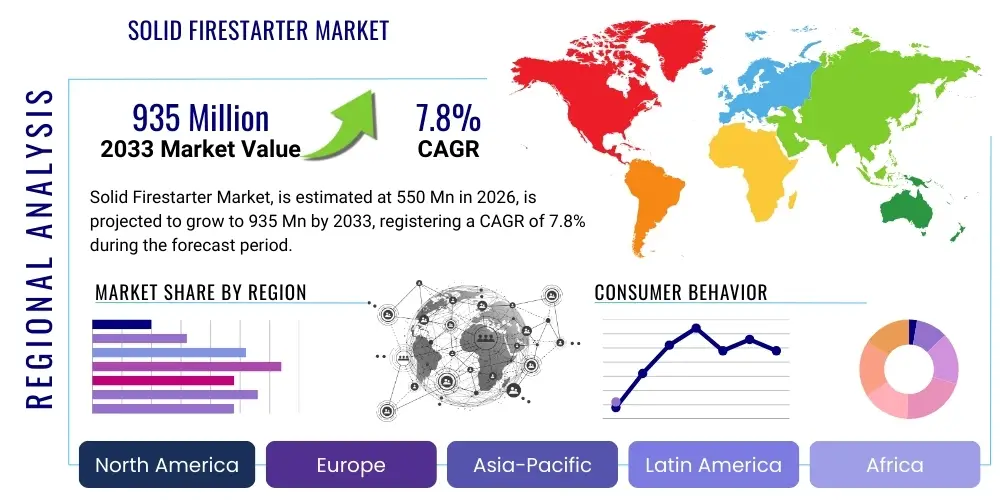

Solid Firestarter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442056 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Solid Firestarter Market Size

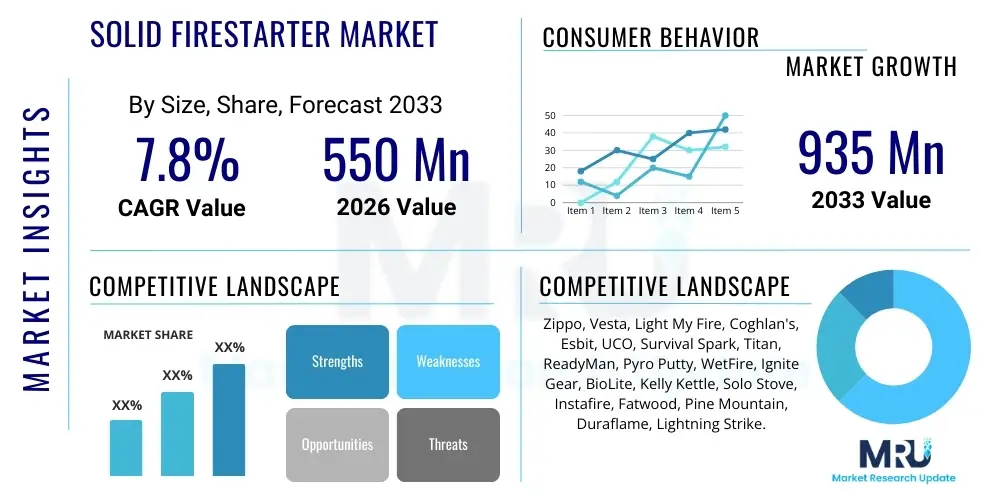

The Solid Firestarter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 935 Million by the end of the forecast period in 2033.

Solid Firestarter Market introduction

The Solid Firestarter Market encompasses a variety of manufactured products designed to initiate combustion reliably and efficiently, primarily used for lighting fires in demanding environments, for recreational purposes, or household heating. These products, ranging from compressed wood wool and wax-infused cubes to specialized chemical formulations, offer superior performance compared to traditional methods like paper or kindling, providing extended burn times and resistance to adverse conditions such as moisture or wind. The primary applications span outdoor activities, including camping, hiking, and hunting, as well as essential household uses like lighting fireplaces, wood stoves, and barbecue grills, reflecting their utility across multiple consumer segments demanding ease of use and consistent ignition.

Major applications of solid firestarters revolve around enhancing user convenience and safety. In outdoor recreation, rapid ignition is crucial for survival and comfort, driving demand for waterproof and compact solutions. The benefits of modern solid firestarters include significantly reduced preparation time, predictable ignition temperature, and often, an environmentally conscious composition, particularly with increasing regulatory pressure toward non-toxic alternatives. The driving factors behind market expansion are primarily the global rise in outdoor tourism and recreational activities, coupled with growing consumer preference for convenience products in domestic heating and grilling scenarios, further amplified by marketing efforts highlighting reliability under adverse weather conditions.

The product description generally involves materials consolidated into a solid form factor that contains a high concentration of flammable components, ensuring sustained heat output long enough to ignite larger fuel sources. Continuous innovation is focused on improving efficacy, portability, and minimizing environmental impact through the development of bio-based and cleaner-burning formulations. The fundamental utility of these products—reliable fire initiation—positions the market favorably for sustained growth, driven by both functional necessity and lifestyle adoption across diverse geographical regions.

Solid Firestarter Market Executive Summary

The Solid Firestarter Market is currently experiencing robust growth, primarily fueled by strong business trends indicating increased consumer spending on outdoor recreational equipment and the enduring appeal of traditional heating methods. Key business trends include the shift towards sustainable and non-toxic firestarter formulations, driving premium pricing and brand differentiation, alongside strategic mergers and acquisitions aimed at consolidating supply chains and expanding product portfolios to niche markets like specialized survival gear. Companies are increasingly leveraging direct-to-consumer (D2C) channels and e-commerce platforms to bypass traditional retail bottlenecks and reach a wider, globally dispersed consumer base interested in specialized outdoor goods.

Regionally, North America and Europe maintain dominance due to established camping cultures, high disposable incomes, and widespread use of indoor fireplaces and barbecue equipment. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, propelled by increasing urbanization, rising middle-class participation in leisure travel, and expanding tourism infrastructure, particularly in countries like China and India where outdoor adventure tourism is rapidly gaining traction. Latin America and the Middle East & Africa (MEA) represent emerging markets characterized by foundational growth in commercial grilling sectors and early adoption of packaged fire-starting solutions for domestic use, albeit often sensitive to price points.

Segment trends reveal that the Wax/Paraffin-Based segment holds a significant market share due to its cost-effectiveness and excellent moisture resistance, making it popular for both household and outdoor use. Conversely, the Wood Wool segment is experiencing accelerated growth driven by consumer demand for all-natural and environmentally friendly ignition sources. Application-wise, Camping & Outdoor Recreation remains the largest segment, emphasizing the need for ultra-lightweight, high-performance products, while the Household Heating segment provides stable, recurring revenue, particularly during colder seasons. Innovation in chemical formulations and packaging design remains a critical competitive differentiator across all segments, ensuring consistent market dynamism and catering to evolving user expectations regarding performance and ecological responsibility.

AI Impact Analysis on Solid Firestarter Market

User queries regarding AI's impact on the Solid Firestarter Market frequently center on supply chain optimization, predictive demand forecasting, and consumer personalization, rather than direct product innovation, given the low-tech nature of the physical firestarter. Users commonly ask: "How can AI reduce manufacturing costs of firestarters?" "Will AI-driven logistics improve seasonal availability?" and "Can AI predict which type of firestarter will sell best in different regions?" Analysis reveals a consensus that AI's primary influence will be logistical and marketing, enabling manufacturers to forecast seasonal peaks in demand with greater accuracy, especially for specialized outdoor gear, thereby minimizing inventory holding costs and reducing stock-outs during critical periods like the summer camping season or winter heating peak. Furthermore, AI-driven retail platforms will enhance consumer experience by personalizing product recommendations based on activity profiles (e.g., recommending waterproof cubes for backpacking versus wood wool for chimney use), significantly improving conversion rates and inventory turnover efficiency.

- AI optimizes procurement by predicting raw material price fluctuations (e.g., paraffin wax, wood fiber), leading to strategic purchasing decisions.

- Predictive maintenance analytics applied to manufacturing machinery minimizes unplanned downtime, ensuring consistent production capacity.

- Advanced demand forecasting models, leveraging machine learning, significantly improve inventory management for seasonal variations in camping, grilling, and heating demand.

- AI-powered customer service chatbots enhance pre-purchase inquiries regarding product safety, burn time specifications, and environmental certifications.

- Generative AI tools assist in designing optimized, sustainable packaging that reduces material waste and transportation volume.

- Personalized marketing driven by AI algorithms targets specific outdoor enthusiast communities with highly relevant product variants, boosting campaign ROI.

- Supply chain risk management utilizes AI to model geopolitical disruptions or extreme weather events affecting regional distribution networks.

DRO & Impact Forces Of Solid Firestarter Market

The Solid Firestarter Market is driven by the escalating global participation in outdoor recreational activities and the persistent consumer demand for highly reliable, convenient ignition sources, especially those with strong environmental credentials. Restraints primarily involve the volatility in raw material pricing, particularly for petroleum derivatives used in wax-based firestarters, and increasing regulatory scrutiny regarding the chemical composition and emissions of combustion products. Significant opportunities exist in the expansion into emerging markets, the development of premium, bio-based alternatives (like compressed bio-char or certified sustainable wood fibers), and the strategic integration of firestarters into larger survival kits and emergency preparedness product bundles, capitalizing on heightened public awareness regarding disaster readiness. These forces collectively shape the market trajectory, creating an environment where efficiency and sustainability are crucial for competitive advantage, driving continuous innovation in material science and production methodologies.

Segmentation Analysis

The Solid Firestarter Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse needs of both recreational and domestic consumers globally. This detailed segmentation allows manufacturers to tailor product development and marketing strategies to specific end-user requirements, whether focusing on high-performance, lightweight options for extreme outdoor conditions or cost-effective, bulk solutions for consistent household use. The analysis of these segments highlights distinct growth dynamics; for instance, while traditional wax-based firestarters retain volume leadership due to low cost and durability, the emerging segments focusing on natural wood wool or compressed bio-fuels are demonstrating superior growth rates, reflecting a powerful underlying shift toward ecological preferences and consumer willingness to pay a premium for sustainable products. Understanding the interplay between these segments is vital for predicting future market direction and investment prioritization.

- By Type:

- Wood Wool (Natural/Compressed Fiber)

- Wax/Paraffin Based (Cubes, Blocks)

- Chemical Cubes (High-Energy, Specialty Formulations)

- Gel/Liquid Based (Packaged in solid form factors)

- By Application:

- Camping & Outdoor Recreation

- Household Heating (Fireplaces/Stoves)

- Emergency Preparedness & Survival

- BBQ & Grilling

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Supermarkets/Hypermarkets (Mass Retail)

- Specialty Outdoor Stores (Retail focused on gear)

- Direct Sales (Bulk/Industrial)

Value Chain Analysis For Solid Firestarter Market

The value chain for the Solid Firestarter Market begins with upstream activities involving the sourcing and processing of core raw materials, predominantly paraffin wax, natural wood fibers (wood wool), specialized ignition chemicals (potassium nitrate, hexamine), and packaging materials. Key upstream relationships are focused on establishing stable, long-term contracts with chemical suppliers and forestry operations, often prioritizing those with sustainable sourcing certifications to meet rising consumer demand for ecological products. Efficient material handling and quality control at this stage are crucial to minimize contamination and ensure consistent product efficacy, directly impacting the final manufacturing cost and retail price points.

The midstream process involves manufacturing, formulation, and packaging. This stage is characterized by high levels of automation in pressing, mixing, and curing processes, particularly for high-volume wax-based cubes. Companies invest heavily in specialized machinery to ensure uniform density, burn rates, and moisture resistance across production batches. Direct distribution channels involve large manufacturers selling directly to major retailers or commercial clients (e.g., military or bulk buyers), allowing for greater control over branding and pricing. Indirect distribution, conversely, relies on wholesalers, distributors, and third-party logistics providers to reach scattered retail outlets and international markets, requiring robust partner management to maintain cold chain or moisture control integrity during transit, although this is less critical than for food products.

The downstream segment focuses on retail and end-user engagement, encompassing online retail, mass market supermarkets, and specialized outdoor gear shops. The shift towards e-commerce necessitates sophisticated digital marketing and optimized logistics for last-mile delivery. Potential customers are heavily influenced by product reviews, burn time guarantees, and safety certifications. Specialty stores play a critical role in educating consumers about premium products (e.g., highly specialized survival firestarters), while supermarkets capture the bulk of commodity sales. The efficient navigation of this value chain, from sustainable sourcing upstream to effective consumer engagement downstream, determines market share and profitability.

Solid Firestarter Market Potential Customers

The primary end-users and buyers in the Solid Firestarter Market are broadly categorized into four segments: recreational users, domestic consumers, institutional/commercial buyers, and emergency preparedness entities. Recreational users, comprising hikers, campers, backpackers, and hunters, demand lightweight, highly reliable, and waterproof firestarters suitable for adverse weather conditions. They often prioritize premium features, compact size, and rapid ignition, purchasing through specialty outdoor stores and dedicated e-commerce platforms focused on high-performance gear.

Domestic consumers form the largest volume segment, using solid firestarters primarily for indoor heating (fireplaces and wood stoves) and outdoor grilling (BBQs). Their purchasing decisions are highly influenced by price, ease of use, and bulk packaging options. They typically source products through mass retail channels like supermarkets and hypermarkets. Institutional buyers include commercial establishments such as restaurants specializing in wood-fired cuisine, resorts, and organized large-scale event organizers requiring predictable and safe ignition methods for large heating elements or cooking apparatus.

The emergency preparedness and government sectors represent a specialized, high-volume customer base. These entities, including military logistics, disaster relief organizations, and survival gear retailers, require firestarters certified for long shelf life, extreme temperature tolerance, and non-toxic properties. Demand here is often dictated by government procurement standards and tends to be less price-sensitive than the consumer segment, focusing instead on guaranteed performance and standardized specifications for inclusion in essential survival kits. These diverse customer profiles necessitate manufacturers to maintain broad product lines catering to differing quality, price, and functional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 935 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zippo, Vesta, Light My Fire, Coghlan's, Esbit, UCO, Survival Spark, Titan, ReadyMan, Pyro Putty, WetFire, Ignite Gear, BioLite, Kelly Kettle, Solo Stove, Instafire, Fatwood, Pine Mountain, Duraflame, Lightning Strike. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Firestarter Market Key Technology Landscape

The technology landscape in the Solid Firestarter Market is characterized less by digital innovation and more by material science advancements and manufacturing precision aimed at enhancing thermal efficiency, moisture resistance, and ecological compliance. Traditional technologies involve the simple compression of flammable materials saturated with hydrocarbons, such as paraffin wax applied to sawdust or wood fiber. Modern manufacturing processes utilize precise volumetric dosing and high-pressure molding techniques to ensure uniformity in firestarter density, which is critical for achieving consistent and reliable burn times under varied environmental conditions. A key technological focus is on encapsulation techniques that shield the core flammable material from humidity, ensuring instantaneous ignition even after prolonged exposure to moisture, a critical requirement for the lucrative outdoor and survival segments.

Recent technological shifts emphasize the transition toward bio-based and cleaner-burning formulations. This includes the utilization of renewable materials like recycled paper pulp, bio-wax derivatives, and sustainably sourced wood wool treated with natural ignition accelerants rather than harsh chemicals. Innovation is also evident in the development of specialized chemical cubes, often using non-toxic solid fuel sources such as methenamine compounds which offer high caloric output and minimal smoke and odor residue, catering specifically to indoor heating applications where air quality is a concern. The manufacturing technology also incorporates advanced quality control systems, utilizing infrared scanning and weight measurements to verify the consistency of the flammable load within each firestarter unit, guaranteeing product safety and performance standards globally.

Furthermore, packaging technology plays a crucial supporting role. Manufacturers are adopting specialized, resealable, and waterproof pouches and containers that not only protect the firestarters from environmental degradation but also contribute to the ease of transport and storage. Advancements in barrier materials ensure prolonged shelf life, which is particularly important for products marketed toward emergency preparedness. The overall technological direction is clear: maximizing caloric output per unit volume, ensuring ignition reliability across all weather extremes, and achieving the highest feasible level of material sustainability and low emission profile, balancing performance requirements with increasing consumer demand for ecological responsibility.

Regional Highlights

- North America (USA, Canada): This region holds a dominant market share, driven by a deeply ingrained culture of camping, hiking, and extensive recreational use of wood-burning appliances. Demand is characterized by a strong preference for high-quality, premium, and reliable firestarters, particularly those certified for use in managed wilderness areas. The market benefits from high consumer spending power and robust infrastructure supporting outdoor activities, making it a critical area for product innovation and specialized retail expansion.

- Europe (Germany, UK, France, Scandinavia): Europe is a mature market exhibiting high demand for sustainable and eco-friendly firestarters, spurred by stringent environmental regulations concerning emissions (e.g., in Germany and Nordic countries). The Household Heating segment is significant, relying heavily on wood stoves and fireplaces. Manufacturers here focus heavily on bio-based wood wool and non-toxic chemical formulations to comply with regional ecological standards and cater to environmentally conscious consumers.

- Asia Pacific (APAC) (China, India, Japan, Australia): APAC is the fastest-growing region due to rapid urbanization, rising disposable incomes, and the burgeoning trend of domestic and international tourism leading to increased participation in outdoor leisure activities. While countries like China and India present enormous volume potential, Australia and Japan contribute significantly to the high-value, specialized outdoor gear segment. Growth is driven by the expansion of organized retail and e-commerce platforms facilitating product accessibility.

- Latin America (Brazil, Mexico): This region represents an emerging market characterized by significant regional variations. Demand is driven by local traditions of outdoor grilling and, in some areas, reliance on wood or charcoal for cooking. The market is generally price-sensitive, leading to high consumption of cost-effective, bulk-packaged wax or paraffin-based firestarters, presenting opportunities for local manufacturing and cost optimization.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in urban centers and tourist destinations, driven by commercial grilling (restaurants) and expatriate communities utilizing modern heating/grilling equipment. Emergency preparedness initiatives in politically volatile or disaster-prone areas also contribute to steady, institutional demand for long-lasting, reliable fire-starting solutions. Market penetration remains lower than in Western regions but is accelerating through international retail partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Firestarter Market.- Zippo

- Vesta

- Light My Fire

- Coghlan's

- Esbit

- UCO

- Survival Spark

- Titan

- ReadyMan

- Pyro Putty

- WetFire

- Ignite Gear

- BioLite

- Kelly Kettle

- Solo Stove

- Instafire

- Fatwood

- Pine Mountain

- Duraflame

- Lightning Strike

Frequently Asked Questions

Analyze common user questions about the Solid Firestarter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Solid Firestarter Market?

The market growth is fundamentally driven by the increasing global consumer participation in outdoor recreational activities, such as camping and hiking, coupled with sustained demand for convenient and highly reliable ignition sources for domestic heating and grilling.

Which type of solid firestarter holds the largest market share globally?

Wax/Paraffin-Based firestarters typically hold the largest market share due to their superior cost-effectiveness, widespread availability, excellent resistance to moisture, and proven reliability for general household and outdoor use.

How is sustainability impacting the development of new solid firestarters?

Sustainability is a major trend, driving manufacturers to develop bio-based products, specifically wood wool and compressed natural fiber firestarters, which appeal to environmentally conscious consumers seeking non-toxic, low-emission alternatives to traditional chemical or petroleum-derived products.

Which geographical region exhibits the fastest growth rate for firestarters?

The Asia Pacific (APAC) region, particularly driven by markets in China and India, is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rising disposable incomes and rapid expansion of the outdoor recreation and tourism sectors.

What are the main distribution channels used in the Solid Firestarter Market?

The main distribution channels include mass retail (Supermarkets/Hypermarkets), specialized retail (Outdoor Gear Stores), and increasingly important, E-commerce platforms (Online Retail), which facilitate direct access to consumers globally.

The Solid Firestarter Market is undergoing a transformation characterized by a dual focus on enhanced performance and environmental responsibility, moving beyond basic utility toward sophisticated, specialized products tailored for specific user needs, from survivalists to domestic grill enthusiasts. The integration of advanced materials, such as non-toxic binders and high-caloric biomass, is setting new industry standards for ignition efficiency and ecological footprint. Furthermore, the competitive landscape is highly fragmented, necessitating aggressive marketing and robust supply chain resilience, particularly in navigating the fluctuating costs of raw materials and the complex logistics of international distribution. Market players must continuously innovate in both product formulation and retail strategy, especially leveraging the growth of online sales channels which offer unparalleled reach and direct consumer interaction. The long-term success in this market will depend significantly on the ability of companies to certify their products for sustainability while maintaining the core promise of reliable, rapid, all-weather ignition, thereby satisfying the increasingly nuanced demands of the global consumer base. Investment in scalable manufacturing technologies that can handle diverse material inputs—from petroleum derivatives to organic fibers—will be key to capturing market share across different price points and geographic regions, ensuring that operational flexibility matches market volatility.

In analyzing the segmentation by application, the Camping & Outdoor Recreation sector mandates continuous research into extreme-performance variants. Products in this category must withstand significant pressure, temperature extremes, and prolonged moisture exposure without degradation, pushing the boundaries of material encapsulation and chemical stability. For instance, manufacturers are exploring novel polymer coatings and hermetically sealed packaging designs to ensure a shelf life exceeding five years, crucial for emergency and survival applications. Conversely, the Household Heating and BBQ segments prioritize bulk value and low smoke/odor profiles, leading to innovations in compressed sawdust logs treated with vegetable waxes, offering a balance between sustained burn time and lower cost per use. This divergence in end-user requirements dictates specialized R&D pathways, meaning successful market leaders often maintain separate product lines optimized for each major application category, maximizing appeal and preventing brand dilution across segments. The market's future will see further convergence of convenience and ecological imperatives, pushing the entire industry toward next-generation solid fuel solutions that offer zero-residue combustion and maximum thermal output.

The role of distribution channels in the market’s evolution cannot be overstated. While physical retailers (supermarkets and specialty stores) remain vital for immediate, high-volume purchases, the burgeoning significance of E-commerce (online retail) is facilitating market access for smaller, specialized brands focusing on niche survival or ultra-light backpacking gear. Online platforms not only offer global reach but also allow for detailed product information dissemination, critical for explaining complex features like burn temperature, toxicity levels, and certification standards—information often limited on physical packaging. Moreover, the optimization of logistics for bulk shipping, particularly to remote outdoor retail locations or directly to consumers, presents an ongoing operational challenge that leverages AI and supply chain modeling to minimize transportation costs and environmental impact. Effective channel management, therefore, requires a hybrid approach: maintaining strong traditional retail partnerships for mainstream volume while aggressively expanding digital presence and optimizing fulfillment processes to capitalize on the rapid growth of the specialized consumer segment, ensuring market resilience against macroeconomic fluctuations. The complexity of cross-border regulatory compliance, particularly concerning hazardous goods classification, also adds a layer of specialization to the global distribution network, requiring tailored logistical solutions for international market penetration.

The influence of safety regulations and quality assurance protocols is becoming increasingly pronounced across the Solid Firestarter Market. Consumers and regulatory bodies are demanding higher transparency regarding the chemical composition and the potential release of volatile organic compounds (VOCs) during combustion. This pressure necessitates substantial investment by manufacturers in testing and certification processes, such as compliance with ISO standards for ignition safety and various environmental certifications. For example, firestarters intended for indoor use must meet stringent air quality requirements, often favoring those based on natural, refined ingredients that produce minimal ash and smoke. Failure to comply with these expanding regulations, particularly in developed economies, can result in significant market access restrictions or product recalls, elevating the barrier to entry for new competitors. Consequently, the larger, established market players are better positioned, leveraging existing certification infrastructure and R&D capabilities to proactively reformulate products, ensuring long-term regulatory compliance and building consumer trust through documented safety and environmental claims. This continuous cycle of regulatory adaptation and product refinement underscores the market’s move toward professionalized quality management.

Furthermore, consumer perception related to fire safety is a persistent factor influencing product design and marketing. Concerns over accidental ignition or fire spread, especially when children or pets are involved, drive demand for products with specialized safety features, such as child-resistant packaging and formulations that only ignite under specific, controlled conditions (e.g., extremely high localized heat). Educational marketing campaigns are also becoming crucial, instructing users on proper storage, handling, and disposal of solid firestarters to mitigate risk and ensure safe use. This emphasis on user safety not only protects consumers but also safeguards the brand reputation of manufacturers, demonstrating a commitment beyond mere compliance. The evolution of firestarter technology is therefore intrinsically linked to safety engineering, aiming to deliver maximum ignition performance while minimizing inherent hazards. Innovations in non-flammable outer coatings or delayed-ignition mechanisms, activated only upon exposure to a sustained flame, represent the next frontier in product differentiation based on enhanced user safety protocols, particularly important for products bundled into household preparedness kits where they might be stored for extended periods. This comprehensive approach to safety and reliability is paramount for sustaining consumer confidence and driving incremental sales growth across key segments.

The market's future outlook is strongly tied to macroeconomic trends and technological substitution. While the solid firestarter segment is robust, it faces indirect competition from advanced alternative ignition technologies, such as plasma lighters and rechargeable electric fire starting tools, particularly in the high-end outdoor gear market where portability and clean energy sources are highly valued. Although electric alternatives currently lack the extended burn time and fuel source capability of solid firestarters, their increasing reliability and environmental cleanliness pose a long-term competitive threat, forcing solid fuel manufacturers to intensify their focus on bio-degradability and superior material performance at a lower cost basis. Moreover, global economic stability directly influences discretionary spending on outdoor recreation and luxury heating items (like specialized chimney fires), creating a strong correlation between GDP growth and the uptake of premium firestarter products. Therefore, while core demand remains stable, market participants must remain agile, diversifying their product offerings to include both traditional, reliable solids and potentially exploring integration or partnership opportunities with next-generation electronic ignition specialists to maintain relevance across all consumer technology preference vectors.

The impact of urbanization globally also plays a subtle yet important role. As populations shift toward cities, the demand for traditional wood-burning appliances in residential settings may decline, reducing the need for bulk household firestarters. Conversely, urbanization often leads to increased participation in structured recreational activities (e.g., weekend camping trips), favoring compact, high-performance firestarters. Manufacturers must strategically adjust their production and distribution to reflect this demographic shift, perhaps focusing less on domestic bulk goods and more on conveniently packaged, high-margin, single-use or travel-sized products for the urban explorer. This structural change demands dynamic supply chain management, capable of pivoting quickly to service dense urban retail hubs and specialized online delivery networks, rather than broad, rural distribution models. Understanding these nuanced demographic shifts and tailoring product offerings accordingly—for instance, promoting low-smoke options for city apartment dwellers using balcony grills—is crucial for maintaining high revenue growth rates in a continuously evolving global consumer environment. This strategic alignment ensures that the Solid Firestarter Market remains resilient against broad societal trends that could otherwise undermine its established application base.

Focusing on the segmentation by Type, the Wood Wool segment's ascent is notable. These natural fiber products, often compressed and bound with vegetable wax, capitalize on the 'all-natural' marketing narrative, resonating deeply with outdoor enthusiasts and health-conscious domestic users. Manufacturers in this space are investing in certification logos (like FSC for forestry sourcing) to authenticate their claims, turning sustainability into a measurable competitive advantage. The premium pricing of high-quality wood wool firestarters reflects the complex sourcing and certification process, yet consumers are demonstrating price inelasticity due to the perceived benefits of cleaner burning and lower chemical residue. Conversely, Chemical Cubes, while less environmentally friendly, continue to be indispensable in high-demand emergency and military applications where guaranteed, long-term stability and specific BTU output are non-negotiable requirements, often overriding ecological concerns in mission-critical scenarios. This bifurcation highlights a key market dynamic: while consumer preferences lean heavily towards green products, high-performance specifications will always maintain a niche for specialized chemical solutions, demanding that manufacturers pursue parallel innovation tracks to satisfy both ends of the performance-to-sustainability spectrum.

The final element of market structure involves intense competitive rivalry, characterized by both large, diversified corporations and numerous small, specialized niche players. Large companies leverage scale economies in raw material procurement and expansive distribution networks to dominate the commodity market (wax/paraffin cubes). They often compete primarily on price and accessibility. In contrast, smaller brands differentiate themselves through specialization—for instance, focusing exclusively on ultra-light survival products or highly aesthetic, artisan-grade wood wool firestarters marketed toward boutique outdoor retailers and specialized home décor channels. Intellectual property, primarily relating to unique binding agents, waterproofing compounds, and proprietary long-burn formulations, provides a crucial competitive edge. Successful market strategies involve continuous product refinement, aggressive digital marketing campaigns targeting specific user communities (e.g., van lifers, extreme campers), and strategic partnerships with outdoor equipment manufacturers to co-bundle products. Monitoring competitor activity, particularly concerning patent filings and environmental certification announcements, is critical for anticipating market shifts and maintaining a proactive stance in this dynamic, yet traditional, consumer goods sector.

The convergence of material science and consumer ethics further defines the competitive strategy. Companies are exploring innovative materials such as discarded food waste or agricultural byproducts (e.g., compressed coffee grounds or nut shells) treated with sustainable, non-toxic ignition promoters to create novel, highly differentiated products. This not only addresses waste management concerns but also allows companies to carve out unique market positions based on circular economy principles. For example, a firestarter made from recycled organic material can command a higher price point and generate significant media attention, reinforcing the brand's commitment to ecological stewardship. This technological pursuit of "upcycled" firestarters represents a significant long-term opportunity, especially as global consumer interest in minimizing waste continues to accelerate. Furthermore, ensuring supply chain traceability for all materials, from the source of the wood fiber to the final packaging, is becoming a non-negotiable requirement for penetrating premium Western markets. Robust internal auditing and third-party verification are essential tools for maintaining integrity and validating sustainability claims in a market where greenwashing poses a significant risk to brand trust.

The economic resilience of the Solid Firestarter Market is bolstered by its dual function as both a discretionary leisure item and an essential emergency product. During economic downturns, while spending on new camping gear might decrease, the demand for emergency preparedness items often increases, providing a crucial counterbalance to sales volatility. This inherent stability makes the market an attractive investment area, particularly for manufacturers who successfully market their products across both application spectrums. Furthermore, seasonality is a dominant, predictable factor, with peak sales aligning heavily with summer outdoor activities and winter heating seasons. Effective inventory management, utilizing the AI forecasting tools mentioned earlier, is paramount for capitalizing on these seasonal peaks without incurring excessive storage costs during off-peak months. The long shelf life of most solid firestarters also mitigates the risk associated with overstocking, allowing for strategic production scheduling that optimizes factory utilization throughout the year. The market's stability, underpinned by consistent seasonal and emergency demand, ensures a predictable revenue stream despite external macroeconomic pressures, setting it apart from more volatile consumer electronics or fashion-driven sectors.

Finally, the long-term outlook requires careful monitoring of regulatory convergence across international markets. Harmonization of standards for fire safety, combustion emissions, and material sourcing would significantly simplify global distribution and manufacturing, reducing compliance costs. Currently, manufacturers must navigate fragmented requirements, which adds complexity and cost to products aimed at global export. Industry lobbying efforts are increasingly focused on promoting unified standards, particularly within trade blocs like the EU and across NAFTA countries. Achieving regulatory standardization would be a major catalyst for market efficiency and increased international trade, allowing companies to focus resources more heavily on innovation rather than compliance overhead. For regional players aiming for international expansion, early engagement with emerging international standards bodies and proactive adaptation of product formulations to meet the highest anticipated future regulatory benchmarks will be a critical success factor in gaining sustainable global market access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager