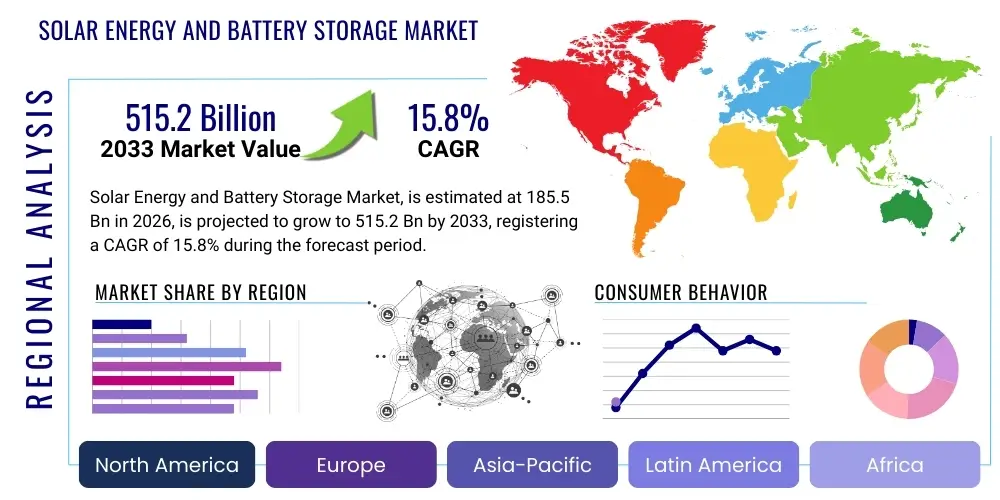

Solar Energy and Battery Storage Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442302 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Solar Energy and Battery Storage Market Size

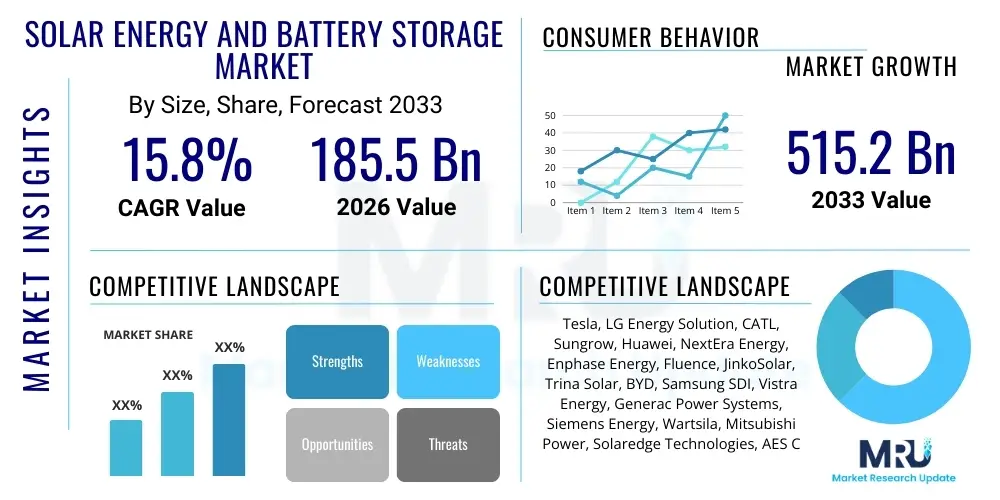

The Solar Energy and Battery Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $515.2 Billion by the end of the forecast period in 2033.

Solar Energy and Battery Storage Market introduction

The Solar Energy and Battery Storage Market encompasses the combined deployment of photovoltaic (PV) systems and integrated energy storage solutions, primarily utilizing advanced battery technologies to manage the inherent intermittency of solar power generation. This coupling is fundamental to the global energy transition, allowing renewable energy sources to provide reliable, dispatchable power that can effectively substitute fossil fuels. The market is driven by decreasing technology costs, robust regulatory incentives aimed at grid modernization, and the imperative need for enhanced energy security and resilience against climatic events. Solar PV systems convert sunlight into electricity, while Battery Energy Storage Systems (BESS) capture and store this energy for later use, balancing supply and demand, and enabling peak shaving and frequency regulation services for grid operators.

Key products within this integrated market include utility-scale solar farms paired with large-capacity lithium-ion battery banks, residential rooftop solar installations utilizing compact home energy storage solutions, and commercial & industrial (C&I) facilities implementing microgrids for operational continuity. Major applications span from providing essential grid services—such as transmission congestion relief and voltage support—to enhancing energy independence for individual consumers and businesses. The technological focus is rapidly shifting towards higher efficiency solar cells (like TOPCon and HJT) and next-generation battery chemistries (like sodium-ion and solid-state batteries) that promise improved safety, reduced cost, and greater cycle life, fueling accelerated market penetration across all geographic sectors.

The primary benefits driving market adoption include significant reductions in carbon emissions, lower long-term operational costs compared to traditional generation sources, and improved grid reliability, especially in remote or underserved areas. Driving factors include aggressive national decarbonization targets, favorable policy mechanisms like feed-in tariffs and tax credits (e.g., the U.S. Inflation Reduction Act), and growing corporate demand for 24/7 clean power. The integration of advanced power electronics and digital management systems further optimizes the performance and economic viability of co-located solar and storage assets, cementing their role as foundational elements of future sustainable energy infrastructure.

Solar Energy and Battery Storage Market Executive Summary

The global Solar Energy and Battery Storage Market is undergoing profound transformation, characterized by exponential growth in deployment across all scales—utility, C&I, and residential. Current business trends indicate a critical shift from standalone solar projects to hybrid facilities, where storage capacity is often mandated or incentivized to ensure reliable power delivery. Investment inflows are heavily concentrated on manufacturing capacity expansion, particularly in the battery supply chain, aiming to localize production and mitigate geopolitical supply chain risks. Furthermore, standardization and modularization of BESS components are accelerating deployment timelines and reducing balance-of-system costs, making projects increasingly attractive to institutional investors seeking reliable, long-term returns in the energy sector.

Regional trends highlight Asia Pacific (APAC) as the dominant force in both manufacturing and deployment, driven primarily by China’s massive domestic installation targets and manufacturing scale, followed closely by robust growth in India, Australia, and South Korea. North America, propelled by strong federal and state regulatory support, particularly in the U.S., shows rapid expansion in both front-of-meter (FTM) utility projects and behind-the-meter (BTM) distributed energy resources (DERs). Europe is focusing heavily on grid modernization and energy independence, utilizing solar and storage to reduce reliance on imported fossil fuels, with Germany, the UK, and Italy leading the charge in implementing supportive regulatory frameworks for distributed storage integration.

In terms of segment trends, the utility-scale segment, specifically FTM applications, remains the largest revenue contributor due to massive capacity requirements for grid stability and peak load shifting. However, the residential and C&I BTM segments are exhibiting the fastest growth rates, spurred by rising electricity prices and the desire for resilience. Lithium-ion batteries, specifically LFP (Lithium Iron Phosphate) chemistry, continue to dominate the technology segment due to cost competitiveness and improved safety profiles, though significant R&D investment is being channeled into non-lithium alternatives such as sodium-ion and zinc-based flow batteries, which promise better long-duration storage capabilities crucial for addressing seasonal energy storage challenges.

AI Impact Analysis on Solar Energy and Battery Storage Market

Common user inquiries concerning AI integration in the Solar Energy and Battery Storage Market revolve primarily around four critical areas: optimization of energy flow and dispatch (How can AI maximize revenue from stored energy?); predictive maintenance and asset longevity (Will AI reduce failure rates and extend battery life?); accurate generation forecasting (How reliable are AI models for predicting solar output under diverse weather conditions?); and enhanced grid integration (Can AI handle the complexity of managing millions of DERs?). These questions underscore high expectations for AI to transform intermittent solar assets into highly reliable, digitally managed energy sources. The core theme is the anticipated transition from reactive, schedule-based operations to proactive, predictive, and economically optimized energy management, leveraging machine learning to process massive datasets on weather, market pricing, and equipment performance to achieve unprecedented levels of efficiency and financial returns.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failures in solar panels, inverters, and battery cells, reducing downtime and operational expenditures (OPEX).

- Optimized Energy Trading and Dispatch: Algorithms analyze real-time electricity prices, grid needs, and regulatory signals to determine the optimal time to charge, discharge, or sell stored solar energy, maximizing revenue streams.

- Enhanced Solar Forecasting: Deep learning models significantly improve the accuracy of short-term and long-term solar generation forecasts, compensating for cloud cover and atmospheric variability, crucial for grid stability planning.

- Smart Grid Integration and VPPs (Virtual Power Plants): AI facilitates the aggregation and coordinated control of numerous distributed solar and storage assets, allowing them to function collectively as a reliable, large-scale VPP for grid services.

- Battery Lifecycle Management: Machine learning optimizes charging and discharging cycles based on specific battery degradation models, thereby extending the useful life and capacity retention of BESS assets.

DRO & Impact Forces Of Solar Energy and Battery Storage Market

The market is significantly influenced by a powerful combination of drivers, regulatory frameworks, technological limitations, and emerging strategic opportunities. Primary drivers include the escalating global commitment to net-zero carbon emissions, which necessitates rapid deployment of renewables, coupled with the dramatic reduction in the Levelized Cost of Electricity (LCOE) for solar PV and battery components, making them competitive with conventional power generation. However, the market faces strong restraints, particularly the complexity and cost associated with securing raw materials (like lithium and cobalt) for batteries, geopolitical supply chain volatility, and the inherent intermittency of solar output, which requires substantial energy storage infrastructure to mitigate. Impact forces are currently dominated by the positive momentum of favorable governmental policies and tax incentives globally, pushing the market into a phase of rapid industrial scaling.

Key restraints also include the slow pace of grid modernization in many developing regions, which limits the capacity to absorb large influxes of decentralized solar power, and stringent, often lengthy permitting processes that delay utility-scale project deployment. The safety and thermal management of large lithium-ion battery installations remain a technical and public concern, necessitating continuous innovation in fire suppression and thermal regulation systems. Furthermore, market saturation in certain developed regions for residential solar and storage necessitates focusing on maximizing value through advanced optimization rather than just capacity installation.

Opportunities are abundant and center on long-duration energy storage (LDES) solutions beyond standard lithium-ion, which are essential for true energy independence and seasonal energy shifting. The emergence of Green Hydrogen production powered by excess solar energy offers a path for decarbonizing heavy industry and transport. Additionally, the development of microgrids and islanded systems, particularly in regions prone to grid instability or natural disasters, provides substantial growth avenues. The integration of Vehicle-to-Grid (V2G) technology, utilizing electric vehicle batteries as distributed storage assets, further broadens the scope of the BESS market, offering dynamic resources for grid support and unlocking new revenue streams for stakeholders.

Segmentation Analysis

The Solar Energy and Battery Storage Market is meticulously segmented based on technological parameters, operational scale, and end-use applications, allowing stakeholders to precisely target investment and product development. Segmentation by component includes solar PV modules, battery systems (cells, modules, racks), inverters (string, central, hybrid), and supporting balance of system (BOS) hardware. Crucial segmentation based on application divides the market into Front-of-Meter (FTM), primarily utility-scale projects providing bulk power and grid services, and Behind-the-Meter (BTM), encompassing residential and C&I systems focused on self-consumption, backup power, and energy cost management. This structure reflects the diverse functionality and varying regulatory landscapes governing distributed versus centralized energy assets.

Further categorization is based on battery technology, dominated by Lithium-Ion (specifically NMC, NCA, and LFP chemistries), which is favored for its high energy density and cycling efficiency, particularly in short- to medium-duration applications. However, alternative storage technologies like Flow Batteries, Flywheels, and Compressed Air Energy Storage (CAES) are becoming increasingly relevant in the Long-Duration Energy Storage (LDES) segment, crucial for multi-day storage needs. The segmentation by deployment type, such as hybrid (solar and storage co-located) versus retrofit (storage added to existing solar assets), provides granular insight into market adoption strategies and equipment compatibility requirements.

The strategic analysis of these segments is vital for understanding market dynamics, as differential growth rates are observed across regions and applications. For instance, the C&I BTM segment is seeing surging demand driven by businesses seeking demand charge reduction and power quality improvement, whereas the residential BTM market is heavily sensitive to local net metering policies and government subsidies. Analyzing these segment boundaries allows manufacturers to tailor product specifications—such as higher power density for residential use versus lower capital cost and longer cycle life for utility applications—optimizing their competitive positioning within the complex energy ecosystem.

- By Technology:

- Lithium-Ion Batteries (NMC, LFP, NCA)

- Flow Batteries (Vanadium Redox, Zinc-Bromine)

- Lead-Acid Batteries (Declining Share)

- Other Technologies (Sodium-Ion, Solid-State, CAES, Flywheels)

- By Deployment Type:

- Front-of-Meter (FTM)

- Behind-the-Meter (BTM)

- By Application (BTM):

- Residential

- Commercial & Industrial (C&I)

- By Application (FTM):

- Grid Services (Frequency Regulation, Reserve Capacity)

- Peak Shaving/Load Shifting

- Transmission & Distribution Investment Deferral

- By Component:

- Solar PV Modules (Monocrystalline, Polycrystalline, Thin-Film)

- Inverters (Central, String, Microinverters)

- Battery Management Systems (BMS)

- Software and Control Systems

Value Chain Analysis For Solar Energy and Battery Storage Market

The value chain for the integrated Solar Energy and Battery Storage Market is complex and highly interdependent, spanning from upstream raw material extraction to downstream deployment, operation, and eventual recycling. Upstream activities involve the mining and processing of critical materials—silicon for solar cells, and lithium, cobalt, nickel, and graphite for batteries. This stage is currently characterized by significant concentration risk and price volatility, particularly for battery materials, leading to intense efforts by key players to secure long-term supply agreements and invest in sustainable sourcing methods. Midstream activities encompass the sophisticated manufacturing processes of solar PV modules (ingot slicing, cell fabrication, module assembly) and the production of battery cells, modules, and full racks, where economies of scale and technological efficiency dictate competitive advantage.

Downstream analysis focuses on system integration, project development, engineering, procurement, and construction (EPC) services, which bring together the various components into functional, scalable energy systems. This stage requires specialized expertise in power electronics, grid interconnection standards, and system optimization software. The distribution channel is bifurcated: direct sales channels dominate utility-scale FTM projects, where large developers contract directly with manufacturers and EPC firms. Conversely, the BTM residential and C&I markets rely heavily on indirect distribution, involving a network of wholesalers, authorized distributors, and certified local installers who manage customer acquisition and decentralized system installation. Efficient logistics and robust installer training programs are paramount for success in these indirect channels.

The entire value chain is increasingly being shaped by circular economy principles, particularly at the end-of-life stage. The focus on robust recycling infrastructure for both solar panels (to recover silver, copper, and glass) and battery components (to recover lithium, cobalt, and nickel) is crucial, driven by regulatory pressures and the long-term sustainability imperative. Furthermore, secondary life applications, where batteries are repurposed for less demanding tasks after their primary grid service life, are emerging as a vital segment, minimizing waste and improving the overall economics of BESS deployment. Value creation is maximized by companies that successfully integrate vertically, controlling supply chain risks and ensuring seamless system performance from raw material to grid connection.

Solar Energy and Battery Storage Market Potential Customers

Potential customers for the Solar Energy and Battery Storage Market are segmented into distinct groups defined by their operational scale, energy needs, and regulatory environment. The largest segment remains the utility sector, comprising Independent Power Producers (IPPs), Public Utility Commissions (PUCs), and Transmission System Operators (TSOs). These entities are the primary buyers of large-scale, Front-of-Meter (FTM) systems, utilizing them for capacity firming, ancillary grid services, and replacing retiring fossil fuel plants. Their procurement decisions are driven by regulatory mandates, long-term power purchase agreement (PPA) pricing, and the necessity to maintain grid reliability and stability while integrating high penetrations of variable renewable energy sources. They seek robust, high-availability systems with proven long cycle life guarantees.

The second major group is the Commercial and Industrial (C&I) sector, which includes large factories, data centers, hospitals, educational institutions, and retail chains. These customers adopt Behind-the-Meter (BTM) solar and storage primarily to reduce escalating operational costs via demand charge management and time-of-use optimization. Crucially, they seek enhanced energy resilience, implementing storage for backup power to maintain critical operations during grid outages, a feature increasingly vital in regions facing extreme weather events. The C&I sector demands customized solutions that integrate seamlessly with existing building management systems and comply with rigorous safety standards, focusing on high power throughput and fast return on investment (ROI).

The third, and fastest-growing, customer base is the residential sector. Homeowners, driven by rising utility costs, environmental consciousness, and the desire for energy independence, purchase rooftop solar coupled with home battery solutions. Residential customers prioritize ease of installation, aesthetic integration, safety, and reliable backup power for essential appliances. The purchasing decision is heavily influenced by local incentives (tax credits, rebates) and the perceived long-term value of self-sufficiency. Furthermore, government and military installations represent a specialized, high-security customer segment requiring highly resilient, microgrid-capable solar and storage systems for critical infrastructure protection and energy security in remote or sensitive locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $515.2 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, LG Energy Solution, CATL, Sungrow, Huawei, NextEra Energy, Enphase Energy, Fluence, JinkoSolar, Trina Solar, BYD, Samsung SDI, Vistra Energy, Generac Power Systems, Siemens Energy, Wartsila, Mitsubishi Power, Solaredge Technologies, AES Corporation, Eos Energy Enterprises |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar Energy and Battery Storage Market Key Technology Landscape

The technological landscape of the Solar Energy and Battery Storage Market is defined by continuous innovation focused on increasing energy efficiency, reducing manufacturing costs, and enhancing system safety and longevity. In solar PV, the transition from traditional Passivated Emitter and Rear Cell (PERC) technology is accelerating towards highly efficient alternatives such as Tunnel Oxide Passivated Contact (TOPCon) and Heterojunction (HJT) cells. These technologies offer superior conversion efficiencies, better performance under low-light conditions, and lower degradation rates over the lifespan of the panel, crucial for maximizing the energy yield from fixed land area. Furthermore, advancements in bifacial module design are capturing light from both sides, substantially increasing overall energy generation and making solar deployment economically viable in more diverse geographic settings.

In the battery storage domain, Lithium Iron Phosphate (LFP) chemistry has emerged as the preferred choice for grid-scale and C&I applications due to its inherent safety advantages (thermal stability) and longer cycle life compared to NMC chemistries, despite having a lower energy density. However, significant technological momentum is building behind non-lithium chemistries aimed at Long-Duration Energy Storage (LDES). Sodium-ion batteries are rapidly gaining traction as a potentially low-cost, domestically sourced alternative, leveraging abundant raw materials, making them attractive for static storage applications. Similarly, advancements in Vanadium Redox Flow Batteries (VRFBs) and other flow battery systems are maturing, offering solutions for multi-hour to multi-day energy storage required for deep grid decarbonization.

The convergence of solar and storage is heavily reliant on sophisticated digital and power electronics technology. Hybrid inverters capable of managing both DC power from solar PV and the bidirectional flow of power to and from the battery are becoming standard, improving system efficiency and integration complexity. Furthermore, advanced Battery Management Systems (BMS) are utilizing refined algorithms and hardware to monitor cell health, manage temperature fluctuations, and prevent thermal runaway, thereby extending the battery’s operational life and enhancing system safety. Communication protocols and data analytics platforms are increasingly standardized, enabling seamless integration into utility control rooms and facilitating the monetization of flexible capacity through sophisticated market participation.

Regional Highlights

Regional dynamics are highly varied, reflecting differences in policy support, grid maturity, resource availability, and local demand drivers.

- Asia Pacific (APAC): APAC dominates the global market both in manufacturing capacity and deployment scale. China is the undisputed global leader, setting aggressive installation records annually, driven by state-level mandates and vast manufacturing economies of scale in PV and BESS components. India is emerging as a critical growth hub, focused on utility-scale projects and microgrids to enhance rural electrification and energy security. Australia remains a leader in high residential penetration rates for solar and storage, supported by strong consumer demand for energy independence and favorable local incentives.

- North America: The market is defined by rapid expansion, primarily driven by the U.S. Inflation Reduction Act (IRA), which provides substantial tax credits (Investment Tax Credits - ITC) for co-located solar and storage projects. This has led to a surge in utility-scale FTM projects and robust growth in BTM residential and C&I installations, particularly in high-demand states like California, Texas, and New York. Canada is also seeing increased investment, focusing on integrating storage into remote and Northern communities to reduce reliance on diesel generation.

- Europe: Driven by ambitious climate targets (Fit for 55, REPowerEU) and the urgent need to achieve energy independence from imported gas, Europe is experiencing explosive growth, particularly in distributed BTM storage. Germany, the UK, and Italy are leading the deployment of residential and C&I storage systems. Policies incentivize self-consumption and grid contribution, while the introduction of Virtual Power Plant (VPP) concepts is optimizing the use of decentralized assets across the continent.

- Latin America: This region presents significant long-term potential, capitalizing on excellent solar irradiance resources. Brazil and Chile are at the forefront, implementing favorable regulatory frameworks for distributed generation and launching large-scale tenders for utility-scale solar projects paired with storage to stabilize grids and manage energy supply during dry seasons. Investment remains challenged by economic volatility and slower grid infrastructure development compared to developed markets.

- Middle East and Africa (MEA): The Middle East is heavily investing in monumental solar PV projects paired with storage (e.g., in UAE and Saudi Arabia) as part of economic diversification and decarbonization strategies, seeking to monetize their abundant solar resource. Africa, meanwhile, is a high-impact market for off-grid and microgrid solutions, utilizing solar and storage to address chronic energy access deficits and displace costly diesel generators in remote areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar Energy and Battery Storage Market.- Tesla

- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

- Sungrow Power Supply Co., Ltd.

- Huawei Technologies Co., Ltd.

- NextEra Energy, Inc.

- Enphase Energy, Inc.

- Fluence Energy, Inc. (A Joint Venture of Siemens and AES)

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- BYD Company Limited

- Samsung SDI Co., Ltd.

- Vistra Energy Corp.

- Generac Power Systems, Inc.

- Siemens Energy AG

- Wartsila Corporation

- Mitsubishi Power, Ltd.

- SolarEdge Technologies, Inc.

- AES Corporation

- Eos Energy Enterprises, Inc.

Frequently Asked Questions

Analyze common user questions about the Solar Energy and Battery Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the integration of solar and battery storage?

The primary driver is the necessity of overcoming solar energy's intermittency to ensure stable, dispatchable power supply required for deep grid decarbonization. Policy incentives, such as the U.S. Investment Tax Credit (ITC) for co-located systems, and the rapid decline in LCOE for both solar PV and battery components, further accelerate this integration by making hybrid systems economically superior to traditional peak power generation sources.

Which battery chemistry currently dominates the utility-scale energy storage market?

Lithium Iron Phosphate (LFP) chemistry currently dominates the utility-scale segment due to its superior safety profile, longer cycle life, and high thermal stability compared to Nickel Manganese Cobalt (NMC) chemistries. Although LFP has a slightly lower energy density, its long-term cost of ownership and enhanced safety performance make it the preferred choice for static, large-scale grid applications where space constraints are less critical than reliability.

How does the Inflation Reduction Act (IRA) impact the North American Solar and Storage Market?

The IRA provides massive, long-term stability and support through tax credits, particularly the ability to claim the Investment Tax Credit (ITC) for standalone storage projects and co-located systems. Crucially, it incentivizes domestic manufacturing of solar and battery components, accelerating supply chain localization, reducing reliance on foreign sources, and stimulating substantial capital investment in U.S.-based production facilities and deployment projects.

What role does Long-Duration Energy Storage (LDES) play in future market growth?

LDES is critical for market maturity, enabling the reliable storage of energy for periods exceeding 8 hours, often extending to multiple days or even seasons. LDES solutions, which include flow batteries, compressed air, and green hydrogen, are necessary to achieve 100% renewable grids by handling multi-day weather events and seasonal variations in solar generation, going beyond the capabilities of current short-duration lithium-ion systems.

What are the major challenges related to the raw material supply chain for battery storage?

Major challenges include the high concentration of critical raw material extraction (lithium, cobalt, nickel) and processing in a few geopolitical regions, leading to supply bottlenecks and price volatility. Ethical sourcing concerns and the lack of robust, large-scale recycling infrastructure further complicate the supply chain, necessitating continuous innovation in battery chemistries that utilize more abundant elements like sodium or zinc to mitigate these risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager