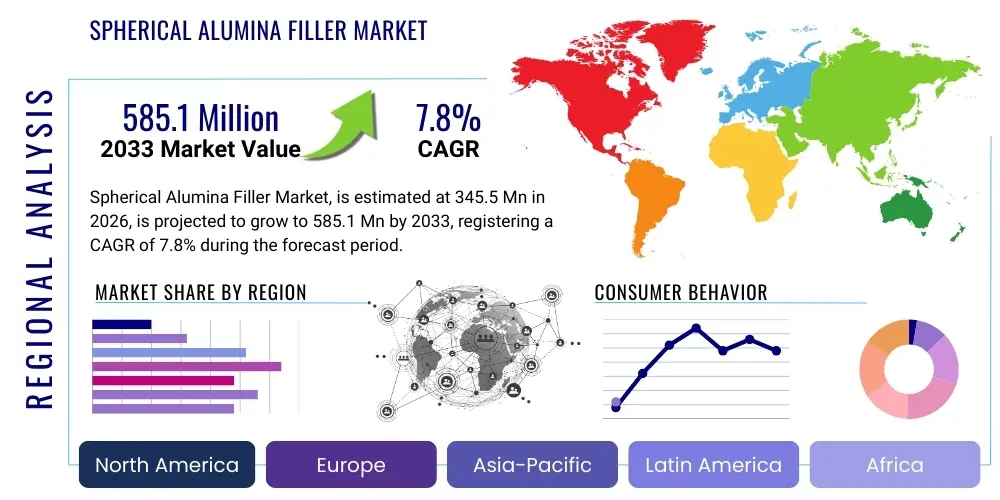

Spherical Alumina Filler Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442253 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Spherical Alumina Filler Market Size

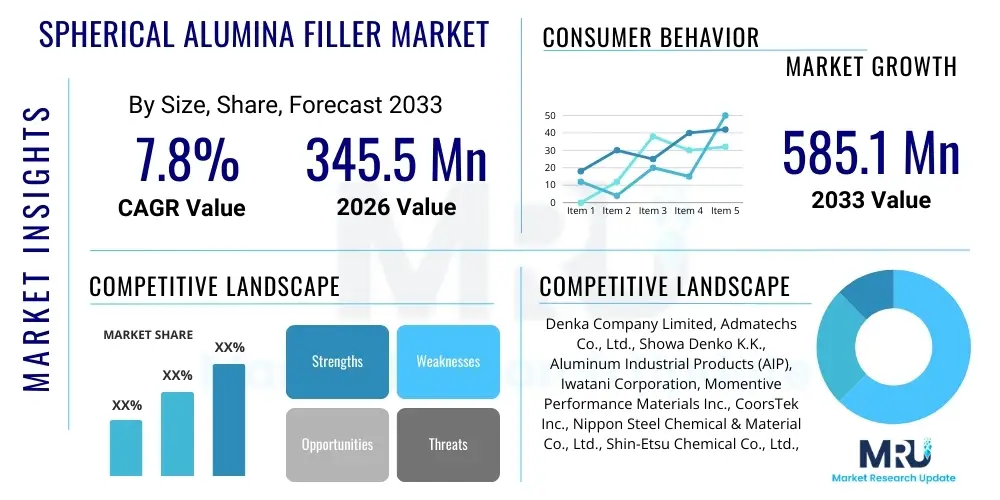

The Spherical Alumina Filler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 345.5 Million in 2026 and is projected to reach USD 585.1 Million by the end of the forecast period in 2033.

Spherical Alumina Filler Market introduction

The Spherical Alumina Filler Market encompasses the production, distribution, and utilization of high-purity alumina particles engineered into a perfect spherical shape. This unique morphology provides distinct advantages over traditional irregular or crushed alumina fillers, primarily due to enhanced flowability, minimized viscosity increase in composite matrices, and superior packing density. These characteristics are critical for demanding applications requiring high thermal conductivity, electrical insulation, and low thermal expansion. The spherical nature significantly reduces internal friction and stress concentration points within end products, leading to improved mechanical and thermal performance.

Spherical alumina fillers are predominantly utilized in advanced composite materials, thermal interface materials (TIMs), structural ceramics, and encapsulation compounds. A major application driver is the electronics industry, particularly in thermal management solutions for high-power density components such as CPUs, GPUs, and IGBT modules. The efficiency of heat dissipation is directly proportional to the filler's thermal conductivity and uniform dispersion, areas where spherical alumina excels. Furthermore, the material is increasingly adopted in LED packaging and automotive electronics due to its reliability under stringent operational conditions.

Key benefits driving market adoption include exceptionally high thermal conductivity, necessary for dissipating heat in miniaturized electronic devices; excellent dielectric properties, crucial for electrical insulation; and low coefficient of thermal expansion (CTE), which helps prevent material failure caused by thermal cycling. Major driving factors include the continuous miniaturization of electronic devices, the rapid expansion of 5G infrastructure requiring advanced thermal management, and increasing demand for lightweight, high-performance materials in the electric vehicle (EV) sector, where battery thermal management systems are paramount.

Spherical Alumina Filler Market Executive Summary

The global Spherical Alumina Filler Market is characterized by robust growth, driven primarily by technological advancements in electronics and electric vehicles. Business trends indicate a strong focus on capacity expansion among leading manufacturers, particularly in the Asia Pacific region, to meet the surging demand for high-performance thermal interface materials (TIMs) and epoxy molding compounds (EMCs). Key market players are investing heavily in optimizing production processes, such as plasma spheroidization and chemical synthesis routes, to achieve tighter particle size distribution and higher purity levels, thereby commanding premium pricing and strengthening competitive positioning. Strategic partnerships between spherical alumina producers and compound formulators are also becoming prevalent to accelerate application development and customization for specific end-user needs, ensuring supply chain resilience and technical expertise sharing.

Regionally, Asia Pacific (APAC) dominates the market, largely attributed to the concentration of electronics manufacturing hubs, semiconductor foundries, and the rapidly growing EV production base in countries like China, South Korea, and Japan. North America and Europe exhibit mature market dynamics, characterized by demand from specialized aerospace, defense, and high-reliability industrial sectors, focusing on ultra-high-end specifications and regulatory compliance. The regional trend is towards localization of supply chains to mitigate geopolitical risks and shipping uncertainties, prompting manufacturers to establish production or processing facilities closer to major consumption centers in APAC.

Segment trends highlight the dominance of the medium particle size segment (e.g., 10-50 µm) for mainstream thermal management applications, offering an optimal balance between thermal performance and cost efficiency. However, the ultra-fine particle segment (e.g., 1-5 µm) is showing the fastest growth trajectory, driven by advanced semiconductor packaging requirements, where gap-filling capability and thin-layer thermal conductivity are paramount. By application, the Thermal Interface Materials (TIMs) segment remains the largest consumer, while the segment related to structural ceramics, particularly in energy storage and high-temperature environments, is poised for significant future expansion due to ongoing research into novel composite structures.

AI Impact Analysis on Spherical Alumina Filler Market

User queries regarding the impact of Artificial Intelligence (AI) on the Spherical Alumina Filler Market often center on how AI-driven optimization affects material synthesis, quality control, and, crucially, the end-use demand spurred by advanced computing infrastructure. Key themes revolve around AI's ability to model complex particulate interactions, predict optimal filler loading ratios for new composite formulations, and automate sophisticated quality inspection processes, thereby enhancing product consistency and reducing waste. Furthermore, users frequently ask how the massive data processing demands of AI and Machine Learning (ML) hardware—requiring significantly higher power densities—will translate into increased demand for ultra-high thermal conductivity spherical alumina in specialized cooling systems, heat sinks, and advanced packaging substrates. The consensus expectation is that AI acts as both a transformative manufacturing tool (improving material performance) and a powerful demand generator (driving the need for superior thermal management solutions).

The implementation of AI/ML algorithms in the research and development phase allows manufacturers to rapidly screen thousands of potential precursor chemistries and processing parameters (such as furnace temperature profiles in plasma spheroidization) that influence sphericity, particle size distribution, and surface functionalization. Traditional trial-and-error methods are resource-intensive; AI models significantly truncate the development cycle for fillers tailored to specific thermal, electrical, or rheological specifications. This accelerates the launch of next-generation fillers optimized for extremely demanding applications, like those found in advanced sensor arrays or high-frequency communication modules, ensuring the industry can rapidly adapt to evolving material performance benchmarks.

Moreover, AI's profound impact on the demand side cannot be overstated. The proliferation of data centers, autonomous vehicles, and edge computing devices, all fueled by AI, necessitates exponential improvements in thermal dissipation capabilities. Spherical alumina fillers are integral components in the TIMs and epoxy resins used in these high-power density environments. As AI workloads increase, demanding more compact and powerful chips, the reliance on high-filler-loading composites to manage operational temperature rises will intensify, making the production efficiency and quality control enabled by AI in filler manufacturing a critical success factor for the entire electronics supply chain.

- AI optimizes manufacturing parameters (e.g., plasma jet velocity, temperature) for superior sphericity and purity.

- Predictive modeling using ML accelerates the discovery of new composite formulations and optimal filler concentrations.

- Increased computational demands (data centers, 5G, autonomous driving) driven by AI elevate demand for high-thermal-conductivity fillers.

- Computer vision and automated quality inspection powered by AI ensure tight particle size distribution and minimize defects.

- AI-driven supply chain management improves logistics and raw material procurement efficiency for alumina processing.

DRO & Impact Forces Of Spherical Alumina Filler Market

The market dynamics for spherical alumina fillers are profoundly influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), which together constitute the primary impact forces shaping the industry trajectory. The primary driver is the pervasive demand for efficient thermal management, specifically stemming from the power density increases across sectors like electric vehicles (EVs), high-performance computing (HPC), and 5G infrastructure. These applications require filler materials that can provide high heat dissipation without compromising the mechanical integrity or dielectric performance of the composite matrix. The superior packing density and low viscosity of spherical alumina, enabling high filler loading, uniquely position it to capitalize on these thermal requirements, driving consistent demand growth across all major geographical regions.

Restraints primarily revolve around the high capital expenditure required for establishing advanced spheroidization processes, such as plasma torch technology, which ensures the high purity and tight particle size distribution necessary for premium applications. Furthermore, the market faces competition from alternative, albeit less thermally efficient, ceramic fillers like boron nitride and silicon carbide, which may be preferred in certain specialized, high-cost-sensitive applications. Supply chain instability, particularly concerning the sourcing and price volatility of high-purity raw material alumina, presents an ongoing operational challenge that limits instantaneous capacity responsiveness to surging demand spikes, particularly in the highly competitive Asian markets.

Significant opportunities exist in emerging applications, notably in advanced battery technology, where spherical alumina can be used in separators or thermal runaway protection systems within battery packs, a high-growth area driven by the global energy transition. Additionally, developing cost-effective surface modification techniques (functionalization) to enhance compatibility between the filler and diverse polymer matrices offers a pathway to unlocking new composite markets, such as advanced structural adhesives and specialized coatings. The transition toward smaller, higher-frequency electronic components mandates continuous innovation in ultra-fine spherical particles, creating an opportunity for technology leaders to establish enduring competitive advantages through intellectual property and process secrecy.

Segmentation Analysis

The Spherical Alumina Filler Market is systematically segmented based on particle size, application, and end-use industry, reflecting the diverse technical requirements across various sectors. Particle size segmentation is paramount, as the diameter and distribution directly dictate the rheological properties and maximum packing fraction attainable in a composite system; generally, smaller particles are utilized for thin-film applications requiring high surface area, while larger, broader distributions are optimal for general-purpose thermal compounds. Application-based segmentation differentiates between usage in thermal interface materials (TIMs), structural components, and dielectric materials, each requiring specific grades of sphericity and purity. The detailed segmentation structure enables market participants to strategically tailor their product offerings and manufacturing capabilities to specific, high-growth niche markets.

The market for Spherical Alumina is intrinsically tied to the performance characteristics demanded by modern electronics, which mandates highly specialized segmentation. For instance, the demand for high-reliability components in aerospace and defense drives the premium pricing for ultra-high purity (>99.99%) segments, whereas commercial consumer electronics prioritize cost-effectiveness and scalability, favoring broader particle size distributions and standard purity levels. Understanding these segmentation nuances is crucial for accurate forecasting and strategic capacity planning, especially considering the long lead times associated with scaling up high-specification ceramic production.

Furthermore, segmentation by end-use industry clearly delineates the fastest-growing consumption areas. The electronics segment, inclusive of semiconductor packaging and LED modules, remains the core market engine, but the Electric Vehicle (EV) segment, encompassing battery packs and power electronics, represents the highest growth potential due to regulatory push and global electrification trends. This multifaceted segmentation structure provides a granular view of market dynamics, allowing for targeted product development (e.g., specialized surface treatments for enhancing dispersion in EV battery sealants) and optimized channel strategy across different industrial ecosystems.

- By Particle Size:

- Small (< 10 µm)

- Medium (10 µm - 50 µm)

- Large (> 50 µm)

- By Application:

- Thermal Interface Materials (TIMs)

- Epoxy Molding Compounds (EMCs)

- Structural Ceramics and Composites

- Adhesives and Sealants

- Coatings and Paints

- By End-Use Industry:

- Electronics and Semiconductors

- Automotive (Especially EV Battery Management)

- Aerospace and Defense

- Industrial and Power Systems

- Consumer Goods

Value Chain Analysis For Spherical Alumina Filler Market

The value chain for spherical alumina fillers is rigorous and capital-intensive, starting with the extraction and refining of high-purity bauxite, which is processed into raw calcined alumina. Upstream activities are dominated by specialized chemical and metallurgical companies focusing on maintaining strict quality control over the precursor material, as impurities at this stage detrimentally affect the final thermal and dielectric properties of the spherical product. The critical manufacturing step involves the spheroidization process—typically plasma melting, high-temperature sintering, or chemical vapor deposition—which transforms irregular alumina particles into highly uniform spheres. This phase represents the highest value addition and technological barrier to entry, requiring proprietary equipment and specialized operational expertise to achieve the requisite levels of sphericity and particle size consistency.

Midstream activities involve sophisticated processing steps such as surface treatment and classification. Surface modification (e.g., silane coupling agents) is vital to ensure optimal wettability and dispersion when the filler is incorporated into organic polymer matrices, dramatically influencing the composite's final performance. Accurate particle size classification ensures the end product meets the tight specifications required by semiconductor manufacturers. The downstream segment involves blending, compounding, and formulation by end-product manufacturers, such as producers of thermal greases, potting compounds, or structural adhesives. These companies purchase the spherical filler and integrate it into their proprietary formulations, adapting filler loading and matrix chemistry to achieve the specific thermal and mechanical performance required by the end application.

Distribution channels are categorized into direct and indirect routes. Direct sales are common for high-volume, highly customized orders, especially those going to large semiconductor packaging houses or Tier 1 automotive suppliers, ensuring technical collaboration and tailored supply agreements. Indirect distribution utilizes specialized chemical distributors and agents who manage smaller volumes and provide regional inventory stocking, technical support, and logistical fulfillment to a broader base of small-to-medium enterprise (SME) compounders and specialty material developers. The reliance on indirect channels is higher in fragmented markets like Europe and North America, whereas large integrated manufacturers in Asia Pacific often prefer direct relationships to maintain tighter control over quality assurance and technical specifications.

Spherical Alumina Filler Market Potential Customers

The primary consumers and buyers of spherical alumina fillers span several high-technology and precision engineering sectors, all unified by the stringent requirement for superior thermal management and reliable electrical insulation. The largest cohort of potential customers resides within the Electronics and Semiconductor industry, specifically including Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT) companies, and specialized thermal management material suppliers. These entities purchase spherical alumina for incorporation into epoxy molding compounds (EMCs) used for chip encapsulation, thermal greases, phase change materials (PCMs), and specialized ceramic substrates that must reliably dissipate heat from microprocessors and power transistors. The increasing performance demands in these sectors mandate continuous sourcing of ultra-high-purity and fine-particle grades.

Another rapidly expanding customer base is the Automotive industry, particularly manufacturers focused on Electric Vehicles (EVs) and hybrid systems. Potential customers here include EV battery pack manufacturers, suppliers of power electronics modules (inverters, converters), and producers of high-reliability sensor systems. Spherical alumina is crucial for thermal management within battery modules to prevent thermal runaway and for insulating high-voltage components. These customers prioritize long-term durability, thermal cycling resistance, and large-scale, consistent supply, often leading to multi-year procurement contracts with established filler producers who can meet stringent automotive quality standards (e.g., AEC-Q requirements).

Furthermore, specialized industrial sectors represent lucrative niche markets. Potential customers include aerospace and defense contractors requiring light-weight, thermally stable composites for radomes and engine components; LED lighting manufacturers utilizing fillers for high-power LED packaging compounds; and producers of high-voltage insulation systems (GIS and switchgear). These buyers are less price-sensitive than consumer electronics markets and place a premium on customized particle surface treatments, stringent quality documentation, and exceptional reliability in extreme operating conditions. Procurement decisions are heavily influenced by technical support capabilities and compliance with complex regulatory frameworks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 345.5 Million |

| Market Forecast in 2033 | USD 585.1 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denka Company Limited, Admatechs Co., Ltd., Showa Denko K.K., Aluminum Industrial Products (AIP), Iwatani Corporation, Momentive Performance Materials Inc., CoorsTek Inc., Nippon Steel Chemical & Material Co., Ltd., Shin-Etsu Chemical Co., Ltd., Suzhou Baisheng Photoelectric Material Co., Ltd., Imerys, Alpha Assembly Solutions (MacDermid Alpha), Futamura Chemical Co., Ltd., Saint-Gobain, Zibo Chuanqiang Chemical Co., Ltd., Beijing Hualian Ceramics Co., Ltd., Hongwu International Group Ltd., Qingdao Sanzhen Aluminum Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spherical Alumina Filler Market Key Technology Landscape

The technological landscape of the Spherical Alumina Filler Market is defined by sophisticated particle engineering methods aimed at achieving high purity, consistent sphericity, and narrow particle size distribution (PSD). The prevailing method for producing premium, ultra-high-end spherical alumina is Plasma Spheroidization (or Plasma Melting). This process involves feeding high-purity irregular alumina powder through an ultra-high-temperature plasma torch (often inductively coupled plasma, ICP), which instantly melts the particles. Surface tension forces then pull the molten material into a perfect spherical shape before rapid cooling and solidification. This technology is critical because it yields products with superior flowability and minimal defects, essential for high-filler-loading thermal compounds used in advanced semiconductor packaging. Continuous innovation focuses on optimizing plasma generation efficiency and refining the cooling trajectory to control microstructural properties.

While plasma spheroidization dominates the high-performance segment, other technologies, such as flame fusion (gas combustion heating) and chemical precipitation methods, are employed for lower-cost or specific application grades. Flame fusion offers a balance of quality and cost, often used for medium-grade fillers, though it may result in slightly broader PSDs and lower sphericity compared to plasma methods. Chemical precipitation techniques, including sol-gel processing, are utilized to create very fine, nano-sized spherical particles, crucial for next-generation composite films and coatings where thin layers are necessary. The selection of technology is fundamentally driven by the required purity level, target particle size, and, significantly, the budget constraints imposed by the target end-use market.

Crucially, the technological competitive edge is increasingly moving beyond just particle formation to encompass surface functionalization and homogenization. Surface modification technologies, involving chemical treatments like silane, titanate, or zirconia coupling agents, are essential for ensuring chemical compatibility between the inorganic alumina sphere and the organic polymer matrix (e.g., epoxy, silicone, polyimide). Effective functionalization prevents particle agglomeration and enhances the overall thermal transfer efficiency of the composite. Furthermore, advanced classification and sorting technologies, often leveraging air separation or micro-sieving, are paramount for ensuring a consistent, tight particle size distribution, directly impacting the final composite's viscosity and maximum filler loading potential.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily fueled by the concentration of global electronics manufacturing, semiconductor foundries, and the dominance in electric vehicle (EV) battery production. Countries like China, Japan, and South Korea host major players in thermal interface material formulation and chip packaging, generating massive demand for spherical alumina. Government initiatives supporting local semiconductor self-sufficiency further accelerate the deployment of high-specification fillers in advanced packaging technologies (e.g., 3D stacking).

- North America: North America represents a mature, high-value market driven by innovation in aerospace, defense electronics, high-performance computing (HPC), and specialized medical devices. Demand focuses on ultra-high purity grades and customized solutions for mission-critical applications where failure tolerance is minimal. The region benefits from significant R&D spending and robust technical collaboration between material suppliers and application engineers, particularly concerning thermal management solutions for advanced military hardware and data centers.

- Europe: The European market demonstrates steady growth, strongly influenced by the automotive sector's rapid transition towards electrification (EVs) and stringent industrial automation standards. Germany, France, and the UK are key contributors, focusing on utilizing spherical alumina in high-reliability power electronics and specialized industrial coatings. Regulatory pressures concerning energy efficiency and thermal safety standards act as consistent market drivers for superior heat dissipation materials across industrial and commercial sectors.

- Latin America and Middle East & Africa (MEA): These regions currently hold smaller market shares but are exhibiting promising growth potential, driven by infrastructure development and increasing investment in localized manufacturing capabilities. Growth in MEA is linked to energy sector investments (power transmission and distribution requiring high-voltage insulation) and localized electronics assembly operations. Latin America’s market expansion is tied to the growth of local automotive assembly and basic consumer electronics production, gradually increasing the regional demand for commodity-grade spherical fillers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spherical Alumina Filler Market.- Denka Company Limited

- Admatechs Co., Ltd.

- Showa Denko K.K.

- Aluminum Industrial Products (AIP)

- Iwatani Corporation

- Momentive Performance Materials Inc.

- CoorsTek Inc.

- Nippon Steel Chemical & Material Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Suzhou Baisheng Photoelectric Material Co., Ltd.

- Imerys

- Alpha Assembly Solutions (MacDermid Alpha)

- Futamura Chemical Co., Ltd.

- Saint-Gobain

- Zibo Chuanqiang Chemical Co., Ltd.

- Beijing Hualian Ceramics Co., Ltd.

- Hongwu International Group Ltd.

- Qingdao Sanzhen Aluminum Material Co., Ltd.

- Unifrax (now Lydall/Clearlake Capital)

- Axor Ceramics

Frequently Asked Questions

Analyze common user questions about the Spherical Alumina Filler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Spherical Alumina Filler and why is its shape important?

Spherical Alumina Filler is a high-purity aluminum oxide material engineered into uniform, near-perfect spheres. The spherical shape is critical because it minimizes viscosity in polymer composites, allowing for higher filler loading and thus maximizing thermal conductivity without compromising flowability during manufacturing processes like injection molding or dispensing. It also ensures consistent dielectric performance and reduced abrasion.

Which end-use industry is the primary driver of demand for high-grade spherical alumina?

The Electronics and Semiconductor industry is the primary demand driver. Specifically, the need for advanced thermal management solutions in high-power density components (CPUs, GPUs, memory modules) and LED packaging requires spherical alumina to be incorporated into Thermal Interface Materials (TIMs) and Epoxy Molding Compounds (EMCs) to efficiently dissipate operational heat, ensuring device reliability and longevity.

What technological process is commonly used to manufacture premium spherical alumina fillers?

Plasma Spheroidization (or Plasma Melting) is the dominant technology for producing premium spherical alumina. This process uses ultra-high-temperature plasma torches to melt and reshape high-purity alumina powder, yielding highly uniform spheres with exceptional purity and a narrow particle size distribution, which are necessary for the highest-specification applications.

How does the adoption of Electric Vehicles (EVs) impact the Spherical Alumina Filler Market?

The rapid adoption of EVs significantly drives market growth as spherical alumina is essential for thermal management within battery packs and power electronics (inverters and converters). It is used in thermal gap fillers and sealants to enhance heat transfer away from battery cells and critical electronic components, preventing overheating and ensuring the safety and efficiency of the vehicle's electrical system.

What is the main challenge faced by manufacturers in the Spherical Alumina Filler market?

The main challenge is the high capital cost and technical complexity associated with the plasma spheroidization manufacturing process required to achieve ultra-high purity and consistency. Additionally, maintaining a stable supply chain for high-purity raw material alumina and managing competitive pricing pressure from alternative, lower-cost thermal fillers pose ongoing operational difficulties for market participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager