Sodium Petroleum Sulfonate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440749 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Sodium Petroleum Sulfonate Market Size

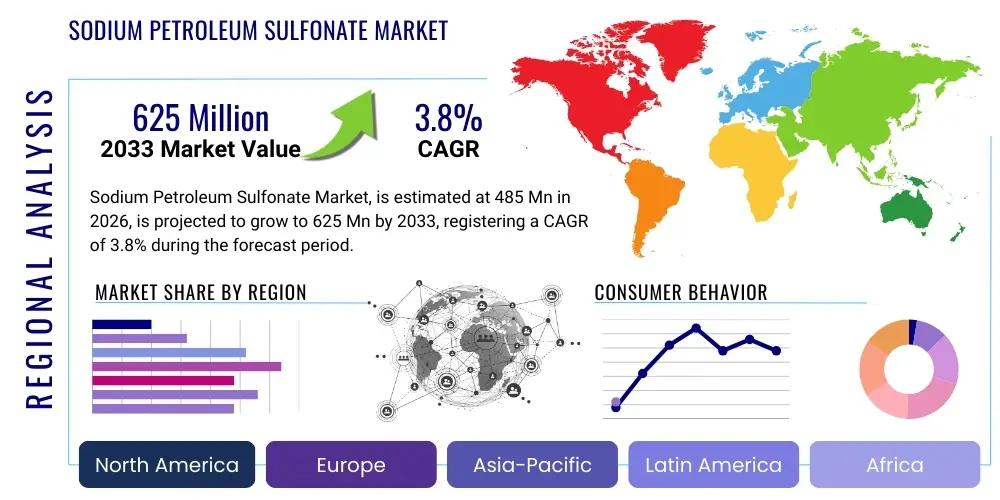

The Sodium Petroleum Sulfonate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 485 Million in 2026 and is projected to reach USD 625 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the expanding demand for high-performance lubricants, particularly in the automotive and industrial sectors, where Sodium Petroleum Sulfonate (SPS) acts as a critical rust inhibitor and detergent additive. The market size reflects stable, mature demand complemented by incremental technological advancements focusing on higher purity and tailored molecular weights for specialized applications.

Sodium Petroleum Sulfonate Market introduction

Sodium Petroleum Sulfonate is a crucial class of anionic surfactants derived from the refining of petroleum products, predominantly serving as an essential component in formulating lubricating oils, greases, and protective coatings. These compounds, often referred to simply as SPS, possess excellent surface-active properties, making them indispensable as emulsifiers, rust inhibitors, and dispersants. Their inherent ability to form stable emulsions between oil and water phases, coupled with strong metal surface adhesion, drives their adoption across diverse heavy industries. The product’s versatility allows it to function effectively in both aqueous and non-aqueous environments, enhancing the performance and longevity of mechanical systems and stored metals.

The primary applications of SPS center around its role as a key additive in automotive and industrial lubricants, contributing significantly to engine cleanliness by preventing sludge formation and acid neutralization. Furthermore, medium and high molecular weight sulfonates are extensively utilized in corrosion preventative formulations, protecting metallic infrastructure, tools, and finished goods during transit and storage from environmental degradation. These protective qualities, combined with their cost-effectiveness compared to synthetic alternatives, solidify the market position of Sodium Petroleum Sulfonate as a foundational chemical intermediate. The global demand is closely tied to overall industrial output, particularly in construction, manufacturing, and oil and gas exploration sectors.

Driving factors for this market include the stringent regulatory requirements mandating extended service intervals for machinery and the continuous development of advanced industrial fluids requiring superior additive packages. The benefits derived from using SPS—such as enhanced thermal stability, improved demulsibility, and excellent rust protection—justify their sustained incorporation into complex chemical formulations. Specifically, the expansion of the oilfield chemical market, where SPS acts as an effective Enhanced Oil Recovery (EOR) agent (specifically in surfactant flooding), provides a significant impetus for future market expansion, especially in mature oil fields seeking tertiary recovery methods.

Sodium Petroleum Sulfonate Market Executive Summary

The Sodium Petroleum Sulfonate market is characterized by mature competition and stable demand, driven by sustained consumption in lubricant additives, metalworking fluids, and rust prevention coatings. Key business trends indicate a shift towards producing specialized, highly purified SPS grades—particularly those with specific molecular weight distributions—to meet evolving performance standards in synthetic and semi-synthetic lubricant formulations. Manufacturers are focusing heavily on optimizing the sulfonation process to improve yield and reduce residual oil content, addressing end-user demands for superior detergency and rust inhibition capabilities. The market structure remains largely consolidated, dominated by major integrated petrochemical companies with robust backward integration into crude oil refining and specialized chemical processing capabilities, ensuring stable raw material supply.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China and India, exhibits the highest growth potential, fueled by rapid industrialization, expanding automotive production, and substantial infrastructure development projects requiring large volumes of protective coatings and industrial lubricants. North America and Europe, while mature, maintain stable demand due to stringent regulatory frameworks governing machinery maintenance and environmental protection, driving the adoption of high-quality, eco-compliant SPS derivatives. In contrast, emerging economies in Latin America and the Middle East and Africa (MEA) are witnessing growth linked directly to increasing drilling activities and localized manufacturing expansion, boosting the requirement for specialized oilfield and industrial protective chemicals.

Segment trends reveal that the medium molecular weight segment (400-500 MW) commands the largest market share due to its balanced utility as both an emulsifier and a rust inhibitor, making it highly versatile across metalworking fluids and general industrial lubrication. However, the high molecular weight segment (above 500 MW) is projected to record slightly faster growth, primarily driven by its superior performance in severe anti-corrosion applications and advanced lubricant packages designed for heavy-duty engines and maritime applications. The application segment analysis highlights the lubricant additives category as the primary revenue generator, followed closely by rust preventive materials, underscoring the intrinsic role of SPS in preserving metallic assets against degradation.

AI Impact Analysis on Sodium Petroleum Sulfonate Market

Common user questions regarding AI's impact on the Sodium Petroleum Sulfonate market revolve around optimizing production efficiency, enhancing quality control during synthesis, and predicting complex supply chain fluctuations. Users are keenly interested in whether AI can accelerate the development of bio-based or synthetic alternatives that might replace traditional petroleum sulfonates, and how machine learning algorithms can be utilized to better manage fluctuating crude oil prices—the primary cost driver. The consensus theme is that AI will not fundamentally alter the chemical demand for SPS but will drastically improve the operational aspects of its production and application. Specifically, there is high expectation for AI-driven predictive maintenance in end-user industries (automotive, manufacturing), which will, in turn, influence the specific performance requirements and consumption patterns of SPS-containing lubricants and metalworking fluids.

- AI implementation in predictive maintenance models, leading to optimized lubricant replenishment cycles and potentially affecting SPS additive demand stability.

- Optimization of sulfonation reaction parameters (temperature, residence time, acid concentration) using machine learning to maximize yield and purity, reducing production costs.

- Enhanced supply chain visibility and risk management through AI-powered forecasting models, crucial for managing the volatility of petroleum feedstock sourcing.

- AI-assisted formulation development, allowing researchers to quickly test and predict the synergistic effects of SPS with other lubricant components (e.g., anti-wear and antioxidant agents).

- Advanced quality control systems utilizing computer vision and spectral analysis (integrated with AI) for real-time monitoring of residual oil content and molecular weight distribution during manufacturing.

- Potential for AI algorithms to guide the discovery of novel, higher-performance, and environmentally friendlier surfactant chemistries, influencing long-term competitive dynamics.

DRO & Impact Forces Of Sodium Petroleum Sulfonate Market

The market dynamics for Sodium Petroleum Sulfonate are governed by a complex interplay of inherent technical advantages and external economic pressures. The primary drivers include the mandatory use of high-quality rust inhibitors and dispersants in modern machinery, sustained growth in the global automotive fleet, and the necessity of corrosion control across extensive industrial infrastructure. However, the market faces significant restraints, chiefly related to the volatility of crude oil prices, which directly impacts raw material costs (petroleum feedstocks), and the growing pressure from environmental regulations favoring biodegradable or bio-derived alternatives. Opportunities primarily arise from the increasing application of SPS in tertiary oil recovery techniques (EOR) and the expansion of specialized, high-purity grades for advanced synthetic lubricant blending.

Impact forces within this market are substantial, reflecting the commodity nature of the product and its dependency on global economic health. Supply chain stability, particularly concerning the consistent sourcing and refining capacity for appropriate petroleum fractions, dictates market responsiveness. Furthermore, regulatory scrutiny, especially regarding the toxicological profile of some SPS grades and their handling, exerts significant influence on market access and formulation requirements in developed regions like Europe and North America. The moderate threat of substitutes exists mainly from synthetic alternatives, such as synthetic alkylbenzene sulfonates, which offer higher purity and tailored structures but remain generally more expensive than their petroleum-derived counterparts.

Overall, the balance of DRO suggests a steady, moderate growth trajectory. While the market is mature, continuous technological upgrades in end-user machinery necessitate corresponding advancements in lubricant and protective fluid quality, sustaining demand for SPS. The increasing focus on extending equipment lifespan in capital-intensive industries ensures the persistent requirement for effective rust prevention and dispersion capabilities, securing the critical role of Sodium Petroleum Sulfonate as a foundational additive in industrial chemistry globally, despite environmental and pricing challenges.

Segmentation Analysis

The Sodium Petroleum Sulfonate market is primarily segmented based on molecular weight, which significantly dictates the product's primary function and application scope; the concentration/formulation (often dictated by active ingredient percentage); and the final end-use application. Understanding these segments is crucial as different molecular weights offer varying degrees of detergency, emulsifying strength, and rust inhibition capacity. Low molecular weight sulfonates are typically employed as emulsifiers for oil-in-water systems, while higher molecular weights excel in corrosion prevention and heavy-duty dispersant roles. Geographic segmentation reflects industrial concentration and regulatory divergence across global regions.

The segmentation structure highlights the market's reliance on specific industrial needs. For instance, the oilfield chemical segment demands very particular specifications, often requiring high thermal stability and compatibility with brine, driving demand for specialized SPS grades. Conversely, the lubricant additive market demands broad compatibility with base oils and synergistic additives. This granularity ensures that manufacturers can tailor production to meet diverse technical requirements across automotive, marine, aerospace, and general manufacturing sectors, maintaining the product’s competitive edge against synthetic alternatives by offering application-specific performance optimization.

- By Molecular Weight:

- Low Molecular Weight SPS (typically below 400 MW)

- Medium Molecular Weight SPS (400 MW to 500 MW)

- High Molecular Weight SPS (above 500 MW)

- By Total Base Number (TBN) and Active Content:

- Neutral SPS

- Overbased SPS (e.g., Calcium Sulfonates, often derived from SPS, offering higher TBN)

- High Purity / Low Oil Content Grades

- By Application:

- Lubricant Additives (Engine Oils, Hydraulic Fluids, Gear Oils)

- Rust Preventive Materials and Coatings

- Metalworking Fluids (Cutting Fluids, Rolling Oils, Quenching Oils)

- Oilfield Chemicals (Enhanced Oil Recovery/EOR, Drilling Muds)

- Emulsifiers and Dispersants (Pesticides, Textile Processing)

- Industrial Greases

- By End-Use Industry:

- Automotive and Transportation

- Industrial Manufacturing and Heavy Machinery

- Oil and Gas (Upstream and Downstream)

- Construction and Infrastructure

- Marine and Aerospace

Value Chain Analysis For Sodium Petroleum Sulfonate Market

The value chain for Sodium Petroleum Sulfonate begins with upstream petroleum refining and the procurement of specific naphthenic or paraffinic crude oil fractions, followed by the crucial step of sulfonation of the selected base oil or specialized feedstock (white oils or detergent intermediate base stocks). Upstream analysis focuses heavily on the integration of major oil companies that often produce the feedstock internally, granting them significant cost advantages and control over supply quality. The consistency of the base stock quality directly determines the properties of the resulting sulfonate, including molecular weight distribution and residual oil content, which are critical performance indicators for end-users. Access to reliable and cost-effective crude oil derivatives is the primary determinant of success in the upstream segment, creating a high barrier to entry for smaller, specialized chemical processors without direct access to refining operations.

The midstream phase involves the specialized chemical processing—sulfonation, neutralization (typically using sodium hydroxide), and purification (e.g., desalting and filtration). This stage requires capital-intensive chemical plants equipped with specialized reactors and robust safety protocols. Manufacturers at this level must manage complex chemical reactions and separation processes to achieve the required specifications, particularly concerning active sulfonate content and purity (low chloride and moisture content). Optimization of this processing stage is vital for cost control and product differentiation. Following processing, SPS is often formulated into various concentrations or blended with diluent oils before distribution, often tailored to specific application requirements like oil solubility or viscosity.

Downstream analysis encompasses the distribution channels, which are segmented into direct sales to major lubricant blenders and large industrial consumers (e.g., automotive OEMs and large metalworking plants), and indirect sales through specialized chemical distributors and regional agents serving smaller formulators and end-users. The final stage involves the incorporation of SPS into finished products such as engine oils, protective waxes, or EOR formulations, where performance attributes like corrosion inhibition and detergency are evaluated. Direct channels are preferred for high-volume, long-term contracts where technical support and customized specifications are paramount, whereas indirect distribution allows for wider market penetration and logistical efficiency in fragmented regional markets.

Sodium Petroleum Sulfonate Market Potential Customers

Potential customers for Sodium Petroleum Sulfonate are widely dispersed across heavy industrial sectors, necessitating specialized sales strategies based on application focus. The largest volume buyers are global lubricant blenders and additive package manufacturers who rely on SPS as a key component for formulating finished engine oils, hydraulic fluids, and transmission fluids. These customers require consistent supply of high-purity SPS with specific Total Base Numbers (TBNs) and molecular weights, essential for meeting international performance standards (e.g., API, ACEA specifications). Their purchasing decisions are heavily influenced by performance data, regulatory compliance, and security of supply rather than just marginal price differences.

Another significant customer base lies within the manufacturers of rust preventive compounds and protective coatings, including those serving the marine, defense, and automotive aftermarket sectors. These customers utilize SPS's excellent film-forming and moisture-displacement properties to create barrier protection for metal components during storage, transit, or harsh operational environments. Furthermore, companies involved in metalworking processes—including steel mills and precision machining operations—are key buyers, utilizing SPS in water-soluble or oil-based metalworking fluids to provide lubricity, cooling, and critical corrosion protection during high-speed cutting and forming operations.

The emerging high-growth customer segment comprises oilfield service companies and exploration and production (E&P) firms globally. These entities leverage SPS for Enhanced Oil Recovery (EOR) techniques, specifically surfactant flooding, to reduce interfacial tension between reservoir rock and trapped oil, thus maximizing hydrocarbon extraction. This application requires large volumes of technically specific, high-solubility sulfonates designed to perform under high-salinity and high-temperature downhole conditions, representing a highly technical and lucrative customer segment driving future R&D in SPS customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 Million |

| Market Forecast in 2033 | USD 625 Million |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sonneborn LLC, Chemtura Corporation, King Industries, Inc., ExxonMobil Chemical Company, Chevron Oronite Company, Afton Chemical Corporation, Lamberti S.p.A., HollyFrontier Corporation, Lubrizol Corporation, MORESCO Corporation, Ganesh Benzoplast Ltd., Shrinath Petro-Chem Pvt. Ltd., Eastern Petroleum, R. T. Vanderbilt Company, Inc., NOF Corporation, Nanjie Specialty Chemical Co., Ltd., BASF SE, Croda International Plc, Phillips 66. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Petroleum Sulfonate Market Key Technology Landscape

The core technology surrounding Sodium Petroleum Sulfonate production remains the sulfonation process, which utilizes oleum or sulfur trioxide (SO3) to react with specific petroleum fractions. However, technological advancements are centered less on altering the fundamental chemistry and more on optimizing process control and enhancing product quality to meet demanding specifications. A key technological focus is the development and implementation of continuous sulfonation reactors, which offer better control over reaction kinetics compared to traditional batch processes. This continuous operation minimizes side reactions, leads to narrower molecular weight distributions, and crucially, results in lower residual oil content, yielding high-purity products essential for synthetic lubricant formulations and specialized EOR applications. Manufacturers are increasingly utilizing advanced process simulation software to model reaction variables, ensuring predictable output and maximizing feedstock conversion efficiency, directly impacting cost competitiveness.

Another significant area of technological innovation involves purification and neutralization techniques. Modern facilities employ sophisticated membrane filtration and solvent extraction methods post-neutralization to remove impurities such as inorganic salts, excess moisture, and unreacted components. The objective is to produce ultra-clean SPS that exhibits superior stability and better compatibility with complex additive packages, particularly those containing sensitive metal components. Furthermore, the technology surrounding 'overbasing'—the process used to create high-TBN metallic sulfonates (often calcium or magnesium salts, derived from SPS)—is continually evolving. New overbasing technologies aim to increase the metallic content (and thus TBN) while maintaining low viscosity and improving colloidal stability, which is vital for heavy-duty diesel engine oils requiring exceptional acid neutralization capacity and detergency.

The future technology landscape is also being shaped by sustainability initiatives. There is growing research into creating hybrid or functionalized sulfonates using partial bio-based feedstocks or exploring novel methods to manage and treat waste streams generated during the sulfonation process, such as spent acid management. While fully synthetic bio-derived sulfonates are still prohibitively expensive for commodity applications, process improvements focused on minimizing environmental footprint and energy consumption during the manufacturing of traditional SPS are paramount. Furthermore, quality assurance technologies, including advanced spectroscopic methods (like FT-IR and NMR) combined with chemometrics, are being used for rapid, precise determination of molecular structure, TBN, and active component percentage, ensuring that the final product adheres rigorously to specialized customer specifications before shipment.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market due to rapid industrial expansion, particularly in China, India, and Southeast Asian nations. The region’s escalating manufacturing base, coupled with massive infrastructure investments (e.g., construction and marine transport), drives high demand for protective coatings and industrial lubricants. Furthermore, the large and growing automotive manufacturing sector necessitates substantial volumes of high-performance lubricant additives, positioning APAC as the primary engine for future SPS consumption growth globally.

- North America: A mature yet highly stable market characterized by stringent lubricant performance standards and significant activity in the oil and gas sector. Demand is primarily driven by the established heavy machinery, aerospace, and automotive industries. The focus here is increasingly on high-quality, specialized SPS grades utilized in advanced synthetic formulations and in Enhanced Oil Recovery (EOR) operations across major oil basins, maintaining steady high-value consumption.

- Europe: This region exhibits stable demand, heavily influenced by strict regulatory frameworks such as REACH, which mandates meticulous registration and safety assessment of chemical substances. European manufacturers prioritize eco-friendly formulations, driving interest in lower toxicity and highly optimized SPS grades. Key applications include sophisticated metalworking fluids and high-specification lubricant packages for precision European machinery and automotive OEMs.

- Latin America: Growth in this region is volatile but promising, linked strongly to localized resource extraction (mining and oil) and agricultural machinery maintenance. Key markets like Brazil and Mexico are seeing increasing investment in industrialization, boosting the demand for both protective coatings and industrial lubricants necessary to maintain aging and newly deployed equipment, often relying on imported SPS formulations.

- Middle East and Africa (MEA): Demand is largely concentrated in the GCC states, driven by massive investments in oil and gas infrastructure, petrochemical processing, and maritime industries. SPS is critical here for corrosion protection in coastal environments and as a core component in specialized oilfield chemicals (e.g., drilling fluids and EOR agents), directly correlating market growth with energy sector capital expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Petroleum Sulfonate Market.- Sonneborn LLC

- Chemtura Corporation (now part of Lanxess)

- King Industries, Inc.

- ExxonMobil Chemical Company

- Chevron Oronite Company

- Afton Chemical Corporation

- Lamberti S.p.A.

- HollyFrontier Corporation

- Lubrizol Corporation

- MORESCO Corporation

- Ganesh Benzoplast Ltd.

- Shrinath Petro-Chem Pvt. Ltd.

- Eastern Petroleum

- R. T. Vanderbilt Company, Inc.

- NOF Corporation

- Nanjie Specialty Chemical Co., Ltd.

- BASF SE

- Croda International Plc

- Phillips 66

Frequently Asked Questions

Analyze common user questions about the Sodium Petroleum Sulfonate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of Sodium Petroleum Sulfonate (SPS) in lubricant formulations?

SPS primarily functions as a rust inhibitor, offering excellent corrosion protection for metal surfaces, and as a dispersant, preventing the agglomeration of sludge and contaminants within the lubricant oil, thereby maintaining engine cleanliness and extending fluid lifespan.

How does the molecular weight of SPS affect its performance and application?

Molecular weight determines the surfactant properties: low molecular weight SPS typically acts as an effective emulsifier, while medium to high molecular weight grades offer superior detergency, dispersancy, and robust film-forming characteristics vital for advanced rust prevention and heavy-duty applications.

Is Sodium Petroleum Sulfonate used in Enhanced Oil Recovery (EOR), and what is its role?

Yes, SPS is widely used in EOR, particularly in surfactant flooding, where it significantly lowers the interfacial tension between the injected water and the residual crude oil trapped in reservoir pores, mobilizing the oil for enhanced extraction rates.

What is the main driver influencing the fluctuating cost of Sodium Petroleum Sulfonate?

The primary driver influencing the cost of SPS is the volatility in crude oil prices, as SPS is derived from specific petroleum fractions (feedstock). Production costs are directly correlated with global petrochemical market trends and the expense of specialized refining processes.

What are the key differences between Neutral and Overbased Sodium Sulfonates?

Neutral sulfonates contain very little excess metal base and primarily act as emulsifiers and rust inhibitors. Overbased sulfonates (often calcium or magnesium salts) contain a large excess of alkaline reserve (high TBN), making them highly effective detergents and acid neutralizers crucial for heavy-duty engine lubrication.

Market Dynamics Deep Dive: Regulatory and Substitution Analysis

The Sodium Petroleum Sulfonate market is highly susceptible to regulatory shifts, particularly concerning environmental impact and worker safety. In mature markets like Europe (governed by REACH regulations) and North America (EPA oversight), there is increasing scrutiny on the biodegradability and ecotoxicity of petroleum-derived substances. This regulatory pressure forces manufacturers to invest in higher purity grades that minimize residual non-sulfonated components and to explore functional alternatives that meet stricter environmental criteria. Compliance requires extensive data submission and testing, adding significant complexity and cost to market entry and product maintenance. This pressure, while restraining overall growth slightly, simultaneously drives innovation towards more refined and environmentally acceptable manufacturing processes and formulations, ensuring product viability in demanding regulatory landscapes.

Substitution is a persistent threat, albeit moderate, primarily stemming from synthetic alternatives such as synthetic alkylbenzene sulfonates and specific non-ionic surfactants. Synthetic sulfonates offer the advantage of high purity, precise molecular structure control, and often tailored performance characteristics not achievable with petroleum-derived products. While synthetic options are generally more expensive, they gain traction in high-specification, low-volume applications like aerospace lubricants or specialized industrial fluids where performance outweighs cost. However, for high-volume, cost-sensitive applications—such as large-scale rust prevention or basic industrial oils—the cost-effectiveness of SPS ensures its continued dominance, buffering the market against widespread substitution.

Furthermore, internal competition within the additive market—such as competition between different metal salts of sulfonates (e.g., Sodium vs. Calcium vs. Barium sulfonates)—also shapes market dynamics. The phase-out of Barium sulfonates due to toxicity concerns has shifted demand predominantly towards Calcium and Sodium variants. This internal substitution dynamic highlights the market’s responsiveness to health and safety standards. Strategic positioning requires SPS manufacturers not only to optimize production efficiency but also to actively participate in regulatory dialogue, proving the safe use and essential function of their products within critical industrial applications to secure long-term market access.

- Regulatory Compliance Challenges:

- Adherence to global regulations (REACH, TSCA) requires detailed toxicological and environmental data.

- Increasing pressure to reduce residual oil content and aromatic components to meet stringent health standards.

- Mandates for testing and registration add significant operating expenses for manufacturers.

- Substitution Landscape:

- Competition from high-purity synthetic sulfonates (e.g., Synthetic Alkyl Aryl Sulfonates) in specialized fluids.

- Threat from bio-derived surfactants (biosurfactants) in niche, environmentally sensitive applications.

- Internal substitution favoring Calcium Sulfonates (overbased) for applications requiring high TBN and detergency.

- Impact of Sustainability Goals:

- R&D focus shifting towards optimizing SPS biodegradability profiles without compromising anti-corrosion effectiveness.

- Demand for sustainable sourcing and minimized carbon footprint in the manufacturing process.

Detailed Application Analysis: Beyond Lubricants

While lubricant additives constitute the largest segment, the utility of Sodium Petroleum Sulfonate extends significantly into several other industrial domains, each demanding specific characteristics. In the metalworking fluid industry, SPS is indispensable, primarily in forming stable oil-in-water emulsions for cutting and grinding operations. These fluids require excellent cooling and lubricating properties, coupled with strong corrosion inhibition to protect both the machine tools and the finished parts from rusting during processing. Low to medium molecular weight SPS grades are favored here for their efficient emulsifying capabilities and low foaming tendencies, which are critical for high-speed machining environments. The performance of the SPS directly impacts the fluid’s stability, service life, and the quality of the metallic surface finish achieved.

Rust prevention, a stand-alone application area, is vital across nearly every manufacturing sector. SPS, particularly the high molecular weight varieties, forms highly tenacious, water-resistant films on metal surfaces. These films act as effective barriers against moisture and oxygen, crucial for preserving steel, iron, and other sensitive metals during prolonged storage, intercontinental shipping, and in harsh, corrosive operating environments (like marine and offshore structures). SPS is utilized in solvent-borne, oil-based, and wax-based rust preventive coatings, providing versatile protection depending on the required film thickness and removability. The effectiveness of SPS in preventing flash rusting and long-term atmospheric corrosion ensures its continued high demand in the protective coatings segment, driving significant market revenue.

The application in Enhanced Oil Recovery (EOR) represents the most technically complex and high-growth area. In surfactant flooding, SPS is injected into oil reservoirs to drastically lower the capillary forces that hold oil within the rock matrix. This application requires custom-synthesized SPS variants that are stable under extreme conditions of high temperature, high pressure, and high salinity characteristic of deep reservoirs. Success in this field relies on precise tailoring of the sulfonate structure to match the specific crude oil and reservoir brine composition. The increasing deployment of EOR technologies globally, driven by the desire to maximize returns from aging oil fields, positions the oilfield chemical segment as a critical driver for specialized, high-performance SPS demand in the coming decade.

- Metalworking Fluids Requirements:

- Must provide excellent emulsion stability (oil-in-water or water-in-oil).

- Requires effective short-term corrosion inhibition for machined parts.

- Needs good compatibility with biocides and other performance additives.

- Rust Preventive Coatings:

- Utilization of high molecular weight grades for superior film formation.

- Application in temporary or permanent protective coatings for industrial equipment and auto parts.

- Demand driven by international shipping and long-term equipment storage needs.

- Enhanced Oil Recovery (EOR):

- Requires tailored SPS structures for optimal performance in high-salinity and high-temperature conditions.

- SPS formulations must exhibit ultra-low interfacial tension (IFT) with crude oil to mobilize trapped reserves.

- Demand is highly cyclical and dependent on capital expenditure within the upstream oil and gas sector.

Pricing and Cost Structure Analysis

The pricing structure for Sodium Petroleum Sulfonate is inherently linked to the price of crude oil, which constitutes the primary raw material cost. Since SPS is derived from specific, highly refined petroleum fractions (intermediate base stocks), fluctuations in global crude markets translate directly into cost volatility for manufacturers. Beyond feedstock costs, energy consumption during the exothermic sulfonation process is a major operating expense, particularly in regions with high industrial energy tariffs. Labor and overhead costs associated with operating complex chemical manufacturing facilities, coupled with the capital intensity of the purification and blending stages, form the remainder of the core cost structure. Manufacturers must maintain high operational efficiencies and minimize waste to preserve competitive margins in this commodity-driven chemical market.

Pricing strategy within the market is differentiated based on product specification and application. Commodity-grade, standard concentration SPS for general industrial use tends to be highly price-competitive and subject to rapid spot price changes, reflecting feedstock costs. Conversely, high-purity, specialized grades (such as those with very low residual oil content or specific molecular weights for EOR or synthetic lubricants) command a significant premium. These specialized products are sold based on performance guarantees and technical support rather than pure volume pricing. The cost of regulatory compliance and the complexity of quality control also contribute to the higher price points for European and North American-marketed products, where testing and certification are mandatory.

Supply chain optimization plays a crucial role in controlling final pricing. Integrated producers who source their own base stocks from internal refining operations often possess the lowest cost structure, enabling them to exert price leadership. Non-integrated blenders and formulators, relying on external base stock procurement, face greater risk from price spikes and supply disruptions. Forward-looking manufacturers mitigate risk through strategic hedging of feedstock purchases and long-term supply contracts with major oil companies. The ability to efficiently distribute high-viscosity chemical products in bulk quantities also influences logistical costs, ultimately affecting the final selling price to large end-users.

- Key Cost Components:

- Petroleum Feedstock (Specific base oils or white oils): Dominant cost factor, highly volatile.

- Sulfonating Agents (SO3 or Oleum): Moderate, stable chemical input costs.

- Energy and Utilities: High consumption required for reaction, heating, and purification processes.

- Capital Depreciation: High capital intensity of specialized chemical processing plants.

- Pricing Determinants:

- Purity Level (Residual oil content): High purity commands premium pricing.

- Molecular Weight Distribution: Tailored grades for specific applications yield better margins.

- Volume and Contract Terms: Bulk purchasers receive favorable pricing; spot market is more volatile.

- Mitigation Strategies:

- Backward integration into petroleum refining operations.

- Implementing advanced continuous processing to maximize yield and minimize energy use.

- Strategic long-term hedging agreements for key raw materials.

Emerging Market Trends and Technological Innovations

Several emerging trends are shaping the future trajectory of the Sodium Petroleum Sulfonate market, moving beyond conventional applications. A significant trend is the increasing demand for ultra-low viscosity, high-TBN calcium sulfonates derived from SPS. These advanced metal sulfonates are essential for the next generation of engine oils (like API SN/SP and ILSAC GF-6), which prioritize fuel efficiency and must maintain excellent engine protection under severe operational conditions. Innovation focuses on improving the colloidal stability of these overbased systems, preventing sedimentation, and ensuring compatibility with complex modern additive packages, thereby enhancing the overall performance longevity of the final lubricant product.

Another major trend is the focus on formulating "green" or environmentally preferable SPS derivatives. While traditional petroleum sulfonates present challenges regarding ultimate biodegradability, researchers are exploring methods to chemically modify the hydrocarbon backbone or refine the base stock selection to create products with improved environmental profiles. This trend is driven by environmental regulatory pressures and corporate sustainability initiatives, leading to increased R&D investment in functionalized sulfonates that offer a balance between high performance (especially corrosion resistance) and ecological acceptability, positioning these products favorably in markets like Scandinavia and Western Europe.

Furthermore, the digitalization of end-user industries (Industry 4.0) is impacting the requirements placed on lubricant additives. As sensors and predictive maintenance systems become standard in heavy machinery, there is a rising demand for lubricants that maintain consistent performance parameters over extended periods. This translates to a need for SPS grades with exceptional thermal and hydrolytic stability to ensure fluid integrity over longer service intervals, reducing operational downtime. Manufacturers are responding by offering more tightly controlled, specification-driven products, moving away from generalized commodity formulations and focusing on providing specialized chemical solutions tailored to specific equipment lifetime and performance metrics.

- Focus on High-Performance Additives:

- Increasing production of high-TBN calcium sulfonates for modern, low-emission engine oils.

- Development of sulfur-free or low-sulfur SPS derivatives for specialized applications to avoid catalyst poisoning.

- Green Chemistry and Sustainability:

- Research into bio-renewable or semi-synthetic feedstocks for sulfonate synthesis.

- Technological advancements to improve the inherent biodegradability of final SPS products.

- Digitalization and Operational Requirements:

- Demand for SPS with superior thermal and oxidative stability to support extended drain intervals mandated by predictive maintenance systems.

- Increased use of data analytics in R&D to optimize molecular structure for targeted application performance.

- Oilfield Specialization:

- Innovations in SPS designed for high-salinity, high-temperature EOR applications to increase oil recovery factors in challenging reservoirs.

- Development of unique fluid packages compatible with harsh downhole drilling environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sodium Petroleum Sulfonate Market Size Report By Type (NO. 35, NO. 40, NO. 45, NO. 50, NO. 55), By Application (Metalworking Fluids, Anti-Corrosion Compounds, Emulsifier, Motor Oil and Fuel Additives, Textile Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Sodium Petroleum Sulfonate Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (NO. 35, NO. 40, NO. 45, NO. 50, NO. 55), By Application (Metalworking Fluids, Anti-Corrosion Compounds, Emulsifier, Motor Oil and Fuel Additives, Textile Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager