Soldering Flux Paste Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440764 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Soldering Flux Paste Market Size

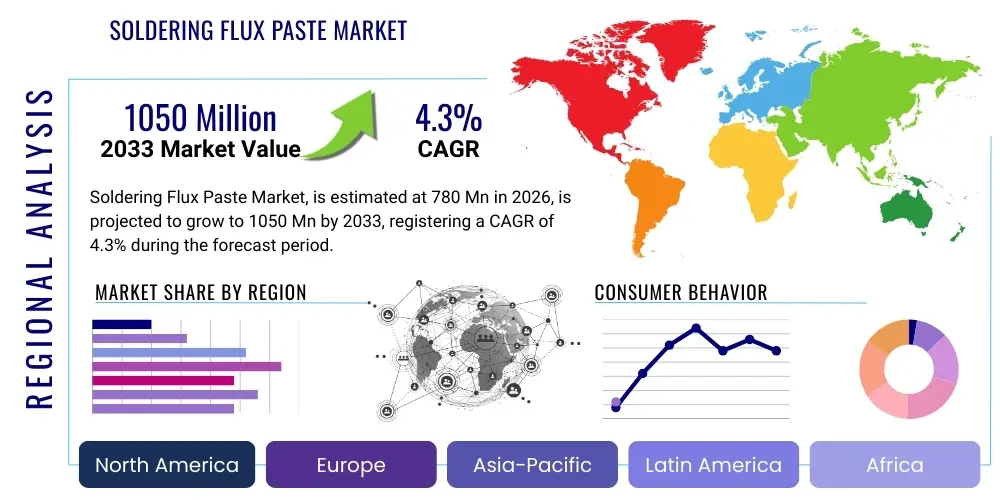

The Soldering Flux Paste Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.3% between 2026 and 2033. The market is estimated at USD 780 million in 2026 and is projected to reach USD 1050 million by the end of the forecast period in 2033.

Soldering Flux Paste Market introduction

Soldering flux paste is an indispensable material in the electronics manufacturing industry, facilitating strong and reliable solder joints by meticulously cleaning metal surfaces of oxides and other detrimental impurities. This viscous, pasty compound typically consists of a fluxing agent, a specialized binder, and a solvent, all precisely formulated to achieve optimal wetting, superior solder flow, and consistent joint formation during various sophisticated soldering processes. Its primary and critical applications span across advanced surface mount technology (SMT) assembly, traditional through-hole component integration, and essential rework operations in an extraordinarily diverse array of industrial sectors. The escalating global demand for increasingly miniaturized electronic devices, coupled with the relentless expansion of pervasive technologies such as the Internet of Things (IoT), high-speed 5G infrastructure, and sophisticated advanced automotive electronics, are unequivocally identified as key driving factors propelling the market forward. The tangible benefits of utilizing high-quality flux paste include significantly enhanced joint reliability, drastically reduced manufacturing defects, improved overall manufacturing efficiency, and crucial compliance with increasingly stringent global environmental and performance standards. The market continues to dynamically evolve with continuous innovations in lead-free and halogen-free formulations, diligently addressing both escalating regulatory pressures and complex technical requirements for the assembly of high-performance electronic components across all industries.

Soldering Flux Paste Market Executive Summary

The Soldering Flux Paste Market is experiencing robust and sustained expansion, primarily fueled by the unwavering growth of the global electronics industry across multiple sectors. Key business trends within this market indicate a strong and irreversible shift towards environmentally compliant products, most notably lead-free and halogen-free flux pastes, driven by increasingly stringent international regulations and pervasive corporate sustainability initiatives. Manufacturers are consistently investing heavily in cutting-edge research and development to create highly specialized flux formulations capable of meeting the rigorous demands of advanced packaging technologies and high-density interconnects. Regionally, Asia Pacific continues to assert its dominance as the undisputed powerhouse of the market, owing to its preeminent position in global electronics manufacturing, with substantial contributions from manufacturing giants like China, South Korea, Taiwan, and Japan. North America and Europe, while representing smaller market volumes, remain crucial for innovation in high-reliability applications such as aerospace, defense, and medical devices. Segment-wise, the no-clean flux paste category continues to gain significant traction due to its inherent ability to reduce or eliminate post-soldering cleaning steps, thereby profoundly enhancing manufacturing efficiency and substantially lowering operational costs. The automotive electronics sector, particularly with the rapid proliferation of electric vehicles and sophisticated autonomous driving systems, presents a burgeoning and highly lucrative opportunity for specialized flux pastes requiring superior thermal cycling performance and uncompromising long-term reliability. Overall, the market's trajectory is characterized by relentless technological advancement, strict regulatory compliance, and a highly responsive approach to the increasing complexity, miniaturization, and performance demands inherent in modern electronics manufacturing.

AI Impact Analysis on Soldering Flux Paste Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) across manufacturing processes is poised to significantly transform the Soldering Flux Paste Market, albeit indirectly, by enhancing the efficiency and precision of the electronics assembly lines that utilize these materials. Users frequently inquire about how AI-driven quality control systems might impact the demand for specific flux types, or if AI can optimize flux dispensing and application, thereby reducing waste and improving solder joint integrity. There's also curiosity surrounding AI's role in predictive maintenance for soldering equipment, which could indirectly influence the choice and performance expectations of flux pastes by ensuring optimal operational conditions. Furthermore, concerns are often raised about the data privacy implications of AI systems monitoring manufacturing parameters and the potential for AI to automate tasks currently requiring skilled human oversight in flux application and inspection. This shift towards intelligent manufacturing environments necessitates that flux paste manufacturers not only focus on material performance but also on compatibility with automated systems and data-driven process optimization strategies.

The impact of AI extends beyond mere automation, influencing product development cycles and supply chain management. AI algorithms can analyze vast datasets from manufacturing operations, including solder joint quality metrics, flux consumption rates, and equipment performance, to identify optimal flux formulations for specific applications. This data-driven approach allows manufacturers of flux pastes to tailor products more precisely to customer needs, predicting performance under various conditions and accelerating the development of next-generation materials. For instance, AI could simulate the behavior of different flux compositions during reflow, analyzing parameters like spread, slump, and residue characteristics, thereby reducing the need for extensive physical prototyping and speeding up time-to-market for innovative products, particularly those designed for challenging lead-free or ultra-fine pitch applications. This analytical capability transforms product lifecycle management by enabling real-time optimization and proactive problem-solving based on aggregated performance data across multiple production batches and environments.

Moreover, AI is set to redefine supply chain resilience and demand forecasting within the soldering flux paste ecosystem. By leveraging advanced predictive analytics, AI systems can anticipate fluctuations in demand for electronic components, and consequently, for soldering materials, allowing manufacturers to optimize inventory levels, prevent stockouts, and manage raw material procurement more effectively. This is particularly crucial given the global nature of electronics manufacturing and the potential for geopolitical or logistical disruptions that can impact raw material availability, such as specific resins or activators. AI-powered supply chain visibility can also help identify potential risks, such as raw material shortages or shipping delays, enabling proactive mitigation strategies and ensuring a more stable and predictable supply chain. The ability to forecast demand with greater accuracy means reduced waste, improved operational efficiency, and a more stable supply of critical soldering flux pastes to the market, ensuring continuity for high-volume, precision electronics production lines globally.

- AI-powered visual inspection systems enhance solder joint quality, influencing demand for fluxes that leave minimal, easily inspectable residues and are compatible with automated optical inspection (AOI).

- Predictive analytics optimize flux dispensing parameters, reducing material waste, improving process consistency, and enabling adaptive control in real-time manufacturing environments.

- Machine learning algorithms assist in the development of novel flux formulations by simulating performance characteristics under various conditions, accelerating R&D cycles and material discovery.

- AI-driven supply chain optimization improves raw material sourcing and finished product distribution efficiency, enhancing resilience against market volatility and logistical challenges.

- Automated quality control systems reduce reliance on manual inspection, promoting more consistent flux application and identifying potential defects earlier in the assembly process.

- Enhanced data analysis provides deeper insights into flux performance under diverse manufacturing conditions, driving targeted product innovation and customization for specific customer needs and applications.

DRO & Impact Forces Of Soldering Flux Paste Market

The Soldering Flux Paste Market is shaped by a complex interplay of dynamic drivers, inherent restraints, promising opportunities, and overarching impact forces that collectively dictate its growth trajectory and evolutionary path. A primary driver is the pervasive trend of miniaturization in electronics, demanding fluxes capable of handling ultra-fine-pitch components and high-density packaging without compromising reliability. This is further propelled by the rapid proliferation of 5G technology, the exponential growth of the Internet of Things (IoT) across industrial and consumer applications, and the accelerating integration of advanced electronics in the automotive sector, including electric vehicles (EVs) and autonomous driving systems. These segments require increasingly robust and precise soldering solutions that can withstand harsh operating environments and demanding performance specifications, directly boosting the demand for high-performance flux pastes. The continuous innovation in semiconductor packaging, moving towards smaller and more complex designs, also acts as a significant catalyst for flux paste development and adoption.

However, stringent environmental regulations, particularly those aimed at reducing volatile organic compounds (VOCs) and eliminating halogen content, act as significant restraints, necessitating costly research and development and extensive product reformulation efforts for manufacturers. Compliance with directives such as RoHS, REACH, and other regional environmental mandates forces companies to invest heavily in developing lead-free and halogen-free alternatives, which often present technical challenges in achieving equivalent performance to traditional chemistries. The market also faces the challenge of intense price competition, especially for commoditized products in high-volume markets, which can squeeze profit margins for manufacturers and hinder investment in further innovation. Moreover, the inherent sensitivity of flux paste to storage conditions and shelf life can pose logistical challenges and add to operational complexities for both manufacturers and end-users, requiring careful inventory management.

Opportunities within this market are substantial and diverse, largely stemming from ongoing technological advancements and the emergence of new application areas. The growing adoption of advanced packaging techniques like BGA (Ball Grid Array), CSP (Chip Scale Package), and flip-chip technologies creates a demand for highly specialized flux pastes engineered for these complex, high-density interconnections. The expansion of the medical device industry, with its critical reliability requirements for life-sustaining equipment, and the increasing investment in aerospace and defense electronics, which demand extreme durability under harsh conditions, further open lucrative avenues for high-performance, custom-formulated fluxes. Furthermore, the global push towards sustainable manufacturing practices and the circular economy presents a significant opportunity for developing bio-based, ultra-low VOC, or recyclable flux solutions that align with evolving environmental consciousness and regulatory frameworks, potentially creating new market niches and premium product categories with higher value propositions.

- Drivers:

- Rapid growth in consumer electronics (smartphones, wearables), advanced automotive electronics (EVs, ADAS), and telecommunications sectors (5G, IoT infrastructure).

- Increasing miniaturization and complexity of electronic components demanding ultra-fine pitch soldering capabilities.

- Growing requirement for high-reliability solder joints in critical applications such as medical devices, aerospace, and defense.

- Continuous advancements in semiconductor packaging technologies like BGA, CSP, and System-in-Package (SiP).

- Global expansion of electronics manufacturing facilities, particularly in emerging economies.

- Restraints:

- Strict global and regional environmental regulations (e.g., RoHS, REACH, halogen-free directives) driving up R&D and production costs for compliant formulations.

- Intense price competition and commoditization pressures, particularly in high-volume, standard flux product categories.

- Volatility and potential disruptions in the supply chain for key raw materials (resins, activators, solvents).

- Challenges associated with ensuring consistent performance of flux pastes across diverse manufacturing processes and environmental conditions.

- Limited shelf life and specific storage requirements for optimal flux paste efficacy.

- Opportunities:

- Development of highly specialized fluxes for emerging applications like micro-LEDs, advanced driver-assistance systems (ADAS), and quantum computing components.

- Expansion into new geographical markets with burgeoning electronics manufacturing bases and increasing domestic demand.

- Innovation in sustainable, bio-degradable, and ultra-low residue flux formulations that offer superior performance and environmental benefits.

- Rising demand from niche, high-growth sectors such as electric vehicle battery management systems and industrial robotics.

- Technological partnerships to integrate flux pastes with advanced dispensing and inspection systems for improved process control.

- Impact Forces:

- Evolving regulatory landscape regarding chemical usage, waste disposal, and product safety, mandating continuous adaptation from manufacturers.

- Global economic trends, including inflation, recessions, and consumer spending patterns, directly influencing electronics production and material demand.

- Accelerated technological breakthroughs in component design (e.g., smaller chip sizes, new substrates) and assembly automation (e.g., AI-driven pick-and-place).

- Geopolitical events, trade wars, and regional conflicts affecting global supply chains, raw material prices, and market access for manufacturers.

- Shifting industry standards and certifications, often driven by consortiums and leading OEMs, dictating product specifications, quality benchmarks, and market entry requirements.

Segmentation Analysis

The Soldering Flux Paste Market is meticulously segmented to provide a granular understanding of its diverse landscape, reflecting critical variations in product composition, application methodologies, and complex end-user requirements. This comprehensive segmentation is absolutely crucial for manufacturers to accurately identify specific market niches, strategically tailor their product development initiatives, and devise highly targeted marketing and sales strategies. Each distinct segment exhibits unique growth drivers, competitive dynamics, and technological demands, necessitating continuous innovation aimed at addressing the specific challenges and performance requirements inherent to that category. This analytical approach empowers both flux paste manufacturers and various stakeholders across the electronics supply chain to pinpoint areas of significant growth potential, anticipate future trends, and proactively adapt to evolving technological advancements and regulatory shifts across the global electronics manufacturing ecosystem, ensuring market relevance and competitiveness.

Segmentation by type delves deeply into the chemical backbone and functional properties of the flux paste, differentiating primarily between rosin-based, water-soluble, no-clean, and halogen-free formulations. Rosin-based fluxes, traditionally derived from natural pine resin, are renowned for their excellent wetting properties and robust protective barrier during soldering, though they typically necessitate post-soldering cleaning due to residues. Water-soluble fluxes, conversely, offer the distinct advantage of easy cleanup using deionized water, making them an environmentally appealing option for certain applications, but they sometimes pose compatibility challenges with highly sensitive components due to their aggressive nature. The no-clean segment, which leaves minimal, non-corrosive, and electrically safe residues that do not require removal, has witnessed significant and sustained growth due to its ability to streamline manufacturing processes, drastically reduce costs associated with cleaning equipment and solvents, and minimize overall environmental impact. Halogen-free flux pastes represent another critical sub-segment, driven by environmental mandates and concerns over halogenated compounds during component recycling and potential long-term reliability issues. Further sub-segmentation within these types can involve variations in activator chemistry (e.g., mild, moderate, activated), rheology (e.g., viscosity for printing vs. dispensing), and thermal stability, catering to an expansive array of demanding soldering processes and component sensitivities, from standard SMT assembly to highly demanding BGA rework and advanced power electronics.

Beyond the fundamental chemical type, the market is also critically segmented by application method and the diverse end-user industries that rely on these materials. Application segments include surface mount technology (SMT) for assembling miniaturized chip components, through-hole technology (THT) for larger, leaded components, specialized rework and repair applications for post-assembly modifications, and traditional hand soldering for prototyping or low-volume tasks. Each application method demands specific rheological properties, activity levels, and residue characteristics from the flux paste to ensure optimal performance, prevent defects, and maximize process efficiency. The end-user industry segmentation is particularly vital for strategic market analysis, encompassing broad and influential categories such as consumer electronics (smartphones, tablets, laptops, wearables), automotive electronics (engine control units, infotainment systems, ADAS modules, EV battery management), telecommunications (network infrastructure, 5G modules, data centers), highly regulated medical devices (diagnostic equipment, implants, surgical tools), industrial electronics (automation controls, power supplies, robotics), and the critically demanding aerospace & defense sectors (avionics, radar systems, satellite components). The stringent quality and reliability demands of sectors like automotive, medical, and aerospace drive continuous innovation for highly specialized, robust, and long-lasting flux pastes, while the high-volume, cost-sensitive nature of consumer electronics fuels demand for economically efficient and high-throughput solutions. This multifaceted segmentation clearly highlights the market's adaptability, responsiveness, and continuous evolution to meet the diverse and ever-increasing technical needs of global industrial demands.

- By Type:

- Rosin-Based Flux Pastes (RMA, RA)

- Water-Soluble Flux Pastes (OA, WS)

- No-Clean Flux Pastes (NC)

- Low-Residue Flux Pastes

- Halogen-Free Flux Pastes

- Lead-Free Compatible Flux Pastes

- Low-VOC Flux Pastes

- By Application:

- Surface Mount Technology (SMT) Paste Printing

- Through-Hole Technology (THT) Assembly

- Rework and Repair Operations

- Hand Soldering Applications

- BGA (Ball Grid Array) and CSP (Chip Scale Package) Assembly

- Flip-Chip Packaging

- Wave Soldering Processes

- Reflow Soldering Processes

- Pin Transfer/Dipping

- By End-User Industry:

- Consumer Electronics (Smartphones, PCs, Laptops, Wearables, Home Appliances)

- Automotive Electronics (ECUs, ADAS, Infotainment, EV Power Management)

- Telecommunications (5G Infrastructure, Network Equipment, Servers)

- Medical Devices (Diagnostic Equipment, Implants, Monitoring Systems)

- Industrial Electronics (Automation & Control, Robotics, Power Supplies)

- Aerospace and Defense (Avionics, Radar, Satellite Systems)

- LED Lighting and Displays

- Power Electronics (Inverters, Converters)

- Computing and Data Storage

Value Chain Analysis For Soldering Flux Paste Market

The value chain for the Soldering Flux Paste Market is an intricate and highly specialized network that strategically begins with the rigorous sourcing of specific raw materials and culminates in the precise application of the final product across diverse, high-stakes electronics manufacturing processes globally. Upstream activities in this chain involve a highly specialized supply base that provides critical chemical components, which include various types of resins (e.g., natural rosin, synthetic polymers), activators (e.g., organic acids, amine hydrohalides, mild halides), solvents (e.g., alcohols, glycol ethers, esters), and essential rheology modifiers (e.g., thixotropic agents, gelling agents). The unwavering quality, consistent availability, and robust performance of these raw materials are absolutely paramount, as they directly and fundamentally influence the functional properties, long-term reliability, and environmental compliance profile of the finished flux paste. Manufacturers of soldering flux paste often engage in deep, collaborative partnerships with these specialized chemical suppliers to ensure not only consistent material quality but also to jointly develop new, innovative formulations that meet increasingly stringent regulatory and technical specifications. These upstream suppliers are thus critical enablers for innovation, particularly in the ongoing efforts to meet global lead-free and halogen-free standards, requiring a high degree of technical expertise, intellectual property, and extremely strict quality control throughout their operations.

Midstream in the value chain, the manufacturing process transforms these raw materials into various sophisticated flux paste formulations through precision blending, meticulous mixing, and specialized packaging. This complex stage demands advanced chemical engineering capabilities, state-of-the-art production facilities, rigorous quality assurance protocols, and strict adherence to international manufacturing standards such as ISO certifications. Flux paste manufacturers invest substantially in comprehensive research and development (R&D) programs to meticulously optimize formulations for highly specific applications, such as ultra-fine-pitch component assembly, high-temperature lead-free processes, or environmentally sensitive requirements like ultra-low VOC emissions. Once produced, these highly engineered flux pastes are then strategically distributed to end-users through a combination of direct and indirect channels. Direct sales channels typically cater to large-volume customers, which include major global Electronics Manufacturing Service (EMS) providers or prominent Original Equipment Manufacturers (OEMs) who often require extensive technical support, customized product solutions, and direct lines of communication for specific engineering challenges. This direct approach not only fosters stronger, long-term relationships but also allows for highly tailored product offerings, immediate feedback loops crucial for continuous product improvement, and rapid resolution of specific client technical challenges.

Downstream activities encompass the broad distribution and ultimate utilization of soldering flux pastes by a vast and varied array of end-users. Indirect channels leverage extensive networks of specialized industrial distributors, authorized agents, and regional resellers who efficiently serve smaller to medium-sized manufacturers, numerous contract assemblers, and highly specialized repair and rework facilities that may require a broader range of readily available products or localized logistical and technical support. These distributors often provide invaluable value-added services such as efficient inventory management, expert technical consulting, robust supply chain integration, and regional logistics solutions, ensuring timely and cost-effective delivery. The ultimate consumption and application of flux paste occur within diverse electronics assembly plants, where the material is applied using highly automated dispensing equipment, advanced screen printing systems, or precise manual methods. The consistent and optimal performance of the chosen flux paste directly and critically impacts the overall quality, long-term reliability, and manufacturing efficiency of the final electronic product, making its selection an absolutely vital strategic decision for electronics manufacturers globally. Post-sale support, including comprehensive technical assistance, expert troubleshooting, detailed compliance documentation, and ongoing training, is also an indispensable component of the value chain, fundamentally ensuring sustained customer satisfaction, fostering repeat business, and solidifying long-term market presence and brand loyalty.

Soldering Flux Paste Market Potential Customers

The potential customer base for the Soldering Flux Paste Market is exceptionally broad and incredibly diverse, meticulously reflecting the ubiquitous and indispensable nature of electronics across virtually every industrial sector and consumer segment globally. At its core, the primary purchasers are sophisticated entities deeply involved in the intricate assembly, precision manufacturing, and critical repair of electronic components and highly complex devices. This extensive group predominantly includes major global Electronics Manufacturing Service (EMS) providers, which are third-party companies specializing in the comprehensive design, high-volume manufacturing, rigorous testing, and efficient distribution of electronic components and complete assemblies for numerous Original Equipment Manufacturers (OEMs). These large-scale, high-throughput operators require vast quantities and a wide variety of specialized flux pastes meticulously tailored for their high-volume, automated production lines and extremely diverse product portfolios, making them cornerstone clients and indispensable partners within the global flux paste market. Their operational scale and diverse product requirements drive significant demand for both standard and custom-formulated solutions.

Original Equipment Manufacturers (OEMs) represent another profoundly significant customer segment, particularly those that maintain robust in-house electronics assembly and manufacturing capabilities. Prominent companies producing cutting-edge consumer electronics (e.g., smartphones, laptops, smart home devices), advanced automotive components (e.g., engine control units, sophisticated infotainment systems, ADAS modules), critical telecommunications equipment (e.g., 5G base stations, network routers), life-saving medical devices (e.g., diagnostic imaging systems, implantable devices), and complex industrial control systems frequently procure soldering flux pastes either directly from manufacturers or through their highly integrated supply chain partners. These OEMs often possess exceptionally specific and stringent requirements for flux performance, which are inherently driven by their unique product designs, uncompromising reliability standards, and highly optimized manufacturing processes, leading to a consistent demand for custom-formulated or extremely high-performance specialty fluxes. Their purchasing decisions are heavily influenced by a multitude of factors such as strict compliance with international industry standards (e.g., IPC, JEDEC), critical regulatory mandates (e.g., automotive AEC-Q guidelines, medical ISO standards), and the absolute imperative for consistent, repeatable, and defect-free results in mission-critical applications where failure is not an option.

Beyond these colossal-scale manufacturers, a substantial and continuously growing segment of potential customers includes smaller, highly specialized contract manufacturers, niche repair and rework facilities, innovative prototyping firms, and even individual electronics hobbyists or educational institutions. These diverse customers often procure flux pastes through sophisticated indirect distribution channels, such as specialized industrial supply houses, major electronics distributors, or user-friendly online retailers, seeking accessible, reliable products suitable for lower-volume production runs, highly specialized rework tasks, or educational purposes. The dynamic growth in niche markets, such such as custom Internet of Things (IoT) device development, bespoke industrial control systems for specialized machinery, advanced aerospace prototyping, and emerging wearable technologies, further expands and diversifies this customer base, driving a steady demand for versatile, high-quality flux pastes that can accommodate an incredibly wide range of soldering applications, component types, and substrate materials. The fundamental need for high-performance soldering flux paste extends across the entire lifecycle of an electronic product, from its initial intricate assembly and manufacturing to its eventual critical repair, maintenance, and refurbishment, underscoring its enduring market relevance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 780 Million |

| Market Forecast in 2033 | USD 1050 Million |

| Growth Rate | CAGR 4.3% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kester (ITW EAE), Alpha Assembly Solutions (MacDermid Enthone Industrial), Indium Corporation, Henkel AG & Co. KGaA, Tamura Corporation, AIM Solder, Qualitek International, Heraeus Electronics, Inventec Performance Chemicals, Shenmao Technology Inc., Nihon Superior Co. Ltd., ENEOS Corporation, SMTmax, Fusion Inc., Cobar (Balver Zinn Josef Jost GmbH & Co. KG), Yashida Co. Ltd., Felder GMBH, Multicore (Element Solutions Inc.), Loctite (Henkel), Johnson Matthey. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soldering Flux Paste Market Key Technology Landscape

The Soldering Flux Paste Market is characterized by an exceptionally dynamic and continuously evolving technology landscape, fundamentally driven by the relentless pace of innovation in electronics manufacturing processes and an increasingly stringent set of global performance and environmental demands. A primary and enduring technological focus revolves around the rigorous development of lead-free compatible flux pastes, which became an absolute necessity with the worldwide implementation of critical regulations such as RoHS (Restriction of Hazardous Substances). This monumental shift necessitated the creation of entirely new chemical formulations capable of providing highly effective wetting and superior oxide removal at significantly higher lead-free soldering temperatures, often requiring enhanced thermal stability, reduced susceptibility to thermal degradation, and robust compatibility with new lead-free alloy compositions. Beyond the lead-free imperative, the profound emphasis on halogen-free formulations has gained significant and accelerating traction, diligently addressing escalating concerns about potential corrosive residues, long-term reliability issues, and environmental impact during product recycling and disposal, thereby pushing manufacturers to develop innovative alternative activator chemistries that consistently deliver comparable or even superior performance without the inclusion of halogens. This ongoing quest for environmentally benign yet high-performing materials underpins much of the current R&D effort in the industry.

Another critical and rapidly advancing area of technological innovation is the diligent creation of ultra-low-residue and entirely no-clean flux pastes. These cutting-edge innovations are meticulously designed to minimize or completely eliminate the need for laborious and costly post-soldering cleaning steps, thereby drastically reducing manufacturing throughput times, lowering associated operational costs (e.g., for cleaning chemicals, equipment, and wastewater treatment), and significantly diminishing the overall environmental footprint of electronics assembly. Achieving this demanding goal requires extraordinarily precise formulation to ensure that any remaining residues are electrically benign, optically clear for automated inspection, non-corrosive, and do not in any way interfere with subsequent crucial processes such as conformal coating, wire bonding, or encapsulations. Furthermore, the pervasive trend of miniaturization in modern electronics, including the widespread proliferation of ultra-fine-pitch components and advanced packaging technologies such as BGA (Ball Grid Array), CSP (Chip Scale Package), and flip-chip, has vigorously driven the development of specialized flux pastes with meticulously optimized rheology and exceptional printability characteristics. These advanced pastes must maintain unparalleled structural integrity during high-speed stencil printing or precise dispensing, meticulously prevent slumping or bridging, and ensure incredibly accurate deposition for minuscule solder pads, often requiring unique polymer binders, thixotropic agents, and sophisticated particle size control of the solid constituents.

The sophisticated technology landscape also profoundly encompasses advanced analytical and rigorous quality control techniques indispensably employed throughout flux paste development and high-volume manufacturing. This includes highly sensitive advanced spectroscopic methods (e.g., FTIR, Raman), comprehensive thermal analysis (e.g., TGA for decomposition, DSC for phase transitions), and precise rheological measurements (e.g., viscometry, thixotropy index) to exhaustively characterize material properties, predict real-world performance under various stress conditions, and ensure batch-to-batch consistency. Moreover, continuous innovations in dispensing and printing technologies, such as advanced jetting systems and optimized stencil printing designs, directly and significantly influence flux paste formulation, as pastes must be meticulously designed for seamless compatibility with these high-precision application methods. For example, fluxes specifically intended for jetting must possess highly specific viscosity, surface tension, and atomization properties to ensure consistent droplet formation and precise placement, avoiding satellite formation. Furthermore, the increasing integration of smart manufacturing principles, Industry 4.0 initiatives, and advanced data analytics, sometimes strategically leveraging Artificial Intelligence (AI) and Machine Learning (ML), allows for real-time process optimization, predictive quality control, and adaptive manufacturing, further refining the performance, consistency, and reliability of soldering flux pastes in increasingly complex and demanding assembly environments. This holistic and multi-disciplinary approach, spanning from fundamental material science to sophisticated application engineering, unequivocally defines the cutting edge of soldering flux paste technology, ensuring its continued relevance and innovation.

Regional Highlights

The global Soldering Flux Paste Market exhibits distinct and highly influential regional dynamics, which are largely and intrinsically tied to the geographical distribution of the world's electronics manufacturing capabilities, technological innovation hubs, and prevailing consumption patterns. Asia Pacific (APAC) stands as the undeniable powerhouse and unequivocally dominates the global market, primarily due to the region's colossal and rapidly expanding footprint in global electronics production. Countries such as China, South Korea, Taiwan, and Japan serve as critical global epicenters for advanced semiconductor manufacturing, high-volume consumer electronics assembly, and sophisticated telecommunications equipment production, collectively necessitating immense volumes and diverse types of high-performance soldering flux paste. Additionally, emerging manufacturing economies like India and Southeast Asian nations such as Vietnam, Malaysia, and Thailand are rapidly establishing themselves as significant and growing manufacturing bases, further solidifying APAC's unparalleled leadership in the market. The region benefits immensely from robust industrial infrastructure, a vast and highly skilled workforce, and proactive government initiatives that aggressively support and incentivize the electronics industries, collectively driving both surging demand and continuous innovation for cutting-edge flux paste solutions tailored for high-speed, high-density assembly processes.

North America and Europe represent highly mature markets for soldering flux paste, characterized by a strong and unwavering emphasis on high-reliability applications, pioneering research and development (R&D), and exceptionally stringent regulatory compliance frameworks. In North America, the demand for soldering flux paste is predominantly driven by critical sectors such as aerospace and defense, advanced medical devices, and high-performance computing, where product reliability, extreme durability, and long-term functional integrity are absolutely paramount. European countries, most notably Germany, France, and the UK, contribute significantly to the market through their highly specialized automotive electronics, advanced industrial automation, and niche telecommunications sectors. These regions frequently lead in the early adoption of advanced, environmentally friendly flux formulations, such as halogen-free, ultra-low VOC (Volatile Organic Compound), and water-soluble products, primarily due to their proactive environmental protection regulations (e.g., REACH, RoHS) and deeply embedded corporate sustainability mandates. While the overall market volume in these regions might be comparatively lower than in APAC, the average selling price and the demand for premium, highly specialized, and custom-formulated fluxes are notably higher, reflecting a focus on value over sheer volume and specialized, high-margin applications.

Latin America, the Middle East, and Africa (MEA) collectively constitute emerging but increasingly promising markets for soldering flux paste, experiencing gradual yet significant growth primarily driven by expanding industrialization, increasing penetration of consumer electronics, and developing telecommunications infrastructure across these regions. Countries like Mexico and Brazil in Latin America boast growing automotive and electronics assembly industries, leading to a steady increase in demand for both standard and specialized flux pastes. In the MEA region, substantial investments in infrastructure development, ambitious digital transformation initiatives, and the nascent growth of local manufacturing capabilities are collectively creating new but promising opportunities for market expansion. While these regions currently represent a smaller share of the global soldering flux paste market, they are projected to demonstrate higher compounded annual growth rates as their manufacturing bases mature, technological adoption accelerates, and domestic demand for a wider array of electronic products steadily rises. Establishing robust localized distribution networks, providing comprehensive technical support, and meticulously adapting product offerings to specific local economic conditions and diverse regulatory frameworks are absolutely crucial for successful market penetration and sustained growth in these dynamic and evolving regions, highlighting the need for tailored market entry strategies.

- Asia Pacific (APAC): Dominant and fastest-growing market due to its extensive electronics manufacturing ecosystem (China, Japan, South Korea, Taiwan, India, Southeast Asia); immense demand from consumer electronics, telecommunications (5G), automotive, and industrial sectors; focus on high-volume production, cost efficiency, and continuous process optimization.

- North America: Significant market share, driven by high-reliability applications in aerospace, defense, medical devices, and advanced computing; strong emphasis on R&D for cutting-edge materials; stringent environmental regulations promoting advanced, compliant flux formulations.

- Europe: Key market influenced by automotive electronics, industrial automation, and specialized telecommunications; strict adherence to environmental standards (e.g., REACH, RoHS, WEEE); strong focus on innovation in lead-free, halogen-free, and high-performance flux technologies for critical applications.

- Latin America: Emerging market with increasing industrialization and growth in electronics assembly, particularly in automotive (e.g., Mexico, Brazil) and consumer electronics; rising domestic demand and foreign investment contribute to market expansion; potential for strong future growth.

- Middle East & Africa (MEA): Developing market experiencing growth from infrastructure projects, digital transformation, and nascent electronics manufacturing; opportunities in telecommunications, industrial applications, and consumer electronics; market penetration requires localized strategies and technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soldering Flux Paste Market.- Kester (ITW EAE)

- Alpha Assembly Solutions (MacDermid Enthone Industrial)

- Indium Corporation

- Henkel AG & Co. KGaA

- Tamura Corporation

- AIM Solder

- Qualitek International

- Heraeus Electronics

- Inventec Performance Chemicals

- Shenmao Technology Inc.

- Nihon Superior Co. Ltd.

- ENEOS Corporation

- SMTmax

- Fusion Inc.

- Cobar (Balver Zinn Josef Jost GmbH & Co. KG)

- Yashida Co. Ltd.

- Felder GMBH

- Multicore (Element Solutions Inc.)

- Loctite (Henkel)

- Johnson Matthey

Frequently Asked Questions

Analyze common user questions about the Soldering Flux Paste market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is soldering flux paste and why is it important in electronics manufacturing?

Soldering flux paste is a viscous material used in electronics assembly to clean metal surfaces by removing oxides and impurities, facilitating the wetting of solder to form strong, reliable electrical connections. It prevents re-oxidation during the soldering process, ensuring high-quality solder joints essential for the performance and longevity of electronic devices.

What are the main types of soldering flux pastes available in the market?

The primary types include rosin-based (requiring cleaning), water-soluble (easy to clean with water), and no-clean flux pastes (leaving minimal, electrically safe residues). Each type is chosen based on specific application requirements, environmental regulations, and desired post-soldering processes.

How do environmental regulations impact the soldering flux paste market?

Environmental regulations like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) significantly impact the market by driving demand for lead-free, halogen-free, and low-VOC (Volatile Organic Compound) flux formulations. Manufacturers continuously innovate to meet these stricter compliance standards, ensuring safer products and reduced environmental footprints.

What are the key drivers for growth in the soldering flux paste market?

Key growth drivers include the continuous miniaturization of electronic components, the rapid expansion of the Internet of Things (IoT) and 5G technologies, increasing demand for advanced automotive electronics, and the rising complexity of electronic devices that require precise and reliable solder joints for optimal performance.

What role does technology play in the development of new soldering flux pastes?

Technology plays a crucial role, driving innovation in areas like lead-free and halogen-free chemistries, low-residue formulations, and optimized rheology for advanced dispensing and printing methods. Advanced analytical techniques and compatibility with AI-driven manufacturing processes are also key in developing high-performance, specialized flux pastes for modern electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager