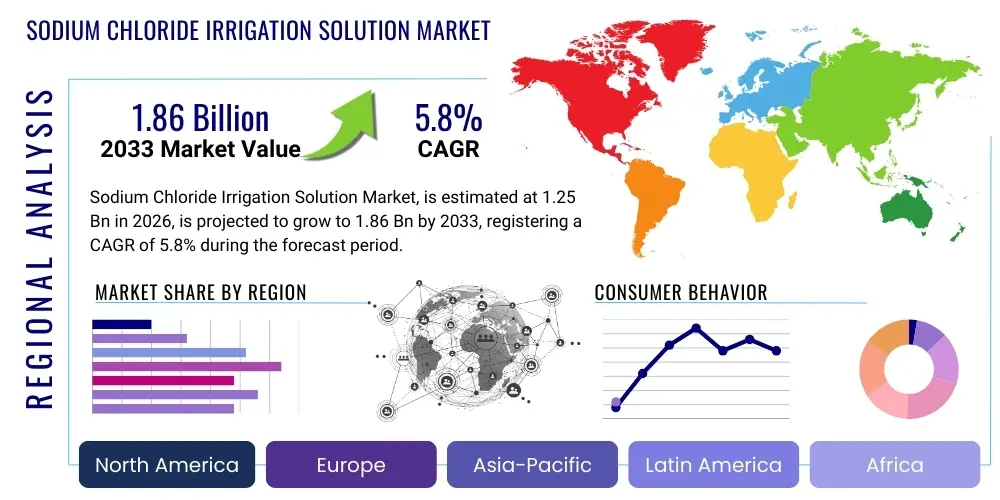

Sodium Chloride Irrigation Solution Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442787 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Sodium Chloride Irrigation Solution Market Size

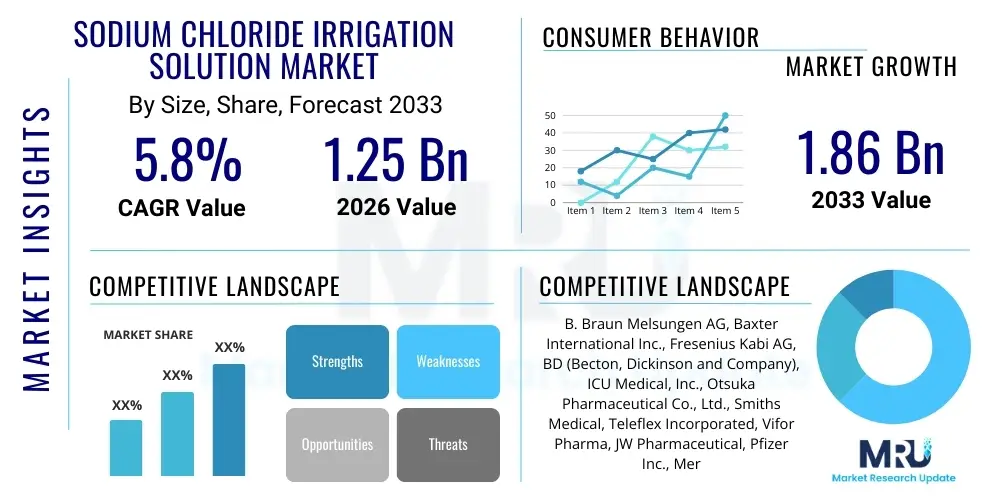

The Sodium Chloride Irrigation Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.86 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing volume of surgical procedures worldwide, mandatory adherence to stringent sterilization and infection control guidelines across healthcare facilities, and the pervasive need for isotonic solutions in standard medical practice for flushing, cleaning, and moistening biological tissues. The inherent safety profile and physiological compatibility of sodium chloride solutions cement their irreplaceable status within hospitals and ambulatory settings, driving stable demand growth regardless of specific therapeutic area shifts.

Furthermore, the growth trajectory is significantly influenced by demographic trends, particularly the aging global population, which necessitates greater frequency of complex surgical interventions and chronic wound care management. As healthcare infrastructure improves in developing nations, access to standardized surgical and post-operative care also expands, creating new frontiers for market penetration. Innovations in packaging, such as semi-rigid plastic containers and ready-to-use irrigation systems, contribute to enhanced product utility, safety, and logistical efficiency, thereby supporting the steady upward valuation of the market throughout the forecast period. Investment in automated manufacturing processes to ensure high-volume sterile production remains a key determinant of market capacity and pricing stability.

Sodium Chloride Irrigation Solution Market introduction

The Sodium Chloride Irrigation Solution Market encompasses the global production and distribution of sterile, non-pyrogenic isotonic solutions used extensively across various medical disciplines, predominantly for the irrigation of wounds, moistening of surgical dressings, rinsing during operative procedures, and flushing of medical devices and catheters. These solutions, typically 0.9% Sodium Chloride (Normal Saline), mimic the physiological concentration of salt in the human body, minimizing cellular damage or osmotic disturbance upon contact with delicate tissues. Key applications span general surgery, orthopedics, ophthalmology, urology, and specialized wound care, driven by their critical role in preventing post-operative infections and maintaining tissue viability. Major driving factors include escalating global surgical volumes, increased focus on hospital-acquired infection (HAI) prevention, and technological advancements in product delivery systems that enhance sterility and ease of use in clinical settings.

Sodium Chloride Irrigation Solution Market Executive Summary

The Sodium Chloride Irrigation Solution market demonstrates resilient growth, underpinned by non-discretionary clinical demand. Current business trends indicate a strong move toward sustainable packaging solutions and enhanced security features, such as tamper-evident seals and RFID tracking, driven by regulatory pressures and supply chain integrity concerns. Regional trends highlight mature, high-value consumption in North America and Europe, balanced against rapid expansion and infrastructure development in the Asia Pacific (APAC) region, where rising healthcare expenditure and medical tourism are significant accelerators. Segment trends show the wound care and surgical applications segment maintaining market dominance due to high volume usage, while the end-user segment is increasingly shifting towards Ambulatory Surgical Centers (ASCs) and specialized clinics for cost-effective procurement and high procedural efficiency. Competition centers on production efficiency, global distribution networks, and securing long-term contracts with major Group Purchasing Organizations (GPOs) to ensure consistent volume sales across diverse healthcare networks.

AI Impact Analysis on Sodium Chloride Irrigation Solution Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Sodium Chloride Irrigation Solution market frequently focus on optimizing highly sensitive manufacturing processes, improving supply chain visibility to prevent sterile stock shortages, and enhancing predictive maintenance for high-speed filling and sterilization equipment. Users are primarily concerned about how AI can ensure zero contamination rates in large-volume production while simultaneously driving down operational costs and forecasting regional demand volatility caused by infectious disease outbreaks or major logistical bottlenecks. Key themes revolve around integrating sophisticated sensor data with ML algorithms for real-time quality control checks (e.g., integrity of seals, particulate matter detection) and optimizing complex global distribution routes to maintain temperature stability and prevent expiration in transit. There is a clear expectation that AI will transform the manufacturing process from reactive quality assurance to proactive, predictive quality management, ensuring continuous compliance with stringent pharmaceutical Good Manufacturing Practices (GMP).

- AI-driven optimization of inventory management systems to minimize stockouts and wastage in high-volume hospital systems.

- Predictive maintenance analytics for sterilization and filling machinery, reducing downtime and ensuring continuous production flow.

- Enhanced quality control systems utilizing computer vision and ML for automated, real-time inspection of packaging integrity and solution clarity.

- Improved global logistics planning and route optimization, factoring in regulatory constraints, temperature requirements, and geopolitical risks.

- Demand forecasting models refined by machine learning to predict consumption spikes related to seasonal surgeries or public health crises.

DRO & Impact Forces Of Sodium Chloride Irrigation Solution Market

The market dynamics are significantly shaped by a confluence of accelerating drivers, stringent restraints, and substantial growth opportunities, modulated by powerful external impact forces. The primary drivers include the global demographic shift towards an older population requiring more frequent surgical care, the increasing prevalence of diabetes and associated chronic wounds necessitating extensive irrigation and wound management, and continuous updates to healthcare regulations mandating superior infection control standards, compelling the increased utilization of sterile solutions across all clinical settings. Furthermore, advancements in minimally invasive surgical techniques, though reducing overall surgical time, often rely on continuous irrigation for visibility and debris clearance, maintaining high procedural demand for the product.

Conversely, the market faces notable restraints, chiefly stemming from volatile raw material pricing, particularly plastic resins used for flexible containers, and increasing regulatory complexity surrounding single-use plastic waste disposal, leading to environmental compliance costs. The market is also highly sensitive to competitive pricing pressures, particularly from bulk purchasing contracts established by powerful Group Purchasing Organizations (GPOs) which often standardize procurement and drive down profit margins for commodity medical supplies. Maintaining sterility and compliance across diverse global manufacturing sites also imposes significant operational expenditure, acting as a barrier to entry for smaller manufacturers.

Opportunities for expansion lie in the robust growth of healthcare infrastructure within emerging economies, presenting untapped markets where the adoption of standard western surgical practices is accelerating. Additionally, the development of enhanced, multi-component irrigation systems, such as pre-filled, measured-dose syringes and specialized pressurized irrigation devices that integrate the solution, represent a key technological opportunity for premium product positioning. Regulatory changes focusing on reducing hospital-acquired infections (HAIs) in non-acute settings, such as outpatient clinics and long-term care facilities, further expand the addressable market beyond traditional hospital settings, providing avenues for market diversification and sustainable volume growth across different tiers of the healthcare ecosystem.

Segmentation Analysis

The Sodium Chloride Irrigation Solution market is systematically segmented based on Product Type, Application, and End-User, allowing for granular analysis of demand patterns and strategic targeting. The segmentation highlights the diverse clinical utility of the solution, ranging from high-volume general surgery to specialized, low-volume procedures like ophthalmology. Understanding these segments is critical for manufacturers to tailor packaging, volume sizes, and marketing strategies effectively, addressing the unique requirements of different clinical environments and procurement pathways. The dominance of isotonic saline (0.9%) remains absolute across all segments, serving as the benchmark standard due to its physiological compatibility and regulatory acceptance globally.

- Product Type:

- 0.9% Normal Saline Solution (Isotonic)

- Other Concentration Solutions (e.g., Hypertonic, Hypotonic – used for specific, non-irrigation purposes but sometimes manufactured alongside irrigation solutions)

- Application:

- Wound Care and Irrigation (Chronic and acute wounds)

- Surgical Washing (Intraoperative rinsing and debris removal)

- Ophthalmic Procedures (Rinsing and maintaining corneal hydration)

- Urological Procedures (Catheter flushing and transurethral surgery)

- Drug Dilution and IV System Priming (Although primarily irrigation, sometimes includes related high-volume sterile applications)

- End-User:

- Hospitals (Tertiary and secondary care centers, highest volume consumers)

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics (e.g., Dental, Dermatology, Ophthalmology)

- Long-Term Care Facilities and Home Healthcare

Value Chain Analysis For Sodium Chloride Irrigation Solution Market

The value chain for Sodium Chloride Irrigation Solutions is characterized by high volume, low margin, and strict regulatory oversight across all phases, requiring tight integration between raw material suppliers and final distribution channels. Upstream analysis reveals that raw materials primarily involve pharmaceutical-grade water (WFI), high-purity sodium chloride, and medical-grade plastic resins (PP, PE) for container manufacturing. Water purification and sterilization are the most capital-intensive steps upstream. Downstream operations are dominated by efficient, large-scale manufacturing processes, including automated blending, high-speed sterile filling, terminal sterilization (usually autoclaving), and sophisticated quality control testing to ensure non-pyrogenicity and sterility. The distribution channel is bifurcated into direct sales to large hospital networks and indirect sales facilitated by major medical supply distributors and GPOs, which play a crucial role in procurement standardization and centralized logistics management, effectively mediating the manufacturer-end-user relationship. The competitive advantage lies in optimizing logistics to handle the weight and volume of the product efficiently and maintaining regulatory compliance across complex cross-border supply routes.

Sodium Chloride Irrigation Solution Market Potential Customers

Potential customers, or end-users/buyers, for Sodium Chloride Irrigation Solutions are highly institutionalized entities within the global healthcare system that require large volumes of sterile fluids for daily operations. Hospitals, especially those with high surgical caseloads and emergency departments, represent the most significant consumer segment, purchasing solutions in large containers (e.g., 500ml, 1000ml, 3000ml) through established procurement contracts negotiated via GPOs or direct tenders. Ambulatory Surgical Centers (ASCs) are rapidly increasing their purchasing power, favoring smaller, more convenient packaging sizes suitable for outpatient procedures. Specialized clinics, including ophthalmology centers, dental surgery offices, and chronic wound care clinics, represent niche buyers requiring specialized, often highly protected packaging formats. Additionally, military medical logistics and disaster relief organizations are substantial, albeit sporadic, high-volume buyers, requiring solutions with extended shelf lives and robust packaging for deployment in challenging environments. The procurement decision process is driven equally by cost-efficiency, reliability of supply, and assurance of product sterility and regulatory compliance, making long-term vendor stability a key attribute sought by buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.86 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | B. Braun Melsungen AG, Baxter International Inc., Fresenius Kabi AG, BD (Becton, Dickinson and Company), ICU Medical, Inc., Otsuka Pharmaceutical Co., Ltd., Smiths Medical, Teleflex Incorporated, Vifor Pharma, JW Pharmaceutical, Pfizer Inc., Merck KGaA, Laboratorios Grifols, Aguettant, PCH, Huaren Pharmaceutical, Cisen Pharmaceutical, Kelun Pharmaceutical, Sino-US Zizhu Pharmaceutical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Chloride Irrigation Solution Market Key Technology Landscape

The technology landscape in the Sodium Chloride Irrigation Solution market is focused less on chemical innovation and more on advanced manufacturing engineering, packaging science, and sterilization methodology to ensure absolute product safety and logistical efficiency. A critical technology is the implementation of fully automated, aseptic filling lines and form-fill-seal (FFS) technology for flexible plastic containers (bags and bottles), which drastically reduces the risk of human error and contamination. Terminal sterilization techniques, predominantly moist heat autoclaving, must be precisely controlled and validated according to stringent pharmacopeial standards (e.g., USP, EP) to achieve a sterility assurance level (SAL) of 10-6. Modern manufacturing facilities utilize sophisticated Supervisory Control and Data Acquisition (SCADA) systems and computerized system validation (CSV) to monitor all critical parameters, from water purity generation through to final packaging integrity testing.

A key area of innovation involves packaging materials, moving toward non-PVC (polyvinyl chloride) flexible containers to address environmental concerns and minimize the potential for leaching, thereby enhancing drug safety when solutions are used for dilution. Furthermore, the integration of advanced barcoding and serialization technologies, often mandated by global track-and-trace regulations, is vital for managing supply chain security and recall efficiency. Manufacturers are also exploring specialized closures and port designs that minimize the risk of contamination during spiking and handling in the clinical setting, offering tamper-evident features that immediately signal if the sterility barrier has been compromised prior to use.

The deployment of robust Quality Management Systems (QMS), often supported by cloud-based platforms, is essential for continuous compliance monitoring across multi-site global operations. These systems track batch records, manage deviation investigations, and ensure rapid response to quality excursions. Future technological shifts may involve implementing in-line analytical techniques, such as near-infrared (NIR) spectroscopy, for rapid, non-destructive compositional analysis, further accelerating quality release times and ensuring product consistency at unprecedented manufacturing speeds, reinforcing the stability and high-volume capacity required by this essential medical consumables market.

Regional Highlights

- North America: This region holds a dominant market share, driven by a highly established and resource-intensive healthcare system, high per-capita expenditure on surgical procedures, and extremely strict regulatory standards (FDA compliance) that favor established manufacturers with proven quality assurance. The presence of major GPOs exerts significant pressure on pricing but guarantees consistent, high-volume demand. The United States is the single largest consumer due to high rates of complex surgeries and a strong focus on post-operative infection prevention protocols.

- Europe: Characterized by sophisticated healthcare systems and universal coverage models, Europe represents a mature market focusing heavily on sustainability and reduction of plastic waste. Demand is stable, supported by standardized surgical practices and aging demographics across countries like Germany, France, and the UK. Compliance with European Pharmacopoeia (EP) standards and directives like the Medical Device Regulation (MDR) necessitates continuous investment in quality systems by local and international players.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate during the forecast period. This surge is fueled by massive investments in public and private healthcare infrastructure, increasing surgical capacity in populous nations like China and India, and the rising availability of affordable healthcare services. While price competition is intense, the sheer volume potential and the rapid urbanization leading to increased access to modern medical treatments make APAC a strategic growth region.

- Latin America (LATAM): Growth is steady but constrained by economic volatility and fluctuating currency values. Market access is often complex due to varied national regulatory requirements. Brazil and Mexico are the primary markets, driven by private healthcare expansion and efforts to standardize clinical practice, offering opportunities for manufacturers who can navigate distribution challenges and manage import tariffs effectively.

- Middle East and Africa (MEA): This region shows polarized demand, with high-spending GCC countries (Saudi Arabia, UAE) adopting advanced medical technologies and imported products quickly, largely driven by medical tourism initiatives. The African sub-region presents humanitarian and public health demand, often influenced by NGO and governmental procurement, with significant growth potential tied to improvements in basic surgical capacity and hospital modernization projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Chloride Irrigation Solution Market.- B. Braun Melsungen AG

- Baxter International Inc.

- Fresenius Kabi AG

- BD (Becton, Dickinson and Company)

- ICU Medical, Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Smiths Medical

- Teleflex Incorporated

- Vifor Pharma

- JW Pharmaceutical

- Pfizer Inc.

- Merck KGaA

- Laboratorios Grifols

- Aguettant

- PCH

- Huaren Pharmaceutical

- Cisen Pharmaceutical

- Kelun Pharmaceutical

- Sino-US Zizhu Pharmaceutical

- Nipro Corporation

- CVS Health (as a major distributor/private labeler)

Frequently Asked Questions

Analyze common user questions about the Sodium Chloride Irrigation Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between normal saline irrigation solution and intravenous (IV) saline solution?

The primary difference lies in the intended use and regulatory classification. While both solutions typically contain 0.9% sodium chloride, irrigation solutions are designed for external application, flushing wounds, or rinsing tissues and are not intended for systemic administration via injection or infusion. IV solutions, conversely, must meet more stringent sterility and particulate matter standards specifically for injection into the bloodstream. Although highly sterile, irrigation solutions are typically packaged in larger volumes, often with different port configurations, emphasizing external use and high-volume rinsing during operative procedures, adhering to distinct pharmacopeial monographs concerning packaging integrity and labeling.

Which application segment drives the highest volume demand for Sodium Chloride Irrigation Solutions globally?

The Surgical Washing and Intraoperative Rinsing segment consistently drives the highest volume demand for Sodium Chloride Irrigation Solutions globally. This is attributed to the mandatory requirement for continuous flushing during a wide array of procedures, including orthopedics, general surgery, and abdominal operations, necessary for clearing blood, debris, and maintaining visualization. The high incidence of both elective and emergency surgical procedures, coupled with protocol mandates for large-volume lavage to prevent post-operative infection, ensures that this application area consumes vastly greater quantities of the solution compared to specialized niche applications like ophthalmology or simple wound care procedures conducted in outpatient settings.

How do Group Purchasing Organizations (GPOs) influence the pricing and competition in the irrigation solution market?

Group Purchasing Organizations (GPOs) significantly influence pricing and competition by aggregating the purchasing power of multiple hospitals and healthcare systems, enabling them to negotiate highly favorable, standardized, high-volume contracts with manufacturers. This practice leads to fierce price competition among suppliers, often driving down the Average Selling Price (ASP) for commodity items like saline solutions. For manufacturers, securing GPO contracts ensures consistent high-volume sales and predictable revenue streams, but requires demonstrating stringent cost-efficiency in manufacturing and supply chain operations, often marginalizing smaller competitors unable to meet the required capacity or aggressive pricing structure dictated by these large procurement entities.

What are the main sustainability challenges facing manufacturers in the Sodium Chloride Irrigation Solution market?

The main sustainability challenge stems from the inherent nature of the product requiring single-use, sterile plastic packaging (usually bags or bottles) for every volume unit sold. The immense volume of production translates directly into substantial plastic waste generation, raising environmental concerns and prompting regulatory scrutiny across regions, particularly Europe. Manufacturers are increasingly pressured to develop and adopt more recyclable materials, implement waste reduction programs, and invest in energy-efficient sterilization processes. Addressing this involves exploring bio-based or biodegradable polymers that still maintain the necessary material integrity and gas barrier properties required for terminal sterilization and long shelf life, representing a significant investment and R&D hurdle.

Which emerging economies are showing the most accelerated growth potential for sterile irrigation solutions?

China and India are demonstrating the most accelerated growth potential, underpinned by rapid infrastructural development in their respective healthcare sectors. China's shift towards higher quality medical consumables, driven by substantial government investment and rising private health insurance penetration, is rapidly increasing the demand for sterile solutions. Similarly, India's burgeoning medical tourism sector, combined with expanding surgical capacity in tier 2 and tier 3 cities, mandates higher consumption volumes of standard surgical supplies like saline irrigation. These markets offer immense untapped volume potential, provided manufacturers can successfully navigate complex local regulatory environments and manage intensive price competition against local suppliers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager