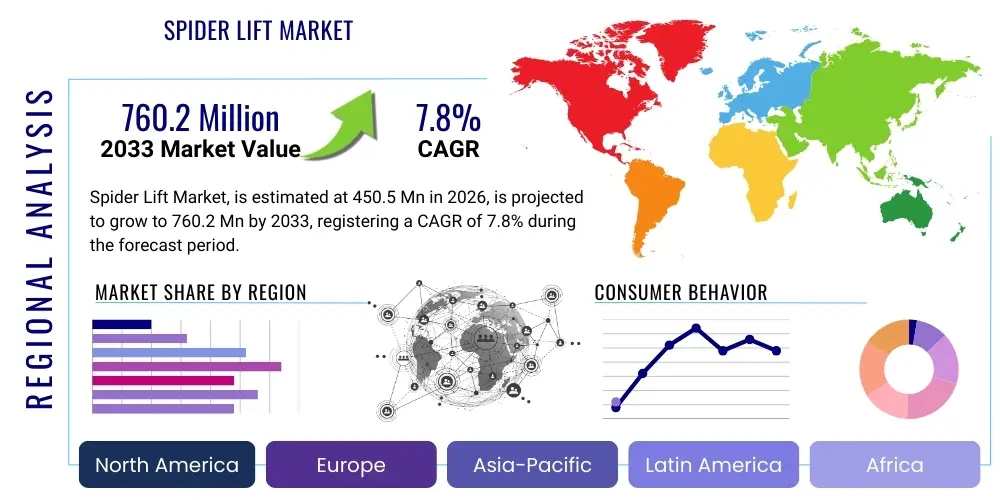

Spider Lift Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442062 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Spider Lift Market Size

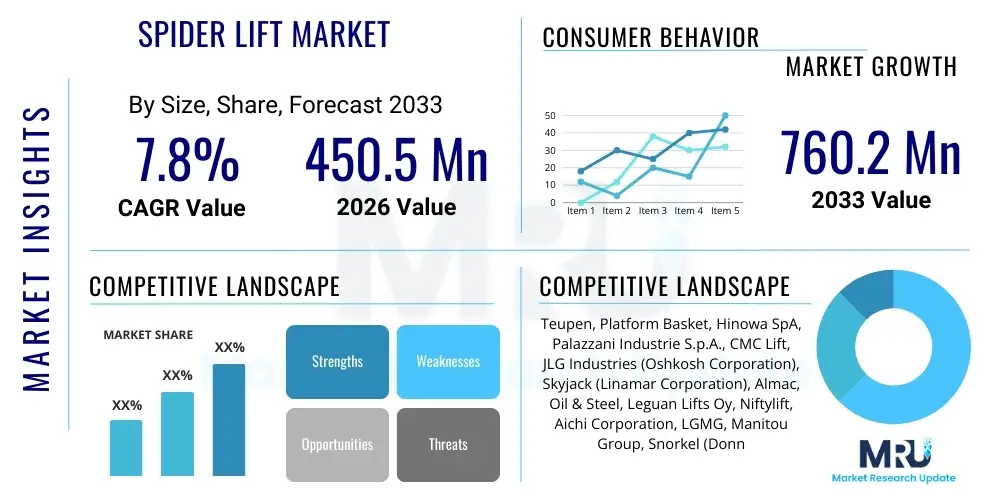

The Spider Lift Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 760.2 million by the end of the forecast period in 2033.

Spider Lift Market introduction

The Spider Lift Market, characterized by compact and versatile tracked access platforms, encompasses equipment designed for reaching heights in confined, challenging, or uneven terrain environments. These specialized aerial work platforms (AWPs), also known as tracked or compact access platforms, are essential for tasks requiring high reach combined with low ground pressure and narrow passage capabilities. Their primary design feature involves four independently adjustable legs (outriggers) resembling a spider, which stabilize the machine on slopes or uneven surfaces, providing a safer and more flexible solution compared to conventional boom lifts or scissor lifts in specific operational settings. The versatility of spider lifts makes them indispensable across a variety of professional sectors.

Major applications for spider lifts span construction, particularly specialized restoration and maintenance work on historical buildings or complex architectural structures; tree care and arboriculture, where maneuvering through dense foliage or soft ground is necessary; and facility management, especially in large structures, shopping malls, or airports for internal and external maintenance. Furthermore, the burgeoning demand for infrastructure maintenance, alongside stringent safety regulations governing working at height, propels the adoption of these specialized machines. Benefits include superior outreach capabilities, minimal ground disturbance dueolow weight and tracked chassis, electric or hybrid power options for indoor use, and exceptional transportability due to their compact stowed dimensions.

Driving factors contributing significantly to market expansion include accelerated urbanization leading to continuous vertical construction and retrofitting projects, increased global focus on occupational safety standards mandating certified and stable working platforms, and technological advancements such as hybrid powertrains and improved telemetry systems enhancing operational efficiency and reliability. The growing rental sector also plays a pivotal role, allowing smaller contractors access to high-specification equipment without significant capital investment, thereby increasing overall market penetration and utilization rates across diverse industries demanding flexible height access solutions.

Spider Lift Market Executive Summary

The Spider Lift Market is experiencing robust growth fueled by several converging global business trends, including the persistent demand for specialized access equipment in niche construction and maintenance environments, and the shift towards environmentally friendly machinery. Key business trends indicate a strong move toward electrification and hybridization of models to comply with increasingly strict emissions regulations in urban centers and for indoor applications, positioning manufacturers focused on sustainable solutions for competitive advantage. Furthermore, digitalization is integrating sophisticated telematics and predictive maintenance capabilities into spider lifts, optimizing fleet management for rental companies and enhancing safety through real-time data monitoring. Mergers, acquisitions, and strategic partnerships, particularly between technology providers and established AWP manufacturers, are also reshaping the competitive landscape, focusing on innovation and broadening geographic distribution channels.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, driven by massive infrastructure development projects, rapid industrialization, and increased foreign direct investment in construction sectors, particularly in China and India. North America and Europe, while mature markets, maintain dominance in terms of technological adoption and stringent safety standards, necessitating continuous upgrades to existing fleets and driving demand for premium, high-reach models. European markets show a particularly strong preference for compact, urban-friendly electric and hybrid lifts due to dense city structures and severe environmental legislation. Meanwhile, emerging economies in Latin America and the Middle East & Africa (MEA) are witnessing rising demand correlating with growing urban populations and significant capital investments in commercial and residential infrastructure.

Segment trends underscore the dominance of the 10-20 meter working height segment due to its versatility across general construction and facility management tasks, balancing reach with operational footprint. However, the ultra-high reach segment (above 30 meters) is projected to exhibit the highest CAGR, primarily utilized in specialized industrial and complex architectural maintenance where conventional equipment falters. Regarding power sources, hybrid and electric models are rapidly displacing diesel-only variants, reflecting both regulatory pressure and end-user desire for versatile machines suitable for both internal and external operations. The rental industry segment continues to hold the largest market share, leveraging the high cost and specialized nature of these machines, providing scalability and flexibility to contractors worldwide.

AI Impact Analysis on Spider Lift Market

User queries regarding the impact of Artificial Intelligence (AI) on the Spider Lift Market primarily revolve around how autonomy, predictive maintenance, and enhanced safety protocols can be integrated into these compact machines. Users often ask: "Will AI allow spider lifts to navigate complex terrains autonomously?", "How can machine learning reduce unexpected equipment failures?", and "Can AI-driven telematics optimize fleet deployment and energy consumption?". The core concerns center on the reliability of autonomous systems in dynamic construction environments, the investment return on integrating expensive sensor technology, and the potential for AI to dramatically enhance the operational lifespan and safety envelope of the lifts. Key expectations include improved operational efficiency, reduced human error in positioning and stabilization, and advanced risk assessment capabilities.

The integration of AI and Machine Learning (ML) algorithms is poised to transform the operational paradigm of spider lifts, moving them beyond basic mechanized equipment toward intelligent, self-monitoring systems. AI-driven predictive maintenance utilizes sensor data collected from engine performance, hydraulic systems, and track wear to forecast potential failures long before they occur, allowing maintenance schedules to be optimized based on actual component degradation rather than generalized operational hours. This shift reduces unscheduled downtime significantly, a critical factor for rental companies where utilization rates directly translate to profitability, thereby enhancing overall asset reliability and extending the serviceable life of the equipment. Furthermore, AI contributes to sophisticated diagnostics, enabling faster and more accurate remote troubleshooting, minimizing the need for extensive on-site service calls.

Beyond maintenance, AI enhances safety and operational performance, particularly through advanced stabilization and positioning systems. ML models process real-time input from inclinometers and load sensors to dynamically adjust outrigger stability, especially critical when operating on challenging slopes or soft ground. Future iterations are expected to incorporate computer vision and object recognition AI to assist operators in obstacle avoidance and secure working envelope definition, preventing collisions and overreaching limits automatically. This progressive integration of AI ensures that spider lifts remain compliant with increasingly stringent global safety standards while offering superior performance in highly constrained and dangerous working environments, maximizing user confidence and productivity.

- Autonomous positioning and dynamic stability adjustment using real-time sensor fusion.

- Predictive maintenance analytics optimizing maintenance schedules and reducing downtime.

- Enhanced telematics driven by Machine Learning for improved route optimization and fleet management.

- Computer vision systems assisting in obstacle detection and proximity warning for increased safety.

- Optimization of hybrid/electric power management systems for maximum battery life and fuel efficiency.

- AI-driven operator assistance features reducing human error during complex maneuvers.

- Automated compliance monitoring ensuring operations remain within certified load limits and environmental constraints.

DRO & Impact Forces Of Spider Lift Market

The market dynamics of spider lifts are primarily dictated by a strong combination of safety-driven regulations and infrastructural expansion, collectively forming the core Drivers (D). The primary driver is the global emphasis on worker safety at height, leading to mandates requiring certified, stable, and inspected AWPs, which spider lifts, with their superior stability and compact design, are well-positioned to fulfill. Concurrently, the increasing complexity of urban architecture, infrastructure restoration, and specialized industrial maintenance necessitates equipment capable of accessing restricted areas and elevated structures with minimal disruption. Technological advances, particularly in lightweight materials and hybrid power systems, further enable higher reach capabilities without compromising maneuverability, making them increasingly attractive over traditional access methods.

However, the market faces significant Restraints (R), principally the high initial acquisition cost of spider lifts compared to standard vertical mast lifts or scaffolding, which poses a barrier to entry for smaller construction firms or niche maintenance providers. The specialized nature of these machines also requires highly trained operators, and the shortage of such skilled labor in certain regions impedes mass adoption. Furthermore, while their compact size is an advantage, the overall capacity and outreach, while improving, may still be limited compared to larger, truck-mounted or self-propelled boom lifts, restricting their applicability in heavy industrial or large-scale civil engineering projects. Supply chain volatility for specialized components, such as lightweight structural steel and advanced electronic controls, also introduces cost and delivery uncertainties.

Opportunities (O) abound, stemming from the expanding rental market, where the high utility and versatility of spider lifts make them prime candidates for fleet inclusion, lowering the effective adoption barrier for end-users. The global trend towards sustainable construction and green buildings creates immense potential for electric and hybrid models, particularly in noise-sensitive and emissions-restricted areas. Geographically, untapped potential lies in emerging economies undergoing rapid infrastructure modernization where the need for safe, flexible access solutions is growing exponentially. Moreover, the development of integrated digital platforms offering remote diagnostics, operational optimization, and enhanced operator training presents significant avenues for value addition and service differentiation, moving the industry towards a more comprehensive equipment-as-a-service model.

The cumulative effect of these Drivers, Restraints, and Opportunities dictates the Impact Forces (I) on the market. Currently, the positive impact of stringent safety mandates and infrastructural investment substantially outweighs the constraints imposed by high capital costs, resulting in a net positive market trajectory. Technological innovation, particularly in hybridization and AI integration for safety and efficiency, is intensifying this positive force, rapidly increasing the Total Addressable Market (TAM) by enabling spider lifts to compete effectively in operational settings previously dominated by heavier equipment. This dynamic ensures sustained growth, provided manufacturers successfully navigate supply chain complexities and maintain price competitiveness relative to the specialized functionality offered.

Segmentation Analysis

The Spider Lift Market is comprehensively segmented based on key functional and application parameters, allowing for detailed analysis of demand trends across different product specifications, power sources, and end-user industries. Understanding these segments is crucial for manufacturers to tailor product development and for rental companies to optimize their fleet composition. The segmentation primarily focuses on the working height, which determines the operational capability; the type of power source, reflecting environmental suitability and fuel flexibility; and the end-use application, which defines the operational environment and required features, such as indoor or outdoor performance, and required load capacity and outreach parameters.

The core segmentation by working height (e.g., up to 10m, 10m-20m, 20m-30m, and above 30m) illustrates the versatility of the machines, with medium-height lifts forming the backbone of general construction and maintenance activities, while ultra-high reach lifts target highly specialized industrial and telecom applications. Segmentation by power source (Diesel, Electric/Battery, Hybrid) highlights the crucial shift toward electrification driven by sustainability goals and indoor operational necessity. Finally, the end-user segmentation (Construction, Rental, Utility/Telecommunications, Arboriculture) provides insight into the specific demands—for instance, arboriculture requires extremely low ground pressure and maximum maneuverability, whereas construction values rapid setup and stability on diverse surfaces.

Analyzing these segments reveals that the 10-20 meter segment holds the maximum market share due to its optimal balance of reach, stability, and compactness suitable for most commercial maintenance and medium-scale construction. However, the Hybrid power source segment is expected to witness the highest CAGR as it offers the best of both worlds: high performance for external work combined with zero-emission capability for sensitive indoor environments. The rental segment remains the dominant distribution channel, capitalizing on the high utilization rate and capital expenditure avoidance for end-users, underscoring the necessity for robust, durable, and easily maintainable equipment profiles tailored specifically for the fleet ownership model.

- By Working Height:

- Up to 10 Meters

- 10 Meters to 20 Meters

- 20 Meters to 30 Meters

- Above 30 Meters

- By Power Source:

- Diesel

- Electric/Battery

- Hybrid

- Bi-Energy (DC/AC)

- By Type:

- Wheel Mounted Spider Lifts

- Track Mounted Spider Lifts

- By Application/End-User:

- Construction and Renovation

- Rental Fleets

- Facility Management and Maintenance

- Utilities and Telecommunications

- Arboriculture and Forestry

- Industrial Cleaning and Inspection

- By Lifting Capacity:

- Up to 200 kg

- 200 kg to 300 kg

- Above 300 kg

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Spider Lift Market

The Value Chain for the Spider Lift Market begins with upstream activities involving the sourcing and processing of raw materials, primarily high-strength steel alloys, specialized hydraulic components, advanced electronic controls (sensors, microprocessors), and power systems (diesel engines, high-capacity batteries, and electric motors). Key upstream players are metal fabricators, specialized hydraulics manufacturers, and powertrain suppliers. Due to the requirement for lightweight yet robust structures, procurement focuses heavily on materials that offer high strength-to-weight ratios. Efficiency at this stage is critical, as material costs and technological sophistication directly impact the final machine's performance and manufacturing cost. Strategic partnerships with key component suppliers are vital for maintaining competitive advantage and ensuring quality control.

Midstream activities encompass the core manufacturing process, where major OEMs design, assemble, and test the spider lifts. This stage includes complex engineering for boom structure optimization, integration of advanced safety and control systems (such as computerized stability monitoring), and final assembly of the chassis, tracks, and outriggers. Quality assurance and compliance with international safety standards (like ANSI and CE) are paramount during manufacturing. Manufacturers often specialize in specific height classes or power configurations, utilizing lean manufacturing principles to handle low-volume, high-complexity production runs. Significant investment is placed in R&D to improve reach, reduce stowed dimensions, and enhance the integration of hybrid and electric technologies, optimizing the overall utility profile of the product.

Downstream activities involve the distribution, sales, rental, and post-sale service of the equipment. Distribution channels are predominantly indirect, relying heavily on a global network of specialized equipment distributors and, most significantly, large international and regional rental companies. Rental fleets are the largest consumers, driving standardization and demand for high-durability machines. Direct sales occur mainly for very large industrial clients or specific government entities. After-sales service, including routine maintenance, spare parts supply, and specialized repairs, is a crucial profit center and a key differentiator for OEMs, ensuring high uptime for rental partners. The efficiency of this downstream network directly influences customer satisfaction and repeat business, emphasizing the necessity for robust technical support and readily available training programs for operators and maintenance personnel.

Spider Lift Market Potential Customers

Potential customers for spider lifts are highly diversified, reflecting the machine's adaptability across varied operational environments, particularly those involving height access in constrained or sensitive locations. The largest single customer segment remains the equipment rental industry, which purchases fleets of spider lifts to offer specialized access solutions to a broad range of smaller contractors and niche maintenance firms. These rental companies serve as the primary distribution nexus, utilizing the lifts' high utilization rates to justify the significant initial capital outlay. Rental customers prioritize durability, ease of maintenance, robust telemetry systems, and versatility across electric/hybrid power configurations to maximize operational revenue and minimize downtime, ensuring maximum profitability from their specialized assets.

Beyond rental fleets, direct end-users span sectors requiring vertical access where traditional platforms are impractical or impossible. Construction and renovation companies constitute a major buyer group, particularly those engaged in high-end specialized projects like restoring historical buildings, maintaining ornate facades, or working in landscaped areas where low ground pressure is essential to avoid damage. Facility management companies for large commercial properties, shopping centers, airports, and industrial complexes are also key end-users, requiring quiet, often electric, lifts for atrium maintenance, lighting replacement, and internal infrastructure repairs while minimizing disruption to ongoing operations.

Furthermore, specialized industries such as arboriculture and forestry rely heavily on tracked spider lifts for tree pruning and hazardous removal due to their exceptional ability to navigate steep slopes and uneven, soft terrain with minimal environmental impact. Utilities and telecommunication companies use them for line maintenance, tower inspection, and equipment installation in remote or difficult-to-reach locations. These end-users prioritize maximum outreach capabilities, track performance, and integrated safety features. The growing demand for green infrastructure maintenance and high-altitude cleaning services further expands the customer base, signaling a continued diversification of buyers seeking precise, compact, and high-performance access solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 million |

| Market Forecast in 2033 | USD 760.2 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teupen, Platform Basket, Hinowa SpA, Palazzani Industrie S.p.A., CMC Lift, JLG Industries (Oshkosh Corporation), Skyjack (Linamar Corporation), Almac, Oil & Steel, Leguan Lifts Oy, Niftylift, Aichi Corporation, LGMG, Manitou Group, Snorkel (Donnelly Group), E-Lift, Dingli, Genie (Terex Corporation), Merlo S.p.A., Zhejiang Dingli Machinery Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spider Lift Market Key Technology Landscape

The technological landscape of the Spider Lift Market is rapidly evolving, driven primarily by demands for enhanced safety, improved energy efficiency, and greater maneuverability in complex environments. A critical area of focus is the development of advanced stabilization and control systems. Modern spider lifts utilize sophisticated computer-controlled outrigger deployment and monitoring systems (often incorporating inclinometers and pressure sensors) to ensure maximum stability on uneven ground while automatically limiting outreach and load capacity to prevent tipping incidents, substantially exceeding the safety features found in previous generations of aerial work platforms. Furthermore, the integration of advanced materials, such as high-tensile steel and aluminum, contributes significantly to reducing the overall weight of the machine, enhancing transportability and enabling operation on sensitive or weight-restricted surfaces without compromising boom strength or reach.

Another dominant technological trend involves the transition toward sustainable power sources. Hybrid and pure electric (battery-powered) drivetrains are becoming the industry standard, offering zero-emission operation essential for indoor or environmentally sensitive projects. Hybrid systems typically combine a small diesel engine with a lithium-ion battery pack, providing the flexibility of extended external operation and the clean power needed for internal use. This technological duality addresses the fundamental requirement for versatility. Manufacturers are also focusing on optimizing battery technology, incorporating fast-charging capabilities, and developing intelligent energy management systems to extend operational cycles and monitor battery health remotely via integrated telematics, directly impacting fleet utilization rates.

Finally, connectivity and digitalization represent a major technological frontier. Modern spider lifts are equipped with advanced telematics solutions, utilizing GPS and cellular data transmission to provide real-time data on location, operational status, engine diagnostics, and fault codes. This technology allows rental companies to track asset utilization, schedule predictive maintenance based on actual usage patterns, and remotely diagnose issues, drastically improving service response times. The ongoing incorporation of digital interfaces, advanced operator feedback systems, and potentially augmented reality (AR) for maintenance and training purposes further solidifies the market's trajectory toward highly intelligent, interconnected, and service-oriented access solutions, improving overall operational safety and efficiency across the entire value chain.

Regional Highlights

The geographical distribution and growth trajectories of the Spider Lift Market show distinct regional dynamics influenced by economic maturity, safety regulations, and infrastructure investment levels. Europe currently holds a substantial market share, driven by stringent regulatory frameworks regarding working at height (e.g., EU Directives) and the high penetration rate of rental equipment. The demand in Europe is particularly strong for electric and hybrid spider lifts due to dense urban populations and robust environmental policies restricting combustion engine usage. Countries like Germany, the UK, and France are major adopters, focusing on facility management, municipal maintenance, and complex architectural preservation projects requiring specialized, compact access.

North America is another dominant market, characterized by large construction and utility sectors, and high adoption of advanced AWP technology. The strong emphasis on occupational safety standards (OSHA, ANSI) ensures continuous demand for certified and technologically sophisticated spider lifts. The U.S. market is highly competitive, driven by large rental corporations that continually upgrade their fleets with high-reach and multi-fuel models. The preference here leans towards larger capacity lifts for commercial construction, although the residential and specialized services segment also contributes significantly to market growth, maintaining a steady and mature demand profile across the region.

Asia Pacific (APAC) is projected to experience the fastest growth rate throughout the forecast period. This explosive growth is attributed to rapid urbanization, massive government investment in infrastructure development (e.g., railways, smart cities), and the increasing awareness of modern industrial safety practices, replacing traditional scaffolding methods. China and India are the key growth engines, where domestic manufacturers are rapidly increasing production capacity and technological capability. While price sensitivity remains a factor, the shift toward higher quality, safer access equipment in specialized construction and industrial maintenance sectors is fueling substantial demand, making APAC the primary focus for market expansion in the long term.

- North America (US & Canada): Mature market focused on high safety standards, fleet modernization, and demand driven by large rental houses and commercial construction projects. High adoption rate of advanced telematics.

- Europe: Leading market for electric and hybrid technology, driven by strict urban emission zones and high regulatory requirements for worker safety. Strong focus on compact lifts for heritage and complex maintenance work.

- Asia Pacific (APAC): Highest projected growth, fueled by urbanization, massive infrastructure spending (China, India), and increasing awareness of mechanized safety solutions replacing manual labor.

- Latin America (LATAM): Emerging growth market, tied to commercial and residential building cycles. Increased professionalization of construction driving slow but steady adoption of specialized lifts.

- Middle East & Africa (MEA): Growth driven by mega-projects in the GCC countries (Saudi Arabia, UAE), focusing on large infrastructure and high-rise maintenance, favoring lifts with high reach and robust performance in extreme temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spider Lift Market.- Teupen

- Platform Basket

- Hinowa SpA

- Palazzani Industrie S.p.A.

- CMC Lift

- JLG Industries (Oshkosh Corporation)

- Skyjack (Linamar Corporation)

- Almac

- Oil & Steel

- Leguan Lifts Oy

- Niftylift

- Aichi Corporation

- LGMG

- Manitou Group

- Snorkel (Donnelly Group)

- E-Lift

- Dingli

- Genie (Terex Corporation)

- Merlo S.p.A.

- Zhejiang Dingli Machinery Co., Ltd.

- Imer Group

- RUTHMANN GmbH & Co. KG

- Falcon Lifts A/S

- Multitel Pagliero S.p.A.

Frequently Asked Questions

Analyze common user questions about the Spider Lift market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using a spider lift over a traditional boom or scissor lift?

Spider lifts offer superior access in confined or narrow spaces, exceptional stability on uneven or sloping terrain due to independent outriggers, and significantly reduced ground pressure due to their tracked chassis and low weight, making them ideal for sensitive floors and landscaping areas.

Which power source segment is expected to grow the fastest in the spider lift market?

The Hybrid power source segment is projected to achieve the highest Compound Annual Growth Rate (CAGR) as it combines the high-performance endurance of diesel for outdoor use with the clean, zero-emission capability of electric power for strict indoor and urban environments, maximizing operational versatility.

How is AI impacting the safety and maintenance of spider lifts?

AI is primarily enhancing safety through dynamic stability control and operator assistance features, while Machine Learning (ML) algorithms are driving predictive maintenance programs. These systems utilize sensor data to forecast component failure, reducing unscheduled downtime and optimizing service intervals, thus increasing overall asset reliability.

What is the dominant end-user application segment for spider lifts globally?

The Equipment Rental Fleets segment is the dominant end-user, accounting for the largest share of market demand. Rental companies purchase these specialized machines to provide flexible, high-specification access solutions to a diverse clientele in construction, facility management, and arboriculture without requiring large capital investment from the end-users.

What key factors are restraining the wider adoption of spider lifts?

The major restraint is the high initial acquisition cost of spider lifts compared to standard aerial work platforms. Additionally, the need for specialized training for operators and potential limitations in lifting capacity relative to larger, heavier boom lifts also slightly restricts mass-market penetration across all industrial applications.

Which working height category holds the largest market share?

The 10 Meters to 20 Meters working height segment currently holds the largest market share. This category strikes an optimal balance between maximum reach capabilities and compact stowed dimensions, making it the most versatile choice for common maintenance, renovation, and general construction tasks across various sites.

Are spider lifts commonly used in historical building restoration?

Yes, spider lifts are frequently used in historical building restoration and facade maintenance. Their compact size allows access through narrow archways or delicate interior spaces, and their low ground pressure prevents damage to sensitive paving or antique flooring, making them the preferred solution for heritage sites.

What role does telematics play in the Spider Lift Market?

Telematics plays a crucial role by providing real-time data on asset location, operational status, and diagnostics. This enables rental companies to optimize fleet management, enhance security against theft, monitor usage patterns for billing accuracy, and implement timely, data-driven maintenance schedules.

How is the Asia Pacific region influencing the global Spider Lift market?

The Asia Pacific region is driving market expansion through robust economic growth, massive investment in new infrastructure projects, and rapid urbanization. While price sensitivity is present, the increasing focus on modern construction safety standards is rapidly increasing the adoption rate for specialized access equipment.

What is the significance of track-mounted versus wheel-mounted spider lifts?

Track-mounted spider lifts are significantly more popular due to their superior ability to traverse difficult, uneven, muddy, or sloping terrains with minimal ground disturbance, providing greater stability and versatility in outdoor and construction environments. Wheel-mounted variants are less common but suitable for smooth industrial floors.

Are European regulations a significant driver for electric spider lifts?

Absolutely. Strict environmental regulations, especially the introduction of Low Emission Zones (LEZ) and ultra-low noise requirements in densely populated European cities, strongly mandate the use of electric or hybrid machinery, making these regions primary drivers for battery-powered spider lift technology.

What are the material trends impacting spider lift manufacturing?

Manufacturers are increasingly utilizing high-strength, lightweight materials like specialized aluminum alloys and high-tensile steel in boom construction. This reduces the machine's overall weight, improving transportability and allowing for higher reach capabilities without increasing the footprint or necessary operating weight.

Do spider lifts typically have a lower or higher lifting capacity compared to standard boom lifts?

Spider lifts generally have a lower maximum lifting capacity compared to large, standard boom lifts. Their design priority is focused on achieving maximum height and outreach with minimal weight and compact size, often sacrificing high payload capacity for superior maneuverability and low ground pressure.

How do competition and specialization influence the market structure?

The market is moderately fragmented, with intense competition among specialized European manufacturers known for high-end technology and larger North American and Asian players focusing on volume and cost efficiency. Specialization in ultra-high reach or extreme terrain capability provides crucial competitive differentiation among OEMs.

What impact does urbanization have on the demand for spider lifts?

Urbanization increases the density of construction and maintenance requirements in confined urban environments. This necessitates compact equipment that can operate quietly and cleanly, driving strong demand for hybrid and electric spider lifts that excel in maneuvering and accessing vertical spaces within dense city landscapes.

Is operator training a critical factor for market growth?

Yes, the specialized nature of spider lifts and their advanced stabilization systems necessitates highly specific operator training. The availability of certified and skilled operators is a critical factor; conversely, a shortage of trained personnel acts as a restraint on rapid market expansion in some developing regions.

What types of projects require spider lifts with a working height above 30 meters?

Spider lifts with working heights above 30 meters (ultra-high reach) are typically required for specialized industrial maintenance, complex inspections of large architectural structures, telecommunications tower servicing, and maintenance of high-altitude utilities where conventional heavy equipment cannot access the base location.

How do bi-energy power systems differ from hybrid spider lifts?

Bi-energy systems allow the machine to operate solely using either a combustion engine or an electrical hook-up (AC power), providing operational flexibility. Hybrid systems typically use both power sources concurrently or sequentially with an integrated battery pack, often optimizing efficiency and providing a more seamless transition between external and internal use.

What is the role of the Arboriculture sector in the Spider Lift Market?

The Arboriculture (tree care) sector is a significant niche consumer. Spider lifts are favored here because their tracked chassis minimize damage to sensitive landscaping and their superior articulation allows operators to maneuver around complex tree branches to perform precision pruning and hazardous tree removal safely.

Are there major price differences between track-mounted and wheel-mounted spider lifts?

Yes, track-mounted spider lifts, which constitute the majority of the market, generally command a higher price due to the complexity of the tracked chassis, advanced hydraulic systems for independent outriggers, and the specialized materials needed to achieve low ground pressure while maintaining robustness.

How do load sensing systems contribute to operational safety?

Load sensing systems are essential safety features that continuously monitor the weight in the platform and the boom angle. If the load exceeds safe limits or if the machine stability is compromised due to outrigger sinking, the system automatically restricts or slows boom movements, preventing catastrophic failure and tipping.

What are the expectations for market growth in the Middle East & Africa (MEA)?

The MEA region is expected to show gradual, targeted growth. Demand is concentrated in GCC nations due to ongoing large-scale construction and facility maintenance projects. Growth is tied to regulatory changes that favor mechanized access over scaffolding and investment in maintenance infrastructure.

How does the complexity of urban design drive the demand for compact access equipment?

Modern urban architecture often features complex geometries, narrow access points, and delicate interior spaces (like atriums or glass roofs). The compact stowed dimensions and precise maneuverability of spider lifts are uniquely suited to operate effectively in these challenging, high-density environments where larger platforms cannot fit or operate safely.

What are the primary challenges in the spider lift supply chain?

Supply chain challenges typically involve volatility in the pricing and availability of high-strength steel alloys, specialized hydraulic pumps, and, increasingly, complex electronic components and lithium-ion batteries needed for hybrid and electric models, affecting manufacturing lead times and overall cost efficiency.

How is the residual value of spider lifts viewed within the rental industry?

Spider lifts often maintain a relatively high residual value compared to general-purpose AWPs, primarily due to their specialized nature and long operational lifespan when properly maintained. High demand for used equipment in emerging markets further supports robust residual values, benefiting rental fleet ROI calculations.

Are electric spider lifts suitable for heavy outdoor construction sites?

Pure electric spider lifts are primarily optimized for indoor and finished outdoor work. While they offer excellent performance, their suitability for heavy, rugged outdoor construction sites can be limited by battery capacity constraints and the need for frequent recharging. Hybrid models offer a better compromise for rough, extended outdoor use.

What factors differentiate leading OEMs in the spider lift market?

Leading OEMs differentiate themselves through continuous innovation, particularly in achieving greater outreach with lower weight, integrating sophisticated safety electronics, offering robust global service networks, and rapidly introducing advanced sustainable power options (hybrid/electric) that meet stringent regulatory compliance.

How important are maintenance and service contracts to the spider lift market?

Maintenance and service contracts are extremely important, especially for rental companies, as high equipment uptime is crucial for profitability. Comprehensive service support from OEMs ensures rapid technical assistance, access to genuine spare parts, and extended machine lifespan, forming a critical part of the overall ownership cost structure.

Does the market favor lifts with single or double articulated booms?

The market increasingly favors spider lifts with multi-articulated or telescopic/articulated hybrid booms (double articulation). These designs offer superior up-and-over capabilities and greater maneuverability at height, allowing the operator to reach complex positions over obstacles or beneath roof structures more effectively than single-section booms.

What regulatory bodies primarily govern the use and design of spider lifts?

Key regulatory bodies include the American National Standards Institute (ANSI) in North America, the European Committee for Standardization (CEN) governing CE marking in Europe, and various national occupational health and safety administrations (like OSHA), which mandate strict design and operational standards for aerial work platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager