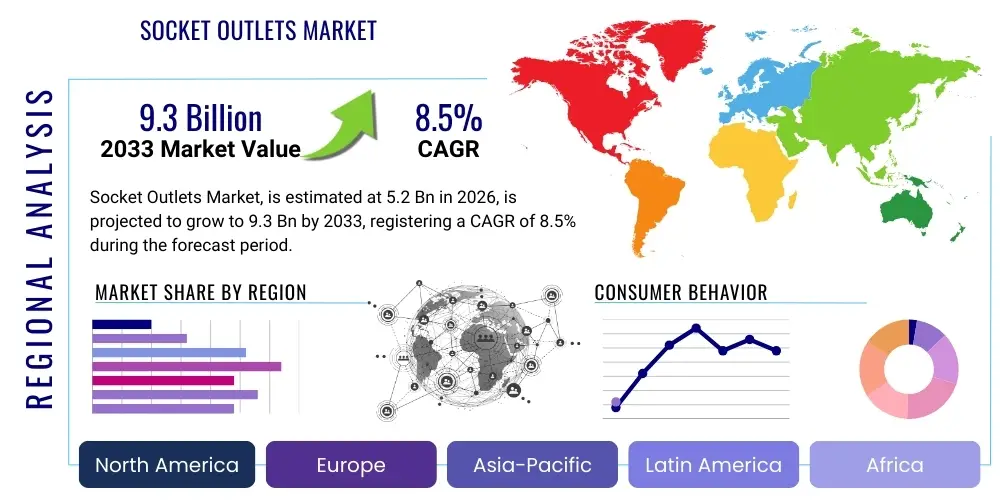

Socket Outlets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443414 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Socket Outlets Market Size

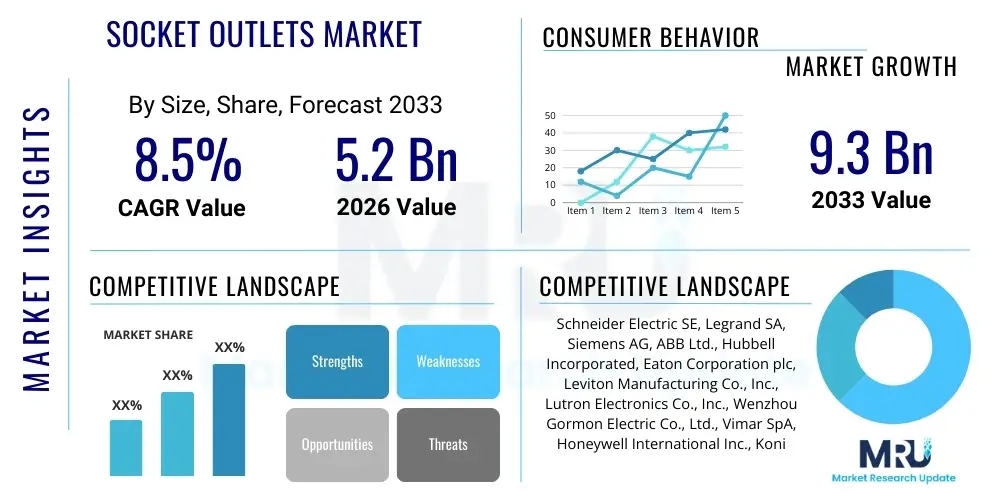

The Socket Outlets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.3 Billion by the end of the forecast period in 2033.

Socket Outlets Market introduction

The Socket Outlets Market encompasses devices designed to connect electrical equipment to the primary power supply. Historically a highly standardized and commoditized sector, the market is currently undergoing a transformative shift driven by the integration of smart technologies, stringent energy efficiency regulations, and the rapid expansion of the Internet of Things (IoT) infrastructure globally. Traditional socket outlets, which serve basic power connectivity, are being supplemented and partially replaced by advanced smart sockets offering features such as remote control, power monitoring, surge protection, and compatibility with voice assistants. This transition enhances user convenience, improves energy management capabilities, and addresses growing security concerns associated with electrical infrastructure.

Key products within this sector include standard wall sockets (single and multi-gang), specialized industrial sockets (high voltage/current ratings), and increasingly, integrated USB and USB-C charging ports embedded directly into the outlets. Major applications span residential buildings, commercial spaces (offices, retail), and industrial environments (manufacturing plants, data centers). The essential benefit provided by modern socket outlets is not merely power delivery but also enhanced safety through ground fault circuit interrupters (GFCIs) and arc fault circuit interrupters (AFCIs), critical for protecting both users and connected devices from electrical hazards. Furthermore, the longevity and reliability of power infrastructure rely heavily on the quality and certification of these fundamental components.

Driving factors for market growth include widespread global construction activities, particularly in emerging economies, government initiatives promoting smart grid technologies and energy conservation standards, and the rising consumer adoption of smart home ecosystems. The market is characterized by intense competition based on safety certifications, modular design flexibility, and the breadth of smart features offered. Manufacturers are continually innovating to provide universal designs that accommodate various international standards while maintaining cost-effectiveness and durability necessary for long-term infrastructural deployment.

Socket Outlets Market Executive Summary

The Socket Outlets Market is demonstrating robust growth, primarily fueled by the accelerating convergence of electrical infrastructure with digital intelligence. Current business trends indicate a strong focus on smart socket development, enabling real-time energy usage monitoring and integration with home automation platforms, which significantly elevates the average selling price (ASP) per unit compared to conventional outlets. Key industry players are aggressively investing in modular wiring systems and standardized installation mechanisms to simplify deployment in both new construction and retrofitting projects. Furthermore, sustainability is becoming a pivotal trend, compelling manufacturers to use eco-friendly materials and design products that minimize standby power consumption, aligning with global green building standards and consumer preferences for environmentally conscious products.

Regionally, the market dynamics are highly heterogeneous. North America and Europe lead in terms of smart socket adoption and adherence to stringent safety standards (e.g., UL, CE), driven by high consumer spending power and mature smart home markets. Conversely, the Asia Pacific (APAC) region, particularly China and India, presents the highest growth opportunities due to massive urbanization, large-scale infrastructure projects, and increasing electrification rates, predominantly driving demand for traditional and mid-range sockets but rapidly transitioning towards integrated USB-C and smart solutions. Latin America and MEA are experiencing steady growth, supported by foreign investment in construction and necessary upgrades to aging electrical grids, often leapfrogging older technologies directly into safer, modern systems.

Segment trends reveal that the residential segment maintains the largest market share by volume, while the commercial and industrial segments are driving higher revenue growth due to the demand for heavy-duty, industrial-grade, and complex smart building management systems. Technology-wise, Wi-Fi and Bluetooth-enabled smart sockets are dominant, but there is an emerging trend favoring sockets utilizing mesh networking protocols like Zigbee and Z-Wave for more reliable whole-house coverage. The growing proliferation of electric vehicles (EVs) is also creating a specialized niche for high-capacity garage and industrial sockets designed explicitly for charging infrastructure, demanding robust safety features and specialized installation services, further segmenting the application landscape.

AI Impact Analysis on Socket Outlets Market

Common user questions regarding the impact of AI on the Socket Outlets Market frequently center around energy optimization capabilities, predictive maintenance for electrical failures, and seamless integration with complex smart home ecosystems. Users inquire specifically about how AI can move beyond simple timer functions to dynamically manage power distribution based on behavioral patterns, real-time grid load, and device-specific requirements. Concerns often revolve around data privacy associated with continuous energy monitoring and the interoperability standards necessary for AI algorithms controlling diverse brands of sockets and connected devices. Expectations are high for AI to deliver truly autonomous energy savings and enhanced safety features, such as proactively detecting minor electrical anomalies before they escalate into major failures or fires.

Based on this analysis, AI's influence is pivoting the socket outlet from a simple power conduit to an intelligent data collection and control point. Key themes emphasize AI's role in creating 'context-aware' electrical systems. This involves algorithms learning household or commercial consumption patterns (e.g., when the kettle is used, when charging peaks occur) and adjusting power flow and device prioritization accordingly. This optimization minimizes peak demand charges for utilities and maximizes energy efficiency for consumers. The market expects AI to drive the need for higher-specification hardware capable of processing edge computing tasks, demanding more robust sensors and standardized communication modules embedded within the socket infrastructure itself.

The shift towards predictive maintenance, enabled by AI monitoring subtle changes in electrical current, temperature, and voltage fluctuations, represents a significant evolution in product value proposition. Instead of failing suddenly, AI-enabled sockets can signal an impending failure or safety hazard, allowing preemptive action. This capability is particularly critical in industrial and commercial settings where downtime is extremely costly. Furthermore, AI facilitates complex voice and gesture control integration, making the user interface for controlling power flow more intuitive and accessible, thereby accelerating consumer adoption rates for advanced socket systems.

- AI enables dynamic energy management based on learned usage patterns, optimizing consumption.

- Predictive maintenance algorithms use socket data to foresee electrical anomalies and component failures.

- Enhanced security features utilizing AI to detect unauthorized device connection or unusual power draws.

- Improved interoperability and seamless integration with broader smart home and building management systems (BMS).

- Facilitation of sophisticated, context-aware automated controls (e.g., regulating charging speed based on user schedule).

- Data aggregation and analysis provided by sockets inform smart grid operational efficiency and load balancing.

DRO & Impact Forces Of Socket Outlets Market

The Socket Outlets Market is shaped by a confluence of accelerating drivers (D) related to technological advancement and urbanization, countervailing restraints (R) tied to standardization challenges and cybersecurity risks, and substantial opportunities (O) arising from infrastructure upgrades and the EV revolution. The primary impact force driving current growth is the mandatory implementation of rigorous electrical safety standards across developing regions, significantly pushing the adoption of high-quality, certified socket solutions over uncertified, low-cost alternatives. Simultaneously, the inherent inertia within the construction industry regarding adopting new, higher-cost smart infrastructure acts as a systemic restraint, slowing down the penetration rate of advanced products, especially in renovation projects where compatibility with existing wiring is a major concern. Overall market dynamics reflect a balancing act between the demand for highly intelligent, flexible power points and the necessity for cost-effective, universally applicable safety standards.

Drivers: A paramount driver is the exponential growth of the global smart home market, where smart sockets serve as foundational elements for energy monitoring and device control, often acting as repeaters or nodes in the IoT network. Secondly, the increasing regulatory focus on energy efficiency globally, particularly in developed economies, mandates the use of energy-saving components, promoting sockets with built-in power monitoring and shut-off capabilities. Furthermore, rapid infrastructural development in emerging economies, coupled with significant governmental spending on electrification and modernization of commercial buildings, guarantees a continuous baseline demand for standard and specialized sockets. The integration of USB ports (especially USB-C Power Delivery standards) directly into wall outlets addresses consumer convenience and reduces the reliance on external adapters, serving as a powerful modernization incentive.

Restraints: The primary restraint remains the highly fragmented landscape of international electrical standards (e.g., Type A, C, G, I plugs and voltages), complicating global manufacturing and distribution, necessitating diverse product lines and hindering market consolidation. High initial deployment costs associated with smart sockets and related professional installation services deter large-scale adoption, particularly in price-sensitive markets. Moreover, as sockets become smarter and connected, they become susceptible to cyber threats, creating significant user apprehension regarding data privacy and network vulnerability, demanding complex security firmware updates that increase the total ownership cost.

Opportunities: A critical opportunity lies in the expanding infrastructure for Electric Vehicle (EV) charging, which requires specialized, high-capacity, and safety-certified socket outlets (e.g., NEMA 14-50) in residential, commercial, and public garages. The vast, untapped market for retrofitting existing buildings with smart, energy-monitoring sockets presents a multi-billion dollar opportunity, particularly in mature economies looking to enhance building energy performance without major structural overhauls. Finally, developing advanced modular wiring systems that allow for easy scalability and replacement of socket modules (e.g., swapping a traditional socket for a USB-C PD or smart module) will unlock flexibility and appeal significantly to commercial builders and data center operators seeking quick deployment solutions.

- Drivers:

- Rapid growth in smart home and IoT device adoption.

- Stringent global energy efficiency regulations promoting intelligent power control.

- Increased construction and electrification activities in Asia Pacific and MEA.

- Integration of high-speed USB charging standards (USB-C PD).

- Restraints:

- Lack of universal international standardization (plug types, voltages).

- High initial capital expenditure for smart and industrial-grade sockets.

- Growing cybersecurity risks associated with connected smart sockets.

- Compatibility issues during retrofitting old electrical infrastructures.

- Opportunities:

- Expansion of Electric Vehicle (EV) charging infrastructure requiring specialized sockets.

- Large-scale residential and commercial retrofitting projects demanding energy management solutions.

- Development of modular and highly flexible wiring systems for commercial applications.

- Emergence of AI-driven predictive maintenance services integrated into socket hardware.

- Impact Forces:

- High Impact: Safety and regulatory compliance (GFCI/AFCI mandates).

- Medium Impact: Consumer preference shift toward convenience and integration (USB ports).

- Low Impact: Raw material price volatility (affected by commodity costs).

Segmentation Analysis

The Socket Outlets Market is segmented based on Type, Application, and Technology, reflecting the diverse requirements across residential, commercial, and industrial end-users. The Type segmentation distinguishes between conventional (standard) sockets, which still constitute the bulk of unit sales globally, and smart sockets, which represent the highest growth trajectory in terms of revenue and technological investment. Smart sockets are further differentiated by their connectivity methods, ranging from Wi-Fi to proprietary mesh networks. Application segmentation reveals distinct product needs; for instance, residential demand emphasizes aesthetic integration and basic smart features, whereas industrial applications require extreme durability, high current ratings, and specialized certifications for hazardous locations.

Analyzing the segmentation highlights a persistent duality in the market. While developed regions increasingly prioritize smart, connected, and multi-functional outlets, emerging economies prioritize volume and reliability in conventional sockets to meet fundamental electrification goals. Technology segmentation is vital as it dictates the future of energy management; the shift from simple timers in sockets to embedded microcontrollers capable of running complex algorithms is reshaping the competitive landscape. Manufacturers are strategically positioning themselves by focusing either on high-volume, cost-effective standard products or high-margin, feature-rich smart devices integrated into proprietary ecosystems, catering to distinct consumer bases and regional regulations.

The strategic implication of this segmentation is clear: success requires tailoring product features to specific regional safety standards and application demands. For example, North American commercial construction favors modular, heavy-duty duplex outlets, while European residential installations often require integrated safety shutters and adherence to specific design aesthetics. Understanding the precise needs of segments like data centers (requiring high-density power distribution units) versus residential kitchens (demanding GFCI protection and USB charging) is crucial for effective product development and market penetration strategies. The growth of specialized outlets, such as those designed specifically for outdoor use or medical facilities, further illustrates the granular nature of demand within the broader market structure.

- By Type:

- Standard/Conventional Socket Outlets

- Smart/Connected Socket Outlets (Wi-Fi, Bluetooth, Zigbee, Z-Wave)

- Industrial/Heavy Duty Sockets (High Amperage, Specialized Locking)

- Integrated USB Socket Outlets (USB-A, USB-C PD)

- By Application:

- Residential (Homes, Apartments)

- Commercial (Offices, Retail, Healthcare, Hospitality)

- Industrial (Manufacturing, Data Centers, Utilities)

- Institutional (Schools, Government Buildings)

- By Technology:

- Non-Connected (Traditional Mechanical)

- Basic Connected (Timer, On/Off Remote Control)

- Advanced Connected (Energy Monitoring, Voice Control, AI Integration)

- Safety Enhanced (GFCI, AFCI, Surge Protected)

Value Chain Analysis For Socket Outlets Market

The value chain for the Socket Outlets Market begins with upstream activities, primarily encompassing the sourcing and processing of raw materials such as plastics (Polycarbonate, ABS for housing), copper (for conductors and contacts), brass, and specialized semiconductor components for smart variants. Key upstream challenges involve managing the volatility of commodity prices and ensuring compliance with sustainability standards, demanding efficient supply chain logistics and strong supplier relationships. Specialized component providers, including microcontroller manufacturers and communication module suppliers, play an increasingly crucial role, especially for smart socket production, dictating the functionality and cost structure of the final product. Quality control at the component level is paramount, given the safety-critical nature of electrical sockets.

Midstream activities involve core manufacturing, assembly, and rigorous testing and certification processes. This stage is dominated by large, established electrical equipment manufacturers who leverage economies of scale and advanced automation to minimize unit costs. Given the diversity of global standards, manufacturers often operate geographically dispersed facilities to produce region-specific products efficiently, obtaining essential safety certifications (e.g., UL in North America, CE in Europe, CCC in China). Distribution channels are highly varied. Direct channels are typically used for large-scale industrial or governmental infrastructure projects, allowing manufacturers to offer tailored solutions and technical support directly. Indirect channels, which form the majority of sales, rely on a robust network of wholesalers, electrical distributors, large format retailers (DIY stores), and increasingly, e-commerce platforms.

Downstream analysis focuses on installation, maintenance, and end-user engagement. Professional electricians and contractors are the primary downstream influencers, as they often specify the brands and types of sockets used in construction and renovation projects, making training and contractor loyalty programs crucial marketing strategies. For smart sockets, maintenance often involves firmware updates and software support, shifting the manufacturer's responsibility beyond hardware lifespan. End-user feedback loops, particularly concerning ease of use and smart functionality integration, drive continuous product improvement. E-commerce platforms are increasingly serving as potent downstream channels, facilitating direct-to-consumer sales for retrofit smart sockets and accessories, often bypassing traditional distribution tiers.

Socket Outlets Market Potential Customers

The primary consumers and buyers in the Socket Outlets Market are broadly categorized into three major groups: the Construction and Infrastructure Sector, the Consumer/Residential Segment, and Specialized Industrial/Commercial Operators. The Construction sector, comprising general contractors, electrical contractors, and real estate developers, constitutes the largest buyer group by volume, particularly in regions experiencing rapid housing and commercial infrastructure growth. These buyers prioritize bulk pricing, adherence to local building codes, installation speed (favoring modular systems), and long-term reliability for their projects. Their purchasing decisions are often based on specifications mandated by architects and engineers, focusing on robust product certification and warranty provisions.

The Consumer/Residential Segment includes individual homeowners, apartment dwellers, and DIY enthusiasts who purchase sockets for small renovations, replacements, or the integration of smart home features. This group places a high value on aesthetics, ease of installation, brand reputation, and the integration of convenience features like USB ports and smart controls. Their purchasing decisions are heavily influenced by retail availability, online reviews, and marketing emphasizing safety and technological novelty. The growth in this segment is strongly tied to the adoption rate of IoT devices, as smart sockets become essential components for maximizing the functionality of other connected devices within the home ecosystem.

Specialized Industrial and Commercial Operators encompass entities such as factory managers, data center administrators, hospital facility managers, and telecommunications providers. These buyers require highly specialized, durable, and safety-compliant sockets (e.g., industrial grade locking plugs, specialized PDU outlets, medical-grade tamper-resistant receptacles). Their procurement process is characterized by stringent technical requirements, a focus on specific amperage/voltage ratings, and a need for minimized downtime. For sectors like data centers, customers demand high-density power solutions with advanced monitoring capabilities, often requiring customized solutions integrated with proprietary building management systems (BMS). The growth of EV charging infrastructure also places fleet operators and municipal authorities in this key customer category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, Legrand SA, Siemens AG, ABB Ltd., Hubbell Incorporated, Eaton Corporation plc, Leviton Manufacturing Co., Inc., Lutron Electronics Co., Inc., Wenzhou Gormon Electric Co., Ltd., Vimar SpA, Honeywell International Inc., Koninklijke Philips N.V., Panasonic Corporation, TE Connectivity Ltd., Cooper Wiring Devices, EGLO Leuchten GmbH, Connectec, Midea Group Co., Ltd., TCL Corporation, Bull Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Socket Outlets Market Key Technology Landscape

The technology landscape of the Socket Outlets Market is defined by the ongoing transition from purely mechanical components to sophisticated electronic and connected devices. The core technological advancements revolve around miniaturization of safety components, integration of microcontrollers, and enhanced communication protocols crucial for smart functionality. Key safety technologies, such as improved Ground Fault Circuit Interrupters (GFCIs) and Arc Fault Circuit Interrupters (AFCIs), are becoming smaller, more reliable, and mandatory in many jurisdictions, necessitating complex internal circuitry. The increasing adoption of Power Delivery (PD) technology within integrated USB-C ports allows sockets to intelligently negotiate power output with connected devices, optimizing charging speed and efficiency while protecting battery health. This requires embedded chips capable of high-speed communication and power management.

In the smart segment, the technological focus is on connectivity and interoperability. Most smart sockets rely on Wi-Fi and Bluetooth for direct consumer connectivity, but professional installations increasingly utilize mesh networking protocols like Zigbee and Z-Wave. These protocols offer greater range, reliability, and lower power consumption, making them ideal for whole-building energy management systems. Furthermore, manufacturers are incorporating edge computing capabilities, meaning some data processing and control decisions occur locally within the socket, minimizing latency and reducing reliance on cloud infrastructure. This shift is essential for implementing AI-driven predictive maintenance and immediate safety shut-off functions, where response time is critical.

Material science and manufacturing technology also play a pivotal role. The development of flame-retardant and high-temperature-resistant engineering plastics ensures enhanced fire safety and durability, particularly for industrial and high-load sockets. Modularization technology is gaining traction, allowing builders to install a standardized socket housing quickly, into which various functional inserts (e.g., standard power, USB, data, smart module) can be snapped. This technological approach significantly reduces installation time and offers future-proofing capabilities, allowing users to upgrade functionality without replacing the entire wall infrastructure, directly addressing a major restraint in the retrofitting market.

Regional Highlights

- North America: This region is characterized by high penetration of smart home technology and stringent adherence to safety standards, particularly those mandated by UL (Underwriters Laboratories) and the NEC (National Electrical Code). The market here is driven by advanced features, energy efficiency demands, and a significant trend towards integrated USB-C Power Delivery (PD) functionality in both residential and commercial sectors. High labor costs encourage the adoption of pre-wired modular systems and snap-in assemblies. The expansion of EV charging infrastructure heavily influences demand for high-amperage specialty sockets (NEMA standards). Key growth is seen in premium smart outlets offering comprehensive ecosystem integration with major platforms like Amazon Alexa and Google Home, focusing on cybersecurity robustness and aesthetic design integration.

- Europe: The European market is highly fragmented due to diverse national plug standards (e.g., Schuko, British Standard, French/Belgian). However, it exhibits a unified focus on sustainability, driven by the EU's ambitious energy efficiency directives (e.g., EPBD). Growth is concentrated in smart sockets leveraging Zigbee and Z-Wave protocols for localized home automation and adherence to the CE marking requirements. Germany and the UK are leading adopters of smart and modular wiring solutions in new construction. Retrofitting is a major revenue stream, requiring manufacturers to develop products compatible with diverse existing installations. Regulatory demands for tamper-resistant sockets and enhanced AFCI/GFCI protection are continuously tightening, pushing technological refinement.

- Asia Pacific (APAC): APAC is the fastest-growing region, dominated by high-volume demand from massive urbanization and rapid infrastructural development in China, India, and Southeast Asia. While traditional, cost-effective sockets still constitute the bulk of unit sales, the market is rapidly pivoting toward advanced solutions, especially in Tier 1 and Tier 2 cities in China, which lead the world in smart city and IoT adoption. Government initiatives promoting domestic manufacturing and affordable smart technologies are key drivers. Standardization efforts, particularly in China (CCC certification) and India, are improving product quality. The huge potential for new residential construction ensures sustained double-digit growth rates, balancing low ASP conventional products with high-volume deployment.

- Latin America (LATAM): The LATAM market is experiencing steady modernization driven by foreign investment and necessary grid improvements. Brazil and Mexico are the largest contributors, adopting a mix of standard and basic connected sockets. Safety compliance remains a critical concern, with increasing mandates for certifications. The market is highly price-sensitive, meaning smart adoption is slower than in North America and Europe, often limited to high-end residential and new commercial projects. Opportunities exist in transitioning from older, often non-standardized installations to modern, safer, and centrally regulated socket systems, frequently utilizing IEC standards as a baseline for conformity.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, concentrated primarily in the GCC countries (UAE, Saudi Arabia) due to ambitious mega-projects and large-scale smart city developments. These markets demand premium, high-specification products, often complying with British or European standards, emphasizing integrated building management systems (BMS) and modular wiring for luxury residential and complex commercial towers. The African sub-continent is focused on basic electrification and durable, low-cost sockets. Oil and gas sectors demand specialized industrial sockets meeting explosion-proof requirements and extreme durability standards, representing a significant niche market within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Socket Outlets Market, assessing their product portfolios, strategic initiatives, and market positioning.- Schneider Electric SE

- Legrand SA

- Siemens AG

- ABB Ltd.

- Hubbell Incorporated

- Eaton Corporation plc

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Wenzhou Gormon Electric Co., Ltd.

- Vimar SpA

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Panasonic Corporation

- TE Connectivity Ltd.

- Cooper Wiring Devices

- EGLO Leuchten GmbH

- Connectec

- Midea Group Co., Ltd.

- TCL Corporation

- Bull Group

Frequently Asked Questions

Analyze common user questions about the Socket Outlets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional to smart socket outlets?

The primary driver is the rising adoption of IoT and smart home ecosystems, coupled with increasing consumer demand for energy efficiency and remote control capabilities. Smart sockets enable detailed power consumption monitoring and integration with voice assistants, enhancing convenience and reducing utility costs.

Are integrated USB ports in sockets becoming the industry standard?

Yes, integrated USB ports, particularly those supporting high-speed Power Delivery (PD) through USB-C, are rapidly becoming a standard feature in new construction and premium sockets globally. This trend simplifies charging infrastructure and eliminates the need for bulky external adapters, driven by consumer convenience and device proliferation.

How do regional electrical standards impact the global Socket Outlets Market?

Regional standards (e.g., NEMA in North America, Schuko in Europe) create market fragmentation and necessitate significant manufacturing complexities, as products must be tailored to specific plug types, voltages, and safety certifications (UL, CE, CCC), preventing the mass globalization of a single socket design.

What role does safety technology like GFCI and AFCI play in market growth?

GFCI (Ground Fault Circuit Interrupter) and AFCI (Arc Fault Circuit Interrupter) technologies are mandatory safety requirements in many developed countries, especially in residential wet areas and bedrooms. The continuous improvement and mandatory adoption of these advanced safety mechanisms drive the demand for high-quality, certified socket outlets, regardless of smart features.

What is the main opportunity presented by the Electric Vehicle (EV) market for socket outlets?

The EV market generates significant demand for specialized, high-capacity industrial-grade sockets (Level 2 charging) in residential garages and commercial parking lots. This requires robust, safety-certified installations (e.g., NEMA 14-50 type), creating a high-value niche segment within the overall market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager