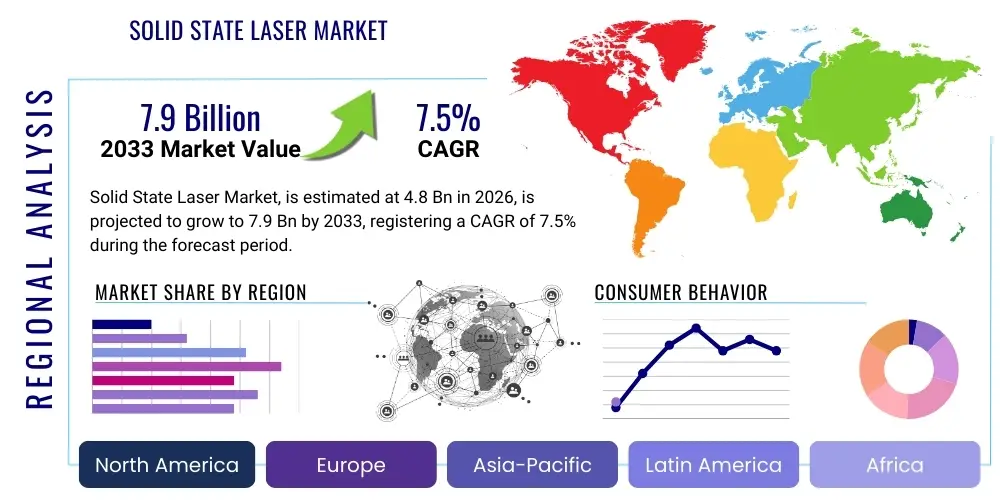

Solid State Laser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442649 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Solid State Laser Market Size

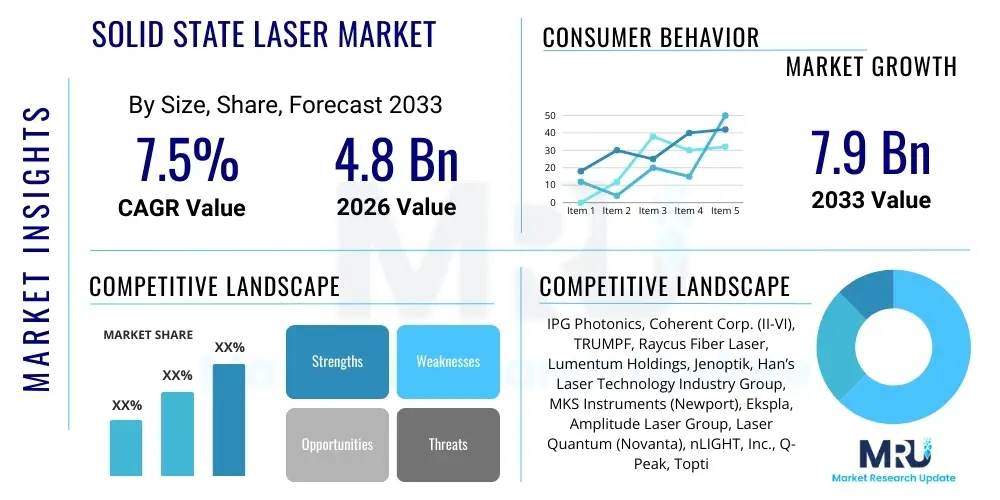

The Solid State Laser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Solid State Laser Market introduction

The Solid State Laser (SSL) market encompasses devices that utilize a solid medium, such as crystalline materials or glass doped with ions, as the gain medium to produce coherent light. These lasers, which include diode-pumped solid-state lasers (DPSSL), fiber lasers, and disc lasers, have largely replaced traditional gas and dye lasers across numerous high-precision industrial and scientific applications due to their superior efficiency, compact size, extended lifetime, and stability. Key drivers for adoption include the demand for high-speed, high-quality material processing in manufacturing, advancements in medical diagnostics and surgery, and the increasing complexity of optical communication systems requiring reliable, powerful light sources. The technological migration toward compact, maintenance-free systems is fundamentally reshaping the market landscape.

Solid State Lasers are characterized by their ability to generate high peak powers and narrow linewidths, making them indispensable in complex processes such as micro-machining, semiconductor fabrication (lithography and annealing), and specialized medical procedures like ophthalmology and dermatology. Unlike older laser technologies, SSLs offer wavelength flexibility through harmonic generation techniques, allowing them to target specific materials or biological tissues with precision. Furthermore, the inherent ruggedness of the solid gain medium enables operation in demanding industrial environments, contributing significantly to their penetration across aerospace, automotive, and defense sectors where reliability and operational endurance are paramount considerations.

The primary benefits driving the robust growth of the SSL market include enhanced energy efficiency compared to legacy systems, the ability to operate at fundamental and harmonic wavelengths, and minimal cooling requirements. Major applications span from high-power cutting and welding in heavy industries to highly sensitive sensing and metrology instruments. Driving factors are predominantly centered on the global expansion of advanced manufacturing methodologies (Industry 4.0), the accelerating pace of miniaturization in electronics, and substantial investments in defense technologies requiring sophisticated laser targeting and ranging systems. This sustained demand profile, coupled with continuous innovation in crystal growth and pumping technologies, ensures a strong trajectory for the Solid State Laser industry.

Solid State Laser Market Executive Summary

The Solid State Laser Market demonstrates strong upward momentum, driven predominantly by advancements in diode pumping technology and the escalating global demand for micro-processing capabilities in the electronics sector. Business trends indicate a pivot toward highly customized laser systems tailored for specific application parameters, moving away from standardized products. Key industry players are increasingly focusing on vertical integration, acquiring specialized component manufacturers (such as crystal growers or optical lens producers) to control the quality and cost of their systems. Furthermore, strategic alliances between laser manufacturers and end-user system integrators, particularly in the additive manufacturing space, are becoming commonplace to accelerate market penetration and deployment of new laser sources capable of handling advanced materials.

Regional trends highlight the Asia Pacific (APAC) region, particularly China, South Korea, and Taiwan, as the dominant growth engine, fueled by massive investments in consumer electronics, automotive manufacturing, and semiconductor production facilities. North America and Europe maintain strong leadership in high-end scientific research, advanced defense applications, and highly specialized medical devices, emphasizing quality and performance over sheer volume. The competitive environment in APAC, however, is leading to faster price erosion for commodity SSLs, necessitating continuous innovation in other regions to maintain profit margins. Geopolitical factors, including trade regulations on advanced technology exports, also influence regional market dynamics, particularly concerning high-power lasers used in military and aerospace applications.

Segment trends reveal that the DPSS (Diode-Pumped Solid-State) laser segment remains a foundational cornerstone, yet fiber lasers are rapidly gaining market share due to their exceptional beam quality, flexibility, and scalability for high-power industrial applications like welding and cutting. The application segment is overwhelmingly led by material processing, followed closely by medical and aesthetic procedures, which require specific wavelengths for minimally invasive treatments. Within material processing, the shift from traditional subtractive methods to laser-based additive manufacturing (3D printing) and high-precision micro-drilling is defining the future growth vectors for the market, demanding higher stability and pulse control from solid-state sources.

AI Impact Analysis on Solid State Laser Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Solid State Laser Market predominantly center on optimization, predictive maintenance, and quality control. Common questions explore how AI algorithms can fine-tune laser parameters (power, pulse duration, focal spot size) in real-time for complex material processing tasks, thereby minimizing defects and maximizing throughput. Users are also keen on understanding AI’s role in predicting the failure of critical laser components, such as pump diodes or crystal elements, allowing for scheduled maintenance rather than catastrophic shutdowns. A pervasive theme is the expectation that integrating AI will lead to 'smart' laser systems capable of adapting autonomously to changes in material feedstock or environmental conditions, significantly elevating process reliability and reducing operational costs across sectors like micro-electronics and automotive manufacturing.

The implementation of AI and machine learning (ML) models is revolutionizing the operation and control of complex solid-state laser systems. By analyzing massive datasets collected from sensors monitoring temperature, current, spectral output, and acoustic emissions, AI algorithms can identify subtle correlations indicative of process instability or imminent hardware degradation, far surpassing human capabilities in monitoring system health. This predictive capability translates directly into higher uptime, improved utilization rates, and a reduction in wasted material resulting from imperfect laser treatments. Furthermore, in demanding applications such as aerospace component welding, AI ensures compliance with stringent quality standards by comparing real-time processing data against established tolerance models, instantaneously flagging deviations.

Beyond operational efficiency, AI is deeply integrated into the R&D cycle for solid-state laser technology. ML is employed to accelerate the discovery and optimization of new gain media (crystals or glasses) by simulating material properties and predicting performance under various pumping conditions, dramatically reducing the time and cost associated with experimental material science. This application of computational intelligence is crucial for pushing the boundaries of power output, wavelength generation, and efficiency in next-generation solid-state devices. Consequently, AI acts not just as an operational optimizer but as an enabler for fundamental material and system innovation within the SSL ecosystem.

- Real-time process optimization in micromachining and welding using ML algorithms.

- Predictive maintenance schedules for critical laser components (e.g., pump diodes, optics).

- Automated quality control and defect detection systems utilizing computer vision integrated with laser processing.

- Enhanced adaptive beam shaping and delivery systems based on material feedback.

- Acceleration of new gain medium discovery through AI-driven material simulation and synthesis prediction.

- Optimization of complex pulse profiles for enhanced material interaction and reduced heat-affected zones.

- Improved energy consumption management and cooling efficiency through autonomous system control.

DRO & Impact Forces Of Solid State Laser Market

The Solid State Laser Market is fundamentally influenced by a strong set of drivers centered around technological superiority and increasing industrial needs, coupled with persistent restraints related to cost and complexity, while opportunities lie in emerging application frontiers. Key drivers include the exponential growth in demand for high-precision micro-electronics processing, where SSLs provide the necessary resolution and power control for delicate tasks like circuit dicing and display manufacturing. Restraints primarily involve the high initial capital investment required for high-power DPSSL and fiber laser systems, which can be prohibitive for smaller manufacturing entities, coupled with the complexity associated with integrating these advanced systems into existing industrial production lines, often requiring specialized expertise and infrastructure modifications.

Opportunities are significant in new application domains, particularly the rapid adoption of laser-based additive manufacturing (3D printing) technologies across aerospace and medical implant sectors, demanding robust, high-power solid-state sources. Furthermore, the expansion of laser-based directed energy weapons (DEW) in defense offers a high-value, albeit regulatory-sensitive, growth avenue. The market also faces impact forces stemming from rapid technological evolution, specifically the continuous race to develop more efficient pump diodes and novel crystal structures, which can quickly render current systems obsolete. Price competition, especially from mass-produced fiber lasers originating in Asian markets, exerts downward pressure on profitability for traditional solid-state laser manufacturers, forcing them to focus on niche, high-performance applications.

The synergistic impact of these forces dictates market trajectory. The critical constraint of high upfront cost is being partially mitigated by technological advancements that increase system longevity and efficiency, improving the total cost of ownership (TCO). Simultaneously, the immense opportunity presented by new digital manufacturing paradigms, supported by enabling technologies like AI for process control, ensures that the market remains highly dynamic and attractive for investment. The continuous need for improved speed and accuracy in global manufacturing serves as the overarching impact force, compelling sustained innovation in solid-state laser design and deployment.

Segmentation Analysis

The Solid State Laser market segmentation is crucial for understanding the diverse applications and technological dependencies within the industry, primarily categorized by type (distinguishing between the underlying gain medium technology), application (the end-use sector), and power output (determining suitability for light versus heavy material processing). The Type segment often differentiates between traditional Diode-Pumped Solid-State (DPSS) lasers, the increasingly dominant Fiber Lasers, and specialized Disc Lasers, each possessing unique beam characteristics and scalability potential. This differentiation is vital because a fiber laser might dominate high-power cutting in automotive, while a femtosecond DPSS laser is essential for high-precision ophthalmic surgery.

Segmentation by application clearly delineates the primary revenue streams. Material processing consistently leads, covering cutting, welding, marking, and annealing across diverse manufacturing environments. Other significant segments include medical (surgery, aesthetics, diagnostics), defense (targeting, range finding, directed energy), and scientific research (spectroscopy, fundamental physics experiments). The power output classification dictates market penetration; low-to-medium power lasers are pervasive in marking and medical applications, while high-power systems are exclusively reserved for heavy-duty industrial processing and advanced defense platforms.

The intricate layering of these segments allows market stakeholders to strategically allocate R&D resources toward high-growth niches. For instance, the convergence of DPSS technology with ultra-fast pulsed operation (picosecond and femtosecond lasers) is creating a premium sub-segment focused on cold ablation and transparent material processing, particularly critical for advanced semiconductor and display manufacturing. Analyzing these segment trends confirms that future growth will be concentrated in high-performance, short-pulsed systems capable of handling next-generation composite materials and ultra-thin substrates with minimal thermal damage.

- By Type:

- Diode-Pumped Solid-State (DPSS) Lasers

- Fiber Lasers

- Disc Lasers

- Others (e.g., Ceramic Lasers)

- By Power:

- Low Power (up to 100W)

- Medium Power (100W to 1kW)

- High Power (above 1kW)

- By Application:

- Material Processing (Cutting, Welding, Marking, Ablation, Additive Manufacturing)

- Medical & Aesthetic

- Military & Defense

- Scientific & Research

- Telecommunication & Sensing

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Solid State Laser Market

The Solid State Laser market value chain is extensive and begins with highly specialized upstream activities involving the sourcing and refinement of raw materials, specifically the growth and doping of specialized crystalline materials (like Nd:YAG or Ti:Sapphire) and the manufacturing of critical high-power semiconductor pump diodes. These upstream components are characterized by high barriers to entry due to required purity standards, complex manufacturing processes, and intellectual property surrounding crystal growth techniques and diode laser efficiency. Companies that control these foundational elements often hold a significant competitive advantage in terms of cost structure and system performance, ensuring a reliable supply of the highest quality gain media and pumping sources essential for high-efficiency solid-state operation.

Midstream activities focus on the assembly, integration, and engineering of the complete laser system. This includes integrating the gain medium, optical components (mirrors, lenses), cooling systems, and sophisticated power supply and control electronics. This stage involves complex engineering expertise to ensure thermal management, beam quality, and system stability under rigorous operating conditions. Distribution channels for solid-state lasers are bifurcated: direct channels are typically used for high-value, customized industrial and scientific systems, where extensive customer support, training, and direct technical consultation are required during deployment. Indirect channels, involving distributors, resellers, and system integrators, are more common for standardized, lower-power units or for penetration into geographically diverse markets.

Downstream activities involve system integration into the end-user environment, which is frequently carried out by specialized Original Equipment Manufacturers (OEMs) who build the laser into a larger manufacturing platform (e.g., a 3D printing machine or a micro-machining workstation). Post-sale service, maintenance, and application support constitute a crucial part of the downstream value chain, often representing a significant recurring revenue stream for the laser manufacturer. The efficacy of the distribution channel—whether direct sales teams handling large defense contracts or indirect specialized integrators focusing on localized manufacturing needs—directly impacts market reach and customer satisfaction, emphasizing the requirement for robust service networks globally.

Solid State Laser Market Potential Customers

The primary end-users and buyers of Solid State Laser technology are highly sophisticated entities requiring precision, speed, and reliable high-power density. The largest customer segment falls under the Material Processing industry, encompassing major global automotive manufacturers utilizing SSLs for advanced welding and cutting of lightweight materials, electronics companies employing them for micro-drilling and precise marking of components (PCBs, display screens), and aerospace firms leveraging high-power fiber and disc lasers for additive manufacturing of critical structural parts. These buyers prioritize total cost of ownership (TCO), system reliability (uptime), and the ability of the laser source to maintain consistent beam quality under continuous operation, often purchasing customized, high-power systems directly from leading laser manufacturers.

Another critically important customer base resides in the Medical and Aesthetic sectors. Hospitals, specialized surgical centers, and cosmetic clinics purchase solid-state lasers (especially DPSS and ultra-fast pulsed lasers) for non-invasive surgical procedures, vision correction, skin treatment, and diagnostic imaging. For these buyers, regulatory compliance (FDA/CE approval), safety features, specific wavelength output tailored to biological tissue absorption, and the clinical efficacy of the device are the key purchasing criteria. Equipment is frequently acquired through medical device distributors or specialized OEMs that integrate the laser engine into the final clinical system.

Finally, Government, Defense, and Scientific Research institutions represent a high-value customer segment. Defense agencies purchase solid-state systems for advanced applications such as laser range finding, target designation, and high-power directed energy weapons (DEW). Research laboratories and universities worldwide are consistently major buyers, utilizing highly customized, ultra-stable solid-state lasers (e.g., Ti:Sapphire and fiber oscillators) for fundamental physics experiments, high-speed spectroscopy, and advanced materials analysis. These procurement decisions are driven by stringent technical specifications, performance guarantees, and the need for cutting-edge capabilities, often involving long procurement cycles and direct contracting with suppliers specializing in high-security or research-grade equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Coherent Corp. (II-VI), TRUMPF, Raycus Fiber Laser, Lumentum Holdings, Jenoptik, Han’s Laser Technology Industry Group, MKS Instruments (Newport), Ekspla, Amplitude Laser Group, Laser Quantum (Novanta), nLIGHT, Inc., Q-Peak, Toptica Photonics, Quantel Laser (Lumibird), Photonics Industries International, DPSS Lasers Inc., Access Laser Company, HÜBNER GmbH, and Rofin-Sinar Technologies (Coherent). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid State Laser Market Key Technology Landscape

The technology landscape of the Solid State Laser market is highly dynamic, marked by continuous advancements focused on increasing efficiency, power density, and beam quality while reducing overall system footprint and cost. Diode-Pumped Solid-State (DPSS) technology remains central, where high-power semiconductor diodes replace traditional flashlamps, dramatically improving efficiency and lifetime. Recent advancements in DPSS focus on improved crystal cooling techniques, such as thin-disk and slab geometry, which mitigate thermal lensing effects and enable the scaling of output power into the multi-kilowatt range without significant degradation of beam quality. This technological focus is crucial for precision industrial applications demanding diffraction-limited beams, particularly in demanding environments like aerospace manufacturing and semiconductor chip repair.

Fiber laser technology represents the fastest-growing segment, fundamentally shifting the technological paradigm. Fiber lasers utilize the optical fiber itself, doped with rare-earth elements like ytterbium, as the gain medium. Their main advantage lies in their exceptional surface-area-to-volume ratio, which allows for superb heat dissipation and enables unprecedented power scaling (up to tens of kilowatts) while maintaining excellent beam quality and robustness. Current technological breakthroughs in fiber lasers involve developing novel large-mode area (LMA) fibers to suppress non-linear effects, and advancements in combining multiple laser beams (beam combining) to achieve ultra-high power levels necessary for heavy-duty cutting, remote welding, and defense applications.

The most specialized technological frontier involves Ultra-Fast Lasers (UFLs), specifically picosecond and femtosecond solid-state systems, which are integral to modern micro-machining. These lasers operate by delivering extremely high energy pulses over extremely short durations, enabling 'cold ablation' where material removal occurs before significant heat transfer can damage surrounding areas. Technological developments in this area focus on integrating advanced regenerative amplifiers, optimizing dispersion management, and improving the stability of mode-locked oscillators. These UFL systems are crucial for fabricating sophisticated components in the display, medical device, and semiconductor sectors, where minimizing the heat-affected zone (HAZ) is paramount for maintaining material integrity and device functionality, ensuring continued market investment in high-end DPSS and fiber-based ultra-fast solutions.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed leader in the Solid State Laser Market in terms of volume consumption and manufacturing growth. This dominance is directly attributable to the region's massive manufacturing base, particularly in consumer electronics, automotive components, and semiconductor production. China, South Korea, and Taiwan house major fabrication plants that rely heavily on fiber lasers for high-speed cutting and welding, and ultra-fast DPSS lasers for micro-processing of integrated circuits and displays. Government initiatives promoting advanced manufacturing (e.g., 'Made in China 2025') further incentivize the adoption of high-power laser systems, driving significant market expansion, though intense domestic competition in China leads to lower average selling prices for commodity laser sources.

North America (NA) represents a mature yet high-value market, characterized by strong demand for specialized, high-performance solid-state laser systems in defense, aerospace, and advanced medical applications. The region maintains technological leadership in complex ultra-fast laser systems used for scientific research and advanced ophthalmology. Significant R&D investment, both private and governmental (through agencies like DARPA), continuously fuels innovation, particularly in high-energy military applications and precision spectroscopy. US-based companies typically focus on high-margin, technically demanding products, prioritizing performance and intellectual property over mass-market volume.

Europe holds a robust position, particularly in Western economies like Germany, known for its excellence in industrial engineering and high-quality manufacturing (Industry 4.0). European manufacturers are key innovators in developing high-power Disc Lasers and customized fiber laser solutions for demanding automotive and heavy industrial applications. The market is supported by strong regulatory frameworks and a focus on operational efficiency and sustainable manufacturing practices, leading to a high demand for energy-efficient DPSS and fiber systems. Meanwhile, the Middle East and Africa (MEA) and Latin America (LATAM) remain nascent markets, with adoption primarily concentrated in oil and gas infrastructure development, basic marking applications, and limited medical procedures, offering long-term growth potential as industrialization accelerates.

- Asia Pacific (APAC): Dominates material processing due to semiconductor, consumer electronics, and automotive manufacturing density; highest volume growth.

- North America: Leads in high-end scientific research, military/defense applications (Directed Energy Weapons), and complex medical device manufacturing; high average selling price.

- Europe: Strong focus on high-quality industrial manufacturing (Germany, Italy); technological leadership in disc laser development and advanced automotive welding applications.

- Latin America (LATAM): Emerging market primarily driven by infrastructure projects, resource extraction, and basic industrial marking applications.

- Middle East & Africa (MEA): Growth centered around developing industrialization zones and defense modernization programs, albeit starting from a smaller base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid State Laser Market.- IPG Photonics

- Coherent Corp. (II-VI)

- TRUMPF

- Raycus Fiber Laser

- Lumentum Holdings

- Jenoptik

- Han’s Laser Technology Industry Group

- MKS Instruments (Newport)

- Ekspla

- Amplitude Laser Group

- Laser Quantum (Novanta)

- nLIGHT, Inc.

- Q-Peak

- Toptica Photonics

- Quantel Laser (Lumibird)

- Photonics Industries International

- DPSS Lasers Inc.

- Access Laser Company

- HÜBNER GmbH

- Rofin-Sinar Technologies (Coherent)

Frequently Asked Questions

Analyze common user questions about the Solid State Laser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Fiber Lasers and traditional DPSS Lasers?

The primary difference lies in the gain medium and beam delivery. Fiber lasers use an optical fiber doped with rare-earth elements as the gain medium and deliver the beam via a flexible fiber, offering superior thermal management, high power scalability, and excellent beam quality. Traditional Diode-Pumped Solid-State (DPSS) lasers use a bulk crystal (like Nd:YAG) and traditional free-space optics, which are less flexible but often preferred for applications requiring specific, short-pulse characteristics (e.g., ultra-fast femtosecond processing).

Which application sector generates the highest revenue in the Solid State Laser Market?

The Material Processing sector consistently generates the highest revenue, driven by pervasive industrial needs such as high-speed cutting, precision welding, and marking across automotive, aerospace, and electronics manufacturing. The sector's growth is further amplified by the rapid integration of solid-state lasers into advanced technologies like laser additive manufacturing (3D printing) and micro-machining processes essential for modern semiconductor fabrication.

How is the adoption of Artificial Intelligence (AI) influencing Solid State Laser performance?

AI adoption is significantly improving SSL performance by enabling real-time process optimization and predictive maintenance. AI algorithms analyze operational data to automatically adjust laser parameters (power, pulse) to maintain optimal processing quality regardless of material variation, minimize defects, and accurately predict component failures (like pump diodes), maximizing system uptime and reducing operational costs for end-users.

What is the role of ultra-fast solid-state lasers in the electronics industry?

Ultra-fast solid-state lasers (picosecond and femtosecond lasers) are crucial for high-precision processing in the electronics industry, specifically for cutting, drilling, and structuring fragile and transparent materials like specialized glass, sapphire, and thin films. Their capability for "cold ablation" minimizes thermal stress and heat-affected zones (HAZ), which is critical for fabricating high-density components in smartphones, OLED displays, and microprocessors without inducing damage.

What are the key geographical factors driving the growth of the Solid State Laser Market in the Asia Pacific region?

The growth in the APAC region is primarily driven by massive capital investments in global semiconductor fabrication plants (fabs), the sustained expansion of consumer electronics manufacturing, and the large-scale integration of automated laser systems into the regional automotive supply chain. Favorable government policies supporting technological upgrades in domestic manufacturing further solidify APAC's position as the leading consumer and producer of solid-state laser systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager