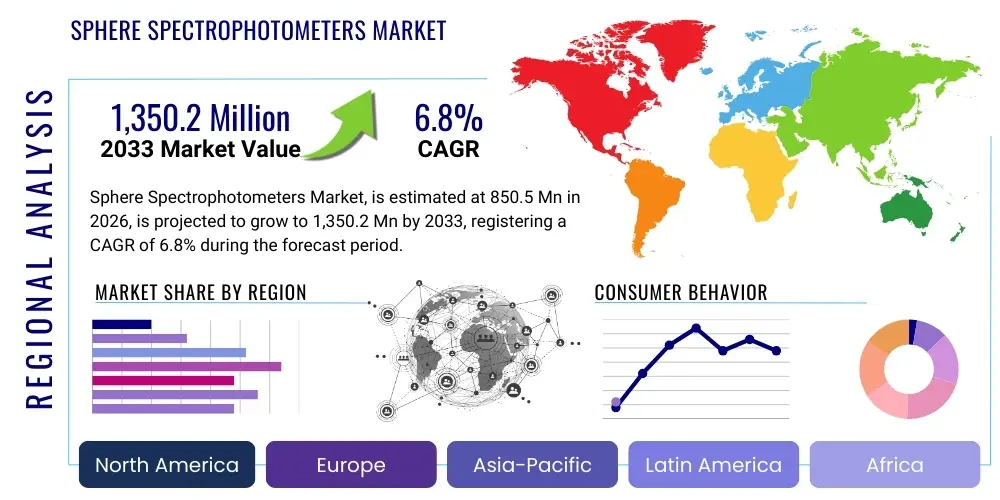

Sphere Spectrophotometers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441672 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Sphere Spectrophotometers Market Size

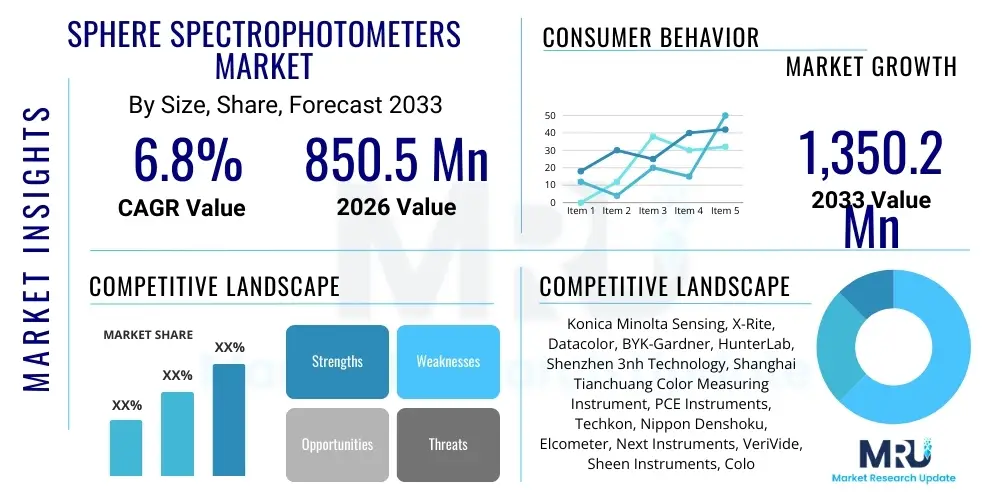

The Sphere Spectrophotometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,350.2 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-precision color measurement solutions across complex industrial applications, particularly those dealing with textured, reflective, or highly glossy materials. The stringent quality control standards implemented globally across sectors like automotive, aerospace, and textiles necessitate instruments capable of neutralizing the impact of surface texture and gloss when measuring color, a function inherently offered by sphere spectrophotometers.

Sphere Spectrophotometers Market introduction

Sphere Spectrophotometers are sophisticated optical instruments designed to measure color accurately, irrespective of the surface texture, gloss, or directionality of the sample. These devices utilize an integrating sphere (typically conforming to CIE d/8 or d/0 geometry) which allows them to capture both specular reflectance (gloss) and diffuse reflectance, thus providing a total color measurement value (SCI - Specular Component Included) or excluding the gloss component (SCE - Specular Component Excluded). The primary product categories include portable, benchtop, and inline sphere spectrophotometers, each tailored for different operational environments, ranging from laboratory research and development to high-speed manufacturing quality control. Major applications span color formulation in paints and coatings, quality assurance in plastics and textiles, and regulatory compliance in pharmaceuticals and food & beverage processing, where color consistency is paramount for brand integrity and consumer safety.

The core benefits derived from utilizing sphere spectrophotometers include unparalleled accuracy, high repeatability, and versatility in measuring complex sample types that traditional 0°/45° geometry instruments cannot handle effectively. Driving factors propelling market growth involve the rising complexity of material science requiring metrology solutions for advanced materials, the globalization of supply chains demanding harmonized color standards (e.g., ISO and ASTM standards), and significant technological advancements in detector sensitivity and processing power, making these devices faster and more user-friendly. Furthermore, the growing adoption of digital color management workflows, which rely on precise spectral data provided by sphere spectrophotometers, is accelerating their deployment across numerous industrial verticals seeking to reduce waste and optimize production efficiency through rigorous quality assurance protocols.

Sphere Spectrophotometers Market Executive Summary

The Sphere Spectrophotometers Market is experiencing robust growth fueled by several converging trends, including the rapid expansion of the automotive refinish market demanding precise color matching for metallic and effect finishes, and the increasing sophistication of quality control requirements in packaging and printing industries. Business trends highlight a strong focus on instrument miniaturization and enhanced connectivity, driven by the Industrial Internet of Things (IIoT), allowing manufacturers to deploy instruments directly on the production line for real-time monitoring and data collection. Major vendors are focusing on developing hybrid instruments that integrate features like gloss measurement and multi-angle measurement capabilities, addressing the comprehensive needs of industrial users. The competitive landscape is characterized by strategic partnerships between instrument manufacturers and software providers to offer integrated digital color formulation and quality control ecosystems, securing deeper market penetration.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, primarily due to the vast expansion of manufacturing hubs, particularly in China and India, coupled with rising adoption of international quality standards in industries like textiles, electronics, and construction materials. North America and Europe maintain leading market shares, characterized by early adoption of advanced color management systems and established regulatory frameworks that mandate high levels of material and color consistency, especially within automotive and aerospace sectors. Segment-wise, the benchtop category currently dominates revenue due to its superior accuracy and reliability in R&D and laboratory settings, while the portable segment is expected to show the fastest CAGR, driven by increasing applications in field diagnostics and mobile quality inspection across distributed manufacturing environments. The core application driving demand remains Color Measurement, although Appearance Measurement (texture, gloss) is emerging as a critical complementary segment, necessitating multi-functional spectrophotometers.

AI Impact Analysis on Sphere Spectrophotometers Market

Analysis of common user questions reveals significant interest regarding how Artificial Intelligence (AI) and Machine Learning (ML) can overcome the traditional limitations of spectral data interpretation and application in complex manufacturing environments. Users frequently inquire about the reliability of AI-driven color matching, the potential for autonomous calibration, and the integration of predictive algorithms for quality control failures. Key themes revolve around improving the speed and accuracy of color formulation for difficult or special effects colors (e.g., metallic, pearlescent) and the transition from reactive quality control to proactive, predictive assurance using large datasets collected by networked sphere spectrophotometers. There is also considerable interest in AI's role in correlating spectral data with visual perception, thereby closing the gap between instrumental measurement and human acceptance criteria.

The integration of AI is transforming sphere spectrophotometry from a pure measurement tool into an intelligent decision-support system. AI algorithms are increasingly employed to analyze complex spectral curves, noise reduction, and identify subtle color deviations that might be missed by standard delta E calculations, particularly in high-volume production. This computational enhancement allows for highly precise tolerance setting and automated classification of acceptable versus reject materials, drastically improving throughput and reducing dependence on manual expert interpretation. Furthermore, ML models trained on vast libraries of spectral and formulation data enable predictive color matching, suggesting optimal pigment combinations based on desired target color and substrate material characteristics, significantly cutting down on trial-and-error costs associated with traditional formulation processes.

The long-term impact of AI on this market centers on the creation of fully autonomous color management systems. These systems will not only measure and analyze color but will also learn from environmental factors, production variables (e.g., temperature, humidity), and material batches to provide real-time adjustments to coating or textile processes. This predictive maintenance and continuous self-optimization capability is highly valuable in reducing material waste and ensuring global color consistency across decentralized manufacturing facilities. The necessity for advanced data analytics capabilities, far beyond simple statistical reporting, is thus driving the development of sphere spectrophotometers equipped with integrated computing power suitable for on-device AI model execution.

- AI-driven Predictive Color Formulation: Enhances speed and accuracy in generating pigment recipes, reducing physical trials.

- Automated Spectral Data Interpretation: Machine learning algorithms classify complex spectral data patterns for non-standard or effect colors.

- Real-time Quality Deviation Prediction: Uses sensor data fusion to predict process drifts before color tolerance limits are breached.

- Self-Calibration and Diagnostics: AI monitors instrument performance and schedules proactive maintenance or calibration adjustments autonomously.

- Enhanced Data Visualization and Correlation: Links instrumental measurements (dE values) directly to visual perception models for improved tolerance agreement.

- Integration with Digital Twins: Supports virtual prototyping and simulation of color under various lighting and material conditions.

DRO & Impact Forces Of Sphere Spectrophotometers Market

The Sphere Spectrophotometers Market is shaped by a critical interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the stringent enforcement of global quality standards (e.g., ISO, ASTM) requiring high-precision color measurement across industries, and the continuous innovation in material science leading to complex surfaces (e.g., metallic flakes, high-gloss plastics) that necessitate integrating sphere technology for accurate data collection. Furthermore, the persistent trend towards digitalization of color management workflows, replacing subjective visual evaluation with objective spectral data, significantly boosts instrument adoption. However, market growth is constrained by the relatively high initial capital investment required for high-end benchtop models, which presents a barrier to entry for small and medium-sized enterprises (SMEs), alongside the necessity for specialized technical expertise for sophisticated calibration and operation, limiting widespread deployment without substantial user training.

Opportunities for expansion are abundant, particularly in emerging markets where industrialization is accelerating and local manufacturers are increasingly striving to meet global supply chain color consistency demands. The development of more affordable, ruggedized portable sphere spectrophotometers that maintain high accuracy opens up new applications in field inspection and remote quality auditing. Furthermore, the integration of Internet of Things (IoT) connectivity and cloud-based data storage and analysis platforms offers significant opportunities for vendors to provide software-as-a-service (SaaS) models, enhancing the value proposition beyond the hardware. The primary impact forces driving strategic decisions within this market are the demand for automation in quality control, forcing manufacturers to integrate instruments inline, and the competitive pressure to achieve zero-defect manufacturing, thereby prioritizing the highest level of spectral accuracy offered by sphere geometry.

The balance of these forces suggests a market trajectory favoring advanced, connectivity-enabled devices. While the restraint of cost and complexity remains relevant, the overarching drivers related to quality assurance, regulatory mandates, and the efficiency gains from digital color management are powerful enough to sustain the forecasted growth rate. The market leaders who successfully leverage the opportunity to simplify user interfaces, integrate AI for automated decision-making, and reduce the instrument footprint will likely capture the largest share of future demand, particularly within high-volume production environments where uptime and integration are critical performance metrics. The industry's continuous evolution towards higher reflectance and transmission standards, particularly in optical coatings and transparent materials, further solidifies the essential role of sphere spectrophotometers.

Segmentation Analysis

The Sphere Spectrophotometers Market is structurally segmented based on crucial attributes including geometry type, aperture size, product type, application, and end-use industry, providing a granular view of market dynamics and targeted opportunities. Understanding these segments is vital for vendors to tailor product development and marketing strategies. The geometry segment, defined primarily by d/8 (diffuse illumination/8-degree viewing) and d/0 (diffuse illumination/0-degree viewing) configurations, reflects the instrument's capability to manage specular components. Product types range from highly precise benchtop models utilized in R&D and main quality labs to portable and hand-held devices favored for quality checks on the production floor or supply chain logistics. End-use segmentation is highly diverse, demonstrating the ubiquitous need for accurate color science across virtually all manufacturing sectors.

- By Geometry Type

- d/8 Sphere Spectrophotometer (Diffuse Illumination, 8° Viewing)

- d/0 Sphere Spectrophotometer (Diffuse Illumination, 0° Viewing)

- Customized Sphere Geometries

- By Aperture Size

- Small Aperture (2mm - 4mm)

- Medium Aperture (6mm - 12mm)

- Large Aperture (above 12mm)

- By Product Type

- Benchtop Spectrophotometers

- Portable/Handheld Spectrophotometers

- Inline Spectrophotometers (Non-Contact)

- By Application

- Color Measurement and Quality Control

- Color Formulation and Matching

- Appearance Measurement (Gloss, Opacity)

- UV Measurement and Analysis (e.g., UV absorbers)

- Material Characterization

- By End-Use Industry

- Paints and Coatings

- Automotive (OEM and Refinish)

- Textiles and Apparel

- Plastics and Polymers

- Printing and Packaging

- Food and Beverage

- Pharmaceuticals and Cosmetics

- Aerospace and Defense

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Sphere Spectrophotometers Market

The value chain for the Sphere Spectrophotometers Market commences with upstream activities centered around the procurement and manufacturing of highly specialized components, followed by midstream assembly, distribution, and ultimately, downstream utilization by end-users. Upstream suppliers are critical, providing high-quality optical components, including precision optics, advanced light sources (e.g., Xenon flash lamps, LEDs), diffraction gratings, and high-sensitivity detectors (e.g., silicon photodiode arrays). The precision required for the integrating sphere itself, typically coated with barium sulfate or specialized PTFE, necessitates highly controlled manufacturing processes. Any variability in these raw materials directly impacts the accuracy and reliability of the final instrument, making supplier relationships for specialized optics and electronics a high-priority area.

The midstream phase involves the sophisticated assembly, calibration, and integration of hardware with proprietary software, which provides the core analytical capabilities (e.g., color difference calculations, formulation algorithms). Distribution channels are multifaceted, employing both direct and indirect routes. Direct distribution is common for large industrial accounts, particularly for complex benchtop or inline systems requiring substantial pre-sale consultation, installation, and post-sale technical support and calibration services. Indirect distribution involves specialized distributors and channel partners who provide regional access, particularly in emerging markets, often bundling the spectrophotometers with complementary products like color light booths and software licenses.

Downstream activities focus heavily on after-sales service, including mandatory routine calibration, maintenance contracts, software updates, and advanced application training. The service component is a significant revenue generator and a crucial factor in customer retention due to the instrument’s sensitivity and the strict regulatory requirements for metrology traceability in many industries. Potential customers, spanning diverse sectors from automotive to pharmaceuticals, rely heavily on the support infrastructure to maintain the validity of their color data, ensuring the high integrity of the quality control process. The efficiency of the value chain is increasingly judged by the seamless integration of instruments into the customer's existing IT infrastructure and manufacturing execution systems (MES).

Sphere Spectrophotometers Market Potential Customers

The primary customers for Sphere Spectrophotometers are sophisticated industrial entities and research institutions whose operational integrity or product quality is highly dependent on precise, non-subjective color and appearance measurement. End-users fall broadly into two categories: those engaged in color production (manufacturers of coatings, plastics, textiles) and those engaged in quality inspection (automotive OEMs, brand owners, packaging firms). For manufacturers of paints and coatings, the instruments are essential for accurate color formulation, ensuring batch-to-batch consistency, and fulfilling highly specific customer color standards, especially for specialized effect pigments.

In the automotive industry, customers include both Original Equipment Manufacturers (OEMs) who use benchtop systems for paint quality control and high-end refinish shops that rely on portable sphere spectrophotometers for matching metallic and pearl finishes under demanding conditions. Furthermore, customers in the printing and packaging sectors utilize these instruments to maintain strict brand color consistency across different substrates and printing technologies (e.g., offset, digital), complying with strict corporate identity guidelines. The pharmaceutical industry constitutes a growing customer base, using spectrophotometers for quality assurance related to tablet coating color, packaging identification, and raw material purity, where color often serves as an indicator of chemical composition or adulteration.

Therefore, the profile of the ideal customer is an organization committed to rigorous quality control, operating under globally standardized processes, and dealing with products where color variance leads to significant financial losses, regulatory non-compliance, or brand damage. These customers prioritize instrument precision, long-term stability, and comprehensive service and calibration support over initial purchase price, driving demand for high-end, professionally maintained equipment. The migration toward digital quality management systems is also shifting the customer expectation, requiring integrated hardware and software solutions that can seamlessly communicate data across global operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,350.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Konica Minolta Sensing, X-Rite, Datacolor, BYK-Gardner, HunterLab, Shenzhen 3nh Technology, Shanghai Tianchuang Color Measuring Instrument, PCE Instruments, Techkon, Nippon Denshoku, Elcometer, Next Instruments, VeriVide, Sheen Instruments, Color Robotics, Rhopoint Instruments, Shenzhen Test & Measurement Technology, VIVID Technology, Beijing Century, Wuxi Donglin Science and Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sphere Spectrophotometers Market Key Technology Landscape

The Sphere Spectrophotometers market is defined by several sophisticated technological advancements aimed at increasing accuracy, versatility, and usability. The core technology centers around the integrating sphere itself, with modern designs utilizing high-reflectance materials like Spectralon (a PTFE derivative) to ensure near-perfect diffuse reflection, minimizing light loss and maximizing measurement precision. Advanced illumination systems now frequently incorporate pulsed Xenon flash lamps coupled with long-lasting, stable LED arrays to provide balanced, full-spectrum illumination covering the visible and near-UV range (360 nm to 740 nm), crucial for characterizing samples containing fluorescent whitening agents (FWAs).

Detection technology has seen significant evolution, moving towards high-resolution silicon photodiode arrays (PDAs) and CMOS sensors that allow for rapid and precise capture of the entire spectral curve in milliseconds. This rapid data acquisition is vital for inline applications where speed is critical. Furthermore, a significant technological trend is the development of instruments that combine spectral measurement with multi-angle gloss measurement, providing a comprehensive characterization of both color and appearance from a single device. The integration of advanced computational optics and embedded microprocessors facilitates complex on-board calculations, reducing reliance on external computing power and enhancing portability.

Connectivity and data management represent another key technological pillar. Newer generation instruments are invariably equipped with wireless connectivity (Wi-Fi, Bluetooth) and support standard industrial communication protocols, enabling seamless data transfer to centralized color quality databases and cloud-based management systems. This digital integration supports the implementation of global color standards and remote diagnostics. Moreover, continuous innovation in calibration algorithms and automated self-diagnosis features, often powered by proprietary software and ML routines, ensures the long-term reliability and traceability of spectral measurements, which is fundamental for maintaining ISO 17025 compliance in regulated industries.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region, driven by exponential growth in manufacturing output, particularly in automotive component production, consumer electronics, and textile dyeing in countries like China, India, and Vietnam. The rising adoption of global quality standards and the shift from subjective quality checks to objective, instrumental measurement protocols are key accelerators. High demand for affordable, portable solutions for distributed supply chain management characterizes this market.

- North America: This region holds a significant market share, characterized by high technological maturity, stringent regulatory environments (e.g., FDA standards in pharmaceuticals), and substantial investment in advanced research and development. Key drivers include the dominance of major automotive OEMs and aerospace industries, which demand the highest level of spectral accuracy for mission-critical components.

- Europe: Europe is a mature market driven by established manufacturing excellence in Germany, Italy, and France, particularly in the premium automotive, luxury goods, and specialized coatings sectors. The focus here is on integrated solutions, traceability, and sustainability, leading to high adoption rates of inline and benchtop spectrophotometers that support closed-loop color correction and waste reduction efforts.

- Latin America (LATAM): Characterized by emerging industrialization, particularly in Brazil and Mexico, the LATAM market shows increasing demand, largely driven by foreign direct investment in manufacturing and the necessity to harmonize quality control processes with international parent companies. Cost-effectiveness and ease of use are crucial purchasing criteria in this region, favoring mid-range portable devices.

- Middle East and Africa (MEA): This region is developing, with growth centered around infrastructure projects, petrochemical industries, and growing pharmaceutical manufacturing in countries like Saudi Arabia and South Africa. Demand is currently sporadic but rising, focusing on robust, high-performance instruments capable of operating reliably in challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sphere Spectrophotometers Market.- Konica Minolta Sensing Americas Inc.

- X-Rite, Pantone (A Danaher Company)

- Datacolor

- BYK-Gardner GmbH (Altana AG)

- HunterLab

- Shenzhen 3nh Technology Co., Ltd.

- Shanghai Tianchuang Color Measuring Instrument Co., Ltd.

- PCE Instruments

- Techkon GmbH

- Nippon Denshoku Industries Co., Ltd.

- Elcometer

- Next Instruments Pty Ltd.

- VeriVide Limited

- Sheen Instruments

- Color Robotics

- Rhopoint Instruments

- VIVID Technology

- Beijing Century Scientific Instrument Co., Ltd.

- Wuxi Donglin Science and Technology Development Co., Ltd.

- Opto-Line International, Inc.

Frequently Asked Questions

Analyze common user questions about the Sphere Spectrophotometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Sphere Spectrophotometer over a 0°/45° device?

The primary advantage is the ability of the Sphere Spectrophotometer to measure color accurately regardless of surface texture or gloss. It can include (SCI) or exclude (SCE) the specular reflectance component, providing flexibility to match human visual perception or isolate the true color value, which is impossible with standard directional geometry instruments.

Which end-use industry is expected to drive the highest growth for Sphere Spectrophotometers?

The Automotive industry, specifically the refinish and OEM coating sectors, is expected to drive the highest growth. This demand stems from the increasing complexity of special effect finishes (metallic, pearl) and the critical need for absolute color consistency across global assembly and repair operations, requiring the precision of sphere geometry.

How does the integration of IoT impact the utility of Sphere Spectrophotometers in manufacturing?

IoT integration allows instruments (especially inline and portable models) to transmit spectral data instantly to centralized cloud platforms and Manufacturing Execution Systems (MES). This enables real-time process monitoring, automated quality alerts, and facilitates global supply chain color management and remote instrument diagnostics, significantly enhancing operational efficiency.

What is the typical measurement geometry used for evaluating reflective or high-gloss samples?

For highly reflective or glossy samples, the standard geometry utilized is d/8 (diffuse illumination/8-degree viewing). Crucially, the measurement must be conducted with the Specular Component Excluded (SCE) mode to disregard the surface gloss and obtain the color value as if the sample were matte, providing a true spectral fingerprint of the colorant.

What are the main constraints facing the adoption of high-end Benchtop Sphere Spectrophotometers?

The main constraints include the high initial capital expenditure associated with purchasing high-precision, benchtop laboratory instruments. Furthermore, these sophisticated devices require specialized technical personnel for operation, meticulous calibration, and ongoing maintenance, posing an accessibility challenge for smaller industrial operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager