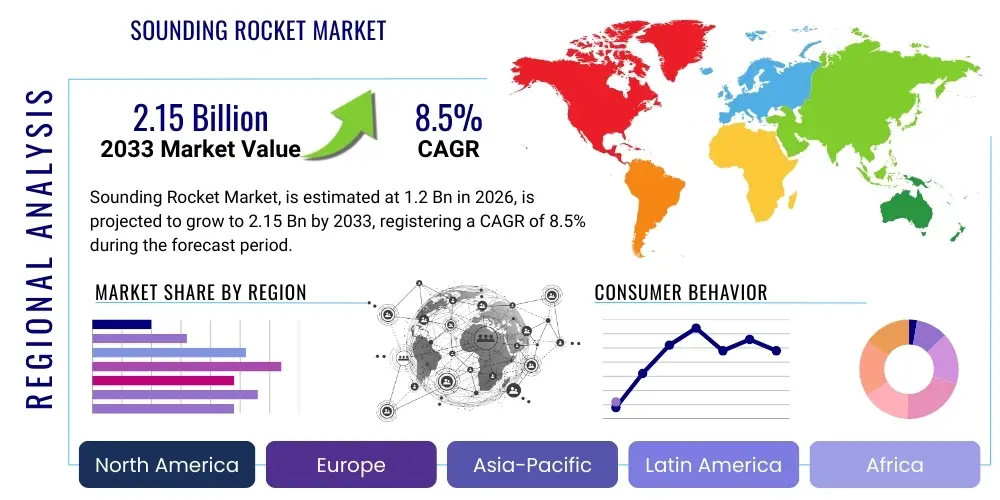

Sounding Rocket Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442459 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Sounding Rocket Market Size

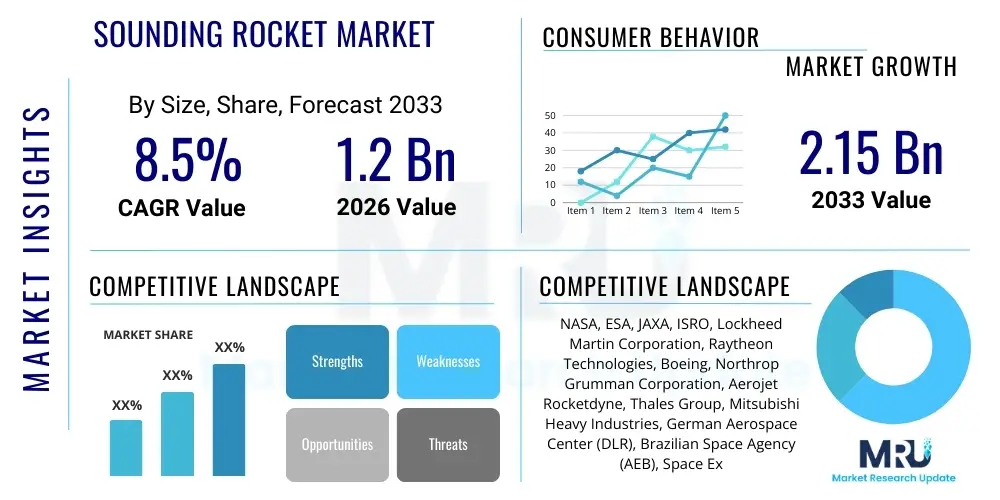

The Sounding Rocket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Sounding Rocket Market introduction

The Sounding Rocket Market encompasses the design, manufacturing, launch, and services related to sub-orbital rockets primarily used for scientific research, atmospheric studies, microgravity experiments, and technology demonstration missions. These rockets, characterized by their relatively short duration flights (typically 5 to 20 minutes) and specific trajectories targeting the upper atmosphere or near space environments, provide cost-effective and rapid access to space for instruments and payloads that do not require full orbital deployment. The foundational product description involves solid or liquid fueled rocket motors, advanced telemetry systems, recovery mechanisms, and modular payload sections tailored to specific experimental requirements, ranging from atmospheric composition measurement to astronomy observations above the distorting effects of the troposphere.

Major applications of sounding rockets span critical scientific fields, including heliophysics, magnetospheric research, aeronomy, and biological experiments under transient microgravity conditions. They serve as indispensable tools for governmental space agencies and academic institutions needing timely verification of new sensor technologies or conducting targeted physical research that bridges the gap between high-altitude balloon flights and costly orbital missions. A significant benefit of utilizing sounding rockets is their high cadence and flexibility; unlike complex satellite missions, sounding rocket campaigns can be planned and executed relatively quickly, allowing researchers to respond rapidly to transient phenomena, such as solar flares or specific atmospheric events, thereby advancing fundamental knowledge of Earth's interaction with the space environment.

Driving factors underpinning the market growth include increasing global investment in space science by emerging economies, the rising need for high-altitude atmospheric data collection critical for climate modeling and communications security, and the persistent demand for reliable, reusable platforms for testing satellite components before committing to expensive orbital launches. Furthermore, the commercialization of space and the emergence of private entities offering tailored launch services are lowering the barrier to entry, making sounding rockets more accessible to a broader range of academic and technological innovators worldwide. The inherent simplicity and proven reliability of these platforms continue to secure their relevance in the dynamic space exploration landscape, particularly as governments prioritize localized atmospheric monitoring capabilities.

Sounding Rocket Market Executive Summary

The Sounding Rocket Market is undergoing significant evolution driven by technological miniaturization and increased private sector participation, shifting the business trend towards smaller, more versatile vehicles capable of high-frequency launches. Key business trends indicate a move toward hybrid propulsion systems and standardized payload interfaces (e.g., CubeSat standards adapted for suborbital flight) to enhance efficiency and reduce lead times, attracting commercial research entities alongside traditional government clientele. The regional trends highlight North America and Europe as established leaders due to legacy space programs and robust academic funding, while the Asia Pacific region, particularly countries like India and China, demonstrates the highest growth potential owing to burgeoning national space ambitions and substantial government investments in indigenous rocket development and atmospheric research capabilities. Latin America and MEA are increasingly participating, often through international collaborations focused on specific equatorial or high-latitude atmospheric studies, indicating market diversification.

Segment trends reveal that the Scientific Instruments payload segment maintains dominance, reflecting the primary purpose of sounding rockets, though the Technology Demonstrators segment is rapidly expanding as private companies utilize sub-orbital flights for rapid prototyping and risk reduction of small satellite components. Altitude segmentation shows sustained interest in Mesospheric and Stratospheric research due to critical data requirements related to climate change and ozone layer dynamics, necessitating continued technological refinement for precision altitude control. The end-user analysis confirms that Government & Military entities remain the largest purchasers, utilizing sounding rockets for defense research, reconnaissance training, and fundamental space physics. However, the Commercial Space Companies segment is experiencing the fastest growth, fueled by ventures offering specialized services, further decentralizing launch capabilities and fostering competition in the suborbital domain.

The overall strategic outlook suggests that the market will consolidate around providers capable of offering highly customizable launch services combined with integrated data acquisition and recovery services. Innovation in propulsion technologies, particularly focusing on environmentally friendly propellants and enhanced payload recovery mechanisms, will be pivotal for maintaining competitive advantage. Furthermore, the convergence of sounding rocket missions with high-altitude balloon campaigns and small satellite orbital launches positions these vehicles as crucial, flexible elements in a broader, tiered system of space access. Successful market penetration necessitates addressing the cost-sensitivity of academic institutions while maintaining the stringent safety and reliability standards demanded by military and government organizations, ensuring that the market trajectory remains robust and technologically advanced throughout the forecast period.

AI Impact Analysis on Sounding Rocket Market

Analysis of common user questions regarding AI's influence on the Sounding Rocket Market centers predominantly on how artificial intelligence can optimize flight trajectories, enhance real-time data processing capabilities, and automate pre-launch diagnostics, significantly improving mission success rates and scientific return. Users frequently inquire about the feasibility of AI-driven adaptive mission planning, where on-board systems adjust flight parameters or experiment procedures based on real-time atmospheric readings or payload status, minimizing human intervention and maximizing data relevance. Furthermore, concerns are raised about the security implications of integrating AI into launch control systems and the required computational power for processing vast amounts of high-speed telemetry data generated during short flights. The overriding expectation is that AI will transform sounding rocket missions from pre-programmed events into dynamic, intelligent scientific campaigns, especially in the context of atmospheric monitoring and rapid anomaly detection, making the entire process faster, safer, and more scientifically effective.

The integration of AI technologies is fundamentally altering the operational efficiency and data quality aspects of the sounding rocket lifecycle. Specifically, AI algorithms are being deployed to analyze historical launch data and meteorological conditions to predict optimal launch windows and minimize weather-related delays, thereby optimizing operational schedules and resource utilization. In the post-flight data analysis phase, machine learning techniques are proving invaluable for filtering noise, identifying statistically significant anomalies, and correlating sensor readings across multiple instruments at speeds unattainable by traditional processing methods. This sophisticated data synthesis capability ensures that scientific teams extract maximum value from the limited flight time, positioning AI as a crucial enabler for next-generation atmospheric and astronomical research conducted via sub-orbital vehicles.

- AI-Enhanced Trajectory Optimization: Utilizing machine learning models to dynamically calculate and adjust rocket trajectories in real-time based on atmospheric density and wind sheer, ensuring precision altitude attainment and minimizing deviations.

- Automated Pre-Launch Diagnostics: AI systems performing rapid, comprehensive checks of all subsystems (propulsion, telemetry, payload integrity) to predict potential failures, reducing manual oversight and shortening countdown procedures.

- Real-Time Adaptive Payload Control: On-board AI enabling instruments to autonomously adjust exposure times, sensitivity, or sequencing based on incoming data, maximizing the capture of transient scientific phenomena.

- High-Speed Telemetry Analysis: Machine learning algorithms processing high-volume, high-velocity flight data instantly to filter noise, identify critical events, and package usable data segments for immediate downlink and post-flight recovery.

- Predictive Maintenance for Launch Infrastructure: AI models analyzing sensor data from launch pads and ground support equipment to predict equipment fatigue and schedule maintenance proactively, increasing operational uptime.

DRO & Impact Forces Of Sounding Rocket Market

The market dynamics of sounding rockets are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. Key drivers include the exponential increase in global space research budgets, particularly in Asia, alongside the persistent, intrinsic advantage of sounding rockets offering low-cost, quick-turnaround access to altitudes inaccessible by balloons but not requiring full orbital velocity. This cost-effectiveness and rapid deployment capability make them irreplaceable for proof-of-concept testing of new technologies—a critical stepping stone for small satellite constellations and deep-space missions. Furthermore, the growing global focus on climate change and upper atmospheric monitoring mandates continuous data collection, cementing the role of these vehicles in foundational environmental science, driving sustained government and academic investment and ensuring a stable baseline demand for launch services.

Restraints, however, significantly challenge market expansion. Foremost among these are the short flight durations, which limit the scope and complexity of experiments and often necessitate rapid, precise payload recovery, introducing logistical and technical hurdles. Moreover, stringent regulatory environments, especially concerning airspace restrictions and international treaties governing atmospheric testing, create bureaucratic bottlenecks that can delay research campaigns and increase operational costs. Competition from emerging low-cost small-lift orbital vehicles and high-altitude pseudo-satellites (HAPS) poses a structural restraint, potentially diverting budgets away from sub-orbital missions for longer-duration data collection requirements. Overcoming these restraints requires innovation in reusable stages and improved regulatory harmonization.

Opportunities for growth are concentrated in the development of next-generation propulsion systems, including advanced hybrid rockets and bio-propellants, which address environmental concerns and improve performance margins, thereby attracting private sector funding focused on sustainable technology. The emerging commercial segment, dedicated to offering microgravity experiments for industrial applications (e.g., advanced materials science or pharmaceutical crystallization), represents a high-value opportunity, leveraging the unique conditions provided by sub-orbital flight. The primary impact forces affecting the market trajectory are technology maturity (driving down costs and improving reliability), geopolitical stability (affecting international collaboration and launch site availability), and the cyclical nature of government research funding (creating periodic fluctuations in mission volume). Successful market navigation hinges on exploiting the technological niche of rapid, cost-controlled high-altitude access while mitigating regulatory and competitive pressures.

The overall impact forces dictate that while the market is niche, its strategic importance in bridging terrestrial and orbital research sustains its growth trajectory. The inherent ability of sounding rockets to customize trajectories and achieve precise high-altitude objectives within localized geographic zones differentiates them from satellite systems. This specialization, particularly for time-sensitive transient phenomena observation or critical component verification under real flight conditions, ensures that even with competition from cheaper orbital launchers, the specialized application base of sounding rockets will continue to drive steady investment, particularly from military and core research institutions globally. The market's resilience is tied directly to its utility as a reliable, flexible proving ground for cutting-edge space technology.

Segmentation Analysis

The Sounding Rocket Market is meticulously segmented across Payload, Altitude, End-User, and Propellant types, providing a detailed framework for understanding market demand and strategic planning. This multi-dimensional segmentation allows stakeholders to analyze specific demand patterns, such as the increasing need for technology demonstration launches by private commercial entities versus the steady, traditional demand for scientific instruments driven by government agencies. Payload segmentation, including Scientific Instruments, Communication Systems, and Technology Demonstrators, is crucial as it reflects the primary application purpose of the mission, directly influencing the complexity and design parameters of the rocket vehicle. Altitude segmentation delineates the required performance envelope, separating simpler stratospheric missions from more demanding mesospheric or sub-orbital high-altitude flights requiring more powerful boosters and sophisticated trajectory control systems, impacting overall mission cost and provider capability requirements.

The End-User segmentation provides insight into funding sources and procurement dynamics, differentiating the stringent requirements of Government & Military customers (focused on reconnaissance, defense research, and long-term climate monitoring) from the often faster-paced, experimental needs of Academic & Research Institutions and the cost-sensitive, iterative development cycles characteristic of Commercial Space Companies. Propellant segmentation—Solid Fuel, Liquid Fuel, and Hybrid—is foundational, defining the operational logistics, safety profile, cost per launch, and thrust characteristics of the available rockets. Solid fuel systems, being simpler and highly reliable, dominate volume usage for smaller missions, while hybrid and liquid fuels are gaining traction for missions requiring precise thrust throttling, environmental sustainability, and advanced recovery capabilities. Analyzing these intersections is essential for manufacturers to tailor their offerings effectively.

The ongoing trend in segmentation analysis points towards growth in the Technology Demonstrators segment, closely tied to the rise of Commercial Space Companies as end-users, reflecting the shift toward private sector innovation in space technology validation. Geographically, while government spending continues to stabilize the core scientific instrument segment, the burgeoning regional capabilities in the Asia Pacific are driving demand for versatile, domestically manufactured solid-fuel sounding rockets suitable for both scientific exploration and military applications. Successful market entry strategies must leverage the demand for modular, multi-segment rockets capable of carrying diverse small payloads, effectively blending the low-cost advantages of standardized vehicles with the high customization required by specialized scientific missions. This nuanced understanding of segmented demand allows for optimized resource allocation and targeted marketing efforts within the global space research ecosystem.

- By Payload:

- Scientific Instruments

- Communications Systems

- Technology Demonstrators (e.g., CubeSat components testing)

- By Altitude:

- Sub-orbital (reaching space boundaries)

- Mesospheric (50 km to 85 km)

- Stratospheric (10 km to 50 km)

- By End-User:

- Government & Military

- Academic & Research Institutions

- Commercial Space Companies

- By Propellant:

- Solid Fuel

- Liquid Fuel

- Hybrid Fuel

Value Chain Analysis For Sounding Rocket Market

The Value Chain for the Sounding Rocket Market begins with the Upstream Analysis, which focuses primarily on the sourcing and manufacturing of raw materials and complex components. This stage involves specialized suppliers providing high-performance composites for airframes, propulsion system components (including solid propellants, tankage for liquids/hybrids, and nozzles), and specialized avionics such as guidance, navigation, and control (GNC) systems. Key upstream activities involve rigorous material testing, advanced machining, and quality control compliant with aerospace standards, often requiring high levels of security clearance and governmental oversight. The efficiency and reliability achieved in the upstream segment directly influence the final cost structure and reliability of the complete rocket system, making supplier diversification and long-term procurement contracts strategically vital for market participants.

The midstream activity centers on the integration and testing of the final vehicle, where manufacturers assemble the rocket stages, integrate the specialized payload sections (often supplied by the end-user scientists), and conduct comprehensive system-level checks, including structural integrity, telemetry functionality, and flight readiness. This stage requires highly specialized facilities, including clean rooms and dynamic testing equipment. Following manufacturing and integration, the downstream segment encompasses the critical launch services, including mission planning, range safety coordination, ground support operations, and, crucially, payload recovery efforts. Launch service providers, often governmental agencies or large commercial operators, manage the intricate logistics of transporting the rocket to the launch site, setting up the launch complex, and executing the countdown and flight, demanding extensive infrastructure and highly trained personnel.

Distribution channels for sounding rockets are highly specialized, relying predominantly on Direct Channels due to the bespoke nature of the product and service. Government space agencies and military organizations typically procure rockets directly from certified prime contractors following lengthy contractual processes. Academic and research institutions often contract specialized commercial launch service providers who act as the direct conduit, providing both the vehicle and the launch infrastructure. Indirect distribution is minimal but occurs when large defense contractors subcontract specialized component manufacturing (upstream) or outsource certain non-critical logistics (downstream). The increasing adoption of standardized interfaces (like universal payload mounts) may slightly shift the model toward more accessible commercial brokers for standardized missions, but the core business remains driven by direct, highly customized service agreements focused on mission success.

The total value delivered across the chain relies heavily on maintaining an unbroken chain of certification and reliability. From the high-grade material providers in the upstream segment to the operational excellence of the launch teams in the downstream, failure at any point incurs severe financial and scientific penalties. The high barrier to entry due to capital investment in infrastructure and technical expertise limits the number of players, concentrating market power among integrated contractors who can manage both the manufacturing (upstream) and launch provision (downstream). The future evolution of the value chain is anticipated to see greater vertical integration by commercial players seeking to control costs and lead times, offering end-to-end mission services from concept validation to data delivery, thereby simplifying the procurement process for academic and private sector end-users globally.

Sounding Rocket Market Potential Customers

Potential customers for the Sounding Rocket Market are concentrated within highly specialized sectors requiring repeatable, high-altitude access for specific research and testing objectives. The primary End-Users/Buyers include national space agencies such as NASA, ESA, JAXA, and ISRO, which use sounding rockets as foundational tools for fundamental space physics, Earth observation, and preparatory missions for larger orbital projects. Military and defense departments represent another major customer group, utilizing these rockets for testing advanced reconnaissance payloads, verifying missile defense components in real atmospheric conditions, and conducting communications research, driven by national security priorities and substantial long-term funding cycles, often prioritizing high reliability and specialized trajectory capabilities.

Academic and Research Institutions constitute a vital segment, relying on sounding rockets for student training, postgraduate research in atmospheric sciences, and deploying novel instruments developed in university labs. These customers are highly sensitive to cost and seek vehicles that offer rapid deployment schedules to align with academic semesters and research grant timelines. They often collaborate directly with government agencies or specialized commercial launch providers to secure mission slots, valuing flexibility in payload specifications and access to diverse launch locations globally, including high-latitude sites crucial for auroral studies and magnetospheric interaction research, where sounding rockets provide unique observational opportunities.

The rapidly growing segment of potential customers is the Commercial Space Companies sector, including established aerospace prime contractors (testing components) and emerging start-ups focused on providing microgravity services or rapid technology validation. These buyers leverage sounding rockets for sub-orbital tourism platforms (in development), testing satellite subsystems (e.g., attitude control systems, solar arrays) under actual flight loads and vacuum conditions, and conducting materials science experiments that benefit from short bursts of microgravity. This segment prioritizes fast turnaround times and competitive pricing, favoring modular designs and reusable components, indicating a shift towards a service-oriented model where the customer is buying 'time in space' rather than purchasing the hardware itself, driving innovation in cost reduction across the value proposition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NASA, ESA, JAXA, ISRO, Lockheed Martin Corporation, Raytheon Technologies, Boeing, Northrop Grumman Corporation, Aerojet Rocketdyne, Thales Group, Mitsubishi Heavy Industries, German Aerospace Center (DLR), Brazilian Space Agency (AEB), Space Exploration Technologies Corp. (SpaceX), Exos Aerospace. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sounding Rocket Market Key Technology Landscape

The technology landscape of the Sounding Rocket Market is characterized by continuous evolution centered on improving reliability, increasing payload capacity relative to vehicle mass, and enhancing data retrieval capabilities. A primary area of focus is advanced propulsion systems, moving beyond traditional solid motors towards high-performance liquid and hybrid fuels that offer thrust vector control (TVC) capabilities, allowing for more precise trajectory adjustments and greater control over the vehicle's descent for recovery. Hybrid rockets, utilizing solid fuel and liquid oxidizers, are particularly attractive due to their inherent safety features, throttleability, and reduced environmental footprint compared to legacy propellants. Furthermore, material science advances, particularly the use of carbon fiber composites and lightweight alloys, are essential for reducing the structural mass of the rocket, thereby increasing the effective payload ratio and allowing higher apogees or heavier scientific instrumentation.

Telemetry and avionics represent another critical technological frontier. Modern sounding rockets are incorporating increasingly sophisticated, miniaturized GPS/INS (Inertial Navigation Systems) units combined with robust, high-bandwidth communication systems capable of handling the massive data streams generated by contemporary scientific instruments. The adoption of CubeSat standards for sub-orbital payloads is driving modularity and standardization, simplifying integration processes for researchers and reducing overall mission preparation time. Crucially, the development of reliable, autonomous flight termination and recovery systems, including improved parachute deployment mechanisms and soft landing technologies (sometimes incorporating controlled re-entry aids), is pivotal for ensuring the safe return of valuable payloads and reusable rocket components, which directly impacts the economic viability of future commercial missions and high-cadence campaigns.

Digital simulation and modeling software also play a profound role, enabling engineers to accurately predict aerodynamic performance, thermal stresses, and structural responses under various atmospheric conditions before a physical launch, reducing the need for costly iterative flight testing. This computational sophistication is being coupled with the aforementioned AI integration for real-time fault detection and adaptive flight control, ensuring that the mission remains optimal even in unforeseen circumstances. Ultimately, the successful deployment of sounding rockets relies on the maturation of technologies that enhance precision, minimize environmental impact, and streamline operational logistics, making sub-orbital research accessible, dependable, and scientifically superior compared to older generations of research vehicles. Investment in modular, multi-mission capabilities—where one vehicle design can accommodate vastly different payload types and altitude requirements—is defining the competitive edge.

Regional Highlights

Regional dynamics play a crucial role in shaping the Sounding Rocket Market, reflecting disparities in government spending, academic infrastructure, and technological maturity across continents. North America, led by the United States, remains a dominant force, characterized by substantial, long-standing funding from NASA and the Department of Defense. This region benefits from a highly mature industrial base, specialized launch facilities (like Wallops Flight Facility), and robust commercial sector participation, which drives continuous innovation in propulsion and recovery technologies. The focus here is often on high-altitude scientific research, advanced military testing, and the integration of AI for mission optimization, maintaining a leadership position in both technological capacity and overall market volume.

Europe, driven by the European Space Agency (ESA) and national centers like the German Aerospace Center (DLR) and the Swedish Space Corporation (SSC), holds a stable market share, concentrating heavily on atmospheric and microgravity research, often utilizing high-latitude launch ranges like Esrange Space Center. European programs emphasize international collaboration and the development of reusable vehicle technologies to enhance cost-efficiency and environmental sustainability. While the overall volume may be less than North America, European demand is characterized by high requirements for scientific precision and complex, multi-national mission execution, focusing on core academic research necessary for global climate and solar physics studies.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth throughout the forecast period, fueled by the aggressive space ambitions of nations such as China, India (ISRO), Japan (JAXA), and South Korea. These countries are rapidly investing in indigenous sounding rocket programs not only for scientific exploration but also for establishing domestic launch capabilities and demonstrating technological sovereignty. This region sees heavy utilization of solid-fuel rockets due to their reliability and relative ease of manufacture, catering to increasing domestic military requirements and expanding university-level research programs, making APAC a critical future growth engine driven by government mandates and economic expansion.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets, with activities generally focused on localized atmospheric research and collaborative missions supported by developed nations. Brazil's space agency (AEB) and associated launch sites contribute significantly to LATAM activities, particularly in equatorial atmospheric studies. In MEA, limited but strategic investments are being made, often targeting specialized defense applications and foundational space science education, leveraging partnerships to access necessary vehicle technologies and launch services. Growth in these regions is heavily dependent on sustained governmental funding and successful technology transfer agreements, gradually building capability in areas critical for regional climate monitoring and resource management, ensuring geopolitical relevance.

- North America (USA, Canada): Market leader; high technology adoption; focus on defense and high-altitude science; strong commercial service sector involvement; key driver for advanced avionics and reusable technology.

- Europe (Germany, Sweden, Norway): Mature market; emphasis on international collaboration and high-latitude atmospheric research; steady demand from DLR, ESA, and SSC; innovation in hybrid propulsion systems.

- Asia Pacific (China, India, Japan, South Korea): Fastest growing region; high government investment in domestic programs; dual-use capability (scientific and military); focus on solid fuel rockets and establishing sovereign launch capabilities.

- Latin America (Brazil): Emerging market; focus on equatorial atmospheric research; increasing domestic capability development; reliant on strategic international partnerships for technology infusion.

- Middle East and Africa (MEA): Niche market; driven primarily by defense requirements and entry-level space education programs; growth tied to technology transfer and foreign investment in specialized research areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sounding Rocket Market.- NASA (National Aeronautics and Space Administration)

- ESA (European Space Agency)

- JAXA (Japan Aerospace Exploration Agency)

- ISRO (Indian Space Research Organisation)

- Lockheed Martin Corporation

- Raytheon Technologies

- Boeing

- Northrop Grumman Corporation

- Aerojet Rocketdyne

- Thales Group

- Mitsubishi Heavy Industries

- German Aerospace Center (DLR)

- Brazilian Space Agency (AEB)

- Space Exploration Technologies Corp. (SpaceX) (via suborbital testing platforms)

- Exos Aerospace

- Blue Origin (via New Shepard suborbital system)

- Rocket Lab (via suborbital testing services)

- B2Space (high-altitude services)

- Swedish Space Corporation (SSC)

- Astra Space

Frequently Asked Questions

Analyze common user questions about the Sounding Rocket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a sounding rocket and a satellite launch vehicle?

Sounding rockets are sub-orbital vehicles designed for short, high-altitude flights (typically minutes in space) to gather data or test equipment, returning to Earth without achieving the orbital velocity required to remain in space indefinitely, unlike satellite launch vehicles which place payloads into permanent orbits.

What are the main scientific applications of sounding rockets?

Sounding rockets are crucial for atmospheric research (measuring temperature, pressure, wind, and composition), heliophysics (observing the Sun's effects on Earth's atmosphere), astronomy (above atmospheric interference), and conducting microgravity experiments for material science and biological research.

How does the commercialization of space impact the sounding rocket market?

Commercialization introduces new providers offering standardized, reusable, and cost-effective launch services, primarily catering to the rapidly growing Technology Demonstrators segment and private entities needing short-duration microgravity access for research and rapid prototyping, thereby expanding the traditional customer base.

What is the typical flight duration and altitude reached by a sounding rocket?

A typical sounding rocket flight lasts between 5 and 20 minutes from launch to splashdown. They usually reach altitudes ranging from 50 kilometers (mesosphere) up to approximately 1,500 kilometers (sub-orbital), depending on the specific mission profile and rocket configuration.

What types of propulsion systems are most commonly used in sounding rockets?

The most common propulsion systems are Solid Fuel rockets due to their simplicity and reliability. However, Liquid Fuel systems and Hybrid Fuel systems (offering better control and reusability potential) are increasingly being adopted for advanced missions requiring precise thrust modulation or environmentally friendly operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager