SocialFi Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441582 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

SocialFi Market Size

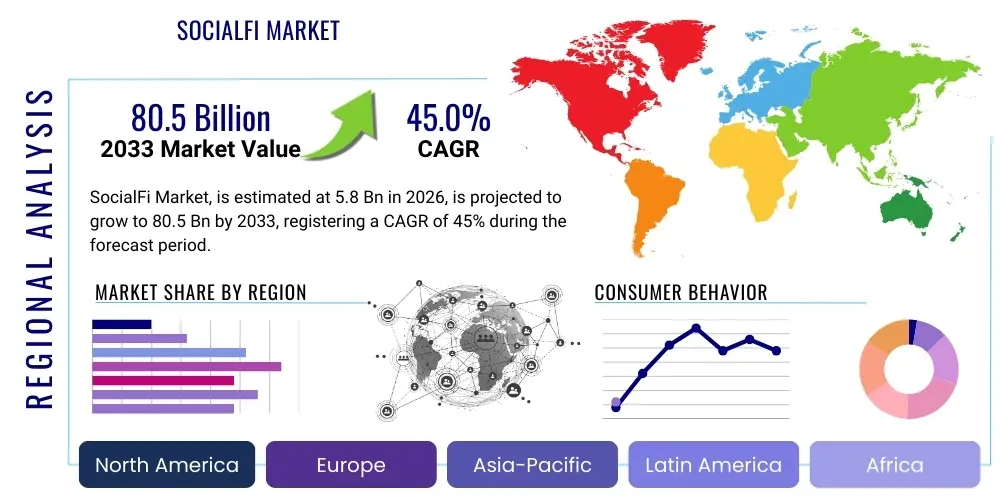

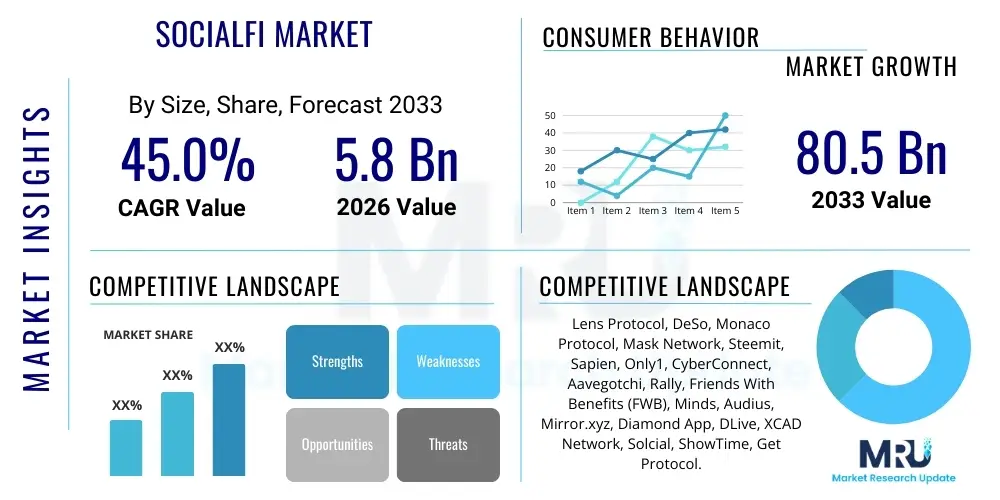

The SocialFi Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.0% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 80.5 Billion by the end of the forecast period in 2033.

SocialFi Market introduction

The SocialFi market, a fusion of social media functionality and decentralized finance (DeFi) principles, represents a paradigm shift from traditional Web2 social platforms. This domain is fundamentally built on blockchain technology, aiming to decentralize user data ownership, content creation monetization, and community governance. Unlike established platforms where centralized entities control user data and advertising revenue, SocialFi protocols empower creators and users through tokenization, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs). This architectural change fosters a more equitable value distribution, aligning the incentives of the platform developers, content creators, and the general user base. The primary objective is to solve the current inefficiencies related to censorship, data exploitation, and unfair revenue models prevalent in the incumbent social media landscape.

The core products within the SocialFi ecosystem include decentralized identity systems (DIDs), creator token platforms, decentralized content hosting solutions, and social marketplaces for unique digital assets (NFTs). Major applications span across various functionalities, including social networking, content monetization, community governance, peer-to-peer tipping, and social trading. For instance, platforms are emerging that allow users to tokenize their social influence, enabling fans to invest directly in a creator's future success. This integration of financial incentives with social interactions creates novel engagement loops, transforming passive consumption into active economic participation. Furthermore, the inherent transparency and immutability offered by blockchain ensure that interactions and transactions are verifiable, reducing the reliance on central trust mechanisms.

The driving factors propelling the growth of the SocialFi market are multifaceted. A primary driver is the increasing dissatisfaction among users regarding privacy violations and algorithmic manipulation by centralized corporations. Users are actively seeking platforms that offer genuine data ownership and immunity from arbitrary content moderation. Secondly, the rapid expansion of the global creator economy demands more robust, transparent, and efficient monetization tools than traditional advertising models provide. SocialFi offers direct, peer-to-peer payment rails and fractional ownership of content, drastically increasing creator earnings potential. Finally, the broader proliferation of Web3 technologies, especially the maturation of Layer 1 and Layer 2 scaling solutions, has improved the necessary infrastructure, making decentralized social experiences faster, cheaper, and more accessible to the mass market.

SocialFi Market Executive Summary

The SocialFi market is characterized by intense technological innovation and rapid user adoption, positioning it as one of the fastest-growing sectors within the broader Web3 economy. Current business trends indicate a strong focus on interoperability, with new protocols prioritizing modular architecture to facilitate seamless data and asset transfer between different decentralized applications (dApps). There is also a significant trend towards integrating governance mechanisms, where token holders actively participate in decisions regarding platform upgrades, moderation policies, and treasury management. Furthermore, venture capital interest remains robust, channeling substantial investment into decentralized identity solutions and tools that simplify the user experience (UX), crucial for bridging the gap between crypto-native users and mainstream social media consumers. Businesses are strategically focusing on niches such as intellectual property rights management and community-specific fan tokens to differentiate their offerings in a competitive landscape.

Regionally, the market is currently dominated by early adopters in North America and Asia Pacific (APAC), primarily driven by high crypto penetration rates and a large population of tech-savvy developers and content creators. North America leads in terms of capital investment and foundational protocol development, often serving as the incubator for cutting-edge decentralized social frameworks. Conversely, APAC, particularly countries like South Korea and Southeast Asian nations, exhibits rapid consumer adoption, driven by strong existing mobile engagement and a culturally ingrained acceptance of digital asset ownership. Emerging markets in Latin America and the Middle East and Africa (MEA) are showing promising growth, motivated by the desire to bypass restrictive centralized financial systems and capitalize on digital economic opportunities, positioning these regions as future growth accelerators for decentralized infrastructure.

Segmentation trends reveal that the Creator Token and NFT segment is undergoing the most explosive growth. Content creators are increasingly bypassing traditional agencies and utilizing personalized utility tokens (social tokens) to build exclusive micro-economies around their personal brand, offering tiered access, unique benefits, and investment opportunities to their followers. Another critical segment is the platform component, where protocols are vying for market share by focusing on specific user needs, such as professional networking, short-form video content, or gaming communities integrated with social layers. The long-term success of these segments hinges on reducing technical complexity and providing robust, censorship-resistant infrastructure that can handle massive transaction volumes while maintaining minimal operational costs for the end-user. The convergence of gaming (GameFi) and SocialFi also represents a major segment trend, where social interactions drive in-game economies and vice versa.

AI Impact Analysis on SocialFi Market

Common user inquiries regarding AI's impact on SocialFi often revolve around three central themes: content moderation efficacy, data privacy implications, and the role of AI-generated content (AIGC) in decentralized ownership models. Users are concerned about whether decentralized platforms can leverage AI for effective, scalable content filtering against spam, bots, and malicious activity without resorting to centralized control or infringing upon the core value of censorship resistance. There is also significant discussion surrounding the use of machine learning to analyze decentralized user data streams (while maintaining privacy through zero-knowledge proofs), seeking to offer personalized experiences without exploiting user information in the manner of Web2 platforms. Furthermore, the advent of sophisticated AIGC raises fundamental questions about intellectual property—specifically, how SocialFi protocols will verify authorship and assign tokenized ownership (NFTs) to content generated collaboratively by humans and AI algorithms, ensuring fair creator compensation.

The integration of Artificial Intelligence is poised to radically enhance the functionality and scalability of SocialFi platforms, addressing several limitations inherent in early Web3 systems. AI will be instrumental in developing advanced decentralized identity verification systems, utilizing biometric analysis or behavior modeling to prevent Sybil attacks and fraudulent accounts, thereby securing community governance structures (DAOs). Furthermore, AI-driven recommendation engines, operating on encrypted or decentralized datasets, can deliver highly relevant content discovery without the need for large, centralized data silos, drastically improving user engagement while upholding privacy mandates. This enables platforms to offer algorithmic personalization, traditionally a strength of Web2, within a decentralized and privacy-preserving framework, making the overall experience more compelling for mainstream users accustomed to personalized feeds.

Conversely, the impact of AI also introduces new complex challenges, particularly concerning ethical deployment and governance. The use of decentralized machine learning models requires robust auditing mechanisms to ensure algorithmic fairness and prevent bias, a task complicated by the immutable nature of blockchain records. Ensuring that AI tools do not inadvertently centralize moderation decisions, thus defeating the purpose of a decentralized social network, is a persistent operational and philosophical hurdle. Successful integration will require the development of transparent, on-chain AI models governed by DAOs, allowing the community to vote on model parameters and audit outputs, thereby maintaining trust and preventing single points of control over critical functions like content ranking or identity verification.

- AI-driven decentralized content moderation for spam and malicious activity without centralized censorship.

- Development of sophisticated, privacy-preserving recommendation algorithms using decentralized machine learning models.

- Enhanced security and anti-fraud measures using AI for decentralized identity (DID) verification and Sybil resistance.

- Automated assignment of tokenized ownership (NFTs) and fractional rights to AI-Generated Content (AIGC).

- Integration of personalized AI assistants to enhance user interaction, social trading, and asset discovery within SocialFi dApps.

DRO & Impact Forces Of SocialFi Market

The trajectory of the SocialFi market is shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively form the critical impact forces determining its widespread adoption and long-term viability. The principal drivers are centered on the consumer desire for greater control, specifically the increasing awareness and demand for solutions that combat centralized data exploitation and algorithmic bias characteristic of established Web2 platforms. This fundamental user shift, coupled with the exponential growth of the global creator economy—where creators seek direct, transparent, and higher-earning monetization paths—provides a continuous influx of both talent and investment into the decentralized social space. These drivers create compelling pull factors, pushing users and developers away from legacy structures towards decentralized alternatives that promise sovereignty and financial equity.

Despite strong foundational drivers, the SocialFi market faces significant and entrenched restraints. Regulatory uncertainty remains a paramount concern globally; the lack of clear legal frameworks regarding social tokens, decentralized autonomous organizations (DAOs), and digital assets complicates operational scaling and institutional investment, often leading to market apprehension. Furthermore, technical friction poses a major barrier to mass adoption; high gas fees on certain foundational blockchains, coupled with a steep learning curve related to wallet management, seed phrases, and complex DeFi integrations, deter non-crypto native users from transitioning fully. Scalability challenges, although improving with Layer 2 solutions, still represent a constraint, as decentralized platforms must demonstrate the capacity to handle the massive transaction throughput demanded by global social media activity.

Opportunities within the SocialFi market are primarily concentrated in cross-chain interoperability and the integration with emerging digital ecosystems, notably the Metaverse. Developing seamless pathways for users to move their decentralized identities and tokenized assets across various blockchain networks is crucial for fostering a truly open and expansive social graph. The burgeoning Metaverse offers a massive opportunity for SocialFi protocols to provide the foundational social and economic layers, allowing users to monetize virtual interactions, own digital land, and establish token-gated communities within persistent virtual worlds. Furthermore, the development of enterprise-grade decentralized identity solutions presents a significant opportunity to extend SocialFi principles beyond consumer applications and into secure professional and institutional networking environments, utilizing blockchain for verifiable credentials and reputation management. These factors create strong competitive pressure on centralized entities, compelling them toward a more decentralized operational posture.

Segmentation Analysis

The SocialFi market is analyzed across several distinct and rapidly evolving dimensions, including Component, Monetization Model, Application, and Blockchain Platform. This granular segmentation provides critical insights into the areas of highest growth potential and technological maturity. The Component segmentation differentiates between the foundational Protocols or Platforms, which provide the core social graph and infrastructure, and the Services layer, which includes third-party tools like analytics, moderation services, and identity management dApps built atop the main protocols. Understanding this dichotomy is essential for investors looking to back either infrastructure providers or value-added service creators. The complexity of the market necessitates a clear view of which technological stack is currently attracting the most development talent and user activity.

Analysis by Monetization Model highlights the diverse ways platforms and creators generate revenue in the decentralized economy. Key models include the issuance and trading of Creator Tokens, which establish personal economic value; the use of Non-Fungible Tokens (NFTs) for exclusive content access, intellectual property ownership, and digital collectibles; and, increasingly, decentralized advertising models that share ad revenue directly with the users viewing the content. This segmentation demonstrates a clear shift away from centralized data aggregation and towards direct, transparent economic relationships between creators, consumers, and advertisers. The rapid innovation in hybrid models, combining token-gated access with DeFi staking mechanisms, is a significant trend driving market value.

Application-based segmentation helps delineate specific use cases driving adoption. Content creation platforms (e.g., decentralized blogging or video sharing), community building tools (e.g., token-gated DAOs or decentralized forums), and social trading applications (combining financial tracking and peer-to-peer investment discussion) are the dominant categories. Each application caters to a distinct user demographic and offers unique challenges and opportunities in terms of scalability and regulatory compliance. Finally, segmenting the market by the underlying Blockchain Platform (e.g., Ethereum, Solana, Polygon, BSC) is crucial, as throughput, gas costs, and developer ecosystem size heavily influence the viability and scalability of the SocialFi dApps deployed on them. Protocols built on high-throughput, low-cost chains are generally favored for applications requiring frequent, micro-transactions.

- By Component:

- Platform (Protocols and Infrastructure)

- Service (Analytics, Moderation Tools, Identity Management)

- By Monetization Model:

- Creator Tokens (Social Tokens)

- Non-Fungible Tokens (NFTs)

- Decentralized Advertising and Tipping

- Staking and Yield Generation

- By Application:

- Content Creation and Sharing

- Community Governance (DAO integration)

- Social Trading and Investment

- Decentralized Identity and Reputation Management

- By Blockchain Platform:

- Ethereum and Layer 2 Solutions (Polygon, Arbitrum)

- Solana

- Binance Smart Chain (BSC)

- Others (Flow, Avalanche, Near Protocol)

Value Chain Analysis For SocialFi Market

The SocialFi value chain begins with the Upstream analysis, focusing on the foundational infrastructure components. This stage involves blockchain infrastructure providers (Layer 1 and Layer 2), decentralized storage solutions (like IPFS and Arweave), and core smart contract development platforms. Key stakeholders here include protocol engineers, validators, and infrastructure financiers who ensure the network's security, scalability, and uptime. The quality and cost-effectiveness of this upstream layer directly dictate the performance and viability of all decentralized applications built subsequently. Innovations in this phase, such as zero-knowledge proofs for privacy and novel consensus mechanisms, are crucial for reducing transaction costs and improving data integrity, thus providing a competitive advantage to the entire ecosystem.

The midstream segment comprises the core SocialFi protocols and application developers—the entities that establish the social graph, implement decentralized identity (DID) standards, and build the primary user-facing interfaces. This includes governance model architects (DAOs) and tokenomics designers who structure the platform's internal economy. These protocols integrate the upstream infrastructure and package it into usable decentralized social applications, focusing heavily on user experience (UX) to compete effectively with established Web2 platforms. The efficiency of the governance model and the fairness of the token distribution scheme are critical determinants of midstream success, influencing developer recruitment and community loyalty.

The downstream analysis focuses on market distribution and end-user engagement, encompassing distribution channels, direct monetization avenues, and the role of third-party integrators. Distribution is primarily executed through decentralized application stores, web browsers with integrated crypto wallets (e.g., MetaMask, Phantom), and community outreach programs designed to onboard non-crypto users. Direct distribution is crucial, often involving direct token drops or incentive mechanisms (like play-to-earn or create-to-earn models) to attract initial users. Indirect distribution involves partnerships with existing Web3 ecosystems, such as Metaverse platforms or GameFi projects, leveraging their existing user bases. The value chain culminates in the monetization of social influence, where creators and consumers derive tangible economic benefit directly from their social activities, bypassing traditional centralized intermediaries.

SocialFi Market Potential Customers

The potential customer base for the SocialFi market is segmented into three primary groups: The Creator Economy, Privacy-Conscious Individuals, and Web3 Developers/Investors. The Creator Economy, comprising individual content creators, influencers, artists, musicians, and independent journalists, represents the most immediate and motivated customer segment. These individuals are actively seeking platforms that offer significantly higher revenue shares, direct fan monetization tools (creator tokens, NFTs), and full ownership of their audience data and intellectual property. Their dissatisfaction with arbitrary demonetization and platform algorithm changes drives a strong willingness to adopt decentralized alternatives that offer predictable and transparent income streams.

The second major segment includes general social media users who prioritize data privacy, freedom of speech, and sovereign control over their digital identity. This segment is growing rapidly due to repeated high-profile data breaches and increasing public awareness of centralized algorithmic manipulation. These users are seeking censorship-resistant communication channels and platforms where their activity cannot be exploited for targeted advertising without their explicit, tokenized consent. They act as the volume driver for decentralized platforms, provided the user experience is sufficiently streamlined to rival Web2 usability.

The third critical segment encompasses Web3 Developers, investors, and institutional entities. Developers serve as the builders and early adopters, utilizing SocialFi protocols (such as Lens Protocol or CyberConnect) as modular layers to build specialized dApps, contributing to the expansion of the ecosystem. Investors, including Venture Capital firms and decentralized autonomous organizations (DAOs), are customers of the market's underlying tokens and governance rights, seeking high-growth opportunities within decentralized digital assets. Institutional entities are emerging potential customers for decentralized identity solutions, requiring verifiable credentials and secure, blockchain-based professional networking tools that offer enhanced security and auditability compared to traditional centralized platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 80.5 Billion |

| Growth Rate | 45.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lens Protocol, DeSo, Monaco Protocol, Mask Network, Steemit, Sapien, Only1, CyberConnect, Aavegotchi, Rally, Friends With Benefits (FWB), Minds, Audius, Mirror.xyz, Diamond App, DLive, XCAD Network, Solcial, ShowTime, Get Protocol. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SocialFi Market Key Technology Landscape

The technological underpinnings of the SocialFi market are characterized by a convergence of advanced blockchain protocols and cutting-edge data architecture designed to facilitate decentralized, secure, and highly efficient social interactions. The most foundational technology is the utilization of Layer 1 and Layer 2 scaling solutions, which address the historical limitations of blockchain throughput and cost. Layer 2 solutions, such as optimistic and ZK (zero-knowledge) rollups, are crucial for enabling the high volume of micro-transactions (likes, comments, tips) necessary for a functional social network environment, reducing gas fees to negligible amounts and ensuring near-instantaneous confirmations. Furthermore, these platforms heavily rely on smart contract technology to automate complex financial and governance agreements, such as token distribution, DAO voting rights, and automated royalty payments for NFT sales.

Decentralized Identity (DID) and verifiable credentials form the core layer of user ownership and security within SocialFi. Protocols employ technologies that allow users to manage their digital identity cryptographically, ensuring that their reputation, data, and social graph are portable and not tied to any single centralized platform. This often involves the use of self-sovereign identity standards where cryptographic keys stored securely in a user's wallet control their identity. This contrasts sharply with Web2 models where platforms act as the sole custodians of user identity. The shift towards DID is paramount for enabling true interoperability, allowing users to seamlessly transition between different decentralized applications without recreating profiles or losing accumulated social capital.

Finally, robust decentralized data storage solutions and interoperability frameworks are essential technological components driving market expansion. SocialFi content—ranging from text posts to high-resolution videos—cannot be practically stored on-chain due to high costs and storage limits. Therefore, decentralized file storage systems, such as IPFS (InterPlanetary File System) or Arweave, are utilized to host content securely and immutably, with only the content hash stored on the blockchain for verification. Furthermore, emerging cross-chain communication protocols (e.g., Cosmos IBC or specialized bridges) are necessary to ensure that social assets, creator tokens, and identity data can traverse different blockchain ecosystems, facilitating a unified, borderless decentralized social experience. This technological landscape supports the core promise of SocialFi: empowering users through ownership and portability.

Regional Highlights

Regional dynamics play a significant role in shaping the adoption and innovation landscape of the SocialFi market, driven by varying regulatory environments, economic conditions, and technological infrastructure maturity. North America, particularly the United States, stands as the primary hub for venture capital investment and foundational protocol development. The region benefits from a dense concentration of Web3 engineering talent, established crypto liquidity, and institutional interest in blockchain applications. Key market relevance in North America is centered on complex technological innovation, governance models (DAO structuring), and the creation of developer toolkits, setting the pace for global standards and attracting substantial early-stage funding for high-risk, high-reward projects like decentralized identity infrastructure and social trading protocols.

The Asia Pacific (APAC) region demonstrates robust market relevance primarily through high consumer adoption and diverse use cases, often focused on mobile-first applications and the integration of SocialFi principles into GameFi ecosystems. Countries such as South Korea, Japan, and Singapore are key players, driven by strong existing digital payment infrastructure and a population generally more receptive to digital asset ownership (NFTs and social tokens). APAC is often characterized by the rapid scaling of successful models, focusing on ease-of-use and localized content creation platforms. Regulatory environments remain heterogeneous, with some nations fostering supportive frameworks (like Singapore) while others maintain stricter control, leading to dynamic market adaptation and strong regional competitive pressure among decentralized application providers.

Europe and the Middle East and Africa (MEA) represent distinct growth trajectories. Europe, guided by progressive data protection regulations like GDPR, exhibits high demand for privacy-centric SocialFi solutions, focusing heavily on secure decentralized identity and transparent data handling mechanisms. Key countries like the UK, Germany, and Switzerland are developing hubs for regulatory clarity around digital assets, supporting stable, compliance-focused growth. MEA regions, particularly countries facing high financial volatility or restrictive centralized financial systems, find SocialFi appealing as an economic empowerment tool. This region’s market relevance is tied to the adoption of decentralized platforms for cross-border payments, peer-to-peer commerce, and accessing global creator markets, often utilizing low-cost blockchain networks to overcome traditional banking barriers.

- North America (US, Canada): Dominant in capital investment, foundational protocol development, and innovation in decentralized identity and governance (DAOs).

- Asia Pacific (China, South Korea, Japan, Singapore): Leading in consumer adoption, integration with GameFi, and focus on mobile-first, high-throughput social applications; significant market size due to creator economy growth.

- Europe (UK, Germany, Switzerland): High demand for privacy-focused solutions; strong regulatory focus influencing compliance and security standards for decentralized platforms.

- Latin America (Brazil, Mexico): Rapid adoption driven by seeking alternatives to traditional financial systems; strong growth potential for social trading and localized creator monetization.

- Middle East and Africa (MEA): Emerging markets prioritizing economic empowerment and censorship resistance, focusing on low-cost blockchain solutions for general social interaction and commerce.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SocialFi Market.- Lens Protocol

- DeSo

- Monaco Protocol

- Mask Network

- Steemit

- Sapien

- Only1

- CyberConnect

- Aavegotchi

- Rally

- Friends With Benefits (FWB)

- Minds

- Audius

- Mirror.xyz

- Diamond App

- DLive

- XCAD Network

- Solcial

- ShowTime

- Get Protocol

Frequently Asked Questions

Analyze common user questions about the SocialFi market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is SocialFi and how does it differ from traditional social media platforms?

SocialFi (Social Finance) combines social media functionality with decentralized finance (DeFi), leveraging blockchain technology. Unlike traditional Web2 platforms that centralize control and monetize user data, SocialFi grants users ownership of their data, content, and monetization streams through tokens, NFTs, and decentralized governance (DAOs).

How do creators earn money on SocialFi platforms?

Creators primarily earn through direct peer-to-peer transactions, bypassing intermediaries. Monetization models include selling Non-Fungible Tokens (NFTs) representing unique content or access, issuing personal Creator Tokens that followers can invest in, receiving tokenized tips, and earning rewards from decentralized advertising models based on verified engagement.

What is the role of Decentralized Identity (DID) in the SocialFi ecosystem?

Decentralized Identity (DID) allows users to cryptographically own and control their digital identities and social graphs. This enables portability, meaning users can move their reputation, followers, and credentials between different SocialFi applications without being tied to a single platform, ensuring sovereignty and resistance against censorship.

What are the primary challenges facing the mass adoption of SocialFi?

The main challenges include regulatory uncertainty surrounding social tokens and decentralized autonomous organizations (DAOs), significant technical friction for non-crypto native users (complex wallet management), and the need for decentralized platforms to achieve the massive transaction scalability required for global social networking.

Which blockchain platforms are most critical for SocialFi infrastructure?

Platforms built on scalable, low-cost blockchains and Layer 2 solutions are most critical, including Ethereum Layer 2s (like Polygon and Arbitrum), Solana, and Binance Smart Chain (BSC). These platforms offer the necessary transaction speed and low fees required to support frequent, high-volume social interactions and micro-transactions essential for mass adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager