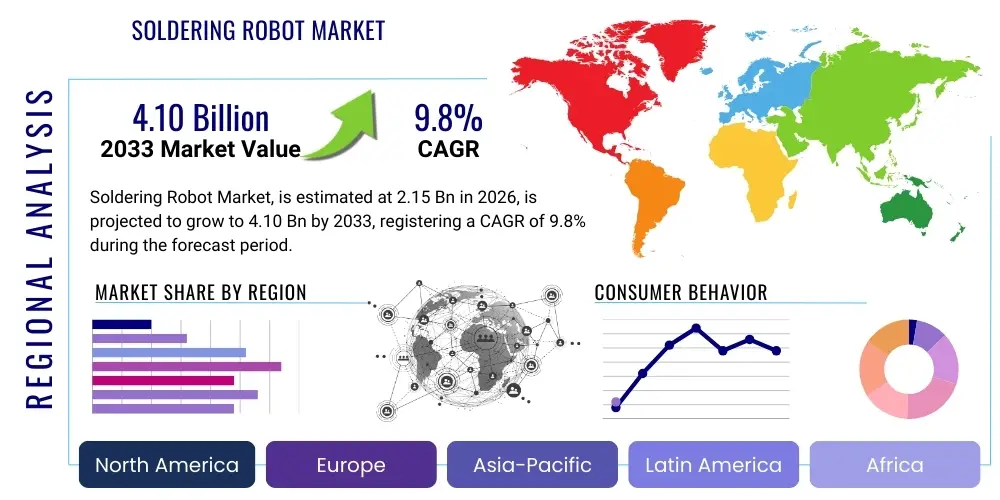

Soldering Robot Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442285 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Soldering Robot Market Size

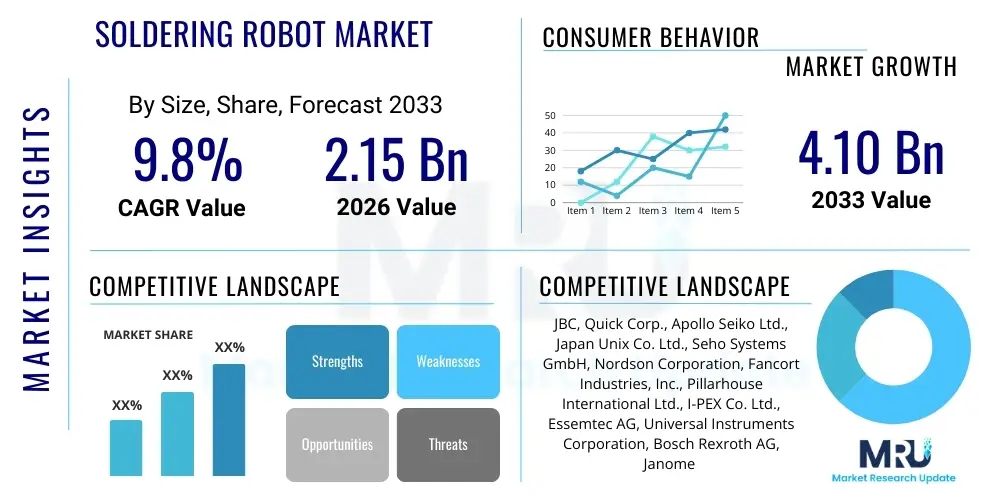

The Soldering Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 4.10 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-precision, automated manufacturing processes across core industrial sectors, particularly in advanced electronics assembly and automotive component production. The continuous push toward miniaturization of electronic components necessitates soldering solutions that offer repeatability and accuracy far beyond human capability, positioning robotic systems as indispensable assets in modern production lines globally.

Market expansion is further supported by the increasing global emphasis on Industry 4.0 paradigms, which prioritize interconnected manufacturing ecosystems and real-time data integration. Soldering robots, equipped with advanced vision systems and integrated quality control sensors, align perfectly with these smart factory initiatives, providing superior throughput and drastically reducing defect rates associated with manual or semi-automated processes. Emerging economies, particularly in the Asia Pacific region, are rapidly adopting these technologies to scale up their production capacities while adhering to stringent international quality standards, thereby contributing significantly to the overall market valuation throughout the forecast period.

Soldering Robot Market introduction

The Soldering Robot Market encompasses specialized automated systems designed to execute highly precise soldering tasks used primarily in electronic assembly, replacing manual soldering irons or bulky traditional automation setups. These robots utilize advanced mechanical arms, sophisticated heating elements (such as laser, selective, or hot bar), and integrated software control systems to achieve consistent, high-quality solder joints essential for the reliability and longevity of electronic products. The core product description involves articulated robotic arms or Cartesian systems customized for precise material handling and heat application, capable of processing fine-pitch components and complex circuit board layouts.

Major applications of soldering robots span high-volume manufacturing environments, including consumer electronics (smartphones, tablets), automotive electronics (ECUs, sensors), medical devices (diagnostic equipment, implantables), and aerospace systems, where reliability is non-negotiable. The primary benefits derived from the adoption of soldering robots include vastly improved solder joint consistency, increased production speed and throughput, reduction in material waste, and enhanced operator safety by removing personnel from high-heat and fume environments. These systems are crucial for maintaining strict quality compliance in critical applications, driving the shift from labor-intensive assembly to fully automated production lines globally.

The market is significantly driven by the rapid growth of the electronics sector, particularly the migration to complex printed circuit board (PCB) designs requiring micro-soldering capabilities. Additionally, the automotive industry's electrification trend, demanding robust and reliable soldering for battery packs and power modules, acts as a pivotal driving force. Continuous technological advancements, such as enhanced vision inspection, AI-powered process optimization, and improved flux management systems, further solidify the market's growth trajectory, ensuring robots can handle future component complexity and speed requirements effectively.

Soldering Robot Market Executive Summary

The Soldering Robot Market is experiencing dynamic shifts, characterized by strong business trends centered on automation adoption, robust regional growth fueled primarily by Asia Pacific's manufacturing dominance, and distinct segmentation trends favoring high-accuracy laser and selective soldering technologies. Business trends indicate a strong enterprise focus on integrating robotics with broader Industrial Internet of Things (IIoT) frameworks, moving beyond simple task automation to comprehensive, data-driven manufacturing processes. This includes adopting modular robot designs and flexible production cells that can be rapidly reconfigured to meet changing component sizes and product cycles, ensuring capital investment longevity and adaptability for manufacturers.

Regionally, the market is profoundly influenced by Asia Pacific (APAC), which serves as the global epicenter for electronics manufacturing. Countries like China, Japan, South Korea, and increasingly Vietnam and India, are major consumers of soldering robots, driven by vast export requirements and the need to maintain competitive cost structures coupled with high quality. North America and Europe, while possessing mature markets, demonstrate growth through high-value, specialized applications such as aerospace and medical device production, prioritizing stringent quality control and complex small-batch runs. These developed markets are also leading the adoption of the most advanced, AI-integrated systems for predictive maintenance and quality assurance.

Segmentation trends highlight the increasing demand for laser soldering robots due to their unparalleled precision and minimal thermal impact on sensitive components, making them ideal for miniaturized electronics. However, selective soldering robots maintain dominance in high-throughput PCB assembly requiring through-hole component soldering. The End-Use industry trend sees the Automotive sector emerging as the fastest-growing segment, propelled by electric vehicle (EV) manufacturing needs and the proliferation of advanced driver-assistance systems (ADAS) that rely on flawlessly soldered electronic control units (ECUs). These converging trends underscore a market maturation where technology sophistication and application-specific tailoring define competitive advantage.

AI Impact Analysis on Soldering Robot Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Soldering Robot Market reveals several key themes focused primarily on process optimization, quality control, and adaptability. Users frequently inquire about how AI can achieve zero-defect production, automate complex programming for diverse product mixes, and enable real-time compensation for thermal variations or component placement inaccuracies. A significant concern revolves around the practical integration of AI algorithms into existing robotic infrastructure and the necessity for specialized personnel to manage these smart systems. Users anticipate AI to move soldering robots beyond fixed programming into predictive maintenance and autonomous decision-making capacities, thereby drastically improving throughput and reducing dependence on expert manual oversight for quality inspection.

The implementation of AI algorithms, particularly deep learning and machine vision, is fundamentally reshaping the capabilities of soldering robots, transforming them from mere automated tools into intelligent manufacturing assets. AI enables enhanced visual inspection systems to identify subtle solder defects, such as insufficient wetting or bridging, with accuracy superior to traditional rule-based systems. Furthermore, AI optimizes soldering parameters (heat profile, travel speed, flux volume) dynamically based on real-time feedback regarding component variation or environmental factors, ensuring optimal joint quality across large production batches and varied materials. This predictive process control minimizes trial-and-error setup times and facilitates instantaneous adjustments necessary for maintaining highly regulated standards, which is crucial in industries like medical technology and aerospace.

Beyond quality assurance, AI facilitates operational efficiency and flexibility. Machine learning models are utilized for predictive maintenance, analyzing robot operational data (motor load, temperature, cycle times) to foresee potential component failures before they cause costly downtime, maximizing overall equipment effectiveness (OEE). Moreover, AI-driven path planning and programming significantly reduce the time required to set up new production runs, allowing manufacturers to quickly pivot between different product assemblies (high-mix, low-volume environments). This adaptability, driven by generative AI modeling of optimal soldering paths, directly addresses the market demand for flexible, scalable, and highly efficient assembly solutions, ensuring the robot can intelligently respond to unplanned variations in the production environment.

- AI enables real-time, dynamic optimization of soldering parameters (temperature, dwell time, flux).

- Deep learning vision systems achieve superior, high-speed defect detection and classification (zero-defect manufacturing).

- Predictive maintenance driven by AI models reduces unplanned downtime and maximizes robot longevity.

- AI automates complex path generation and programming for high-mix, low-volume production environments.

- Integration of machine learning facilitates autonomous calibration and thermal compensation for increased joint consistency.

- Generative algorithms aid in designing optimal soldering nozzle configurations and flow patterns.

DRO & Impact Forces Of Soldering Robot Market

The Soldering Robot Market dynamics are dictated by a confluence of accelerating drivers (D), persistent restraints (R), compelling opportunities (O), and potent impact forces, all shaping strategic investments and technological adoption. The primary driver is the pervasive demand for high-reliability electronics across consumer, medical, and defense sectors, coupled with the miniaturization trend in PCBs which mandates robotic precision beyond human capabilities. This is intrinsically linked to the critical impact force of global quality standards and regulatory compliance, particularly in sensitive applications where solder joint failure is catastrophic. Restraints, conversely, center on the substantial initial capital investment required for high-end robotic systems and the complex specialized skills needed for programming, integration, and maintenance, often hindering adoption by small and medium enterprises (SMEs). Simultaneously, the ongoing global skilled labor shortage provides an internal pressure point, pushing manufacturers towards automation despite initial cost concerns.

Opportunities are vast, primarily revolving around the rapid expansion of the Electric Vehicle (EV) market, which requires high-power, flawlessly soldered components for battery management systems and power electronics, offering a new, high-volume growth avenue. Further opportunity lies in developing more user-friendly, collaborative soldering robots (cobots) that lower the technical barrier to entry and integrate more seamlessly into existing production lines without extensive safety infrastructure overhaul. The shift towards sustainable manufacturing is also an impact force, driving demand for laser soldering systems that are energy-efficient and minimize material usage, aligning operational excellence with environmental responsibility. The convergence of these factors mandates strategic planning for vendors, requiring them to focus on lower TCO (Total Cost of Ownership) and accessible programming interfaces to unlock wider market penetration.

The overall impact forces are dominated by technological acceleration and competitive pressure. The relentless pace of innovation in component technology and surface mount device (SMD) packaging constantly challenges the robot manufacturers to upgrade precision, speed, and thermal control capabilities. Furthermore, intense competition among leading automation vendors drives price performance optimization and rapid feature development, such as improved vision integration and simplified user interfaces. This creates a highly responsive market where only vendors providing comprehensive service, rapid integration support, and future-proof robotic platforms can sustain market leadership, effectively making technological parity a baseline requirement rather than a competitive edge. The ultimate impact force remains the sustained global shift toward automated, data-driven manufacturing excellence embodied by Industry 4.0 standards.

Segmentation Analysis

The Soldering Robot Market is highly segmented based on the type of soldering technology employed, the end-use application, and the configuration of the robotic system, reflecting diverse industrial requirements for precision, throughput, and thermal management. Segmentation provides critical insights into market maturity and growth potential, highlighting which technological approaches are gaining traction in specific sectors, such as the preference for laser soldering in high-density electronics versus selective soldering for traditional through-hole applications. Understanding these segments is crucial for manufacturers to tailor their product offerings and strategic investments, ensuring alignment with the specific technical demands of leading industry verticals like automotive and consumer electronics.

The market structure is characterized by distinct needs regarding scale and complexity. While the electronics manufacturing sector remains the largest consumer, driving demand for both surface mount and through-hole applications, the fastest growth is observed in specialized segments requiring extreme reliability, such as medical implant assembly and aerospace avionics. This specialized demand pulls the market toward advanced, high-precision robotic systems capable of handling extremely small components (01005 chips) and intricate geometries. Regional market dynamics further influence segmentation, with APAC exhibiting high-volume demand for general-purpose selective soldering, while North America and Europe show increasing preference for specialized laser and hot bar soldering robots for complex, high-value component bonding.

- By Type:

- Selective Soldering Robot

- Laser Soldering Robot

- Hot Bar Soldering Robot

- Micro Soldering Robot (General Purpose)

- By End-Use Industry:

- Electronics Manufacturing (Consumer Electronics, Industrial Electronics, Communication Equipment)

- Automotive (ECUs, Power Modules, Battery Management Systems)

- Aerospace and Defense

- Medical Devices and Healthcare Equipment

- Industrial Automation and Machinery

- By Application:

- Surface Mount Technology (SMT) Assembly

- Through-Hole Technology (THT) Assembly

- Cable and Connector Soldering

- Odd-Shaped Component Soldering

- By Robot Configuration:

- Cartesian (X-Y-Z) Robots

- Articulated Robots

- SCARA Robots

Value Chain Analysis For Soldering Robot Market

The Soldering Robot market value chain begins with upstream activities involving core component suppliers, including manufacturers of high-precision motors, sophisticated sensors, integrated vision systems (cameras and lighting), robotic structural components (actuators, frames), and specialized soldering technology components (laser sources, heating tips, flux systems). The procurement and integration of these complex components are critical, as the robot's overall performance, particularly repeatability and speed, is directly dependent on the quality and synchronization of its upstream inputs. Key relationships at this stage involve partnerships between robot assemblers and specialized technology firms ensuring access to the latest motor and vision advancements, which are crucial for maintaining competitive performance metrics in the final product.

Midstream activities involve the design, assembly, software development (including motion control and proprietary programming interfaces), and integration testing conducted by the primary soldering robot manufacturers. This is the stage where intellectual property related to thermal management, solder joint quality assurance algorithms, and user flexibility is created. Distribution channels, both direct and indirect, then carry the products to the end-users. Direct channels often involve the sale of highly customized, complex, integrated production cells directly to large Tier 1 electronics manufacturers or automotive giants, requiring extensive post-sales support and technical consultation for installation and ramp-up. Indirect channels, utilizing specialized industrial distributors and system integrators, cater typically to SMEs and geographical regions where direct presence is less feasible, focusing on standardized or modular solutions.

Downstream activities center heavily on installation, calibration, post-sales services, maintenance contracts, and the supply of consumables such as specialized solder wire, flux, and replacement tips or laser optics. System integrators play a vital role in the downstream segment, customizing the robot cell environment to fit the specific PCB handling, conveyor systems, and data logging requirements of the customer’s factory floor. The continuous need for technical upgrades and software support ensures a long-tail revenue stream for robot manufacturers, emphasizing the importance of robust service networks. The effectiveness of the downstream ecosystem determines customer satisfaction and repeat business, particularly regarding minimizing downtime and ensuring the robot consistently meets stringent production output and quality metrics.

Soldering Robot Market Potential Customers

Potential customers for soldering robots are predominantly found across high-volume and high-reliability manufacturing sectors that require automated precision assembly of electronic components. The primary end-users are large-scale Electronics Manufacturing Service (EMS) providers and Original Equipment Manufacturers (OEMs) specializing in consumer devices, who continuously seek to optimize throughput, reduce labor costs, and achieve impeccable solder joint quality for millions of units annually. These customers utilize soldering robots across their global facilities to ensure standardized, high-quality production outputs, leveraging the robots' ability to handle complex components and fine-pitch soldering required for modern smart devices.

Beyond consumer electronics, the Automotive industry represents a rapidly expanding customer base, particularly manufacturers involved in electric vehicle (EV) battery systems, advanced driver-assistance systems (ADAS), and complex engine control units (ECUs). The necessity for extreme robustness and reliability in automotive electronics, often operating in harsh thermal or vibrational environments, makes robotic soldering essential for adhering to strict automotive quality standards (e.g., IATF 16949). The long-term performance and safety implications of component failure mandate the use of automated, verifiable soldering processes that only robotic systems can consistently deliver.

Other crucial segments include the Medical Device manufacturing sector, which requires micron-level accuracy and validated processes for implantable devices, diagnostic equipment, and surgical instruments, and the Aerospace and Defense industry, where zero-defect manufacturing is mandatory for mission-critical avionics and communication systems. These industries prioritize compliance, traceability, and the ability to handle exotic materials and complex, custom-designed PCBs, making them prime candidates for advanced, high-capital laser and selective soldering robot installations. The expanding industrial automation market, covering machinery and control systems, also forms a steady customer base seeking reliable, long-life electronic assemblies for factory equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.10 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JBC, Quick Corp., Apollo Seiko Ltd., Japan Unix Co. Ltd., Seho Systems GmbH, Nordson Corporation, Fancort Industries, Inc., Pillarhouse International Ltd., I-PEX Co. Ltd., Essemtec AG, Universal Instruments Corporation, Bosch Rexroth AG, Janome Industrial Equipment, Mitsubishi Electric Corporation, Hanwha Precision Machinery, YAMAHA Motor Co. Ltd., KUKA AG, FANUC Corporation, ABB Ltd., Seiko Epson Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Soldering Robot Market Key Technology Landscape

The technological landscape of the Soldering Robot Market is characterized by a strong focus on enhancing precision, thermal control, and system flexibility, driving innovation particularly in laser and vision integration systems. Key advancements include the proliferation of high-power, short-pulse fiber lasers for soldering, which allow for localized heating with minimal thermal impact on adjacent sensitive components, crucial for high-density, double-sided PCBs. Furthermore, advanced motion control systems leveraging high-speed servo motors and proprietary vibration dampening techniques ensure sub-micron level repeatability in placement and soldering tip positioning, addressing the needs arising from the miniaturization of electronic components down to the 01005 package size and smaller. These precision enhancements are fundamental to realizing the market's requirements for zero-defect assembly in critical applications.

Another pivotal area of technological innovation is the integration of sophisticated 3D machine vision and AI-enabled inspection systems. These systems utilize high-resolution cameras and structured light projection to precisely map component placement, compensate for slight positional variances in real-time (fiducial recognition and auto-correction), and perform immediate post-solder inspection. AI algorithms analyze joint morphology, predicting potential failures based on visual data, significantly accelerating the quality assurance process beyond traditional human inspection or simple 2D imaging. Moreover, the development of modular and collaborative robot architectures (cobots) is gaining traction. These systems are designed for safer human-robot interaction and easier redeployment, reducing the complexity and space requirements often associated with traditional industrial robotic cells, making high-precision soldering accessible to a broader base of manufacturers, including SMEs.

Furthermore, significant technological resources are dedicated to improving the core consumables and delivery systems. Innovations in customized solder wire feeders, non-contact flux dispensing systems (e.g., jet dispensing), and advanced tip materials (for selective soldering) extend operational life and improve the consistency of material application. The focus on software continues to evolve toward platform independence and simplified programming interfaces utilizing graphical user interfaces (GUIs) and simulation tools. These technological advancements collectively aim to reduce the Total Cost of Ownership (TCO), increase operational uptime, and future-proof the soldering robotic systems against anticipated complexities in component assembly over the next decade, ensuring they remain central to advanced electronics manufacturing processes globally.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, dominating the global electronics manufacturing sector. This growth is fueled by massive production volumes across China, Japan, South Korea, and emerging hubs like Vietnam and India, necessitating rapid adoption of high-speed, reliable soldering automation to meet global export demands and domestic market growth in consumer electronics and electric vehicles. The region is characterized by high investment in selective and micro-soldering robots for high-throughput assembly lines.

- North America: North America is a mature market focusing on high-value, high-reliability applications, particularly in aerospace, defense, and advanced medical device manufacturing. Adoption here is driven less by volume and more by the need for regulatory compliance, traceability, and the use of the most sophisticated technologies, such as advanced laser soldering and AI-driven quality assurance systems, emphasizing complexity and precision over sheer speed.

- Europe: Similar to North America, Europe shows strong demand driven by the automotive (especially EV production standards) and industrial electronics sectors. Strict environmental regulations and the drive toward highly automated, sustainable Industry 4.0 factories push the adoption of energy-efficient laser soldering robots. Germany, France, and the UK are key markets focusing on both innovation and localized, flexible manufacturing capabilities.

- Latin America (LATAM): LATAM is an emerging market experiencing steady growth, primarily led by electronics assembly facilities and the establishment of automotive component manufacturing hubs (e.g., Mexico and Brazil). Market growth relies heavily on standardized, cost-effective robotic solutions, often facilitated by international systems integrators focusing on increasing production scalability and reducing reliance on manual labor.

- Middle East and Africa (MEA): The MEA region is currently the smallest market but shows potential, particularly in industrial automation projects, telecommunications infrastructure build-out, and localized defense electronics manufacturing. Growth is sporadic and highly dependent on government investment in industrialization and technology transfer initiatives, often preferring established international vendors for reliability and long-term support contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Soldering Robot Market.- Apollo Seiko Ltd.

- Japan Unix Co. Ltd.

- Nordson Corporation

- JBC Tools

- Pillarhouse International Ltd.

- Quick Corp.

- Seho Systems GmbH

- Fancort Industries, Inc.

- I-PEX Co. Ltd.

- Essemtec AG

- Universal Instruments Corporation

- Bosch Rexroth AG

- Janome Industrial Equipment

- Mitsubishi Electric Corporation

- Hanwha Precision Machinery

- YAMAHA Motor Co. Ltd.

- KUKA AG

- FANUC Corporation

- ABB Ltd.

- Seiko Epson Corporation

Frequently Asked Questions

Analyze common user questions about the Soldering Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Soldering Robot Market?

The Soldering Robot Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033, driven primarily by demand for automated high-precision electronics assembly in key industries globally.

Which technology segment is experiencing the fastest adoption in the Soldering Robot Market?

The Laser Soldering Robot segment is demonstrating the fastest adoption growth due to its superior precision, non-contact process, and minimal thermal stress, making it ideal for the highly complex, miniaturized components characteristic of modern electronic devices.

How is the Electric Vehicle (EV) sector influencing the demand for soldering robots?

The EV sector is a critical growth driver, demanding highly reliable and robust soldering for power electronics, battery management systems (BMS), and on-board chargers, increasing the necessity for automated selective and hot bar soldering systems capable of high-power connections.

What are the primary restraints affecting the wider adoption of soldering robot systems?

The primary restraints include the significant initial capital investment required for high-precision robotic cells and the operational complexity involved in programming, integrating, and maintaining these sophisticated systems, especially for smaller manufacturing operations.

What role does Artificial Intelligence (AI) play in the modern Soldering Robot Market?

AI is crucial for enabling advanced capabilities such as real-time, dynamic optimization of soldering parameters, superior defect detection through machine vision, and predictive maintenance, transitioning robots toward autonomous and zero-defect manufacturing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Soldering Robot Market Statistics 2025 Analysis By Application (Consumer Electronics, Appliances Electronics, Automotive Electronics), By Type (3-axis Robot, 4-axis Robot), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Soldering Robot Market Statistics 2025 Analysis By Application (Consumer Electronics, Appliances Electronics, Automotive Electronics), By Type (6-axis Robot, 5-axis Robot, 4-axis Robot, 3-axis Robot, 2-axis Robot), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager