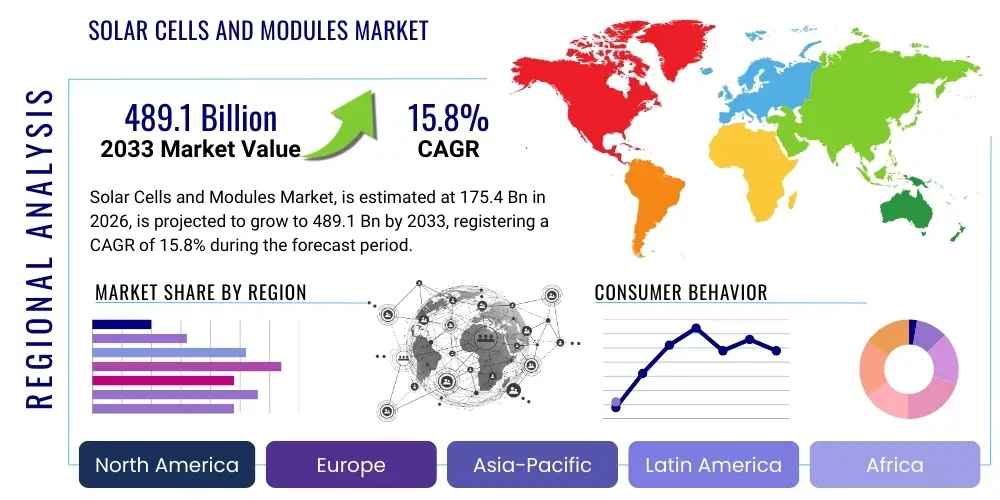

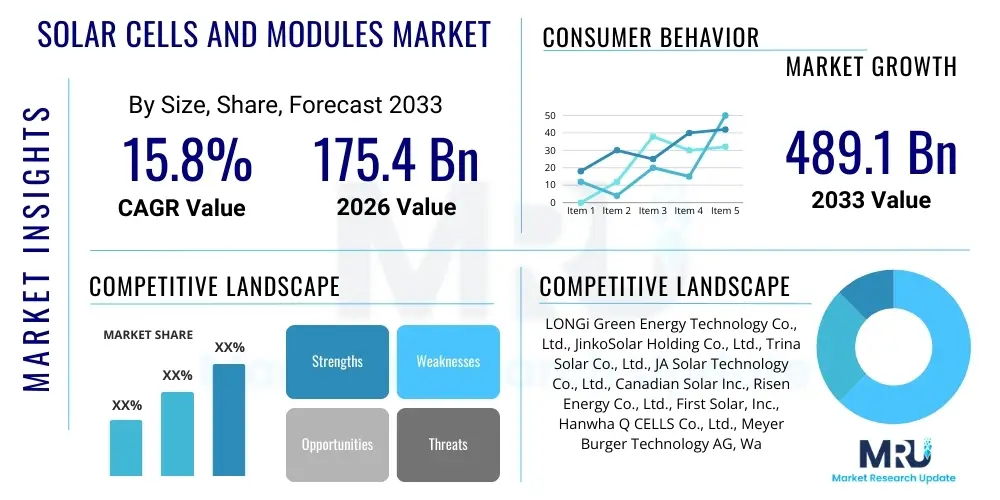

Solar Cells and Modules Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443390 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Solar Cells and Modules Market Size

The Solar Cells and Modules Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 175.4 Billion in 2026 and is projected to reach USD 489.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global decarbonization mandates, significant governmental incentives supporting renewable energy infrastructure, and continuous technological advancements enhancing the efficiency and durability of photovoltaic (PV) systems, making solar energy increasingly competitive with traditional power generation sources.

Solar Cells and Modules Market introduction

The Solar Cells and Modules Market encompasses the global production, distribution, and utilization of photovoltaic devices designed to convert solar radiation directly into electricity. Solar cells, the fundamental unit, are typically fabricated from semiconductor materials, predominantly silicon, and are assembled into interconnected modules or panels. These modules form the core component of various solar energy systems, ranging from residential rooftop installations and commercial ground-mounted arrays to utility-scale solar farms and integrated building materials (BIPV). The market's product portfolio is broad, covering crystalline silicon technologies (monocrystalline and multicrystalline) and thin-film technologies (CdTe, CIGS, amorphous silicon), each catering to specific performance, cost, and application requirements across diverse geographical and environmental conditions. The increasing demand for sustainable energy solutions, coupled with rapidly falling manufacturing costs through economies of scale and automation, underpins the robust growth trajectory observed globally.

Major applications of solar cells and modules span the entire energy ecosystem. Utility-scale projects represent the largest segment, crucial for bolstering national grid stability and achieving large-scale energy transition goals. The commercial and industrial (C&I) sector utilizes solar to mitigate peak electricity demands and reduce operational expenses, often deploying large rooftop or carport installations. Residential applications, spurred by net-metering policies and rising electricity prices, enable homeowners to achieve energy independence. Beyond terrestrial applications, specialized solar cells are critical for powering satellites and space exploration missions. The primary benefits include decentralized power generation, reduced carbon emissions, enhanced energy security, minimal operating noise, and long operational lifespans, often exceeding 25 years, providing long-term economic returns on investment, making solar PV a cornerstone of the future energy mix.

Key driving factors accelerating market expansion include stringent international climate agreements necessitating massive shifts towards renewables, such as the Paris Agreement commitments, and national renewable energy targets (e.g., China’s carbon neutrality goals, the EU’s Green Deal initiatives, and the U.S. Inflation Reduction Act). Additionally, advancements in cell efficiencies, particularly the transition to PERC (Passivated Emitter Rear Cell), TOPCon (Tunnel Oxide Passivated Contact), and Heterojunction (HJT) architectures, are continually improving energy yields. Furthermore, supportive regulatory frameworks, encompassing favorable feed-in tariffs, tax credits, and renewable portfolio standards (RPS), dramatically improve project financing viability. The growing awareness of energy poverty and the need for off-grid solutions in developing nations also contribute significantly to market penetration, especially in rural and remote areas where grid extension is prohibitively expensive or technically unfeasible.

Solar Cells and Modules Market Executive Summary

The Solar Cells and Modules Market is currently experiencing transformative business trends characterized by significant capacity expansion, strategic vertical integration among leading manufacturers, and intensified competition focused on achieving lower Levelized Cost of Electricity (LCOE). Manufacturers are heavily investing in next-generation technologies like N-type cells (TOPCon and HJT) to push efficiency boundaries beyond the theoretical limits of legacy P-type cells, driving substantial capital expenditure into new gigawatt-scale production facilities, predominantly located in the Asia Pacific region. Supply chain stability remains a critical focus, with increased localization efforts in North America and Europe aimed at reducing reliance on single-source regions and mitigating geopolitical trade risks. Merger and acquisition activities are prominent, particularly as smaller, specialized component providers are integrated into large, vertically aligned PV conglomerates seeking to control the entire manufacturing process from polysilicon production to module assembly and project development, thereby securing cost advantages and quality control across the value chain.

Regional trends highlight the dominance of Asia Pacific, specifically China, which not only commands the vast majority of global manufacturing capacity but also represents the largest consuming market for PV installations, fueled by aggressive domestic renewable energy targets. However, North America and Europe are exhibiting accelerating growth rates driven by robust policy support and substantial public funding designed to revitalize local manufacturing bases and incentivize deployment. The European market, particularly Germany, Spain, and the Netherlands, is focusing on residential and C&I installations, driven by high energy prices and energy security concerns stemming from recent geopolitical instability. In contrast, emerging markets in Latin America and the Middle East & Africa (MEA) are emerging as critical demand centers, propelled by abundant solar resources and the necessity of deploying new power generation capacity quickly, often through utility-grade power purchase agreements (PPAs). These regions are increasingly attracting foreign direct investment for large-scale solar project development.

Segment trends illustrate the continuous technological shift towards high-efficiency modules, with monocrystalline PERC and its successor N-type architectures (TOPCon, HJT) rapidly displacing traditional multicrystalline modules due to superior performance characteristics and marginal cost differences. The utility-scale segment maintains its lead in terms of installed capacity, but the distributed generation (DG) segment, encompassing residential and C&I, is showing the highest growth momentum, driven by consumer demand for energy independence and advancements in energy storage integration (hybrid PV systems). Furthermore, the thin-film segment, while smaller, maintains niche relevance in applications requiring flexibility, low-light performance, or specific aesthetic properties, though crystalline silicon remains the undisputed mainstream technology. Sustainability and recycling capabilities are also becoming crucial segment differentiators, with regulatory pressures increasing the focus on end-of-life management for PV modules, influencing future design and material choices.

AI Impact Analysis on Solar Cells and Modules Market

User queries regarding AI's impact on the Solar Cells and Modules Market primarily revolve around operational efficiency gains, predictive maintenance capabilities, manufacturing optimization, and grid integration complexity. Common questions include: "How can AI reduce solar manufacturing costs?" "What role does machine learning play in optimizing solar farm performance?" "Can AI accurately forecast solar power generation in variable weather conditions?" and "How is AI improving fault detection in solar panels?" This collective user interest signifies a clear expectation that Artificial Intelligence and Machine Learning (ML) will act as pivotal accelerators, moving beyond simple automation to enable smart solar ecosystems. Key themes emerging from these concerns are the desire for higher yield from existing assets, minimizing downtime through accurate prediction, achieving ultra-high precision in manufacturing processes, and leveraging advanced algorithms to manage the growing complexity of integrating massive, intermittent solar generation into existing electricity grids. Users anticipate that AI will ultimately lower the Levelized Cost of Electricity (LCOE) through continuous, data-driven optimization across the entire solar lifecycle, from material sourcing and cell fabrication to real-time grid balancing and asset management.

The integration of AI into solar cell and module manufacturing processes is resulting in unprecedented levels of precision and quality control. In the initial stages, AI-powered computer vision systems monitor wafer and cell production, instantly identifying microscopic defects that human inspection might miss, thereby increasing yield rates and material utilization. Predictive maintenance algorithms analyze data from module sensors (temperature, current, voltage) and weather patterns to anticipate equipment failure or degradation months in advance, scheduling timely interventions and significantly reducing unscheduled downtime for utility-scale parks. This move from reactive to proactive maintenance minimizes energy loss and maximizes the effective operational lifespan of solar assets. Furthermore, sophisticated machine learning models are optimizing supply chain logistics and inventory management, predicting material demand based on global installation forecasts and geopolitical factors, leading to reduced procurement costs and enhanced resilience against supply chain disruptions.

Beyond manufacturing and maintenance, AI is revolutionizing the deployment and operational phase of solar energy. Site selection is increasingly performed using geospatial AI that analyzes terrain, solar irradiation levels, land use restrictions, and connection proximity to existing infrastructure, dramatically speeding up the pre-development phase and optimizing array layout for maximum energy harvest. Crucially, AI-driven energy management systems (EMS) are essential for grid stability. These systems use deep learning models to perform highly accurate, short-term forecasting of solar generation output, allowing grid operators to better balance supply and demand and seamlessly integrate large volumes of intermittent solar power. This enhanced predictability reduces the need for expensive spinning reserves and facilitates higher renewable penetration levels without compromising grid reliability, thus solidifying AI's role as a key enabler for the solar energy transition.

- AI-enhanced Quality Control: Utilizes computer vision for real-time defect detection during cell manufacturing, maximizing production yield and consistency.

- Predictive Maintenance: ML algorithms analyze performance data to forecast equipment failures (inverters, trackers, modules), optimizing maintenance schedules and minimizing downtime.

- Optimized Grid Integration: Advanced forecasting models predict solar power output under variable weather conditions, facilitating better grid management and stability.

- Automated Project Development: Geospatial AI optimizes solar farm site selection, land assessment, and array layout design, reducing pre-construction timelines.

- Smart Energy Management: AI-driven software manages hybrid systems (PV + Storage), optimizing charging/discharging cycles for peak efficiency and revenue generation.

- Supply Chain Resilience: Machine learning predicts material availability and pricing fluctuations, improving procurement strategies for raw materials like polysilicon and glass.

DRO & Impact Forces Of Solar Cells and Modules Market

The Solar Cells and Modules Market is driven by compelling global energy policy shifts and technological efficiencies (Drivers), yet faces considerable headwinds from supply chain volatility and regulatory uncertainties (Restraints), while emerging technologies and untapped geographical regions present vast potential (Opportunities). The primary impact forces shaping the market trajectory are the rapidly decreasing cost of solar power, which makes it economically superior to fossil fuels in many geographies, and the intensifying geopolitical focus on energy independence, leading to increased localized manufacturing and trade protectionism. The inherent intermittency of solar energy necessitates massive investment in battery energy storage systems (BESS) and smart grid infrastructure, creating a powerful symbiotic force that binds the PV market's growth to advances in energy storage technology. Furthermore, mounting pressure from environmental, social, and governance (ESG) investing criteria strongly favors solar PV development, funneling substantial private capital into the sector globally.

Key market drivers include favorable government policies such as tax credits (e.g., ITC in the U.S.), feed-in tariffs, and renewable portfolio standards globally. Technological breakthroughs, especially in N-type cell efficiency (TOPCon and HJT), significantly boost energy density and module performance, reducing the overall footprint required for utility-scale projects. The steep decline in manufacturing costs, achieved through massive scaling and automation, makes solar PV the lowest-cost energy source in many parts of the world. Simultaneously, significant restraints dampen growth potential, notably the high upfront capital expenditure required for large-scale solar projects, which necessitates robust financing mechanisms. Global supply chain bottlenecks, particularly concerning polysilicon and specialized components like high-efficiency glass and silver paste, introduce pricing instability and project delays. Furthermore, the limited grid infrastructure capacity in several developing nations and bureaucratic hurdles related to project permitting and land acquisition pose substantial limitations to rapid deployment.

Opportunities in the market center around the expansion of the Building-Integrated Photovoltaics (BIPV) segment, which offers aesthetic and functional advantages for urban environments and commercial architecture, representing a high-value niche. The growing need for resilient energy systems and the transition to electric vehicles (EVs) create vast opportunities for integrated solar-plus-storage solutions, especially in the residential and C&I sectors, enabling peak shaving and backup power capabilities. The recycling and refurbishment sector for end-of-life solar modules is also rapidly emerging as a major opportunity, driven by sustainability mandates and the sheer volume of panels expected to retire over the next decade, transforming waste management into a circular economy advantage. The combined effect of these impact forces — policy, technology, cost reduction, and sustainability focus — dictates a future where solar energy penetrates deep into conventional energy markets, but success is contingent upon mitigating supply chain risks and successfully integrating solar output with next-generation grid infrastructure.

- Drivers: Global commitment to decarbonization; Continuous technological advancements (PERC, TOPCon, HJT); Declining Levelized Cost of Electricity (LCOE); Favorable governmental incentives and policies (FITs, tax credits); Rising electricity demand in developing economies.

- Restraints: Supply chain volatility and reliance on concentrated manufacturing hubs; High upfront capital investment requirements; Intermittency of solar generation necessitating storage; Land acquisition challenges and bureaucratic permitting delays; Trade protectionism measures (tariffs).

- Opportunities: Integration with Battery Energy Storage Systems (BESS); Growth in Building-Integrated Photovoltaics (BIPV); Untapped potential in emerging markets (Africa, Southeast Asia); Development of circular economy models focused on module recycling.

- Impact Forces: Strong ESG investment criteria; Geopolitical focus on energy independence; Symbiotic relationship with BESS technology adoption; Technological acceleration in material science.

Segmentation Analysis

The Solar Cells and Modules Market is comprehensively segmented based on technology, end-user application, and geographical region to capture diverse market dynamics and specialized product requirements. Technology segmentation distinguishes between crystalline silicon (c-Si), which dominates the market and is further broken down into monocrystalline and multicrystalline, and thin-film technologies, including Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si). This breakdown is crucial as it reflects varying efficiencies, manufacturing costs, and suitability for different climates and installation types. Monocrystalline silicon currently holds the largest market share due to its superior efficiency and continued cost reduction, particularly through advanced cell architectures like PERC and N-type technologies, which are setting new industry benchmarks for performance.

The market is also segmented by end-user application, which typically includes Utility-Scale, Commercial & Industrial (C&I), and Residential sectors. Utility-scale projects, characterized by massive ground-mounted arrays, account for the largest annual capacity additions, serving the primary need for bulk power generation and grid stabilization. However, the C&I sector is exhibiting the fastest growth due to the immediate financial savings realized by businesses through self-consumption, often coupled with sophisticated energy management systems. Residential installations, driven by consumer desire for energy independence and decreasing system costs, form a crucial component of the distributed generation landscape. Each end-user segment has distinct requirements regarding module size, aesthetic integration (especially in residential and BIPV), power output rating, and financing models, necessitating specialized product lines and distribution strategies from manufacturers.

Further segment analysis often considers component type (solar cells vs. modules vs. PV systems) and installation type (rooftop vs. ground-mounted). The market’s evolution is strongly tied to the shift toward integrated systems, where the module is no longer a standalone product but part of a complete solution incorporating inverters, mounting structures, and storage solutions. The geographical segmentation remains vital, with regions demonstrating widely varying regulatory environments, irradiation levels, and market maturity, necessitating regional specialization in sales and service delivery. The current momentum favors high-efficiency, standardized monocrystalline modules across nearly all application segments, demanding rigorous supply chain management and continuous investment in incremental efficiency improvements to maintain competitive advantage.

- By Technology:

- Crystalline Silicon (c-Si)

- Monocrystalline (P-type PERC, N-type TOPCon, HJT)

- Multicrystalline

- Thin Film

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

- Crystalline Silicon (c-Si)

- By Application/End-User:

- Utility-Scale

- Commercial & Industrial (C&I)

- Residential

- Off-Grid Systems

- By Deployment Type:

- Ground-Mounted

- Rooftop (Pitched Roof, Flat Roof)

- Floating Solar (FSPV)

- Building-Integrated Photovoltaics (BIPV)

- By Component:

- Solar Cells

- Solar Modules/Panels

- Balance of System (BOS) Components (Inverters, Mounting, Wiring)

Value Chain Analysis For Solar Cells and Modules Market

The Solar Cells and Modules market value chain is extensive and highly complex, stretching from raw material procurement to final system deployment and ongoing maintenance, and characterized by a high degree of integration among key players. The upstream segment begins with the sourcing and purification of silicon, involving the production of metallurgical-grade silicon followed by the energy-intensive process of converting it into electronic-grade polysilicon, which demands specialized high-purity facilities. This is followed by ingot pulling or crystallization, wafer slicing (forming the foundation of the solar cell), cell fabrication (involving doping, texturing, and passivation processes), and finally, module assembly where cells are interconnected, laminated, and framed. Control over the polysilicon and wafer stages is strategically critical, as these components determine the quality and cost base of the final module, making price stability and technological efficiency in the upstream segment paramount for overall market competitiveness.

The midstream and downstream activities involve the crucial steps of market access and deployment. The midstream focuses on the distribution channels, which include direct sales to large utility developers for major projects, and indirect channels such as wholesalers, distributors, and certified installers for the residential and C&I markets. Effective logistics, encompassing global shipping and inventory management, are vital due to the fragility and bulkiness of the modules. Downstream operations center on project development, which covers site assessment, securing financing, engineering, procurement, and construction (EPC). Project developers and EPC firms translate the supply of modules into functional power generation assets. Post-installation services, including operations and maintenance (O&M), which increasingly utilize remote monitoring and AI-driven predictive analytics, close the loop, ensuring long-term asset performance and maximized returns for asset owners.

The dynamics of the value chain are currently defined by the rapid shift towards vertical integration, especially among major manufacturers, who seek to internalize costs and secure supply by controlling stages from polysilicon production through to module shipment. Direct distribution channels are typically favored for high-volume utility projects, offering better price control and direct communication between manufacturer and developer. Conversely, the residential and smaller commercial markets heavily rely on extensive networks of certified, local installers and specialized distributors who provide localized knowledge, financing options, and tailored installation services. The increasing complexity of the PV system, particularly the integration of storage and smart inverters, is enhancing the value of the downstream services segment, moving the focus beyond just the module cost to the total system performance and longevity, emphasizing the importance of high-quality balance of system components and reliable after-sales support.

Solar Cells and Modules Market Potential Customers

The potential customers for solar cells and modules are highly diversified, broadly categorized into three main segments: Power Generation Utilities, Commercial & Industrial entities, and Residential consumers. Power Generation Utilities, including Independent Power Producers (IPPs) and state-owned enterprises, represent the largest buyers, procuring massive volumes of high-efficiency modules for utility-scale solar farms typically exceeding 10 megawatts. These buyers are primarily motivated by the Levelized Cost of Electricity (LCOE), reliability, and bankability of the module manufacturer. Their procurement is highly standardized, often relying on long-term Power Purchase Agreements (PPAs) that require guaranteed output and module performance over decades, making technical specifications, long-term warranties, and financial stability of the supplier key decision factors.

The Commercial & Industrial (C&I) segment includes a vast array of businesses, such as manufacturing plants, large retail chains, agricultural farms, data centers, and educational institutions. C&I customers seek solar solutions primarily to hedge against rising energy costs, achieve corporate sustainability goals (reducing Scope 2 emissions), and enhance energy resilience. For this group, installation speed, maximizing rooftop space utilization, and integration with existing electrical infrastructure are paramount. The purchasing decision is often driven by a return on investment (ROI) calculation, factoring in available tax incentives and financing options (e.g., leases or power purchase agreements). This segment increasingly demands integrated solutions that pair solar with battery storage to manage peak demand charges and ensure continuity of operations, especially for energy-intensive facilities.

Residential consumers form the third major customer base, driven by the desire for reduced monthly utility bills, energy independence, and environmental consciousness. These customers typically purchase smaller systems (3kW to 15kW) and often integrate them with residential battery storage and smart home energy management systems. The purchasing decision for residential customers is heavily influenced by aesthetics (BIPV options), ease of financing, and the reputation of the local installer. Furthermore, specialized niches within the market include military and defense applications requiring rugged, durable solar solutions, developers of portable or mobile power systems, and remote communities relying on off-grid PV systems to meet basic electrification needs, demonstrating the vast and varied end-user landscape for solar cells and modules globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 175.4 Billion |

| Market Forecast in 2033 | USD 489.1 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Trina Solar Co., Ltd., JA Solar Technology Co., Ltd., Canadian Solar Inc., Risen Energy Co., Ltd., First Solar, Inc., Hanwha Q CELLS Co., Ltd., Meyer Burger Technology AG, Waaree Energies Ltd., GCL System Integration Technology Co., Ltd., Tongwei Co., Ltd., Shunfeng International Clean Energy Limited, Sharp Corporation, Solar Frontier K.K., Talesun Solar, SunPower Corporation, REC Solar Holdings AS, Wuxi Suntech Power Co., Ltd., Eging PV. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Cells and Modules Market Key Technology Landscape

The Solar Cells and Modules Market is undergoing a rapid technological transition, primarily driven by the pursuit of higher efficiency and lower material consumption. The dominant technology remains Crystalline Silicon (c-Si), which is transitioning aggressively from traditional P-type cells, such as standard Aluminum Back Surface Field (Al-BSF), to high-performance P-type Passivated Emitter Rear Cell (PERC) architectures. PERC technology significantly improved energy conversion rates by reducing electron recombination losses. However, the industry is now experiencing a fundamental shift towards N-type silicon cell structures, specifically Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) technologies. These N-type cells offer substantially higher theoretical efficiency limits, superior temperature coefficients, and lower degradation rates, making them the new standard for premium and high-output modules. This pivot necessitates major capital investments in manufacturing lines capable of handling N-type specific processes, indicating a maturing, yet highly innovative, technological landscape focused on continuous performance improvement.

Parallel to the c-Si evolution, thin-film technologies maintain a critical, albeit smaller, market presence. Cadmium Telluride (CdTe), pioneered by companies like First Solar, is notable for its lower manufacturing energy footprint, ease of production scaling, and superior performance in hot, arid conditions, often competing effectively on cost per watt with c-Si for utility-scale projects. Copper Indium Gallium Selenide (CIGS) offers flexibility and aesthetic advantages, proving useful for specialized applications like flexible modules and Building-Integrated Photovoltaics (BIPV). However, the mainstream technology focus remains on pushing the efficiency of silicon-based cells, including the emerging potential of tandem cell structures, particularly Silicon-Perovskite tandem cells. Tandem configurations aim to stack multiple absorber materials to capture a broader spectrum of light, promising theoretical efficiencies exceeding 30%, which could fundamentally redefine the power output benchmarks for solar modules within the forecast period and ensure solar energy’s competitive edge over all other power sources.

In addition to cell structure advancements, manufacturing technologies are also evolving rapidly. Automated production lines, integrated with AI and robotics, are crucial for achieving the necessary economies of scale and minimizing manufacturing variance, particularly for complex N-type structures. Furthermore, module-level technologies, such as bifacial modules, which capture solar radiation from both the front and rear sides, are becoming the standard for ground-mounted installations, increasing overall energy harvest by 10-30% depending on ground reflectivity (albedo). Half-cut cell technology and gapless soldering techniques are also widely adopted to reduce internal resistance, minimize hot spot risks, and enhance module resilience. The combination of N-type silicon, bifacial design, and advanced assembly processes represents the current technological apex of the solar module market, driving down the marginal cost of manufacturing high-power modules and cementing solar PV’s role in the global energy transition.

Regional Highlights

The global Solar Cells and Modules Market exhibits highly disparate growth trajectories and maturity levels across key geographical regions, dictated by localized policy frameworks, solar irradiance levels, and existing energy infrastructure capacity. Asia Pacific (APAC) dominates the market both in terms of manufacturing capacity and consumption, largely driven by aggressive national targets in China and India. North America and Europe are rapidly expanding deployment, propelled by robust governmental support aimed at localization and decarbonization. Latin America and MEA, characterized by high solar irradiance and pressing energy needs, represent high-potential emerging markets focusing on large-scale utility projects.

- Asia Pacific (APAC): APAC is the epicenter of the global solar industry, housing over 80% of the world's solar cell and module manufacturing capacity, predominantly concentrated in China. China not only leads in production but also in domestic deployment, driven by ambitious carbon neutrality goals and massive utility-scale and distributed generation installations. India is rapidly emerging as a critical growth engine, supported by the PLI (Production Linked Incentive) scheme to boost domestic manufacturing and large-scale solar park initiatives. Other regions like Southeast Asia (Vietnam, Thailand) are crucial export hubs and growing consumer markets. This region’s growth is fundamentally tied to the ability to continually optimize manufacturing costs and scale up high-efficiency N-type technology adoption.

- North America: The North American market, particularly the United States, is experiencing a boom, significantly fueled by the Inflation Reduction Act (IRA), which provides unprecedented incentives for both deployment and domestic manufacturing. The focus is shifting towards strengthening the domestic solar supply chain, spanning from polysilicon production to module assembly, aimed at reducing reliance on foreign imports and increasing energy security. Demand is robust across all segments: residential, C&I, and utility-scale, often integrating advanced battery storage solutions to maximize grid benefit and system resilience, making it a high-value market focused on performance and quality.

- Europe: Europe is characterized by strong regulatory push towards renewables (EU Green Deal) and high electricity prices, which accelerate the adoption of residential and C&I solar, particularly in Germany, Spain, and the Netherlands. The region is actively seeking to diversify its PV supply chain, implementing policies to incentivize European manufacturing capacity, focusing on advanced technologies like HJT and specialized modules. Europe leads in BIPV and high-standardized quality requirements, prioritizing sustainability and module circularity (recycling). Policy stability and interconnection capacity remain critical factors for sustained growth.

- Latin America: This region presents exceptional solar resources, driving the market through large-scale utility projects, particularly in Brazil, Mexico, and Chile. Growth is primarily driven by long-term PPAs and competitive auctions that favor low-cost energy generation. While manufacturing bases are less established compared to APAC, the high irradiation levels ensure favorable LCOE, positioning the region as a major global deployment hub, though often susceptible to political and economic stability fluctuations.

- Middle East and Africa (MEA): MEA is characterized by massive, multi-gigawatt solar projects in resource-rich nations like the UAE and Saudi Arabia, driven by governmental diversification strategies away from oil and gas, and the highest solar irradiance globally. In Africa, the market is bifurcated between utility-scale projects (South Africa, Egypt) and critical off-grid/mini-grid solutions addressing energy access gaps in remote regions. The low operating cost potential makes solar PV the optimal choice for new capacity additions across the continent, requiring durable, high-temperature-tolerant modules.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Cells and Modules Market, providing insights into their strategic positioning, technological focus, production capacity, and recent corporate developments. These companies are instrumental in shaping global pricing trends, technological standards, and supply chain logistics, defining the competitive landscape through continuous investment in advanced cell architectures and vertical integration strategies. Their ability to scale production while maintaining high efficiency levels is critical to meeting the escalating global demand for solar energy solutions.- LONGi Green Energy Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- JA Solar Technology Co., Ltd.

- Canadian Solar Inc.

- Risen Energy Co., Ltd.

- First Solar, Inc.

- Hanwha Q CELLS Co., Ltd.

- Meyer Burger Technology AG

- Waaree Energies Ltd.

- GCL System Integration Technology Co., Ltd.

- Tongwei Co., Ltd.

- Shunfeng International Clean Energy Limited

- Sharp Corporation

- Solar Frontier K.K.

- Talesun Solar

- SunPower Corporation

- REC Solar Holdings AS

- Wuxi Suntech Power Co., Ltd.

- Eging PV

Frequently Asked Questions

Analyze common user questions about the Solar Cells and Modules market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current dominant solar cell technology driving market growth?

The current dominant technology is high-efficiency Crystalline Silicon (c-Si), specifically Monocrystalline N-type cells, including TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction). These N-type architectures offer superior efficiency, better temperature coefficients, and lower degradation rates compared to previous P-type PERC cells, setting the new benchmark for module power output and long-term reliability in utility-scale and distributed generation applications.

How is the Inflation Reduction Act (IRA) impacting the U.S. Solar Cells and Modules Market?

The IRA is profoundly impacting the U.S. market by providing substantial tax credits and incentives designed to revitalize and localize the domestic solar manufacturing supply chain, from polysilicon and wafers to finished modules. This legislation accelerates deployment rates and encourages massive capital investment in establishing American manufacturing capacity, aimed at reducing dependency on foreign supply chains and ensuring long-term energy security through robust local production.

What are the key differences between monocrystalline and thin-film solar modules?

Monocrystalline modules, made from single, highly pure silicon crystals, offer the highest efficiency per unit area and dominate the market, suitable for space-constrained installations. Thin-film modules (e.g., CdTe, CIGS) use thinner semiconductor layers, resulting in lower efficiency but offering advantages like flexibility, lighter weight, better performance in low-light/high-temperature conditions, and often a lower manufacturing energy footprint, making them suitable for niche or utility-scale applications where land is abundant.

What role does sustainability and module recycling play in the future of the solar market?

Sustainability and module recycling are emerging as critical differentiators, driven by environmental mandates and the vast volume of panels approaching end-of-life status. Future solar cells and modules are increasingly designed for easier disassembly and material recovery, minimizing waste and promoting a circular economy. Regulations, particularly in Europe, are focusing on Extended Producer Responsibility (EPR), mandating collection and recycling schemes to recover valuable materials like silicon, silver, and copper, ensuring the long-term environmental viability of solar energy.

How are solar cells and modules integrated with energy storage solutions?

Solar cells and modules are increasingly integrated with Battery Energy Storage Systems (BESS) to create hybrid PV systems. This integration addresses the intermittency of solar power by storing excess energy generated during the day for use at night or during peak demand periods. This combination maximizes self-consumption, enables grid services like frequency regulation and peak shaving for utility projects, and provides crucial backup power and enhanced energy resilience for residential and commercial customers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solar Cells and Modules Market Size Report By Type (Single Crystal Silicon, Polycrystalline Silicon, Others), By Application (Residential, Commercial, Ground Station, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Solar Cells And Modules Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Polycrystalline Silicon, Single Crystal Silicon, Others), By Application (Ground Station, Commercial, Residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager