to local county departments managing child protective services or elderly assistance, are the largest customers, often mandating specific security standards and integration capabilities. Non-profit organizations (NGOs) and charities represent a rapidly growing customer base, driven by the need to efficiently manage their limited budgets while satisfying increasingly rigorous reporting requirements from private donors and public grantors. These entities require highly scalable, cost-effective solutions, often favoring subscription-based cloud models.

The third major customer category includes healthcare providers, particularly large hospital systems and integrated health networks, which employ social workers to manage discharge planning, mental health referrals, and post-treatment continuity of care. These customers require seamless integration with Electronic Health Records (EHR) systems to ensure comprehensive patient data visibility and coordinated care planning, bridging the gap between clinical and social determinants of health. Additionally, educational institutions, particularly universities running clinical social work programs or managing student welfare services, also utilize these platforms for tracking student cases and ensuring compliance with privacy regulations. The procurement decision process is often multi-layered, involving IT security officers, program directors focused on service delivery, and financial teams assessing the long-term cost of compliance and efficiency gains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.95 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce (Nonprofit Cloud), Eccovia Solutions, Social Solutions Global (Apricot), WellSky, ClientTrack, Clarity Human Services, Foothold Technology, CiviCore, Casebook, Harris Computer, Bonterra, Microsoft (Dynamics 365), Athena Software, Penelope (Bonterra), PlanStreet, AWARDS (Foothold), ProviderSoft, Procura, Harmony, Kipu Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Social Work Case Management Software Market Key Technology Landscape

The technological infrastructure supporting the Social Work Case Management Software Market is rapidly evolving, moving towards highly scalable, modular, and interoperable systems built predominantly on cloud platforms. SaaS architecture, typically leveraging major infrastructure providers like AWS, Azure, or Google Cloud, provides the foundation for rapid deployment, automatic updates, and robust disaster recovery capabilities—features essential for highly sensitive public sector applications. A major technology focus is API-first design, which enables seamless integration with legacy government databases, electronic health records (EHRs), and financial management systems, thereby eliminating data silos and improving the holistic view of the client. Furthermore, mobile-first design is critical, empowering social workers to access and update case files securely while conducting field visits, thereby enhancing data accuracy and reducing data entry latency.

Security technologies are paramount in this sector, utilizing advanced encryption techniques (both in transit and at rest), multi-factor authentication, and blockchain-inspired audit trails to maintain strict compliance with global privacy regulations such as GDPR, CCPA, and HIPAA. Beyond core data management, the technological landscape is increasingly incorporating sophisticated Business Intelligence (BI) and data visualization tools, allowing administrators to monitor caseload burden, track resource utilization, and generate actionable insights from aggregated data. The adoption of emerging technologies like machine learning is beginning to influence decision support systems, enabling predictive modeling for identifying high-risk clients or anticipating resource demands, signaling a shift from historical reporting to forward-looking strategic management within social service agencies.

Regional Highlights

- North America (Dominant Market Share): The region holds the largest market share primarily due to the complex and heavily regulated health and human services sector in the United States and Canada. High adoption rates are driven by mandatory federal and state funding requirements for detailed reporting and outcome measurement, coupled with strong technological infrastructure and a significant presence of key software vendors specializing in governmental compliance. The emphasis is on seamless integration with Medicaid/Medicare billing systems and sophisticated data analytics platforms for justifying public expenditure.

- Europe (Mature and Compliance-Driven): European market growth is robust, strongly influenced by the need to comply with the General Data Protection Regulation (GDPR), which demands stringent data residency and privacy controls. Key growth areas include the UK, Germany, and the Nordic countries, where well-established public welfare systems are undergoing modernization to improve cross-border collaboration and integrate mental health and social support services digitally. Emphasis is placed on multi-lingual support and jurisdictional flexibility.

- Asia Pacific (APAC) (Fastest Growing Region): While currently a smaller market, APAC is projected to exhibit the highest CAGR. This growth is spurred by increasing government expenditure on social safety nets in densely populated countries and rapid digital infrastructure build-out. Countries like Australia and New Zealand are early adopters, while emerging economies like India and Southeast Asian nations are increasingly migrating away from paper-based systems to foundational case management platforms to manage rapid urbanization and social disparity challenges.

- Latin America (Emerging Adoption): Adoption is gradual but accelerating, driven by international aid projects and government initiatives focused on poverty reduction and healthcare access. The primary demand is for affordable, scalable cloud solutions that can operate effectively despite varying levels of connectivity and technical skill across different jurisdictions. The focus often remains on basic client tracking and operational transparency to combat corruption and improve aid distribution efficiency.

- Middle East and Africa (MEA) (Niche Growth Areas): Market penetration is limited but growing, centered in specific Gulf Cooperation Council (GCC) countries with high-tech spending and in South Africa, which has established social welfare programs. Growth is driven by the need for centralized management of expatriate workforce issues, humanitarian aid, and developing domestic social service structures, demanding highly secure, localized software implementations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Social Work Case Management Software Market.- Salesforce (Nonprofit Cloud)

- Eccovia Solutions

- Social Solutions Global (Apricot)

- WellSky

- ClientTrack

- Clarity Human Services

- Foothold Technology

- CiviCore

- Casebook

- Harris Computer

- Bonterra

- Microsoft (Dynamics 365)

- Athena Software

- PlanStreet

- ProviderSoft

- Kipu Health

- Harmony Healthcare IT

- Qualifacts (CareLogic)

- Streamline Healthcare Solutions

- Netsmart Technologies

Frequently Asked Questions

Analyze common user questions about the Social Work Case Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Social Work Case Management Software and how does it differ from standard CRM?

Social Work Case Management Software is specialized for human services, focusing on complex, longitudinal relationships, detailed mandated reporting, compliance (like HIPAA), and service outcome tracking, whereas standard CRM primarily targets sales, marketing, and commercial client relationships.

Which deployment model (Cloud vs. On-Premise) is currently preferred by social service agencies?

Cloud-Based (SaaS) deployment is increasingly preferred, especially by non-profits and government agencies, due to lower upfront capital expenditure, enhanced scalability, automatic maintenance updates, and superior mobile accessibility for field workers.

How does the integration of Artificial Intelligence benefit case management workflows?

AI integration benefits workflows by automating routine administrative tasks (note summarization), enhancing decision support through predictive risk modeling, optimizing resource allocation based on real-time data, and identifying high-priority cases that require immediate human intervention.

What are the primary security and compliance challenges for social work software vendors?

Primary challenges involve maintaining stringent data confidentiality and integrity according to varying jurisdictional laws (e.g., HIPAA, GDPR, 42 CFR Part 2 for substance abuse data), ensuring data residency requirements are met, and consistently preventing unauthorized access to highly sensitive client records.

What is driving the market growth in the Asia Pacific (APAC) region?

APAC market growth is driven by increasing government investment in formalized social welfare programs, the rapid digital transformation of public sector services, and the necessity to manage large populations through centralized and efficient digital record-keeping systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager