Socket Head Bolt Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441138 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Socket Head Bolt Market Size

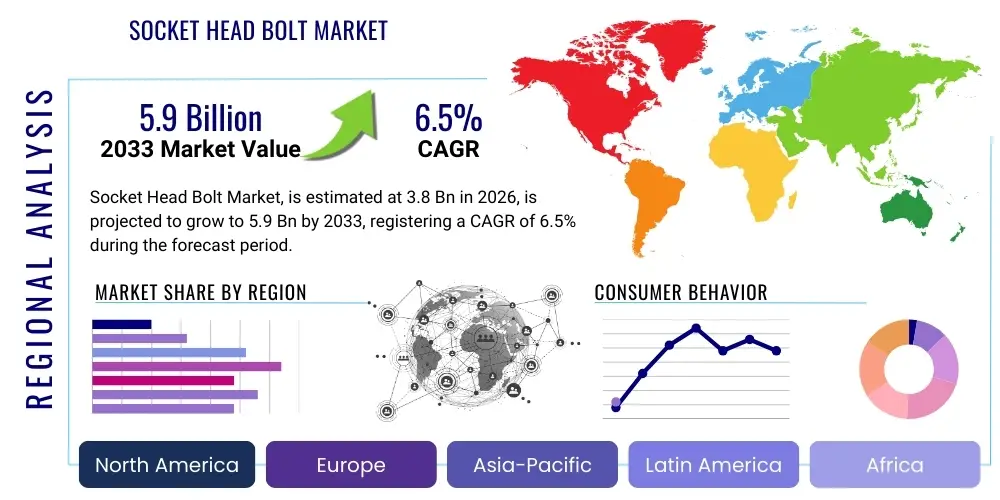

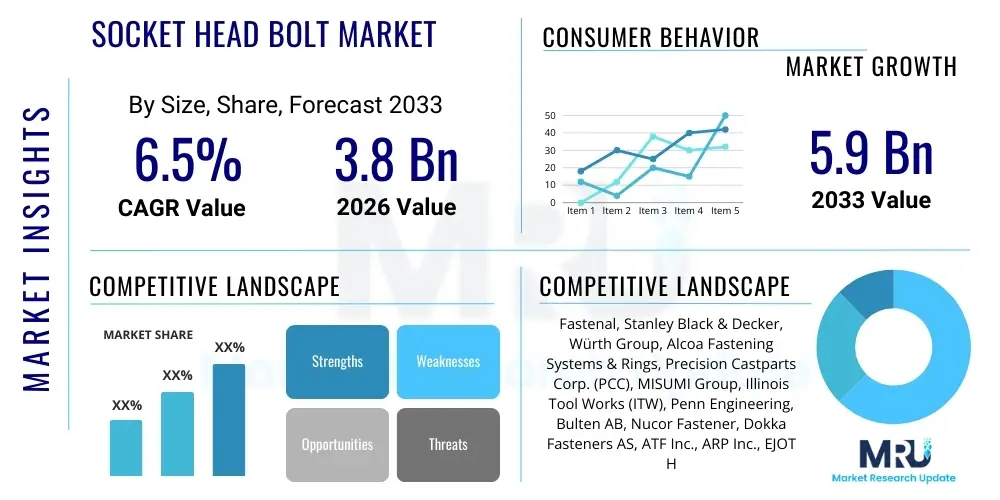

The Socket Head Bolt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-strength, precise fastening solutions across critical industries such as automotive, aerospace, heavy machinery, and renewable energy infrastructure. The superior torque transmission capabilities and compact profile of socket head bolts make them indispensable components in modern industrial design, particularly where space efficiency and robust connection integrity are paramount.

Socket Head Bolt Market introduction

The Socket Head Bolt Market encompasses the production, distribution, and utilization of externally threaded fasteners featuring an internal hexagonal drive, designed for tight spaces and high clamping loads. These specialized fasteners are crucial for assembling components in demanding environments requiring tamper resistance, high tensile strength, and reduced external protrusion. The primary product description includes various configurations such as socket head cap screws, set screws, and shoulder screws, manufactured predominantly from materials like alloy steel, stainless steel, and specialized alloys to meet diverse strength and corrosion resistance requirements across applications.

Major applications for socket head bolts span heavy machinery manufacturing, where they secure critical mechanical elements; the automotive sector, used extensively in engine assembly and chassis construction; aerospace and defense, demanding extremely high precision and reliability; and the construction industry, particularly in structural framing and specialized equipment. The intrinsic benefits of using these fasteners include superior fatigue resistance, easier maintenance access with hex keys, and the ability to achieve higher preloads compared to traditional external drive fasteners, thereby enhancing overall joint reliability. These attributes collectively act as key driving factors, propelling sustained market demand as industries increasingly prioritize optimized assembly techniques and long-term durability in complex systems.

Socket Head Bolt Market Executive Summary

The global Socket Head Bolt Market exhibits robust business trends characterized by a shift towards specialized, high-performance alloys and customized threading solutions tailored for lightweighting initiatives in aerospace and automotive manufacturing. Key industry players are focusing on advanced manufacturing techniques, including cold forging and precision CNC machining, to enhance dimensional accuracy and material integrity, crucial for mission-critical applications. Furthermore, consolidation within the global fastener supply chain and strategic long-term contracts with major OEM consumers are defining the competitive landscape, emphasizing quality control and certified manufacturing processes as primary differentiators among suppliers.

Regionally, the Asia Pacific region dominates market growth, fueled by massive infrastructure investments, rapid industrialization, and the exponential expansion of manufacturing bases in countries like China, India, and South Korea, which drives significant demand for heavy machinery and automotive components. North America and Europe, while mature markets, maintain high revenue share due to stringent quality standards in aerospace and sophisticated machinery production, requiring high-value, niche fastener solutions. Segment trends indicate a pronounced preference for Alloy Steel socket head cap screws due to their optimal balance of strength and cost efficiency, though Stainless Steel is seeing increased adoption in corrosive or high-temperature environments, particularly within the energy and chemical processing sectors. The growing market for specialized finishes, such as zinc flake coatings and protective sealants, also reflects a wider industry trend towards enhanced fastener lifespan and reduced maintenance requirements.

AI Impact Analysis on Socket Head Bolt Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Socket Head Bolt Market primarily revolve around operational efficiency, predictive maintenance integration, and supply chain optimization. Users frequently inquire about how AI can refine manufacturing tolerances, minimize material waste, and forecast demand fluctuations more accurately. Key themes emerge around the use of machine learning algorithms for real-time quality inspection during production, leveraging computer vision systems to detect micro-cracks or dimensional inconsistencies faster than traditional methods. Furthermore, there is significant anticipation regarding AI's role in optimizing inventory levels and ensuring just-in-time delivery of specialized bolts, mitigating the risks associated with global supply chain disruptions and minimizing expensive inventory holding costs for high-volume users.

- AI-driven Predictive Maintenance: Enhancing machine uptime in manufacturing by forecasting equipment failures in fastener production lines, reducing unplanned downtime.

- Quality Control Automation: Utilizing deep learning models for high-speed, non-destructive inspection of bolts for material flaws, surface defects, and precise thread geometry conformance.

- Supply Chain Optimization: Employing machine learning algorithms for dynamic routing, optimized warehousing strategies, and better forecasting of raw material needs (e.g., steel coil types) based on global macroeconomic indicators.

- Generative Design Integration: Using AI to explore novel socket head bolt geometries for weight reduction and increased tensile strength specific to custom applications like electric vehicle chassis.

- Automated Pricing and Bidding: Implementing smart systems to determine competitive, margin-optimized pricing strategies in large-volume fastener contracts based on real-time commodity pricing and operational capacity.

DRO & Impact Forces Of Socket Head Bolt Market

The Socket Head Bolt Market is influenced by a dynamic interplay of factors encompassing strong industry drivers, specific market restraints, and emerging technological opportunities, which collectively determine the market's trajectory and profitability. The major drivers include the relentless expansion of the global industrial and manufacturing base, particularly in heavy machinery and precision instrumentation, coupled with increasingly stringent safety and reliability standards in sectors like aerospace and automotive which mandate the use of high-integrity fasteners. Market growth is further augmented by rapid urbanization and subsequent infrastructural development across emerging economies, necessitating robust and durable fastening solutions for structural integrity.

However, the market faces significant restraints, primarily centered on the inherent volatility of raw material costs, specifically alloy steel and specialized metallic elements like nickel and molybdenum, which directly impact manufacturing profit margins. Additionally, the proliferation of counterfeit or substandard fasteners, particularly in less regulated markets, poses a continuous threat to brand integrity and requires substantial investment in anti-counterfeiting measures and strict quality certifications. Opportunities for growth are substantial, particularly in the adoption of lightweight materials, such as titanium and advanced composites, for specialized socket bolts used in next-generation electric vehicles and aerospace applications seeking significant weight reduction. Furthermore, the rising demand for specialty coatings to enhance corrosion resistance in harsh operational environments presents a lucrative avenue for product differentiation and premium pricing.

The primary impact forces shaping the market are technological advancements in cold forging processes, allowing for faster production cycles and improved material properties, and increasing global regulatory standardization which pressures manufacturers to comply with international norms (e.g., ISO, DIN), thereby streamlining global trade but increasing compliance costs. The sustainability movement also acts as a force, pushing suppliers towards energy-efficient manufacturing and the use of recycled materials, influencing procurement decisions from environmentally conscious OEMs. These forces necessitate continuous investment in research and development and agile supply chain management to maintain competitive advantage.

Segmentation Analysis

The Socket Head Bolt Market segmentation provides a granular view of market dynamics based on key characteristics including material composition, specific product type, and application industry. Analyzing these segments helps stakeholders identify high-growth areas and tailor product offerings to meet precise technical requirements across diverse operational environments. The market exhibits significant variation in demand for specialized materials, ranging from standard carbon steel for general industrial use to high-grade titanium and specialized nickel alloys required for critical, high-stress applications such as deep-sea oil and gas infrastructure or high-performance race engines.

- By Material Type: Stainless Steel, Alloy Steel, Carbon Steel, Others (Titanium, Brass, Nickel Alloys).

- By Product Type: Socket Head Cap Screws, Socket Set Screws, Socket Shoulder Screws, Button Head Socket Screws, Flat Head Socket Screws.

- By Application/End-Use Industry: Automotive, Machinery Manufacturing (General and Heavy), Construction and Infrastructure, Aerospace and Defense, Energy (Oil & Gas, Wind, Solar), Electronics and Consumer Goods.

Value Chain Analysis For Socket Head Bolt Market

The value chain for the Socket Head Bolt Market commences with upstream analysis focusing on raw material procurement, primarily high-quality steel wire rods, specialized alloys (e.g., chrome-molybdenum), and chemical coatings. Stability and pricing in this segment are highly sensitive to global commodity markets, impacting the cost of manufacturing. Key activities at this stage involve securing long-term contracts with metal suppliers and advanced metallurgical testing to ensure compliance with precise specifications before forging begins. Manufacturing efficiency, particularly through optimizing cold heading and thread rolling processes, determines the overall production cost base and capacity utilization, marking the core transformative stage in the value chain.

Downstream analysis centers on finished product handling, quality assurance, inventory management, and distribution to end-users. After final heat treatment and surface finishing (e.g., galvanization, passivation), the bolts are packaged, often in bulk or specific kit configurations, tailored to industrial client requirements. The distribution channel is crucial, involving both direct sales to major Original Equipment Manufacturers (OEMs) and indirect sales through a vast network of industrial distributors, maintenance, repair, and operations (MRO) suppliers, and online marketplaces. Direct sales ensure customized service and traceability for mission-critical parts in sectors like aerospace, while indirect channels provide market reach and accessibility for standard catalog items to smaller manufacturers and repair shops.

The relationship between direct and indirect distribution channels is symbiotic; direct channels secure high-volume, long-term specialized orders, while indirect channels provide geographic market penetration and handle smaller, more frequent transactions. Efficient logistics, minimizing warehousing costs, and ensuring rapid fulfillment are paramount throughout the distribution phase. The final element involves post-sale support, including technical assistance on application torque requirements and material compatibility, reinforcing the fastener supplier's role as a technical partner rather than just a commodity provider. This full-service approach adds significant value, especially in demanding industrial applications.

Socket Head Bolt Market Potential Customers

The primary end-users and buyers of socket head bolts are broadly categorized into heavy industrial fabricators and precision engineering sectors that rely on high-integrity mechanical connections. These products are indispensable components for manufacturing organizations that require robust, high-tensile fasteners capable of withstanding extreme vibration, temperature fluctuations, and immense load-bearing stresses. Potential customers are entities that prioritize reduced maintenance downtime, reliable assembly processes, and component longevity, making them willing to invest in premium, certified socket head bolts over standard alternatives.

The largest segments of end-users include major automotive manufacturers, both traditional internal combustion engine (ICE) vehicle producers and burgeoning electric vehicle (EV) companies, utilizing these bolts extensively in battery packs, motor assemblies, and chassis components. Secondly, heavy machinery manufacturers producing construction equipment, agricultural machinery, and mining apparatus represent significant buyers, demanding materials with exceptional wear and shear resistance. Lastly, the aerospace sector, encompassing commercial aircraft, defense systems, and space technology, constitutes a high-value niche segment where material traceability, certification, and zero-defect quality are non-negotiable purchasing criteria. These sophisticated buyers often require custom sizes, specialized coatings, and exotic materials, driving innovation in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal, Stanley Black & Decker, Würth Group, Alcoa Fastening Systems & Rings, Precision Castparts Corp. (PCC), MISUMI Group, Illinois Tool Works (ITW), Penn Engineering, Bulten AB, Nucor Fastener, Dokka Fasteners AS, ATF Inc., ARP Inc., EJOT Holding GmbH & Co. KG, Optimas Solutions, SFS Group, MW Industries, Bossard Group, Parker-Kalon, LISI Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Socket Head Bolt Market Key Technology Landscape

The technological landscape of the Socket Head Bolt Market is rapidly evolving, driven by the need for enhanced fastener performance, manufacturing efficiency, and material innovation. The core manufacturing technology remains advanced cold forging or cold heading, a process optimized to improve the mechanical properties of the steel, resulting in superior grain structure and enhanced tensile strength compared to machined parts. Modern cold forging equipment incorporates high-speed multi-station machines capable of producing complex geometries with minimal material waste and extremely tight tolerances, significantly reducing overall per-unit cost while maintaining exceptional quality suitable for demanding automotive and aerospace applications. Furthermore, advancements in specialized tooling and die materials, often utilizing tungsten carbide, allow for extended production runs and reduced downtime for tooling changes, further bolstering productivity.

Another crucial technological area involves heat treatment and surface finishing. Controlled atmosphere furnaces and vacuum heat treatment processes are employed to achieve precise hardness and strength profiles, optimizing the balance between ductility and fatigue resistance, essential parameters for high-stress cyclic loading applications. Surface technologies are also advancing rapidly, with manufacturers moving beyond standard zinc plating to more sophisticated corrosion-resistant coatings such as zinc flake (lamellar) systems and specialized protective sealants. These advanced coatings offer superior resistance to harsh chemicals, road salt, and extreme temperature cycling, significantly extending the lifespan and reliability of the fastener in critical infrastructure and marine environments, directly addressing reliability demands from major OEMs.

The integration of Industry 4.0 principles, including sensor technology and automated inspection systems, is fundamentally transforming quality assurance within the market. Non-contact measurement systems, optical sorters, and eddy current testing are used to verify dimensions, material composition, and detect minor surface anomalies at high production speeds. This technology ensures that every batch of socket head bolts meets the strict specifications required by international standards (e.g., ASTM, DIN). Additionally, material science research is focusing on developing new, lightweight alloys—including high-strength aluminum and advanced titanium grades—specifically tailored for high-performance socket bolts where mass reduction is critical, especially in the booming electric mobility sector and next-generation aerospace programs, marking a significant technological shift toward specialized material adoption.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and supply equilibrium of the Socket Head Bolt Market, reflecting varying industrial growth rates, regulatory environments, and technological adoption levels across geographies.

- Asia Pacific (APAC): This region is the undisputed growth engine, propelled by colossal investments in infrastructure projects, robust manufacturing activities, and the rapid expansion of the automotive sector, particularly in electric vehicles. Key contributors like China, India, and Southeast Asian nations show massive appetite for both standard and high-tensile socket head bolts for machinery and construction. The growing presence of global OEMs setting up production facilities further solidifies APAC's dominant market position.

- North America: Characterized by a strong focus on high-value, high-precision fasteners, primarily driven by the demanding requirements of the aerospace, defense, and oil & gas industries. The U.S. and Canada represent mature markets where quality and certification are prioritized over price. There is substantial demand for specialized materials like titanium and nickel-alloy socket bolts used in advanced technological applications.

- Europe: A highly regulated market dominated by Germany, France, and the UK, emphasizing quality, sustainability, and adherence to European standards (EN/DIN). The automotive sector, particularly premium and luxury vehicle manufacturing, alongside machinery and precision engineering, sustains significant demand. Strict environmental regulations also drive interest in sustainably sourced materials and advanced anti-corrosion finishes.

- Latin America (LATAM): Growth in this region is linked to fluctuating commodity prices and infrastructure investments, primarily in Brazil and Mexico. The demand is often concentrated in mining, construction, and localized automotive assembly operations, seeking reliable, cost-effective socket fastening solutions.

- Middle East and Africa (MEA): Market growth is heavily influenced by large-scale energy projects, including oil, gas, and major renewable energy installations, alongside substantial investments in urban development and construction (e.g., GCC countries). The demand is concentrated on fasteners requiring extreme resistance to high temperatures, salinity, and corrosion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Socket Head Bolt Market.- Fastenal

- Stanley Black & Decker

- Würth Group

- Alcoa Fastening Systems & Rings

- Precision Castparts Corp. (PCC)

- MISUMI Group

- Illinois Tool Works (ITW)

- Penn Engineering

- Bulten AB

- Nucor Fastener

- Dokka Fasteners AS

- ATF Inc.

- ARP Inc.

- EJOT Holding GmbH & Co. KG

- Optimas Solutions

- SFS Group

- MW Industries

- Bossard Group

- Parker-Kalon

- LISI Aerospace

Frequently Asked Questions

Analyze common user questions about the Socket Head Bolt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using socket head bolts over hex head bolts?

Socket head bolts offer superior clamping force, require less clearance space around the head due to their internal drive system, and provide a cleaner, more aesthetic finish. They are also less prone to stripping and are ideal for high-stress, cyclical loading applications where joint integrity is paramount.

Which material segment holds the largest share in the socket head bolt market?

Alloy Steel (specifically high-strength grades like 12.9) currently dominates the market share due to its excellent strength-to-cost ratio, making it the preferred choice for general machinery, heavy equipment, and most automotive applications requiring high tensile strength and fatigue resistance.

How is the growth of the electric vehicle (EV) sector impacting demand for socket head bolts?

The EV sector is driving increased demand for lightweight, specialized socket head bolts, particularly those made from aluminum, titanium, or advanced composites, essential for securing battery casings, motor assemblies, and critical structural components while minimizing overall vehicle weight to maximize range.

What key standards and certifications must socket head bolt manufacturers adhere to?

Manufacturers must rigorously adhere to international standards such as ISO (International Organization for Standardization), DIN (Deutsches Institut für Normung), and specific national standards like ASTM (American Society for Testing and Materials). Certifications like ISO 9001 and specific aerospace standards (e.g., AS9100) are also frequently required by major industrial buyers.

What technological advancements are optimizing socket head bolt manufacturing efficiency?

Modern manufacturing is increasingly relying on advanced multi-station cold forging techniques for higher speed and precision, vacuum heat treatment for optimal strength profiles, and AI-integrated optical sorting and non-contact inspection systems to ensure zero-defect quality control at high volumes.

The subsequent analysis delves into a meticulous evaluation of the market's performance metrics, strategic implications, and the competitive strategies being deployed by leading global players. The depth of the market is explored through detailed segment-by-segment forecasts, emphasizing the factors driving demand for specialized fasteners in emerging industrial clusters. This comprehensive review provides critical data points for investors, manufacturers, and supply chain partners looking to capitalize on the sustained growth in precision fastening solutions globally. The market for socket head bolts, particularly those engineered for high performance, is highly sensitive to shifts in global industrial output and capital expenditure across major manufacturing hubs. Understanding the nuances between standard commercial grades and aerospace-grade, mission-critical fasteners is essential for strategic planning within this sector. The increasing complexity of mechanical assemblies, driven by miniaturization and the need for higher power density, ensures that the demand for internally driven fasteners will continue to outpace the growth of conventional external drive bolts. Manufacturers are increasingly leveraging digital twins and simulation software during the design phase to predict the performance of their socket head bolts under various load conditions and environments, enhancing product validation before physical prototyping. This digital transformation is not only speeding up the product development cycle but also setting new benchmarks for fastener reliability and predictability in high-stakes applications. The detailed regional analysis confirms that while APAC remains volume-driven, North America and Europe continue to set the precedent for quality innovation and the adoption of cutting-edge materials and coatings, often dictated by strict regulatory oversight in sectors like defense and medical devices, where failure is not an option. The overall market resilience is strongly tied to global GDP health and the willingness of industrial economies to invest in new infrastructure and updated manufacturing equipment.

Further examination into the raw material procurement dynamics reveals that manufacturers are actively seeking diversification strategies to mitigate pricing risks associated with core alloying elements like nickel, chromium, and vanadium. These elements are critical for achieving the high strength and corrosion resistance required for premium socket head bolts. Long-term hedging strategies and vertical integration, where possible, are becoming common practices among large fastener conglomerates to stabilize input costs and ensure supply continuity, particularly during periods of intense geopolitical volatility or resource scarcity. This focus on resilient material sourcing is a non-negotiable component of modern fastener manufacturing strategy. The rise of additive manufacturing (3D printing) presents a nascent, yet potentially disruptive, technological opportunity. While not yet economically viable for mass production of standard socket head bolts, additive techniques are being explored for producing highly specialized, geometrically complex, and low-volume fasteners made from exotic or non-conventional alloys. These niche applications typically serve prototyping needs or highly specialized end-users in the medical or space exploration sectors, pushing the boundaries of traditional fastener design and metallurgy. Moreover, the competitive intensity within the Socket Head Bolt Market is substantial, characterized by a mix of large, multinational distributors and specialized, high-precision manufacturers. Differentiation strategies increasingly revolve around providing comprehensive inventory management services (Vendor Managed Inventory - VMI), customized kitting solutions for assembly lines, and superior technical support, rather than simply competing on price. This shift towards service integration elevates the value proposition of key market players and strengthens their long-term relationships with Tier 1 and Tier 2 suppliers in major industrial chains.

The specific demands arising from the global transition to renewable energy sources, such as offshore and onshore wind power, introduce unique challenges for socket head bolt manufacturers. Fasteners used in wind turbine towers, nacelles, and particularly in subsea foundations, require exceptional resistance to fatigue, stress corrosion cracking, and dynamic loading. This segment necessitates socket bolts manufactured to extremely tight specifications, often utilizing proprietary high-strength steel grades and advanced polymer coatings to withstand the highly aggressive marine environment for decades without failure. This niche application acts as a significant driver for innovation in both material science and surface engineering within the market. Another critical dimension of the market analysis involves assessing the impact of global trade agreements and tariffs on the cross-border movement of manufactured fasteners. Fluctuations in import duties and regional trade blocs can significantly alter the cost structure for manufacturers operating complex global supply chains, often influencing decisions on where to locate production facilities and how to manage inventory stocks to minimize tariff exposure while maintaining rapid delivery capabilities. Geographic diversification of manufacturing capacity is becoming an essential risk mitigation strategy for large players. The increasing focus on sustainability and Environmental, Social, and Governance (ESG) criteria is also influencing the purchasing decisions of major industrial buyers. Customers are showing a preference for socket head bolt suppliers who can demonstrate reduced carbon footprints, utilize closed-loop recycling processes for steel, and adhere to strict ethical labor standards. This pressure encourages manufacturers to invest in energy-efficient production equipment and transition towards greener supply chain practices, fundamentally changing the operational landscape and adding a layer of non-price based competition to the market. The continued evolution of machinery manufacturing towards higher operational speeds and increased power output mandates the use of precision-engineered socket head bolts that can handle dynamic shear and tension loads without compromising joint integrity. This necessitates ongoing collaborative research between fastener manufacturers and heavy equipment designers to co-develop specialized fastening systems optimized for next-generation machinery, ensuring that the fastener technology keeps pace with advancements in mechanical engineering and power transmission.

In the construction segment, the adoption of modular building techniques and the proliferation of pre-fabricated structural elements necessitate quick, reliable, and standardized fastening solutions. Socket head bolts, particularly those designed for structural applications, play a key role in ensuring rapid assembly while meeting stringent load-bearing requirements. The convenience and reliability offered by these fasteners in large-scale construction projects contribute significantly to their steady demand, contrasting sharply with the often slower and less predictable methods involving welding or specialized bolting systems. Furthermore, regulatory updates related to structural integrity and seismic resistance often lead to immediate upgrades in fastener specifications, favoring high-performance socket head bolts that comply with the latest engineering codes. The electronics and consumer goods sector, while using smaller diameter socket head bolts, contributes significantly to market volume due to high production scales. These fasteners are crucial for assembling precision electronic devices, securing internal components, and enabling ease of disassembly for servicing or recycling, aligning with the growing demand for repairable and sustainable electronic products. The requirement here is typically for miniature fasteners with non-magnetic properties or specialized plating to prevent interference with sensitive electronic components, driving a sub-segment focused on micro-fastening technology and unique material requirements like brass or non-ferrous alloys. The overall market is experiencing a consolidation trend where larger, globally diversified fastener companies are acquiring smaller, specialized manufacturers to gain access to niche technologies, proprietary processes, or specific regional distribution networks. This strategic consolidation aims to streamline operational efficiencies, harmonize quality standards across product lines, and offer a more integrated, comprehensive fastener portfolio to global OEM clients, thereby reducing procurement complexity for the end-users. This dynamic fosters increased competition among the top-tier players while presenting challenges for smaller, independent suppliers to maintain market relevance without specialization or scale advantages.

Focusing on the segmentation by Product Type, the Socket Head Cap Screws segment remains the dominant revenue generator due to their broad applicability across virtually all industrial sectors requiring high strength and clean installation profiles. However, segments like Socket Set Screws are showing robust growth, driven by their indispensable role in transmitting torque in rotating machinery components such as pulleys and gears, where they secure collars and shafts without protruding from the assembly surface. The demand for Button Head Socket Screws is also growing steadily, particularly in applications where aesthetics and reduced snag hazards are necessary, such as in consumer product assembly or protective guarding installations, offering a compromise between functionality and visual appearance. The detailed analysis of the supply side highlights that lead times and order fulfillment speed are increasingly vital competitive factors. As OEMs adopt leaner, just-in-time inventory models, fastener suppliers must utilize highly efficient warehouse management systems and robust logistics partnerships to ensure delivery reliability. Suppliers who can offer comprehensive traceability records—from the raw steel batch to the final heat treatment certification—gain a significant edge, especially in safety-critical sectors like automotive and aerospace, where component failure can have catastrophic consequences and require immediate root cause analysis and reporting. The future trajectory of the Socket Head Bolt Market is inextricably linked to technological developments in materials science and advanced manufacturing automation. Continued investment in research aimed at developing fasteners with built-in monitoring capabilities (smart fasteners), such as those integrating micro-sensors to measure tension and vibration in real-time, represents the next frontier of innovation. Although currently a niche area, the adoption of smart socket head bolts promises to revolutionize predictive maintenance protocols and significantly enhance the structural safety and operational life of complex industrial assets, representing a potential high-value segment for future market expansion.

The penetration of e-commerce platforms and digital procurement tools is fundamentally changing how socket head bolts are bought and sold, particularly for Maintenance, Repair, and Operations (MRO) supplies. Online marketplaces provide greater price transparency and easier access to niche products, enabling smaller buyers to source specialized fasteners previously available only through direct industrial distributors. This digital shift compels traditional distributors to enhance their online presence, improve digital catalog accuracy, and offer highly competitive pricing and logistics options to maintain market share against agile online competitors. The availability of comprehensive technical specifications, 3D models, and application guides online also adds value, assisting engineers and procurement managers in making informed decisions quickly. Moreover, the geopolitical risks associated with key manufacturing regions, especially regarding steel production, constantly necessitate contingency planning for supply chain resilience. Manufacturers are strategically diversifying their sourcing bases away from single-country dependence to mitigate the impact of sudden policy changes, trade wars, or regional conflicts. This involves cultivating relationships with certified suppliers across multiple continents, ensuring a geographically robust supply network capable of absorbing regional shocks and maintaining consistent product flow to demanding global customers. The specialized requirements of the medical device industry form another important, albeit smaller, segment for high-precision socket head bolts. Fasteners used in surgical equipment, diagnostic machinery, and prosthetic implants demand biocompatible materials (like specific grades of titanium or stainless steel), extreme surface finishes to prevent bacterial adhesion, and absolute reliability. This segment places a premium on miniaturization, sterile packaging, and adherence to rigorous medical regulatory standards (e.g., FDA, CE marking), driving innovation toward specialized machining processes and material certification protocols unique to this critical application area. The stringent requirements of the medical field often serve as a proving ground for the highest quality manufacturing techniques before they are applied more broadly across industrial markets.

Finally, effective intellectual property (IP) management is becoming crucial for market leaders, especially those investing heavily in proprietary alloy formulations, advanced coating technologies, and unique fastener geometries designed for optimized performance in highly specialized environments. Securing patents and vigorously defending against infringement is essential to protect the R&D investment and maintain differentiation in a market susceptible to commoditization. The ability to offer protected, patented solutions provides manufacturers with a significant competitive moat, particularly when negotiating high-stakes, long-term supply contracts with major global customers who seek performance assurance and exclusivity in component design. This emphasis on IP reflects the market's progression towards highly engineered solutions rather than simple bulk commodities.

The Socket Head Bolt Market exhibits clear trends towards high-specification demand, driven by the requirement for lighter, stronger, and more resilient mechanical joints across all critical industrial sectors. This necessitates continuous material science advancements and manufacturing process optimization to meet the evolving engineering needs of next-generation equipment. The interplay between raw material costs, technological capacity, and global supply chain reliability remains the central challenge and determinant of competitive success in this essential industrial component market.

To ensure the highest level of detail and comprehensive analysis, attention is drawn to the niche market segments related to extreme temperature applications, such as those found in gas turbines or cryogenic systems. These environments require socket head bolts made from superalloys like Inconel or Hastelloy, which maintain their mechanical properties under intense thermal stress. These segments, although smaller in volume, command significantly higher price points and rely entirely on specialized metallurgical expertise and certified manufacturing facilities capable of processing these difficult-to-work materials. This technical requirement reinforces the necessity for high capital expenditure and specialized labor, creating high barriers to entry for new competitors attempting to serve these critical, high-revenue niche areas of the market.

Another defining characteristic of the modern Socket Head Bolt Market is the increasing integration of traceability features. For high-grade fasteners, detailed marking systems, often including unique lot numbers or proprietary codes etched directly onto the bolt head or shank, are now standard practice. This comprehensive traceability allows end-users, particularly in aerospace and defense, to quickly identify the fastener's exact origin, material batch, heat treatment cycle, and date of manufacture. Such precision in tracking is vital for regulatory compliance and essential for isolating product batches in the event of a material recall or field failure, adding a necessary layer of quality assurance that goes beyond standard physical specifications.

Finally, the ongoing demand for reduced assembly time and labor costs is fueling interest in pre-applied thread lockers and specialized sealants on socket head bolts. Manufacturers are providing value-added services by pre-treating fasteners to prevent loosening under vibration or to ensure liquid-tight sealing upon installation. These pre-applied solutions simplify the assembly process for OEMs, eliminate the need for secondary manual operations on the production line, and guarantee a consistent application of thread retention agents, contributing to higher assembly efficiency and predictable joint performance. This move towards pre-engineered fastener solutions highlights the market's drive to optimize the entire fastening process, not just the component itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager