Speedlight flashes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442372 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Speedlight flashes Market Size

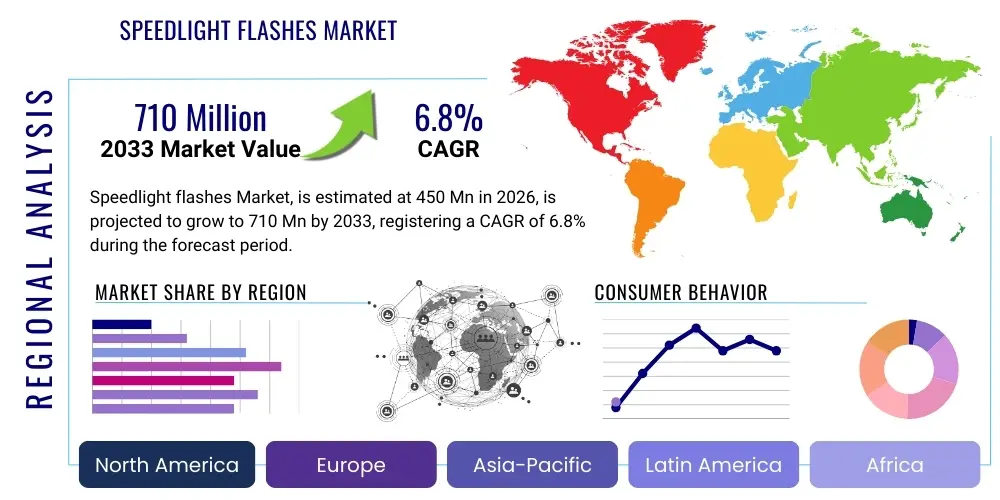

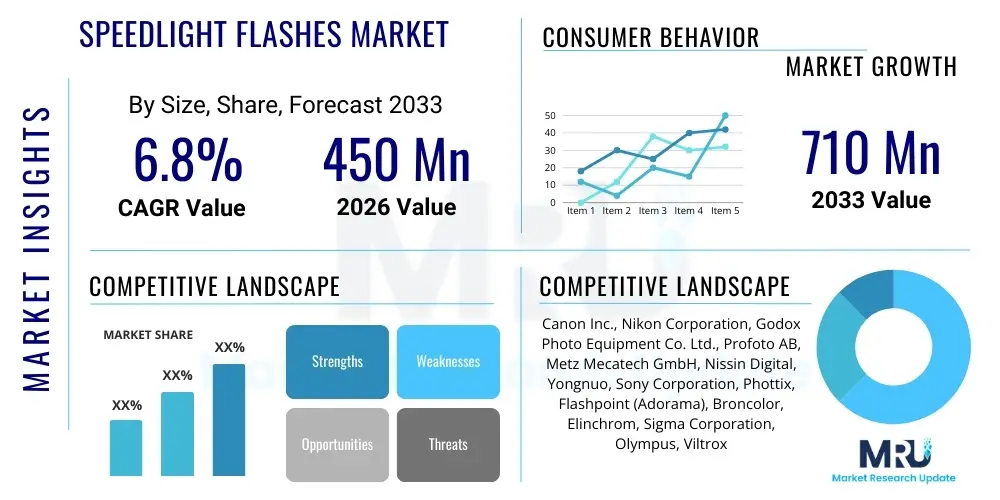

The Speedlight flashes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Speedlight flashes Market introduction

The Speedlight flashes Market encompasses the global trade and utilization of compact, portable electronic flash units designed primarily for digital single-lens reflex (DSLR) and mirrorless cameras. These devices, often referred to generically as external camera flashes or hot-shoe flashes, are essential tools for photographers seeking enhanced control over illumination, superior light quality compared to built-in flashes, and the ability to freeze motion effectively. The core function of a speedlight is to provide a brief, intense burst of light, allowing users to overcome challenging lighting conditions, minimize shadows, and achieve professional-grade results in portraiture, event photography, and macro applications. Technological advancements, particularly in Through-The-Lens (TTL) metering and wireless communication, have solidified speedlights as indispensable accessories for both professional studios and enthusiastic hobbyists, driving sustained market penetration across various photography disciplines.

Major applications for speedlight flashes span a wide range of photographic contexts, most notably professional wedding and event documentation where reliable, quick recycling times and flexible illumination are paramount. Furthermore, speedlights are extensively used in journalistic and sports photography for supplementary lighting, and increasingly in creative applications where the portability allows for complex, multi-light setups without the logistical burden of heavy studio strobes. The market benefits significantly from the continuous innovation cycles among camera manufacturers, which necessitate corresponding advancements in compatible flash technology, including high-speed sync (HSS) capabilities and advanced radio-frequency triggering systems. These technological synergies ensure that speedlights remain a highly relevant component in the digital imaging ecosystem, contributing substantially to the creative possibilities available to modern photographers globally.

The primary driving factors propelling the growth of the Speedlight flashes Market include the persistent expansion of the global content creation economy, marked by a burgeoning number of professional photographers and videographers requiring robust lighting solutions. The increasing accessibility and falling costs of advanced mirrorless camera systems also fuel demand for compatible, high-performance external flashes. Key benefits associated with speedlights—such as their extreme portability, versatility in providing bounce and diffused lighting, and sophisticated automation features like TTL—make them highly attractive investments. Moreover, the robust second-tier market offering feature-rich, cost-effective third-party speedlights broadens consumer choice and market accessibility, thereby sustaining a healthy competitive landscape and stimulating overall market volume growth.

Speedlight flashes Market Executive Summary

The global Speedlight flashes Market is characterized by robust technological integration and shifting competitive dynamics, primarily driven by the transition from traditional DSLR platforms to advanced mirrorless camera systems. Current business trends indicate a strong polarization in product offerings: high-end segments are dominated by premium brands focusing on complex radio-controlled systems, powerful output, and seamless TTL integration with proprietary camera bodies, while the mid-range and entry-level segments are highly contested by Asian manufacturers offering exceptional value through feature parity at significantly lower price points. A critical trend is the miniaturization of units combined with increased power efficiency, responding directly to the smaller form factor and increased battery life expectations set by mirrorless technology. This competitive pressure encourages rapid innovation in recycling speed and thermal management, ensuring speedlights can keep pace with high-frame-rate shooting capabilities.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by escalating consumer disposable incomes, a large base of emerging professional photographers, and the strong manufacturing presence of key third-party flash brands. North America and Europe, while mature markets, maintain high market values due to a large installed base of professional users who prioritize system reliability and brand loyalty, driving demand for premium, integrated solutions from established camera ecosystems (Canon, Nikon, Sony). Emerging markets in Latin America and Africa are showing accelerating adoption, influenced by the global spread of digital content consumption and the need for portable, affordable professional tools. Regulatory compliance concerning radio frequencies and electromagnetic compatibility (EMC) standards is becoming an increasingly important factor influencing product distribution across these major regions.

Segment trends reveal that the Off-Camera Flash (OCF) segment is experiencing significant growth, driven by the increasing popularity of sophisticated lighting techniques that utilize wireless control and multiple light sources. The TTL (Through-The-Lens) segment continues to hold the largest market share in terms of revenue, as ease of use and automated exposure calculation appeal strongly to event photographers operating under rapidly changing light conditions. However, the manual control segment remains robust, primarily serving specialized creative professionals and advanced hobbyists who require absolute consistency and precise power control. Compatibility segmentation shows increasing fragmentation, with universal or cross-brand compatible speedlights gaining traction, reflecting consumers' desire for flexibility when combining equipment from different manufacturers, thus slightly eroding the historical dominance of proprietary brand systems.

AI Impact Analysis on Speedlight flashes Market

User queries regarding AI's influence on the Speedlight flashes Market often revolve around whether AI-powered computational photography will render external flashes obsolete, or conversely, if AI can enhance the functionality of speedlights themselves. Key concerns focus on AI cameras' ability to simulate flash effects or correct for poor lighting in post-processing, thereby minimizing the perceived necessity of hardware accessories. Users are also keen on understanding how AI algorithms might be integrated into flash control systems to predict optimal exposure, manage complex multi-flash ratios, or even automatically learn lighting preferences based on previous shooting conditions. The overarching expectation is for AI to transform speedlights from manual tools into intelligent, adaptive components of the photographic ecosystem, capable of instantaneous environmental analysis and precise light modulation.

- AI integration into camera bodies may reduce reliance on basic fill-flash, but enhances sophisticated usage scenarios.

- Computational algorithms are being developed to optimize flash duration and intensity in real-time, improving TTL accuracy in complex scenes.

- AI can facilitate advanced facial and subject recognition for dynamic light sculpting and ratio balancing in multi-flash setups.

- Demand for AI-compatible communication protocols in speedlights is emerging to support predictive light setting adjustments.

- AI-driven post-processing software may create virtual lighting effects, potentially impacting the entry-level accessory market.

DRO & Impact Forces Of Speedlight flashes Market

The Speedlight flashes Market is shaped by a confluence of powerful dynamics: technological advancements in wireless control (Driver), intense competitive pricing pressures in the third-party segment (Restraint), and the expanding content creation industry requiring professional illumination tools (Opportunity). The primary driver is the continuous improvement in battery technology and radio frequency triggering systems, enabling highly reliable, portable, and fast off-camera lighting setups. However, the market faces significant restraint from the integration of powerful computational photography features in modern smartphones and mid-range mirrorless cameras, which can digitally compensate for some low-light scenarios. Impact forces include high initial investment costs for professional-grade systems and the dependency on proprietary hot-shoe interfaces, which create vendor lock-in but also drive brand-specific accessory sales.

Opportunities for growth are heavily concentrated in the development of modular and interoperable flash systems that can communicate across different camera brands effectively, mitigating the proprietary nature of the market. Furthermore, the rising adoption of hybrid photography/videography workflows presents an opportunity for manufacturers to integrate continuous LED lighting features into speedlights, enhancing their utility beyond traditional still photography. Geopolitical risks, intellectual property disputes related to TTL protocol reverse-engineering, and the volatility of component supply chains, particularly semiconductors used in high-performance power circuits, represent critical, high-impact forces that directly influence manufacturing costs and product availability, affecting overall market stability and pricing structure across all tiers of the market.

Restraints also include consumer confusion regarding the vast array of third-party options and complex technical specifications, which can deter entry-level users from purchasing external flashes, leading them to rely solely on camera computational capabilities. Moreover, the ecological movement is increasingly pushing manufacturers toward developing more sustainable, repairable products with long-lasting lithium-ion batteries, replacing reliance on disposable alkaline batteries. These environmental and consumer expectation shifts pose both a challenge and an eventual driver for responsible product development, requiring significant upfront investment in R&D for more efficient and durable power management systems to sustain long-term market viability.

Segmentation Analysis

The Speedlight flashes Market exhibits distinct segmentation based on application, operational mode (Type), and compatibility, reflecting the diverse requirements of photographers ranging from amateur enthusiasts to specialized studio professionals. Understanding these segments is crucial for manufacturers to tailor product features, pricing strategies, and distribution channels effectively. The application segmentation clearly delineates demand between event-based high-reliability usage (e.g., weddings, photojournalism) and controlled, creative studio environments. Operational mode distinguishes between user preference for automated ease (TTL) versus precise manual control. The compatibility segment underscores the market's entrenched dependence on specific camera ecosystems (Canon, Nikon, Sony), although cross-brand compatibility solutions are rapidly disrupting this traditional structure by offering greater system flexibility to multi-brand professionals.

Further granularity in segmentation involves factors such as guide number (output power), recycling speed, and battery type (AA vs. Li-ion). High guide number and fast recycling speed are non-negotiable requirements for professional event shooters, while rechargeable Li-ion batteries are increasingly preferred across all segments due to superior performance and reduced operational cost over time. The competitive landscape within these segments is fluid; while original equipment manufacturers (OEMs) dominate the premium TTL segment due to optimal integration, third-party players capitalize heavily on the manual and high-power segments where proprietary software integration is less critical. This segmentation analysis provides a roadmap for market penetration and product portfolio expansion based on identified gaps in features, pricing, or system interoperability.

- By Type:

- TTL (Through-The-Lens) Flashes

- Manual Flashes

- Hybrid (TTL/Manual) Flashes

- By Application:

- Professional Photography (Event, Portraiture, Photojournalism)

- Hobbyist and Enthusiast Photography

- Studio and Commercial Setup

- By Power Source:

- AA Battery Powered

- Lithium-Ion Battery Powered (Li-ion)

- By Compatibility:

- Canon E-TTL/E-TTL II Systems

- Nikon i-TTL Systems

- Sony ADI/P-TTL Systems

- Universal/Cross-Brand Radio Systems

Value Chain Analysis For Speedlight flashes Market

The value chain for the Speedlight flashes Market begins with upstream activities focused on the sourcing of critical electronic components, primarily high-voltage capacitors, IGBT transistors for switching, custom microcontrollers for TTL/radio communication, and advanced thermal management materials. Semiconductor suppliers play a non-negotiable role in determining the speed, reliability, and cost structure of the final product. Original Equipment Manufacturers (OEMs) often maintain tight control over the design and production of proprietary communication chips necessary for seamless TTL integration, creating a barrier to entry for third-party manufacturers who must reverse-engineer these protocols. Efficient upstream logistics are vital, especially given global supply chain constraints affecting electronic components, influencing the overall production lead times and final product pricing across the entire market spectrum.

Mid-stream activities involve the core manufacturing, assembly, quality control, and testing of the flash units. This stage is dominated by large-scale contract manufacturers, particularly in East Asia, who possess the necessary expertise for high-precision electronics assembly and rigorous thermal management testing essential for high-power devices. Distribution channels are bifurcated: Direct distribution (OEMs selling via brand stores and specialized photography retailers) leverages brand loyalty and offers premium service, while indirect distribution relies heavily on global e-commerce platforms (Amazon, B&H Photo, Adorama) and specialized regional distributors, which is the primary route for cost-competitive third-party brands. The choice of channel significantly impacts market reach, brand perception, and pricing flexibility for all market participants, determining profitability margins.

Downstream activities center on end-user engagement, post-sales support, and product education. The complexity of modern speedlight systems necessitates strong educational content (tutorials, workshops) provided by both manufacturers and retailers, fostering user proficiency and driving upgrades. Direct channels enable manufacturers to collect valuable end-user feedback for product iteration, particularly concerning firmware updates and compatibility issues, which are critical in a rapidly evolving camera technology landscape. The aftermarket segment, including diffusers, gels, and power packs, also constitutes an important part of the downstream value chain, providing ancillary revenue streams and enhancing the utility of the core speedlight product for end-users seeking specialized lighting effects.

Speedlight flashes Market Potential Customers

The primary end-users and potential buyers in the Speedlight flashes Market are highly segmented across professional, prosumer, and enthusiast demographics, each motivated by distinct purchasing criteria. Professional photographers, including those specializing in weddings, corporate events, and editorial work, constitute the highest-value customer base, prioritizing reliability, extremely fast recycling times (often facilitated by external battery packs), consistent power output (high guide number), and seamless TTL integration with their primary camera system. These users often invest in multi-unit setups and prioritize brand names known for robust build quality and extensive global support, making them the target market for premium-priced OEM and high-end third-party offerings.

The second major segment comprises advanced hobbyists and dedicated enthusiasts who seek significant creative control without the necessity of full studio strobe setups. These customers value versatility, portability (especially off-camera functionality), and excellent cost-to-feature ratios. They frequently purchase mid-range manual or hybrid speedlights from value-oriented brands that offer advanced features like built-in radio triggers and Li-ion battery convenience. This segment is highly sensitive to online reviews and technical specifications, often driving the adoption of innovative features originating from third-party manufacturers before they are integrated into OEM flagship models, thus representing a significant growth engine for the mass market.

Additionally, the emerging market of content creators, including professional vloggers and short-form video producers, increasingly represents a rapidly expanding customer base. While traditionally focused on continuous lighting, this group is adopting speedlights for high-quality product photography and stylized still images used for marketing and social media engagement. Their criteria emphasize compactness, integrated continuous LED video lighting functionality within the flash unit, and user-friendliness, often favoring solutions that are easily triggered via smartphone or dedicated small remote controllers, highlighting a growing demand for hybrid lighting solutions that bridge the gap between stills and video production needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Inc., Nikon Corporation, Godox Photo Equipment Co. Ltd., Profoto AB, Metz Mecatech GmbH, Nissin Digital, Yongnuo, Sony Corporation, Phottix, Flashpoint (Adorama), Broncolor, Elinchrom, Sigma Corporation, Olympus, Viltrox |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Speedlight flashes Market Key Technology Landscape

The technological landscape of the Speedlight flashes Market is currently defined by innovations aimed at enhancing portability, power efficiency, and seamless wireless connectivity. The transition from infrared (IR) optical triggering systems to robust 2.4 GHz radio frequency (RF) integrated transceivers represents the most significant shift, enabling photographers to control multiple off-camera flash units reliably over longer distances, often with complex group and ratio management capabilities. High-Speed Sync (HSS) technology, which allows the flash to synchronize with shutter speeds far exceeding the camera’s mechanical limit (typically 1/250th of a second), is now a standard feature in professional units, critical for overpowering ambient daylight and achieving shallow depth-of-field effects in bright conditions. Further advancements focus on precise thermal management systems, crucial for preventing overheating during rapid-fire sequences, thus ensuring performance consistency during demanding professional assignments.

A secondary, yet crucial, technological development is the widespread adoption of Lithium-Ion (Li-ion) battery technology in place of traditional alkaline or NiMH AA batteries. Li-ion power sources significantly reduce the unit’s overall weight, dramatically decrease recycling times (often down to 1.5 seconds at full power), and provide a more consistent, reliable power curve throughout the battery life. This shift addresses a key pain point for event photographers and constitutes a competitive differentiator for manufacturers. Concurrently, the sophistication of TTL metering systems continues to evolve, utilizing pre-flash measurement and advanced algorithms to calculate complex exposure settings more accurately, particularly when bouncing light off colored surfaces or when utilizing light modifiers such as softboxes and umbrellas.

Future technology trends point towards increased integration of continuous LED modeling lights within speedlight units, serving the burgeoning hybrid photographer market that switches frequently between high-resolution stills and video capture. Furthermore, proprietary communication systems are facing challenge from open-standard radio systems, driving demand for universal triggers and receiver technology that can interface with multiple camera brands' TTL protocols simultaneously. Research into smarter, modular flash heads—allowing users to quickly interchange Fresnel heads for concentrated light with round heads for softer, more natural light fall-off—is reshaping product design and enhancing user versatility without requiring separate investments in dedicated studio strobe systems. These iterative technological improvements ensure the sustained relevance of external flashes despite advancements in camera sensor sensitivity.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by high manufacturing output (particularly in China, housing major third-party brands like Godox and Yongnuo) and rapidly expanding consumer markets in India, Southeast Asia, and China. Increasing disposable income, coupled with a surge in digital content creation and professional photography schools, fuels high demand for both affordable, feature-rich speedlights and premium equipment.

- North America: North America holds the largest revenue share in the market, characterized by a mature professional photography industry and strong brand loyalty towards major OEMs (Canon, Nikon, Sony). The market here is defined by demand for high-end, reliable, battery-powered off-camera flash systems with sophisticated radio control, essential for professional wedding and studio work.

- Europe: Europe represents a significant and sophisticated market, demonstrating strong demand for innovation, particularly in sustainable power solutions and regulatory compliance (CE marking). Germany, the UK, and France are key contributors, emphasizing professional-grade equipment and advanced lighting modifiers, reflecting a high density of specialized photography studios and agencies.

- Latin America (LATAM): LATAM is an emerging high-potential region, where market growth is accelerating due to increased digitalization and social media penetration, driving demand for accessible, mid-range external flashes. Pricing sensitivity is high, favoring third-party brands that offer competitive features at lower cost points, necessitating robust localized distribution networks.

- Middle East and Africa (MEA): The MEA region shows steady growth, concentrated primarily in the Gulf Cooperation Council (GCC) countries where professional events and commercial photography thrive. Adoption is spurred by urbanization and the influx of international marketing and media production houses, requiring professional lighting tools, often imported through specialized distribution channels focusing on reliability in extreme climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Speedlight flashes Market.- Canon Inc.

- Nikon Corporation

- Godox Photo Equipment Co. Ltd.

- Profoto AB

- Metz Mecatech GmbH

- Nissin Digital

- Yongnuo

- Sony Corporation

- Phottix

- Flashpoint (Adorama)

- Broncolor

- Elinchrom

- Sigma Corporation

- Olympus

- Viltrox

- Cactus Image

- PowerLite

- Fujifilm Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Speedlight flashes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Speedlight flashes Market between 2026 and 2033?

The Speedlight flashes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period, reflecting strong demand driven by professional and enthusiast photographers adopting advanced wireless lighting systems.

How is the shift to mirrorless cameras impacting the demand for speedlights?

The shift to mirrorless cameras is driving innovation toward smaller, lighter, and more power-efficient speedlights, with increased integration of Li-ion battery technology and sophisticated radio triggering systems to meet the demands of high-frame-rate mirrorless shooting.

Which technology is currently the most significant driver of innovation in the speedlight market?

The most significant driver is the transition from infrared optical triggering to integrated 2.4 GHz radio frequency (RF) wireless communication, enabling robust off-camera control, multi-flash setups, and seamless High-Speed Sync (HSS) capabilities over longer distances.

Do third-party speedlight manufacturers pose a major threat to Original Equipment Manufacturers (OEMs)?

Yes, third-party manufacturers, particularly those based in the APAC region like Godox and Yongnuo, pose a significant competitive threat by offering feature parity, including TTL and HSS, at substantially lower price points, capturing substantial market share in the enthusiast and budget-conscious professional segments.

What are the primary advantages of Lithium-Ion powered speedlights over traditional AA battery models?

Lithium-Ion powered speedlights offer significantly faster recycling times (often under 1.5 seconds at full power), reduced overall weight, a more consistent power output curve, and lower long-term operational costs compared to units relying on disposable or rechargeable AA batteries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager