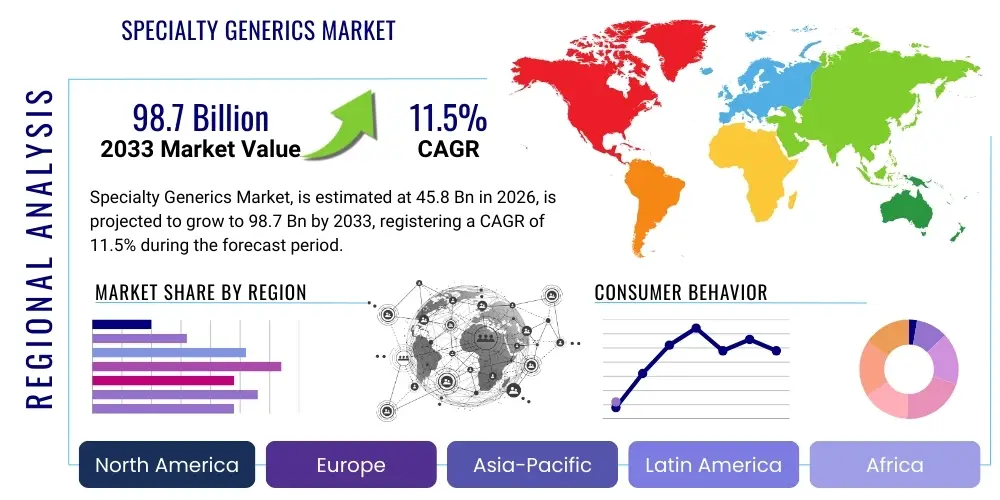

Specialty Generics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441831 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Specialty Generics Market Size

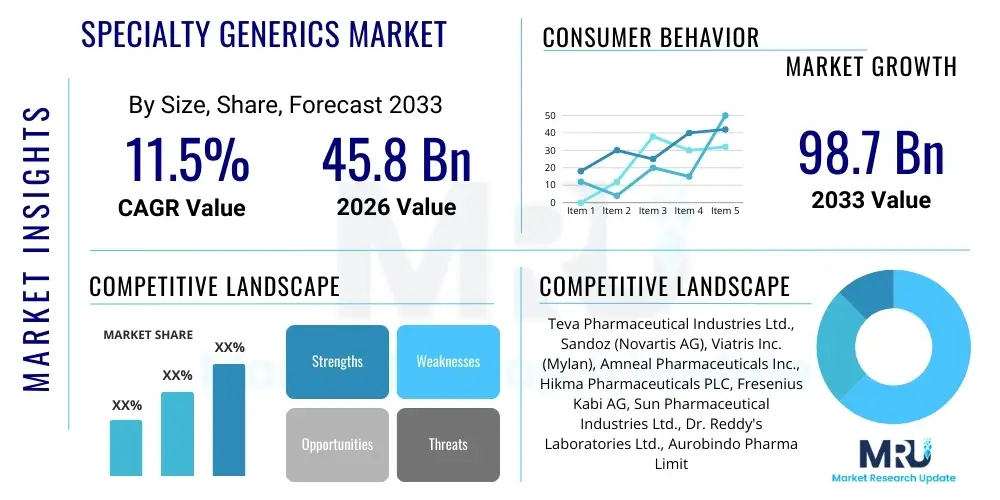

The Specialty Generics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 98.7 Billion by the end of the forecast period in 2033.

Specialty Generics Market introduction

The Specialty Generics Market encompasses generic versions of complex, high-cost biopharmaceuticals or drugs used to treat chronic, rare, or complex diseases such as oncology, autoimmune disorders, multiple sclerosis, and hepatitis C. These generics differ significantly from traditional commodity generics due to their sophisticated manufacturing processes, specialized handling requirements, and complex distribution channels, often involving exclusive specialty pharmacies. The critical distinction lies in the need for complex formulations, including injectables, biologics (biosimilars), and extended-release dosage forms, which necessitate rigorous regulatory scrutiny and advanced analytical testing to ensure therapeutic equivalence and patient safety.

The primary applications of specialty generics are concentrated in high-expenditure therapeutic areas where patent expirations of branded specialty drugs create significant cost-saving opportunities for healthcare systems and payers. The immediate benefit to consumers and healthcare providers is enhanced affordability and accessibility to life-saving treatments, drastically reducing the economic burden associated with chronic disease management. Furthermore, the introduction of specialty generics fosters market competition, compelling innovators to focus on next-generation therapies and driving continuous improvement in pharmaceutical efficacy and delivery methods, ultimately benefiting the patient population globally.

Driving factors in this market are intrinsically linked to the increasing prevalence of chronic conditions requiring specialty treatments, coupled with a robust pipeline of specialty drugs facing patent cliffs between 2026 and 2033. Regulatory pathways, especially those established by the FDA (e.g., 505(b)(2) pathway for complex generics and the establishment of biosimilar guidelines), are maturing, providing clearer routes to market for generic manufacturers. Additionally, aggressive cost-containment strategies adopted by major global payers, seeking to manage spiraling pharmaceutical expenditure, strongly incentivize the uptake and preference for specialty generic formulations over their branded counterparts, accelerating market expansion.

Specialty Generics Market Executive Summary

The global specialty generics market is characterized by robust commercial activity driven by patent expirations of blockbuster specialty medicines and increasing government focus on reducing healthcare spending through generic substitution. Key business trends include strategic collaborations between generic drug manufacturers and specialty pharmacy networks to manage complex patient services, mandatory Risk Evaluation and Mitigation Strategies (REMS), and controlled distribution channels. Manufacturers are heavily investing in analytical capabilities required to develop complex generic formulations, focusing particularly on large-molecule biosimilars, which represent the highest value opportunity within this segment. Market profitability remains high, although it is increasingly subjected to intense pricing pressure from Pharmacy Benefit Managers (PBMs) negotiating preferred generic placement on formularies.

Regionally, North America maintains market dominance due to its highly developed specialty drug infrastructure, high prescription volumes, and the aggressive implementation of generic substitution policies, particularly in the United States. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by expanding healthcare access, increasing disposable income, and government initiatives promoting local manufacturing and generic usage in countries like China and India. Europe also represents a mature but growing market, constrained slightly by varying national reimbursement policies but boosted significantly by the strong penetration of biosimilars, especially in Western European countries focused on fiscal responsibility in healthcare expenditure.

Segment trends indicate that the Oncology therapeutic area remains the most lucrative segment, given the extremely high cost and utilization of cancer treatments globally, making cost-effective generics critically important. By route of administration, the injectable segment, which includes complex sterile preparations and pre-filled syringes, holds the largest market share due to the nature of specialty diseases requiring parenteral administration, such as rheumatology and immunology treatments. Furthermore, the demand for non-biologic complex generics (e.g., liposomal drugs, complex peptides) is accelerating as manufacturers successfully navigate the technical hurdles associated with proving bioequivalence for these intricate dosage forms.

AI Impact Analysis on Specialty Generics Market

User queries regarding AI's influence on the Specialty Generics Market frequently revolve around three core themes: improving the speed and accuracy of complex formulation development, optimizing the regulatory pathway for demonstrating bioequivalence (especially for biosimilars), and enhancing supply chain predictability and security. Users are particularly concerned about how AI can address the significant R&D risk associated with complex generics—namely, the high failure rate in early development due to formulation stability or difficulties in achieving precise analytical comparability. The consensus expectation is that AI tools will drastically reduce the time and cost associated with preclinical testing and clinical trial simulation, thereby lowering the barrier to entry for specialty generic manufacturers and ensuring higher quality products reach the market faster. Furthermore, users anticipate AI-driven predictive analytics will play a pivotal role in demand forecasting and minimizing the risk of supply chain disruptions for these critical, often temperature-sensitive, medications.

The integration of Artificial Intelligence and Machine Learning (ML) is beginning to revolutionize the R&D pipeline for specialty generics by enabling rapid screening of excipients and optimizing process parameters for complex drug delivery systems, such as microspheres or nanoscale formulations. AI algorithms can analyze vast datasets concerning stability profiles, dissolution rates, and pharmacokinetic variability across different patient populations, predicting the optimal formulation characteristics that maximize stability and bioavailability while ensuring therapeutic equivalence to the reference product. This predictive modeling capability significantly reduces the reliance on traditional, time-consuming, and resource-intensive trial-and-error laboratory experiments, substantially accelerating the development timeline for technically challenging generic molecules.

Beyond the lab, AI is crucial for operational excellence and regulatory compliance in the specialty generics sector. AI-powered tools are being deployed for advanced quality control (QC), using image recognition and sensor data to monitor complex manufacturing processes like sterile filling and lyophilization, ensuring consistent quality and minimizing batch failure rates. In the regulatory domain, Natural Language Processing (NLP) is assisting in analyzing regulatory submission guidelines and prior approval documentation, ensuring comprehensive and compliant filings, particularly for abbreviated new drug applications (ANDAs) and biosimilar applications. This comprehensive technological adoption ensures that specialty generic firms can scale their operations efficiently while maintaining the stringent quality standards required for complex pharmaceutical products.

- AI optimizes complex generic formulation stability and bioavailability prediction.

- Machine Learning accelerates target identification and process optimization for biosimilar development.

- Predictive analytics enhances supply chain resilience and demand forecasting for high-cost generics.

- AI-driven quality control improves manufacturing consistency and reduces batch failure rates in sterile environments.

- NLP tools streamline regulatory submission analysis, ensuring faster time-to-market compliance.

DRO & Impact Forces Of Specialty Generics Market

The specialty generics market is shaped by a strong combination of economic drivers and technical restraints, balanced by significant strategic opportunities. The primary driver is the accelerating wave of patent expirations for specialty biologics and complex small molecules, which opens up massive revenue pockets for generic manufacturers seeking market entry. This driver is amplified by global healthcare cost-containment pressures, where payers actively encourage and mandate the use of lower-cost generic alternatives. However, the market is restrained by the inherent technical difficulty and capital-intensive nature of developing and manufacturing complex formulations or biosimilars, requiring specialized analytical infrastructure and stringent regulatory approval processes that often delay market entry. The major opportunity lies in entering underserved therapeutic areas, particularly rare diseases, and leveraging advanced manufacturing technologies to establish an early-mover advantage in biosimilar categories, leading to increased patient access and substantial market penetration.

Drivers: The global shift toward value-based healthcare models heavily relies on reducing pharmaceutical expenditure without compromising treatment quality. This macroeconomic imperative places substantial pressure on healthcare systems to prioritize specialty generics, which offer significant savings over their branded equivalents. Furthermore, the rising global prevalence of chronic diseases, notably cancer, autoimmune conditions, and diabetes, necessitates wider availability of affordable, specialized treatments, further bolstering demand. Regulatory support, particularly in the US and EU, through accelerated review programs for complex generics and streamlined biosimilar pathways, encourages pharmaceutical companies to invest heavily in this segment, viewing it as a reliable long-term growth area.

Restraints: The most significant restraint is the high technological barrier to entry. Developing specialty generics requires sophisticated analytical technologies to prove bioequivalence or biosimilarity, a process often costing hundreds of millions of dollars and several years. Litigious challenges from originator companies, aggressively defending their intellectual property and delaying generic market access, also pose substantial hurdles. Furthermore, establishing trust among physicians and patients regarding the efficacy and interchangeability of biosimilars remains an ongoing challenge that requires extensive educational efforts and careful marketing, particularly in sensitive therapeutic areas like oncology.

Opportunities and Impact Forces: Strategic alliances between specialty generic manufacturers and distribution partners, including specialty pharmacies and PBMs, present significant market opportunities by ensuring efficient cold chain management and patient support programs required for these complex medicines. The development of advanced drug delivery systems, such as long-acting injectables or targeted drug release mechanisms, offers a distinct technological advantage for manufacturers who can improve upon the dosing schedule or administration method of the original branded product. The overarching impact force is the undeniable push from governments and payers globally to reduce the cost of healthcare, ensuring that specialty generics will continue to gain market share aggressively across all major regional pharmaceutical markets.

Segmentation Analysis

The Specialty Generics Market is segmented primarily based on therapeutic application, route of administration, and distribution channel, providing a granular view of market dynamics. Therapeutic segmentation highlights the concentration of high-cost treatments where generic penetration offers the highest cost savings, while administrative segmentation reflects the technical complexity of drug delivery. Distribution channels are critical in specialty generics due to the need for specialized handling, temperature control, and often mandatory patient support services, differentiating them significantly from the distribution model of conventional generics. Understanding these segments is crucial for manufacturers in strategically prioritizing their R&D investments and commercialization efforts.

- By Therapeutic Application:

- Oncology

- Autoimmune Diseases

- Hepatitis C

- Human Immunodeficiency Virus (HIV)

- Multiple Sclerosis

- Growth Hormone Deficiency

- Others (Ophthalmology, Infertility, etc.)

- By Route of Administration:

- Injectable (Subcutaneous, Intravenous)

- Oral

- Ophthalmic

- Topical and Transdermal

- Inhalable

- By Distribution Channel:

- Specialty Pharmacies

- Retail Pharmacies

- Hospital Pharmacies

- Mail-Order Pharmacies

- By Type of Generic:

- Complex Generics (Liposomal, Nanoparticle)

- Biosimilars

- High-Potency Active Pharmaceutical Ingredients (HPAPIs)

Value Chain Analysis For Specialty Generics Market

The value chain for specialty generics is highly complex, beginning with intensive upstream research and development focused on demonstrating comparability and bioequivalence, requiring specialized analytical capabilities far beyond those needed for simple generics. The upstream phase involves sourcing high-quality, often complex, Active Pharmaceutical Ingredients (APIs) and critical excipients, followed by highly controlled and sterile manufacturing processes. Due to the nature of specialty drugs (many being injectables or requiring complex formulations), manufacturing must comply with rigorous Good Manufacturing Practices (GMP) under strict aseptic conditions. Successful patent litigation strategies and robust regulatory filing are integral components of the upstream value chain, determining the speed and feasibility of market entry.

The downstream component of the value chain is dominated by complex distribution and patient services. Unlike traditional pharmaceuticals, specialty generics often require cold chain logistics to maintain drug integrity, necessitating specialized packaging and transportation. Distribution channels are primarily centered around specialty pharmacies, which possess the requisite expertise to manage intricate reimbursement processes, handle limited-distribution drugs, and provide critical patient education and adherence support programs. Direct distribution from the manufacturer to the specialty pharmacy or hospital is common, minimizing the number of touchpoints and maintaining strict temperature control, reducing the risk of product degradation, which is paramount for high-cost, critical medications.

The reliance on specialized distribution channels, both direct and indirect, highlights the market's differentiation. Direct distribution often facilitates closer relationships between manufacturers and healthcare providers, enabling the deployment of proprietary patient support tools. Indirect distribution, leveraging major PBM-owned specialty pharmacies or independent regional specialty providers, ensures wide coverage and efficient formulary access. Payer negotiation and management of formulary placement by PBMs act as a pivotal point in the downstream value chain, significantly impacting market access and generic uptake rates, ultimately determining the commercial success of a specialty generic product.

Specialty Generics Market Potential Customers

The primary end-users and buyers of specialty generic products are integrated healthcare systems, major pharmacy benefit managers (PBMs), governmental health organizations, and specialized insurance providers, all of whom prioritize cost reduction in high-cost therapy areas. PBMs, such as Express Scripts and CVS Caremark, act as crucial gatekeepers, leveraging their substantial purchasing power to negotiate rebates and secure favorable formulary placement for specialty generics, thereby driving prescribing behavior across large patient populations. Hospitals and oncology centers are significant direct consumers, purchasing these generics for inpatient administration and treatment protocols, especially for life-threatening conditions.

Governmental purchasers, including Medicare, Medicaid, and national health services across Europe and Asia Pacific, represent the largest volume buyers, utilizing tenders and preferred drug lists to maximize savings through the adoption of biosimilars and complex generics. These entities view specialty generics as fundamental tools for fiscal sustainability, enabling them to expand access to expensive treatments while managing overall budget expenditures effectively. The end patients, although not direct buyers, are the ultimate beneficiaries; their access is mediated by the prescribing physician and the payer's coverage policies, making payer organizations the critical customer segment determining market demand and volume.

Specialty pharmacies are also key customers and integral partners, procuring large volumes of specialty generics and managing the complex dispensing process, including patient financial assistance and injection training. Their purchasing decisions are often dictated by contracts established with PBMs and manufacturers. Furthermore, academic research institutions and contract research organizations (CROs) serve as buyers for specialty generics when conducting comparative effectiveness studies or post-market surveillance trials, contributing indirectly to the establishment of clinical confidence and market growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 98.7 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Viatris Inc. (Mylan), Amneal Pharmaceuticals Inc., Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Aurobindo Pharma Limited, Zydus Lifesciences Ltd., Cipla Ltd., Wockhardt Ltd., Torrent Pharmaceuticals Ltd., Baxter International Inc., STADA Arzneimittel AG, Alvogen, Endo International plc, Pfizer Inc. (Hospira), Celltrion Healthcare Co., Ltd., Biocon Biologics Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Specialty Generics Market Key Technology Landscape

The specialty generics market is highly dependent on sophisticated analytical and manufacturing technologies required to meet the stringent criteria of regulatory bodies for complex products. A critical technology is advanced analytical characterization, utilizing techniques such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Nuclear Magnetic Resonance (NMR) to compare the structural integrity, purity, and functional properties of the generic product against the reference listed drug (RLD). For biosimilars, this technological toolkit is even more extensive, including bioassays, epitope mapping, and comparative clinical studies to establish functional and structural biosimilarity, ensuring the generic version elicits the same therapeutic effect and safety profile as the original biologic.

Manufacturing excellence is predicated on the use of aseptic fill-finish technology, especially for injectable specialty generics, which often require complex sterile processing under isolator technology to prevent microbial contamination. Furthermore, advanced drug delivery technologies, such as micro-encapsulation, liposomal technology, and sophisticated emulsion systems, are essential for creating complex generics (e.g., modified-release formulations or targeted drug delivery) that mimic or improve upon the pharmacokinetic profiles of the branded product. These technologies demand state-of-the-art facilities and high levels of automation to ensure consistency and large-scale viability, moving far beyond standard tablet or capsule manufacturing.

The emerging technological landscape is increasingly focused on continuous manufacturing processes and the integration of Quality by Design (QbD) principles, facilitated by Process Analytical Technology (PAT). PAT allows for real-time monitoring and control of critical quality attributes during manufacturing, significantly improving efficiency, reducing batch variation, and minimizing the risk of product failure. Furthermore, the adoption of specialized platform technologies for cell line development and protein purification is critical for the cost-effective and timely production of high-quality biosimilars, making technological superiority a major competitive differentiator in the specialty generics domain.

Regional Highlights

- North America: This region accounts for the largest market share, driven primarily by the lucrative US market. The high expenditure on specialty medications and aggressive strategies employed by Pharmacy Benefit Managers (PBMs) and payers to encourage generic and biosimilar uptake underpin market growth. Clear regulatory pathways for complex generics (505(j) and 505(b)(2)) and biosimilars have facilitated a rapid increase in product launches, particularly in therapeutic areas like immunology and oncology. The market is highly competitive, characterized by intense pricing wars among major generic players seeking preferred formulary status.

- Europe: The European market demonstrates significant biosimilar penetration, particularly in countries like Germany and the UK, due to centralized tendering and national health service mandates favoring the most cost-effective treatment options. While regulatory harmonization (EMA approval) simplifies market entry, pricing and reimbursement remain fragmented across national markets. Eastern European countries are emerging as significant growth areas due to improving healthcare infrastructure and strong governmental push for affordable specialty drugs.

- Asia Pacific (APAC): APAC is projected to experience the fastest growth rate globally. Key drivers include the large patient population base in countries such as India and China, increasing healthcare expenditure, and a growing number of local manufacturers specializing in complex generics and biosimilars. Government initiatives aimed at promoting domestic pharmaceutical manufacturing and facilitating faster approval processes for generics are key catalysts. Market access remains varied, with significant differences between highly regulated markets like Japan and rapidly expanding, developing markets.

- Latin America (LATAM): Growth in LATAM is spurred by increasing patent expiries and a focus on expanding public access to essential specialty medicines. However, market growth is often challenged by economic instability, bureaucratic regulatory procedures, and variable intellectual property protection across countries, making strategic prioritization crucial for manufacturers. Brazil and Mexico are the largest contributors to regional market revenue.

- Middle East and Africa (MEA): This region is characterized by significant investment in healthcare infrastructure, driven by oil-rich economies and a growing incidence of chronic diseases. The adoption of specialty generics is increasing due to partnerships with international manufacturers to establish local production hubs and reliance on international tenders for high-cost treatments. Regulatory frameworks are rapidly evolving to accommodate biosimilar approvals and substitution policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Specialty Generics Market.- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis AG)

- Viatris Inc. (Mylan)

- Amneal Pharmaceuticals Inc.

- Hikma Pharmaceuticals PLC

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Aurobindo Pharma Limited

- Zydus Lifesciences Ltd.

- Cipla Ltd.

- Wockhardt Ltd.

- Torrent Pharmaceuticals Ltd.

- Baxter International Inc.

- STADA Arzneimittel AG

- Alvogen

- Endo International plc

- Pfizer Inc. (Hospira)

- Celltrion Healthcare Co., Ltd.

- Biocon Biologics Ltd.

Frequently Asked Questions

Analyze common user questions about the Specialty Generics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between specialty generics and traditional generics?

Specialty generics are complex drugs, often biologics (biosimilars) or intricate small molecules, used to treat complex diseases (e.g., cancer, MS). They require specialized manufacturing, cold chain distribution, and patient support, differentiating them significantly from simple, mass-produced traditional generics.

Which therapeutic area drives the highest demand in the specialty generics market?

The Oncology segment currently drives the highest market demand and value due to the extremely high cost of branded cancer treatments and the growing incidence of various cancers globally, making affordable generic alternatives critically important for patient access and budget management.

What are the biggest restraints impacting the growth of specialty generics?

The major restraints include the substantial capital investment and technical expertise required for complex formulation development and achieving bioequivalence, coupled with aggressive patent litigation tactics used by originator companies to delay generic market entry.

How do Pharmacy Benefit Managers (PBMs) influence the specialty generics landscape?

PBMs are crucial in the specialty generics market as they control formulary placement and reimbursement. They leverage their purchasing volume to negotiate steep discounts and rebates, aggressively promoting specialty generics and biosimilars to achieve significant cost savings for health plans.

What is the projected Compound Annual Growth Rate (CAGR) for the market?

The Specialty Generics Market is projected to exhibit a robust growth trajectory with an estimated Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033, driven by patent expirations and increasing global cost-containment measures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager