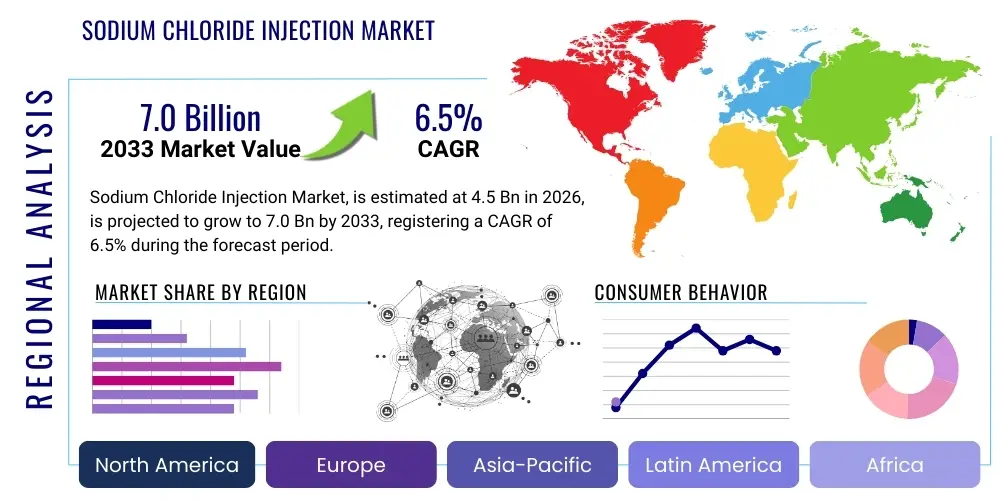

Sodium Chloride Injection Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443003 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Sodium Chloride Injection Market Size

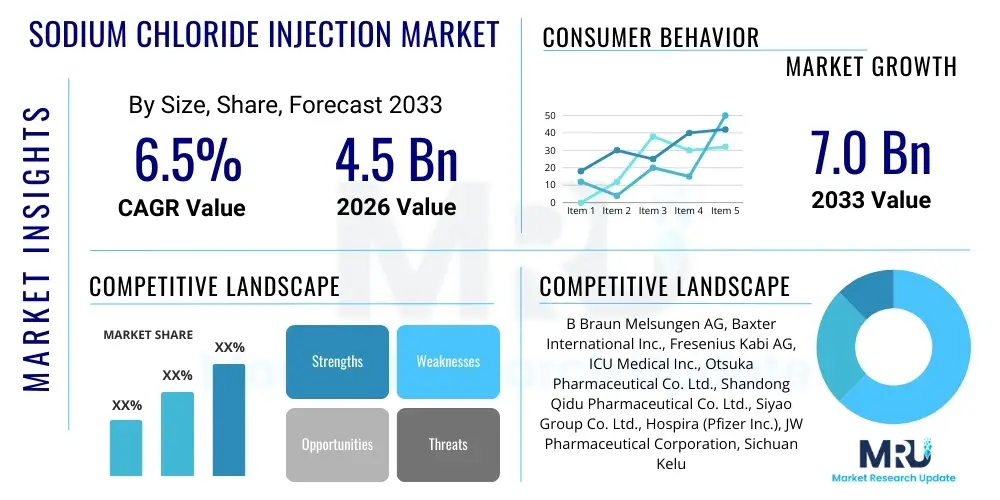

The Sodium Chloride Injection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the indispensable nature of saline solutions in global healthcare systems, coupled with sustained increases in surgical volumes and chronic disease prevalence requiring intravenous fluid management.

Sodium Chloride Injection Market introduction

The Sodium Chloride Injection Market centers around the production and distribution of sterile solutions of sodium chloride (salt) in water, primarily used for intravenous administration. These essential pharmaceutical products serve numerous critical functions in clinical practice, including hydration, electrolyte management, volume expansion, and acting as a vehicle or diluent for other injectable medications. The standard product, Normal Saline (0.9% NaCl), is physiologically crucial for restoring fluid balance in dehydrated patients and maintaining plasma volume during surgical procedures or critical care interventions. Variations, such as 0.45% (hypotonic) and 3% or 5% (hypertonic) saline, cater to specific pathological conditions like severe hyponatremia or cerebral edema, broadening the scope of application across diverse medical specialties. The market’s resilience stems from the high-volume, non-discretionary demand inherent in hospital operations and emergency services globally.

Major applications span across critical care units, general surgery, trauma management, nephrology, and oncology. In critical care, rapid infusion of saline is often the first line of treatment for hypovolemic shock, ensuring immediate restoration of circulatory function. Furthermore, surgical suites rely heavily on these injections for irrigation and maintaining patent intravenous access throughout lengthy operations. The clinical benefits—including maintaining homeostasis, ensuring efficient drug delivery, and minimal metabolic disruption when administered correctly—solidify its status as a core medical commodity. The market is characterized by stringent quality control requirements mandated by regulatory bodies like the FDA and EMA, focusing on ensuring sterility, purity, and freedom from particulate matter or endotoxins, given its direct administration into the bloodstream.

Driving factors propelling market expansion include the global demographic shift towards an older population segment, which typically requires more complex medical care and prolonged hospitalization involving IV therapy. Substantial investments in expanding hospital capacity, particularly in rapidly developing regions of Asia Pacific and Latin America, also contribute significantly to increased consumption volumes. Additionally, the continuous need for fluid replacement in common conditions like gastrointestinal illnesses and chronic diseases such as diabetes (which can lead to dehydration or ketoacidosis) provides a foundational level of stable demand. While the product itself is relatively standardized, manufacturing efficiency, supply chain robustness, and cost-effective packaging solutions are critical differentiators among key market participants, enabling them to capture market share in this highly competitive, yet essential, sector.

Sodium Chloride Injection Market Executive Summary

The Sodium Chloride Injection Market is poised for stable and robust growth, primarily driven by the expanding global healthcare infrastructure and the escalating prevalence of surgical interventions and critical illnesses. Business trends indicate a strong focus on optimizing supply chains to mitigate risks associated with commodity shortages, a recurring issue highlighted during public health crises. Manufacturers are increasingly adopting advanced production technologies, such as Blow-Fill-Seal (BFS) systems and non-PVC bag manufacturing, to enhance product safety, minimize contamination risks, and improve logistical efficiency. Consolidation among major pharmaceutical and medical supply companies is observed, aimed at achieving economies of scale and establishing deeper geographical penetration, especially in high-growth emerging economies where healthcare expenditure is rising rapidly. The market structure remains highly competitive, with established multinational players dominating the large-volume segments, while regional manufacturers often compete effectively on pricing for lower-volume government tenders.

Regional trends reveal that North America and Europe currently represent the largest revenue generating regions due to well-established healthcare systems, high per capita healthcare spending, and sophisticated critical care infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is fueled by massive governmental and private investments in constructing new hospitals and clinics, coupled with the increasing accessibility of advanced medical treatments to a burgeoning middle class in countries like China and India. Regulatory harmonization efforts across economic blocs are also influencing market dynamics, pushing manufacturers to standardize quality protocols globally, impacting market entry strategies and product registration processes.

Segmentation trends highlight the dominance of the 0.9% Sodium Chloride concentration segment due to its universal application in hydration and drug dilution. However, specialized segments, particularly the hypertonic saline solutions used in neurocritical care and specific trauma cases, are witnessing faster, albeit smaller, growth rates, driven by advancements in specialized medical protocols. By packaging, the non-PVC plastic bags segment is overwhelmingly outpacing glass bottle and rigid plastic container formats, driven by safety concerns, superior handling characteristics, and significant cost savings related to shipping and disposal. End-user analysis reaffirms hospitals as the dominant purchasing entity, though the home healthcare and ambulatory surgical center segments are expanding rapidly, necessitating changes in packaging sizes and distribution methodologies to suit decentralized care models.

AI Impact Analysis on Sodium Chloride Injection Market

User queries regarding the impact of Artificial Intelligence (AI) in the sodium chloride injection domain frequently center on optimizing manufacturing efficiencies, predicting supply chain disruptions, and enhancing quality control measures rather than direct product innovation, given the commodity nature of saline. Common concerns revolve around how AI can minimize contamination risk during high-volume production, whether predictive analytics can prevent critical shortages, and if machine learning algorithms can improve inventory management in large hospital networks. Users expect AI to stabilize pricing and availability, two historically volatile aspects of the market. The core theme is leveraging AI to transform the operational and logistical framework of production and distribution, ensuring higher reliability and cost-effectiveness of this essential medical supply.

The primary influence of AI in this sector will manifest through advanced manufacturing process control (APC) and highly sophisticated supply chain modeling. AI algorithms can analyze thousands of variables in real-time within sterile manufacturing environments, predicting potential deviations in sterilization cycles, fill volume accuracy, or contamination risks far earlier than traditional quality assurance protocols. This predictive maintenance and quality assurance capability significantly reduces batch rejection rates, leading to higher throughput and lower overall production costs. Furthermore, sophisticated demand forecasting models, powered by machine learning, integrate historical usage data, seasonal variations, public health alerts (e.g., flu season, pandemics), and regional logistical constraints to provide significantly more accurate demand predictions, thereby allowing manufacturers to adjust production proactively and mitigate the risk of catastrophic supply shortages, which have severely impacted patient care historically.

Beyond manufacturing, AI is revolutionizing inventory management within major hospital groups and distributor networks. By utilizing algorithms that track consumption patterns at the unit level and integrate with Electronic Health Records (EHR) systems to anticipate surgical schedules and procedure volumes, AI systems ensure ‘just-in-time’ delivery, minimizing warehousing costs and reducing wastage from expired stock. Although the chemical composition of the injection remains constant, the application of AI fundamentally transforms the economic and logistical stability of the market. This integration of smart technology elevates the reliability of the supply chain, which is paramount for an indispensable commodity with very thin profit margins, ensuring continuous access for healthcare providers globally, particularly in resource-constrained settings.

- Enhanced predictive quality assurance (PQA) in sterile manufacturing environments.

- Optimization of complex supply chain logistics and routing using machine learning algorithms.

- Significant reduction in production waste and improved batch consistency via Advanced Process Control (APC).

- Accurate, real-time demand forecasting to prevent critical stock shortages in hospital networks.

- Automated inventory management systems integrated with hospital EHRs for optimized stock levels.

DRO & Impact Forces Of Sodium Chloride Injection Market

The Sodium Chloride Injection Market operates under a dynamic set of Drivers, Restraints, and Opportunities (DRO) which collectively shape its growth trajectory and competitive landscape. The primary driver is the fundamental, non-negotiable need for intravenous fluids in nearly all therapeutic areas, ensuring an inelastic baseline demand. This is coupled with opportunities arising from technological shifts towards safer packaging and strategic expansion into emerging markets. Conversely, the market faces significant restraints, chiefly revolving around intense pricing pressure due to its commodity status and the severe regulatory scrutiny mandated for sterile injectables. The market dynamics are highly sensitive to these impact forces, requiring manufacturers to continuously balance cost efficiency with uncompromising quality assurance to maintain market viability and profitability across diverse regional regulatory frameworks.

Key drivers include the continuous expansion of global healthcare spending, particularly on inpatient and emergency services, alongside the demographic imperative of an aging global population requiring more frequent and prolonged IV therapy. Furthermore, the rising incidence of chronic diseases like cardiovascular disorders, diabetes, and infectious illnesses requiring supportive care substantially increases saline consumption volumes. However, significant restraints impede faster growth. The intense price competition, driven by public procurement policies and the necessity for bulk purchasing, compresses profit margins considerably. Additionally, the market is highly susceptible to manufacturing and supply chain failures; even minor contamination incidents or operational shutdowns can lead to massive product recalls and subsequent critical national shortages, demanding stringent and expensive compliance protocols that elevate operational costs.

Opportunities for growth are present through geographical expansion into underserved markets, especially in Africa and parts of APAC, where healthcare infrastructure is rapidly developing and local manufacturing capacity is limited. Innovation in packaging, such as the development of novel plastic formulations that extend shelf life or environmentally friendly biodegradable materials, presents a strong differentiating factor. The market also benefits from strategic partnerships between regional distributors and multinational pharmaceutical companies, facilitating broader access and more efficient market penetration. The major impact forces thus include high volume demand (a driving force), commodity pricing pressure (a restraining force), and the ongoing shift toward non-PVC packaging for safety and environmental benefits (a structural opportunity). Successful market players will be those who can leverage automated manufacturing to minimize cost while upholding superior quality standards and ensuring supply chain resilience against unforeseen global events.

Segmentation Analysis

The Sodium Chloride Injection Market is systematically segmented based on various critical parameters including Concentration, Packaging Type, Application, and End User. Analyzing these segments provides deep insights into consumption patterns and market potential across different therapeutic environments. The concentration segmentation highlights the prevailing demand for isotonic solutions (0.9%), while packaging segmentation demonstrates the clear industry preference for flexible, non-PVC plastic bags over rigid alternatives due to logistical advantages and safety profiles. Application segmentation illustrates the pervasive use across core medical fields, confirming its ubiquitous necessity. This detailed breakdown aids manufacturers and distributors in tailoring product offerings, optimizing production scale, and strategically targeting regions or end-user groups exhibiting the highest growth potential and specific requirements, such as customized volume sizes for emergency medical services (EMS).

- By Concentration: 0.9% Normal Saline, 0.45% Half Normal Saline, 3% Hypertonic Saline, 5% Hypertonic Saline, Others (e.g., proprietary balanced solutions).

- By Packaging Type: Non-PVC Plastic Bags, Glass Bottles, Rigid Plastic Containers (e.g., Polypropylene Bottles).

- By Application: Hydration and Fluid Replacement, Drug Dilution and Delivery, Wound Irrigation, Electrolyte Balance Maintenance, Other Clinical Uses (e.g., diagnostics).

- By End User: Hospitals, Clinics and Ambulatory Surgical Centers (ASCs), Specialty Clinics (e.g., Dialysis Centers), Home Healthcare Settings, Emergency Medical Services (EMS).

Value Chain Analysis For Sodium Chloride Injection Market

The value chain for the Sodium Chloride Injection market begins with the procurement of raw materials, primarily highly purified water (WFI - Water for Injection) and pharmaceutical- grade sodium chloride salt. Upstream activities are characterized by rigorous purification processes and quality checks to ensure compliance with pharmacopeial standards, which is critical since the final product is a sterile injectable. Manufacturers (midstream) invest heavily in sterile production facilities, including highly automated filling lines (often using Blow-Fill-Seal technology), sterilization equipment, and sophisticated quality control laboratories to manage endotoxin testing and sterility assurance. The capital-intensive nature of achieving and maintaining regulatory compliance significantly impacts midstream operational costs and serves as a major barrier to entry for new competitors, fostering a consolidated manufacturing base dominated by players capable of high-volume, continuous production.

Downstream activities involve complex logistics and distribution, moving sterile, temperature-sensitive, high-volume products across vast geographical areas. Distribution channels are predominantly direct to large hospital networks or indirect via national and regional medical supply distributors. Direct channels allow for better inventory control and immediate communication, vital during supply shortages, while indirect channels provide comprehensive reach, particularly to smaller clinics and remote healthcare facilities. Given the commodity status of saline, efficiency in storage, transportation, and inventory management is paramount; optimization of these downstream elements directly translates into competitive advantage, especially when competing for government tenders where logistical capability and reliability are weighted heavily alongside pricing.

The end-point of the value chain involves consumption by healthcare providers in diverse settings, from tertiary care hospitals (which account for the largest consumption volume) to home care providers. The product life cycle is relatively short, leading to constant demand velocity. Suppliers often engage in long-term contracts with procurement groups (GPOs) to ensure stable sales volume, reinforcing the interdependence between manufacturing scale and reliable distribution capacity. The regulatory framework acts as a pervasive force across the entire chain, from raw material sourcing (GMP compliance) to final administration (product traceability), ensuring that quality remains the overarching priority despite intense cost pressures inherent in the market structure.

Sodium Chloride Injection Market Potential Customers

The primary customers for sodium chloride injections are institutional buyers within the global healthcare ecosystem, driven by the absolute necessity of the product for patient treatment. Hospitals represent the largest and most concentrated purchasing segment, encompassing multi-specialty, general, and specialized institutions, including those focused on pediatrics, oncology, and cardiac care. These entities procure massive volumes through centralized purchasing departments or Group Purchasing Organizations (GPOs), demanding reliability of supply, competitive bulk pricing, and adherence to strict quality protocols. The size of the facility and its case mix—particularly surgical volume and the number of intensive care unit (ICU) beds—are key determinants of purchasing magnitude.

Ambulatory Surgical Centers (ASCs) and specialized clinics, such as dialysis and infusion centers, form the next significant customer base. As healthcare shifts towards outpatient settings for cost efficiency, the demand from ASCs is rising rapidly. These centers require varied volumes, often preferring smaller, easily storable packaging formats. Home healthcare providers and long-term care facilities also constitute an expanding customer segment, particularly with the growth of chronic disease management at home, where continuous infusion therapies are required. Their needs often center on ease of use, stability under varying environmental conditions, and secure, often pre-filled, delivery systems.

Government agencies, including military and public health disaster relief organizations, are also substantial purchasers, often through large-scale tenders for emergency stockpiling or routine provision in publicly funded healthcare systems. These buyers prioritize mass availability, extended shelf life, and proven logistical resilience during periods of high demand or disaster. Ultimately, any institution or service involved in intravenous therapy, surgical procedures, or critical patient stabilization is a core, non-discretionary buyer of sodium chloride injections, underscoring the broad and stable customer base defining the market's fundamental stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | B Braun Melsungen AG, Baxter International Inc., Fresenius Kabi AG, ICU Medical Inc., Otsuka Pharmaceutical Co. Ltd., Shandong Qidu Pharmaceutical Co. Ltd., Siyao Group Co. Ltd., Hospira (Pfizer Inc.), JW Pharmaceutical Corporation, Sichuan Kelun Pharmaceutical Co. Ltd., Vifor Pharma Group (CSL), Terumo Corporation, Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories, Macleods Pharmaceuticals Ltd., Wockhardt Ltd., Eurofarma Laboratorios, AdvaCare Pharma, Sandoz International GmbH (Novartis), Teva Pharmaceutical Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Chloride Injection Market Key Technology Landscape

The manufacturing technology landscape for Sodium Chloride Injection is heavily focused on achieving and maintaining absolute sterility and efficiency during high-volume production runs. The most pivotal technology driving market standards is the Blow-Fill-Seal (BFS) system. BFS is an advanced aseptic process where containers are blow-molded, filled, and hermetically sealed in a continuous, automated sequence within a sterile environment. This process drastically reduces the risk of contamination compared to traditional separate-stage manufacturing, making it the preferred method for producing large volumes of sterile liquids like saline. The adoption of BFS technology is crucial for manufacturers aiming for cost leadership while meeting stringent regulatory mandates regarding particulate matter and microbial contamination, particularly for products destined for critical care settings.

Another significant technological shift involves the evolution of packaging materials, specifically the widespread adoption of non-PVC plastic bags (e.g., polyolefin or polypropylene). Non-PVC systems offer multiple advantages: they eliminate the risk associated with phthalate leaching (a concern with older PVC bags), are lighter and more durable for easier transportation, and facilitate simpler disposal. Furthermore, innovations in multi-layer film technology have improved oxygen and moisture barrier properties, extending the product's shelf life and stability. While the core chemical composition remains unchanged, packaging technology is a key area of differentiation, influencing purchasing decisions by hospitals seeking safer and logistically superior products.

In addition to manufacturing and packaging, the industry utilizes sophisticated in-line monitoring and control systems—often integrated with AI/ML systems as discussed previously—to ensure real-time quality assurance. These technologies include high-speed visual inspection systems utilizing machine vision to detect microscopic particulates, and advanced sterilization monitoring protocols (e.g., validated terminal sterilization cycles) that automatically log and verify compliance parameters. The continuous evolution of these enabling technologies ensures that while sodium chloride injection is a mature product, its production remains on the cutting edge of pharmaceutical manufacturing science, essential for maintaining patient safety and supply chain integrity in a high-demand, low-margin environment.

Regional Highlights

- North America: Dominates the market value due to high healthcare expenditure, sophisticated critical care infrastructure, and substantial surgical volumes. Strict regulatory standards drive demand for premium, high-quality manufacturing, often favoring major domestic and European suppliers. The United States remains the largest single consumer globally, driven by an advanced insurance-based healthcare system.

- Europe: Characterized by mature, well-funded public health systems. The market features high consumption consistency, rigorous Pharmacopoeia standards, and a strong presence of major manufacturers like B Braun and Fresenius Kabi. The push for environmental sustainability is accelerating the adoption of advanced, non-PVC packaging solutions across the region.

- Asia Pacific (APAC): Expected to register the highest CAGR, primarily fueled by rapid infrastructure development in populous countries like China and India. Increasing health consciousness, rising disposable incomes, and government initiatives to expand universal health coverage are significantly boosting demand for basic IV fluids. This region is becoming a major manufacturing hub due to lower operational costs.

- Latin America (LATAM): Growth is stable but subject to economic volatility and fluctuating currency values, which impact import costs. Expansion of private healthcare systems and increasing institutional purchases in countries like Brazil and Mexico are primary growth drivers. Local manufacturing capacity is slowly increasing to address supply stability concerns.

- Middle East and Africa (MEA): Represents an emerging but high-potential market. Growth is driven by significant investments in specialized healthcare infrastructure in the GCC countries and humanitarian aid initiatives across Africa, leading to a steady increase in demand for bulk sterile fluids. Challenges include fragmented distribution networks and reliance on imported products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Chloride Injection Market.- B Braun Melsungen AG

- Baxter International Inc.

- Fresenius Kabi AG

- ICU Medical Inc.

- Otsuka Pharmaceutical Co. Ltd.

- Shandong Qidu Pharmaceutical Co. Ltd.

- Siyao Group Co. Ltd.

- Hospira (Pfizer Inc.)

- JW Pharmaceutical Corporation

- Sichuan Kelun Pharmaceutical Co. Ltd.

- Vifor Pharma Group (CSL)

- Terumo Corporation

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories

- Macleods Pharmaceuticals Ltd.

- Wockhardt Ltd.

- Eurofarma Laboratorios

- AdvaCare Pharma

- Sandoz International GmbH (Novartis)

- Teva Pharmaceutical Industries Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Chloride Injection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Sodium Chloride Injection Market?

The primary factor is the indispensable clinical need for fluid replacement, volume expansion, and drug delivery vehicles in surgical procedures and critical care settings globally. Demographic trends, particularly the aging population, further amplify this stable, non-discretionary demand.

Which packaging type is becoming dominant in the Sodium Chloride Injection Market?

Flexible, non-PVC plastic bags are rapidly becoming the dominant packaging type, replacing traditional glass bottles and rigid plastic containers. This shift is driven by enhanced patient safety, reduced weight, lower disposal costs, and better logistical handling properties.

How does the commodity nature of saline affect market dynamics?

The commodity status of sodium chloride injection leads to intense, centralized pricing pressure, resulting in thin profit margins for manufacturers. Success in this market relies heavily on achieving massive economies of scale and exceptional supply chain efficiency to maintain profitability.

What is the projected Compound Annual Growth Rate (CAGR) for this market?

The Sodium Chloride Injection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2026 to 2033, driven largely by infrastructural development in emerging economies and persistent clinical necessity.

How is technology, specifically AI, impacting the production of saline solutions?

AI is primarily impacting the manufacturing and logistics aspects by enabling Advanced Process Control (APC) for real-time quality assurance, optimizing production output, and utilizing machine learning for precise demand forecasting to prevent critical product shortages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager