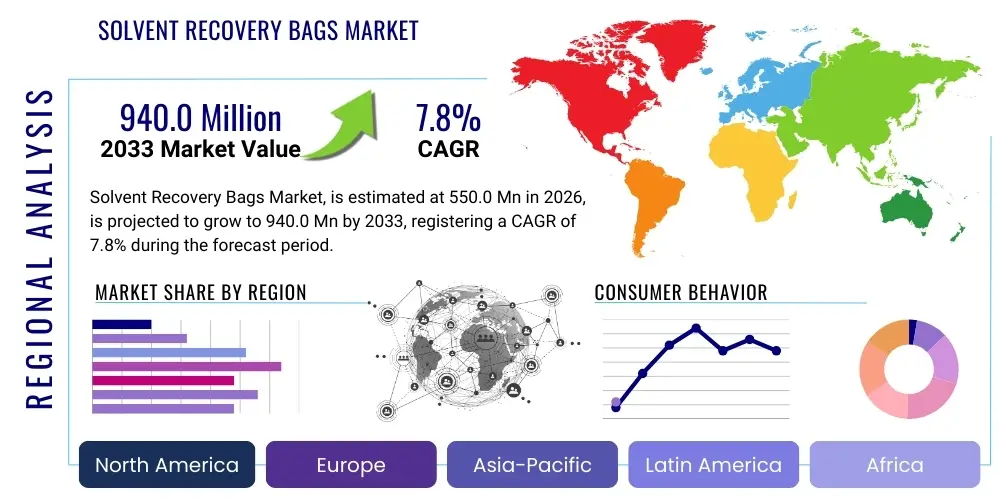

Solvent Recovery Bags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441412 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Solvent Recovery Bags Market Size

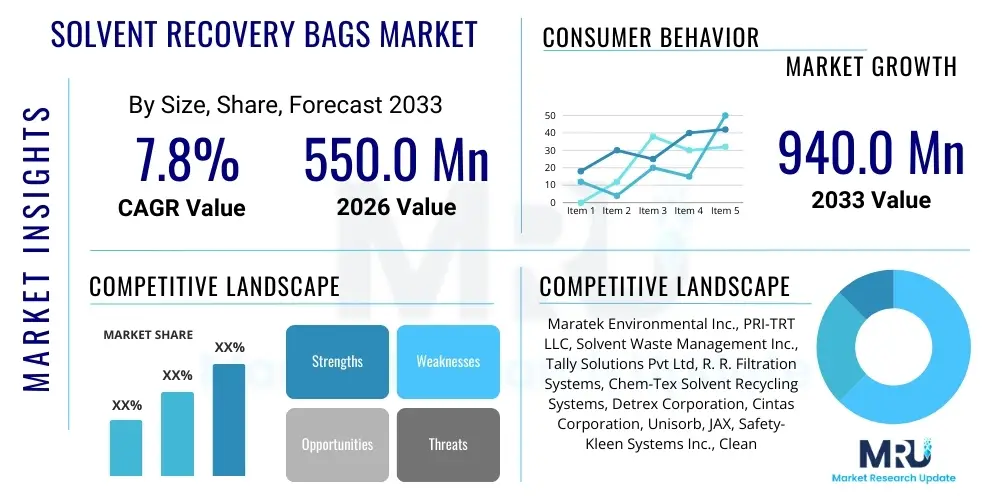

The Solvent Recovery Bags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 550.0 million in 2026 and is projected to reach USD 940.0 million by the end of the forecast period in 2033.

Solvent Recovery Bags Market introduction

The Solvent Recovery Bags Market encompasses the manufacturing, distribution, and utilization of specialized filtering containment systems designed to efficiently separate non-volatile residues and sludge from reusable industrial solvents. These bags are integral components of solvent distillation and recycling units, enhancing the purity and extending the lifecycle of solvents used across various heavy and specialized industries. Primarily, these products cater to sectors handling substantial volumes of chemical cleaning agents, such as dry cleaning establishments, automotive paint shops, aerospace manufacturing, and pharmaceutical laboratories, where regulatory compliance regarding waste disposal is exceptionally stringent.

The core product, a solvent recovery bag, acts as a high-efficiency liner or filter mechanism within the distillation apparatus. Its function is crucial: it prevents the accumulation of tars, pigments, polymers, and other contaminants from fouling the distillation unit, thereby minimizing equipment downtime and significantly reducing the labor associated with cleaning distillation chambers. By capturing these undesirable solids, the bags facilitate a streamlined recovery process, ensuring that the reclaimed solvent meets the necessary purity standards for subsequent reuse, which directly translates into considerable operational cost savings for end-users.

Major applications for solvent recovery bags include the recovery of perchloroethylene (PCE) in dry cleaning, various hydrocarbon solvents in industrial degreasing, and specialty chemicals like toluene or xylene in printing and coating operations. The market is primarily driven by the increasing global emphasis on sustainability, rising raw material costs for virgin solvents, and stricter environmental protection agency guidelines mandating responsible hazardous waste management. The key benefit these products offer is a closed-loop system for solvent use, dramatically lowering the volume of hazardous waste requiring specialized off-site disposal, consequently improving the environmental footprint of industrial processes.

Solvent Recovery Bags Market Executive Summary

The Solvent Recovery Bags Market is poised for substantial growth driven primarily by structural shifts toward circular economy models within industrial manufacturing and cleaning sectors. Business trends indicate a strong move toward high-capacity, chemically resistant PTFE and nylon-based bag materials that offer superior thermal stability and compatibility with aggressive solvent mixtures. Manufacturers are focusing on developing intelligent bag systems integrated with RFID or NFC technology for automated tracking of usage cycles and optimizing replacement schedules, reflecting a push toward Industry 4.0 integration within waste management protocols. Furthermore, competitive strategies emphasize long-term supply agreements and customized bag solutions tailored to specific distillation unit designs and solvent chemistries, particularly in the high-volume pharmaceutical and aerospace coating industries.

Regionally, North America and Europe maintain dominance, characterized by highly mature regulatory frameworks (such as REACH in Europe and RCRA in the US) that incentivize solvent recycling to mitigate liability associated with hazardous waste transport and disposal. Asia Pacific, particularly China and India, represents the fastest-growing market segment. This accelerated growth is fueled by rapid industrialization, increasing awareness of environmental mandates, and the subsequent adoption of modern solvent recovery equipment in the burgeoning textile, electronics, and automotive repair industries. Latin America and the Middle East and Africa are emerging regions, experiencing gradual market penetration as foreign direct investment introduces advanced distillation technologies, necessitating corresponding specialized filtration components like recovery bags.

Segment trends highlight the dominance of the Standard Solvent Capacity segment due to its widespread use in small to medium-sized dry cleaning and automotive repair shops. However, the High-Temperature/High-Durability segment (e.g., PTFE bags) is projected to exhibit the highest CAGR, driven by demand from demanding industrial applications recovering high-boiling point solvents under extreme thermal conditions. Furthermore, the rising popularity of eco-friendly, bio-based solvents, while still niche, is creating a parallel demand for specialized bag liners compatible with these less aggressive but chemically unique compounds, compelling innovation in material science within the filtration market.

AI Impact Analysis on Solvent Recovery Bags Market

User inquiries regarding AI's influence on the Solvent Recovery Bags market often revolve around predictive maintenance, optimization of solvent purity, and supply chain automation. Users are keen to understand if AI-driven systems can monitor solvent degradation in real-time to precisely determine the optimal bag replacement time, thereby reducing operational waste and maximizing solvent recovery efficiency. Key concerns also address whether AI algorithms can predict future demand for specific bag types based on fluctuating industrial output and regulatory changes, optimizing inventory management for suppliers. The overarching expectation is that AI integration will shift solvent recovery from a reactive maintenance process to a highly proactive, data-driven operation, although direct manufacturing processes of the bags themselves are expected to remain largely chemical and mechanical.

- AI-powered Predictive Maintenance: Analyzing distillation cycle data (temperature, pressure, duration) to forecast residue build-up and precisely schedule the replacement of solvent recovery bags, minimizing unnecessary waste and maximizing bag utilization lifespan.

- Optimized Inventory Management: Utilizing machine learning algorithms to predict demand fluctuations for various bag sizes and materials based on seasonal industrial usage, ensuring just-in-time inventory and reducing stock-outs.

- Process Efficiency Monitoring: AI systems track the solvent purity levels post-recovery, correlating filter performance with the bag material type and solvent load, leading to data-driven improvements in bag design and filtration efficacy.

- Automated Compliance Reporting: Integration of AI-driven sensors on distillation units provides automated, immutable records of waste volume captured in the bags, streamlining regulatory reporting processes related to hazardous waste generation.

- Supply Chain Resilience: AI models analyze geopolitical and logistical risks to optimize the sourcing and distribution networks for specialized raw materials (e.g., specific polymers) used in high-performance solvent recovery bag fabrication.

DRO & Impact Forces Of Solvent Recovery Bags Market

The dynamics of the Solvent Recovery Bags Market are heavily influenced by a potent combination of environmental mandates (Drivers), complexity of chemical compatibility (Restraints), advancements in materials science (Opportunities), and fluctuating solvent pricing structures (Impact Forces). The major driver is the escalating cost of purchasing new, virgin solvents, making in-house recycling an economically imperative choice for large industrial users. Simultaneously, governments globally are enforcing stricter guidelines on volatile organic compound (VOC) emissions and hazardous waste disposal, compelling industries to adopt closed-loop systems, thereby increasing the mandatory use of recovery bags. This regulatory push is a persistent, non-negotiable force sustaining market growth.

Restraints primarily center on the logistical and technical challenges associated with handling and disposing of the filled recovery bags, which contain highly concentrated hazardous sludge. The high initial capital investment required for high-capacity distillation and recovery equipment can deter smaller enterprises, especially in developing economies. Furthermore, the specialized nature of these bags requires precise chemical compatibility; selecting the incorrect bag material for a specific solvent (e.g., using nylon where PTFE is required) can lead to filter failure, solvent contamination, and potential safety hazards, increasing user apprehension and requiring specialized training.

Opportunities are robust, driven by the increasing commercialization of innovative, sustainable bag materials, including biodegradable or easily recyclable polymers, addressing the end-of-life disposal problem. The expansion into niche applications, such as the recovery of expensive specialty chemicals in biotechnology and electronics manufacturing, presents high-margin growth avenues. The key impact force remains the volatile pricing of crude oil and related petrochemicals, as solvent prices are inextricably linked to petroleum derivatives. When solvent prices rise, the economic incentive for purchasing recovery bags and investing in recycling equipment skyrockets, providing a massive boost to market demand. Conversely, periods of extremely low solvent cost can temporarily dampen the urgency for large-scale recycling investments.

Segmentation Analysis

The Solvent Recovery Bags Market is comprehensively segmented based on three critical factors: Material Type, Capacity, and End-Use Industry, each reflecting distinct operational needs and regulatory compliance requirements across diverse industrial landscapes. Understanding these segments is crucial for strategic market entry and product development, as performance attributes such as thermal resistance, chemical inertia, and filter efficiency vary significantly depending on the intended application. The material type segmentation, encompassing materials like nylon, polypropylene, and polytetrafluoroethylene (PTFE), dictates the bag's durability and chemical tolerance, directly influencing its suitability for harsh environments or aggressive solvents. Meanwhile, capacity segmentation addresses volume requirements, ranging from small-scale lab applications to high-volume industrial recycling operations. The end-use industry segmentation provides a clear view of where demand originates, identifying key consumption areas like automotive, pharmaceutical, and dry cleaning, which often have unique regulatory compliance profiles dictating procurement decisions.

- By Material Type

- Nylon Bags

- Polypropylene (PP) Bags

- Polytetrafluoroethylene (PTFE) Bags

- Polyethylene (PE) Bags

- Other Specialty Polymers

- By Capacity

- Standard Capacity (Up to 5 gallons)

- Medium Capacity (5-20 gallons)

- High Capacity (Above 20 gallons)

- By End-Use Industry

- Dry Cleaning Industry

- Automotive and Aerospace Coatings

- Printing and Graphics Industry

- Pharmaceutical and Chemical Manufacturing

- Industrial Degreasing and Parts Cleaning

- Electronics Manufacturing

Value Chain Analysis For Solvent Recovery Bags Market

The value chain for the Solvent Recovery Bags Market commences with upstream analysis focusing on the procurement of specialized raw materials, primarily high-performance polymers such as specific grades of PTFE, nylon, and polypropylene films, sourced from major chemical producers. Quality control at this stage is paramount, as the chemical resistance and thermal tolerance of the final product are determined by the integrity of these foundational materials. Key challenges in the upstream sector include managing price volatility of petrochemical feedstocks and securing supply chains for high-purity, specialized polymer resins used in manufacturing chemically inert filtration media. Manufacturing processes involve precision cutting, welding (often ultrasonic or heat sealing), and proprietary surface treatments to enhance filtration efficiency and ensure leak-proof containment under thermal stress within distillation units.

Downstream analysis highlights the crucial link between manufacturers and the large ecosystem of solvent recovery equipment providers. Solvent recovery bag companies often collaborate closely with original equipment manufacturers (OEMs) of distillation units to ensure perfect compatibility and secure preferred supplier status. The primary distribution channel involves specialized industrial chemical distributors and hazardous waste management service providers who offer these bags as essential consumables alongside solvent sales, recovery equipment maintenance, or waste removal services. Direct sales channels are common for large industrial end-users (e.g., major pharmaceutical companies or aerospace facilities) that require customized solutions and direct technical support from the bag manufacturer.

The distribution network relies on both direct and indirect channels. Indirect distribution, leveraging industrial supply houses and regional distributors, allows for broad market penetration across smaller dry cleaning and automotive repair segments. Direct distribution, which often includes dedicated technical sales teams, focuses on high-volume, highly regulated markets where consultation and technical documentation are mandatory parts of the procurement process. The efficiency of the value chain is increasingly being optimized through digital platforms that enable end-users to manage and automate the reordering of consumables, minimizing downtime associated with waiting for replacements, thus cementing the market position of suppliers who offer integrated logistical support alongside their physical products.

Solvent Recovery Bags Market Potential Customers

The primary consumers (End-Users/Buyers) of solvent recovery bags are industrial and commercial entities that utilize large quantities of solvents for cleaning, coating, or extraction processes and are legally or economically motivated to reclaim these valuable chemicals. This segment includes thousands of small to mid-sized dry cleaning businesses, which form the historical backbone of demand, utilizing bags primarily for perchloroethylene recovery. However, high-value, high-volume customers are increasingly found in advanced manufacturing sectors where solvent purity is non-negotiable and regulatory scrutiny is highest. These potential buyers prioritize bag quality, documented chemical compatibility, and reliable supply chains over marginal cost savings, recognizing the far higher cost of contaminated final products or regulatory fines.

Key growth segments among potential customers include global automotive refinish centers and aerospace maintenance, repair, and overhaul (MRO) facilities. These operations use specialized solvents for paint stripping, degreasing, and surface preparation before coating. Given the stringent quality standards in aerospace (e.g., required purity for cleaning jet engine components) and the need for quick turnaround times in automotive body shops, these customers require robust, high-capacity bags that withstand aggressive chemical action and high operating temperatures. The economic incentive is strong in these sectors, as virgin solvents are costly, and minimizing hazardous waste volume is a critical component of environmental health and safety (EHS) compliance.

Moreover, the pharmaceutical and fine chemical manufacturing sectors represent crucial potential customers, particularly those involved in solvent-intensive extraction and purification steps. While their solvent volumes might be lower than those of dry cleaners, the solvents themselves (e.g., highly pure alcohols, acetonitrile) are often expensive and require exceptional recovery purity, driving demand for the highest-grade PTFE bags. These buyers often integrate the bag procurement process directly into their validated manufacturing protocols, seeking suppliers who can provide extensive certifications and batch traceability. The diversity of chemical use across all these sectors ensures a consistently wide and stable base for potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 940.0 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maratek Environmental Inc., PRI-TRT LLC, Solvent Waste Management Inc., Tally Solutions Pvt Ltd, R. R. Filtration Systems, Chem-Tex Solvent Recycling Systems, Detrex Corporation, Cintas Corporation, Unisorb, JAX, Safety-Kleen Systems Inc., Clean Burn, Inc., Recycle Safe, SEMA Equipment, Inc., SolvTech Ltd, GreenChem Industries, Fil-Tec Inc., Filter-Max Solutions, PureSolv Systems, and Kleen-Co Waste Management. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solvent Recovery Bags Market Key Technology Landscape

The technology landscape surrounding the Solvent Recovery Bags Market is centered on advanced materials science and manufacturing precision, rather than complex mechanical engineering, as the bag itself is a consumable filter component designed for integration into specialized distillation equipment. The primary technological focus is on enhancing the chemical and thermal resistance of the filter media. Key advancements include the development of multilayered polymer structures that offer superior tensile strength and barrier properties, ensuring the bag remains structurally sound even when exposed to high-temperature, aggressive organic solvents over long periods. Specific techniques like plasma treatment or specialized coatings are sometimes employed to modify the polymer surface, optimizing sludge adherence while maintaining solvent permeability, thereby improving filtration rates without compromising bag integrity.

A significant technological driver is the shift toward higher efficiency filtration technologies, particularly for applications requiring extremely high solvent purity, such as electronics or pharmaceutical use. This involves moving beyond standard felt or mesh structures to micro- and nanofiber membranes incorporated into the bag liner. These high-tech materials increase the effective surface area for filtration and allow for the capture of finer particulate matter that conventional bags might miss, leading to recovered solvents meeting near-virgin quality standards. Furthermore, the integration of smart technology is emerging, where bags are equipped with passive RFID tags or QR codes. This technology allows end-users and waste management facilities to track the specific usage history, solvent compatibility, and disposal routing of each bag, facilitating superior compliance auditing and optimized inventory control within industrial facilities.

Manufacturing technology emphasizes highly automated, contamination-free production lines, particularly for PTFE and chemically sensitive bags. Precision welding techniques, such as ultrasonic sealing, are critical to guarantee hermetic seals that prevent leakage during the distillation process and subsequent removal. The long-term technological trajectory includes research into fully recyclable or biodegradable polymers that can effectively handle hazardous waste containment while minimizing the environmental burden associated with the final disposal of the filled bags. Innovation in this space focuses on bio-based polymers or advanced composites that break down safely after specific chemical treatment post-recovery, addressing a major environmental challenge faced by end-users.

Regional Highlights

- North America: This region holds a dominant share, largely due to stringent environmental regulations enforced by the EPA regarding VOC emissions and hazardous waste handling (RCRA). The high operational costs of solvents and a mature industrial base in dry cleaning, automotive refinishing, and aerospace manufacturing drive consistent demand. The market benefits from rapid adoption of advanced, high-capacity distillation units, increasing the consumption of high-grade PTFE and nylon recovery bags.

- Europe: Europe is characterized by regulatory harmonization under directives like REACH, promoting widespread solvent recycling across member states. Germany, the UK, and France are key contributors, driven by advanced manufacturing sectors (especially automotive and chemicals). Innovation is focused on sustainable solutions, with growing demand for recovery bags made from recyclable materials or designed for minimal residue volume, aligning with the EU's push toward a circular economy.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive industrial expansion, particularly in China, India, and Southeast Asia. As these countries rapidly adopt modern industrial standards, there is an increasing shift from simple disposal to solvent recovery. While cost remains a sensitive factor, escalating government enforcement of environmental protection laws is making solvent recycling a mandatory practice, driving exponential growth in the consumption of standard and medium-capacity bags.

- Latin America: Market penetration is moderate but steadily increasing. Brazil and Mexico are the largest regional markets, influenced by multinational corporations establishing manufacturing and automotive repair operations that adhere to global EHS standards. Growth is dependent on the pace of capital investment in modern solvent recovery equipment, and demand is currently focused on cost-effective, durable nylon and polypropylene bags.

- Middle East and Africa (MEA): This region is an emerging market, with growth concentrated in industrial hubs, especially in the UAE and Saudi Arabia, driven by petrochemical processing and infrastructure development projects. The demand for solvent recovery bags is directly tied to the establishment of modern industrial cleaning facilities and the adoption of imported European or North American distillation technologies requiring specialized consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solvent Recovery Bags Market.- Maratek Environmental Inc.

- PRI-TRT LLC

- Solvent Waste Management Inc.

- Tally Solutions Pvt Ltd

- R. R. Filtration Systems

- Chem-Tex Solvent Recycling Systems

- Detrex Corporation

- Cintas Corporation

- Unisorb

- JAX Inc.

- Safety-Kleen Systems Inc.

- Clean Burn, Inc.

- Recycle Safe

- SEMA Equipment, Inc.

- SolvTech Ltd

- GreenChem Industries

- Fil-Tec Inc.

- Filter-Max Solutions

- PureSolv Systems

- Kleen-Co Waste Management

Frequently Asked Questions

Analyze common user questions about the Solvent Recovery Bags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Solvent Recovery Bags Market?

Market growth is primarily driven by the increasing cost of virgin industrial solvents, coupled with increasingly stringent global environmental regulations mandating responsible hazardous waste reduction and solvent recycling across manufacturing, dry cleaning, and automotive industries.

Which material type offers the highest chemical and thermal resistance for aggressive solvents?

Polytetrafluoroethylene (PTFE) bags typically offer the highest chemical compatibility and thermal resistance, making them ideal for recovering aggressive, high-boiling point solvents used in pharmaceutical or demanding industrial applications.

How does the use of recovery bags benefit industrial end-users financially?

Solvent recovery bags significantly reduce operational costs by minimizing the frequency of purchasing expensive virgin solvents, drastically lowering the volume and associated disposal fees for hazardous waste, and reducing distillation equipment cleaning time.

Which geographical region is projected to exhibit the fastest market growth rate?

Asia Pacific (APAC), particularly driven by industrial expansion and rising environmental enforcement in China and India, is projected to register the fastest compound annual growth rate (CAGR) in the solvent recovery bags market.

What role does technology play in the future development of solvent recovery bags?

Future technology focuses on developing fully recyclable or biodegradable polymer materials, integrating RFID tracking for inventory and compliance, and using advanced microfiber structures to achieve higher solvent purity post-recovery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager