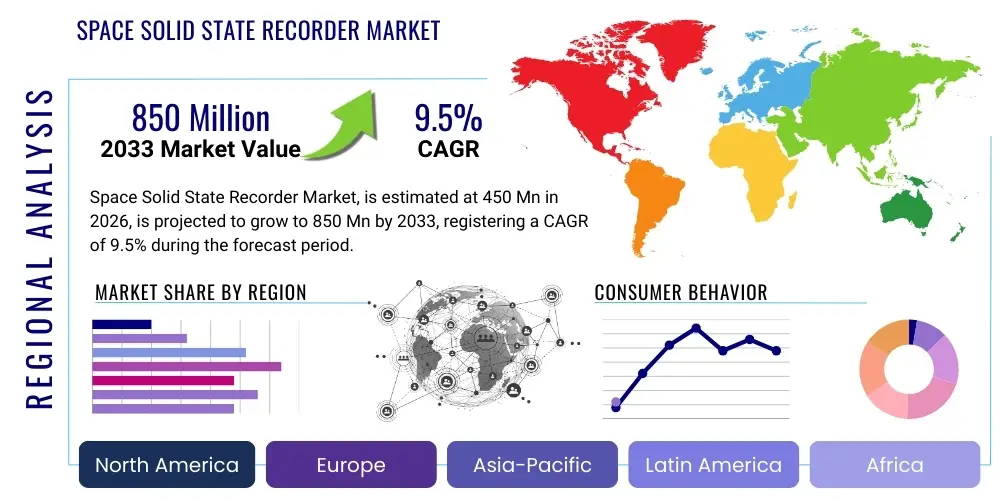

Space Solid State Recorder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441967 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Space Solid State Recorder Market Size

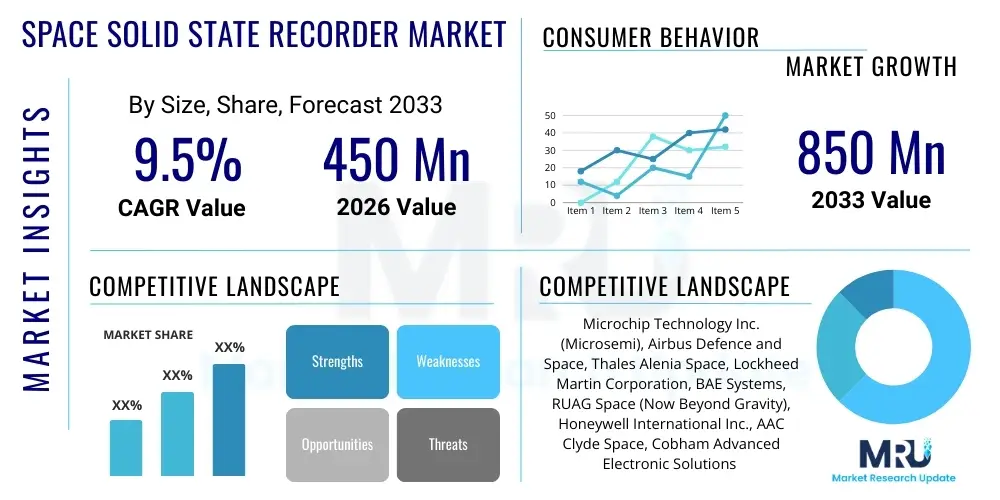

The Space Solid State Recorder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 850 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the exponential growth in satellite deployment, particularly within Low Earth Orbit (LEO) constellations, which demand reliable, high-speed, and high-capacity data storage solutions for advanced Earth observation, communication, and scientific missions. The increasing sophistication of on-board sensors, generating massive volumes of data, necessitates robust and radiation-tolerant Solid State Recorders (SSRs) capable of handling terabit-per-second throughputs before downlink, positioning them as mission-critical components for contemporary and future space architectures.

Space Solid State Recorder Market introduction

The Space Solid State Recorder (SSSR) market encompasses the design, manufacture, and integration of non-volatile memory devices specifically engineered for reliable operation in harsh space environments, characterized by high radiation levels, extreme temperature variations, and vacuum conditions. These devices utilize NAND or NOR flash memory technology combined with robust error correction mechanisms and radiation-hardened control electronics to ensure data integrity and system longevity over multi-year missions. Unlike older magnetic tape recorders, SSSRs offer vastly superior speed, reduced size, lower power consumption, and significantly enhanced resistance to mechanical failure, making them the standard choice for modern spacecraft data handling systems across all orbital regimes.

Major applications of SSSRs span across diverse sectors including Earth Observation (EO) satellites requiring high-speed data capture from synthetic aperture radar (SAR) and hyperspectral imaging sensors, scientific research missions demanding large buffer storage for complex sensor payloads, and military/intelligence satellites prioritizing secure, high-density data storage for surveillance and reconnaissance data. The increasing operational tempo of commercial space activities, driven by companies building vast communication megaconstellations, further expands the addressable market, as each satellite requires multiple SSSRs for mission data, telemetry, and software storage.

The core benefits derived from SSSRs—superior reliability, high transfer rates (essential for quickly transferring data from sensors to the recorder), and enhanced durability against physical shock during launch—are crucial driving factors. Technological advancements in memory density, coupled with the ongoing push for miniaturization in CubeSat and SmallSat platforms, enable more powerful data processing capabilities within tighter volume constraints, accelerating the adoption across new entrants and established primes alike. Furthermore, the regulatory emphasis on data security and redundancy in space systems bolsters the demand for customized, highly reliable storage solutions.

Space Solid State Recorder Market Executive Summary

The Space Solid State Recorder Market is experiencing profound shifts influenced by the rapid commercialization of space, moving from predominantly government-driven programs to a mixed landscape where commercial LEO operators dictate volume and cost efficiencies. Business trends highlight a strong focus on transitioning from expensive, custom-built radiation-hardened components to utilizing radiation-tolerant commercial off-the-shelf (COTS) memory coupled with advanced mitigation techniques, especially for short-duration or less-critical LEO missions. This shift facilitates faster development cycles and reduced unit costs, although traditional government and deep space missions continue to prioritize fully rad-hardened solutions, maintaining a bifurcated market structure between high-reliability, low-volume systems and high-volume, cost-optimized systems.

Regionally, North America maintains its dominance due to high investment from established defense and space agencies (NASA, DoD) and the pioneering presence of major commercial space players driving LEO constellation deployment. However, the Asia Pacific region, led by China, India, and Japan, is rapidly accelerating its space infrastructure development, focusing heavily on indigenous satellite manufacturing capabilities and sophisticated EO programs, translating into significant growth opportunities for SSSR manufacturers who can meet both cost and performance requirements. Europe remains a strong market anchored by ESA programs and robust commercial satellite manufacturers specializing in GEO communication platforms.

Segment trends indicate that the LEO satellite segment is poised for the fastest growth, primarily driving demand for SSSRs with capacities ranging from hundreds of gigabytes to several terabytes. Furthermore, the segmentation by component reveals increasing complexity in controller design; advanced controllers integrating robust Error Correction Code (ECC) mechanisms, such as BCH or LDPC (Low-Density Parity-Check) codes, are becoming essential to manage the degradation of high-density commercial flash memory in radiation environments. Application-wise, Earth Observation remains the principal consumer of high-throughput SSSRs, followed closely by military and defense applications requiring maximum data security and real-time processing capability.

AI Impact Analysis on Space Solid State Recorder Market

User queries regarding AI’s influence on Space Solid State Recorders frequently center on three key areas: the data volume explosion caused by AI processing requirements, the need for increased on-board computing (edge AI) necessitating faster data access, and the architectural changes required to support continuous, high-speed data flow between sensors, GPUs/FPGAs, and storage. Users are concerned about whether existing SSSRs can handle the instantaneous throughput demands generated by deep learning inference engines and if memory latency will become the bottleneck for autonomous space operations. The consensus theme suggests that AI is transforming SSSRs from simple data archives into active components of the data pipeline, demanding smarter controllers and significantly higher I/O capabilities for data manipulation and rapid triage.

The integration of artificial intelligence and machine learning (AI/ML) directly on-board spacecraft marks a paradigm shift for SSSRs. AI algorithms, particularly those used for image processing, anomaly detection, and autonomous navigation, require massive datasets to operate and perform inferences in real-time. This processing demands low-latency access to stored data and ultra-high-speed write capabilities to buffer intermediate results and processed data before downlink, thereby significantly increasing the required performance specifications for SSSRs, particularly their controller bandwidth and parallel access capabilities. SSSRs must now function more like high-performance compute accelerators rather than mere archival storage devices, adapting to non-sequential access patterns typical of computational workloads.

Furthermore, AI-driven mission autonomy is a critical application. For satellites performing advanced Earth observation or deep space exploration, AI is used to decide what data is valuable enough to transmit back, performing crucial data filtering and compression at the source (on-board). This process generates a continuous stream of filtered, high-value data which must be temporarily stored securely and quickly. SSSRs enable this workflow by providing the necessary persistent storage layer adjacent to the processing units, ensuring that the enhanced capabilities derived from AI—such as optimizing satellite operations, dynamic rescheduling, or rapid response to transient events—are not constrained by storage bottlenecks, thereby elevating mission efficiency and data utility significantly.

- Increased demand for ultra-high-speed interfaces (e.g., PCIe Gen 4/5 integration) between SSSRs and on-board AI processors (GPUs, specialized FPGAs).

- Requirement for smarter SSSR controllers capable of executing pre-processing tasks (e.g., compression, format conversion) autonomously to offload the main processing unit.

- Shift toward storage architectures supporting random access and parallel I/O operations optimized for neural network weights and intermediate tensor storage.

- Necessity for higher capacity SSSRs (multi-terabyte) to accommodate persistent training models and large volumes of raw input data required for on-orbit learning capabilities.

- Enhancement of built-in data integrity features to ensure reliable access to critical AI model parameters throughout the mission life.

DRO & Impact Forces Of Space Solid State Recorder Market

The dynamics of the Space Solid State Recorder market are fundamentally shaped by a confluence of escalating data generation rates (Driver), stringent radiation hardening requirements (Restraint), and the emergence of hybrid storage solutions (Opportunity). The primary impact force accelerating market growth is the explosive proliferation of LEO satellite constellations, particularly those geared towards commercial connectivity and enhanced Earth monitoring, which creates sustained high-volume demand. Conversely, the high non-recurring engineering (NRE) costs associated with qualifying components for deep space and high-radiation orbits act as a stabilizing restraint, ensuring that the market retains a high barrier to entry for new technological suppliers and maintains the dominance of established players with heritage technology. The market thus operates under high technical scrutiny where the tradeoff between cost efficiency and extreme reliability dictates procurement decisions.

Drivers: The increasing resolution and complexity of space-based sensors, including advanced synthetic aperture radar (SAR) systems and high-definition optical payloads, generate unprecedented volumes of raw data that must be stored on-board before transmission. This demand necessitates SSSRs with multi-terabyte capacities and continuous high-throughput capabilities. Furthermore, the reduced cost of launch services and the subsequent shortening of satellite lifecycles, especially in LEO, enable quicker technological refreshment cycles, allowing for the integration of newer, denser flash memory technologies more frequently, thereby driving the replacement and upgrade cycle. The global governmental prioritization of resilient and secure space infrastructure also fuels specialized demand for secure SSSRs with advanced encryption and physical security features.

Restraints: The most significant restraint is the need for extreme radiation tolerance (Total Ionizing Dose, Single Event Effects) and thermal vacuum stability. Qualifying COTS memory for these environments is complex, time-consuming, and expensive. Although COTS mitigation techniques are improving, the inherent vulnerability of high-density commercial flash to space radiation requires complex controller logic and robust shielding, increasing the system's size, weight, and power (SWaP) budget. Additionally, the fragmented and highly regulated space supply chain, particularly for specialized, high-reliability microelectronics, can lead to sourcing constraints and delays, impacting overall production scalability and market responsiveness.

Opportunities: Significant opportunities lie in the development of hybrid storage architectures combining volatile memory (SRAM/DRAM) with non-volatile SSSRs, optimized for on-board processing and rapid data triage, enhancing mission efficiency. The adoption of advanced communication standards (like Optical Inter-Satellite Links, OISL) necessitates corresponding SSSR read/write speeds, creating an opportunity for suppliers pioneering high-speed interfaces like PCIe and customized optical links. The rapidly growing small satellite sector (CubeSats, SmallSats) presents an opportunity for standardized, modular, and ruggedized SSSRs that balance performance and cost for highly proliferated constellations, moving away from bespoke, high-cost units.

Segmentation Analysis

The Space Solid State Recorder market is intricately segmented across various dimensions, reflecting the diverse requirements of different space missions and operational environments. Key segmentation criteria include the type of satellite utilizing the recorder, the orbit in which the satellite operates, the technological components comprising the recorder system, and the primary application driving the data storage necessity. This granular segmentation is crucial for vendors to tailor their products—balancing cost, capacity, throughput, and radiation tolerance—to specific market needs, ranging from cost-sensitive LEO communication satellites to mission-critical deep space probes demanding ultimate reliability and longevity. Understanding these distinct segments allows for targeted product development and market penetration strategies.

The segmentation by satellite type highlights the commercial shift, with LEO constellation satellites dominating unit volume, driving demand for cost-effective, high-throughput solutions. Conversely, military and scientific satellites, often GEO or highly elliptical orbit (HEO) platforms, prioritize resilience and capacity over initial unit cost. The component segmentation reveals where technological focus is highest; memory type (NAND/NOR/MRAM) dictates density and longevity, while the controller/interface (FPGA/ASIC) determines throughput and radiation mitigation effectiveness. This complex structure underscores the necessity for flexible, modular SSSR designs capable of meeting a spectrum of environmental and performance criteria.

- By Satellite Type:

- Small Satellites (CubeSats, Nano/Micro-satellites)

- Medium/Large Satellites (GEO, MEO Platforms)

- Scientific & Exploration Probes

- Military & Intelligence Satellites

- By Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Earth Orbit (GEO)

- Deep Space/Highly Elliptical Orbit (HEO)

- By Component:

- Memory Modules (NAND Flash, NOR Flash, MRAM, RRAM)

- Controller & Processor Units (FPGA-based, ASIC-based)

- Power Supply & Conditioning Units

- Interfaces & Housings (Connectors, Shielding)

- By Application:

- Earth Observation & Remote Sensing

- Communication & Navigation

- Scientific Research & Meteorology

- Military Surveillance & Reconnaissance

Value Chain Analysis For Space Solid State Recorder Market

The value chain of the Space Solid State Recorder market is complex, beginning with highly specialized upstream suppliers and culminating with sophisticated downstream satellite operators and end-users. The upstream segment is dominated by manufacturers of specialized, high-reliability microelectronics, particularly high-density NAND flash memory chips and radiation-tolerant Field-Programmable Gate Arrays (FPGAs) or Application-Specific Integrated Circuits (ASICs) that serve as the core controller. These suppliers are often highly concentrated, meaning the quality and availability of these specialized components significantly impact the entire value chain. Rigorous quality control and screening processes are applied at this stage to ensure components meet stringent space qualification standards, which significantly adds to the component cost compared to terrestrial counterparts.

The middle segment of the value chain involves SSSR system integrators and manufacturers. These companies take the specialized flash modules and controllers and integrate them into a complete, ruggedized recorder unit, incorporating custom Error Correction Code (ECC) logic, radiation shielding, thermal management systems, and standardized space interfaces (like SpaceWire, RapidIO, or MIL-STD-1553). This integration process is heavily dependent on proprietary intellectual property related to radiation mitigation and fault tolerance. The distribution channel is primarily indirect for large programs, relying on established satellite prime contractors (e.g., Airbus, Lockheed Martin) who procure SSSRs as subsystem components for integration into the final spacecraft bus. However, for the burgeoning small satellite market, direct sales models involving standardized SSSR modules are increasingly common, streamlining procurement for New Space companies.

Downstream, the end-users include government space agencies (e.g., NASA, ESA, JAXA), national defense organizations, and, increasingly, large commercial operators of communication and Earth observation constellations (e.g., SpaceX, OneWeb, Planet). These end-users dictate the performance metrics (capacity, throughput, longevity) based on their mission profile. The procurement process is highly formalized, often involving extensive qualification and heritage requirements, favoring vendors with proven flight experience. The value generated at this stage is derived from the successful execution of the mission, which is fundamentally dependent on the reliable data storage and retrieval capabilities provided by the SSSRs, justifying the high investment in these specialized systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 850 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microchip Technology Inc. (Microsemi), Airbus Defence and Space, Thales Alenia Space, Lockheed Martin Corporation, BAE Systems, RUAG Space (Now Beyond Gravity), Honeywell International Inc., AAC Clyde Space, Cobham Advanced Electronic Solutions (CAES), Teledyne Technologies Incorporated, Leonardo S.p.A, General Dynamics Mission Systems, Data Device Corporation (DDC), Space Micro Inc., SITAEL S.p.A., Clyde Space, STAR-Dundee, L3Harris Technologies, Inc., Exxelia International, Ramon.Space. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Space Solid State Recorder Market Key Technology Landscape

The technological landscape of SSSRs is defined by the ongoing struggle to balance high commercial memory density with the extreme reliability requirements of the space environment. A cornerstone technology is advanced Error Correction Code (ECC) implementation, particularly using Low-Density Parity-Check (LDPC) codes, which are highly efficient at correcting multi-bit errors introduced by radiation-induced Single Event Upsets (SEUs) or wear-out effects in high-density NAND flash. While older SSSRs relied on simpler BCH codes, the transition to smaller geometry flash nodes necessitates these more powerful algorithms to maintain data integrity over the mission lifespan. Furthermore, sophisticated scrubbing techniques—the background process of reading, correcting, and rewriting slightly corrupted data—are crucial, often managed by dedicated radiation-tolerant FPGAs acting as the central controller, ensuring continuous data reliability without impacting mission performance.

Another crucial technological development involves the implementation of radiation mitigation strategies, which range from specialized packaging and heavy shielding (traditional rad-hard approach) to active monitoring and redundancy techniques (rad-tolerant COTS approach). For COTS-based systems predominantly used in LEO, architectural innovations such as triplication or quad-redundancy schemes for critical control logic, coupled with selective component screening and temperature cycling during qualification, significantly enhance the operational lifetime. The memory technology itself is also diversifying; while traditional 2D NAND dominates, next-generation solutions, including 3D NAND and novel memory types like MRAM (Magnetoresistive RAM) and RRAM (Resistive RAM), are being explored for their potentially higher intrinsic radiation tolerance and superior endurance, particularly in applications requiring unlimited write cycles, though their space qualification remains a hurdle.

Interface technology is also a major focus, driven by the need to handle sensor data at petabit-per-second rates. Traditional space data buses like SpaceWire and MIL-STD-1553 are increasingly being supplemented or replaced by high-speed commercial interfaces adapted for space, such as PCIe (Peripheral Component Interconnect Express) and RapidIO, offering significantly higher bandwidth for communication between the SSSR, on-board processors, and sensors. The move towards standardized, high-speed interfaces facilitates the integration of advanced computing and AI capabilities, making the SSSR a more integral and responsive part of the overall spacecraft data handling architecture rather than an isolated storage unit. The focus on modular design, utilizing standardized protocols and form factors, is critical for supporting the mass production model demanded by mega-constellations.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share in the Space Solid State Recorder market, characterized by extensive government spending from agencies like NASA and the Department of Defense (DoD), driving demand for highly specialized, certified radiation-hardened SSSRs for deep space and strategic military applications. Furthermore, the region is home to leading commercial satellite operators (e.g., SpaceX, Amazon Kuiper) who are deploying massive LEO constellations, creating unparalleled volume demand for cost-optimized, high-performance SSSRs capable of rapid data capture and downlink. The technological innovation ecosystem, featuring leading component manufacturers and prime contractors, ensures continuous development of cutting-edge memory solutions and control electronics.

- Europe: Europe represents a mature and sophisticated market, primarily driven by the European Space Agency (ESA) and national space programs (e.g., CNES, DLR). The market here is characterized by high demand for robust SSSRs used in complex scientific missions (e.g., Copernicus, Galileo) and GEO telecommunication satellites requiring extremely long operational lifecycles (15+ years). Key European players emphasize heritage, system resilience, and compliance with strict European security standards, fostering a competitive environment focused on high-reliability, long-term performance rather than sheer volume.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market segment, fueled by ambitious national space programs in China, India (ISRO), and Japan (JAXA). These nations are heavily investing in indigenous satellite manufacturing, defense satellite capabilities, and regional navigation systems. The rapid deployment of high-resolution Earth observation satellites and the increasing push for domestic space exploration missions necessitate high-capacity SSSRs. The demand structure in APAC is often price-sensitive but rapidly moving towards high-performance requirements, presenting significant opportunities for vendors capable of localizing manufacturing or offering competitive COTS-based solutions integrated with robust mitigation strategies.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region represents an emerging market, primarily driven by governmental and military procurement of small and medium-sized satellites for telecommunication, resource monitoring, and security applications. While satellite ownership in this region is growing, the procurement of SSSRs often relies heavily on international contractors and established supply chains from North America and Europe. Key growth areas include countries expanding their national sovereign satellite capabilities and requiring initial flight heritage SSSRs, though volume remains lower compared to major space powers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Space Solid State Recorder Market.- Microchip Technology Inc. (Microsemi)

- Airbus Defence and Space

- Thales Alenia Space

- Lockheed Martin Corporation

- BAE Systems

- RUAG Space (Now Beyond Gravity)

- Honeywell International Inc.

- AAC Clyde Space

- Cobham Advanced Electronic Solutions (CAES)

- Teledyne Technologies Incorporated

- Leonardo S.p.A

- General Dynamics Mission Systems

- Data Device Corporation (DDC)

- Space Micro Inc.

- SITAEL S.p.A.

- Clyde Space

- STAR-Dundee

- L3Harris Technologies, Inc.

- Exxelia International

- Ramon.Space

Frequently Asked Questions

Analyze common user questions about the Space Solid State Recorder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial SSDs and Space Solid State Recorders (SSSRs)?

The fundamental difference lies in radiation tolerance and qualification. SSSRs are built using highly specialized radiation-hardened or radiation-tolerant components, coupled with advanced Error Correction Codes (ECC) and rigorous space qualification testing (thermal vacuum, shock) to ensure data integrity and operational longevity in harsh space environments, whereas commercial SSDs are designed only for benign terrestrial conditions.

How does the shift to LEO constellations impact the cost of SSSRs?

The demand from large LEO constellations drives down the cost per unit by prioritizing high-volume manufacturing and accepting slightly lower, but still robust, radiation tolerance (often using COTS mitigation techniques rather than purely rad-hard components) compared to traditional GEO or deep space missions. This market trend facilitates modular, more standardized SSSR designs.

What role does NAND flash memory density play in the future of SSSRs?

Increased NAND density allows satellites to store vastly more data within the same or smaller physical volume. However, higher density nodes are intrinsically more susceptible to radiation damage and wear-out, mandating continuous innovation in radiation mitigation techniques and more powerful ECC implementations to maintain mission reliability for multi-year operations.

Which interfaces are becoming standard for high-speed data transfer in modern SSSRs?

While legacy interfaces like SpaceWire and MIL-STD-1553 are still used, modern, high-throughput missions, especially those involving AI processing, are increasingly adopting high-speed commercial standards adapted for space, such as high-bandwidth versions of PCIe (Peripheral Component Interconnect Express) and customized RapidIO implementations, to manage the explosive growth in sensor data rates.

What is the estimated Compound Annual Growth Rate (CAGR) for the Space Solid State Recorder Market?

The Space Solid State Recorder Market is projected to experience a robust growth, estimated to achieve a Compound Annual Growth Rate (CAGR) of 9.5% between the years 2026 and 2033, driven by the expanding global satellite deployment and advanced data processing requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager