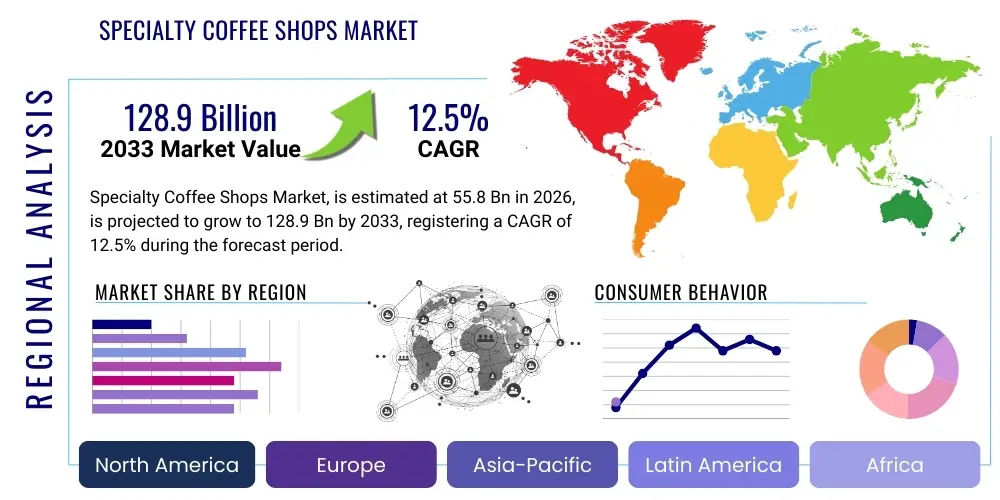

Specialty Coffee Shops Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443638 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Specialty Coffee Shops Market Size

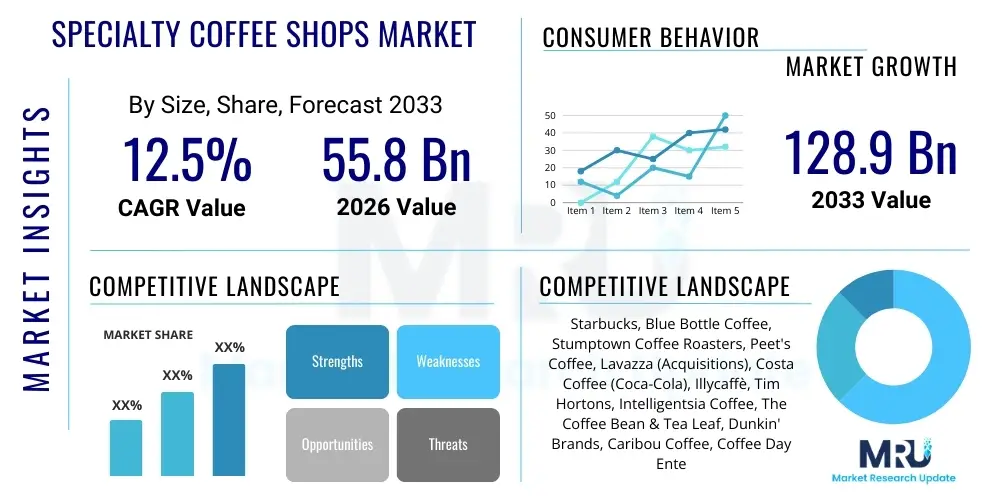

The Specialty Coffee Shops Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 55.8 Billion in 2026 and is projected to reach USD 128.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing consumer awareness regarding ethically sourced and high-quality coffee beans, coupled with rising disposable incomes across key emerging economies. The shift from basic commodity coffee consumption towards experiences centered around origin, brewing methods, and atmospheric retail environments is fundamentally restructuring the competitive landscape.

Specialty Coffee Shops Market introduction

The Specialty Coffee Shops Market encompasses retail establishments primarily focused on selling high-grade coffee, defined by rigorous quality standards, traceability, and ethical sourcing practices, often adhering to the 'third wave' coffee movement principles. These products generally include single-origin coffees, meticulously crafted espresso drinks, and advanced brewing methods such as pour-over, siphon, and cold brew, distinguishing them significantly from conventional mass-market coffee outlets. The core offering is not merely caffeine delivery but a curated consumption experience emphasizing flavor profiles, bean varietals, and the expertise of baristas. Major applications of specialty coffee shops include serving as informal business meeting spaces, recreational social hubs, and remote working environments, reflecting their integration into the modern urban lifestyle and contributing to increased average transaction values compared to standard coffee establishments.

Key benefits driving consumer adoption include superior flavor quality and complexity, the satisfaction derived from supporting sustainable and direct trade practices, and the value of the unique third space experience offered by these venues. Specialty coffee shops often invest heavily in aesthetically pleasing interior design, highly specialized equipment, and staff training to ensure consistency and enhance customer loyalty. This commitment to quality acts as a significant competitive differentiator. Furthermore, specialty shops frequently offer ancillary products such as artisanal pastries, light food options, and retail bags of freshly roasted beans, broadening their revenue streams and reinforcing their status as lifestyle destinations rather than just beverage retailers.

The market is predominantly driven by sustained urbanization, particularly in Asia Pacific, which increases demand for accessible social venues and high-end consumer goods. Demographic shifts, including the growing purchasing power of millennials and Generation Z, who prioritize authenticity, ethical consumption, and sensory experiences over sheer volume, further fuel demand. The proliferation of digital platforms for coffee education and consumption reviews amplifies consumer sophistication, making them more discerning about bean origin and preparation techniques. Consequently, market players are continually innovating, introducing unique brewing technologies, enhancing personalization through mobile ordering applications, and expanding their footprint through localized community engagement strategies to capture this increasingly sophisticated consumer base.

Specialty Coffee Shops Market Executive Summary

The Specialty Coffee Shops Market is currently undergoing significant transformation, characterized by robust globalization of boutique coffee culture and intensified focus on supply chain transparency. Business trends indicate a consolidation within the middle-tier segment, while niche, highly localized micro-roasters continue to thrive by emphasizing exclusivity and hyper-local sourcing partnerships. Technological integration, particularly in operational efficiency and customer engagement, is a defining factor, with leading players leveraging advanced point-of-sale systems and AI-driven inventory management to reduce waste and enhance service speed. Sustainability remains a central business imperative, moving beyond simple fair trade certifications towards comprehensive environmental, social, and governance (ESG) reporting, driven by investor and consumer demands for ethical business practices.

Regionally, North America and Europe maintain dominance, primarily due to established coffee cultures and high consumer spending capacity, but the Asia Pacific (APAC) region is poised for the most rapid expansion throughout the forecast period. This acceleration in APAC is fueled by the burgeoning middle class in countries like China, India, and Indonesia, which are rapidly adopting Westernized coffee consumption habits, often bypassing traditional instant coffee preferences entirely and moving directly to specialty consumption. Latin America, though primarily a production region, is also seeing internal growth in specialty retail, driven by local producers seeking to capture higher domestic value. Regional specialization often dictates market characteristics; for instance, European markets prioritize artisanal preparation and historical café culture, while North American markets emphasize convenience and digital integration.

Segmentation trends reveal significant growth in the "Direct-to-Consumer (D2C)" roasted bean segment, driven by pandemic-era shifts towards at-home premium coffee consumption, supported by subscription models. The "Single-Origin" and "Micro-Lot" categories within the product type segmentation are experiencing above-average growth rates as consumers seek unique flavor profiles and heightened traceability. Furthermore, the segmentation by ownership type shows independent specialty shops maintaining high market influence through their agility and ability to cater to hyper-specific local tastes, though established chains are strategically acquiring or partnering with these independents to gain competitive edge in key urban centers. The rapid adoption of cold brew and ready-to-drink (RTD) specialty coffee variants also represents a critical segment trend influencing future market development, particularly among younger demographics seeking convenient, premium refreshment.

AI Impact Analysis on Specialty Coffee Shops Market

Analysis of common user questions reveals significant interest surrounding how Artificial Intelligence (AI) can enhance the personalized specialty coffee experience, improve operational logistics, and maintain the artisan quality synonymous with the market. Users frequently inquire about AI's role in predicting peak demand times to optimize staffing, the potential for machine learning algorithms to fine-tune espresso extraction parameters based on environmental variables or bean density, and the implementation of robotic baristas—a topic often met with both curiosity and apprehension regarding the displacement of skilled human labor. Key themes revolve around balancing efficiency gains with preserving the 'human touch' critical to the specialty coffee shop ambiance. Users expect AI to seamlessly support baristas, not replace them, focusing on tasks like inventory management, predictive maintenance of expensive equipment, and personalized menu recommendations tailored to individual past purchase data.

A primary concern addressed by users is data privacy related to personalized recommendations, alongside the operational cost versus benefit analysis for independent specialty shops considering complex AI systems. Users recognize AI's capability in supply chain optimization—forecasting global bean price volatility and optimizing procurement strategies—which directly impacts the ability of shops to maintain stable pricing and product quality. The expectation is that AI-powered analytics will allow shops to better trace the sustainability credentials of their beans, addressing the consumer demand for transparency. Furthermore, AI tools are being viewed as crucial for targeted marketing and loyalty program management, ensuring promotions are highly relevant and increase customer lifetime value, moving beyond generic discount offers toward true personalization.

The practical application of AI is already visible in back-of-house operations where computer vision systems monitor waste and ensure compliance with complex preparation standards, particularly in high-volume specialty chains. Future implications suggest AI will be integrated into quality control during the roasting process, utilizing sensors to monitor roast profiles and make real-time adjustments to achieve optimal flavor development, thereby enhancing product consistency which is paramount in the specialty segment. This technological adoption is essential for shops looking to scale their operations without compromising the meticulous standards required by the specialty coffee consumer, ensuring that technological integration ultimately enhances the quality and uniqueness of the end product.

- AI-driven personalized marketing and loyalty program optimization.

- Predictive analytics for inventory management and waste reduction based on demand forecasting.

- Optimization of espresso extraction parameters and brewing consistency using machine learning.

- Robotics implementation for repetitive tasks like dosing and tamping, enhancing efficiency.

- Supply chain traceability and sustainability verification using blockchain and AI tracking.

- Automated preventative maintenance scheduling for high-precision brewing equipment.

- Chatbots and conversational AI for enhanced digital customer service and order modification.

DRO & Impact Forces Of Specialty Coffee Shops Market

The Specialty Coffee Shops Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces determining market trajectory. A primary Driver is the increasing consumer willingness to pay a premium for high-quality, ethically sourced products, often driven by sophisticated consumer education and media coverage emphasizing bean origin and artisanal preparation methods. This is coupled with the powerful socio-cultural trend of coffee shops functioning as essential "third spaces," supporting remote work and social interaction in densely populated urban areas. The opportunity lies in the rapid expansion into emerging markets, particularly in Asia, where coffee consumption per capita is significantly lower than in established markets but growing exponentially, providing untapped potential for specialty brands willing to adapt their offerings to local tastes and consumption patterns.

However, the market faces several significant Restraints, most notably the high operational costs associated with specialty operations, including the procurement of expensive, traceable green beans, the investment required for high-end equipment, and the necessity of highly trained, specialized barista labor, which often leads to elevated salary overheads. Furthermore, market saturation in key metropolitan areas, particularly in North America and Western Europe, intensifies competition, compressing profit margins for independent operators. External impact forces, such as climate change, pose a long-term restraint by threatening the supply stability and quality of specific high-altitude Arabica bean varietals essential for the specialty market. Geopolitical instability in coffee-producing regions also introduces volatility in sourcing and pricing, requiring robust risk management strategies from market participants.

Impact forces are further magnified by regulatory shifts concerning food safety, waste management, and sustainable packaging, requiring continuous investment in compliance and innovation. The opportunity to mitigate these risks and enhance competitiveness lies in technological adoption—specifically, leveraging advanced digital platforms for customer relationship management (CRM) and supply chain transparency (e.g., blockchain). Furthermore, market players can capitalize on the growing demand for customization and niche products, such as specialized single-serve brewing devices, high-end cold brew concentrates, and hybrid café models integrating retail or shared workspace concepts. Successfully navigating the balance between maintaining premium quality standards and managing escalating input costs will be crucial for sustainable growth and market leadership in the forecast period.

Segmentation Analysis

The Specialty Coffee Shops Market is systematically segmented based on various operational and consumer dimensions to provide granular insights into market dynamics and growth potential. Key segmentation criteria include the type of coffee product offered (e.g., Single Origin, Blends), the level of automation utilized in the shop (e.g., Traditional Manual Brewing, Automated/Semi-Automated Systems), the nature of ownership (e.g., Independent, Chain), and the geographic distribution across continents and major economies. This structured approach allows market participants to tailor their strategic investments, product development, and geographic expansion efforts to specific high-growth areas within the complex specialty ecosystem. Understanding these segments is vital for identifying niche consumer preferences, evaluating competitive intensity, and forecasting regional consumption shifts.

A crucial segmentation area involves the type of operation, differentiating between dine-in specialty cafés that emphasize the atmospheric experience, quick-service specialty kiosks focused on high-volume convenience, and specialized roaster-retailers that combine on-site roasting with direct sales. Within the product segment, the shift towards non-dairy and plant-based alternatives for specialty drinks is rapidly evolving, driven by health consciousness and environmental concerns, requiring shops to diversify their milk and ingredient offerings significantly. Moreover, segmentation by price point separates ultra-premium, high-service establishments from high-quality, mid-range specialty concepts, each catering to different consumer demographics and spending habits, influencing location selection and operational models across the market.

The analysis of these distinct market segments reveals that the Independent/Micro-Roaster segment, despite facing capital constraints, demonstrates superior growth potential in terms of brand equity and consumer loyalty due to perceived authenticity and strong local ties. Conversely, the Chain segment leverages operational scale and standardization to penetrate new markets rapidly and efficiently. The ongoing interaction between these segments—through mergers, acquisitions, or strategic partnerships—will define the future competitive structure of the market, necessitating continuous monitoring of segment performance metrics and consumer preference shifts, particularly concerning digital integration and sustainability attributes, which are becoming non-negotiable consumer requirements across all segments.

- By Product Type:

- Single Origin Coffee

- Blended Coffee

- Cold Brew and Nitro Coffee

- Espresso-Based Drinks

- Non-Coffee Specialty Beverages (e.g., Specialty Teas, Matcha)

- By Format:

- Dine-in Cafes

- Takeaway Kiosks/Express Units

- Drive-Through Specialty Shops

- Roaster-Retailers

- By Ownership:

- Independent Specialty Shops

- National and Global Chains (Licensed and Company-Owned)

- Franchised Specialty Outlets

- By Application/End-User:

- Commercial/Office Consumption

- Residential Consumption (e.g., At-Home Retail Purchases)

- Food Service (Hotels, Restaurants)

Value Chain Analysis For Specialty Coffee Shops Market

The Specialty Coffee Shops value chain is intricate, starting significantly upstream with the cultivation, harvesting, and processing of high-quality green coffee beans, primarily Arabica varieties grown in specific microclimates across the 'Bean Belt' (Latin America, Africa, and Asia). Upstream analysis focuses heavily on the direct trade relationships established between specialty roasters and specific farms or cooperatives, bypassing traditional commodity brokers to ensure quality control, traceability, and fair pricing mechanisms. This emphasis on direct sourcing drives significant value by securing exclusive, high-scoring micro-lots and supporting sustainable farming practices. Challenges in the upstream segment include climatic variability, pest management, and the need for continuous investment in farm infrastructure to meet the demanding quality specifications required by specialty roasters, which often involve wet processing, specific drying techniques, and strict grading protocols.

The midstream process is dominated by transportation, warehousing, and, crucially, the meticulous roasting operation. Specialty roasting requires highly skilled operators and precise, technologically advanced equipment (roasters), as the profile development significantly impacts the final flavor complexity. Roasting is often done in small batches to maintain control and freshness, adding substantial value. The roasted beans are then distributed through two primary channels: direct sales to the specialty coffee shop's retail locations (internal distribution) or through specialized third-party distributors focused on supplying independent cafes, restaurants, and corporate offices (external distribution). This stage requires rigorous inventory control, humidity management, and rapid logistics to ensure the beans reach the shop during their peak flavor window, minimizing staling and preserving the specialty integrity.

Downstream analysis centers on the retail environment—the specialty coffee shop itself—where the final value-add is created through professional preparation, presentation, and service. This includes the highly skilled work of baristas who execute complex brewing techniques (e.g., pour-over, latte art) using expensive, precise espresso machines and grinders. The distribution channel at this stage is predominantly direct to the consumer through the physical shop premises, although e-commerce platforms and mobile ordering systems (Direct and Indirect Sales) are rapidly gaining importance, especially for packaged retail coffee and merchandise sales. The direct distribution model ensures control over the consumer experience, enabling shops to charge premium prices for the combination of high-quality product, personalized service, and unique ambiance, solidifying the Specialty Coffee Shops Market’s position as a premium retail segment.

Specialty Coffee Shops Market Potential Customers

The core potential customers for the Specialty Coffee Shops Market can be categorized broadly into three distinct groups: Affluent Urban Millennials and Gen Z Consumers, Corporate and Business Professionals, and the At-Home Coffee Enthusiast/Connoisseur. Affluent Urban Millennials and Gen Z represent the largest and fastest-growing segment, characterized by their high disposable income, strong affinity for premium, experience-driven products, and deep commitment to sustainability and ethical consumption. These consumers actively seek out shops that offer unique flavor profiles, aesthetically pleasing environments for social media engagement, and transparent sourcing narratives. Their purchasing behavior is heavily influenced by digital recommendations and the perceived authenticity of the brand, making them primary targets for high-end, independent specialty operators focusing on experiential retail.

Corporate and Business Professionals constitute the second significant segment, utilizing specialty coffee shops as de facto temporary offices, informal meeting locations, or premium break destinations. For this group, convenience, reliable Wi-Fi, high-quality consistency, and speed of service (often facilitated by mobile ordering) are paramount. Specialty shops located in or near central business districts, offering catering services or specialized corporate subscription accounts for office coffee programs, directly target this lucrative segment. Their demand is driven by the perceived value of premium coffee as a productivity and networking tool, often absorbing the premium price point as a business necessity or employee benefit.

The At-Home Coffee Enthusiast segment, particularly amplified post-pandemic, involves consumers who purchase specialty-grade roasted beans, specialized equipment (grinders, pour-over kits), and often take barista training courses themselves. These buyers are the end-users/buyers of the packaged retail product sold in the shops, often through subscription services or D2C channels. They are motivated by the desire to replicate the specialty café experience at home. Specialty shops serve as their primary source of expertise and supply. Successful engagement with this segment requires strong e-commerce presence, engaging educational content (e.g., brewing guides), and exclusive micro-lot offerings to maintain their loyalty and high average spend per transaction on non-beverage retail items. Targeting all three segments simultaneously through differentiated product and service offerings is key to maximizing revenue generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.8 Billion |

| Market Forecast in 2033 | USD 128.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starbucks, Blue Bottle Coffee, Stumptown Coffee Roasters, Peet's Coffee, Lavazza (Acquisitions), Costa Coffee (Coca-Cola), Illycaffè, Tim Hortons, Intelligentsia Coffee, The Coffee Bean & Tea Leaf, Dunkin' Brands, Caribou Coffee, Coffee Day Enterprises, High Brew Coffee, Toby's Estate Coffee, Campos Coffee, Workshop Coffee, Square Mile Coffee Roasters, Counter Culture Coffee, La Colombe Coffee Roasters. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Coffee Shops Market Key Technology Landscape

The Specialty Coffee Shops Market relies heavily on precision technology to maintain the high quality and consistency demanded by consumers. At the core are advanced espresso machines and high-precision grinders, often incorporating sophisticated temperature and pressure profiling capabilities, coupled with telemetric monitoring systems. These machines utilize PID (Proportional-Integral-Derivative) controllers to ensure hyper-accurate temperature stability, which is essential for consistent extraction and flavor maximization. Grinding technology focuses on achieving optimal particle size distribution uniformity, which directly impacts the clarity and balance of the final brewed cup. Furthermore, automated dosing and tamping systems are being integrated into semi-automatic equipment to reduce human variability and enhance throughput, ensuring that specialty standards are maintained even during peak rush hours, thereby balancing artisanal requirements with operational efficiency.

Beyond the preparation equipment, digital technology forms a critical layer of the specialty coffee landscape, significantly impacting customer interaction and back-of-house operations. Mobile ordering applications, integrated with advanced loyalty programs, allow for seamless customer experiences and valuable data collection used for targeted marketing and personalization. Advanced Point-of-Sale (POS) systems are evolving into complete business intelligence platforms, capable of tracking inventory down to the bean level, analyzing sales trends based on weather and time of day, and generating labor scheduling optimization reports. This shift towards data-driven operational management is crucial for specialty shops dealing with perishable inventory and high labor costs, enabling better forecasting and reducing financial risk associated with waste.

In the supply chain, traceability technologies are becoming standard practice, driven by consumer demand for ethical sourcing. Blockchain technology is emerging as a powerful tool to securely log and verify every step of the coffee bean journey, from farm gate to cup, ensuring transparency regarding pricing, processing methods, and sustainability certifications. Furthermore, the use of industrial IoT (Internet of Things) sensors in roasting facilities and storage environments allows for real-time monitoring of humidity and temperature, safeguarding the integrity of green and roasted beans. The integration of these technologies—from farm tracking systems to in-store automated brewing aids—demonstrates a commitment to technological excellence as a means of upholding the core tenets of the specialty coffee movement: quality, transparency, and consistency across the entire value chain.

Regional Highlights

- North America (NA): Dominates the market value due to mature specialty coffee cultures in the US and Canada, high disposable incomes, and the early adoption of third-wave concepts. Growth is driven by the expansion of established chains (e.g., Blue Bottle, Intelligentsia) and intense competition focused on cold brew innovation, drive-through convenience, and robust digital integration, particularly in high-density urban corridors.

- Europe: Characterized by a strong presence of traditional café culture intersecting with modern specialty concepts, particularly in Scandinavia, the UK, and Italy. The region emphasizes artisanal preparation, sustainability certifications, and micro-roastery growth. European consumers demonstrate a sophisticated understanding of origin and roasting profiles, driving demand for exclusive, small-batch offerings and specialized equipment retail.

- Asia Pacific (APAC): Projected to be the fastest-growing region, driven by rapid urbanization, Western influence, and a massive emerging middle class in countries like China, South Korea, and Japan. South Korea is a leader in specialty coffee consumption and technological adoption, while China represents a huge untapped growth market where consumption is rapidly shifting from tea to premium coffee experiences, often driven by aspirational consumer behavior.

- Latin America (LATAM): While historically a commodity export region, LATAM is experiencing internal market maturation, with local specialty roasters and cafes establishing strong domestic brands. Countries like Colombia, Brazil, and Guatemala are seeing increased domestic consumption of their high-quality beans, focusing on direct-producer relationships and promoting regional traceability and identity.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high wealth concentration and a strong café culture acting as a social hub. Demand here focuses on luxury presentation, high-end imported beans, and sophisticated atmospheric retail concepts. African countries are developing their own specialty retail markets, capitalizing on proximity to high-quality origins (e.g., Ethiopia, Kenya).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Coffee Shops Market, analyzing their strategic initiatives, geographical footprint, and product innovation efforts.- Starbucks Corporation

- Blue Bottle Coffee (Nestlé)

- Stumptown Coffee Roasters (JAB Holding Company)

- Peet's Coffee (JAB Holding Company)

- Lavazza Group

- Costa Coffee (The Coca-Cola Company)

- Illycaffè S.p.A.

- Intelligentsia Coffee (JAB Holding Company)

- The Coffee Bean & Tea Leaf (Jollibee Foods Corporation)

- Dunkin' Brands Group (Inspire Brands)

- Caribou Coffee (JAB Holding Company)

- Coffee Day Enterprises Ltd.

- High Brew Coffee

- Toby's Estate Coffee

- Campos Coffee

- Workshop Coffee Co.

- Square Mile Coffee Roasters

- Counter Culture Coffee

- La Colombe Coffee Roasters (Chobani)

- Tim Hortons (Restaurant Brands International)

Frequently Asked Questions

Analyze common user questions about the Specialty Coffee Shops market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines the 'Specialty Coffee' standard and how does it differ from commodity coffee?

Specialty coffee is defined by the Specialty Coffee Association (SCA) as beans scoring 80 points or above on a 100-point scale, requiring superior quality, distinct flavor attributes, and zero primary defects. Unlike commodity coffee, specialty beans emphasize traceability, ethical sourcing (often direct trade), and professional roasting/preparation, focusing on flavor complexity rather than volume.

Which regions are driving the highest growth rate in the Specialty Coffee Shops Market?

The Asia Pacific (APAC) region, particularly East and Southeast Asia, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by rising disposable income, rapid urbanization, and the adoption of Westernized premium consumption habits among younger demographics in markets like China and South Korea, offering substantial expansion opportunities.

How is sustainability impacting investment and consumer choice within the specialty coffee segment?

Sustainability is a core differentiator, moving beyond certifications to focus on comprehensive supply chain transparency (using technology like blockchain), fair pricing, and climate-resilient farming practices. Consumers highly prioritize shops demonstrating verifiable ethical sourcing and minimizing environmental footprint, influencing their willingness to pay a premium for certified sustainable products.

What technological innovations are reshaping the in-shop operational model?

Key technological innovations include AI-powered demand forecasting and inventory management, high-precision espresso equipment with real-time pressure profiling, and integrated mobile ordering systems. These tools aim to enhance product consistency, reduce operational waste, and speed up the customer transaction process while maintaining the artisanal quality expected in specialty venues.

What is the primary challenge faced by independent specialty coffee shops?

The primary challenge for independent specialty shops is managing the high operational expenditure, encompassing the elevated cost of premium green beans, investment in sophisticated equipment, and the necessity of highly skilled barista wages, compounded by intense competition and market saturation in primary urban zones.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager