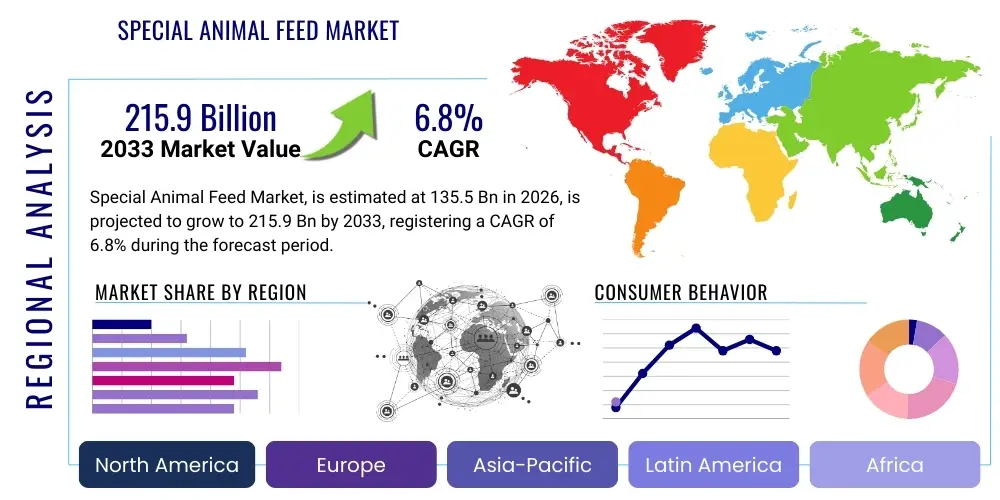

Special Animal Feed Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441820 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Special Animal Feed Market Size

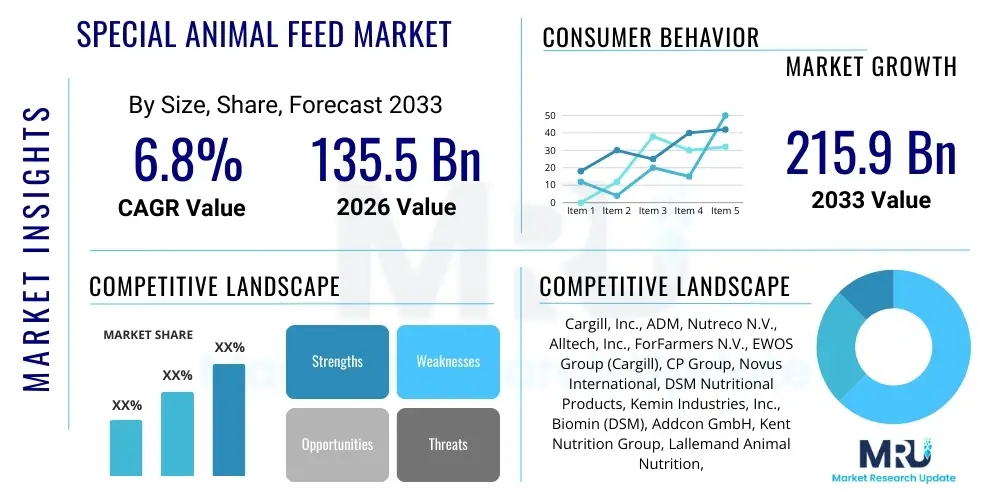

The Special Animal Feed Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 135.5 Billion in 2026 and is projected to reach USD 215.9 Billion by the end of the forecast period in 2033.

Special Animal Feed Market introduction

The Special Animal Feed Market encompasses a diverse range of nutritional products formulated beyond standard rations, targeting specific health outcomes, life stages, or productivity goals across various livestock, poultry, aquaculture, and companion animal sectors. These feeds often include high-performance additives, medicated premixes, functional ingredients (like prebiotics, probiotics, and essential oils), and specialized diets designed for disease management, enhanced growth efficiency, or improved meat/milk/egg quality. The complexity of these formulations requires advanced nutritional science and processing technologies, driving premium pricing and strong growth potential globally.

Major applications of special animal feeds revolve around optimizing production efficiency while addressing sustainability and animal welfare concerns. In livestock, specialized diets focus on reducing methane emissions, enhancing feed conversion ratio (FCR), and improving gut health to minimize antibiotic usage. For aquaculture, feeds are tailored for fast growth in specific salinity and temperature environments, often incorporating alternative proteins like insect meal or algae-based lipids. The primary benefit derived from this market is maximizing genetic potential and ensuring resilience against environmental stressors, leading to higher profitability for producers and safer food products for consumers.

Driving factors for market expansion include the rapidly increasing global demand for animal protein, particularly in developing economies, coupled with stringent regulatory pressures requiring reduction in antibiotic use (Antibiotic Growth Promoters - AGPs). Furthermore, consumer preferences are shifting towards ethically raised and specialty-fed animals (e.g., grass-fed, omega-3 enriched eggs), necessitating specialized dietary inputs. Technological advancements in feed processing, micro-ingredient encapsulation, and precision nutrition strategies also contribute significantly to the commercial viability and efficacy of these specialized feeds.

Special Animal Feed Market Executive Summary

The Special Animal Feed Market is characterized by robust business trends centered on sustainability and technological integration. Key manufacturers are focusing heavily on developing sustainable protein sources, such as microbial and insect proteins, to mitigate volatility in traditional feed commodity prices (soy and corn). There is a significant trend towards functional feed ingredients, including phytogenics and acidifiers, as producers seek effective, natural alternatives to antibiotics. Mergers and acquisitions remain a core strategy, allowing major players to consolidate specialized ingredient portfolios and expand geographic reach, particularly into high-growth markets in Asia Pacific.

Regional trends indicate that Asia Pacific holds the largest market share, driven by massive poultry and swine populations, alongside burgeoning aquaculture industries in countries like China, India, and Vietnam. However, North America and Europe lead in terms of technological adoption and stringent regulatory requirements concerning feed safety and animal welfare, driving demand for premium, highly specific nutritional solutions. Latin America is emerging as a critical growth hub due to increasing industrialization of livestock farming and rising domestic meat consumption, necessitating improved feed efficiency solutions.

Segment trends reveal that the Feed Additives segment, particularly those focused on gut health (probiotics and prebiotics) and enzyme technology, is experiencing the fastest growth. By livestock type, Poultry remains the largest consumer due to high turnover rates and intensive production systems, but the Aquaculture segment is rapidly gaining ground, fueled by the necessity for highly efficient, low-waste diets. Demand for specialized pet nutrition, focusing on life-stage and breed-specific requirements, also constitutes a significant and high-value segment within the broader market structure.

AI Impact Analysis on Special Animal Feed Market

Analysis of common user questions regarding AI's impact on the Special Animal Feed Market indicates strong interest in three main areas: predictive formulation accuracy, optimization of on-farm feed efficiency, and automation within the supply chain. Users frequently inquire about how machine learning can analyze complex biological data (genetics, health status, microflora) to create truly customized, real-time feed adjustments that minimize waste and maximize FCR. Concerns often revolve around the high initial investment cost, data privacy when integrating farm management systems, and the need for specialized personnel to interpret AI-generated insights. Expectations are high regarding AI's ability to drive the next generation of precision nutrition, moving beyond standardized diets to hyper-specific feeding regimens tailored to individual animal groups or even individual animals.

AI and machine learning algorithms are revolutionizing feed formulation by integrating vast datasets concerning ingredient variability, nutrient requirements, and external factors such as weather and disease pressure. This enables the creation of dynamic feed matrixes that adjust daily, ensuring optimal cost and performance targets are met, reducing reliance on expensive safety margins common in traditional formulation methods. Furthermore, predictive modeling powered by AI helps anticipate supply chain disruptions and ingredient quality fluctuations, allowing procurement teams to adjust sourcing strategies proactively and ensuring uninterrupted production of specialized feeds.

The implementation of IoT sensors, coupled with AI analytics, is enabling precision livestock farming, directly influencing the demand for and efficacy of special feeds. Cameras and sensors monitor animal behavior, feed intake, and weight gain, feeding data back into AI systems that recommend precise adjustments to specialized feed delivery systems. This level of granularity improves animal welfare outcomes, reduces the environmental footprint of farming operations, and ensures that specialized, high-cost feeds are utilized with maximum efficacy, justifying the premium price point to the end-user.

- AI-driven Predictive Formulation: Optimization of nutrient profiles based on real-time commodity prices and biological efficacy data.

- Precision Feeding Systems: Utilizing machine learning and IoT data for individualized or group-specific feed delivery and adjustments.

- Supply Chain Optimization: Forecasting ingredient availability and quality, minimizing sourcing risks for specialized components.

- Disease Detection & Prevention: Early identification of health stress via behavior monitoring, prompting tailored specialized nutritional interventions.

- Enhanced R&D Efficiency: Accelerating the discovery and testing of novel functional ingredients and feed additives.

DRO & Impact Forces Of Special Animal Feed Market

The dynamics of the Special Animal Feed Market are heavily influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O). Key drivers include the escalating global demand for high-quality, sustainably produced animal protein, which necessitates improved FCR achieved through specialized nutrition. Simultaneously, regulatory shifts, particularly in developed regions, demanding the phase-out of routine antibiotic use (AGPs) forcefully push producers toward non-antibiotic feed solutions like probiotics, organic acids, and phytogenics. These regulatory and consumer pressures constitute a significant positive force propelling innovation and adoption of specialized feed products.

However, the market faces notable restraints. High raw material price volatility, driven by climate change impacts and geopolitical instability, directly affects the cost of manufacturing premium specialized feeds, potentially limiting uptake in price-sensitive markets. Furthermore, the complexity and high investment required for advanced feed processing technologies (like extrusion and micro-encapsulation) act as barriers to entry for smaller manufacturers. Regulatory heterogeneity across different countries regarding the approval of novel functional ingredients also slows down global market penetration, requiring customized product launches and extensive regional testing.

Opportunities for growth are concentrated in the rapid expansion of aquaculture and companion animal nutrition, which require highly specialized, value-added products that command higher margins. The move towards precision livestock farming, supported by digital technologies, creates opportunities for integrated specialized feed solutions that maximize real-time performance. Furthermore, the development of sustainable, novel protein sources (e.g., microbial, algae, and insect meals) presents a long-term opportunity to secure the supply chain and cater to ecological market demands. These forces—sustainability demands, technological enablement, and regulatory challenges—together determine the market trajectory.

Segmentation Analysis

The Special Animal Feed Market is highly segmented based on livestock type, ingredient type, form, and application, reflecting the diverse nutritional needs across the animal industry. Segmentation allows manufacturers to target specific performance requirements, such as enhanced eggshell quality in poultry or improved disease resistance in shrimp, thereby maximizing product efficacy and market penetration. Ingredient segmentation, particularly between basic ingredients and high-value additives, highlights the shift toward functional nutrition designed to enhance physiological processes rather than merely supplying basic energy and protein.

Further analysis of segmentation reveals critical sub-segments that are outpacing general market growth. For instance, within feed additives, the segment dedicated to gut health modulators (prebiotics, probiotics, and essential oils) is witnessing exponential demand due to the global push for antibiotic reduction. By application, the segment focused on stress and immune system management is growing rapidly, driven by intensive farming conditions and increasing environmental volatility. Understanding these granular segments is crucial for strategic investment and product development, enabling companies to capture niche, high-margin opportunities.

Geographic segmentation is also highly relevant, as different regions prioritize distinct segments based on local regulations, dominant livestock types, and consumer purchasing power. For example, North America and Europe show high demand for specialty pet foods and non-GMO feeds, while Asia Pacific drives the volume growth for specialized aquaculture and swine diets. This differentiation mandates localized marketing and supply chain strategies to effectively address regional nutritional priorities and regulatory frameworks.

- By Ingredient Type:

- Nutritional Additives (Vitamins, Amino Acids, Minerals)

- Functional Additives (Enzymes, Probiotics, Prebiotics, Phytogenics, Organic Acids)

- Specialty Ingredients (Alternative Proteins, Hydrolyzed Proteins)

- By Livestock Type:

- Poultry Feed (Broilers, Layers, Turkeys)

- Swine Feed (Sow, Starter, Finisher)

- Cattle Feed (Dairy, Beef)

- Aquaculture Feed (Fish, Shrimp, Mollusks)

- Companion Animal Feed (Dogs, Cats, Others)

- Equine and Others

- By Form:

- Pellets

- Crumble

- Mash

- Liquids

- Premixes

- By Application:

- Growth Promoters and Yield Enhancement

- Health and Wellness (Immune Support, Gut Health)

- Specialty Diets (Medicated, Life-stage specific)

- Coloration and Quality Improvement

Value Chain Analysis For Special Animal Feed Market

The value chain for the Special Animal Feed Market begins with upstream activities involving the sourcing and processing of core ingredients (e.g., corn, soy, fish meal) and specialized, functional inputs (e.g., synthesized amino acids, fermentation-derived probiotics). This stage is characterized by high capital investment in biotechnology and ingredient research to ensure quality, stability, and bioavailability of the specialized components. Risk management at this stage involves securing contracts for novel ingredients and mitigating volatility in commodity prices, often requiring global sourcing networks and sophisticated logistics to maintain cost-effectiveness.

The midstream processing stage, involving feed manufacturing, is highly technical, particularly for specialized feeds. It requires advanced processes like extrusion, pelletizing under controlled temperature and pressure, and micro-encapsulation of sensitive ingredients (like vitamins and enzymes) to ensure they survive processing and reach the animal's gut intact. Quality control and formulation precision, often supported by AI systems, are paramount here to meet the exact specifications demanded by specialized diets. Manufacturers invest heavily in modern feed mills capable of handling small, precise doses of high-value additives, preventing cross-contamination, and ensuring product safety.

Downstream distribution channels move the finished specialized feed products to the end-users. This involves both direct and indirect routes. Direct sales often cater to large, integrated farming operations and specialty pet food retailers, allowing manufacturers to provide tailored technical support and consulting services regarding feed protocols. Indirect channels utilize regional distributors, cooperative farmer networks, and specialized veterinary suppliers, particularly for small to mid-sized farms. Effective distribution requires specialized warehousing to maintain product integrity (especially for temperature-sensitive probiotics or medicated feeds) and a strong network of technical sales experts capable of demonstrating the return on investment (ROI) of the premium specialized feeds to the producers.

Special Animal Feed Market Potential Customers

Potential customers for the Special Animal Feed Market are diverse, spanning the entire spectrum of animal production and ownership, but are generally unified by the need for enhanced performance, specific health outcomes, or adherence to high quality standards. Large-scale industrial livestock and poultry producers, especially those operating integrated production systems, represent the core buyer segment. These commercial entities require volume, consistency, and measurable performance benefits (such as low FCR or high productivity) to justify the premium cost of specialized feeds, viewing them as crucial investments in profitability and efficiency.

The aquaculture sector forms another critical customer base, including marine and freshwater fish farms and shrimp producers. These end-users demand specialized extruded feeds that are highly palatable, water-stable, and formulated to minimize environmental pollution while maximizing rapid growth in dense farming environments. Since feed constitutes a significant proportion of aquaculture production costs, these buyers are intensely focused on FCR and nutrient utilization efficiency offered by specialized products, including feeds based on novel proteins.

Furthermore, specialized segments such as companion animal owners, equine performance centers, and veterinary clinics constitute high-value niches. Pet owners, increasingly focused on pet wellness and longevity, drive demand for specialized, life-stage specific, and functional feeds (e.g., joint support, weight management, hypoallergenic formulas). Veterinary professionals serve as crucial influencers and direct buyers of medicated or highly specific recovery diets. Lastly, small to medium-sized independent farmers seeking niche market access (e.g., organic, antibiotic-free certification) are growing customers for specialized functional and natural feed supplements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 135.5 Billion |

| Market Forecast in 2033 | USD 215.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., ADM, Nutreco N.V., Alltech, Inc., ForFarmers N.V., EWOS Group (Cargill), CP Group, Novus International, DSM Nutritional Products, Kemin Industries, Inc., Biomin (DSM), Addcon GmbH, Kent Nutrition Group, Lallemand Animal Nutrition, De Heus Animal Nutrition, Land O'Lakes, Inc., Zinpro Corporation, Phibro Animal Health, Vilofoss, Provimi (Cargill) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Special Animal Feed Market Key Technology Landscape

The technological landscape of the Special Animal Feed Market is dominated by innovations aimed at improving nutrient stability, bioavailability, and manufacturing precision. A critical technology is micro-encapsulation, which involves coating sensitive functional ingredients like vitamins, enzymes, and live probiotics. This process protects them from degradation during harsh feed processing conditions (high heat, steam) and ensures targeted release within the animal's digestive tract, significantly boosting their efficacy and enabling the inclusion of previously unstable components in pelleted feeds. Similarly, sophisticated feed milling technologies, including high-precision blending and particle size reduction equipment, are essential for ensuring homogenous distribution of micro-ingredients within complex specialized premixes.

Another area of intense technological focus is the development and commercial scale-up of novel protein processing techniques. This includes advanced fermentation systems used to produce single-cell proteins (like yeast or bacteria meal) and optimized bioconversion processes for insect farming (e.g., black soldier fly larvae). These technologies address sustainability concerns and raw material constraints by providing high-quality, traceable protein alternatives to traditional soy and fishmeal, reducing dependence on volatile agricultural commodities and lowering the ecological footprint of animal farming. Continuous research in optimizing bioreactor efficiency and downstream purification is driving down the cost of these premium ingredients.

Furthermore, digital technologies form the backbone of modern specialized feed management. Near-Infrared Reflectance (NIR) spectroscopy is increasingly used in quality control for rapid, accurate analysis of nutrient content in incoming raw materials and finished specialized feeds, allowing for immediate adjustments to formulation. Integrated data management systems, leveraging cloud computing and edge analytics, link feed mill production data with on-farm performance metrics (via IoT devices), creating a feedback loop crucial for the continuous optimization of customized special feed programs. These precision technologies ensure that high-value feed investments translate directly into measurable performance gains for the producer.

Regional Highlights

The global Special Animal Feed Market exhibits distinct consumption patterns and growth trajectories across major geographical regions, influenced by population density, regulatory environment, and prevailing farming practices. Asia Pacific (APAC) stands as the dominant and fastest-growing region, driven primarily by the high concentration of poultry and swine farming, robust growth in the aquaculture sector, and rising per capita consumption of meat and dairy in rapidly industrializing nations like China, India, and Southeast Asia. The regional focus often centers on productivity-enhancing additives and disease mitigation strategies tailored for intensive farming systems, with strong governmental support for modernization of the feed industry.

North America (NA) represents a mature market characterized by stringent feed safety regulations and a strong emphasis on animal welfare and sustainable practices. Demand in NA is heavily skewed towards high-value special feeds, including performance-enhancing supplements for beef and dairy cattle, specialized pet nutrition, and antibiotic-free diets (raised without antibiotics - RWA). The adoption rate of precision feeding technologies and data analytics in this region is significantly high, enabling sophisticated, customizable feed solutions that maximize genetic potential and minimize environmental impact.

Europe, similar to North America, emphasizes premium, traceable, and sustainable feed solutions, but is particularly noteworthy for its pioneering role in banning AGPs and promoting novel ingredients like phytogenics and organic acids as replacement therapies. European demand is driven by strong regulatory frameworks (e.g., EU Feed Hygiene Regulations) and high consumer demand for welfare-certified and specialty-label products (e.g., organic dairy feeds). Latin America (LATAM) shows significant potential, driven by the expansion of beef and poultry exports and the modernization of feed mills, leading to rising demand for specialized products that improve feed conversion and quality control.

- Asia Pacific (APAC): Highest volume market driven by poultry and aquaculture growth; high demand for functional ingredients to manage high-density farming risks.

- North America (NA): Focus on precision nutrition, RWA (Raised Without Antibiotics) feeds, specialty dairy supplements, and premium pet food formulations.

- Europe: Regulatory leader driving demand for AGP alternatives (phytogenics, organic acids), high uptake of sustainable and traceable feed ingredients.

- Latin America (LATAM): Emerging powerhouse with increasing industrialization of livestock and strong export focus, demanding improved FCR through specialized mineral and enzyme blends.

- Middle East and Africa (MEA): Growing poultry sector and increased investment in localized aquaculture, creating niche demand for specialized climate-resilient feed formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Special Animal Feed Market.- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Nutreco N.V.

- Alltech, Inc.

- ForFarmers N.V.

- CP Group (Charoen Pokphand Foods PCL)

- Novus International

- DSM Nutritional Products (including Biomin)

- Kemin Industries, Inc.

- Addcon GmbH

- Kent Nutrition Group

- Lallemand Animal Nutrition

- De Heus Animal Nutrition

- Land O'Lakes, Inc.

- Zinpro Corporation

- Phibro Animal Health

- Vilofoss

- Adisseo (Bluestar Adisseo Co., Ltd.)

- Provimi (Cargill)

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the Special Animal Feed market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Special Animal Feed Market?

The primary driver is the accelerating global shift towards reducing or eliminating antibiotic growth promoters (AGPs) in livestock production, compelling producers to adopt specialized functional feeds like probiotics, prebiotics, and phytogenics to maintain animal health and productivity.

How do specialized feeds contribute to sustainable livestock production?

Specialized feeds improve Feed Conversion Ratio (FCR), meaning less feed is required per unit of output (meat, milk, or egg). Additionally, specialized formulations, including enzyme additives, enhance nutrient digestibility, reducing nutrient excretion (nitrogen and phosphorus) and minimizing the overall environmental footprint.

Which segment of specialized feed additives is experiencing the highest growth rate?

The functional additives segment, specifically prebiotics, probiotics, and phytogenics (plant-derived compounds), is experiencing the highest growth, driven by their effectiveness as natural alternatives for gut health modulation and immune system support, substituting for traditional antibiotics.

What role does technology play in modern specialized feed formulation?

Technology, particularly Artificial Intelligence (AI) and Near-Infrared Reflectance (NIR) spectroscopy, enables precision nutrition by allowing for real-time analysis of ingredient composition and dynamic formulation adjustments, ensuring optimal nutrient delivery and cost efficiency for complex special diets.

What is the largest geographical market for special animal feeds globally?

Asia Pacific (APAC) represents the largest geographical market, fueled by the vast scale of swine and poultry industries, coupled with rapidly expanding and technologically advanced aquaculture farming operations across key countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager