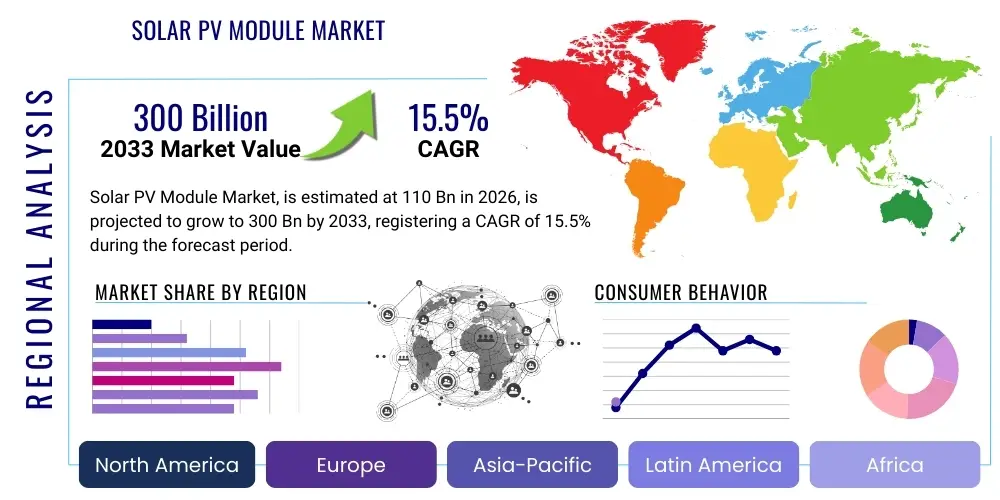

Solar PV Module Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443051 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Solar PV Module Market Size

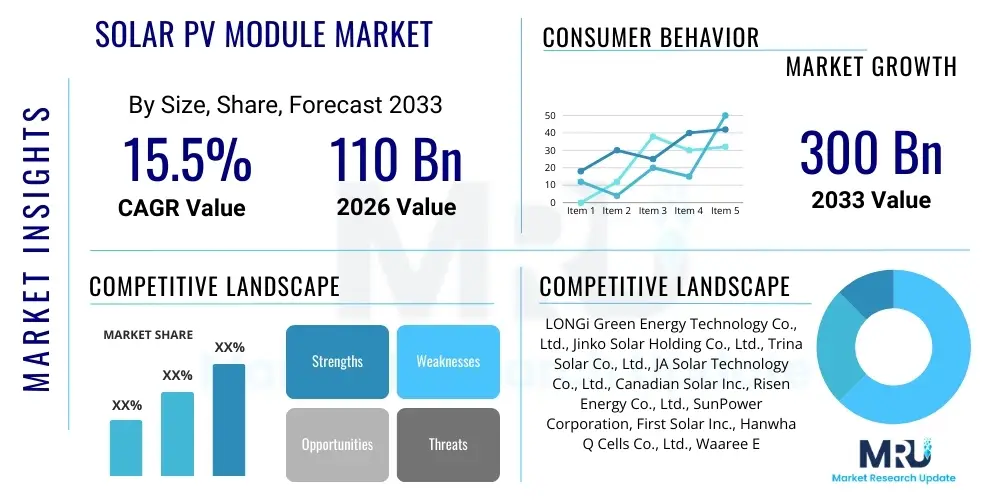

The Solar PV Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 110 Billion in 2026 and is projected to reach USD 300 Billion by the end of the forecast period in 2033.

Solar PV Module Market introduction

The Solar PV Module Market encompasses the manufacturing, distribution, and deployment of devices that convert sunlight directly into electricity using the photovoltaic effect. These modules, typically constructed from crystalline silicon (mono- or multi-crystalline), or thin-film materials, form the fundamental building block of solar power systems, ranging from small-scale residential rooftops to massive utility-scale solar farms. The product description involves highly engineered components, including solar cells encapsulated between glass sheets and backsheets, secured by aluminum frames, designed for maximum efficiency, durability, and resilience against environmental stressors like heat, humidity, and wind load. Technological advancements, particularly the widespread adoption of Passivated Emitter Rear Cell (PERC), Tunnel Oxide Passivated Contact (TOPCon), and Heterojunction (HJT) technologies, are continuously increasing module conversion efficiency and lowering the Levelized Cost of Electricity (LCOE).

Major applications of solar PV modules span across diverse sectors, fundamentally driven by the global imperative to transition towards sustainable energy sources and achieve net-zero carbon targets. Utility-scale installations represent the largest segment, involving vast solar parks connected directly to high-voltage transmission grids, serving millions of homes and businesses. Commercial and industrial (C&I) installations, often situated on large facility rooftops or ground-mounted adjacent to businesses, contribute significantly to distributed generation, providing energy resilience and cost savings. Furthermore, residential applications, frequently combined with battery energy storage systems (BESS), empower consumers (prosumers) to achieve energy independence and participate actively in the decentralized energy landscape.

The primary benefits driving the market include zero-emission electricity generation, significant long-term operational cost reductions compared to fossil fuels, enhanced energy security through distributed generation, and minimal water consumption during operation. Driving factors are multifaceted, centered around supportive government policies such as feed-in tariffs, tax credits, and renewable portfolio standards (RPS), coupled with steep reductions in manufacturing costs driven by economies of scale and automation. Increasing global demand for reliable, affordable electricity, particularly in rapidly industrializing economies, further solidifies the long-term growth trajectory of the solar PV module market, positioning it as a cornerstone of the global energy transition.

Solar PV Module Market Executive Summary

The Solar PV Module Market is experiencing a transformative phase characterized by accelerated technological migration, intense global capacity expansion, and complex geopolitical influences shaping supply chains. Business trends are overwhelmingly focused on enhancing energy density and efficiency, with manufacturers rapidly shifting production from legacy P-type PERC modules to advanced N-type technologies, specifically TOPCon and HJT, which offer superior efficiency, lower degradation rates, and improved bifacial performance. This technological race is fueling massive capital expenditures in automated, high-throughput manufacturing facilities, primarily concentrated in East Asia, though significant localized manufacturing efforts are being spurred by governmental incentives in North America (e.g., Inflation Reduction Act) and Europe (e.g., European Solar Initiative) aimed at supply chain diversification and resilience.

Regional trends indicate Asia Pacific (APAC), led by China, maintaining its dominance in both manufacturing capacity and deployment scale, driven by aggressive domestic renewable targets and robust export capabilities. North America and Europe are exhibiting the fastest growth rates in terms of installed capacity, largely supported by favorable regulatory frameworks, high electricity prices, and corporate power purchase agreements (PPAs) that incentivize large-scale solar adoption. Latin America and the Middle East and Africa (MEA) are emerging as critical frontier markets, leveraging abundant solar irradiation and international investment to address rapidly rising energy demand and infrastructure deficits, particularly in the utility-scale segment, fostering new hubs of solar deployment activity.

Segment trends underscore the sustained preeminence of crystalline silicon modules due to their proven reliability and continuous efficiency improvements. Within this segment, bifacial modules are gaining significant traction across all installation types, maximizing energy yield by capturing light from both sides, especially in ground-mounted and large-scale projects. Furthermore, the application landscape is increasingly dominated by utility-scale projects, reflecting the push towards centralized renewable energy generation, while the integration of solar PV modules with sophisticated energy storage systems (PV+Storage) is becoming standard practice, driven by grid stability requirements and the necessity of managing intermittent renewable generation.

AI Impact Analysis on Solar PV Module Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Solar PV Module Market typically center on three core themes: optimization of manufacturing processes, enhancement of grid integration capabilities, and the acceleration of research and development for next-generation materials and cell designs. Users frequently inquire how AI-driven predictive maintenance can reduce operational costs and downtime in large solar farms, or how machine learning algorithms can improve yield rates and quality control during the cell and module assembly phases. There is also significant interest in AI's role in forecasting solar energy production more accurately to manage grid loads, especially as renewable energy penetration levels rise dramatically. The overarching expectation is that AI will serve as a crucial lever for maximizing efficiency, reliability, and profitability across the entire solar value chain, from polysilicon crystallization to power plant operation, addressing the complexity inherent in manufacturing optimization and intermittent energy management.

AI's application in PV manufacturing focuses heavily on defect detection and yield maximization. By employing computer vision and deep learning models to analyze high-resolution images captured during cell fabrication and module lamination, AI systems can instantly identify micro-cracks, contamination, and soldering issues that are undetectable or inconsistently identified by human operators. This real-time quality control loop allows automated adjustments to machinery parameters, minimizing waste of high-value materials (like silicon wafers) and ensuring higher average power output (Pmax) from finished modules. This integration is vital for maintaining competitive advantage in a high-volume, low-margin industry where minimal percentage gains in efficiency translate to substantial financial benefits.

In the deployment and operational phase, AI models are transforming site planning and asset management. Geospatial analysis combined with historical weather data allows AI to optimize array layouts for maximum solar irradiation capture while minimizing shading and installation costs. Post-deployment, machine learning algorithms analyze vast streams of sensor data from inverters and monitoring systems to predict equipment failure (e.g., potential induced degradation or hotspot formation) before it impacts performance. This shift from reactive to predictive maintenance significantly boosts the effective lifetime energy yield of solar assets, reducing Levelized Cost of Energy (LCOE) and enhancing investor confidence in solar projects, solidifying AI as a cornerstone technology for sophisticated solar asset management.

- AI optimizes silicon wafer slicing, reducing kerf loss and improving material utilization efficiency.

- Machine learning algorithms enhance predictive maintenance in solar farms, minimizing downtime and increasing system reliability.

- AI-driven computer vision systems perform high-speed, high-accuracy defect detection during solar cell manufacturing (e.g., identifying microcracks and surface defects).

- Deep learning models improve solar irradiation forecasting and power output prediction for enhanced grid stability and energy trading strategies.

- AI accelerates R&D by simulating new material combinations and PV architectures (e.g., perovskite cells) rapidly, shortening time-to-market for high-efficiency technologies.

- Automated drone inspections utilizing AI image recognition identify module degradation, soiling, and shading losses across vast utility-scale sites efficiently.

DRO & Impact Forces Of Solar PV Module Market

The dynamics of the Solar PV Module Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces that dictate the pace and direction of growth. Key drivers include aggressive decarbonization commitments by nations and corporations globally, the continuously falling Levelized Cost of Electricity (LCOE) for solar PV making it competitive with, or cheaper than, fossil fuels in most regions, and substantial governmental policy support (e.g., tax incentives, long-term procurement targets). These drivers create an insatiable global demand for solar modules, pushing manufacturers to continuously expand capacity and innovate. Conversely, the market faces restraints such as persistent volatility in key raw material prices (polysilicon, silver paste, glass), vulnerability to geopolitical trade disputes and tariffs, and the complexity of integrating large volumes of intermittent solar power into aging electrical grids without stability issues.

Opportunities in the market center around technological innovation and niche application expansion. Bifacial technology, which boosts energy yield significantly, is rapidly approaching market saturation as the standard, while the shift to N-type technologies (TOPCon and HJT) offers a new frontier for efficiency gains. Furthermore, the development of specialized applications such as Building-Integrated Photovoltaics (BIPV), Floating Solar PV (FSPV) for water bodies, and high-efficiency modules designed for space-constrained urban environments, provides new avenues for market penetration beyond traditional ground-mounted systems. These opportunities promise market differentiation and higher margin potential for specialized module manufacturers, promoting sustained R&D investment.

Impact forces acting upon the market are primarily regulatory and competitive. Regulatory impact forces, stemming from environmental standards, manufacturing mandates, and trade policies (like anti-dumping measures and local content requirements), profoundly influence supply chain structure and investment decisions. The competitive landscape is characterized by intense price pressure driven by the market dominance of a few large, vertically integrated Asian manufacturers, which forces continuous cost reduction and efficiency improvements across the board. The impact of technological disruption, such as the potential commercialization of tandem cell architectures (e.g., Perovskite-Silicon tandem), represents a critical force that could fundamentally alter module efficiency ceilings and manufacturing cost structures in the mid-term forecast period, compelling existing players to adapt rapidly or risk obsolescence.

Segmentation Analysis

The Solar PV Module Market is primarily segmented based on Technology, Material, End-User, and Application, providing a structured view of the varied product offerings and deployment strategies across the industry. The segmentation by technology is crucial as it reflects the current state of PV research and commercial maturity, highlighting the migration towards more efficient cell architectures that maximize power output per unit area. Material segmentation distinguishes the dominant crystalline silicon products from alternative thin-film chemistries, while the End-User and Application segments delineate the primary consumer groups and the scale of deployment, such as residential systems versus massive utility projects. This granular analysis is essential for manufacturers to tailor product specifications, optimize production capacity, and strategize market penetration based on regional demand characteristics and policy frameworks.

The most defining shift within market segmentation is the rapid move away from established P-type crystalline silicon, such as standard multi-crystalline and PERC modules, towards superior N-type technologies. N-type cells, including TOPCon (Tunnel Oxide Passivated Contact), HJT (Heterojunction Technology), and IBC (Interdigitated Back Contact), offer inherent advantages like lower light-induced degradation (LID) and potential-induced degradation (PID), alongside higher maximum efficiency ratings. This migration dictates current manufacturing investment cycles, with TOPCon currently leading in commercial scale-up due to its compatibility with existing PERC production lines, although HJT is gaining traction due to its lower processing temperatures and potential for future tandem cell integration.

Application segmentation reveals the ongoing shift towards utility-scale installations, which continue to drive global demand volumes due to large governmental energy tenders and decreasing project financing costs. However, distributed generation, comprising Residential and Commercial & Industrial (C&I) segments, is becoming increasingly sophisticated, often incorporating specialized module designs like aesthetically pleasing BIPV solutions and modules optimized for shading tolerance. The integration of modules with Battery Energy Storage Systems (BESS) is rapidly becoming a mandatory requirement for distributed and utility projects, fundamentally altering the functional definition of a solar installation from a simple generator to a comprehensive energy management system, thus impacting procurement requirements across all end-user segments.

- By Technology:

- Crystalline Silicon (P-Type, N-Type)

- PERC (Passivated Emitter Rear Cell)

- TOPCon (Tunnel Oxide Passivated Contact)

- HJT (Heterojunction Technology)

- IBC (Interdigitated Back Contact)

- Thin Film

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Amorphous Silicon (a-Si)

- Emerging Technologies (e.g., Perovskites, Tandem Cells)

- Crystalline Silicon (P-Type, N-Type)

- By Material:

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film Materials (CdTe, CIGS)

- By Application:

- Utility-Scale

- Residential

- Commercial & Industrial (C&I)

- Off-Grid

- By Installation Type:

- Ground-Mounted

- Rooftop (Pitched Roof, Flat Roof)

- Floating PV (FSPV)

- Building-Integrated Photovoltaics (BIPV)

Value Chain Analysis For Solar PV Module Market

The Solar PV Module Market value chain is a complex, capital-intensive structure spanning from upstream raw material procurement to downstream system integration and maintenance. Upstream activities begin with the production of metallurgical-grade silicon, which is refined into high-purity polysilicon, a process demanding significant energy input and technological expertise. This polysilicon is then processed into ingots and subsequently sliced into ultra-thin silicon wafers, which serve as the substrate for the solar cell. These upstream stages are highly concentrated geographically, primarily in China, which controls the vast majority of global polysilicon and wafer production capacity, establishing critical choke points in the global supply chain and influencing cost stability across the entire market.

The midstream phase involves the transformation of wafers into functional solar cells through intricate semiconductor processes, followed by the assembly of cells into finished PV modules. Cell manufacturing utilizes advanced techniques like doping, surface passivation, and metallization (e.g., silver paste application) to create the necessary electrical properties. Module assembly involves soldering cells together, encapsulating them with protective layers (EVA/POE), lamination between glass and backsheets, and fitting them into aluminum frames. This stage is critical for ensuring module durability and achieving high power ratings, demanding automated, precision manufacturing lines. Major module manufacturers frequently integrate both cell and module production, striving for vertical integration to control quality and cost.

The downstream sector is characterized by distribution and end-user application. Distribution channels involve logistics providers, wholesale distributors, and specialized renewable energy system integrators (EPC companies). Direct channels include large utility developers procuring modules directly from Tier 1 manufacturers under long-term supply agreements for utility-scale projects. Indirect channels, typically serving the fragmented residential and smaller C&I markets, rely heavily on regional distributors and certified installers who manage the sales, installation, interconnection, and ongoing Operation & Maintenance (O&M) services. The efficiency and reliability of these downstream players are vital for maximizing the energy yield and ensuring the long-term performance of solar assets, completing the entire value realization cycle from raw material to electricity generation.

Solar PV Module Market Potential Customers

The potential customers and end-users of solar PV modules are highly diversified, reflecting the technology's scalability and adaptability across varying energy demands and geographical locations. The primary and largest consumers are utility developers and Independent Power Producers (IPPs) who undertake the development, ownership, and operation of multi-megawatt (MW) to gigawatt (GW) scale solar farms. These entities require high-efficiency, reliable, and cost-competitive modules, often prioritizing bifacial and N-type technologies to maximize returns on their capital-intensive, long-term investments. Procurement decisions in this segment are typically based on bankability, long-term warranty guarantees, and module performance validation under rigorous testing conditions, driving bulk volume purchases through long-term contracts.

The Commercial and Industrial (C&I) sector constitutes another significant segment, comprising businesses, large institutional buildings (e.g., universities, hospitals), factories, and agricultural facilities that consume substantial amounts of electricity during daytime hours. These customers utilize solar PV to hedge against rising grid electricity prices, achieve corporate sustainability goals, and enhance energy resilience, often installing modules on rooftops or in adjacent unused land. Their purchasing criteria often prioritize modules with superior shading tolerance and aesthetic qualities, especially for visible rooftop installations. The C&I segment frequently adopts decentralized generation models, sometimes combined with storage to manage peak demand charges and improve self-consumption rates, requiring tailored module specifications and financing solutions.

Residential consumers form the third crucial end-user group, primarily focusing on solar installations for individual homes, driven by the desire for reduced electricity bills, environmental consciousness, and energy independence, especially in regions with high retail electricity prices or unreliable grid infrastructure. This segment often prefers smaller, aesthetically pleasing modules, increasingly adopting BIPV solutions, and typically bundling the PV system with battery storage and smart energy management systems (prosumer model). Lastly, niche applications such as telecommunication towers, remote off-grid pumping stations, electric vehicle charging infrastructure, and portable power solutions represent specialized customers requiring robust, high-durability modules capable of operating reliably in isolated or extreme environmental conditions, emphasizing product quality and system autonomy rather than pure volume efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110 Billion |

| Market Forecast in 2033 | USD 300 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LONGi Green Energy Technology Co., Ltd., Jinko Solar Holding Co., Ltd., Trina Solar Co., Ltd., JA Solar Technology Co., Ltd., Canadian Solar Inc., Risen Energy Co., Ltd., SunPower Corporation, First Solar Inc., Hanwha Q Cells Co., Ltd., Waaree Energies Ltd., GCL System Integration Technology Co., Ltd., Meyer Burger Technology AG, Shunfeng International Clean Energy Limited, ReNew Power Private Limited, Solaria Corporation, Seraphim Solar System Co., Ltd., Adani Solar, Vikram Solar Ltd., Goldwind Science & Technology Co., Ltd., REC Solar Holdings AS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solar PV Module Market Key Technology Landscape

The Solar PV Module market is characterized by rapid technological iteration aimed at maximizing energy output (Wp) and minimizing the Levelized Cost of Electricity (LCOE). The dominant technological framework remains crystalline silicon, but the specific cell architectures are undergoing a critical shift. The previous industry standard, P-type PERC (Passivated Emitter Rear Cell) technology, is being swiftly replaced by N-type variants due to their inherent advantages, including lower degradation rates (LID/PID), higher minority carrier lifetimes, and better performance under low light and high temperatures. N-type TOPCon (Tunnel Oxide Passivated Contact) is currently the leading technology in terms of capacity scale-up, primarily because its manufacturing process is largely compatible with modified PERC production lines, enabling swift conversion and massive output volumes necessary to meet soaring global demand.

Beyond TOPCon, Heterojunction Technology (HJT) represents another highly promising N-type platform, utilizing amorphous silicon layers to create highly efficient contacts. While HJT requires a higher initial capital expenditure due to different equipment needs, it offers potentially higher efficiencies than TOPCon, particularly when utilized in bifacial module designs, and is highly synergistic with future low-cost wafering techniques. Furthermore, advancements in module construction, independent of cell type, are critical. These include the widespread adoption of larger wafer sizes (e.g., 182mm and 210mm) to increase module power output, half-cut cell technology to reduce internal resistance losses, and multi-busbar (MBB) configurations to minimize shading losses and improve current collection efficiency. Bifacial modules, which generate power from both the front and rear faces, are now the standard for ground-mounted utility projects due to their superior energy yield gains (typically 10-30% depending on site conditions).

Looking ahead, the technological frontier is focused on Tandem Cell architectures, most notably the combination of a high-bandgap material like Perovskite placed on top of a conventional low-bandgap silicon cell. This approach promises to break the fundamental efficiency limits of single-junction silicon cells (Shockley-Queisser limit), potentially pushing commercial module efficiencies towards 30% and beyond. While significant challenges remain in ensuring the long-term stability and durability of Perovskite components in harsh outdoor environments, numerous research and commercial efforts are being heavily funded, positioning tandem technology as the next major disruptive force in the module manufacturing landscape, likely impacting the market towards the end of the forecast period (2030-2033).

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global solar PV module market, dominating both the manufacturing supply chain and installed capacity. China holds an unparalleled position, accounting for over 80% of global polysilicon, wafer, cell, and module production capacity, benefiting from comprehensive industrial policies, vast economies of scale, and relentless technological innovation. India and Southeast Asian countries (Vietnam, Malaysia, Thailand) are experiencing exponential installation growth driven by massive government renewable energy targets and rising domestic electricity demand, rapidly expanding their module assembly capacities, often serving as crucial export hubs to circumvent geopolitical trade restrictions.

- North America: This region is characterized by high growth, particularly in the utility and C&I segments, intensely catalyzed by the US Inflation Reduction Act (IRA). The IRA provides extensive tax credits and production incentives designed specifically to re-shore and build out a robust domestic solar supply chain, spanning from polysilicon refining to module assembly. This policy is driving substantial capital investment in localized manufacturing, diversifying supply away from traditional Asian sources and leading to a significant expansion of domestic module deployment across the US and Canada.

- Europe: Europe is demonstrating rapid solar deployment driven by ambitious EU climate targets (Fit for 55, REPowerEU) and the urgent need to enhance energy security following geopolitical shifts. Germany, Spain, and the Netherlands lead in installation volumes, focusing heavily on both utility-scale projects and prosumer residential installations, frequently integrating BESS. While local manufacturing capacity is currently insufficient to meet demand, strategic initiatives are being implemented to foster a viable domestic PV ecosystem, emphasizing high-efficiency, sustainable, and circular economy-compliant modules.

- Latin America: LatAm represents a high-potential frontier market, leveraging exceptional solar irradiation levels, especially in countries like Brazil, Chile, and Mexico. Brazil, in particular, has seen massive distributed generation growth due to favorable net metering regulations, while Chile is a leader in large-scale solar deployment. The market is primarily import-dependent, making module prices highly sensitive to global supply chain costs and exchange rates, though local content requirements are gradually being introduced to encourage regional industrial development.

- Middle East and Africa (MEA): Growth in MEA is dominated by large-scale, government-tendered utility projects, capitalizing on abundant desert land and high direct normal irradiance (DNI). The UAE and Saudi Arabia are undertaking monumental solar projects to diversify their energy mix and power green hydrogen initiatives, often demanding high-efficiency bifacial modules capable of performing optimally in high-temperature, dusty environments. Africa’s growth is bifurcated, focusing on large grid-connected farms in South Africa and Egypt, and crucial off-grid solutions for rural electrification across the sub-Saharan region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solar PV Module Market.- LONGi Green Energy Technology Co., Ltd.

- Jinko Solar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- JA Solar Technology Co., Ltd.

- Canadian Solar Inc.

- Risen Energy Co., Ltd.

- SunPower Corporation

- First Solar Inc.

- Hanwha Q Cells Co., Ltd.

- Waaree Energies Ltd.

- GCL System Integration Technology Co., Ltd.

- Meyer Burger Technology AG

- Shunfeng International Clean Energy Limited

- ReNew Power Private Limited

- Solaria Corporation

- Seraphim Solar System Co., Ltd.

- Adani Solar

- Vikram Solar Ltd.

- Goldwind Science & Technology Co., Ltd.

- REC Solar Holdings AS

Frequently Asked Questions

Analyze common user questions about the Solar PV Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between P-type and N-type solar PV modules?

The distinction lies in the silicon wafer doping. P-type uses Boron doping and is prone to Light Induced Degradation (LID). N-type uses Phosphorus doping, which provides superior immunity to LID and Potential Induced Degradation (PID), resulting in higher cell efficiency, enhanced bifacial performance, and lower long-term degradation rates, making N-type technologies like TOPCon and HJT the new industry benchmark.

How is the Levelized Cost of Electricity (LCOE) impacting solar PV module adoption?

The rapidly decreasing LCOE for solar PV, driven by technological improvements and economies of scale, has made solar energy cost-competitive with, or cheaper than, traditional fossil fuels across many global regions. This cost parity is the single most significant driver for massive utility-scale and commercial investment, transforming solar from a niche subsidy-dependent technology into a mainstream, economically viable power source.

What is the significance of the shift to TOPCon technology in the Solar PV Module Market?

TOPCon (Tunnel Oxide Passivated Contact) is significant because it is an N-type technology offering high efficiency (often exceeding 25% commercially) and superior performance metrics, while utilizing production equipment that can be efficiently upgraded from existing P-type PERC lines. This compatibility allows manufacturers to scale up production rapidly and cost-effectively, positioning TOPCon as the dominant high-efficiency cell technology being deployed globally in the immediate future.

What role do geopolitical factors play in the global solar supply chain?

Geopolitical factors, including trade tariffs, import restrictions, and nationalistic industrial policies (such as the US Inflation Reduction Act and European local content mandates), heavily influence where modules are manufactured and deployed. These policies fragment the global supply chain, promoting regionalized manufacturing hubs outside of China to enhance energy security, resilience, and compliance with ethical sourcing requirements.

How does Building-Integrated Photovoltaics (BIPV) differ from standard rooftop installations?

BIPV involves solar modules that are aesthetically and structurally integrated into the building envelope, replacing conventional materials like roofing tiles, façade elements, or skylights, rather than being mounted on top of them. BIPV focuses on dual functionality (power generation and architectural integrity), appealing to commercial architects and residential builders prioritizing design and space utilization in urban environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Rooftop Solar PV Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- On Grid Residential Solar PV Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager