Solvent Recycling Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441293 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Solvent Recycling Technology Market Size

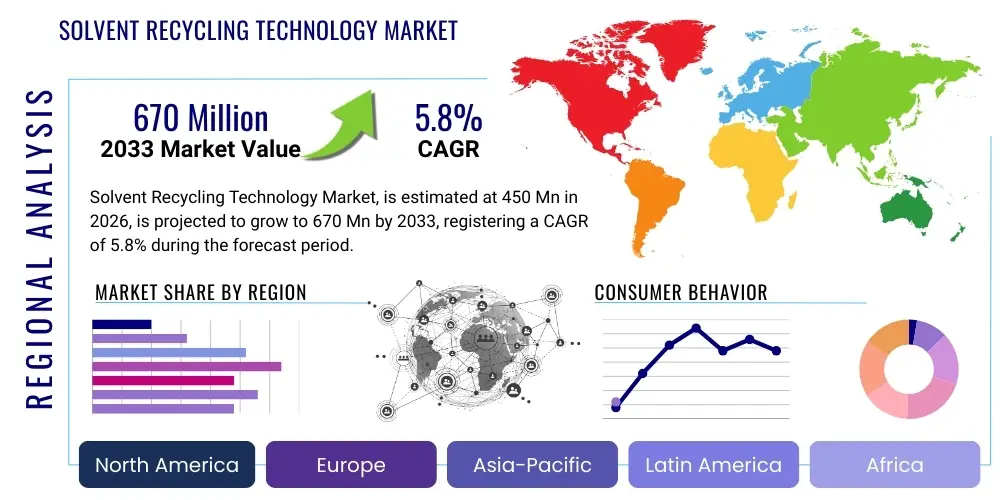

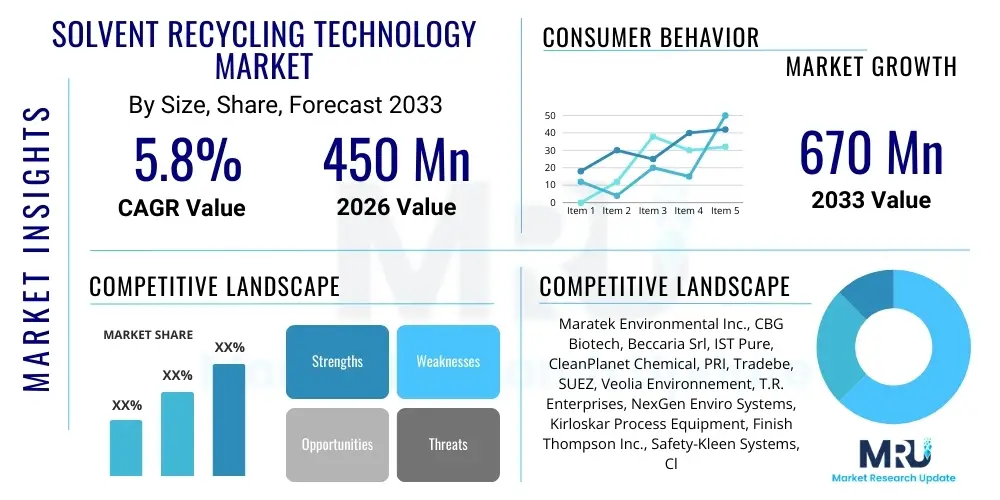

The Solvent Recycling Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $670 Million USD by the end of the forecast period in 2033.

Solvent Recycling Technology Market introduction

The Solvent Recycling Technology Market encompasses specialized equipment and processes designed to recover and purify contaminated industrial solvents, enabling their reuse in manufacturing cycles. This technology is critical for minimizing hazardous waste generation, reducing reliance on virgin solvent procurement, and achieving compliance with increasingly stringent environmental regulations globally. Key products include distillation units, thin-film evaporators, and fractional distillation systems, catering to diverse industries such as printing, pharmaceuticals, automotive, chemicals, and electronics manufacturing, where significant volumes of solvents like acetone, toluene, alcohols, and chlorinated compounds are utilized for cleaning, extraction, and synthesis processes. The core mechanism typically involves heating the contaminated mixture to vaporize the solvent, which is then condensed back into a liquid state, separating it from non-volatile contaminants like oils, resins, and pigments.

Major applications driving market adoption include precision cleaning in the electronics sector, paint stripping and equipment maintenance in the automotive and aerospace industries, and solvent recovery in the active pharmaceutical ingredients (API) production. The primary benefits derived from adopting these systems are substantial cost savings—as purchasing new solvents accounts for a significant operational expenditure—and the profound environmental advantages associated with reduced disposal fees and decreased carbon footprint. Furthermore, the technology aids in establishing circular economy principles within industrial operations, supporting corporate sustainability goals and enhancing public image.

Driving factors for sustained market growth are fundamentally linked to global legislative frameworks, such as the Resource Conservation and Recovery Act (RCRA) in the US and the European Union’s waste directives, which mandate responsible waste management. High and fluctuating costs of virgin solvents, coupled with the rising complexity and expense of hazardous waste disposal, incentivize companies to invest in in-house recycling capabilities. Technological advancements, particularly in continuous processing and enhanced energy efficiency of recycling equipment, further lower the operational barriers to adoption, making solvent management a core strategic function rather than just an environmental necessity.

Solvent Recycling Technology Market Executive Summary

The Solvent Recycling Technology Market demonstrates robust growth, primarily fueled by global mandates for sustainable manufacturing practices and the economic imperative to mitigate operational costs associated with solvent procurement and waste disposal. Current business trends indicate a significant shift toward integrated, automated recycling systems capable of handling complex mixtures and achieving high-purity levels, particularly within the pharmaceutical and specialty chemicals sectors. The market is witnessing increased collaboration between equipment manufacturers and industrial end-users to develop customized, closed-loop systems tailored to specific solvent chemistries and throughput requirements. Consolidation among smaller regional players by large global chemical service providers is also streamlining the supply chain, enhancing service quality, and broadening geographic reach, particularly in emerging industrial hubs.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by rapid industrialization, stringent pollution control measures being implemented in countries like China and India, and expanding foreign investment in manufacturing facilities that adhere to international environmental standards. North America and Europe, while mature markets, continue to represent major revenue shares, characterized by high regulatory pressure and mature adoption rates of advanced, energy-efficient distillation units. European regulatory frameworks, especially those related to volatile organic compounds (VOCs) and industrial emissions, compel continuous investment in sophisticated recycling technologies to ensure compliance and maintain environmental permits.

Segment trends reveal that large-capacity vacuum distillation units are dominating the technology landscape due to their ability to efficiently process high volumes of varied solvents at lower temperatures, minimizing thermal degradation and ensuring high recovery rates. By application, the cleaning and degreasing segment holds the largest share, reflecting the pervasive use of solvents across industrial maintenance and parts fabrication. Furthermore, the pharmaceutical and biotechnology segment is expected to show the highest CAGR, propelled by the critical need to recover expensive, high-purity solvents used in synthesis and chromatography, where even minor impurities can compromise product quality and regulatory approval.

AI Impact Analysis on Solvent Recycling Technology Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex and energy-intensive processes of solvent recycling. Key user concerns revolve around improving purity consistency, predicting maintenance needs, and minimizing energy consumption in distillation columns. Users are highly interested in AI's capacity to analyze real-time input solvent contamination levels and automatically adjust distillation parameters—such as temperature, vacuum pressure, and reflux ratios—to maximize solvent yield and purity while optimizing energy usage. Expectations center on AI-driven process control leading to unprecedented levels of operational efficiency and consistency, moving away from relying solely on fixed operating procedures or infrequent manual adjustments. Furthermore, predictive maintenance powered by AI is sought after to anticipate equipment failures, especially in heat exchangers and pumps, thereby reducing downtime and extending the lifespan of expensive recycling machinery.

- AI integration enables predictive modeling of solvent mixtures, optimizing distillation curves for complex waste streams.

- Machine Learning algorithms analyze historical process data to minimize energy consumption per unit of recovered solvent (energy optimization).

- Automated fault detection and diagnostic systems reduce machine downtime and maintenance costs through real-time monitoring of vibration and temperature anomalies.

- AI enhances product quality control by utilizing spectroscopic data analysis during post-processing to certify recovered solvent purity instantaneously.

- Smart scheduling of batch processes based on plant-wide operational needs and solvent accumulation rates improves throughput efficiency.

DRO & Impact Forces Of Solvent Recycling Technology Market

The Solvent Recycling Technology Market is primarily driven by regulatory push and economic pull factors, mitigated by significant technical and capital restraints, while presenting substantial opportunities derived from sustainability goals and technological refinement. The primary driver is the escalating regulatory burden concerning hazardous waste disposal, compelling manufacturers across sectors to adopt closed-loop solvent management systems. This is synergized by the compelling return on investment (ROI) offered by recycling, which drastically reduces expenditures on purchasing virgin solvents and paying high fees for outsourced waste management. However, a major restraint involves the substantial initial capital investment required for high-capacity, advanced recycling equipment, which can be prohibitive for Small and Medium Enterprises (SMEs). Furthermore, the complex chemistry of mixed solvent streams often requires specialized technical expertise and customized equipment configurations, presenting an operational hurdle.

Opportunities for growth are abundant, particularly in emerging economies where industrial growth is accelerating, and environmental standards are catching up to global benchmarks, creating a pent-up demand for sustainable waste solutions. The increasing corporate focus on ESG (Environmental, Social, and Governance) criteria also mandates the implementation of circular economy practices, pushing large corporations to mandate solvent recovery across all global operational sites. Technological opportunities lie in developing modular, containerized recycling units that are easier to deploy and scale, catering to varying industrial capacities and decentralized manufacturing models. Moreover, the integration of advanced sensors and IoT (Internet of Things) capabilities facilitates remote monitoring and optimization, enhancing the attractiveness of modern systems.

The core impact forces shaping this market include stringent governmental environmental policies, the volatility of petrochemical feedstock prices affecting virgin solvent costs, and the increasing global emphasis on industrial sustainability. The combination of mandatory compliance and financial incentive creates a strong, positive impact force driving market adoption. Conversely, the high technological barrier to entry and the specialized maintenance requirements exert a moderating restraint force. The overall market trajectory is highly positive, as the societal and economic benefits of solvent recycling consistently outweigh the implementation complexities, ensuring steady demand across all industrial manufacturing segments worldwide.

Segmentation Analysis

The Solvent Recycling Technology Market is comprehensively segmented based on technology type, capacity, application, and end-use industry, providing a granular view of demand drivers across various industrial needs. Technology segmentation highlights the prevalence of distillation methods, which are foundational, but also emphasizes the growing adoption of more advanced techniques like thin-film evaporation for heat-sensitive materials and solvent-specific membrane filtration for highly selective separation. Capacity segmentation differentiates between small, medium, and large-scale units, reflecting the diverse throughput needs, from localized maintenance shops requiring small benchtop units to massive chemical plants needing continuous, high-volume recovery systems. This intricate segmentation allows manufacturers to precisely target equipment development and marketing efforts to the specific pain points and regulatory landscapes of various end-user environments.

Application-based segmentation is crucial, distinguishing the requirements for cleaning and degreasing operations—which often involve mixed, contaminated streams—from highly controlled processes like extraction and purification, common in pharmaceutical and high-tech industries. The purity requirements for recycled solvents vary drastically across these applications, influencing the choice of recycling technology. For instance, pharmaceutical solvent recovery demands multi-stage distillation and stringent quality validation, whereas general industrial cleaning might suffice with single-stage vacuum distillation. This heterogeneity in requirements underscores the need for highly customizable recycling solutions that can meet both economic viability targets and critical quality benchmarks.

The end-use industry analysis reveals significant pockets of demand and growth potential. The chemical and pharmaceutical sectors are pivotal, not only due to the large volumes of solvents used but also because of the high value and toxicity of the materials involved, making recovery a priority from both an economic and environmental safety standpoint. Automotive, aerospace, and printing industries are major consumers of recycling services and equipment, driven primarily by maintenance, painting, and coating processes. Analyzing these segments helps stakeholders understand capital expenditure cycles, regulatory influences, and the specific types of solvents (e.g., flammable vs. chlorinated) that dominate each sector, informing strategic investments in specialized solvent recycling technologies and regional service expansions.

- By Technology Type:

- Distillation (Simple, Fractional, Vacuum)

- Thin Film Evaporation

- Membrane Filtration

- Supercritical Extraction

- By Capacity:

- Small (Under 50 Liters/Hour)

- Medium (50–200 Liters/Hour)

- Large (Above 200 Liters/Hour)

- By Application:

- Cleaning and Degreasing

- Extraction and Purification

- Coating and Painting

- Chemical Synthesis

- Others (R&D, Waste Management)

- By End-Use Industry:

- Pharmaceutical and Biotechnology

- Chemical and Petrochemical

- Automotive and Aerospace

- Printing and Packaging

- Electronics and Semiconductors

- Plastics and Polymers

Value Chain Analysis For Solvent Recycling Technology Market

The value chain for the Solvent Recycling Technology Market begins with the upstream suppliers, focusing primarily on manufacturers of specialized components such as distillation columns, heat exchangers, vacuum pumps, advanced control systems, and corrosion-resistant materials (e.g., stainless steel, specialized alloys). Raw material cost volatility, particularly for high-grade metals and automation components, significantly influences the overall manufacturing cost of the recycling units. Component providers must maintain strict quality standards to ensure the durability and safety of the final recycling systems, especially given the hazardous and often flammable nature of the solvents being processed. Efficient sourcing and robust logistics management are critical in this phase to maintain competitive pricing and production schedules for the capital equipment.

Midstream activities involve the design, fabrication, and integration of the complete solvent recycling systems, carried out by specialized equipment manufacturers. This stage requires significant intellectual capital, focusing on engineering proficiency, process optimization, and regulatory compliance (e.g., ATEX certification for explosion proofing). Distribution channels play a vital role, often utilizing a mix of direct sales forces for large, custom installations and indirect channels (distributors, system integrators, and value-added resellers) for standard, smaller capacity units. Direct channels are essential for providing comprehensive pre-sales consultation, system customization, installation supervision, and critical after-sales support and maintenance, which is a major revenue stream in this specialized market.

The downstream analysis focuses on the end-users and service providers. End-users are the industrial facilities (pharmaceutical, automotive, chemical) that utilize the solvents and generate the waste stream. Their decision-making is heavily influenced by ROI calculations, environmental compliance needs, and production continuity requirements. Post-sale services, including routine maintenance, consumables supply (filters, gaskets), and technology upgrades, form the final and often most lucrative part of the value chain. Furthermore, third-party waste management companies that offer centralized solvent recycling services act as crucial indirect customers, purchasing high-throughput equipment to serve multiple smaller clients who cannot justify in-house investment. The effectiveness of the overall value chain hinges on seamless technology transfer and robust service support to ensure sustained, efficient operation of the recycling equipment at the customer site.

Solvent Recycling Technology Market Potential Customers

The primary customer base for Solvent Recycling Technology spans across highly regulated and solvent-intensive manufacturing industries where purity, waste minimization, and operational safety are paramount concerns. End-users fall into two major categories: large-scale industrial producers seeking to implement in-house closed-loop systems, and smaller entities that rely on centralized recycling services provided by third-party waste handlers. In the pharmaceutical sector, customers are particularly focused on recovering high-value solvents like acetonitrile and methanol used in API synthesis and chromatography, driven by high purchase costs and stringent Good Manufacturing Practice (GMP) requirements. These buyers demand ultra-high purity recovery rates, making them potential customers for advanced fractional distillation and thin-film evaporation units.

Another major segment comprises automotive and aerospace manufacturers, whose needs revolve around recovering cleaning solvents, paint thinners, and degreasing agents used in surface preparation and maintenance. These customers prioritize robustness, high capacity, and the ability to handle mixed streams containing high solids content. They are key purchasers of rugged vacuum distillation and simple recovery units. The electronics and semiconductor industry represents a rapidly growing customer segment, requiring extremely high-purity solvents for precision cleaning of wafers and components. Their potential purchases are driven by the necessity to maintain exceptionally low contamination levels in the recovered solvents, often necessitating state-of-the-art filtration alongside distillation.

Beyond direct industrial applications, environmental service companies and specialized waste processors are significant potential customers. These businesses invest in large, versatile recycling centers to manage waste streams aggregated from numerous smaller businesses that generate hazardous solvent waste but lack the scale for internal recycling investment. These buyers look for highly automated, continuous processing systems that can efficiently manage diverse and unpredictable input chemistries while meeting all relevant environmental discharge permits, making them core targets for high-volume recycling equipment providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $670 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maratek Environmental Inc., CBG Biotech, Beccaria Srl, IST Pure, CleanPlanet Chemical, PRI, Tradebe, SUEZ, Veolia Environnement, T.R. Enterprises, NexGen Enviro Systems, Kirloskar Process Equipment, Finish Thompson Inc., Safety-Kleen Systems, Clean Harbors, Detrex Corporation, B&W Distributors, Scientific Waste Solutions, Hotsy Corporation, Eko-Tek Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solvent Recycling Technology Market Key Technology Landscape

The technology landscape in solvent recycling is dominated by thermal separation techniques, with distillation remaining the core method due to its reliability and scalability in achieving high purity. Modern distillation units leverage vacuum technology extensively, allowing solvents to vaporize at significantly lower temperatures. This low-temperature operation is critical for handling heat-sensitive solvents (common in pharmaceutical applications) and for drastically reducing energy consumption, thereby addressing one of the major operational costs. Furthermore, sophisticated control systems utilizing PID controllers and highly sensitive temperature probes are standard, enabling operators to achieve narrow boiling point cuts required for separating complex, multi-component solvent mixtures accurately. Fractional distillation towers, equipped with optimized packing materials or trays, are crucial for achieving the ultra-high purity levels demanded by specialty chemical and electronics manufacturing.

Beyond conventional distillation, advanced thin-film evaporation (TFE) technologies are gaining traction, particularly in applications involving viscous solvent contaminants, high-boiling point solvents, or streams containing high concentrations of dissolved solids like resins or polymers. TFEs minimize residence time and maximize heat transfer efficiency, preventing product degradation and allowing for near-complete recovery of the solvent from challenging waste matrices. Another key technological area involves membrane separation, which offers a non-thermal alternative for specific applications, such as removing fine particulates or separating aqueous mixtures. While membrane technology offers high energy efficiency, its widespread adoption is currently limited by membrane fouling, chemical compatibility issues with aggressive solvents, and the purity achievable, typically requiring a finishing polish using distillation.

The emerging technological frontier focuses heavily on digitalization and system integration. This includes incorporating IoT sensors for real-time monitoring of solvent quality, equipment performance, and energy usage, feeding data into cloud-based platforms for remote management and process optimization. Additionally, modular and skid-mounted designs are becoming prevalent, simplifying installation, minimizing footprint, and allowing systems to be scaled or moved easily to match production fluctuations. The development of specialized corrosion-resistant materials and seal technologies is also crucial for extending the equipment lifespan when dealing with highly aggressive or chlorinated solvent mixtures, ensuring long-term operational integrity and safety compliance in harsh industrial environments.

Regional Highlights

- North America: North America represents a mature and technologically advanced market for solvent recycling, largely driven by stringent federal and state-level environmental regulations, particularly those concerning VOC emissions and hazardous waste generation (EPA regulations). The high cost of waste disposal and robust manufacturing presence in pharmaceuticals, automotive, and aerospace industries ensure consistent demand for advanced, high-efficiency distillation and recovery systems. The US, in particular, showcases high adoption rates of closed-loop systems, emphasizing ROI and sustainability reporting. Canada also contributes significantly, aligning closely with US regulatory and technological trends, favoring automated and certified recycling solutions to meet internal corporate sustainability goals and external compliance mandates.

The regional market is characterized by a strong presence of both global technology providers and specialized service companies offering centralized recycling services. Investment trends show a preference for systems integrating IoT and remote diagnostics, maximizing operational uptime. Market maturity ensures slow, steady growth anchored by replacement cycles and upgrades to newer, energy-saving technologies. Furthermore, the push towards reshoring manufacturing activities in specialized sectors like semiconductors is creating new, high-purity solvent recycling opportunities.

Key drivers include RCRA compliance, the high cost of virgin solvents, and established infrastructure for managing complex industrial waste. The pharmaceutical and automotive sectors are the largest consumers of recycling technology in this region.

- Europe: Europe holds a dominant position in the global solvent recycling market due to pioneering environmental policies, such as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and comprehensive waste framework directives. These regulations strongly incentivize waste minimization and resource recovery, making solvent recycling a fundamental requirement for industrial operations rather than an optional investment. Countries like Germany, France, and Italy lead in implementation, focusing heavily on reducing industrial emissions, particularly VOCs. The region exhibits high acceptance of sophisticated technologies, including thin-film evaporation and specialized fractional distillation systems necessary for complex chemical processes.

The market growth is stabilized by continuous innovation and standardization efforts across the European Union, ensuring harmonized safety and environmental performance standards for recycling equipment (e.g., ATEX certification). There is a significant market for specialized recycling solutions tailored to the fine chemical, paint and coatings, and printing industries. The emphasis on the circular economy model across the EU further reinforces the strategic importance of internal solvent recovery capabilities for maintaining competitiveness and regulatory compliance.

Restraints in this region primarily relate to the high labor and operational costs, which necessitate investment in highly automated, low-intervention recycling machinery. Key technological focus includes energy recovery integration and maximizing solvent purity to reduce the overall material and energy footprint of manufacturing.

- Asia Pacific (APAC): APAC is the most rapidly expanding market globally, driven by explosive growth in manufacturing, particularly in China, India, South Korea, and Southeast Asian nations. Rapid industrialization, coupled with increasing governmental pressure to curb pollution and improve waste management standards, is fueling substantial demand for solvent recycling equipment. Historically, many APAC countries relied heavily on inexpensive virgin solvents and simple disposal methods, but evolving environmental legislation is forcing a decisive shift toward sustainable practices.

China represents the largest segment within APAC, benefiting from government initiatives aimed at pollution control and industrial optimization, which encourages the adoption of advanced foreign and domestic recycling technologies. India’s pharmaceutical and chemical manufacturing booms also create significant demand for high-capacity, specialized solvent recovery units. Market growth is characterized by a strong focus on affordable, reliable, and high-throughput solutions, often initially imported from North America and Europe, but increasingly supplied by competitive local manufacturers.

The market is somewhat fragmented, with a mix of small, local recycling shops and large industrial giants implementing advanced in-house systems. Opportunities are massive, particularly in providing standardized, robust medium-capacity units that cater to the sprawling network of SMEs in this region seeking compliance solutions and cost savings.

- Latin America: The Latin American market for solvent recycling is emerging, with pockets of significant demand centered around industrialized nations such as Brazil, Mexico, and Argentina. Market adoption is primarily spurred by economic benefits, driven by the fluctuating and often high cost of imported virgin solvents, making in-house recovery highly cost-effective. Regulatory enforcement, while sometimes inconsistent, is gradually strengthening, particularly concerning hazardous waste management and water pollution, creating a baseline requirement for compliance.

Major end-use industries include automotive manufacturing (Mexico, Brazil) and chemical/petrochemical processing. The market primarily demands rugged, easy-to-operate, and maintain recycling equipment suitable for environments that might have less access to specialized technical support compared to mature markets. Focus is often on vacuum distillation systems for general cleaning and degreasing applications.

Market penetration is moderate, constrained by economic volatility and higher capital import costs. However, long-term growth is promising as regional integration and sustainability mandates continue to mature, prompting major international corporations operating in the region to enforce global environmental standards, thus investing in recycling technologies.

- Middle East and Africa (MEA): The MEA market is heterogeneous, with significant solvent recycling activity concentrated in the GCC (Gulf Cooperation Council) states, driven by petrochemical, refining, and specialized industrial maintenance operations. Economic drivers dominate the investment decisions, focusing on optimizing expensive resources and reducing operational overhead in industrial complexes. South Africa also maintains a substantial, mature solvent recycling sector rooted in its mining and chemical industries.

The market in the Gulf is heavily influenced by large-scale projects in infrastructure and energy, requiring specialized solvents for cleaning and coating applications. Demand tends to focus on large, robust, and often customized recycling units capable of handling high-volume, continuous processing. Environmental regulations are developing rapidly in key GCC nations, pushing industries toward global best practices for resource management and waste minimization, though enforcement levels vary.

Challenges include technical skills gaps for operating and maintaining complex equipment and relying heavily on imported technology. Opportunities lie in expanding centralized recycling services and providing modular units to industrial facilities seeking sustainable solutions mandated by national economic diversification plans.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solvent Recycling Technology Market.- Maratek Environmental Inc.

- CBG Biotech

- Beccaria Srl

- IST Pure

- CleanPlanet Chemical

- PRI (Process Recovery International)

- Tradebe

- SUEZ

- Veolia Environnement

- T.R. Enterprises

- NexGen Enviro Systems

- Kirloskar Process Equipment

- Finish Thompson Inc.

- Safety-Kleen Systems (A Clean Harbors Company)

- Clean Harbors

- Detrex Corporation

- B&W Distributors, Inc.

- Scientific Waste Solutions

- Hotsy Corporation

- Eko-Tek Systems

Frequently Asked Questions

Analyze common user questions about the Solvent Recycling Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of investing in solvent recycling technology?

The primary economic benefits include significant reduction in expenditure on purchasing virgin solvents and drastically lowered costs associated with hazardous waste disposal, leading to a typical Return on Investment (ROI) period of 12 to 36 months, alongside predictable operational budgeting.

Which technologies are most effective for achieving high-purity solvent recovery, particularly in the pharmaceutical sector?

For high-purity needs, advanced technologies such as fractional vacuum distillation and thin-film evaporation are most effective. These methods minimize thermal stress, enable precise separation of close-boiling components, and ensure the recovered solvent meets stringent regulatory quality benchmarks (e.g., GMP standards).

How do regulatory changes influence the adoption rate of solvent recycling systems globally?

Regulatory changes, especially strict enforcement of VOC limits (Volatile Organic Compounds) and increases in landfill/incineration fees for hazardous waste, act as a primary driver, compelling industries to adopt closed-loop recycling to ensure compliance and avoid punitive fines, accelerating market adoption.

What is the typical lifespan and required maintenance of a modern industrial solvent recycling unit?

Modern industrial solvent recycling units typically have an operational lifespan exceeding 15 to 20 years with proper maintenance. Required maintenance often involves routine replacement of gaskets, seals, and filters, alongside preventative checks on vacuum pumps and heating elements, often facilitated by predictive maintenance software.

Is Asia Pacific poised to surpass North America and Europe in terms of market size for recycling technology?

While APAC is currently the fastest-growing region driven by industrial expansion and rapidly tightening environmental laws, North America and Europe currently maintain larger market sizes due to their maturity. However, sustained high growth in APAC suggests it will become the dominant market revenue contributor within the later stages of the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager